Individuals performing on their own can achieve best outcomes below precise most extraordinary conditions. That is, occasions wherein nobody may be made higher off without rendering others worse off. These individuals need to be logical and nicely-informed, and they have to function in aggressive markets that cowl the complete spectrum of credit score markets and insurance. In the absence of those most excellent conditions, authorities guidelines exist that can enhance society’s efficiency. The interventions’ factors are nicely accepted, including antitrust laws, to save you the abuse and formation of monopoly power. Consumer safety rules are created to address feasible exploitation troubles originating from information asymmetry.

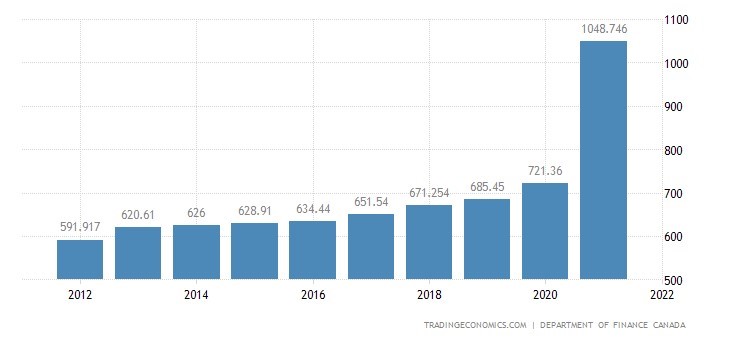

The instructions to hold the monetary system’s protection and soundness are necessitated with the aid of using systemic externalities (financial transaction spillover results affecting many people, even the ones now no longer concerned in the transactions) made while a group fails. Governments have to enforce brand new coverage to deal with present economic marketplace failures. Economic inequality in Canada has begun to increase again as the middle-class begins to shrink while the growth of upper-class experiences (Matteo, 2021). This inequality has been raised through developing marketplace complexity. One of the problems is that monetary establishments have grown too massive to fail. Such big companies pose an aggressive threat and bring perverse incentives. Institutions that end up too huge to fall apart are inspired to tackle immoderate danger because their administrators realize that if the risks pay off, they must hold the profits; however, if they collapse, taxpayers are on the hook. Regulators have to ensure that establishments do now no longer grow to be too massive to fail.

There is scant proof that there are significant economies of scale enough to counteract the poor reasons created with the aid of using gigantism. This subject matter applies to the path as it considers authorities’ intervention in addressing marketplace screw-ups and inefficiencies with the assistance of enforcing new policies. Current marketplace, individuals do not have any incentive to undertake a higher gadget as it might disrupt the profit-churning system they presently recognize and love. Markets allow green allocation of assets and charge discovery (Lauer, 2017). Methods now exist to enable participants to act in their own best interest rather than their customers. The new rule can cope with short-time period inefficiencies affecting charge discovery and ensure that the right incentives are in an area to sell extra green and significant markets. Many marketplace screw-ups exist in the plumbing of trendy economic needs, so why are not the authorities preventing it more challenging to adjust individuals and defend the pursuits of the center class?

There are many proven benefits that traditional finance provides to the current financial system, including access to capital, liquidity, low fees, reliability, and consumer protections. While there is nothing wrong with these benefits on the surface, a deeper dive into the entire systems that make these benefits possible may bring deeply rooted issues that directly affect all people. Misaligned incentives among larger firms lead to inefficiencies from more minor market participants. The normative analysis of the government shows that it should intervene to maintain market integrity and protect participants (Brander, 2014). The research question is this: Should the government implement further regulations to address misaligned incentives between firms and market participants?

Misaligned incentives afflict the present-day economic system, permitting specific companies to take allocable interest and direct straight prosperity moves beyond generating worth or benefiting the community through increased utilization or ethically valuable innovation. Numerous contemporary economic goods and services have no profit makings or productive function. The organization creates retail negotiators of incredible scale, capability, experience, and beneficial governmental rules impact. Some monetary groups earnings without delay from growing volatility, even as others income not directly from improved interconnectivity and complexity. However, due to its reference to the existing financial system and individuals’ more dependence on markets, everybody faces the fee of this evolved monetary gadget while it collapses (Petry et al., 2021). The modern marketplace shape and incentives in the location are outlined, basing the argument on Air Canada’s creation to deal with those marketplace inefficiencies.

