1. Introduction

Huawei Technologies Co., Ltd., a worldwide Chinese technology firm with Chinese operations, is headquartered in Shenzhen, Guangdong, China. It creates and sells cutting-edge telecommunications equipment for both consumers and businesses. Ren Zhengfei, the company’s founder and a former commander in the Liberation People’s Army (PLA). Huawei was originally a manufacturer of telephone switches. Still, it has since branched out into other areas, such as building telecommunications networks, supplying operational and consulting services and equipment to businesses in China and beyond, and producing consumer communications products. Over 170 nations and territories use Huawei products and services (Yan & Huang, 2022). By 2012, it had surpassed Ericsson as the world’s biggest telecom equipment maker. Its 2018 smartphone production was higher than Apple’s, making it the second biggest smartphone producer globally. Huawei’s overall revenue in 2018 was $108.5 billion. The first month Huawei delivered more smartphones than Samsung and Apple combined were July 2020. The key factor contributing to this decrease was the worldwide effect of the COVID-19 pandemic on Samsung’s sales in the second quarter of 2020. Fairview Research’s IFI Claims Patent Services classified Huawei as the fifth most productive firm worldwide in 2021. The EU Joint Research Centre (JRC) identified Huawei as the world’s second most significant R&D investment in its EU Industrial R&D Investment Scoreboard (Chen et al., 2020).

Since it was initially included on the list in 2012, Huawei has racked up an incredible eight overall entries, making it one of the most creative firms according to the BCG. In the category of creative firms, Huawei made the most significant leap in 2020, moving from 48th to sixth position. This was the highest advance of any other company in this area. TExaminingHuawei Technologies Company Limited’s (Huawei) marketing strategy will be the focus of this paper. This study’s objectives are to conduct an internal (Micro) analysis of the company, which will include customer, competitor, and company analysis; an external (Macro) analysis of the industry using a PESTEL analysis; a SWOT analysis; marketing strategy (S, T, D, P) and provide recommendations; and an analysis of the marketing mix (4 P’s) and the provision of recommendations. This work may be broken down into seven distinct sections.

2. Internal (Micro) Analysis: Customer, Competitor & Company

Customers of Huawei include resellers, distributors, enterprises, and government entities that all operate within the same industry. It provides a complete portfolio of custom-tailored products and services that meet the requirements of businesses of any size, from small start-up operations to large multinational firms. Across various product categories, Huawei faces competition from various firms, including telecommunications corporations, consumer electronics companies, and network infrastructure providers. In the market for consumer electronics, Huawei has competition from various corporations, including General Electric, Hitachi, Samsung, and LG, amongst others. It competes with businesses in the telecommunications sector, such as Airtel, Vodafone Essar, China Mobile, and AT & T, amongst others (Abd Rahim et al., 2022).

Regarding research and development, it enjoys an advantage over its rivals. The corporation can retain a competitive advantage across all of its product lines thanks to an investment of around 10% of sales in research and development (R&D) activities and the devotion of approximately 44% of the workforce, or over 79,000 workers. The company devotes fifteen percent of its yearly revenue to research and development, which amounts to CNY 59,607,000,000. Second, the organization has strategic ties and cooperation with other businesses, which gives it a competitive edge in the market. The company has been able to keep a competitive advantage because of its close collaboration with Fortune 500 companies to develop a business-driven information and communication technology infrastructure. It has developed fruitful agreements with firms such as NTTDocomo and Proximus, the cellular operator Zain in the Middle East, and over 50 Chinese PV enterprises.

The corporation will now be concentrating its efforts on one of its three Strategic Business Units (SBUs). Its consumer sector is classified as a question mark by the BCG matrix owing to the significant competition it faces from other businesses operating in this market. On the other hand, its corporate solutions and network communication & infrastructure sectors are rated as Stars by the matrix.

