Introduction

India has a huge expanding economy, with 1.3 billion people and one of the world’s fastest-growing consumer markets. It has a diverse consumer base with significant spending power (Varghese, 2022, p. 55). As a result, it is a popular location for foreign enterprises looking to expand their operations. Green Toys, a toy manufacturer based in the United States, is one company considering entering the Indian market (Ghosh et al., 2022, p. 112). This essay will discuss the analysis of India’s country, the mode of entry most appropriate for the Green Toys Company, and the advantages and disadvantages of such a move.

Company Background

Children’s toys manufactured from recycled plastic are designed and produced by Green Toys Inc., a US-based business. The company, established in 2007, is dedicated to making kid-friendly, environmentally responsible items (Ghosh et al., 2022, p. 113). To suit the needs of its clients, Green Toys Inc. continuously develops new and inventive items using non-toxic, recycled milk jugs. More than 35 countries, including India, sell their goods (Varghese, 2022, p. 55). The business is devoted to using recycled products and decreasing transportation pollution to lessen its environmental impact and carbon footprint.

Analysis of the Indian Market

India, the second-most populous nation in the world with a population of 1.3 billion, is a rapidly developing economic power. In terms of nominal GDP, it is the world’s seventh-largest economy, while purchasing power parity (PPP) is the fourth-largest (Ghosh et al., 2022, p. 112). Among the BRICS nations, it has an economy that is expanding at the highest rate. Over the past 20 years, this rapid expansion has led to a rise in per capita income. A measure that contrasts the purchasing power of various currencies across nations is called purchasing power parity (PPP). It is calculated by estimating the equivalent amount of goods and services that can be purchased with a certain amount of currency in different countries (Tripathi et al., 2022, p. 15). This can inform a company such as Green Toys Company when considering entry into a new market such as India.

The exchange rate between the Indian rupee and the US dollar would be used to determine India’s PPP, which would then be modified to account for variables like inflation, taxes, and subsidies. To assess the viability of joining the Indian market, Green Toys Company could compare the cost of manufacturing, labour, and materials in India with those in other nations. As it can predict the purchasing power of Indian consumers, the PPP of India can also be used to examine the expected profitability of the company in India.

India’s GDP expanded at a rate of 7.2% in 2018 and is projected to rise to 7.4% in 2019. Gross Domestic Product, sometimes known as GDP, is a crucial economic indicator that calculates the total value of all products and services generated in a nation during a specific year (Tripathi et al., 2022, p. 15). It may be used to make educated decisions about a company’s entry into a market and is a significant indicator of the health of an economy. GDP can be used to estimate market size, average household income, and rate of economic growth in a nation while evaluating a company’s entry into the Indian market (Ghosh et al., 2022, p. 115). GDP also provides insight into the population’s purchasing power, which can be used to identify potential target customers for the company’s products and services.

Additionally, GDP can be used to comprehend the Indian market’s competitive environment. Companies can evaluate the number of prospective competitors in the market and the amount of rivalry they may encounter by evaluating the GDP data for India (Tripathi et al., 2022, p. 13). The size and spending power of the country’s current customer base and any future openings for new client groups can also be determined using GDP statistics. In conclusion, using GDP can help decision-makers decide whether to enter the Indian market with Green Toys Company. The company can learn important information about the market’s size, the average income of the populace, and the pace of economic growth in India by examining the GDP data for that nation (Varghese, 2022, p. 55). Businesses can also use GDP to learn more about the Indian market’s competitive environment and current client base.

The industrial structure of the Indian economy is diversified, with the public and private sectors having a significant presence. India’s economic expansion has been fueled by the manufacturing sector, which contributes almost 27% of the country’s GDP (Tripathi et al., 2022, p. 12). The service sector is the greatest driver of the nation’s expansion and responsible for 54% of the GDP. India is a very attractive market for eco-friendly toys because of its big child population and expanding middle class. From 2019 to 2026, the market for green toys is anticipated to expand at a compound annual growth rate (CAGR) of 6.6%. This growth is driven by the increasing awareness of environmental issues among Indian consumers and their willingness to pay a premium for eco-friendly products (Ghosh et al., 2022, p. 118). The Indian government has also supported green toys by providing incentives and subsidies to manufacturers who produce them.

Green Toys must overcome a few obstacles before it can successfully join the Indian market. The lack of consumer awareness of eco-friendly toys, the high production costs, and the prevalence of fierce local competition are a few of them (Ghosh et al., 2022, p. 112). Additionally, the Indian market is very price-sensitive. Therefore Green Toys would need help to compete with the inexpensive local goods (Sarkar et al., 2022, p. 2186). In conclusion, India is a desirable market for green toys because of its sizable child population, expanding middle class, and favourable governmental policies (Varghese, 2022, p. 55). However, Green Toys needs to address certain challenges, such as the lack of consumer awareness, the high cost of production and strong local competition to succeed in the Indian market.