Additionally, a definition of the way the modern nation of the marketplace fails to sell equity and performance and without delay incentivizes monopolistic opposition is given. Reference to the number one regulatory body’s posted literature on those topics and evaluating it to different global markets is likewise supplied to argue those points. This paper tries to keep in mind opportunity structures and solutions. Therefore, it is a cohesive argument that supports the implementation of further regulatory policy on firms in the financial markets (Tullock, 1986). Hence, this paper recommends an economic structure that is more transparent, financialized, complex, and extraordinary oriented to money-making ends that benefit the community. It is not fair for only large firms to produce unbalanced payments in a challenging system, in between finances, build money-making goods, or manage the installation in an organization that provides the best products and services.

According to the SEC, lit markets only accounted for half of the trading volume in January 2021. The remainder of the trading volume was executed in dark pools or internalized in off-exchange wholesalers (Gensler, 2022). Half of all trading volume was completed outside the heavily regulated lit markets, subject to an entirely separate set of rules. “Exchange market makers, for example, must compete on an order-by-order basis to offer the best price. Wholesalers can price their segmented order flow simply by referencing the NBBO, a less competitive benchmark” (Gensler, 2022). Routing orders off the exchange is done because there is a financial incentive. Firms can skim pennies off the top of each trade because there is no competition when they match buy and sell orders internally. There is a conflict of interest when organizations are supposed to be executing orders in the customer’s best interest but are instead executing trades off-exchange to maximize their profits. There is an apparent misalignment in incentives between firms and market participants, leading to customers paying more and firms serving themselves to support the research question. The government must intervene with the new policy as the public’s best interest is disregarded.

Air Canada’s Market Structure

The Trans-Canada Air Lines Act formed Air Canada, passed by the Canadian Parliament on April 10, 1937. After nearly 28 years, it changed its name to Trans-Canada Air Lines.

Initially operating a regular route between Seattle, Vancouver, Washington, and British Columbia, the airline grew to serve more than 90 locations across Canada and the United States by the early twenty-first century, thanks to its routes and connectors.

As a royal corporation, the company held a monopoly on domestic air transportation in Canada from 1937 to 1959. However, restrictions gradually eased in the 1960s and 1970s, and other Canadian airlines competed for international and domestic routes. The company was partly privatized to fully deregulate to compete in a more competitive market and obtain funding for fleet upgrades. It sold 45 percent of its equity to the public and staff and became fully privatized in 1989. Air Canada became one of the top commercial airlines after buying the country’s second-largest carrier, Canadian Airlines International, in 2000 (Jelic et al., 2021). The worldwide airline industry accumulated a profit margin of more than $35. 6 billion in 2006 from a profit of $18.6 billion in 2013 (Matteo, 2021). However, during the United States of America recession in 2008, the airline field was falling on the edge of a colossal disaster that left huge losses.

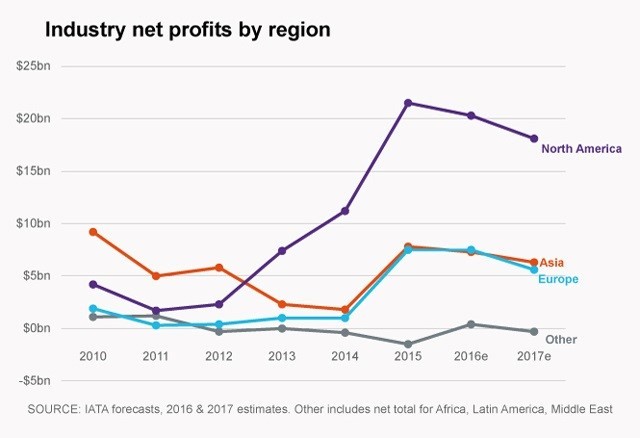

The International Airline transport association issued a statement that explained that they had lost a sum of $26.1 billion in that year. This was a huge downfall for the industry since the nation’s economic development depended on that organization’s financial stability. Despite the that the economy of the country was still doing poorly, the airline organization was doing better than average, which was a recommendable job for the industry’s leaders. Besides, by 2010, the economy was still at its weak point, and the worldwide airline industry had already recovered its losses by attaining a profit of $17.3 billion. The global airline industry managed to profit by flying less while charging more than they did. The airline industry convinced a few travelers to pay more than the usual amount, thus making more profits. This was a great way to recover the money that had been lost.