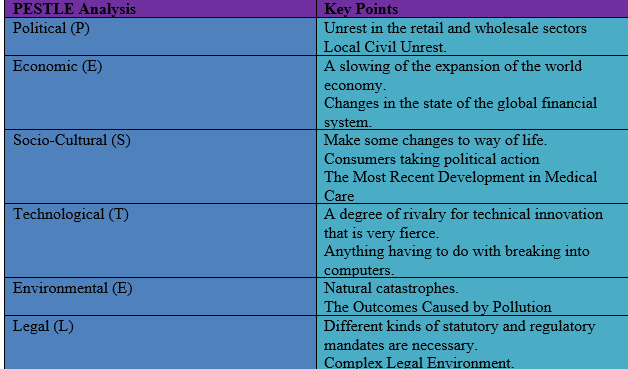

3. External (Macro) Analysis: PESTEL

Using PESTEL, we were able to pinpoint the overarching factors of our environment that were having an impact on the business. PESTEL stands for “political, economic, social, technological, ecological, and legal/regulatory.” One political factor is the ongoing trade war between the United States and China, Huawei’s home market. In this context, Huawei distinguishes out as a leader in producing telecom equipment and smartphones. US national security regulations hampered the company’s operations. Companies like Google, Qualcomm, and Intel have all banned it from their offices in the United States. The political risk of international business is still there for Huawei despite the US relaxing restrictions. Huawei is also in charge of all foreign activities. Business and individual spending are both impacted by the unrest in these countries. The company faces risks due to political instability (GUANGHUI, 2019).

Economic indicators suggest that political conditions in high-income and low-income countries have hampered global economic development. Changes in interest rates and currencies pose a risk to the international monetary system. Many people believe that Huawei’s issues are monetary.

Several cultural indicators suggest that a more digital way of life encourages consumer activism and originality. Moreover, it motivates people to seek out therapeutic tools. The aging of the population is also a factor. Older people are fans of cutting-edge healthcare equipment. This opens the door for Huawei to produce and market many more products.

As innovation in technology travels from research labs to commercial outlets, Huawei must compete for fresh ideas. The company must devote significant resources to research and development if it wants to keep up with technological advances in the industry and integrate them into its goods. The issue of cyber security is urgent. Instability in the operating system is a direct result of hacking. Threatening conditions exist for Huawei (Lin, 2022, April).

Pollution and natural disasters pose risks to business growth. Natural disasters cause much unpredictability, and Huawei has to deal with it. Huawei has a presence in 170 countries worldwide. There are legal and regulatory hurdles that the company must overcome. Conforming to the law is challenging in any country or region. The intricacy of the law affects how businesses conduct themselves.

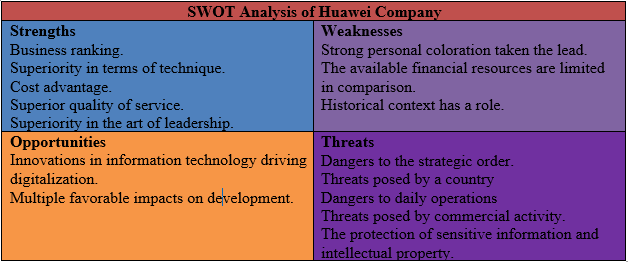

4. HUAWEI SWOT analysis

4.1. Strengths

Business ranking: HUAWEI is the market leader in mobile network infrastructure. While the United States has worked to limit Huawei’s expansion in the American market, the Chinese tech giant has had success elsewhere.

Technical strength: HUAWEI invests ten percent of its annual revenue on research and development, with an additional ten percent set aside for interdisciplinary projects, innovative technologies, and constant monitoring. The company has research and development centers in India, the United States, Sweden, Russia, and China, where they work on technologies including FMC, IMS, WiMAX, and IPTV. Forty-five percent of HUAWEI’s research and development staff are based in the three cities of Beijing, Shanghai, and Nanjing (Grigan, 2021).

