Introduction and Strategic Analysis

Introduction

The Gap Inc, usually known as the Gap, is an American retailer that focuses on clothing and accessories. The company was founded in 1969 by Doris F. Fisher and Donald Fisher, and its headquarters are located in San Francisco, California. Gap’s mission statement is to democratize fashion and hence, make shopping a fun activity. The company hopes to achieve this by bringing about an incredible quality and style to families on a global scale. In order to bridge the gap in the world’s diverse and competitive markets, Gap operates in four chunks: Old Navy Global, Gap Global, Banana Republic Global, and Athleta. Old Navy Global is the oldest segment and also the highest earner, contributing about 55% of the total corporate earnings. Gap Global is the second highest earner, bringing about 25% to the organization’s income. The Banana Republic Global earners more than 10%, while the rest of the income originates from the Athleta segment.

Strategic Analysis

The Old Navy addresses the diversity in styles to ensure that we all have access to quality clothing at appropriate prices all over the world. Even though Athleta is the least earning segment in the corporation, it carries the sole responsibility of unleashing the potential of every woman regardless of ethnicity, age, size, and other considerable factors. The Banana Republic Global focuses on unleashing luxury to all. Lastly, Gap Global focuses on inspiring the world to bring and enhance individuality to the contemporary advents, responsibly made essentials. In more explicit terms, Gap Inc. is built on the ideology that we deserve to belong. The company is made up of an excellent team who are more than willing to take risks, explore new ideas, and enhance the satisfaction of communities, customers, and the planet at large. One of the company’s challenges is losses to imbalances in assortment and sizing.

External Analysis

Porter’s Five Forces analysis does not only address the external factors affecting the company but also its competitive landscape. In regards to Porter’s Five Forces analysis, the critical factors addressed are the threat of subsidies, the bargaining power of the buyers, the threat of new entrants, competitive rivalry, and the bargaining power of suppliers. The Porter’s Five Forces analysis is therefore essential for a company like GAP since it will play an essential role in analyzing its current state in the market and its industry in regards to a number of internal and external aspects such as customers, suppliers (partners and vendors), competitors, alternate solutions, financial capacity and future scope (operations).

The threat of New Entrants

GAP mainly operates in the apparel and fashion industry. This is a competitive industry since multiple innovative products and trends are being launched by new companies. In more explicit terms, the barriers to entry are low since other companies outsource the raw materials used in the production of apparel, and it is only sometimes difficult to get such supplies. This implies that new entrants can easily secure their products and enter the market. However, it is worth noting that production is only a small segment of what GAP engages in to ensure its products sell in the market. Marketing and distribution of the products is usually a complex process that requires the services of expertise, not to mention that the processes involved are capital intensive. In as much as this is a challenge to the new entrants, the selling and distribution of products have become easier with the advent of D2C business models and eCommerce. Social media platforms and influencers have also played a critical role in influencing products and ensuring that they reach substantively large audiences. The implication is that for new entries, even though there might be challenges in the distribution and marketing of the products, the advents in technology have made it easier for such. Therefore, the threat from new entrants is an essential aspect that GAP needs to address and deeply navigate to avoid stiff competition that could reduce its revenues.

Threat of Substitutes

Apparel is a basic need; therefore, there is no chance we could find a better substitute. There, however, is a rise of new fashion and trends in the clothing industry, which the company does not design. This dynamism in the nature of the industry is a key reason why GAP is facing competition from new entrants. In as much as cannot substitute clothing, there are alternate designs produced by competing firms that are still a threat to the stature of the company.

Bargaining Power of Customers

GAP is a company that enjoys a loyal and small customer base. Over time, with the increase in the breadth of the company’s customer base, the customers’ bargaining power also advances, which has greatly troubled customer loyalty in the apparel industry. The availability of substitutes has also contributed to this, and GAP is one of the companies that have been adversely affected. The presence of multiple companies in the same industries has shifted the loyalty of the customers and their decisions to buy apparel. GAP should seek to address the needs presented by their customers and also develop strategies that ease their interaction with new customers.