In 2011, costs were 8% better than the sooner 12 months and 17% better contrasted with 2009. Flights had been more excellent packed than in many years, with much less than one out of 5 seats void on homegrown flights—that sample move on today. As nicely as scaling again, the number of flights, especially coins dropping ones-companies, began to vary price tag expenses given takeoff time and the price tag became sold. For instance, the least costly day to fly is Wednesday, with Friday and Saturday the maximum steeply-priced days to travel. The primary morning journey, the only one that expects you to rise at four a.m., is much less costly than later flights.

Furthermore, the least expensive possibility to buy a price tag was Tuesday at three p.m (Matteo, 2021). Eastern Standard Time, with tickets sold during the cease of the week conveying the best expenses. It would not forestall there. As every crushed voyager knows, companies have connected an extensive collection of recent fees and increased antique ones-costs for food, covers, things, even the choice to board first or choose your seat beforehand of time.

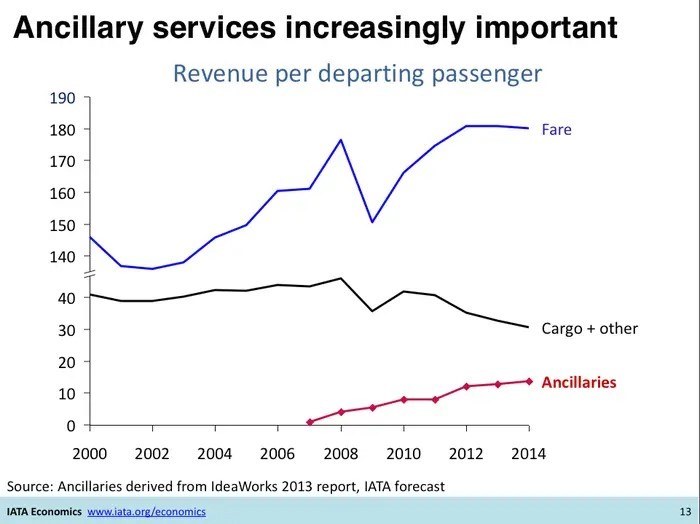

Besides, carriers have moreover ended up more remarkable revolutionary at forcing fees, which might be challenging for explorers to observe beforehand, such as moving an event overcharge even as maintaining that tolls have now no longer increased for the event. Aircraft typically collected US$22.6 billion from subordinate fees in 2010, four.8% of their all-out income. In any case, the part of subordinate costs has increased to 7.8% of the entire payment, arriving at US$59.2 billion in 2015 (Pagano et al,. 2019). Furthermore, in 2016, however, gas being at its most miniature stage in six years, several aircraft stored charging tourists a gas overcharge, which provider controllers accredited companies to pressure amidst rather excessive gas expenses (Krueger, 1974). Calin Rovinescu, the President of Air Canada, assured people that those additional costs would not disappear quickly despite the reality that they deal with a first-rate part of the company’s benefit.

Notwithstanding, enterprise investigators query whether or not aircraft can preserve up with such expanded ranges of productivity. Before, as motion requests got, companies increased restricted delivered seats-excessively fast, prompting falling airfares. The unique case was continuously delayed discipline, says a provider enterprise scientist (Riquier, 2020). Everything necessary was for one transporter to begin to upload restrict forcefully, and in a while, people observed, and we restored all of the first-rate paintings that had been finished.

Misaligned Incentives in Airline Industry

In 2016, the global aviation business profited $35.6 billion, up from 2013’s almost $18.4 billion (Vasigh, 2018). However, during the 2008 recession in the United States, the sector was on the verge of collapse. Even though the economy remained sluggish and airline traffic remained substantially below average, profitability began to improve in 2009. Furthermore, despite a prolonged economic downturn, the global aviation sector had rebounded by 2010, posting a $17.3 billion profit (Vasigh, 2018). How did the airline sector make such a remarkable comeback? Flying less and charging more is the simple solution.

Figure 1: Industry Net Profits by Region

Fares went higher in 2011 than the previous year. Domestic airlines were more packed than in decades, with less than one out of every five seats available; this is still the case today. Airlines began to alter ticket pricing depending on the travel time and the booking time and reduce the number of flights—particularly those losing money.

