Introduction

In International Financial Management, multinational corporations (MNCs) frequently encounter the challenge of managing foreign exchange risks. These risks arise due to fluctuations in currency exchange rates, which can significantly impact the financial performance of these corporations (Pellegrino et al., 2023). This report evaluates various strategies MNCs adopt to mitigate their exposure to such risks.

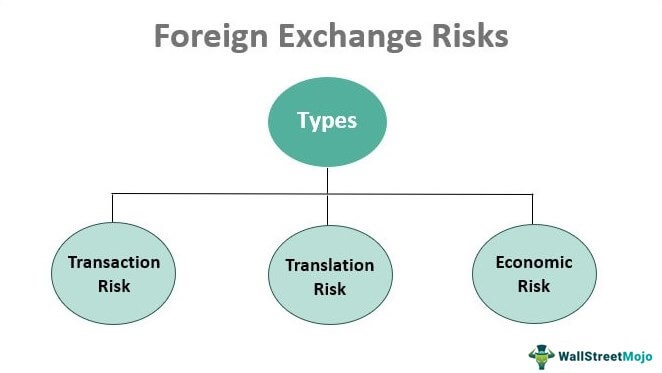

Types of foreign exchange risks

Multinational corporations must navigate various foreign exchange risks in the intricate landscape of International Financial Management. These risks, intrinsic to their global operations, primarily include:

Figure 1: Foreign Exchange Risks

Source: (Bank, 2016).

Transaction risk: This emerges when there is a fluctuation in exchange rates between the time a foreign currency transaction is initiated and when it is settled. The risk here lies in the potential for the currency value to move unfavourably, affecting the cost or proceeds of the transaction.

Translation risk: Encountered during the consolidation of financial statements from various subsidiaries operating in different currencies. Exchange rate changes can lead to significant variations in reported assets, liabilities, income, and equity, distorting a company’s financial health as presented in its consolidated financial statements (Bank, 2016).

Economic risk: Perhaps the most far-reaching pertains to the effect of exchange rate fluctuations on a company’s future cash flows and market value. It extends beyond individual transactions or financial reporting periods, encompassing the broader impact on competitive position, market demand, and long-term financial stability in different currency environments.

Understanding these risks is vital for MNCs in developing robust strategies to mitigate their adverse effects on international financial operations.

Strategies used in managing foreign exchange risks

Hedging Strategies: Hedging, a fundamental aspect of risk management in International Financial Management, is widely adopted by multinational corporations to mitigate the adverse effects of foreign exchange rate fluctuations. The primary hedging instruments include:

- Forward contracts are customised agreements where two parties agree to buy or sell a certain asset (here, a currency) at a pre-determined price on a future date (Tiwary, 2019). Multinational corporations use forward contracts to secure exchange rates for upcoming transactions, thus safeguarding against potential unfavourable shifts in currency values from when the contract is made to when it matures. This method ensures more predictable international transaction costs and revenue streams. However, the rigidity of forward contracts is a downside, as the terms are not easily changeable after the agreement.

- Futures contracts: Unlike forwards, futures are standardised exchange-traded contracts. They have fixed contract amounts and expiration dates, and clearinghouses enable trading, minimising counterparty default risk (Santillán-Salgado et al., 2016). Futures are popular due to their liquidity and ease of entering and exiting positions. They are ideal for MNCs looking to manage short-term currency fluctuation risks, although they offer less flexibility than forward contracts.

- Options contracts: These agreements provide the buyer the right, but not the obligation, to purchase (via a call option) or sell (via a put option) a specific amount of money at a specified price by a certain date. Options are valued for their versatility, which allows holders to take action depending on changes in exchange rates, both positive and negative (Bank, 2016). Options allow one to profit from positive currency movements while safeguarding against negative ones, whereas forwards and futures do not. The premium paid for this flexibility is the cost of the option.

- Swaps: Currency swaps include the exchange of principal and interest payments between different currencies. They are particularly beneficial for managing foreign currency debt obligations and hedging long-term exposure (Tiwary, 2019). Multinational corporations widely use swaps for lower interest or exchange rates in various foreign currency markets.

Each technique serves a distinct purpose in an MNC’s risk management toolkit and provides varying financial ramifications, flexibility, and protection. The specifics of the foreign exchange risk, the firm’s risk tolerance, and its financial objectives all influence which instrument is chosen.

Diversification is an essential strategy multinational corporations adopt to reduce the risks associated with foreign exchange. This method spreads corporate operations and financing over many currencies and geographical areas. This method mitigates the consequences of exchange rate volatility by decreasing a company’s reliance on a certain currency or market. For example, if an MNC has activities in many countries, a decrease in one currency’s value may be countered by a gain in another, neutralising the impact on the firm as a whole (Álvarez-Díez et al., 2016). Diversification tactics include changing raw material sources, sales markets, production sites, and finance sources. The goal is to achieve a natural equilibrium in which gains in one sector of the economy offset losses in another, resulting in more consistent cash flows and profits.

