Introduction

Tesla is an American multinational company that designs and distributes diverse electric vehicles. The company’s product line consists of sedans, SUVs, and pickup trucks. Tesla also manufactures clean energy products like solar roof tiles, electric batteries, and solar panels to ensure sustainability (Khan 213). For years, Tesla has boasted its zero-dollar marketing strategy in the electric vehicle market. The company’s zero-dollar marketing allows Tesla to focus more on innovation and less on advertisements. Tesla claims that it does not spend a lot on marketing its products to the market (Eken 1). However, news reports have exposed Tesla’s false zero-dollar marketing strategy claim. The company has been allocating a significant amount of money to its marketing budget. This has resulted in some fines against the company in some regions, like South Korea. The Korea Fair Trade Commission fined the company about $2.2 million for its false advertisements (Lambert 1). The company did not effectively announce that its range model would drop significantly due to the cold weather. This was because the company did not significantly invest in advertisements that could have created awareness of the product features in the target market. Teala Zero’s marketing decision has also affected its market share in China. The company is facing stiff competition from other electric vehicle manufacturers who invest in traditional advertising strategies. The zero-dollar marketing strategy has limited customers’ awareness of the organization’s products, thus reducing their willingness to purchase Tesla’s products in China. Forbes reports that this has resulted in a decline in Tesla’s market share and sales revenues. The organization’s sales fell by 17.8% in November 2023, while its market share fell from 20.1% in the third quarter of 2023 to 15.9% in the final quarter of 2023 (Sriram and Jin 1) (Kindig 1). This shows that Tesla’s advertisement choice in China affected its profitability. Therefore, the extended essay will investigate the extent to which Tesla has decided to shift from its zero-dollar advertising strategy by answering the research question: To what extent have different factors played a role in Tesla’s decision to move away from its self-proclaimed zero-dollar traditional advertising strategy in China?

Methodology

The extended essay will use both quantitative and qualitative research methodologies. The qualitative analysis will involve the use of secondary data from past studies and news publications on Tesla’s traditional zero-dollar marketing strategy and the latest methods used by the company to market its products. Besides, qualitative methods used close-ended survey questions to gather respondents’ direct opinions in their own words about Tesla’s zero advertising strategy. The quantitative methods used the primary data gathered from the customer survey. The research used close-ended survey questions to evaluate the customers’s perceptions of Tesla’s marketing strategy and the reason the company is shifting from a zero-advertisement strategy.

The extended essay used credible business analysis tools to analyze the research findings. It used analytical tools like SWOT analysis, product position maps, decision trees, blue and red ocean marketing strategies, and profitability ratio analysis. These tools will help evaluate the impact of the Tesla Zero marketing strategy on its operations and how different factors have influenced Tesla to shift from the existing Zero marketing strategy.

Main Body

Survey findings

The primary findings analyzed customers’ perspectives on the Tesla market in China, its advertising methods, and the presence of Elon Musk in social media. It evaluated the trends in the market and how customers felt about the strong presence of Elon Musk and changes in organizational marketing methods.

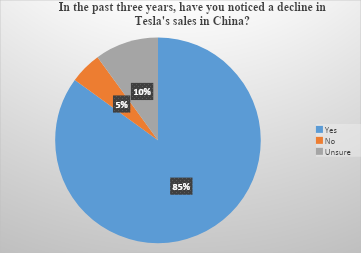

In the past three years, most of the study participants noticed that Tesla’s market share in China was significantly declining. About 85% of the study’s participants felt the Chinese were declining consumption of Tesla’s products. Some evidence supported the participant’s claims. According to a CNN news report, Tesla’s market share in 2021 dropped from 17% to 21% in the same year. Its sales continued to decline even in 2023 (Isidore 1). Reuters reported that Tesla’s sales revenues declined to 5.78% in October 2023 from 5.78% in September (Kindig 1). This informed most of the study’s participants about the downward trajectory of Tesla operations in China. Very few participants were unsure or had not noticed that the Tesla market in China was declining. About 10% and 5% were unsure and had no idea about Tesla’s market trends in China, respectively.