Diffusion of Innovation Theory

According to this theory, individuals will adopt a new idea or product depending on their traits and the social setting in which it is given. This hypothesis can be used to explain Green Toys’ entry into the Indian market because it offers guidance on how the business can successfully advertise to Indian consumers (Ghosh et al., 2022, p. 111). For instance, Green Toys can utilize marketing techniques, including advertising campaigns, social media campaigns, and product demos, to raise awareness of their goods (Varghese, 2022, p. 55). They can also modify their product by looking at its attributes to appeal to the target market.

Consumer Decision-Making Theory

According to this theory, a person’s decision to buy a product is influenced by several variables, including their perception of the product, attitude toward it, and capacity to buy it. By comprehending the variables that affect Indian customers’ decisions to buy a product, this theory may be utilized to explain Green Toys’ introduction into the Indian market (Krishna Kishore et al., 2022, p. 201). For instance, Green Toys can increase the appeal of its goods to Indian consumers by using pricing tactics, product packaging, and promotional activities (Sarkar et al., 2022, p. 2188). To fully comprehend the requirements and preferences of their customers, they can also conduct market research and gather information about their target market.

Making decisions about Green Toys’ entry into the Indian market can be done using these theories. Green Toys can better satisfy the needs of Indian consumers by tailoring their marketing tactics and product offerings by comprehending the motivations and features of their target market. Additionally, Green Toys can create tactics to boost the possibility that Indian consumers will buy their goods by taking a closer look at the variables that affect consumer decision-making.

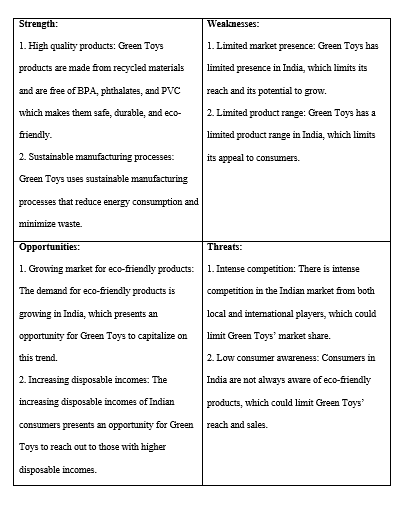

SWOT Analysis

| Strength:

1. High-quality products: Green Toys products are made from recycled materials and are free of BPA, phthalates, and PVC, which makes them safe, durable, and eco-friendly. 2. Sustainable manufacturing processes: Green Toys uses sustainable manufacturing processes that reduce energy consumption and minimize waste. |

Weaknesses:

1. Limited market presence: Green Toys has a limited presence in India, limiting its reach and potential to grow. 2. Limited product range: Green Toys has a limited product range in India, which limits its appeal to consumers. |

| Opportunities:

1. a Growing market for eco-friendly products: The demand for eco-friendly products is growing in India, which presents an opportunity for Green Toys to capitalize on this trend. 2. Increasing disposable incomes: The increasing disposable incomes of Indian consumers present an opportunity for Green Toys to reach out to those with higher disposable incomes. |

Threats:

1. Intense competition: There is intense competition in the Indian market from local and international players, which could limit Green Toys’ market share. 2. Low consumer awareness: Consumers in India are only sometimes aware of eco-friendly products, which could limit Green Toys’ reach and sales. |

Entry Modes

When evaluating potential entry points for Green Toys, it is vital to consider the characteristics of the Indian market. India is a large and diversified market with various cultures, languages, and economic development levels. As a result, Green Toys will have to adapt its products and services to meet the needs and preferences of the regional market (Sarkar et al., 2022, p. 2189). This can be accomplished using a combination of direct and indirect entry points.

Direct Mode of Entry

Direct modes of entry, such as setting up a wholly-owned subsidiary or establishing a joint venture with a local partner, allow Green Toys to retain full control over its operations in India. Green Toys could make all India operations decisions, such as pricing, marketing strategies, and product selection. However, this would require a large initial investment of time and resources and would mean that Green Toys would face significant risks if the venture failed.

Indirect Mode of Entry

Franchises and exporting, for example, are less hazardous and require less upfront investment. Green Toys can reach Indian consumers through franchising by utilizing the existing infrastructure of a local partner, such as a retail chain or distribution network (Krishna Kishore et al., 2022, p. 200). This would allow Green Toys to enter the market quickly and efficiently while reducing its risk exposure. Another option is to export, which allows Green Toys to enter the Indian market without establishing a physical presence in the nation (Ghosh et al., 2022, p. 112). This could be a low-cost way to evaluate the market before committing to a more permanent entry strategy.

The choice of entry mode for Green Toys should be based on the company’s goals and resources. If Green Toys wants to establish a long-term presence in the Indian market and have full control over its operations, then the direct entry is the most suitable option (Sarkar et al., 2022, p. 2186). However, if Green Toys wants to access the market quickly and efficiently, with minimal risk, then indirect entry would be the best choice (Gul et al., 2022, p. 10). The best mode of entry for Green Toys Company is the Indirect mode of entry.

Advantages of Indirect Entry Mode

One of the primary advantages of the indirect entry mode for Green Toys is that it allows the company to gain access to local knowledge and expertise. By partnering with a local partner or intermediary, Green Toys can take advantage of its existing networks and contacts and understand the local market and business environment (Yadav et al., 2022, p. 110). This can help Green Toys to reduce the risks associated with their entry into the Indian market, as well as provide them with the opportunity to learn from the experience of their partner.