Bargaining Power of Suppliers

Apparel companies like GAP work on the basis of excellent relationships with the companies that supply raw materials to them. GAP has more than 1000 suppliers who are situated in more than 40 countries on a global scale. The processes involving the distribution of raw materials are usually capital intensive, and therefore, the suppliers need to bargain with the target companies to advance their profit margins (Helfert & Mcgraw-Hill, 2000; Investing, 2021). Since GAP wants to keep the prices of its final product the same, it has to engage in bargains with its suppliers. In the instances where the bargaining power of the suppliers is substantive, the company has to impose regulations to address such, which might include cutting the costs of its core operations. In extreme cases, the bargaining power of the suppliers could lead to price fluctuations in the market, which could further lead to inflation.

Competitive Rivalry

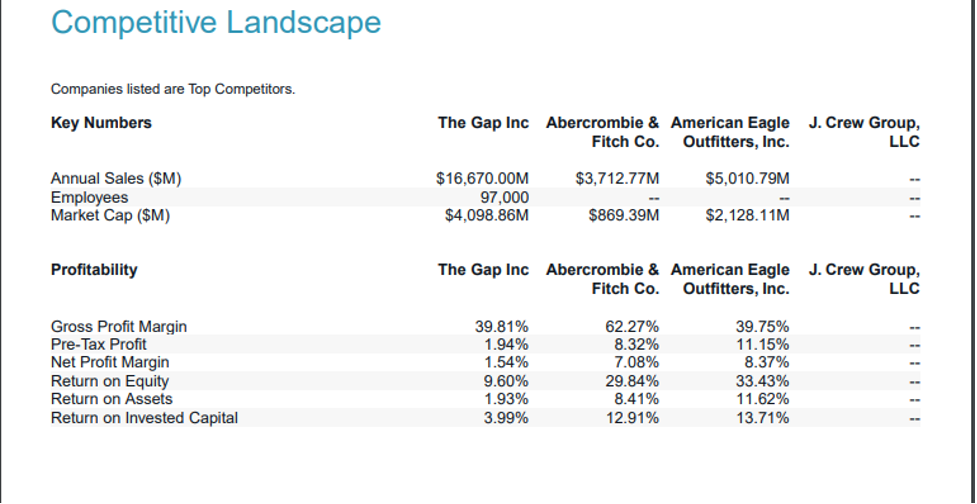

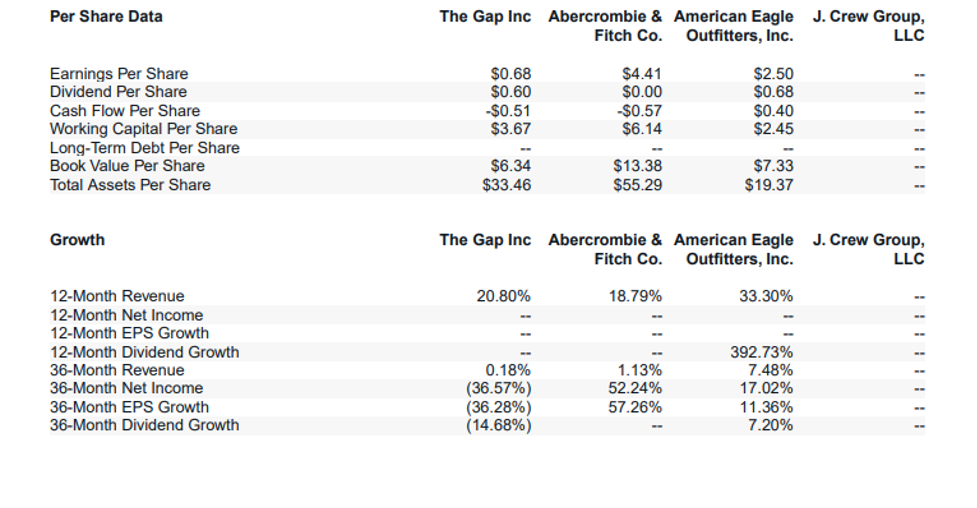

There is immense competition in the apparel industry. Some of the GAP’s worthy competitors include and are not limited to American Eagle Outfitters J. C. Penney, Abercrombie & Fitch, and J. Crew Group. It is also worth noting that GAP does not hold more than 5% of the American apparel market share despite its existence for the past 5 decades. This shows that the depth of the competition is intense. The company needs, therefore, to focus on providing premium services to its customers, which is a challenging process, considering that all the other competitors are striving to achieve a similitude. The competitive rivalry is, therefore, a crucial force that determines the profitability, core operations, and, most critically, the competitive environment of GAP.