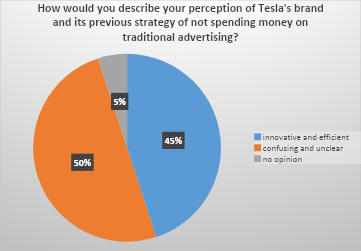

Besides, customers had diverse perspectives on zero-dollar advertising strategy. About 45% felt that the zero-dollar strategy was innovative and efficient. This is because it helped the company cut the cost of dealers and offer direct sales to customers. However, 50% perceived this strategy as confusing and unclear. The lack of advertisements limited the availability of Tesla cars’ knowledge to customers in the market. Most of the customers complained about the product features after purchasing Tesla cars. They had no clue about the internal and external features of the company’s products due to a lack of advertisements.

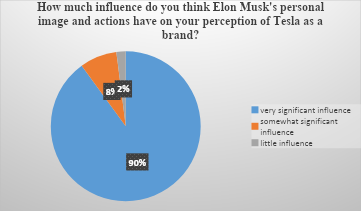

Elon Musk’s personality and presence on social media strongly impact consumers’ perception of the company. Most customers felt that his social presence influenced how they perceived Tesla. Only 8% and 2% felt his presence was somehow influential and little influential, respectively. Therefore, the study can conclude that Elon Musk was a walking advertisement for the company. This helped the company cut the cost of advertising.

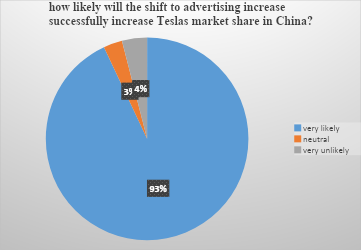

Moreover, customers had diverse opinions on Tesla’s shift from zero advertising to increasing their advertising budget. They felt the advertising would help the company increase its market share in China. 93% of the survey participants felt that if the company shifted to traditional marketing, it had a high chance of increasing its market share (See Appendix 1). Only a few (3% and 4%) were neutron and unsure if the move would help the company increase its market share. Therefore, the company should at least resonate with the majority and shift to traditional advertising methods to attract more customers.

SWOT analysis

Strength

|

Weaknesses

|

Opportunity

|

Threats

|

SWOT analysis investigated the internal and external business environment influencing Tesla’s zero advertising strategy. The company has some strengths, like a strong brand image. Tesla enjoys a premium brand image that attracts several consumers (Jahroh et al. 325). The company’s zero advertising strategy limits the funds it could have used for marketing and focuses on innovation (Pathak et al. 251). Its innovative features, like long-range and autopilot, allow the company to attract several customers. Besides, the dollar strategy allows the company to eliminate dealers. It enables Tesla to sell directly to customers, thus allowing the company to offer its products at a competitive price (Pathak et al. 251). Elon Musk’s influence on the company’s marketing is significant. His personality and strong presence on social media generate a significant business buzz among customers. According to a customer survey, many customers felt that Musk’s presence significantly influenced their perception of Tesla. 90% of the survey participants agreed that Elon Musk’s social media presence and personality influenced their perception of Tesla (see Appendix 1).

Despite the above organization’s strengths, the market in China is shifting due to several market dynamics. The company is receiving negative customer perceptions. Customers recently realized that the company has invested significantly in advertising and marketing. This has created negative customer perceptions. Besides, the company has faced several fines in some regions for false advertisements. For instance, Tesla was fined more than 2.2 million dollars in Korea for false advertisements (Lambert 1). The company had lied about the range of its models during cold seasons. The company also faces stiff competition from EV manufacturers in China and internationally. In China, Tesla faces stiff competition from local rivals such as NIO, Xpeng, and Li Auto (Yang et al. 21). At the international level, Tesla faces competition from companies like Toyota, GM, Nissan, and Ford. Its competitors have heavily invested in advertisements. This has helped them overshadow Tesla’s brand image in the Chinese market. Lack of advertising has also created a negative public perception. The company has been accused of declining to release sensitive information about its products. This has resulted in a decline in the company’s market share in China. Tesla’s market share fell from 20.1% in the third quarter of 2023 to 15.9% in the final quarter of 2023 (Kindig 1).

