Abstract

In ensuring smooth contracting between shareholders and managers, conservatism financial reporting is the most suitable, especially in agency concerns. When the shareholders are distanced from the managers, agency issues arise. In the instance where the separation of control and owner is pronounced, there occur slow managerial ownership. Conservatism encourages situations where the positive outcomes or achievements are recognized while the adverse outcomes are ignored. Therefore, the bad news is acknowledged as losses, while the excellent news is recorded as gains. Lafond & Roychowdhury (2008) help us understand the existing relationship between accounting conservatism and managerial ownership. The ownership structure significantly influences financial reporting. It encompasses information sources including but not limited to decision-makers, financial analysts, academics and auditors. This research paper examines the relationship between internal control weakness and accounting conservatism. It derives potential evidence from the post-Sarbanes-Oxley Period.

Introduction

The rise mainly influenced the motive behind enacting the Sarbanes-Oxley Act of 2002 in company scandals that damaged the confidence of shareholders and investors. The loss of confidence has been associated with the supply of unreliable and invalid financial reporting. Some of the common companies reportedly involved in these scandals are WorldCom and Enron. The Sarbanes-Oxley Act influences financial reporting through accounting conservatism. There is a close connection between these variables. The change in SOX significantly accelerates financial reporting. The weaknesses in the internal control have further implications for the SOX (Mitra et al., 2013). The formulation and enforcement of the Sox was critical in addressing the disparities between managers and shareholders. Managers would gazette invalid financial reports to tap shareholders. In this case, managers would exploit shareholders as they continue to channel wealth and other resources from the firm into their pockets. With the Sarbanes-Oxley Act of 2002, these scandals were mitigated and addressed effectively. The law helped promote a sense of openness and transparency between managerial ownership and shareholders. This paper examines the relationship between internal control weaknesses and accounting conservatism.

According to the Sarbanes-Oxley Act, companies should ensure effectiveness in their financial reporting and safeguard the interests of the shareholders and investors. The regulation emphasizes the need for transparency while providing reports on how a firm behaves financially. Section 404 (b) requires public firms to take full responsibility for financial reporting, provide oversight and ensure the processes align with the set guidelines. The internal control mechanism should take charge and ensure that no malpractices may aim to manipulate investors in the name of misstatements (Mitra et al., 2013). The AICPA mainly urged the enforcement of Section 404 (b) to protect investors’ rights. These laws have significantly created room for improved financial performance reporting.

The level of transparency has increased in the post-Sarbanes-Oxley Period. Across the public firms, investors have similar rights to enjoy based on this Act. However, small-scale companies have maintained that these guidelines and regulations subject them to huge burdens and costs resulting from thorough assessment and monitoring of financial reporting at the organization level. Many corporate firms tried to advocate for their exemption from Section 404 (b). This led to significant amendments that excluded companies from this Act, particularly the public organizations with less than $75 million public float. Small firms were later exempted from Section 404 (b) provisions upon the amendment of the Business Startups Act (JOBS Act). This law, which targeted small enterprises that stayed within the required public float, excepted them from adhering to Section 404 (b) in their first five years of operation.

The Sarbanes-Oxley policy allows financial reporting practices that promote a sense of validity, honesty and integrity. This is significantly meant to build confidence in shareholders and investors based on the credibility and reliability of the information availed by firms while reporting their financial performances. The Sarbanes-Oxley Act was enacted to protect investors, employees, and employers. The Act helped create a sustainable and conducive environment for smooth operations. In this case, any firm operating in line with the set regulations would experience increased assets, creating room for growth. Financial transparency attracts investors as companies embrace Section 404 (b) of the Act. Organizational management is tasked with the enormous responsibility of ensuring credibility. Failure to do so would attract huge penalties and other criminal charges per the Act’s provisions. The organization at large is encouraged to carry out audits to enhance credibility. The law also recognizes the importance of protecting the whistle-blowers of these malpractices at the organizational level. The Sarbanes-Oxley Act is committed to maximizing the capacity to comply with the set regulations on financial reporting and preventing the eruption of deviant behaviours that encourage fraud. The case of Enron and its collapse demonstrated the heavy consequences of financial fraud and non-compliance with the Sarbanes-Oxley Act.