Key Success Factors for GAP

One of the key success factors for GAP and other companies in the same industry is the capacity to embrace technological advances and incorporate such into their core activities, especially manufacturing, marketing, and distribution. Incorporating technology in the company’s core processes will enable it to not only manufacture high-quality products but also ease marketing and advertisement processes. Technically, the world is moving in the technological lane and therefore, it is essential for the company to embrace this as well. This does not, however, mean that GAP has not employed effective technology in its operations. It, however, implies that the company needs to remain up to date with the current advents in technology to ensure that it satisfies the needs of its clients. In the contemporary world, technological advents have been employed by companies in the apparel industry and almost everyone, even those engaging in micro-businesses, to enhance their sales. Therefore, alongside the excellent marketing and distribution team at GAP, embracing these new trends would also be an excellent strategy for addressing the challenges that Porter’s Five Forces raised.

Considering that GAP now has four brands, the company could focus on diversifying its products in these brands. Most of the companies in the industry have fewer segments of operations than GAP has, and therefore, this strategy will not only work to reduce competition but also ensure that the company extends its client base. Typically, product diversification will enable GAP to provide a variety of apparel and fashion, and if this is done appropriately, the company will not only enjoy a tremendous advancement in its company profitability but also in its brand image. GAP can address diversity in their employment paradigms and also in the choices of the colors they use for their products. Colors have multiple tastes and meanings, so extensive research is needed to identify each user. Diving more into products that reflect more on the culture of their target audience is also an excellent way to promote diversity in the manufacturing of apparel.

Lastly, GAP needs to embrace manufacturing, marketing, promotion, and distribution models that are highly competitive in the market to counter the effect of extreme rivalry (Investing, 2021; Macrotrends, 2022). This is especially considering that the company still only owns up to 5% of the American market share even after being in existence for more than 5 decades. Intensive research is required to understand the rivalries’ competitive advantages and to develop effective models to counter the effect. One of the things that GAP could do to enhance its sales is diversify the market. For instance, the company could open new stores in African countries and specialize in apparel that reflects more on their culture. Similar stores could also be opened in other remote regions, and considering that such processes are capital-intensive, the business will be less likely to face threats from new entrants.

Industry Profile and Attractiveness

The apparel industry is characterized by high volatility on the demand side, high-cost pressure, trendiness, disposability of products, short life cycles, globalization, lead time, seasonality, high impulse purchasing, and low predictability (Investing, 2021; Macrotrends, 2022). The apparel industry proposes transforming fabrics into final products or, more explicitly, clothes and accessories. The varying tastes and preferences of customers usually aid the industry. Fashion, trends, and designs are essential concepts in the industry and largely determine the extent to which the companies will thrive. An essential concept that also, to a large extent, defines the apparel industry is the aspect of culture. Therefore, apparel industry players can utilize these, among other concepts, to derive profitability and other positive attributes for their firms.

To its incumbents, the apparel industry is highly attractive. First, clothing is a basic need and therefore, the companies can rest assured that as long as they create quality clothing and accessories, they could get willing buyers. Also, the apparel industry is an excellent platform for those willing to meet new people and learn more about other backgrounds, and experiences. This implies that cultural diversity is also a probable advantage in addition to the profit margins that those in the industry could experience. As the global population is expected to touch 8.1 billion by the time we get to 2025, the apparel industry is expected to bloom tremendously. Also, new trends and fashion call for advancement in the apparel industry since these are greatly correlated.

Like any other industry, the apparel industry faces a couple of challenges. Some of these include worker turnover, extreme competition, inadequate skilled human resources, an increase in labor costs, and tremendous pressure from the Environmental Regulatory Authorities and other associated organizations. Most of these challenges usually lead to an increase in the cost of production, and in the instances where the associated companies need to manage them sufficiently, the prices of the final products might be extremely high. For instance, the high costs of the utilities such as electricity, water, and compressed air, among other utility costs, usually lead to an increase in the price of clothes.

