Executive summary

The report has discussed the compliance of the Bank of China toward the named aspects. For instance, sustainability has been attained through progressive policies, whereas corporate social responsibilities have been achieved through social, economic and legal support offered by the Bank during Covid 19. The report has mentioned the internal organization structure, market entry strategy, and financial risk (foreign exchange risk) management of the firm.

Home and host country of Bank of China

Back in August of 2004, Bank of China Limited opened for business. In June and July of 2006, the Bank made history by being the first Chinese commercial Bank to issue both A-Shares and H-Shares in an IPO and acquire a dual listing on the Hong Kong Stock Exchange and the Shanghai Stock Exchange. The Beijing 2008 Summer Olympics and the Beijing 2022 Winter Olympics and Paralympic Games are the only two significant events for which the Bank is the official Chinese financial sponsor. Topping the list of Global Systemically Important Banks for the eighth year in a row, China’s Bank of China made history in 2018. As the most global and unified Chinese financial organization, the Bank of China has locations in every province and municipality and 57 other countries and territories. In addition to investment banking, capital formation, securities, healthcare, funds, and aircraft leasing, the company’s integrated service platform is built on its corporate banking, consumer banking, financial markets, and other industrial banking activities. BOCHK and the Macau Branch support their respective economies by issuing local currency notes. Forbes ranks the Bank of China as the thirteenth best public company in the world in their 2022 Global 2000 list. This year saw a record number of Beijing-based Chinese corporations cut. U.S. operations, the economy, and the impact of current geopolitical tensions between the U.S. and China were all topics Hu covered in this interview.

While doing so, we draw upon a wide variety of tools. As a company, we have few resources in the United States, but in China, we have a significant presence thanks to our many satellite offices. Supporting local economic growth, as well as trade and investment between the U.S. and China, and the rest of the world, is a top priority, so we concentrate our limited U.S.-based resources on a small number of high-value clients, including large corporations, major real estate developers, and Chinese businesses expanding internationally. Considering the size and potential of the two economies, the United States is undeniably one of the important markets for the Bank of China, which has branches in more than 60 countries and regions worldwide. Fortunately, we have access to a sizable market (here at home), a solid reputation, and a talented pool of individuals.

Corporate social responsibility

To keep banking operations going during a pandemic, the Bank established safeguards. Every business instituted shift schedules, cut down on physically congregating activities and took precautionary and quarantine steps during the epidemic. To further stop the spread of the illness, they also disinfected and sanitized all workplaces. The Bank has also improved its electronic channel services, such as mobile banking, internet banking, and automated teller machines, to meet the demands of its clients better. Facing a global pandemic, the Bank swiftly developed and implemented a contingency plan and emergency response strategy reinforcing the resilience of its international operations against threats and ensuring its businesses were running smoothly and safely. To guarantee a risk-free and profitable business environment, the Bank has prioritized the development of a sustainable compliance management framework for foreign institutions, increased the effectiveness of rule and regulation enforcement, and improved its compliance management capacity. The Bank boosted funding for pandemic preparedness and control by increasing access to credit resources.