The threats and weaknesses of Tesla in China resulting from the Zero advertising strategy influenced the organization’s sales. According to the survey, most customers noticed that Tesla sales have been declining in China in the past three years. 85% were sure that the Tesla market in China was declining, 5% were not aware, and 10% were unsure (see Appendix 1). The statistics reveal that the market share was significantly declining. Therefore, the company had to leverage available advertising opportunities to increase the company’s market share. Tesla should use its strong social media presence and CEO personality to advertise its products in China. The company should also increase its marketing budget to create awareness among customers about the available new Tesla car models.

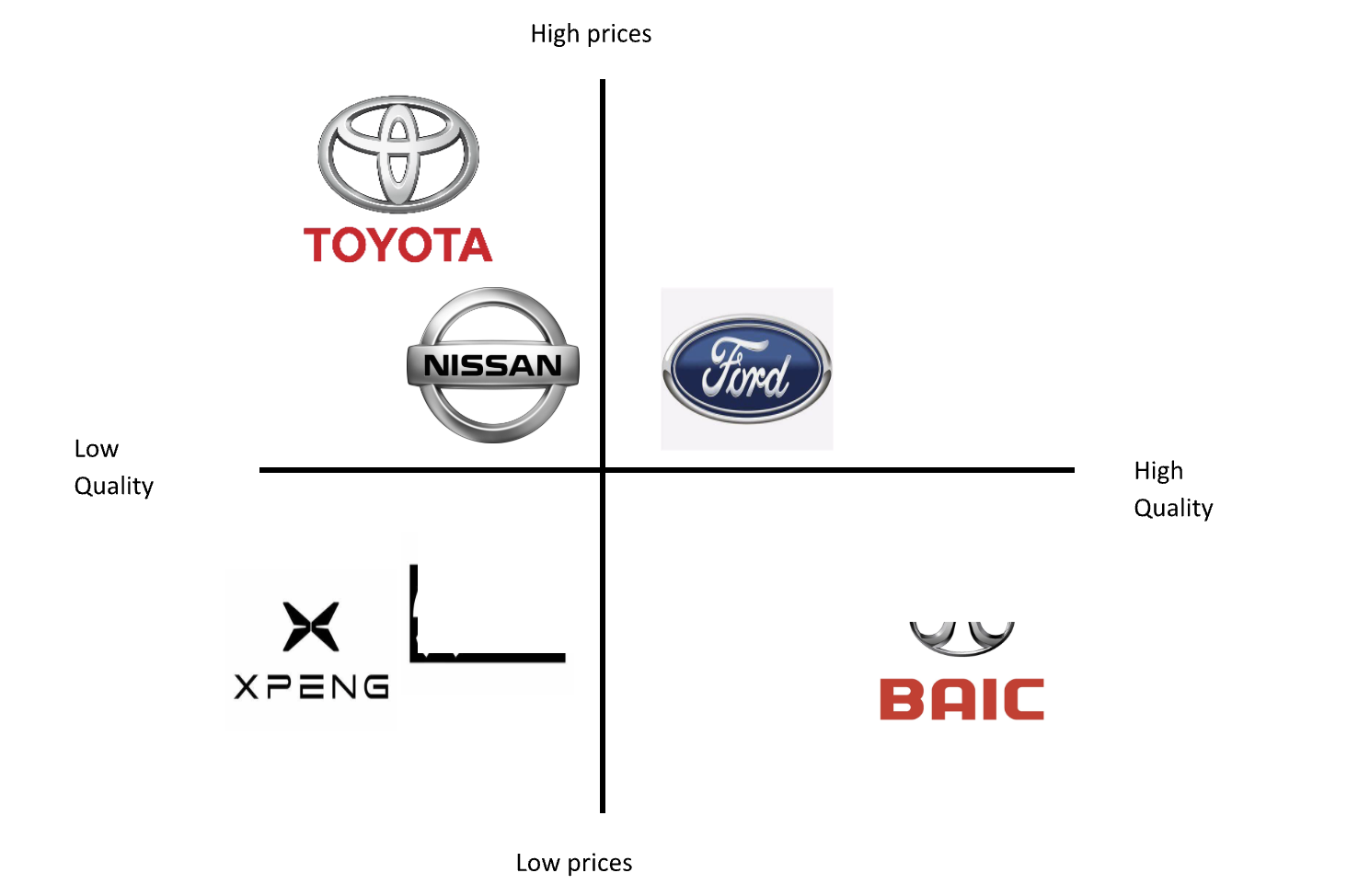

The product position map is a visual representation of customers’ perceptions of the position of a product against its competitors (Maven 1). The vertical axis shows the prices of the product (high prices and lower processing). The horizontal axis reflects the quality of the product (low quality and high quality). The product position map for Tesla will reflect the customer’s perception of the price and quality of the company’s products against those of its key EV manufacturers (see diagram below).The product position map shows that Tesla automobiles are considered premium products by customers. The company sells high-end EV products in its market worldwide. However, it receives stiff competition from other premium-quality companies like Ford and BMW (Han 573). The company also receives competition from other companies like Toyota, Nissan, and Audi (Han 573). This company has a strong global presence, almost similar to Tesla. However, they have a strong advantage over Tesla. They leverage their social network to advertise their products to their target market. Tesla’s