Introduction

As an iconic Scottish brand, Irn-Bru seeks to thoughtfully expand its geographical footprint beyond its home market into new international territories, leveraging its unique product proposition and brand equity to resonate with aligned consumer values and tastes. The research aims to develop a successful go-to-market strategy for Irn Bru in France, a country prioritising growth due to the alignment between French consumers’ values and the unique, high-quality beverage offered as part of its product proposition. With 17 billion litres of soft drinks consumed annually, France represents a sizable opportunity for Irn-Bru as the second-largest soda market in Europe, offering considerable growth headroom if the brand can resonate locally through strategic positioning (Scotland, 2019, p.4). French soda growth is slowing down despite changing consumer preferences for high-end products and healthier alternatives. Irn-Bru, recognised for its secret recipe dating back to 1901, appeals to real flavour experiences and handmade craftsmanship.

Irn Bru is aimed at youthful city dwellers looking for unique brand experiences outside big beverage companies. Despite wealthy competitors, Irn Bru’s savvy internet marketing and powerful retail locations in urban centres present the brand as a culturally relevant upstart competitor brand (Aversa et al., 2021, p.1731). This analysis outlines key market factors and consumer considerations to inform Irn-Bru’s French market entry plan, with launch recommendations focused on targeted seeding initiatives to pave the way for broader adoption.

Market Entry Strategy

The best approach for Irn Bru to join the French market is through a licensing agreement with PepsiCo. Wu et al. (2022, p.128) state that by using Pepsi’s well-established French distribution network in retail and hospitality channels, Irn Bru may increase its reach while reducing its initial resource requirements. This form of collaboration also allows for greater flexibility in monitoring consumer demand through preliminary small-scale testing, with the potential for national scale-up if the results show feasibility. This licencing go-to-market strategy, which leverages Pepsi’s market expertise and Irn Bru’s unique value proposition as a distinction, allows the brand to acquire traction with customers in France faster for a product that differentiates it from other local competitors.

Marketing Strategy

On Facebook and Instagram, Irn Bru can use sponsored social media content and hashtags to reach out to youth. Highlighting the brand’s crafted Scottish origin and past helps fit with the cultural goals of this target age group. Scotland’s rough natural environs and Irn-Bru’s longstanding production legacy generate aspirational connotations to justify the premium pricing. Endorsing new products at consumer sample events and influencer partnerships with well-known French food and beverage personalities with significant online followings give buyers the confidence to try them (Oguji and Owusu, 2021, p.6). By portraying real French customers enjoying the distinct flavour of Irn-Bru, their user-generated social media content adds authenticity. Geotagged social media posts spark localised word-of-mouth exposure beyond paid impressions. Pop-up sampling booths at festivals highlighting gastronomy, arts, and culture encourage immersive brand connection, attracting youngsters seeking new experiences and cultural exploration. They look forward to these occasions.

The brand has partnered with periodicals like Lonely Planet, National Geographic Traveller, and Air France’s in-flight magazine to promote its Scottish-themed travel material. They are also conducting ongoing sampling to counter French palate preferences. Trial stimulation is crucial to explore the unique Irn Bru taste profile and its potential benefits (Kang and Pang, 2022, p.110). A minor price premium versus other premium/imported brands helps achieve required margins while remaining accessible to the core target through discounts and promotions. Digital coupons and price promotions help minimise early scepticism.

Risks and Mitigation

When Irn Bru enters France, it risks being caught off-guard by the restrictions and competition of the country. Large soft drink companies with extensive distribution networks and significant resources, such as Pepsi and Coca-Cola, could hinder Irn-Bru’s entry (Doğan, 2022, p.30). Irn Bru’s flexibility is crucial for its marketing, promotions, and pricing. The company offers a variety of unique product concepts, allowing for quick changes. However, the formula or packaging may need to be altered to comply with France’s strict food safety, quality, labelling, and health claims criteria.