Airlines have also grown increasingly creative in implementing difficult costs for travelers to predict ahead of time, such as applying a holiday surcharge while maintaining that rates have not changed for the holiday. In 2010, ancillary fees brought in a great deal of money worldwide, accounting for a significant percentage of the total income. Even though gasoline prices were at their lowest in six years, in 2016, several airlines continued to levy a fuel tax on customers, which airline regulations authorized them to do in instances of extremely high fuel prices. According to Air Canada’s CEO, these ancillary fees will not go away anytime soon because they account for a large percentage of its revenues.

Figure 2: Ancillary Services Offered by Airlines

How Private Misaligned Incentives create Gains

Discretionary Liquidity and Moral Hazard

Players in the market, such as fixed income asset managers, can protect private profits while raising the risk of moral hazard in credit risk origination. Such is a result of the high demand for fund-level liquidity transformation; converting thinly traded loans and over-the-counter bonds into immediately liquid exchange-traded credit funds can reduce incentives to accomplish underwriting due diligence. This moral hazard potential, which is reminiscent of the originate to distribute factors that increased low-quality mortgage loans during the 2008 crisis, is amplified by the government’s active involvement in credit markets during the coronavirus first sell-off in March 2020. Credit ETFs have inherent, product-level fragilities because they rely on profit-seeking market intermediaries to provide discretionary liquidity for pricing and operational stability. Credit ETFs are comparable to past financial products like auction rate securities (ARS) and portfolio insurance. They rely on the discretionary actions of profit-seeking intermediaries for stability, which proved to be a critical factor in their respective failures.

During the initial coronavirus market sell-off, flaws in the operational environment of credit ETFs were uncovered. Authorized participants, who are significant players in the ETF ecosystem, have taken a step back from serving a critical stabilizing function in the operation of credit ETFs. Bond dealers backed away from taking on balance sheet risk in the underlying markets. After the 2008 fiscal crisis, intermediaries backed away from supporting the ARS market. As a result, there was a historically unparalleled dislocation in credit ETF trading prices about their net asset values (NAV). If these products are regarded as near-cash equivalents or common term safe investments like money market mutual funds, price dislocations in credit ETFs might cause interconnectivity and contagion risk.

Private Equity Playbook Incentive Misalignment

In the most opaque, lucrative, and under-regulated part of the asset management business, private equity (PE) companies enjoy broad operational independence, prompting significant criticism and a call for change (Jonathan, 2020). In the coronavirus epidemic, the PE industry has been chastised for using continuation funds, also known as Sidecar deals, as liquidity vehicles when mergers and public activities have dwindled. These innovations employ new investor money to buy a business previously held by another fund in the PE firm’s portfolio, raising questions regarding fair market price appraisals and investor transparency in the price selection process (Davis, 2019). Because the same PE Company owns both the buyer and the seller, there is a conflict of interest at the essential part of this deal.

Continuation funds show a fundamental incentive misalignment issue. That is, asset managers and financial institutions are unattached from the requirement to produce valuable anything that helps society in specific ways to make a profit. These companies can profit by financial engineering or restructuring, which is sometimes veiled in secrecy, reaping distributive advantages or income that would otherwise be accessible to others and hence comes at their expense.

Regulatory Influence and Rent-Seeking

Another issue with misaligned incentives for market intermediaries is their desire to influence authorities or take other actions to control them and achieve better regulatory treatment. Over the last 50 years, the effectiveness of banks and other financial institutions in obtaining regulatory relief in Canada has been widely documented. Rent-seeking uses regulatory policy to retain and enhance profit without producing anything useful (Philippon, 2016). It is a business distortion that results in a net loss of societal welfare and a wealth transfer to the financial industry. Rent-seeking negatively influences innovation and economic progress, and it has been proven that elevated levels of rent-seeking are self-sustaining due to natural growing returns.