competitors have also invested huge advertising budgets to market their products to their respective markets. This poses a threat to Tesla’s strong market share worldwide. In China, these international automotive makers have also invested a significant advertising budget. They have partnered with local celebrities and influencers to generate ads and content. This has helped them promote their sales and market share in the Chinese market. For instance, Toyota had invested more than 1.7 billion dollars in advertising (Faria 1). The company was ranked the third-largest automobile company in the US based on advertising expenditure in 2022. Its advertising habit helped Toyota increase its market position and shares in China. As of June 2023, in the second financial quarter, the company had increased its revenues by 94% in China (Reuters 1).

Tesla also faced significant competition from local EV manufacturing companies. Chinese automobile companies like Baic, NIO, and Xpeng Automakers significantly increased their market share while Tesla’s was declining (Yang et al. 21). Domestic EV makers enjoyed local support from Chinese customers. This led to a drop in Tesla sales from 21% in March 2021 to 17% in April (Kindig 1). This was the largest protest of Tesla’s care in China, as car owners complained of product features they were unaware of while purchasing the products. Li Auto, Baic, NIO, and Xpeng also invested strongly in advertising to increase their target market and create awareness among Chinese consumers about the price and quality of their car models. This increased their competitiveness against Tesla in the Chinese market. Therefore, the competition and lack of advertisement were major factors leading to the organization’s sales decline. The company should partner with local dealers and increase its advertisement budget in China to promote its sales revenues and competitiveness.