It is vital to conduct ongoing research on potential product revisions. By leveraging PepsiCo’s expertise in navigating French regulations through a licensing partnership, Irn Bru can ensure timely adherence to local laws and restrictions. Irn Bru may require formulation adjustments to conform to French quality and labelling standards while preserving its signature flavour profile and brand identity. Irn Bru can alter its French entry strategy in response to market concerns because it has robust policies to manage the effects of competition and restrictions (Zwarteveen et al., 2022, p.166). Adaptability and close observation of the surroundings will be crucial success factors.

Global Trends

Premiumisation

Because of consumers’ increased preference for high-end goods and experiences, Irn Bru has a strong chance in the French market. French consumers place a high value on quality and artisanal craftsmanship in all areas. French consumers prioritise wine quality over quantity, spending 19% more on premium offerings since 2017. Millennials especially trade up, with wine spending up 15-20% per occasion. Ethics and price are key purchase factors, indicating premium willingness (Plata et al., 2022, p.102). Irn-Bru’s natural ingredients and Scottish heritage offer strong premiumisation potential, as French consumers now associate natural and ethical claims with quality when purchasing non-alcoholic drinks. The marketing should emphasise its century-old manufacturing heritage, Scottish ancestry, and use of exclusive natural flavours and colours. Using imagery that emphasises Scotland’s wild beauty and Irn-Bru’s cultural relevance provides a sense of authenticity and expertise.

Irn Bru, a premium beverage, can be promoted as a high-end, branded experience using bespoke packaging and unique artistic designs. Anderson (2023, p.4) states that, unlike mainstream brands like Coca-Cola, Irn Bru’s marketing uses minimalist design aesthetics, craft-focused language, and media partnerships to increase luxury perceptions. In-depth brand storytelling on social media connects Irn Bru’s heritage to Scottish identity and Millennial audiences. By a multifaceted approach, including product, branding, and positioning, Irn Bru maintains a premium niche in France, justifying its premium pricing compared to conventional soda.

Health and Wellness

With 57% of French customers actively seeking to eat and drink healthier, Irn Bru can leverage the trend of healthy product innovations (Nunes et al., 2020, p.13). As a result of this shift, prominent CSD brands are boosting their wellness credentials by introducing low-calorie and sugar options that include fruit juices, artificial sweeteners, and other natural ingredients. Irn Bru may satisfy health-conscious consumers by utilising stevia and other sweeteners in their reduced or zero sugar line extensions. This allows it to develop to meet the local market’s needs while preserving its past. Lower-sugar versions would appeal to this critical market, which is careful of sugar intake but still loves delectable items because millennials are particularly drawn to businesses that meet their lifestyle requirements.

Reformulation efforts can use naturally occurring French-themed products like citrus fruits to lower sugar content and improve local relevance. Seasonal limited editions with immune-boosting and energy-boosting characteristics may encourage trial and relevance (Nunes et al., 2020, p.16). French shoppers are open to natural and organic promises. Irn Bru should emphasise natural colours and tastes in future marketing, be open to modifications to reduce sugar content and tailor its portfolio to appeal to health-conscious consumers. This will ensure the brand’s messaging is perceived as one that understands local needs rather than an unhealthy indulgence in France.

Recommendation Related to Health/Wellness Trend

Irn Bru should join the market with a lower-sugar line extension to meet the growing French appetite for healthier alternatives. A reduced sugar version made with stevia or other natural sweeteners keeps the original recipe while responding to the 57% of French customers who actively change their diets to eat and drink healthier (McArthur and Powell, 2020, p.112). Finally, this innovation makes Irn Bru more acceptable to non-loyalists and Millennials worried about moderate sugar consumption, letting the brand adapt to changing lifestyle needs. Regardless of Irn-Bru’s natural credentials, it makes business sense for the company to match its portfolio with local health issues so that its positioning fits with France’s shifting preferences rather than being viewed as a risky indulgence.