Cost advantage: One is the affordable, high-caliber staff. About 85% of Huawei’s staff have a bachelor’s degree or above, and 40% are senior research and management professionals. The skilled labor force in China allows Huawei to save costs. The second piece of advice is to reduce research and development as much as possible. Asian engineers are paid less than their European and American counterparts. Huawei offers its recent grads six months of paid internships in R&D instead of the usual high salaries. Self-taught.

High-grade service: Huawei’s home services in China are a reflection of customers’ attitudes and norms. After North America, China has emerged as the world’s second-largest network equipment supplier. HUAWEI is a local Chinese company that serves Chinese consumers’ needs while also satisfying global markets’ technological standards. Businesses prioritize quality goods and buyers’ satisfaction in developed countries like the United States and Europe (Grigan, 2021).

Leadership excellence: Ren Zhengfei is an intellectual heavyweight. Many corporations use his “crisis management” approach as a model. He has established HUAWEI as the go-to brand for many students and faculty in China’s booming information technology industry. He has been a solid leader for over ten years.

4.2. Weaknesses

Lead personal color strong: The CEO of a public company performs these “essential housekeeping functions.” Working together. The mood in the company changes when he becomes the leader. Leaders in businesses often engage in biased and illegal employee evaluations. That this is not due to bad management may be shown even from the company’s first days (Xi, 2021, March).

Financial resources are weak relatively: When compared to the industry frontrunner, HUAWEI’s financial resources fall short. Since it is not publicly traded, the firm cannot get capital market financing. Due to its lack of online presence, it is more challenging to penetrate international markets.

Historical influence: The general public’s skepticism of Chinese corporations’ innovation makes HUAWEI’s offerings seem less secure. The low-cost options offered by HUAWEI make this a breeze.

4.3. Opportunities

Digitalization is being propelled and accelerated by a new generation of IT innovation. The economy’s steady expansion relies heavily on its digital infrastructure’s reliability. The global competitive advantage of the post-crisis era is being shaped by digitization. The United States developed the “Industrial Internet” and the “Advanced Manufacturing Partner Program.” “Industry 4.0” was created in Germany, “new robot strategy” in Japan, and “manufacturing 2025” in China (Grigan, 2021).

The “digital dividend” describes the multiple positive effects on development that the fast growth of digital technology will have. Many doors have opened as a result of the digital revolution. The digital revolution will impact the worldwide market by $1 trillion, and the IoT will expand at a rate ten times its current growth rate. Huawei’s future growth may hinge on the company’s superior network architecture design.

4.4. Threats

Strategic: In the next two to three decades, human civilization will evolve into an intelligent society. It is possible to foresee this cultural shift’s far-reaching consequences on individuals’ daily lives. Increases in economic, technological, and international trade uncertainty are expected as ICT develops.

Countries: Huawei serves 170 countries. Political and economic turmoil, huge swings in currency exchange rates, prohibitions on the use of foreign currencies, the sovereign debt crisis, poor control of management rights, and labor concerns are dangers of doing business abroad. Conflicts, reciprocal sanctions, and other regional events may strain the most significant foreign connections, affecting Huawei’s local operations and economic growth.

Operation: In today’s globalized market, Huawei’s manufacturing, logistics, and service industries depend on foreign suppliers or trade groups. Huawei will feel the effects of its business interruption in one way or another.

Trade: International trade has underperformed the global economy for five years, and trading has become more challenging. Any nation’s trade strategy focuses on economic development and employment creation. Environmental and IP constraints will limit Huawei’s exports.

Information Security and Intellectual Property: Even though Huawei has instituted stringent information security protocols to safeguard its IP, its data, patents, and licenses may be inappropriately used by other providers. Huawei will fail even if its intellectual property is well protected (Grigan, 2021).

5. Marketing Strategy (S, T, D, P) & recommendations

Company operations reach about one-third of the global population, and its presence in 170 countries has helped it preserve its position as the largest telecommunications company in the world. Huawei’s current business portfolio includes consumer electronics like smartphones and air conditioners and enterprise offerings like telephony and network architecture.