Company Situation

Financial Analysis

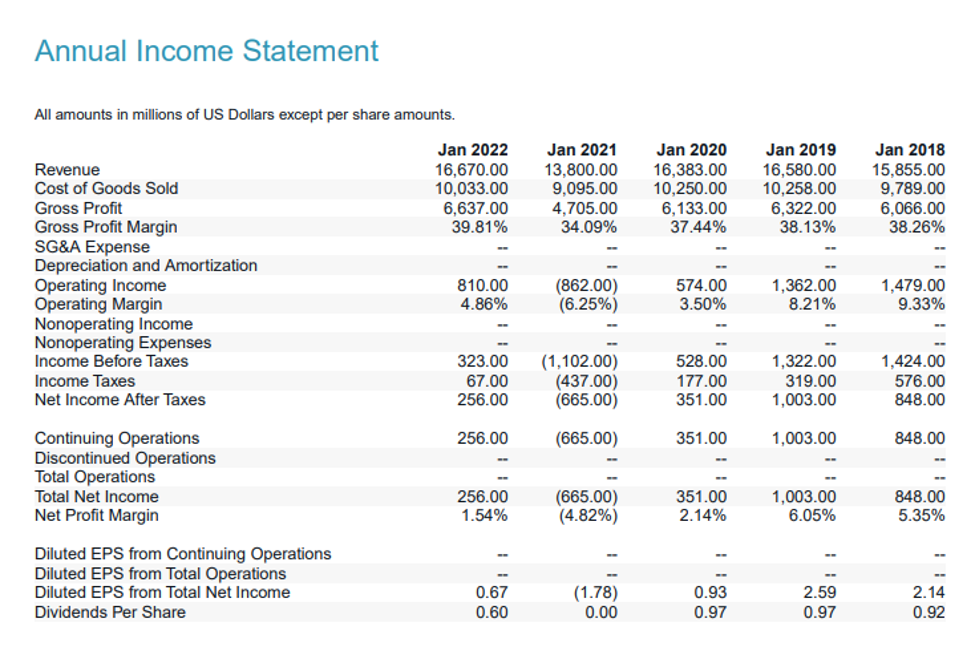

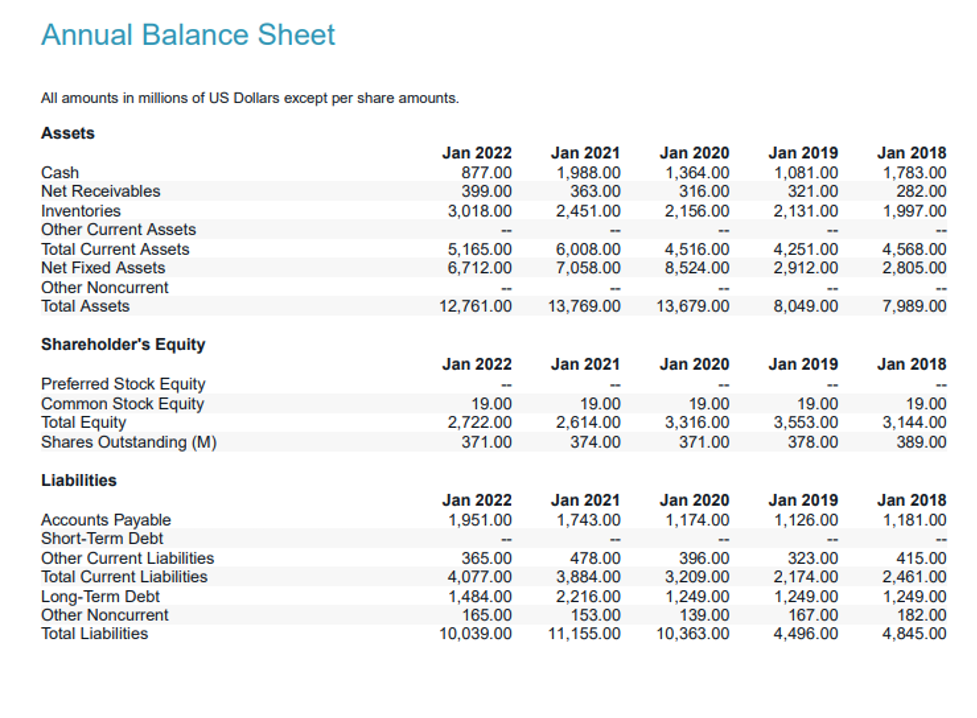

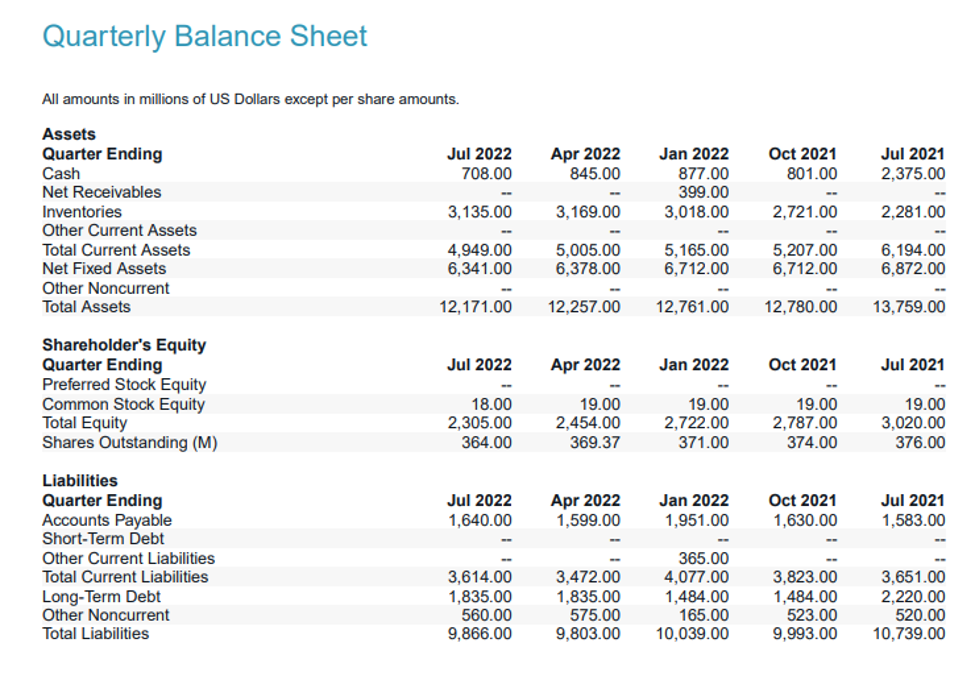

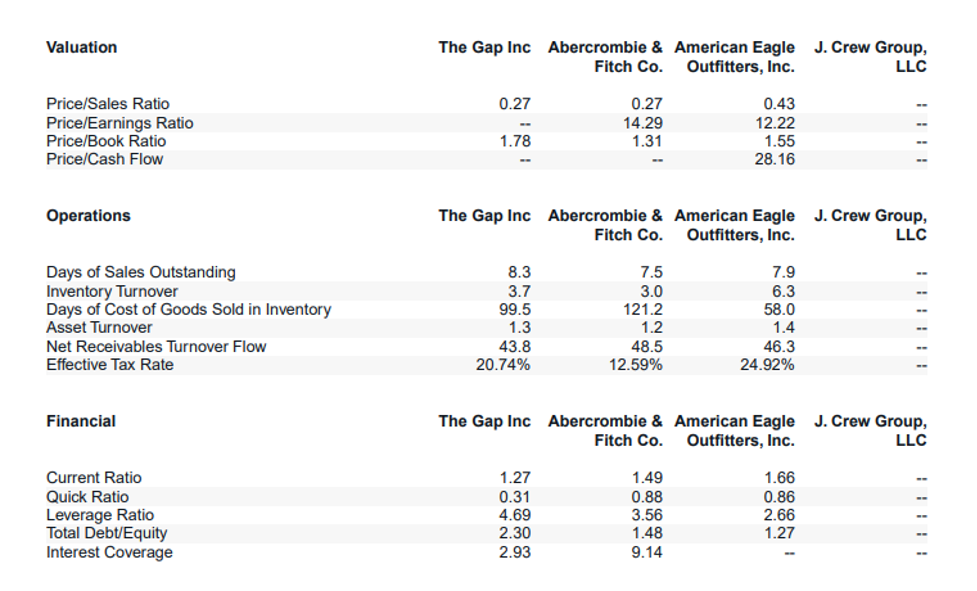

Based on the Gap Inc. profile, the net profit margin for GAP Inc is 1.54%. This is a low net profit margin considering the general rule of thumb that dictates that a 10% net profit margin is average while 20% is considered good. GAP does not have the absolute freedom to control its costs and also sell its apparel (products) at higher prices than costs. In order to attain such a capacity, it needs to work on improving its net profit margin. This can be achieved by reducing utilities, operating costs, and labor costs and increasing the prices of the final products.

