Abstract

The younger generation favors currency e-payment for convenience but attracts attention to digital information and privacy issues. How to gain a competitive advantage in the fierce market competition of digital currency e-payment platforms, improve customer satisfaction, and develop a marketing strategy to attract customers’ willingness to use. This study takes the digital currency E-CNY in China as an example and uses a combination of quantitative research questionnaire moderation and qualitative research interview methods. The aim is to explore the relationship between digital RMB and customers regarding age, gender, service quality, perceived risk, perceived security, perceived ease of use, social influence and compatibility, and willingness to use.

Introduction

Digital RMB is legal tender issued by the People’s Bank of China (PBOC), the central bank of China, in digital form, which is primarily positioned as a cash-based payment voucher, i.e., notes and coins in circulation, equivalent to notes and coins, with value characteristics, and legal tender. The digital RMB has four significant functions: scanning Q.R. code payment, remittance, payment collection, and dual offline payment. The dual offline payment function is based on the NFC function module of smartphones, which enables the transfer function’s operation without the need for afore work. E-CNY is convenient and more secure for individuals and businesses to protect their privacy and data. This is because other digital currencies must go through companies such as third-party payment platforms, which inevitably leaves some personal information in these third-party companies. Currently, money used by households and enterprises combines central bank-issued money and liabilities of private financial institutions, most notably bank deposits. While bank deposits can be transferred electronically using payment cards, mobile applications, etc., money must physically change hands in the transaction. (Keister & Sanches, 2022) The digital RMB is issued, supervised, and controlled by the country’s central bank. (Kiff et al., 2020) It also helps to avoid fraudulent offenses using other payment methods.

Since April 2020, the Central Bank of China (CBOC) has conducted a closed beta test of the digital Renminbi (RMB). In January 2022, the CBOC officially went live to launch a pilot class of the application for the digital Renminbi (E-CHY). The beta app reached over 100 million downloads on the app market but reaped many negative reviews out of a possible five. One-fifth of the roughly nineteen thousand reviews on Apple’s mobile app store were negative, with a rating of 4.0 out of five. It even dropped to a 2.6 rating on the Huawei App Market. Although the number of downloads has reached a certain amount, some users are still unwilling to use it. How can we increase users’ willingness to use, enhance E-CNY’s user satisfaction, and promote the application of digital currency in China? Therefore, research is needed to validate the factors affecting the willingness to use E-CNY.

Research Question

The primary objective of this thesis is to research the application of digital RMB in China and find and analyze the factors affecting users’ intention to use E-CNY.

The research objectives are as follows:

- Review the literature to identify the factors influencing the willingness to use digital RMB

- to propose hypotheses on the factors affecting the willingness to

- collect primary data. Confirm the significance of the influencing factors.

- To give suggestions to promote the development of digital RMB by combining the research results.

Literature review

Digital Currency

The digital RMB is issued directly by the central bank and is a digital representation of the sovereign currency, appearing on the liability side of the monetary authority’s balance sheet (Kiff et al.) Digital currencies arose in the private sector, with decentralization as a fundamental feature (Yang, 2023). Digital currency blends the traditional characteristics of money with the convenience of electronic transactions. Digital RMB as a central bank digital currency is different from cryptocurrencies such as Bitcoin, which, as an alternative currency, is not linked to traditional currencies (Gilbert & Loi, 2018). Moreover, the digital RMB is a legally recognized form of money that can serve as a satisfactory medium of exchange for the payment of goods or services and the fulfillment of financial obligations. Yang (2023) points out that private digital currencies such as Bitcoin, which were not included in the economic and regulatory systems of various countries when they started, have no intrinsic value or anchor currency and generally suffer from shortcomings such as high price volatility, which prevents them from being used as a primary currency and are therefore regarded as a ‘digital asset rather than a currency’ by most countries.

Based on monetary sovereignty interests and national economic security considerations, more and more countries have begun to develop central bank digital currencies in recent years (Stanley, 2022). The advantage of this system of central banks controlling the decision of issuance and commercial banks maintaining the issuance and circulation of digital currencies lies in the fact that it not only disperses the risks and pressures of central banks but also avoids the emergence of the phenomenon of ‘financial disintermediation,’ which produces a crowding-out effect on the deposits of commercial banks and also allows for the reasonable regulation and prevention of money laundering and other illegal behaviors ( Yang, 2023).