It is via segmentation that they can more easily profile and classify the many characteristics of a population. Huawei has a multi-pronged strategy for identifying and catering to its target markets, considering demographic, geographical, and psychological factors for many of its divisions. The company has a targeted strategy tailored to specific demographics of customers. Huawei uses value-based and user-benefit positioning strategies tailored to its products and services.

Several subsidiaries include Huawei Tech Investment Co., Limited, Huawei International Co., Limited, and Huawei International Pte. Ltd manages the company’s telecommunications products’ marketing, sales, and distribution. Distributing channels include in-house sales forces, brick-and-mortar stores, wholesalers, online marketplaces, and specialized wholesalers and distributors serving large businesses.

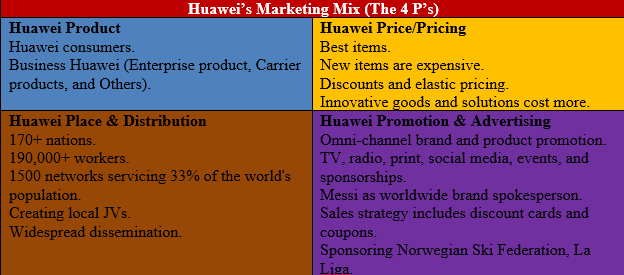

6. Marketing Mix (4 P’s) & recommendations

The Four Ps of Marketing are used in Huawei’s Brand Analysis (Product, Price, Place, Promotion). Marketing strategies include new product development, pricing, and advertising. Huawei’s commercial success may be attributed partly to the company’s marketing mix and strategic initiatives. The marketing approach used by Huawei benefits the brand/competitor (Coline, 2021).

6.1. Huawei Product Strategy

When it comes to telecommunications and mobile devices, Huawei is unrivaled. The two divisions of Huawei’s company cater to different markets and provide different products. The Huawei Consumer Business Group produces a variety of electronic devices, such as smartphones, tablets, personal computers, wearables, mobile internet, and more. Each year, the company moves two hundred million mobile phones. There is also corporate and carrier equipment available here. Numerous sectors use Huawei’s products, including the government, the railway, the electricity grid, schools, the media, and the financial industry.

6.2. Huawei Price/Pricing Strategy

Apple, ZTE, Cisco, and Ericsson are some of Huawei’s competitors. Since competition in the telecom industry is fierce, a key component of Huawei’s marketing strategy is low prices. Buyers now have more bargaining power and are more inclined to switch brands; hence this price strategy was enacted. Given that Huawei’s competitors provide comparable pricing, the company has instead prioritized product quality (Xu et al., 2022). The most cutting-edge and recent Huawei products are more expensive. Because of competition from Chinese rivals and the rise of internet shopping, Huawei may experiment with variable pricing. Companies that produce or transport commodities sometimes use premium pricing to recoup innovation costs. As the pandemic wiped out competition, the company quickly became the market leader in mobile phone units shipped.

6.3. Huawei Place & Distribution Strategy

There are now 195,000 people working at Huawei in 170 different countries. Together with its telecom partners, Huawei has built 1,500 networks that reach 33% of the world’s population (Grigan, 2022). To reward regional firms and government agencies for utilizing Huawei products, Huawei is developing joint ventures with them. Huawei’s extensive distribution network consists of sales agents, distributors, and manufacturers. Huawei avoids the general public. The new collaboration between Huawei and the region’s government creates new avenues for product distribution. Internet sales are a part of the company’s strategy as well.

6.4. Huawei Promotion & Advertising Strategy

Alibaba-owned Huawei uses Omni channel marketing to spread the word about its wares and services. The company promotes itself using traditional media like radio and newspapers, digital channels like the web, and mobile apps like Facebook and Twitter. Huawei has signed Lionel Messi as a brand ambassador. Huawei commercials featured Scarlett Johansson and Henry Cavill. To promote its products, Huawei offers coupons and discounts. Corporate sponsorship extends to La Liga and the Norwegian Ski Federation. Huawei uses social media to raise brand awareness and have conversations with consumers. The promotional efforts of Huawei are discussed.