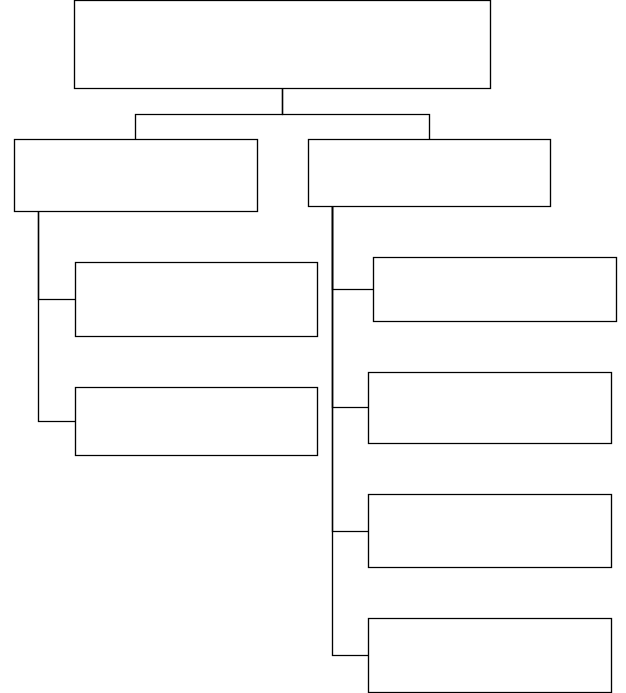

Decision tree analysis

The research will use the decision tree to analyze the possible effects of the company selecting any decision regarding the zero-dollar advertising strategy. Tesla’s decision tree analysis will analyze the impact of Tesla’s decision to shift from traditional advertising to continuing with its existing zero-dollar advertising strategy. Each decision will significantly impact the organization’s operation in China.

The decision to shift to the traditional advertisement method and abandon the zero-dollar advertising strategy was influenced by several factors. Besides, the company’s decision to remain with the existing zero-dollar strategy would have been influenced by diverse factors. In order to continue with the zero-dollar strategy, the company considered the efficiency of the strategy in cutting advertisement costs and its initial marketing strategy of focusing on innovation instead of advertisements. If the company continues with its existing zero strategy, it will have the advantage of cutting advertising costs and allowing it to invest significantly in innovation.

However, the shift in market dynamics in China would have significantly affected the company. The Chinese market was complaining of a lack of awareness. The lack of advertising about Tesla’s products has limited consumers’ awareness. Besides, government advertisement regulations require transparency to ensure product safety for Chinese citizens. The lack of advertisements limited the consumer’s knowledge about Tesla. Most of the customers complained about company products after they had complained. For instance, consumers complained about Tesla’s range during the cold season in South Korea. The company had only included information about its range during normal temperatures. This leads to a lack of trust in customers of Tesla’s car products. Customers’ perception of Tesla was changing in China with the emergence of strong EV manufacturing companies. Local EV manufacturers like Li Auto, Baic, and NIO offered their products to Chinese consumers at a reasonable price (Yang et al. 21). Their products were more affordable than Tesla cars. This led to a shift in consumers’ perception of Tesla. More customers started developing tastes and preferences for locally manufactured automobiles.

Moreover, strong EV advertisements from local and international markets influenced the company’s shift in its marketing models in China. Local automobile companies like Li Auto and international companies like Toyota invested heavily in advertising (Yang et al. 21). They had allocated billions of yen in advertising strategies. This helped in improving sales. Therefore, Tesla had to change its Zero Dolar advertising strategy in China to traditional advertising to attract more customers.

Blue and Red Ocean marketing strategies

Red and blue ocean marketing strategies are competitive analysis strategies used to analyze organizations’ operations in a diverse competitive market. The Red Ocean strategy focuses on organizations’ operations in a competitive market. The company uses its existing marketing strategy to expand its market share. On the other hand, the blue ocean involves the development of new market space rather than competing in existing markets. Telsa’s shift to traditional advertisement strategies represents the blue ocean market strategy.

| Red Ocean Strategy | Blue Ocean strategy |

| Compete in existing market space | New advertisement strategies like social media marketing |

| Beat competitors in the EV market | Create and capture new demands in the EV market |

| Leverage the existing demand for EVs | Create uncontested market space |

| Advertising shift away from Zero advertising strategy | Make competition irrelevant by focusing on innovation rather than advertisements. |

| Premium pricing | Localization and partnership with local advertisers to attract new markets. |

| Leveraging the existing social media presence of Elon Musk | Direct-to-customer model. |