The U.K. has pioneered systematic research into digital currencies and has taken advantage of leading financial theories and technological innovations. Several countries other than China are conducting or have conducted pilot offerings on a limited scale. One of the typical representatives of retail-based central bank digital currencies is Sweden, which has implemented a digital currency to maintain the current U.S. dollar-dominated international monetary system and achieve a competitive platform advantage (Yang, 2023). The main goals of the central banks in these countries are to increase financial inclusion and maintain the relevance of the central bank in the monetary system. Other objectives include reducing the costs associated with physical cash, increasing the efficiency of the payment system, improving the design and implementation of monetary policy, strengthening financial integrity, addressing potential problems related to private payment systems, such as privacy or monopoly rights, and accelerating stimulus payments after COVID-19 to make the payment system more resilient to shocks.

According to Kiff et al. (2020), potential risks are associated with issuing community development bonds in digital currencies. While digital currencies tend to increase the efficiency of exchange, they may also crowd out bank deposits (Keister & Sanches, 2022), undermine the intermediation function of banks, increase the cost of financing for banks, reduce investment, and impede the transmission of monetary policy.

Political factors

In China, government policy is also a factor to consider. For example, in Jinan, Shandong Province, China, the Jinan municipal government has issued the Implementation Plan for the Pilot Work of Digital RMB in Jinan. It strives to reach 4 million personal digital RMB wallets and 50,000 public digital RMB wallets by the end of 2023, with the total digital RMB transaction volume exceeding 4 billion yuan (Zhou, 2023). Building different payment scenarios, such as payment systems in schools, cultural tourism, sports areas, and utility bill payments in daily life, provides the basis and motivation for encouraging digital RMB.

Electronic Payment & Factors Affecting Customers’ Intention.

However, E-CNY issuance is not just about issuing digital currency but matching it with a corresponding electronic payment method, a mobile app. People can get the equivalent value of digital currency in a digital wallet using a tied bank card top-up.

From most of the studies on e-payments, they focus on consumers’ willingness to use them. According to Slade et al.(2015), the factors that significantly influence the desire to use e-payments are perceived usefulness, social influence, and perceived risk. These factors include website availability, perceived risk, use of web assurance seals, trust, security, and perceived advantages Özkan et al.(2010). According to Lu et al.(2017), privacy protection and mobility are also significant factors influencing the willingness to use, and the importance of social influence is verified as one of the factors. It has also been shown that Musa et al.(2015) revealed the significant impact of functional expectations, social influence, and perceived information security on consumers’ willingness to use e-payments by modeling technology acceptance.

Based on previous research, Tang et al. (2021) further identified seven factors influencing users’ intention to use WeChat mobile payment se: service quality, perceived risk, perceived security, perceived ease of use, social influence, compatibility, and age. Some previous studies by Arning, K. and Ziefle, M. (2007), Phang, C. et al.(2006), and Chaouali, W. & Souiden, N. (2019) found that age is a crucial factor influencing technology acceptance. Although Tang et al. (2021) investigated the primary incentives to use mobile payments, there are some limitations, and it did not find any differences in consumers’ preferences in different age groups.

Reviewing the previous studies, this study will further identify the factors influencing users’ intention to use digital RMB e-payment and formulate hypotheses about them. Therefore, the current research can divide consumers into different age groups and determine if there are various influencing factors. Other groups of customers of different ages and genders could also be used to identify differences and moderating effects and to explore their acceptance of the digital RMB in adopting e-payments.

Methodology

This part of the report presents the research methodology used to collect the data required for this study. The method’s credibility is discussed after justifying the questionnaire design, sampling procedures, and data analysis techniques.