7. Conclusion

This study’s primary focus was Huawei’s current approach to marketing. The company’s headquarters are in China, but it operates worldwide as a technology powerhouse. Huawei’s customers include re-sellers, distributors, enterprises, and governments operating in the same field. When compared to rivals, it enjoys a significant R&D advantage. Second, the company’s strategic partnerships and collaborations with other businesses give it an edge in the industry. The firm’s PESTEL analysis revealed the primary political, economic, social, technological, ecological, and legal/regulatory environmental factors impacting the business. The research includes the marketing plan (S, T, D, P) and recommendations. Huawei bases its brand research on the “Four Ps of Marketing” (Product, Price, Place, Promotion). Examples of marketing strategies include product innovation, price, and advertising.

References

Abd Rahim, N. N., Bakar, M. Z. A., Muhamed, A. A., Halif, M. M., & Hassan, M. F. (2022). The Relationship Between Marketing Mix and Customer Loyalty among Malaysian Smartphone Users. International Journal of Academic Research in Business and Social Sciences, 12(1), 2270-2276. https://hrmars.com/papers_submitted/12196/the-relationship-between-marketing-mix-and-customer-loyalty-among-malaysian-smartphone-users.pdf

Chen, H., Dong, Z., Li, G., & Zhao, H. (2020). Joint advertisement and trade-in marketing strategy in the closed-loop supply chain. Sustainability, 12(6), 2188. https://www.mdpi.com/2071-1050/12/6/2188

Coline, D. (2021). Marketing Mix-Samsung. Publications Études & Analyses. https://iide.co/case-studies/marketing-mix-of-samsung/

Grigan, N. (2022). POSITIONING OF CHINESE COMPANY HUAWEI IN THE RUSSIAN MARKET. Sciences of Europe, (94), pp. 36–46. https://cyberleninka.ru/article/n/positioning-of-chinese-company-huawei-in-the-russian-market

Grigan, N. (2021). Strategic analysis of Huawei in Russia: Swot and pest analysis. Norwegian Journal of Development of the International Science, (66), pp. 3–17. https://cyberleninka.ru/article/n/strategic-analysis-of-huawei-in-russia-swot-and-pest-analysis

GUANGHUI, G. (2019). RESEARCH ON MARKETING STRATEGY OF HUAWEI’S HIGH-END SMARTPHONES (Doctoral dissertation, SIAM UNIVERSITY). https://e-research.siam.edu/wp-content/uploads/2019/06/IMBA-2018-IS-Research-on-marketing-strategy-of-Huaweis-high-end-smartphones-compressed.pdf

Lin, H. (2022, April). The Strategy for Huawei Going Global. In 2022 7th International Conference on Social Sciences and Economic Development (ICSSED 2022) (pp. 349–355). Atlantis Press. https://www.atlantis-press.com/proceedings/icssed-22/125973917

Xi, W. (2021, March). Analysis of Huawei’s International Marketing Strategy Based on the SWOT Analysis. In 2021 2nd International Conference on E-Commerce and Internet Technology (ECIT) (pp. 151–154). IEEE. https://www.sciencegate.app/document/10.1109/ecit52743.2021.00041

Xu, Z., Zhu, G., Metawa, N., & Zhou, Q. (2022). Machine learning-based customer meta-combination brand equity analysis for marketing behavior evaluation. Information Processing & Management, 59(1), 102800. https://dl.acm.org/doi/abs/10.1016/j.ipm.2021.102800

Yan, X., & Huang, M. (2022). Leveraging university research within the context of open innovation: The case of Huawei. Telecommunications Policy, 46(2), 101956. https://ideas.repec.org/a/eee/telpol/v46y2022i2s0308596120300483.html

write

write