Literature Review

To establish transparency and accountability during financial reporting, internal control plays an important role—the weaknesses around financial reporting subject shareholders to inevitable uncertainties. Investors need up-to-date and correct financial information to make informed investment decisions. According to a study by Lafond et al. (2008), accounting conservatism is a critical tool that potentially prevents overstatement of financial records. Instead, it ensures that the financial reporting is done in the most trustworthy manner. The study admits that increased managerial ownership proportionally maximizes conservatism as far as financial reporting is concerned. The managerial ownership structure directly affects the accounting activities (Lafond et al., 2008).

The standards behind financial reporting among firms are primarily dictated by corporate oversight and the regulating atmosphere created by the Sarbanes-Oxley law. Internal control mechanisms influence critical management decisions in an organization. This means that weak internal control systems would establish avenues for poor management decisions that may lead to manipulation of financial records for the interests of a few individuals. The efficiency of internal control systems continues to evolve. Changes in laws governing business ethics have consistently shaped how organizations operate. For instance, section 404 (b) of the Sarbanes-Oxley Act has created opportunities for investors (Mitra et al., 2013). The laws encourage legal and ethical business practices that uphold and respect investors’ rights. It has assured investors of access to open and accurate, free, valid, and accurate information. The provision of the law has stipulated the legal actions to be taken against organizations or managers that breach the law for their own selfish gains. Therefore, business transactions have continued to embrace transparency in the post-Sarbanes-Oxley Period despite challenges of internal control systems among firms (Mitra et al., 2013).

In the post-Sarbanes-Oxley period, a direct connection existed between accounting conservatism and internal control weaknesses. Doyle et al. (2007) argue that companies that provide material facts surrounding their financial wellness contain diversified and sophisticated practices, making them enjoy economies of a large scale. However, such firms are subject to weaknesses such as high restructuring costs and weaker financial stability. Before the Sarbanes-Oxley period, studies examining the main subject gave adequate supporting facts concerning internal control (Mitra et al., 2013). A study conducted on 73 companies discovered that the restatement of financial reporting negatively influenced their ability to make profits and expand their presence. Furthermore, small-scale companies with weak internal control present high chances of voluntarily reporting compared to large firms.

Internal control issues are directly linked to the firm’s restatement. Limited literature exists on crucial drivers of restatement. However, relevant studies argue that the level of profitability and size of the firm are negatively affected by events of restatement. A study conducted examining 440 restatements from various firms found that there were significant variations in terms of profitability and company size caused by restatement. Companies experiencing restrictions are more likely to have inadequate internal control mechanisms. One of the critical aspects behind restricting is that it places a company in a delicate situation, allowing ineffective control. It may lead to the loss of potential staff members and even reduce the size of departments, creating room for internal control weakness. The organizational structure must, therefore, be the core for determining a company’s internal control system. The control system should meet the requirements surrounding the firm’s structure.

The company restructuring process further attracts challenges around adjusting and estimating accruals. As a result, there is a high chance for such a firm to experience weak internal control mechanisms because of needing more personnel. Another study demonstrated that there were firms which had internal control issues. Focusing on Nortel Networks, the firm needed to adhere to regulations on balance adjustments and monitoring, which were influenced by restrictions. These expanded the company’s vulnerability to compromised internal control systems. As a result, there is a need for corporate governance to monitor and provide oversight on the company’s financial reporting and ensure they are aligned with the course. Indeed, the quality of internal control is significantly dictated by the level of corporate governance. Reports indicate that firms under corporate governance experience fewer risks related to weak internal control. These firms can have little or no problems with internal control since their financial reporting is well-examined and scrutinized.

Research on the influence of SOX on financial reporting has demonstrated consistency in their findings, revealing that SOX fostered a sense of financial accuracy after it was implemented. It helped fight against the use of material facts that relied on reporting inaccurate financial data and the non-GAAP as a tool for estimating earnings. SOX has successfully been able to fight against the company’s CEOs and managers from providing unreliable financial reports to manipulate the shareholders for their good. The severe penalties introduced by the SOX strengthened the need to provide certified information on the company’s financial performance. As per the SOX, the individuals involved in these malpractices are subject to criminal-related charges. They would be liable for their unethical practices. SOX acknowledges the ability to avail misstatement as an act of fraud. Evidence from the literature therefore, reveal that, after the implementation of SOX regulation, there was a significant fall in financial misstatement at the organization level. Significantly, the SOX increased the level of conservatism. These findings are consistent, citing the urgent need for company managers and CEOs to abide by the set guidelines and standards for financial reporting. As per SOX, the repercussions of financial misstatements were unbearable, making managers provide valid financial performance metrics.

