Abstract

Real estate firm leaders who fail to achieve and maintain a competitive advantage to boost profitability in situations with uncertain, significantly deteriorating marketplaces can lose money or go bankrupt. Uae, United Arab Emirates, the business marketing industry is overcrowded, including over 5,000 active agents and 2,000 certified real estate companies. This numerous research study aimed to look into the tactics used by influential people of Dubai moderate real estate enterprises to gain and sustain a competitive edge and boost profitability amid periods of market instability or decline. This study identified policy options for local governments to explore as they transition to a more stable economy. Such measures are intended to communicate towards the real estate market and key parties the economic rewards of investment in green buildings. Limitation of the research In terms of setting up prices and rents, the UAE is not a fair environment, and even experienced professionals may find it difficult to discern whether a perceived higher value is genuinely a green premium. The second concern is that the results could be skewed by a voluntarily response bias, in which questionnaire respondents who are concerned about environmental issues are more likely to answer. Consequences in Practice This study identified policy options for local governments to explore as they transition to a more stable economy. Such measures are intended to communicate to the real estate market and relevant stakeholders the monetary advantages of investment in public buildings. That is what originality is. Because of its different beginnings and atypical evolutionary path, much study on the demand for buildings comes from advanced markets, and its relevance to the Mideast is debatable. This paper provides fresh perspectives on a market that has received little attention.

CHAPTER 1: INTRODUCTION

1.1 Background information

Many companies expressly create a real estate strategy and utilize its real estate as a tool to communicate and strengthen their competitiveness. Local investors are becoming increasingly concerned that now the real estate market will reach Emirates (UAE) may be impacted by significant price adjustments. Despite considerable decreases in real estate performance indicators, the UAE ranks among the best global locations for long-term investments, particularly when considering good market fundamentals. Those who work with these organizations will find this study interesting(Management & Services, 2011). It looks for solutions to how organizational real estate plans complement an organization’s competitive strategy. Although the literature suggests that a strategic real estate plan can help an organization’s competitive strategy, it doesn’t detail how this relationship works. It also doesn’t quantify the relationship’s consistency between different components. The relationship between property investment and competitiveness is described and analyzed in-depth, qualitatively, and empirically in this work. It develops a literary criticism model of business real estate strategy and how they might help firms compete. It illustrates how organizations employ a commercial real estate program to ensure their competitive edge by using the model to explain and analyze ten firms in practice. It provides instances of real estate techniques that promote competitive tactics to practitioners. It provides a conceptual basis inside which academicians may qualify, quantify, analyze, and evaluate the relationship between real estate and strategy implementation. The paper is divided into sections. The critical issue is presented in the first part. The second section covers the literature as well as the model that is built on it. The third segment delves into the specifics of the model’s use in ten scenarios(Zhang et al., 2011).

Business strategy management is a system for identifying internal and external elements that influence the design of strategies for achieving and maintaining competitive advantage. High compared profitability, above-average results, benefit-cost disparity, superior financial results, financial returns, an essential role in customer satisfaction earnings in overabundance of potential costs, and cross-sectional difference in the propagation between merchandise market demand and marginal cost are all examples of competitive advantage. On the other hand, competition is constantly increasing in several businesses, both locally and globally. The oil and gas sector, which seems to be the UAE’s primary source of income, was hit hard by the international economic meltdown. The real estate sector and other businesses played a critical part in the UAE’s economic recovery. However, an increasing number of property agents surpassed the number of listings, resulting in a highly competitive market and the failure of many businesses. The study’s goal was to look into the techniques used by real estate owners to gain competitiveness and generate more revenue amid moments of market instability or decline(Barasa, 2017).

1.2 Problem statement

The goal of this serious challenges case study would have been to look into the techniques used by UAE investment firm owners to gain competitiveness to boost profits amid periods of market instability or decline. The study participants will be real estate company leaders from the UAE, an emirate with a track record of success inside the Middle East. Respondents will be professional and licensed brokers who work with off-the-plan and ready-to-move-in units multifamily housing properties, including sales and leasing markets. The study’s beneficial interpersonal change consequences also included the potential to develop wealth creation inside the industry and even add to bigger towns by stabilizing marketplaces, increasing the city’s industry, and potentially enhancing families’ livelihoods. Furthermore, investors or ex-pats may make property investments that will help to promote the UAE’s unique culture and society.

1.3 Objectives

1.3.1 General objective

To assess the competitiveness of real estate investment in the United Arabs Emirates.