Country-Specific Communications

Segmentation and Targeting

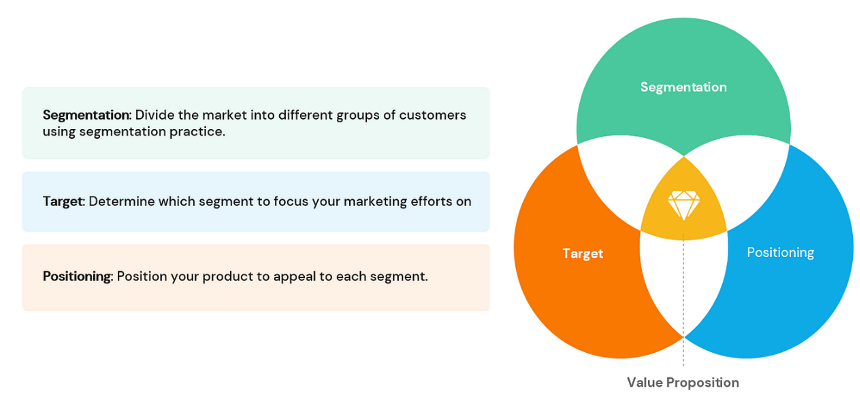

Figure 1: Segmentation, Targeting, and Positioning (STP) Marketing (Fellini and Guetto, 2019, p.28)

In France, metropolitan Millennials aged 18 to 30 are the perfect primary target audience for Irn Bru. Digital and social media are key channels for involvement, as 92% of this tech-savvy group has internet access (Fellini and Guetto, 2019, p.28). Not to mention, Millennials have a spirit of exploration and adventure that is perfect for trying out a novel product like Irn-Bru. Their naive outlook welcomes discovery beyond the typical global soda corporations’ monopolising consciousness. Millennials very highly regard authenticity and creativity in branding. Such psychographic sensibilities are particularly resonant with Irn-Bru’s unique personality, Scottish provenance, and tradition of unconventional marketing ingenuity. The renowned brand features and capacity to provide customised packaging facilitate self-expression, another important customer need.

Focusing efforts in major cities geographically provides cost-effective reach because of Millennials’ urban concentration and mobility patterns. Hubs for postsecondary education and late-night drinking establishments that are well-liked by the target audience permit memorable sampling events and generate talk on social media (France and Ghose, 2019, p.458). Irn Bru is promoted on college campuses as a flavour journey for students looking to try new things. Although Millennials make up 19% of the French population, it is anticipated that early adopters who are prepared to take a chance on a new foreign brand will come from this group (Block et al., 2021, p.867). Introducing Scotland’s national soft drink to France presents a promising opportunity for youth who prefer more sophisticated substitutes for large soda brands.

Marketing Mix

As the brand’s flagship product, the original Irn Bru formula is still vital to recreating the brand’s distinct and exclusive flavour profile. Reducing sugar in line extensions, on the other hand, caters to French customers’ growing health and wellness demands, broadening the audience beyond Irn Bru fans and attracting more health-conscious Millennials (Ponzoa and Erdmann, 2021). Reducing the amount of sugar while retaining the Irn Bru tradition and using natural ingredients by using natural sweeteners such as stevia is feasible. Flavours with a regional French theme gain importance as well. It makes sense to have a premium yet approachable pricing strategy, with Irn Bru justifying a tiny price premium over other imported soda brands because of its unique selling feature, proprietary formula, and higher production costs. This premium positioning corresponds to the French respect for excellence. However, pricing is crucial to encourage acceptance among the key Millennial audience (Wichmann et al., 2022, p.503). While sampling fosters experimentation, clever promotions such as student discounts and digital vouchers introduce the brand to affluent younger customers.

The Irn-Bru brand aims to launch in metropolitan French cities, targeting modern supermarkets, convenience stores, and dining establishments with a young clientele. Distribution can reach national retail chains, travel-related retail stores, and crowded transportation hubs (Abedian et al., 2022, p.140). Social media advertising showcases Scottish brand origins and customisation possibilities. At the same time, influencer seeding events, student campus meetings, music festivals, and cultural activities provide immersion sampling, while TV-sponsored urban out-of-home media sites cater to Millennials’ mobility tendencies.