The fallout in an organization’s control mechanism is affiliated with the structure of such an organization; oversight approaches and the availability of incentives for management. The challenges leading to weaker internal control mechanisms can best be understood in the context of these factors. Doyle et al. (2007) note that the combination of these factors may compromise the ability of the firm to provide adequate oversight throughout the financial reporting practices. Accounting conservatism is, therefore, at risk of being compromised if the management needs to provide adequate oversight and incentives for appropriate financial reporting. Furthermore, it is noted that managerial ownership is directly proportional to accounting conservatism. The higher the managerial ownership, the higher the chances of conservatism across financial reporting. Lafond et al. (2008) demonstrate that a company’s ownership structure dictates accounting choices during financial reporting.

Research indicates that most companies that experience internal control weaknesses are large-scale firms with massive operations. These firms are believed to be stronger financially with diversified business operations. This means that the nature and complexity of the diversified operations make it difficult for the companies to effectively monitor and evaluate their financial records before reporting. This increases the chances of internal control weaknesses. The ability to maintain accurate financial reporting is significantly affected by the rate at which these firms are experiencing massive growth and expansion. Besides, firms with company-wide issues have limited incentives to promote credible and reliable financial reporting practices. These issues are rooted in a firm’s staffing, determination of tax obligations and priorities and issues related to poor documentation. Studies reveal that there is are high chance of a company experiencing poor staffing to have internal control problems amid financial reporting. These firms are mainly characterized by factors such as increased bankruptcy. Lack of access to reliable resources may hinder achieving financial transparency.

Other crucial factors that may influence a firm’s internal control mechanism are processes for risk management, information technology mechanisms, intricacy around product offerings such as geographical distribution, and marketing strategies, among others. Any type of internal control mechanism is vulnerable to these factors. However, they may vary based on the size of an organization. For instance, reflecting on the case of a global firm, Baxter International Inc., the company demonstrated inefficiencies in its internal control system due to the complex nature of organizational structure to meet the required standards to maintain credible financial reporting. Lack of material wellness to internal control mechanism in the case of Baxter International Inc. hindered its efforts in ensuring transparency in financial reporting.

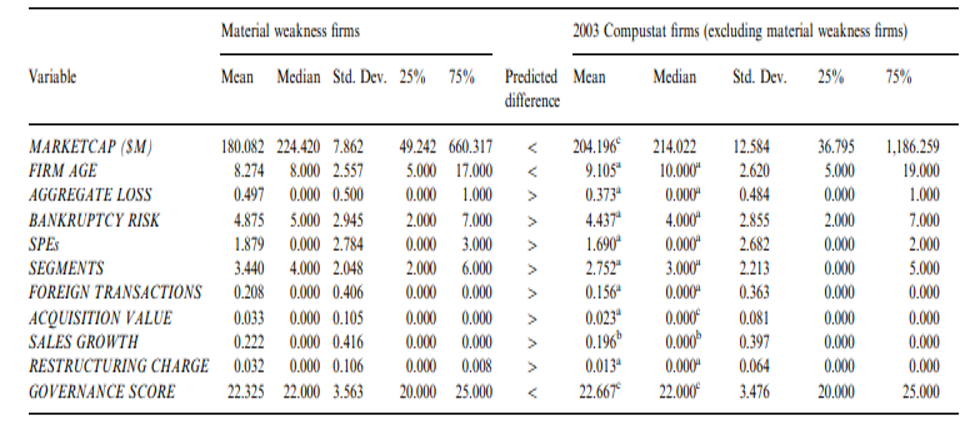

The variables, including market gap, segments, SPEs, and firm age, among others, influence the material weakness of a company and its internal control mechanism. As seen in table 1, the size of a firm is mainly determined by the log of market segmentation. Table 1 shows that the mean value is smaller in relation to material insufficiencies in the firm. This demonstrates that the quality of the internal control mechanism is determined by the actual size of the firm, which is dictated by market segmentation. Another critical variable is the age of the firm. Older firms tend to have weakened internal control mechanisms. The mean material weakness for these firms is distributed in terms of traded duration, 8.3 years and 9.1 years; the data from table 1 shows that these firms are subject to issues of bankruptcy and aggregate loss resulting from the incapacity to unravel credible financial performance data (Doyle et al., 2007).