1.3.2 Specific objectives

- To look into the rate of property investment development in the United Arab Emirates.

- To define the techniques used in the UAE estate market to attract regional and international real estate developers.

- To evaluate the real estate industry using several predictive concepts employed in plenty of other nations and their application to the UAE.

1.4 Research questions

- What techniques should United Arabs Emirates real estate executives employ to gain and maintain a competitive advantage and improve profits amid periods of market instability or decline?

- How do you address both opportunities and challenges posed by Dubai’s evolving economic and real estate market in your strategy and business plans?

- What role does invention play in achieving and maintaining a competitive advantage?

- What measures are you devising now that the UAE has imposed a tax on the real estate sector?

- How are you dealing with Dubai’s property investment sector’s present slump, which includes dropping rental and sale prices?

1.5 Justification

This is advantageous because it allows individuals interested in a specific building to compare office buildings, rents, amenities, or other factors, rendering the property market more open, competitive, and, potentially, efficient. This capacity to analyze a property’s features helps traders that examine property they’re contemplating for their investments to use a thorough methodological approach, and space renters to do the same with the spaces they’re considering for lease(Zhang, 2016). This is not the case with commercial investment property’s environmental ‘class,’ where a variety of evaluation tools, criteria, and indicators are accessible to impact responsible property investment judgment and assessment and for use in reporting sustainability performance. In general, it appears that there is a 1-2 percent advantage for the sustainability property sector, which, according to current literature, is readily recouped through lower utility costs, higher rents, and more excellent occupancy rates. So, why isn’t everyone on board with the sustainable real estate craze? One problem is people’s perceptions of sustainability, and another is incorporating “sustainability” into property investment, occupancy, management, and development practices. This study looks at how real estate agents perceive these notions and how they are incorporated into the real estate strategy judgment process.

CHAPTER 2: LITERATURE REVIEW

2.1 Real estate investment in UAE

The UAE is a federal republic comprising seven UAE: Ajman, Dubai, Fujairah, Ras Al Khaimah, Sharjah, Umm Al Quwain, and Abu Dhabi’s capital. Oil is the leading financial foundation of the UAE and is primarily generated by Abu Dhabi. However, Dubai launched diverse industries over other emirates like the tourists, trade, and, in particular, the real estate business. The state and city enable not just UAE natives but also expatriates to invest and possess real property. Foreigners possess the very same rights as that of the nationals in respect of \slabor, health, school, public freedom, housing & real estate property albeit with specific restrictions and agreementS. Real estate property possession has particular guidelines and standards to follow that covers the interests of locals and tourists alike(Jonasson & Prick, 2019). Legal authority property investment, comprising land, permanent building, or an apartment in construction also used and disposed of.

2.2 Competitiveness

The idea of competitiveness is broad and complex, and it is necessary to distinguish between the sources and the concept. High compared profitability, above-average results, advantage gap, superior financial results, financial returns, an essential role in customer satisfaction earnings in overabundance of potential costs, and pass differential inside the spread among product market requirements and variable costs are all examples of competitive advantage. At the same time, the attributes of distinct product marketplaces, cost leadership, differentiation, locations, technology, technology products, and the firm’s resources and competencies are all core competencies(Kau & Geipele, 2017). More extraordinary uniqueness and satisfied customers are essential to obtain a competitive advantage and impressive service performance (Alfaraj, 2019). As a result, the study revealed the inherent significance of a company’s Information in the value chain and organizational structure. Inside the connection between brand strength & market efficiency, the function between reduced and differentiated benefit is essential.

According to strategy literature, critical competitive development is growing simultaneously as the competitive market. Being a component of an interconnected world underlined the need for more hybrid techniques over a single approach, particularly in the high technology industry. Solitary toward a composite competitive activity advantage, made by mixing, neither any, and forced to stick in terms of conceptualization, reality reflection, and the connection among strategic plan and company performance; for example, Uber turned these methods into innovative hybrid competitiveness, concentrating on customer requirements and increasing value for buyers rather than cutting costs and redrawing boundaries(Pillai & Bhatti, 2021).