Research philosophy and methodology

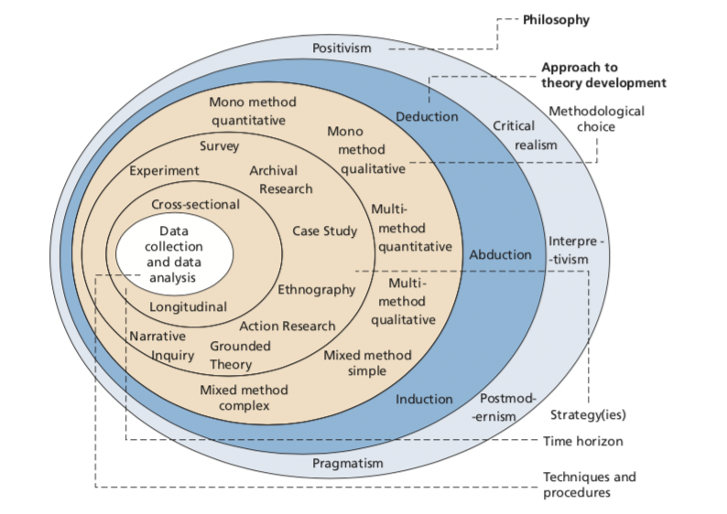

Figure 4.1 Research onion, adopted from Saunders et al., 2019

The research philosophy of this paper is pragmatism. Pragmatists believe that there are many different ways of interpreting the world and conducting research, no one view provides the whole picture, and multiple realities may exist (Saunders et al., 2019). In addition, this study will adopt an inductive approach, using a mixed research methodology, combining quantitative and qualitative research. The quantitative research will use questionnaires to collect primary data. The qualitative research will use semi-structured interviews to collect preliminary data.

Research design

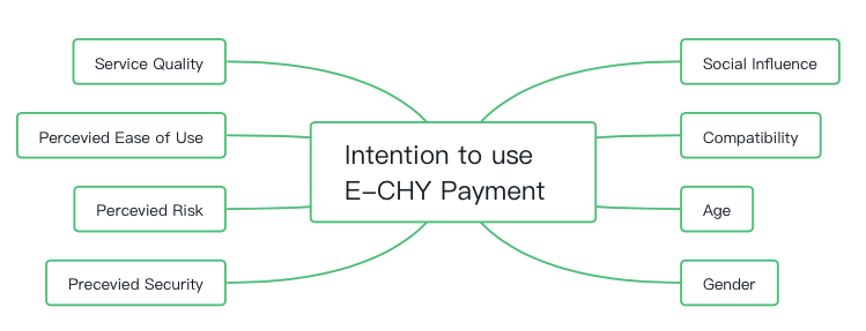

The main objective of this study is to analyze the factors that influence users’ intention to use digital RMB. Referring to the Unified Theory of Technology Acceptance and Use (UTAUT) model proposed by Venkatesh, V.; Morris et al. (2023), and according to Jear (20xx), six factors are summarised that directly affect the intention to use digital payment which not only includes performance expectation, ease of use expectation, social influence, convenience performance but also introduces two factors such as gender and age which adjustment variables such as gender and age. The proposed research model is shown in Figure 4.2.

Figure 4.2

Previous studies show that customers of different ages have different attitudes and perceptions towards digital products and e-payment. Younger generations who grew up in the information age are more likely to understand and accept digital products and e-payment platforms and are more willing to use these convenient products. However, for those who still maintain the concept of privacy protection and high security, digital products and e-payment platforms cannot relieve their worries, so they believe more in black-and-white evidence and are reluctant to contact and use digital products and e-payment platforms.

Both paper and online questionnaires are randomly distributed. The self-administered online survey is conducted through a professional third-party questionnaire platform, and the questionnaire will be allocated using convenience sampling. The total sample size is 500. To ensure the completeness of the questionnaire, the questionnaire is available in both English and Chinese. Compared with the traditional method, online data can reduce some bias (Bell et al.) The questionnaire will be designed with 20 questions to survey users in eight areas: service quality, perceived risk, perceived safety, perceived ease of use, social impact, compatibility, gender, and age. There will be a screening question at the beginning of the questionnaire. Any respondent with experience of using digital RMB is eligible to participate. The questionnaire covers all possible factors and examines the relationship between consumers’ intention to use digital RMB payment platforms through relevant analyses.

This study will also investigate whether individuals or organizations are willing to use digital currencies to receive payments. Therefore, this study will interview individual merchants, shopkeepers, and company finance and management personnel. In the survey by Civelek et al. (2021), the researcher uses structured interviews to determine merchants’ perceptions of using digital currencies, payment methods, and payment systems. Direct semi-structured personal interviews will be used to understand other factors that may influence their adoption decision. The interview method is well suited to collecting large amounts of textual data and opinions from small samples (Clough & Nutbrown, 2012).