The SPEs, Segments and forces from the foreign exchange market are reportedly common among firms with compromised internal control mechanisms. This expands on the existing complexities around financial reporting, hindering transparency and credibility. Influenced by these factors, accounting challenges prevent firms from exercising their responsibilities in information sharing about a firm’s economic and financial well-being. Internal control issues are also directly linked to rapid growth. The rise in acquisition value creates disparities for companies to account for their operations in a more effective manner (Doyle et al., 2007). The acquisition value is higher for materially weak companies, making it difficult for them to adjust to rapid growth and expansion. Furthermore, this increases the chances of error and omission during financial reporting, thus internal control problems. Changes in the structure of an organization cause massive disruptions. As per research, it may be challenging for firms undergoing restructuring changes to ensure credibility in their financial reporting.

Table 1: Material weakness companies against 2003 Compustat companies

In internal control, there are high risks of material weaknesses among smaller, financially unstable, younger and rapidly growing firms. Moreover, findings from various studies have been consistent, demonstrating a close relationship between internal control weakness and accounting conservatism. Factors including limited access to resources and the complex nature of accounting mainly contribute to the insufficiencies of internal control mechanisms. Moreover, the business dynamics and diverse business environments expose firms to difficult economic situations to cope with operations.

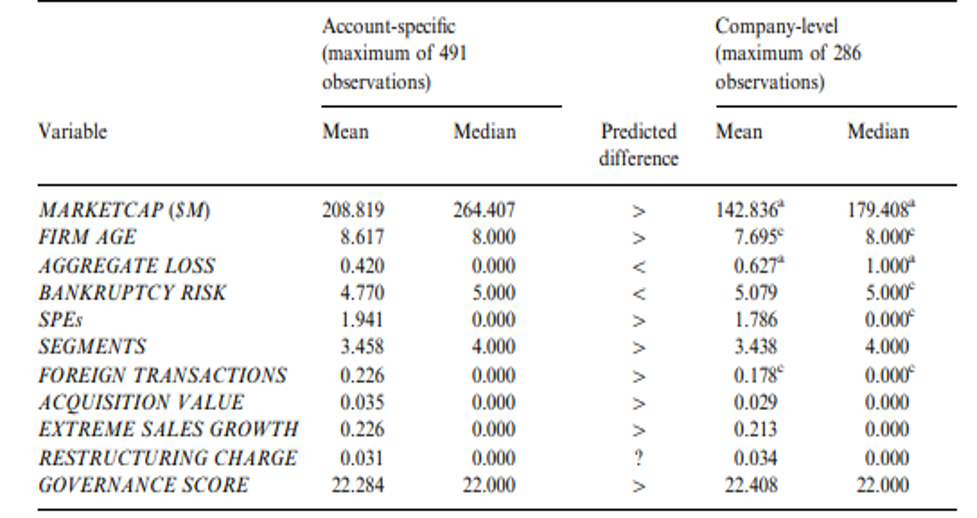

Table 2: Material weakness firms by severity of deficiency

The underlying forces for weakness and the level of severity helps determine and understand the material weakness disclosure of firms. These events are apparent in auditable accounts, in which some may or may not be rectified. The level of complexity in these auditable accounts determines the ability to either achieve or fail to achieve accountability conservatism. Furthermore, the level of staffing also dictates the accuracy of auditable accounts. Poor staffing may result in inaccurate and unreliable financial reporting, thus damaging the interests and confidence of shareholders and investors. The ability to ensure a smooth and efficient internal control is hindered by the acquisition activities of a firm, the rapid change in the business landscape and the challenges around the business’ operating environment. As firm’s growth larger, older and stable in terms of financial stability, they are not able to meet up the financial auditing requirements (Mitra et al., 2013). These kinds of firms tend to have increased levels of transactions, limiting their capabilities to pay attention to financial detail. As a result, they end up experiencing challenges with the internal control.