Social Media Adaptation

Worldwide campaigns such as #GoBru create global brand solidarity. However, social media initiatives designed specifically for the French market should avoid overt references to Scottish culture, which may turn off viewers unfamiliar with the country’s history (Dubbelink et al., 2021, p.12). However, retaining Irn-Bru’s essential aesthetic and flavour characteristics is critical. Adding French language adaptations to owned social channels, packaging, and in-store point-of-sale materials helps make the brand’s uniqueness more relevant and engaging for French consumers encountering Irn Bru for the first time. Genuine reactions to the specific flavour profile of Irn-Bru are captured in user-generated material created by French influencers and customers, adding authenticity. Creative ties with French musicians, artists, and internet innovators resonate more powerfully than celebrity endorsements in sports because they demonstrate the brand’s compatibility with Millennials’ freedom to self-expression.

Continuous social media monitoring helps Irn Bru gauge campaign resonance and make necessary adjustments based on client feedback. French debates highlight themes like premiumisation and health, which can be capitalised on through a gender-specific strategy. Geotargeted advertising targeting major cities can increase interest in Irn Bru’s Scottish heritage (Obermayer et al., 2022, p.361). An artistic perspective paired with French aesthetic principles can enhance Instagram’s premium appeal. To appeal to French customers, Irn Bru should balance its Scottish roots with local features in language, tastes, and influencers, ensuring a seamless experience for new customers (Lopreite et al., 2021, p.24). Irn Bru can gradually broaden its audience by focusing on flavour profiles and subtle messages.

Conclusion

France presents an appealing first European debut market for Irn Bru outside of Scotland, given the country’s large soda consumption, growth potential through smart positioning, and strong cultural affinity with the brand’s uniqueness. To reduce risk and costs, the proposed market entry strategy centred on a planned launch using a licencing partnership model. After Irn Bru shows its viability in France, utilising this niche growth model to expand throughout Western Europe makes sense, especially using the lessons learned from this plan. The French marketing mix and localisation strategy elements can be replicated with minor changes to assist Irn Bru in achieving incremental success overseas.

References

Abedian, M., Amindoust, A., Maddahi, R. and Jouzdani, J., 2022. A game theory approach to selecting marketing-mix strategies. Journal of Advances in Management Research, 19(1), pp.139-158.Retrieved from https://doi.org/10.1108/JAMR-10-2020-0264

Anderson, K., 2023. The emergence of lower-alcohol beverages: The case of beer. Journal of Wine Economics, pp.1-21. Retrieved from https://doi.org/10.1017/jwe.2023.8

Aversa, P., Huyghe, A. and Bonadio, G., 2021. First impressions stick to Market entry strategies and category priming in the digital domain. Journal of Management Studies, 58(7), pp.1721-1760. Retrieved from https://doi.org/10.1111/joms.12712

Block, J.H., Groh, A., Hornuf, L., Vanacker, T. and Vismara, S., 2021. The entrepreneurial finance markets of the future: a comparison of crowdfunding and initial coin offerings. Small Business Economics, 57(2), pp.865-882. Retrieved from http://tinyurl.com/yddbk9xn

Doğan, Ö.F., 2022. Service Design for Market Entry Strategy Development: Case of a Finnish EdTech Company. Retrieved from https://www.theseus.fi/bitstream/handle/10024/788565/OmerFarukDogan.pdf?sequence=2

Dubbelink, S.I., Herrando, C. and Constantinides, E., 2021. Social media marketing as a branding strategy in extraordinary times: Lessons from the COVID-19 pandemic. Sustainability, 13(18), p.10-31. Retrieved from https://www.cogitatiopress.com/mediaandcommunication/article/view/5667/2873