The gross profit margin for GAP Inc is about 39.81%. This shows the profitability of the company after the direct costs of doing business have been deducted. This value is, however, incredible compared to the net profit margin. GAP Inc. can achieve a higher gross profit margin by using strategies similar to those for the net profit margin.

Return on assets is a profitability ratio that showcases the company’s profit margins relative to its assets. Also abbreviated as ROA, analysts, investors, and the management uses this metric to ascertain whether the assets in the company are being used to generate reasonable profits efficiently. GAP’s ROA is about 1.93%. A good ROA should be more than 5%, and this implies that GAP Inc. needs to make better use of its assets to generate the maximum possible profits. Therefore, the company needs to evaluate its resources and assets and develop strategies to utilize them maximumly.

Lastly, the company’s return on invested capital is about 3.9%, which is low. This implies that GAP Inc. needs to allocate its capital to profitable investments and projects appropriately. This further shows why the management needs to come up with better investment decisions. Generally, the profitability ratios show that the company barely survives in the industry and needs to restructure most of its financial and investment decisions to enhance its success.

Liquidity

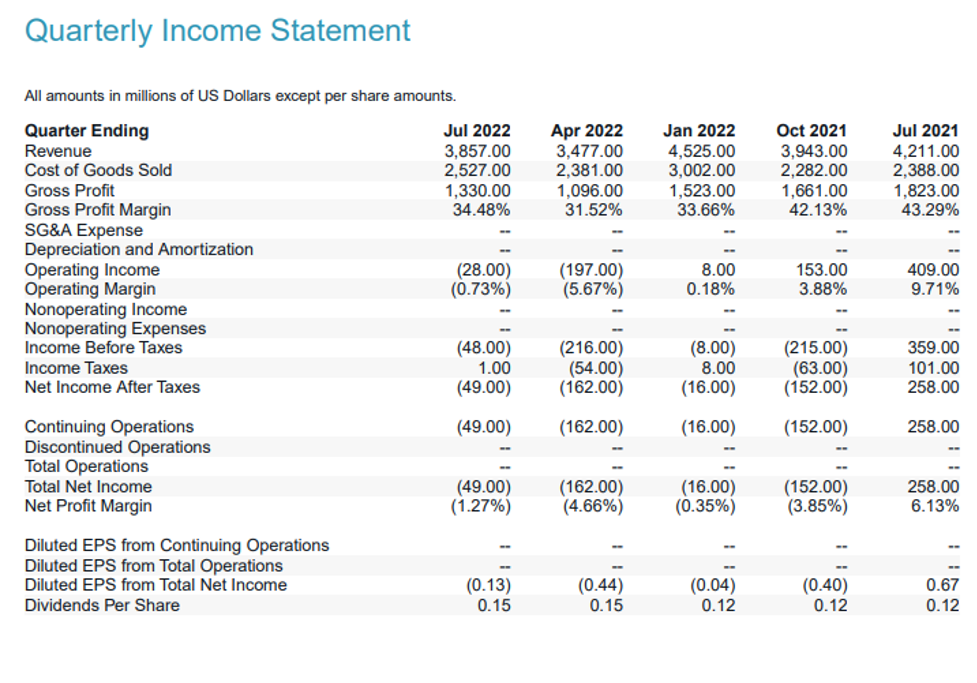

GAP’s current ratio, as per the Gap Inc. profile, is 1.27%. This is a good current ratio considering that a good ratio is considered to lie between 1.5 and 3. In more explicit terms, the company can easily pay its short-term financial obligations without running bankrupt. GAP can, however, delay its capital purchases that would draw cash reserves and amortize its loans to increase this ratio.

GAP’s quick ratio is 0.31, which indicates that it does not have sufficient quick assets to address all of its short-term financial obligations. Normally, a good quick ratio is considered to be 1. This implies that the company has sufficient assets that can be readily liquidated in the instance where it needs to pay off its current liabilities. The only way the company can increase this ratio is by raising the value of its most liquid current assets and declining the value of current liabilities.