Sustainability

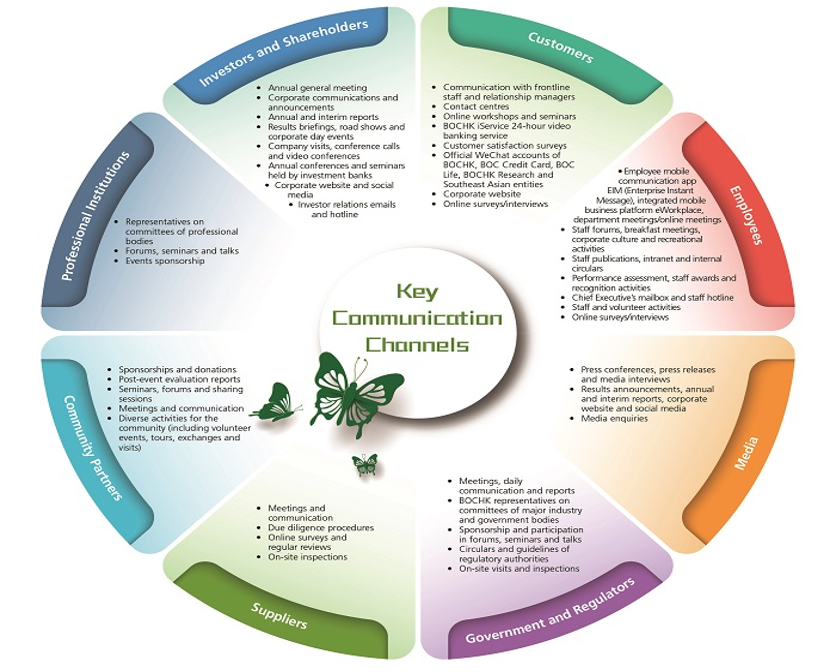

When it comes to suppliers, BOCHK has essential criteria in social, moral, corporate governance, environmental, and fair labor standards. This Code is binding on all of our suppliers and includes references to ILO Core Conventions and the Principles of Decent Work based on those conventions. Compliance with this Code shall be considered a key criterion in choosing new and current suppliers. In the political, social, and cultural environment in which we operate, BOCHK fully supports and respects all internationally recognized human rights. Within the political, social, and cultural contexts in which we operate, we also support and respect the internationally declared environmental and financial standards. Suppliers must also follow all applicable human rights, environmental, and corporate governance regulations in their respective countries. Workers who are representatives, members, or affiliates of a trade union or participate in lawful trade union activities are subject to disciplinary action under Labour and Working Standards legislation. There will be no discrimination, harassment, or abuse of any kind, per Section 4 Each vendor must adhere to fair employment practices. The place of employment should be free from sexual harassment and discrimination based on gender, disability, race, nationality, religion, age, or family status. Second, vendors can’t resort to or condone any intimidation, harassment, or abuse against their employees under any circumstances. 5] Concern for Physical and Mental Well-Being and Risk Management The supplier is responsible for ensuring that all workplaces and living quarters are free from hazards and for developing and enforcing policies and practices to protect employees’ health and safety on the job. When necessary, proper and effective PPE must be made available. Provide and document regular health and safety training.

Internal organization structure

Bank of China executives in a corporation usually develop long-term strategies. When carrying out strategic objectives, leaders need the support of their whole staff. Work quality decreases when individuals get indifferent toward the goals if the team implementing the plan isn’t enthusiastic or believes in the direction the organization is setting a course for. The company’s culture has been founded on the leader’s unmistakable vision, which should be built on the company’s guiding values. For a watch company, lowering production costs might be part of a larger strategy to reach a bigger audience. Marketers may not believe a less expensive watch can live up to the brand’s established standards if the company’s tradition has always been to produce only the best. Only firm executives can demonstrate to consumers that they can provide superior quality at lower costs, the strategy will be easy to implement.

Strategic Planning and Funding-Without sufficient capital, every business strategy will struggle to be implemented. The Chinese Bank must consider the price tag as they craft the plan. The budget must take into account costs for everything from R&D to marketing. Inadequately financed programs will lose steam too soon to be effective. Thus, financial resources are essential for the completion of the task. Suppose an accounting software business wishes to create a new tax preparation program, for instance. In that case, it must ensure that it can maintain all sales, operations, and upgrades for the current platform. It can’t afford to give up what has become its most reliable cash stream. This signifies the company has sufficient funds available, either in the form of retained profits, yearly sales, or venture financing, to complete the program’s development and launch it to the public. While it is possible to think about budgetary requirements in stages, the total expenditures connected with the project plan must be considered. If the firm needs more money, it may finish one phase and be able to go on to the next. SWOT Analysis is often used as a jumping point for thinking about internal dynamics and trends. The business can see what its rivals are up to and focus on its strengths by looking inside and outside. The company can pinpoint its competitive advantages and identify profitable real-time openings.

Entry strategic

The way you enter a market is critical. The financial institution has been interested in trying piggybacking because of its relationships with companies already exporting their products. If you want to sell your goods in a foreign country, you may try contacting local businesses and see if they would be interested in carrying your merchandise. If you and a foreign company were to reach an arrangement like this, the proceeds from each sale would be divided evenly. One further approach to lessen the blow of going global is to hire a marketing partner to do the task while you focus on retail sales in your local market.

Cross-entry is a tactic I advocate for as a global analyst. While fully legal, this approach to entering a market lacks the specific legal criteria of others. Then, businesses may deal with challenges like telling the market how much their goods are worth and finding suitable alternatives. Many companies might benefit financially from using the countertrade method to avoid paying import quotas. Partnerships – The Bank of China forms joint ventures with others that want to sell in overseas markets to reduce the risk of failure. Since a joint venture functions more like one large firm than the combination of two smaller businesses, it has the potential to generate more profit than the sum of its parts. By taking this route into the market, there is a chance of uneven corporate interaction, but this might be reduced if both parties work together to establish fair protocols. When a company seeks to expand into a new market, one option is to sell franchises to interested parties. These parties then run branches of the parent company under the parent company’s name and brand. Franchises provide a fantastic opportunity for companies to expand abroad, not only in North America, where they are more common. Before you can think about franchising, your brand and products must be well-known to consumers in your intended market. Bank of China may capitalize on well-known brands via an indirect management strategy.