The blue and red ocean strategy analyzed the current zero strategy and possible shit to advertising strategy impacts on the organizations market trends in China. Several sources have revealed that the company was facing stiff competition in China. The company had to develop strategies to increase its competition in the existing market or diversify and compete in new markets. According to the Read Ocean strategy, the company was to develop methods of strengthening its market share in the existing local market. The company had to beat its competitors by introducing new advertising methods or improving its existing zero-dollar advertising strategy. However, Tesla’s zero-dollar marketing strategy was failing in China. Research shows that a lack of advertising significantly costs organizations much market share. It limits the customers’ knowledge of the product’s features. Lack of advertisement also does not make customers resonate with the product or evaluate whether to make a purchasing decision. The lack of advertisements for a product limits customers’ awareness of the product’s existence. This limits the organization’s customer base. Therefore, according to Red Ocean, the company had to abandon its existing advertising strategy to adopt current and traditional advertising strategies to increase its competitiveness in the Chinese market. The company had to leverage its strong social media presence to develop attractive ads and content for its available Tesla cars in China. This would have helped the company beat its local and international competitors in China. It would have helped Tesla increase its profitability and regain its strong market position in the EV market in China.

The blue ocean revealed strategies the company would have adapted to expand its market reach in China. According to Blue Ocean, Tesla had to adopt new advertising strategies, like social media marketing. The company could hire Chinese influencers and create innovative social media content to advertise its products. The strategy will help the company reach out to new customers who lack a comprehensive understanding of Tesla’s EV models. The company can also leverage the strong presence of its CEO on social media to advertise its products. According to the survey conducted in this research, most participants felt that Elon Musk had a significant influence on their perception of Tesla. 90% of the participants felt that Elon Musk’s presence influenced their perception of Tesla’s brand (see Appendix 1). Therefore, the company can use Elon Musk’s personality and strong media presence to create new markets and improve its Chinese market share. The company can create and capture new demand for EVs to increase its market share. It should innovate and develop new EV models. The new EV models should be critically advertised on social media to attract new customers and create awareness. Tesla faced stiff competition from partners due to its zero-dollar strategy (Koetsier 1). The strategy eliminated dealers and blockers in its supply chain. This limited the organization’s relationship with local customers. Research shows that local dealers have strong relationships with local customers. They have significant knowledge of customers’ needs and preferences and the trends in market demand. Therefore, eliminating the dealers and marketers from the Tesla supply chain limited the organization’s relationship with local customers. The company should partner with local dealers and local companies to establish a direct relationship with the customers. This would help the company improve its sales and create new demand for Tesla EV cars in China.

Profitability ratio analysis

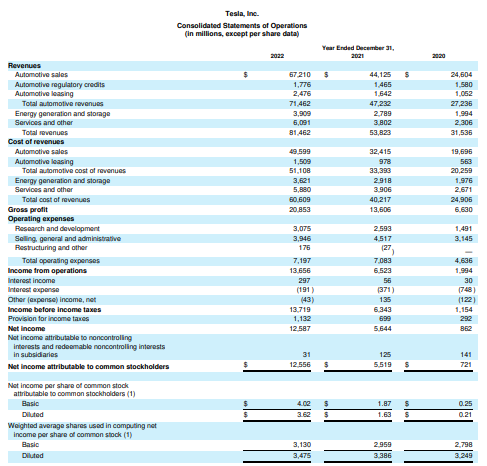

Profitability ratios are financial strategies used to evaluate a company’s financial position. The extended essay will use net profit or loss margin to reflect the company’s financial position after its shares in China declined. It will analyze Tesla’s net profit margin for 2020, 2021, and 2022 to distinguish how the declining market position would affect the organization’s financial stability. The full financial reports for the year 2023 are currently unavailable. Therefore, the company only analyzed the 2020, 22, and 23 financial reports to distinguish the company’s financial position while using the zero-dollar marketing strategy. According to the organization’s annual reports, Tesla generated revenue of 31,536, 53,823, and 81,462 million dollars in 2020, 2021, and 2022, respectively (Tesla 45). The company made a net income of 862 million, 5,644 million, and 12,587 million dollars in the same year.