The Politics, Influence, and Conflicts of Index Construction

Because of the passive funding revolution, markets have become more susceptible to mismatched incentives, political manipulation, and conflicts of interest. Including or except for an organization can motivate billions of bucks in capital moves into or out of home economies. Index providers’ normative perspectives of a company’s governance affect inclusionary choices. Furthermore, many nations, explicitly growing markets, lack the criminal ability to contest exclusionary judgments, infrequently any recourse if they are not deemed funding-worthy, branded as a frontier marketplace, or located on a poor watch list. When asset managers create a custom-designed index for a specific ETF, a phenomenon that happens in many fund types, an excellent set of marketplace inefficiencies develops. Several marketplace externalities get up from the development of custom indexes or the licensing of associate indexes. First, disclosing asset managers’ charge disclosures for linked index licensing fees could harm newbie traders. Second, while benchmarks are heterogeneously built, evaluating the overall performance of a comparable price range is almost tough. The truth is that price ranges with the same names regularly have pretty excellent underlying holdings and ranging coins control and securities lending tactics, obscuring investor comparisons. The extra-tough it’s far for traders to examine price range, the much less in all likelihood hazard and cash may be accurately distributed.

Fund Portfolio Composition and Proxy Voting Conflicts

Investment companies with energetic portfolio composition choices have misaligned incentives and conflicting interests, making funding inclusion selections unconnected to a company’s monetary fundamentals. Because it’s far economically sensible, asset managers can also opt to disregard personal danger worries of underlying portfolio corporations in choosing systemic governance initiatives. Joint finances are more or less two times more likely to make investments within the shares of a funding financial institution if the fund company or own circle of relatives of finances has a brokerage enterprise relationship, as a kind of quid seasoned quo to funding banks. On contentious shareholder disputes, mutual fund proxy balloting selections have also been found to be skewed toward the control of linked brokerages.

SPAC Sponsor Incentive Misalignments

A particular purpose acquisition company, or SPAC, is a ubiquitous monetary intermediary framework that leverages investor monies obtained via a short-time period auction of a company shell to mix with a functioning personal firm. Because of the meager acquisition cost, SPAC sponsors receive a promotion – a material equity investment for a nominal buying price – and choices to buy warrants in the SPAC. These perks often realize enormous returns for the sponsor, even on businesses that suffer post-SPAC due to the low cost of acquisition.

How Misaligned Incentives Lead to Shared Costs

Perpetual Debt Generation & the “Global Doom Loop”

Debt has had a significant component in shaping Canadian culture. Thomas Piketty, a relatively well-known modern-day economist, has very well researched the significance of debt in cutting-edge society and how it impacts social factors, including profits and wealth inequality (Hyman, 2008). He also said that robust monetary hyperlinks exist in most of the numerous country-wide entities,” that’s an essential component of the worldwide financial system (Hyman, 2008). Economic asset ownership, in addition to debt price responsibilities, are examples of those ties. However, compensation agreements had been simplest enforced if periodic interest bills defaulted because the debt precept can be rolled over indefinitely.

Figure 3: Canada’s Debt

The Shared Social Costs of Liquidity Transformation

When credit score ETFs go through a “liquidity transformation,” turning poorly traded and regularly opaque bonds and loans into incredibly liquid ETFs, they bring about shared expenses. The integrity of that merchandise depends on different monetary agencies acting as a stabilizing arbitrage position below marketplace incentives (Alilaj et al., 2020). In the past, discretionary arbitrage has proven to be a delicate stabilizing thing in instances of crisis. Investor herds construct round statistics cascades and noise, and expenses grow to be an unreliable indication of critical statistics.

Private Equity’s Opaque (and Moving) Value Proposition

Leveraged buyouts (LBOs) have an ambiguous long-time cost proposition for society. There is conflicting and contradictory proof that those takeover preparations bring decreased employee pay and task losses, much less corporation investment, and a better danger of financial ruin for businesses compelled to feature beneath a closely leveraged stability sheet (Ford, 2020). Perhaps the maximum extreme price leveled in opposition to PE, which is in step with the thesis of this article, is that it encourages wealth extraction instead of creation. Wages may be reduced (with fee financial savings transferred to PE investors) primarily based on financial performance arguments that the marginal fabricated from workers’ hard work is much less than its price.

The Shared Costs of Securities Price Distortions

Market frenzy, visible within the current meme inventory saga for taking walks useless corporations, was fueled by an incentive to force hedge fund losses or experience a wave to a short-time period speculative payout instead of self-assurance in that firm’s growth prospects. The fact that fintech and democratized marketplace get entry is this kind of basically dislocated marketplace conduct will probably persist (Nathaniel et al., 2021). Moreover, maximum of society, besides corporations that gain from improved marketplace volatility, which include the ones stated above and numerous one-off Reddit legends like “roaring kitty,” might be a great deal worse off in a marketplace wherein valuations do now no longer replicate the monetary realities of corporations or the underlying price of assets.