In addition, the indirect entry mode allows Green Toys to benefit from economies of scale. By partnering with a local partner or intermediary, Green Toys can access the partner’s existing customer base and leverage its existing distribution networks and resources (Varghese, 2022, p. 55). This can provide Green Toys with a cost-effective way to enter the Indian market, which can help to reduce their costs and increase their profitability. Finally, the indirect entry mode allows Green Toys to access local financing. By partnering with a local partner or intermediary, Green Toys can access local financing options, such as bank loans or venture capital, which can help to support the company’s growth and expansion in the Indian market.

Disadvantages of Indirect Entry Mode

One of the key downsides of Green Toys’ indirect entry strategy is that it limits the company’s control over its activities in the Indian market. Green Toys may be unable to control the quality of their products fully and how they are distributed in the Indian market by working with a local partner or middleman (Yadav et al., 2022, p. 109). This might result in a loss of control over the company’s brand and reputation in the Indian market, which can harm the company’s overall success (Nagarjuna, 2022, p. 10). Furthermore, the indirect entry strategy may limit Green Toys’ capacity to capitalize on local prospects (Schlegelmilch, 2022, p. 60). By relying on a local partner or intermediary, Green Toys may miss out on potential opportunities in the Indian market, such as new product launches or partnerships with local businesses.

Conclusion

In summary, India is an attractive market for foreign companies looking to expand their operations. Green Toys should consider a combination of direct and indirect modes of entry when entering the Indian market, depending on the company’s goals and resources. Direct entry would give Green Toys full control over its operations, while indirect entry offers a more cost-effective and less risky way to access the market. Ultimately, Green Toys’ objectives and capabilities should determine the choice of entry mode.

Bibliography

Ghosh, S., Yadav, S., Devi, A. and Thomas, T., 2022. Techno-economic understanding of Indian energy-storage market: A perspective on green materials-based supercapacitor technologies. Renewable and Sustainable Energy Reviews, 161, p.112412.

Gul, D.E.S., Gul, A., Tanoli, A.K., Ahmed, T. and Mirza, M.A., 2022. Contamination by hazardous elements in low-priced children’s plastic toys bought on the local markets of Karachi, Pakistan. Environmental Science and Pollution Research, pp.1-12.

Krishna Kishore, S.V., Kiran, P., Banerjee, J. and Vasudevan, M., 2022. Moderation of income and age on customer purchase intention of green cosmetics in Bangalore. In Achieving $5 Trillion Economy of India (pp. 187-213). Springer, Singapore.

Nagarjuna, B., 2022. The Impact of Make in India on Foreign Direct Investment: An Analytical Study. SEDME (Small Enterprises Development, Management & Extension Journal), p.09708464221084181.

Sarkar, J.G., Sarkar, A., Dwivedi, Y.K. and Balaji, M.S., 2022. Sweat it for sustainability: Impact of physical activity/exercise on sustainable consumption. Psychology & Marketing, 39(11), pp.2184-2199.

Schlegelmilch, B.B., 2022. Selecting and Entering Global Markets. In Global Marketing Strategy (pp. 51-81). Springer, Cham.

Tripathi, R., Yadav, U.S., Tripathi, M.A., Rawat, R. and Kushwaha, J., 2022. Performance of women artisans as entrepreneurs in ODOP in Uttar Pradesh to boost economy: Strategies and away towards Global Handicraft Index for small business. Academy of Marketing Studies Journal, 26(1), pp.1-19.

Varghese, S., 2022. Performance of Green Brands during Post Covid Era. IIBM’S Journal of Management Research, pp.52-59.

Wasan, P., Mulchandani, K. and Mulchandani, K., 2022. Do changes in deferred revenue indicate future financial performance? Evidence from India. Journal of International Accounting, Auditing and Taxation, 46, p.100441.

Yadav, U.S., Tripathi, R., Yadav, G.P., Pandey, N. and Tripathi, M.A., 2022. One Station One Product (OSOP) Scheme of India in a Digital World: A Comparative Study Of OSOP with ODOP with strategies. Journal of Positive School Psychology, pp.10907-10917.

Appendix

The table below shows the opportunity-risk grip for cross-country evaluation

| Countries | |||

| Variables | A-India | B-Philippines | C-Thailand |

| Opportunities | |||

| Market Size | $ 574bn | $ 12bn | $ 19.1bn |

| Growth | 5.87% annually | 7.4% annually | 5.51% annually |

| Competitive Intensity | Competitive | Competitive | Competitive |

| Operation Cost | $ 24, 200 | $ 20,000 | $ 19,400 |

| Market Efficiency | 7/10 | 6/10 | 6.5/10 |

| Tax Rate | 10% | 25% | 20% |

| Risks | |||

| Political | 6/10 | 7/10 | 7/10 |

| Commercial | 8/10 | 6/10 | 7/10 |

| Economic | 8/10 | 6/10 | 7/10 |

| Operational | 7/10 | 6/10 | 6/10 |

The table below shows the opportunity analysis of the Indian Market.

write

write