Foreign exchange (financial risk) and internalization

Note the enormous shift that has taken place in the last two decades in the way corporations handle risk. This has extended to include both risk management and active portfolio management. According to economic analysts, financial risk management is the process by which a company determines its intended level of risk, assesses its actual level, and then uses derivatives or other financial instruments to align the two levels of risk.

state that acknowledging the existence of foreign currency risk for a corporation and that doing something about it is in the firm’s and shareholders’ best interests is the first step in managing that risk. However, the following phase, production risk management, planning for exchange rate fluctuations, and financial exchange rate risk management, is significantly more challenging. Determining the kind and extent of vulnerability to fluctuations in foreign currency rates. Find out what is under danger and how it is threatened. The steps adopted by the Bank are: recognizing the risk, quantifying it, and controlling it. This is known as internalization when a business decides to handle a transaction internally rather than outsourcing it to another company.

Similarly, “Internalization” refers to a commercial transaction inside a company rather than on the open market. When a brokerage business fulfils a purchase order for shares from its inventory rather than executing the deal using external inventory, this is an example of internalization in the investing industry. A global firm may also benefit from internalization. It occurs when a corporation moves some of its assets to one of its foreign subsidiaries. When Bank of China chooses to solve a problem internally rather than hire an outside party to do it can be termed as internalizing the solution. Businesses may produce their materials in-house rather than outsource to a third party producer. This method, known as internal sourcing, involves a corporation delivering goods to clients through its channels instead of contracting with an external shipping provider. Internalization is good for businesses since it reduces the need to outsource activities. The procedure is also advantageous for brokers since they may profit from the spread, or the difference between the buy and sell prices.

In conclusion, the report has assessed key aspects of the Bank of China such as its corporate social responsibility, sustainability, entry methods, foreign exchange risk, and internalization. A global financial analyst the Bank has positive movement toward all the aspects. The Bank of China has maintained its founding principle of “striving for excellence” for well over a century. Based on its core values of “people first,” “integrity,” “reform and innovation,” and “national pride,” the Bank has established a strong reputation in the financial services sector and among its clientele. With the window of opportunity for significant accomplishments at an all-time high, it is imperative that we, as a major state-owned commercial bank The Bank also improved its emergency response strategy, its ability to monitor countries for potential threats, and its ability to manage credit risk, market risk, and liquidity. It also increased its risk warning capacity by inspecting the quality of its international business and assets and by using risk quantification methodologies more extensively. However, for the Bank of China, using financial and operational hedges as part of an integrated risk management strategy aimed at lowering exposure to foreign-exchange risk has grown into a company-wide exercise that considers both short-term and long-term risks. The liberalization and internationalization of economies and financial markets have significantly impacted how foreign currency resources are managed.

Reference List

Aly, W. and Simpson, R, (2018) Political Correctness Gone Viral

https://www.taylorfrancis.com/chapters/edit/10.4324/9780203702444-8/political-correctness-gone-viral-waleed-aly-robert-mark-simpson

Gentzoglanis, A. (2019). Corporate social responsibility and financial networks as a surrogate for regulation. Journal of Sustainable Finance & Investment, 9(3), 214-225.

García-Sánchez, I. M., & García-Sánchez, A. (2020). Corporate social responsibility during COVID-19 pandemic. Journal of Open Innovation: Technology, Market, and Complexity, 6(4), 126.

Saha, R., Cerchione, R., Singh, R., & Dahiya, R. (2020). Effect of ethical leadership and corporate social responsibility on firm performance: A systematic review. Corporate Social Responsibility and Environmental Management, 27(2), 409-429.\

Frederiksen, T. (2018). Corporate social responsibility, risk and development in the mining industry. Resources Policy, 59, 495-505.

Muñoz‐Torres, M. J., Fernández‐Izquierdo, M. Á., Rivera‐Lirio, J. M., & Escrig‐Olmedo, E. (2019). Can environmental, social, and governance rating agencies favor business models that promote a more sustainable development? Corporate Social Responsibility and Environmental Management, 26(2), 439-452.

Boonsathorn, W. (2007) Understanding conflict management styles of Thais and Americans in multinational corporations in Thailand

https://www.emerald.com/insight/content/doi/10.1108/10444060710825972/full/html?skipTracking=true

Calvano, L. (2008) Multinational Corporations and Local Communities: A Critical Analysis of Conflict

https://link.springer.com/article/10.1007/s10551-007-9593-z

GOV. U.K. (2013) £5.6 billion worth of deals signed in China

https://www.gov.uk/government/news/56-billion-worth-of-deals-signed-in-China

Hughes, G. (2009) Political Correctness: A History of Semantics and Culture

https://books.google.co.uk/books?hl=en&lr=&id=Zzw9WabmmVwC&oi=fnd&pg=PP11&dq=political+correctness+on+companies&ots=t0u6Fs7kCA&sig=thsTHvK8r3CVX8lWqqtrXKP9xK8&redir_esc=y#v=onepage&q=political%20correctness%20on%20companies&f=false

write

write