Data source

The source of data for this study is primary data collected through questionnaires and semi-structured interviews. Raw data sources include questionnaire participants and interviewers from businesses, self-employed, and other sample groups. Preliminary data were chosen because they can be obtained as a direct data source through well-designed data collection methods. In addition, primary data sources are broader, more credible, more accurate, and more in line with the research objectives of this study.

Quantitative research mainly uses questionnaires and surveys with fixed questions and options that participants can tick in a defined box. The questionnaire will be divided into three main sections. The first section is used to differentiate between participants’ age range, gender ratio, etc. The second part measures the participants’ selection criteria for these factors. The answers will be on a Likert scale from 1 “strongly agree” to 5 “strongly disagree” to measure the strength of feeling. The third section will ask questions in more detail, and the answers may contain subjective elements. Finally, data will be collected in statistical form for further analysis through statistical tools.

In the qualitative study, the research will be conducted through 20 semi-structured interviews to understand the participants’ perspectives. The interviews will be conducted face-to-face or over the phone, lasting between 10 and 30 minutes. The interviews will be audio-recorded, converted to text, and transcribed to ensure data organization. The final data will be stored electronically in text format.

Data analysis

The data analysis for this study will be quantitative. The questionnaire answers will be analyzed using statistical tools such as SPSS. The questionnaire was first analyzed using descriptive statistics to analyze personal information factors such as age range, gender ratio, etc. Secondly, analysis of variance will be used to show whether there are significant differences between groups, such as age range and gender. Then, the collected data will be analyzed for correlation. Multiple regression analysis was used to confirm the relationship between the eight independent and dependent variables and test the hypotheses proposed. Pearson correlation coefficient analysis was also used to demonstrate the significance of the factor effects.

Regarding the research data of the qualitative study, this study will use thematic analysis. The interview textual data will be calculated and statistically analyzed through the qualitative data analysis software NVivo. The text was remodeled through thematic modeling as a set of themes and distributions of these words. Thematic coding was then done by extracting single or repeated keywords in the textual data. This process helped to categorize the data to identify relationships and patterns in the data.

Research gap and intended contribution

The main contribution of this paper is to identify the factors affecting consumers’ willingness to use digital RMB e-payment, which will provide essential insights into the development of financial innovation technologies, especially digital payment systems, and encourage customers to use digital RMB e-payment applications. This paper will provide a reference and some regular insights into the willingness to use digital currency in other countries. However, based on the fact that this study takes the digital currency of China’s central bank as an example, whether or not this paper is relevant to other countries in the context of socialist policies with Chinese characteristics remains to be explored. Through questionnaire mediation and interviews with different customer groups and age groups, as well as extending previous research, the regression model is used to integrate the relationship between the factors and the intention to use digital payment to predict and explain to what extent the proposed potential factors can explain the intention to use digital payment and to provide a theoretical basis for future research. The research data and results of this thesis will positively impact improving the benefits of the E-CNY application. It gives user impact feedback that can provide references and suggestions for promoting digital currencies, attracting more users to promote financial innovation, and facilitating its development. At the same time, it also gives users a clearer understanding of E-CNY.

Ethical considerations

| Possible risks | Mitigation Methods |

| Difficulty in the distribution and collection of questionnaires to high-age groups | After obtaining consent, patiently explain and guide |

| Difficulty in obtaining consent from interviewees | Obtaining the consent and trust of the participant or seeking assistance |

| Protection of personal information | It was collected by lawful means, with permission and authorization. Protect information from disclosure. |

Action Plan

| Timetable for completion of the project | ||

| The first year | Semester 1 | Read much literature and consult with supervisors to clarify the project theme and feasibility. |

| Semester 2 | Read much literature and communicate frequently with supervisors, organize literature, write the project outline, and start to write it. | |

| Semester 3 | Read a lot of literature, start to write the project, and formulate and revise the questionnaire and focus group interview outline. | |

| The second year | Semester 1 | After obtaining permission, research participants will be sought, and questionnaires will be distributed. |

| Semester 2 | Data collection | |

| Semester 3 | Data analysis | |

| The third year | Semester 1 | Collect and analyze data, write based on data and literature |

| Semester 2 | Write and communicate writing details with supervisors. | |

| Semester 3 | Proofreading | |

Reference

Alzoubi, H.M. et al. (2022). ‘The effect of E-payment and online shopping on sales growth: Evidence from the banking industry,’ International Journal of Data and Network Science, 6(4), pp. 1369–1380. doi:10.5267/j.ijdns.2022.5.014.