Increasing System Complexity but Not Productivity

All earnings come from a firm’s creative or distributive activities in a capitalistic society.

All profit-seeking organizations operate on the above spectrum. While firms (and individuals) frequently participate in both, the most successful societies maximize their potential for creative activity while minimizing the distribution of profits—much of today’s financial market intermediation results in distributive earnings for intermediating corporations (Clements, 2000b). Furthermore, financial intermediaries have probably surpassed the sovereign in deciding the amount of the credit supply. As a result, private credit production is misallocated away from productive applications and “continuously re-absorbed” by financial enterprises.

Three Fundamental Shifts

Market Intermediaries’ power and Influence

Interconnectors between productive enterprises, individual and institutional investors, and universal banks are market intermediates. The three largest asset managers (BlackRock, Vanguard, and State Street, respectively) control trillions in assets through intermediated holdings, which is an excellent percentage of the total value of the world’s securities (Clements, 2020a). PE businesses, as previously explained, are expanding into every sector of the economy. The expanding power of market intermediaries is incredible, especially given that many shareholders do not vote for their shares. Unfortunately, in comparison to Big Tech, the challenges in reacting to the concerns raised by these investing behemoths are far too technical and low-profile to prompt regulatory action.

The Comparability of Investment Products

Due to the pension fund’s exposure to PE funds, greater transparency is required for investor protection. This is especially important if proof of PE outperformance than listed equities gets more ambiguous. Furthermore, a recent study has found that the connection between PE firms’ fundraising and performance evaluation is vulnerable to manipulation because potential PE fund limited partners must evaluate financial performance using internally derived values (Ranko et al., 2021). Hedge funds require more openness, and reforms are needed to make it easier for investors to compare the wildly popular ETFs. Increased ETF transparency allows for more straightforward investor comparisons and can help prevent low-quality products, many of which are pricey, specialized, and compete for uneducated investors.

Calculus of financialization

It is unclear if the financial industry’s continued growth compared to the actual economy, known as economic financialization – as seen by the rise of market intermediation – is a net gain for society. The scholarly literature is littered with objections to financialization, including income inequality, economic rent-seeking, dwindling productivity growth, manufacturing outsourcing, class and political strife, the collapse of the middle class, unsustainable global debt levels, and decreased entrepreneurship (Foroohar, 2019). Increased speculative trading, warped societal values, market volatility, and leeching growth from other sectors while acquiring appealing graduates from other industries to pursue otherwise good careers in finance are some additional objections.

Various market failures in the financial sector have been mentioned, which might be remedied with proper regulation. Market failure is undeniable, but there is also government failure. The government’s negligence was the basis for the government’s loss was the notion that markets do not fail, that free markets lead to efficient solutions, and that government intervention would clog the works. Regulators who did not believe in regulation were appointed, with the unavoidable result that they did not regulate very well. Even if there are excellent regulations, how do people ensure that they will be enforced? There is now a general agreement on the necessity for regulation. Unfortunately, the issue remains: even if there are good rules, how do individuals ensure that they will be implemented? What can we do to avoid regulatory failure?

Conclusion

When capitalistic systems produce undesired outcomes, it is suggested that the government should intervene. Misaligned incentives abound in today’s financial systems, resulting in personal benefits and shared losses. The incentive structure that governs market intermediary conduct in the current economic system is divorced from the capital requirements of productive enterprises, and it does not encourage additional employment or welfare-enhancing innovation. Many items and activities have no monetary or constructive purpose in today’s financial markets. Instead, they benefit financial corporations by growing their power, profitability, scale, and regulatory and economic Influence.

Increased complexity, hierarchy, leverage, volatility, fragility, and interconnection are the externalities of a financial system route. A democratic government’s principal priority is the well-being of its people; hence regulatory measures are required to reduce uncertainty and instability. Increased income and wealth disparity is a global problem, and the coronavirus epidemic has worsened these tendencies. Regulatory changes are needed to reverse the trend of financialization-driven inequality. Because capitalism has changed and will continue to evolve, society is not constrained by a single form or limited to a false dichotomy of socialism against laissez-faire.