Leverage

The debt-to-equity ratio for GAP Inc. is about 2.3. This ratio is an indication of how much debt GAP is using to address (that is, finance) its assets relative to its shareholder’s equity. In this case, a value less than 1 is usually considered safe, while a higher one is considered risky. This shows that the financial leverage for GAP is critically risky and appropriate financial decisions need to be executed to ensure that this ratio is less than 1 or is rather safe. In order to lower this ratio, the company needs to pay off its loans, improve inventory management, restructure its debt protocols, and advance its profitability.

Activity

A good inventory turnover is usually between 5 and 10. This shows that the company is selling and restocking every one to two months for GAP Inc. The inventory turnover is 3.7, showing that the company takes over two months to sell and restock. This could be one of the reasons why the company needs to make sufficient profits to address its financial obligations. To improve on this, GAP Inc. needs to improve demand forecasting accuracy, reorder smarter, use automation to advance insights, and also prioritize its inventory.

SWOT Analysis

The GAP SWOT analysis presents its strengths, weaknesses, opportunities, and threats. This analysis shows that strengths and weaknesses are internal factors, while threats and opportunities are external. The company’s strengths are highlighted below:

- The company has international brand recognition and a multi-brand portfolio.

- The company practices diversity and equity within branding, where equal rights have been the company’s foundation.

- Regarding the supply chain, GAP Inc focuses much on flexibility and speed.

- The sustainability of the business is a crucial concern.

The GAP Inc weaknesses are as highlighted below:

- Over time, the GAP brand name is becoming least appealing, thus needing an improved understanding of the company’s purpose.

- There is increasing competition from brands such as Zara and H&M, who are ever-improving their products and creating a customer-centric collections.

- The company is experiencing a reduced product range, thus shying away from many prospective customers.

The GAP Inc opportunities are highlighted below:

- The company is determined on a world market expansion with a critical focus on Asia.

- GAP Inc has launched and is now enhancing online commerce in order to establish its name internationally.

- The company has realized the effectiveness of celebrity endorsement and advertisement, seriously creating awareness in the target market.

- Enjoys the privilege of being the most popular GAP.

The company’s threats are highlighted below:

- The company is experiencing a considerable decline in profitability and sales.

- The company’s management has been unable to make business improvements.

- Increasing competition remains a significant challenge for the business to thrive.

Strengths

Firstly, the company has international brand recognition and a multi-brand portfolio. The company’s brands operate franchised stores in over 40 countries. Besides, the company can ship order online in over 90 regions. Through this, the brand has become well-known across the world. It is essential to acknowledge that the brand significantly meets its customers’ requirements across international boundaries. Besides, the company’s portfolio involves brands such as GAP Global, Old Navy Global, Athleta, and Banana Republic Global. These brands aim at different customer segments. Secondly, the company practices diversity and equity within branding, where equal rights have been the company’s foundation. Marketing practices within the company ensure that all customers from various backgrounds are comfortable inside the stores and workplaces. Including all stakeholders has created an attractive image for GAP Inc. Thirdly, when it comes to the supply chain, GAP Inc focuses much on flexibility and speed. The company applies techniques such as fabric-based platforming and the positioning method. These techniques have allowed the company to accommodate different seasons effectively. The production process is based on just-in-time and third merchandise made within a quarter rather than the previous 9 months. This has considerably streamlined inventory management. Lastly, the sustainability of the business is a crucial concern. To attain sustainability, the company is approaching the future with creativity sense, a mission, and a clear vision.

Weaknesses

The GAP brand name is becoming least appealing, thus needing an improved understanding of the company’s purpose. The company’s brand popularity is considerably declining as a result of a lack of cluster performance in sales. Multiple stores have been shut down across the world. Once upon a time, the company was a symbol of effortless cool, but it needed help to stand and ensure the brand appealed to the younger generation. This is seriously affecting the company’s sales. Besides, there is increasing competition from brands such as Zara and H&M, who are ever-improving their products and creating a customer-centric collections. These competitors are increasingly gaining traction in the market, although the gap appears to be the same. The prevalence of e-commerce and the growing familiarity with the fast-casual segment significantly affect the company’s sales. Last but not least, the company is experiencing a reduced product range, thus shying away from many prospective customers. Currently, the company is selling nothing new but the basic and the most important. Though this has previously worked well for the company, the consumers now want more.