2.3 Competitive forces

Competitiveness isn’t limited to other participants; instead, competitiveness in a sector is anchored in its fundamental economics and competitive dynamics that extend far beyond the established combatants. Consumers, dealers, entrants, and substitute items are all rivals who, depending on the business, may well be somewhat visible or aggressive. Too frequently, businesses focus on their competitors for market share, forgetting that successful competition entails more than just a battle for market share. Instead, any company’s core fundamentals determine whether it gains or loses market share. The most powerful success factors define an industry’s profitability; hence these are the most important factors to consider while developing a strategy. Within every market, several factors play a role in determining rivalry. Every business has an underlying structure or a collection of fundamental economic and technical qualities that creates competitive dynamics(Talmatchi, 2020). These five competing forces highlight that a company’s competition extends far beyond its experienced players. Customers, suppliers, substitutes, and new firms are all opponents to companies in this industry, according to them, and maybe somewhat prominent depending on the situation(Kihumba, 2017).

2.4 Real estate for entrepreneurs

In real estate management, organizations can adopt three main techniques. Organizations employ either an active approach a valuation approach as another standardizing approach to maximize influential contributions of their real estate to organizational effectiveness. Inside an incremental technique, space is used in tiny increments over time. The more unsure managers are about their company’s prospects, the more remarkable people desire to postpone critical decisions until additional Information is available. The organization’s principal focus within those circumstances is to meet the exact needs of the operations. Organizations that follow an evolutionary strategy do not prioritize employee facilities or aesthetics. It frequently results in a haphazard collection of varied structures that may not always help express its competitive strategy. A value-based strategy conveys its principles and strategic direction through its real estate. It emphasizes a building’s purpose and its significance to the organization. It makes use of the physical surroundings to represent and influence values. A standardization strategy manages and coordinates facility design and property investment operations throughout the company. It establishes standards and ensures that they are followed throughout the organization. Organizations generally rely on forecasts about future facility requirements to standardize judgment on real estate and facilities. A strict compliance approach takes up a lot of space, and one of its most important aspects is the predictable usage of assets. It is concerned with corporate effectiveness, expenses, and employee behavior. The regulated real-estate holdings for businesses are both tacit and explicit expressions of their rational approach(Bratu, 2016).

2.5 Strategic management

Corporate strategy is among the cornerstones of achieving and maintaining a competitive advantage in numerous sectors. This strategic management for achieving competitive advantage starts with the company’s objective, analyzing the current brand, weaknesses, chances, and challenges, and finally formulating and implementing the plan. Internal stakeholders like human resources and shareholders and different parties such as clients, suppliers, competition, the environment, and society are associated with implementing futuristic strategies to gain a competitive edge(Sultan, 2018). All levels and parts of a corporation are involved in strategic management. Strategic management, which encompasses corporate-level strategy created by top management, developed by management positions, and implemented by lower-level management, is essential to success advantage. The method modified the competitive edge based on labor efficiency, sentiment, adaptability, know-how, close connection, and goodwill. The importance of business talents and assets, such as valuation assets, in establishing and sustaining a competitive edge Quality, customer happiness, market stability, innovation, spending, and revenue growth are typical priorities in most plans. Meta-learning, identifying signals, and resistance to excellence disruptions are three skills that can be used to maintain both a high degree and constancy of quality performance(B. Li et al., 2021).

Business owners can devise ideas but try to put them into action, resulting in a loss of competitive advantage. Flexibility acts as a check on the organization’s ability to respond to changing competitiveness and reorganizations. Entrepreneurial incentives that increase this same learning, adjustment, agility, and comprehension of planning rationales augment organizational viewpoints and procedures did learn to readjust assets for long-term strategic ambitions and vanquishing an unavoidable ecologic change competitive advantage. Different competitive advantage tactics in the real estate sector may offer possible methods based on the market, region, and business. Many enterprises in the UAE employ organizational residential property management strategies for efficiency and competitive advantage, whether they are private firms, governmental sectors, or government departments. While the rest already had a company residential property management strategic plan and used various approaches, including such cost reduction, production ease, flexibility, human resource objectives, marketing message ease, sales as well as selling delivery ease, phase structure, and expertise ease, and property investment enterprise value ease(Ansari, 2013).

2.6 Factors affecting competitiveness

Social, environmental, & economic issues all have an impact on opportunities and risks. Consideration of social, ecological, and economic considerations as a strategy for competitive advantage is known as the Triple Bottom Line. The findings led to a system that combined long-term environmental responsibilities levels alongside accounting transactions. The triple bottom line method corporate social responsibility and stakeholder theory are one way for businesses to maintain a competitive advantage. Our study found that socio-economic factors positively affect company appearance, with brand knowledge and cognitive factors resulting in favorable corporate success. However, economic and environmental factors may not have directly impacted corporate performance. the link between organizational performance and long-term competitive advantage, as well as environmental and social responsibility qualities

Environmental factors may have a significant impact on gaining a competitive advantage. Environmental management boosts competitiveness by lowering costs differentiating products and improving relationships with stakeholders. Companies that implement proactive environmental measures save money, resources, and energy by reusing products and reducing waste. Environmental and social variables are part of the competitive economy’s increasing requirements. Performance as part of a comprehensive goal in creating a beautiful natural environment with a monetary worth helps maintain competitive advantage. Environmental management & employee retention as just a competitiveness change depending on the natural focus and cooperation with the company and features. For instance, actors. They are integrating sensing, capturing possibilities, & converting developments to create a lasting competitive advantage via supplier integrated capacity(B. V. Li, 2011).