References

Alilaj, O., Indap, S., & Kruppa, M. (2020, November 13). The Spac sponsor bonanza. Financial Times. https://www.ft.com/content/9b481c63-f9b4-4226-a639-238f9fae4dfc

Brander, J. A. (2014). Government Policy toward Business (5th ed.). Mississauga: John Wiley & Sons Canada.

Clements, R. (2020a). Misaligned Incentives in Markets: Envisioning Finance That Benefits All of Society. DePaul Bus. & Comm. LJ, 19, 1. https://heinonline.org/HOL/LandingPage?

Clements, R. (2020b, April 3). Ryan Clements. Global Financial Markets Center Duke University Corporate Finance, 66, 101798.

Davis, S. J., Haltiwanger, J. C., Handley, K., Lipsius, B., Lerner, J., & Miranda, J. (2019). The economic effects of private equity buyouts (No. w26371). National Bureau of Economic

Ford, J. (2020, September 20). Investors need to lift the lid on private equity. Financial Times. https://www.ft.com/content/d4f55b78-2119-44de-912e-a96d3639a31f

Foroohar, R. (2019, July 29). The Economy’s Greatest Illness: The Rise of Unproductive Finance. Economics. https://evonomics.com/financialization-hidden-illness-ranafoorohar/

Gensler, G. (2022). U.S Securities & Exchange Commission. https://www.sec.gov/news/speech/gensler-global-exchange-fintech-2021-06-09

Hyman, L. (2008). Debtor nation: how consumer credit built postwar America. Enterprise & Society, 9(4), 614-618. https://doi.org/10.1093/es/khn083

Jelic, R., Zhou, D., & Ahmad, W. (2021). Do stressed PE firms misbehave? Journal of Corporate Finance, 66, 101798. https://www.sciencedirect.com/science/article/abs/pii/S092911992030242X

Krueger, A. O. (1974). The political economy of the rent-seeking society. The American economic review, 64(3), 291-303. https://www.jstor.org/stable/1808883

Lauer, D. (2017, December 7). Capitalism Fail Financial Services on the Brink. HuffPost. https://www.huffpost.com/entry/financial-services-industry_b_1605193

Matteo, D. L. (2021, March 30). Wealth Inequality: A Long-Term View. Finances of the Nation. https://financesofthenation.ca/2020/07/28/wealth-inequality-long-term-view/

Nathaniel Popper and Kellen Browning, the ‘Roaring Kitty’ rally: How a Reddit user and his friends roiled the markets, Chicago Tribute (January 29, 2021), https://www.chicagotribune.com/nation-world/ct-nw-nyt-reddit-user-roiledmarkets20210129-onigxuxctnhw7adjsbmhn2udnq-story.html.

Pagano, M., Sánchez Serrano, A., & Zechner, J. (2019). Can ETFs contribute to systemic risk? (No. 9). Reports of the Advisory Scientific Committee.

Petry, J., Fichtner, J., & Heemskerk, E. (2021). Steering capital: The growing private authority of index providers in the age of passive asset management. Review Of International

Philippon, T. (2016). Finance, productivity, and distribution. artículo preparado para el proyecto Chumir-Brookings sobre el Gran Reto de las Políticas. https://www.brookings.edu/wpcontent/uploads/2018/01/philippon-october-2016.pdf Political Economy, 28(1), 152-176. Research. https://www.nber.org/papers/w26371

Riquier, A. (March 30, 2020). The Fed is going to buy ETFs. What does it mean? Marketwatch. School of Law. https://sites.law.duke.edu/thefinregblog/author/ryan-clements/ Society, 9(4), 614-618. https://doi.org/10.1093/es/khn083

Times. https://www.ft.com/content/9b481c63-f9b4-4226-a639-238f9fae4dfcTullock, G. (1986). The Welfare Costs of Tariffs, Monopolies, and Theft. J. Reprints Antitrust L. & Econ., 16, 459. https://heinonline.org/HOL/LandingPage? Handle =hein.journals/jrepale16&div=25&id=&page=

Vasigh, B., Fleming, K., & Tacker, T. (2018). Introduction to air transport economics: from theory to applications. Routledge. https://doi.org/10.4324/9781315299075

write

write