Sharing currency risk involves a mutual agreement between entities involved in international transactions to manage the risk of exchange rate changes collectively. This frequently entails modifying the pricing of products or services in a contract in line with shifts in currency values. For instance, if a currency’s value moves to the disadvantage of one party, the contract might be structured to distribute this financial impact across both parties, rather than having one side shoulder the entire risk (Maggiori, 2017). This strategy is predicated on a collaborative relationship and is particularly relevant in long-term agreements or partnerships where sustaining a fair and balanced relationship is crucial.

Netting is an effective strategy to manage foreign exchange risk by balancing receivables and payables within the same currency. This method can be applied internally within a company or across its subsidiaries. Consider a multinational corporation that receives payments in euros from a client while also owing in euros to a vendor. By netting these euro-denominated transactions against each other, the company can significantly lower its overall exposure to fluctuations in the euro’s value (Tiwary, 2019). This practice reduces the necessity for converting currencies and decreases the costs linked to these transactions. Netting streamlines the handling of transactions in multiple currencies, enhancing efficiency and cost-effectiveness in financial management.

Matching is a financial strategy where an MNC aligns its cash flows in the same currency across its subsidiaries. This means synchronising the inflows (like revenues) and outflows (like expenses) in the same currency to minimise foreign exchange risk. For example, if one subsidiary of an MNC in Europe earns revenues in euros and another incurs expenses in the same currency, aligning these transactions (matching) helps reduce the requirement to convert currencies (Maitha, 2020). This method effectively diminishes the impact of euro exchange rate variability on the corporation as a whole. Through matching, MNCs can more efficiently manage currency risks, ensuring that currency fluctuations have a minimised effect on their overall financial performance.

Natural hedging, or operational hedging, is a strategic approach for managing foreign exchange risk through operational decisions. This method involves procuring raw materials or inputs for production from the same currency region in which the products are sold. Such an approach helps a multinational corporation align its expenditure framework with its income stream in the same currency, thereby naturally countering the effects of currency rate fluctuations (Pellegrino et al., 2023). Additionally, this strategy can extend to diversifying production locations and restructuring supply chains, thereby distributing currency exposure more evenly and effectively.

Strategic planning combined with dynamic hedging is a proactive approach that involves continuous observation and modification of hedging positions in line with changing market conditions and projections. MNCs adopting this method utilise advanced analytical tools and financial modelling to anticipate movements in currency values and adjust their hedging tactics accordingly (Yoon and Jei, 2020). This form of hedging is characterised by its active management and requires an in-depth understanding of the currency markets. Although more complex, its dynamic nature can make it exceptionally effective in reducing foreign exchange risk.

Financial instruments: A comprehensive foreign currency risk management plan frequently comprises a variety of financial instruments that multinational corporations frequently employ. This selection covers currency-tracking exchange-traded funds (ETFs) and more complicated financial products such as options, forwards, futures, and swaps (Shobande and Shodipe, 2021). These tools are adaptable enough to be adjusted to the company’s specific hedging requirements, accommodating both short- and long-term hedging strategies. Their versatility is critical for developing risk management plans tailored to the MNC’s specific financial risks and goals.

Conclusion

Effectively managing foreign currency risks is a vital and dynamic activity in international financial management for multinational corporations. More advanced tactics, such as operational hedging and strategic planning, and more standard hedging strategies, such as forwards and options, are utilized. The company’s particular risk profile, the characteristics of its foreign activities, and the status of the market all influence the selection of an effective strategy. For efficient management of foreign exchange risks, a deep awareness of the complexity of global market dynamics, financial knowledge, and strategic vision are all required.

References

Álvarez-Díez, S., Alfaro-Cid, E. and Fernández-Blanco, M.O., 2016. Hedging foreign exchange rate risk: Multi-currency diversification. European Journal of Management and Business Economics, 25(1), pp.2-7.

BANK, B., 2016. Foreign Exchange Risk Management.

Maggiori, M., 2017. Financial intermediation, international risk sharing, and reserve currencies. American Economic Review, 107(10), pp.3038-3071.

Maitha, A.K., 2020. Foreign Exchange Risk Management Practices and Financial Performance of Manufacturing Firms in Kenya (Doctoral dissertation, University of Nairobi).

Pellegrino, R., Gaudenzi, B. and Zsidisin, G.A., 2023. Mitigating foreign exchange risk exposure with supply chain flexibility: A real option analysis. Journal of Business Logistics.

Santillán-Salgado, R.J., Ulin-Lastra, M.G. and López-Herrera, F., 2016. Currency exchange rate risk hedging strategies using MXN/USD MexDer futures contracts. International Journal of Bonds and Derivatives, 2(3), pp.186-210.

Shobande, O.A. and Shodipe, O.T., 2021. Monetary policy interdependency in Fisher effect: A comparative evidence. Journal of Central Banking Theory and Practice, 10(1), pp.203-226.

Tiwary, A.R., 2019. Study of currency risk and the hedging strategies. Journal of Advanced Studies In Finance (JASF), 10(19), pp.45-55.

Yoon, J.C. and Jei, S.Y., 2020. Purchasing power parity vs. uncovered interest rate parity for NAFTA countries: The value of incorporating time-varying parameter model. Economic Modelling, 90, pp.494-500.

write

write