Net profit margin = net sales/net income*100

2020 net profit margin = 2.73%

2021 net profit margin =10.49%

2022 net profit margin = 39.91%

Worldwide, Tesla was performing well. The organization’s sales revenues and net income were relatively increasing each year. This was due to the low cost of advertisements and the development of innovative products. The analysis of the organization’s profitability shows a relatively great improvement in the net profit margin ratio. The company’s net profit margin ratio increased from 2.73% to 10.49% and 39.91% in 2020, 2022, and 2023, respectively. The company’s profitability was forecast to increase with the same trends in 2023. Despite the increase in organization revenues, Tesla’s market share in China is still declining (Kindig 1). The company faced the challenge of declining market share and revenues in the country. This was due to changes in consumer behaviors in the Chinese market and increased competition from local automotive manufacturers. Besides, the local EV manufacturers had invested heavily in marketing with a huge advertising budget. This helped the companies acquire a significant market share while that of Tesla was dropping. Therefore, the company should also shift its marketing strategy to China, despite working in the rest of the world, to solidify its position in the Chinese market.

Conclusion

In conclusion, the extended essay investigated the research question, “To what extent have different factors played a role in Tesla’s decision to move away from its self-proclaimed Zero-Dollar traditional advertising strategy in China?” The paper found that several factors had influenced the organization’s decision to shift from its traditional zero-dollar marketing strategy. The zero-dollar advertising strategy helped the company cut the cost of advertising and focus on innovation. This strategy has helped the company maintain a strong position in the global EV market. However, the Chinese market is different for Tesla. Relying only on innovation as its marketing strategy has significantly dropped Tesla’s market share and sales revenue in China. The market dynamics in China are different from those in the US and the rest of the world. Besides, local EV companies like NIO, Xpeng, and Li Auto have significantly invested in advertising. International automakers like General Motors have partnered with local partners to improve their market in China. These companies have also allocated huge social media budgets for social media marketing and advertising. Advertisements have helped Tesla’s competitors create awareness among customers and attract new customers. Therefore, factors like lack of customer awareness, increased competition from local EV manufacturers, and heavy investments in advertising for both local and international companies have significantly influenced Tesla to shift from its traditional Zero Dolar advertising strategy. The company has to increase its marketing budget in China to ensure it remains competitive and increases its market share.

References

Eken, Yaprak. “Does Tesla’s $0 Marketing Strategy Actually Work?” Segmentify, 6 Feb. 2024, segmentify.com/blog/tesla-marketing-strategy/.

Faria, Julia. “Toyota’s Advertising Spending in the US 2022.” Statista, 2023, www.statista.com/statistics/261539/toyotas-advertising-spending-in-the-us/#:~:text=Sep%2027%2C%202023%20In%202022%2C%20Japanese%20car%20manufacturer. Accessed 24 Feb. 2024.

Han, J. “How Does Tesla Motors Achieve Competitive Advantage in the Global Automobile Industry?” Archive.org, 2022, scholar.archive.org/work/3fe5chu3dvevjldso4qrxfnoku/access/wayback/www.ngcists.org/journal/file_down.asp?file_idx=633.

Isidore, Chris. “Tesla’s Weak Sales in China Worry Investors | CNN Business.” CNN, 11 May 2021, edition.cnn.com/2021/05/11/business/tesla-china-problems/index.html#:~:text=The%20drop%20came%20as%20Chinese%20electric%20vehicle%20manufacturers. Accessed 24 Feb. 2024.

Jahroh, Siti, et al. “Proceedings of the Business Innovation and Engineering Conference (BIEC 2022).” Google Books, Springer Nature, 2023, p. 325, books.google.com/books?hl=en&lr=&id=Yqy-EAAAQBAJ&oi=fnd&pg=PA325&dq=tesla+company+strengths&ots=OUaH_xGxrj&sig=wbDMq0idDus5mqRS6NxxbvWNkFs. Accessed 25 Feb. 2024.