Opportunities

Firstly, the company is determined on a world market expansion with a crucial focus on Asia. This move will see the company improve its sales over time. The new market has the capacity to grow to purchase and reach the right market. Secondly, GAP Inc has launched and is now enhancing online commerce in order to establish its name internationally. These platforms display and sell various product lines from multiple brands. Through this, the brands’ recognition should significantly increase and grow from the mobile and online spaces. The company also has the potential to invest heavily in native mobile applications. Ultimately, this will speed up making the online experiences more seamless for their clients and help them stay loyal to the company. Thirdly, the company has realized the effectiveness of celebrity endorsement and advertisement, seriously creating awareness in the target market. Analysis reveals that celebrity endorsement will boost expansion, enhance the visibility of the brands, and attract more customers. Last but not least, the company is enjoying the privilege of being the most popular GAP. Through this, the company remains more optimistic about its brands.

Threats

Firstly, GAP Inc is experiencing a considerable decline in profitability and sales. Recently, the company has revealed that sales have reduced by 5%. This has been attributed to delivery delays that have caused the inventory to grow since 2018. The physical stores have become a burden for the brand given that the sales are decreasing, thus considerably impacting margins. Secondly, the company’s management needs help to make business improvements. Enhancements in the supply chain have been made, loyalty programs initiated across brands, and massive investments in technology made, yet the company needs to earn profits. Lastly, competition remains a significant challenge for the business to thrive. The company needs help to enhance its performance, given its intense competition.

| Strengths | Weaknesses |

| Ø Worldwide brand recognition and a multi-brand portfolio. | Ø GAP brand name is becoming the least appealing. |

| Ø Diversity and equity within branding. | Ø Increasing competition from brands such as Zara and H&M. |

| Ø Flexibility and speed in the supply chain. | Ø A reducing product range. |

| Ø Sustainability of the business. | |

| Opportunities | Threats |

| Ø A world market expansion with a critical focus on Asia. | Ø A considerable decline in profitability and sales |

| Ø Enhancing online commerce | Ø The management is unable to make business improvements |

| Ø Effectiveness of celebrity endorsement and advertisement. | Ø Increasing competition remains a challenge |

| Ø The privilege of being the most popular. |

Recommendations

The functional level strategies the company must focus on improvement are the HR department, marketing, and production. For HR, the company needs to increase the hiring of highly-trained employees. It is essential to acknowledge that the company continuing a family chain staff will sometimes require more competent front members, which would be the beginning of failure. Hiring highly trained employees will ensure that work is done correctly, on time, efficiently, and effectively. For marketing, GAP Inc must provide increased brand identification. As mentioned, the company enjoys international brand recognition and a multi-brand portfolio. The brand operates at company-owned and franchise stores in over 40 countries and 90 regions.

The company must maximize the opportunity to ship orders online to promote brand recognition further. E-commerce must be utilized in marketing to display more samples to their clients. In this technological era, the company has no choice but to go digital. Most of the company’s products target the young population. Given this fact, most of these youths are connected through various media platforms; thus, the company must use the said avenues to reach them. Only through this will the company make the online experiences seamless for the target market, thus ensuring they stay loyal to the company. For production, the company must reduce rejections. The production team must use online avenues for customer feedback to ensure the chances of a product being rejected. The communication between the production team and the target customers will help inform what the customers should expect in the market. When customers know what is coming to the market, the chances of rejection of the products will be minimal.

The performance objectives that must be monitored are the company’s revenue growth, profit margins, and customer satisfaction. The end goal is to maximize sales and increase profitability over time. On the other hand, the goals that should be established for nonfinancial indicators are to expand sales to the existing clients and their satisfaction and focus on helping them remain loyal to the company’s brands.

References

Helfert, E. A., & Mcgraw-Hill, I. (2000). Techniques of financial analysis: a guide to value creation. Irwin/Mcgraw-Hill.

Investing. (2021). Gap Financials (GPS). Investing.com. https://www.investing.com/equities/gap.inc-financial-summary#:~:text=The%20Gap%2C%20Inc.%20reported%20earnings

Macrotrends. (2022). Gap Financial Ratios for Analysis 2005-2021 | GPS. Www.macrotrends.net. https://www.macrotrends.net/stocks/charts/GPS/gap/financial-ratios

Subramanyam, K. R. (2018). Financial statement analysis. Mcgraw-Hill.

Appendices

write

write