Comstock Homebuilding Company have reliable auditors that have helped facilitate accurate and timely financial reporting. This has helped remove barriers to effective internal control system of the firm (Doyle et al., 2007). Moreover, there have been reports by these auditors regarding possible conditions creating avenues for material weakness in the firm’s internal control system. These forces have created need for adjustments in effort to strictly align to the required accounting principles and ethical practices empathized by Sarbanes-Oxley Act. The company’s capacity to align by these principles and standards can be traced from their level of completeness in presenting financial data. Independent auditors have been instrumental in spearheading all these. By working closely with relevant finance departments, the company has attained a high level of credibility and a sense of transparency while sharing important facts surrounding the firm’s financial performance over time.

Despite research having played a crucial role in examining the relationship between internal control weaknesses and accounting conservatism, there is still limited knowledge regarding the behavior of material weaknesses disclosures during the first few years in which the Sarbanes-Oxley Act was enacted. There is limited information about how the Act would continue to influence the internal control system in the future even as auditors and relevant persons familiarize with the requirements set by the Act. Moreover, firms have diverse systematic features that make it difficult to realize the extent to which they meet the expectations of the Sarbanes-Oxley Act while drafting and presenting financial statements (Doyle et al., 2007). The incapacity of some firms to reveal their material weakness limits the credibility of research, which aim to establish key factors associating internal control weakness and accounting conservatism. As a result, future research is encouraged to modify and amend materiality decisions.

Firms focusing more on growth are vulnerable to internal control weaknesses with poor accountability conservatism. As demonstrated by research, these firms engage in diverse business operations that limit their focus on monitoring the financial performance records for the interest of the shareholders. However, the Sarbanes-Oxley Act of 2002 laws have been the game changer in bringing in regulations that govern how firms should develop and present their financial records (Lobo et al., 2006). Notably, there is limited literature regarding the effectiveness of these regulations towards internal control systems. There is likelihood of firms strictly adhering to these requirements as they acquire professional auditors to help conduct financial recording with high level of transparency and openness. As time goes by, auditors and relevant managers continue to familiarize themselves with the regulations. This means that the effectiveness of the regulations would be enhanced in the future. Besides, shareholders are also aware of their rights and obligation as far as accessing reliable and valid financial record is concerned. Firms such as Comstock Homebuilding have well established auditors that have helped improve accuracy in financial reporting. This provides sense of direction for future firms intending to protect themselves from the legal consequences associated with the violation of Sarbanes-Oxley Act of 2002.

In conclusion, internal control weakness is directly related to accountability conservatism based on the material facts obtained in the post Sarbanes-Oxley era. In this Period, firms have been forced to strictly abide by the set standards while sharing financial information with their respective shareholders and investors. The provision of the law, Sarbanes-Oxley Act of 2002, was enacted to protect investors against unethical or malicious practices by firms or individuals in organizations striving to serve their own interests (Lafond et al., 2008). The internal control weakness is majorly influenced by factors such as organizational structure, size of the firm, and staffing capacity, among others. The challenges that hinder effectiveness in the internal control systems create opportunities for manipulation of financial reporting. Research shows that enhanced internal control systems result in high accountability conservatism (Doyle et al., 2007). This means that firms which have strong internal control mechanisms have adequate resources, well-equipped personnel and auditors to help create and monitor financial reporting activities. Internal control weakness have also been associated with aspects such size of the firm, level of growth and diversity of business’ operations. Large companies that enjoy economies of scale have demonstrated challenges in their internal control capabilities because of their inability to pay attention to every detail of their financial record, leading to inaccurate and invalid financial data.

Reference

Doyle, J., Ge, W., & McVay, S. (2007). Determinants of weaknesses in internal control over financial reporting. Journal of Accounting and Economics, 44(1-2), 193-223.

Lafond, R., & Roychowdhury, S. (2008). Managerial ownership and accounting conservatism. Journal of Accounting Research, 46(1), 101-135.

Lobo, G. J., & Zhou, J. (2006). Did conservatism in financial reporting increase after the Sarbanes‐Oxley Act? Initial evidence. Accounting Horizons, 20(1), 57-73.

Mitra, S., Jaggi, B., & Hossain, M. (2013). Internal control weaknesses and accounting conservatism: Evidence from the post–Sarbanes–Oxley period. Journal of Accounting, Auditing & Finance, 28(2), 152-191.

write

write