Khan, Md Rahat. “A critical analysis of Elon Musk’s leadership in Tesla motors.” Journal of Global Entrepreneurship Research 11.1 2021: 213–222.https://link.springer.com/article/10.1007/s40497-021-00284-z

Kindig, Beth. “Tesla’s China Market Share Continues to Slide.” Forbes, 2023, www.forbes.com/sites/bethkindig/2023/12/07/teslas-china-market-share-continues-to-slide/?sh=5712d101659f. Accessed 21 Feb. 2024.

Koetsier, John. “Tesla Spends Zero on Ads. Here’s Where BMW, Toyota, Ford, and Porsche Spend Digital Ad Dollars.” Forbes, 2019, www.forbes.com/sites/johnkoetsier/2019/05/06/tesla-spends-zero-on-ads-heres-where-bmw-toyota-ford-and-porsche-spend-digital-ad-dollars/?sh=59a6974211d4. Accessed 25 Feb. 2024.

Lambert, Fred. “Tesla Is Fined Millions of Dollars for False Advertising.” Electrek, 3 Jan. 2023, electrek. Co/2023/01/03/tesla-fined-millions-dollars-false-advertising/.

Maven. How to Create a Product Positioning Map. 2023, maven.com/articles/product-positioning-map. Accessed 25 Feb. 2024.

Pathak, Pankaj, et al. “Unveiling the Success behind Tesla’s Digital Marketing Strategy.” Emerging Technologies in Data Mining and Information Security, vol. 491, Sept. 2022, p. 251, https://doi.org/10.1007/978-981-19-4193-1_24.

Reuters.“Toyota Nearly Doubles Q1 Profit, China Remains Challenging.” Reuters, 1 Aug. 2023, www.reuters.com/business/autos-transportation/toyota-posts-94-jump-q1-operating-profit-2023-08-01/.

Sriram, Akash, and Hyunjoo Jin. “Analysis: Elon Musk’s Embrace of Advertising at Tesla Grabs Marketers’ Attention.” Reuters, 18 May 2023, www.reuters.com/business/autos-transportation/elon-musks-embrace-advertising-tesla-grabs-marketers-attention-2023-05-17/.

Tesla.Tesla Annual Report 2023: Form 10-K (NASDAQ: TSLA). 2023. https://stocklight.com/stocks/us/nasdaq-tsla/tesla/annual-reports/nasdaq-tsla-2023-10K-23570030.pdf

Yang, Jan Y., et al. “An Overview of the EV Stakeholders in China.” Chinese Electric Vehicle Trailblazers, 2023, pp. 21–39, https://doi.org/10.1007/978-3-031-25145-0_3.

Appendices

Appendix 1: Survey Questions on Tesla’s Advertising Shift in China

- In the past three years, have you noticed a decline in Tesla’s sales in China?

- Yes

- No

- Unsure

- How aware are you of the competition faced by Tesla in the Chinese electric vehicle market?

- Very aware

- Somewhat aware

- Not very aware

- Do you agree Tesla’s decision to advertise in China is related to its desire to reshape its brand image there?

- Strongly agree

- Somewhat agree

- Strongly disagree

- How would you describe your perception of Tesla’s brand and its previous strategy of not spending money on traditional advertising?

- Innovative and efficient

- Confusing and unclear

- No opinion

- How much influence do you think Elon Musk’s personal image and actions have on your perception of Tesla as a brand?

- Very significant influence

- Somewhat significant influence

- Little to no influence

- Are you aware of any recent news regarding Tesla being fined for misleading statements about its advertising budget?

- Yes

- No

- Unsure

- Considering Tesla’s recent announcement about gradually increasing its advertising budget, how likely do you think this shift will be successful in the Chinese market?

- Very likely

- Neutral

- Very unlikely

Appendix 2: Tesla consolidated financial statement

write

write