Arning, K.; Ziefle, M.(2007) ‘Understanding age differences in PDA acceptance and performance,’ Comput. Hum. Behav. 2007, 23, 2904–2927.

Bell, E., Harley, B. & Bryman, A., (2022). Business research methods, Oxford: Oxford University Press.

Chaouali, W. and Souiden, N. (2019). “The role of cognitive age in explaining mobile banking resistance among elderly people,” Journal of Retailing and Consumer Services, Vol. 50, pp. 342–350, doi: 10.1016/j.jretconser.2018.07.009.

Civelek, M. et al. (2021). ‘Digital local currencies as an alternative digital payment method for businesses to overcome problems of COVID-19 pandemic’, Polish Journal of Management Studies, 23(2), pp. 57–71. doi:10.17512/pjms.2021.23.2.04.

Clough, P. & Nutbrown, C., (2012). A student’s guide to methodology, London: SAGE.

Dimitrova, I., Öhman, P. and Yazdanfar, D. (2021). ‘Barriers to bank customers’ intention to fully adopt digital payment methods,’ International Journal of Quality and Service Sciences, 14(5), pp. 16–36. doi:10.1108/ijqss-03-2021-0045.

Gilbert, S. & Loi, H. (2018). ‘Digital Currency Risk,’ International Journal of Economics and Finance, 10(2). doi:10.5539/ijef.v10n2p108.

Jin, N. (2007). ‘Analysis of current E-payment solution in China-third party payment platform,’ The First International Symposium on Data, Privacy, and E-Commerce (ISDPE 2007) [Preprint]. doi:10.1109/isdpe.2007.22.

Keister, T. and Sanches, D. (2022). ‘Should Central Banks issue digital currency?’, Working paper (Federal et al. of Philadelphia) [Preprint]. doi:10.21799/frbp.wp.2021.37.

Kiff, J. et al. (2020). ‘A Survey of Research on Retail Central Bank Digital Currency,’ IMF Working Paper.

Lu, J.; Wei, J.; Yu, C.-S.; Liu, C.(2017) ‘How do post-usage factors and espoused cultural values impact mobile payment continuation?’ Behav. Inf. Technol. 2017, 36, 140–164.

Musa, A.; Khan, H.U.; AlShare, K.A. (2015) ‘Factors influence consumers’ adoption of mobile payment devices in Qatar.’ Int. J. Mob. Commun. 2015, 13, 670

Phang, C.; Sutanto, J.; Kankanhalli, A.; Li, Y.; Tan, B.; Teo, H.-H. (2006) ‘Senior Citizens Acceptance of Information Systems: A Study in the Context of e-Government Services,’ IEEE Trans. Eng. Manag. 2006, 53, 555–569.

Saunders, M., Lewis, P. & Thornhill, A. (2019). Research methods for business students 8th ed., Harlow: Pearson.

Slade, E.L.; Dwivedi, Y.K.; Piercy, N.C.; Williams, M.(2015) ‘Modeling Consumers’ Adoption Intentions of Remote Mobile Payments in the United Kingdom: Extending UTAUT with Innovativeness,’ Risk, and Trust. Psychol. Mark. 2015, 32, 860–873.

Stanley, A. (2022). ‘The Ascent of CBDCS[EB/OL]. http://www.imf.org/en/Publications/fandd/issues/2022/09/Picture-this-The-ascent-of – CBDCs , 2022-10-6

Tang, Y.M. et al. (2021). ‘Financial innovation in digital payment with WeChat towards electronic business success,’ Journal of Theoretical and Applied Electronic Commerce Research, 16(5), pp. 1844–1861. doi:10.3390/jtaer16050103.

Yang, S. (2023). ‘Central Bank Digital Currency Legal System Evolution Form International Law Perspective,’ Zheng Fa Lun Cong, 1.

Zhou, X. (ed.) (2023). ‘Jinan Heavy Release!Pilot “E-CNY,” it is about your wallet’, Qilu Evening News, 9 June.

write

write