Fellini, I. and Guetto, R., 2019. A “U-shaped” pattern of immigrants’ occupational careers? A comparative analysis of Italy, Spain, and France. International Migration Review, 53(1), pp.26-58. Retrieved from https://doi.org/10.1177/0197918318767931

France, S.L. and Ghose, S., 2019. Marketing analytics: Methods, practice, implementation, and links to other fields. Expert Systems with Applications, 119, pp.456-475. Retrieved from https://doi.org/10.1016/j.eswa.2018.11.002

Kang, X. and Pang, H., 2022. City selection for fresh produce e-commerce’s market entry strategy: Based on the perspective of urban logistics competitiveness. Transportation Research Interdisciplinary Perspectives, 13, p.100-137. Retrieved from https://doi.org/10.1016/j.trip.2022.100537

Lopreite, M., Panzarasa, P., Puliga, M. and Riccaboni, M., 2021. Early warnings of COVID-19 outbreaks across Europe from social media. Scientific reports, 11(1), p.21-47. Retrieved from https://www.nature.com/articles/s41598-021-81333-1

McArthur, J.J. and Powell, C., 2020. Health and wellness in commercial buildings: Systematic review of sustainable building rating systems and alignment with contemporary research. Building and Environment, 171, p.106-135. Retrieved from https://doi.org/10.1016/j.buildenv.2019.106635

Nunes, R., Silva, V.L., Consiglio-Kasemodel, M.G., Polizer, Y.J., Saes, M.S.M. and Favaro-Trindade, C.S., 2020. We are assessing globally changing food patterns: A country-level analysis on the consumption of food products with health and wellness claims. Journal of Cleaner Production, 264, p.12-16. Retrieved from https://doi.org/10.1016/j.jclepro.2020.121613

Obermayer, N., Kővári, E., Leinonen, J., Bak, G. and Valeri, M., 2022. The wine industry case study shows how social media practices shape family business performance. European Management Journal, 40(3), pp.360-371. Retrieved from https://doi.org/10.1016/j.emj.2021.08.003

Oguji, N. and Owusu, R.A., 2021. Market entry into Africa: Acquisitions and international joint ventures. Studies of foreign firms’ market entry strategies, challenges, and performance in Africa. Thunderbird International Business Review, 63(1), pp.5-9. Retrieved from https://doi.org/10.1002/tie.22170

Plata, A., Motoki, K., Spence, C. and Velasco, C., 2022. Trends in alcohol consumption about the COVID-19 pandemic: A cross-country analysis. International Journal of Gastronomy and Food Science, 27, p.100-197. Retrieved from https://doi.org/10.1016/j.ijgfs.2021.100397

Ponzoa, J.M. and Erdmann, A., 2021. E-commerce customer attraction: Digital marketing techniques, evolution and dynamics across firms. Journal of Promotion Management, 27(5), pp.697-715. Retrieved from https://doi.org/10.1080/10496491.2021.1880521

SCOTLAND, O.A., 2019. ENERGY DRINKS AND CHILDREN. Retrieved from https://www.obesityactionscotland.org/media/cllp1p1x/energy-drinks-and-children.pdf

Wichmann, J.R., Uppal, A., Sharma, A. and Dekimpe, M.G., 2022. A global perspective on the marketing mix across time and space. International Journal of Research in Marketing, 39(2), pp.502-521. https://doi.org/10.1016/j.ijresmar.2021.09.001

Wu, X., Zha, Y., Li, L. and Yu, Y., 2022. Market entry strategy in the presence of market spillovers and efficiency differentiation. Naval Research Logistics (NRL), 69(1), pp.128-143. Retrieved from https://doi.org/10.1002/nav.21983

Zwarteveen, J.W., Zawwar, I. and Angus, A., 2022. Market entry for wind energy: Strategic approaches for the original equipment manufacturer. Business Strategy & Development, 5(3), pp.165-186. Retrieved from https://doi.org/10.1002/bsd2.188

write

write