CHAPTER 3: THEORETICAL FRAMEWORK

3.1 Introduction

This section describes the methodology and research approach to be followed during the actual assessment of competitiveness in real estate investment.

3.2 Research Philosophy

The fundamental focus of epistemology, which is information growth study, is what is regarded as sufficient knowledge inside a discipline. When choosing an overarching research philosophy, there are two main options: phenomenological philosophy or positivism. Phenomenological philosophy, often known as constructivism, is concerned with how humans perceive things around them and how the thinker should account for prejudices in their grasp of the world. This perspective emphasizes on researcher’s personal experience, open & unstructured interviews, and reflective reports in which the investigator is an integral part of the phenomenon. Phenomenological research aims to describe individual experiences and presumes that the globe is socialized, attempting to make sense of the situation instead of looking for causality and fundamental laws, and evolves ideas by inductive reasoning from Information instead of formulating and testing hypotheses. In each phenomenological research, tiny samples are explored using various approaches to identify different phenomenon perspectives throughout time.

In contrast to such phenomenological study, positivism will become an epistemic methodology that affirms the applicability of natural science approaches to the study of community reality and beyond. Positivism is founded on four fundamental concepts. The first criterion is that knowledge can be defined as a measurable event (phenomenalism). The second is that the goal of either model is to provide hypotheses that can be tested, allowing law theories to be evaluated (deductivism). The third element is that knowledge is obtained more by a list of Information that constitutes the basis for laws (inductivism). That science should be conducted in a value-free manner (objectivism).

3.3 Research Approach

According to Saunders et al. (2015), there are three types of research methodology: qualitative, quantitative, & mixed approaches. Qualitative research entails gaining an understanding of social phenomena phenomenon through the subject’s experiences and attitudes; it answers questions about the “what,” “how,” as well as “why” of an occurrence; it ensures the efficiency of production; it involves the researcher’s personality, and it establishes the confirmability of research findings. Because of the exploratory character of the study subject, It shall decide whether descriptive study seems to be the most suited technique for such investigation. Quantitative research uses numerical and statistical data to answer questions like “how many” and “how often.” The investigation won’t require statistical Information or numeric accuracy; thus, a qualitative methodology wasn’t acceptable. Mixed methods research combines qualitative and quantitative data collection, analysis, and interpretation methodologies. Since neither the statistical nor mixed methods are applicable in our investigation, I will be using the qualitative approach.

3.4 Research Design

The research design serves as a plan that enables collecting data, assessment, and evaluation, allowing for the smooth functioning of different research activities and maximizing research efficiency.

A descriptive study will be used as the primary research. It was chosen because it has a propensity to identify, explain, and describe relationships between variables relevant to the subject population. The research goal was to determine the impact of intellectual capital on achieving a competitive advantage in a real estate organization. The study first used the pass survey analysis method to acquire data at a particular time. The goal of something like the sample research is to generate a comprehensive assessment of competitive advantage development.

3.5 Unit of Analysis

Before conducting a regression analysis according to the framework discussed in the preceding chapter, descriptive statistical analysis, mainly frequency range, and frequency tables, were used to aid therein establishment of styles, market dynamics, and connections to end up making it easier for the audience to visualize the original study implications. Just when tables and graphs provided a successful interpretation of findings was data presented in this manner. Interpretive observations were used to provide descriptive data. The researchers recommend using qualitative descriptive evaluation via both regression analyses to demonstrate the relationship between the factors. Correlations in path analysis measure this same extent of linear association. In both the fields of psychology itself and the hard sciences, linear regression is the most complex statistical method. Its main goal is to determine how a dependent variable interacts with independent variables, also known as predictor or explanatory variables. While the focus in residuals is on forecasting one variable from another, the focus in correlation is on how well a linear model can describe this exact cause and effect.

3.6 Data collection: questionnaire and constructs

The above research will be using both quantitative and qualitative. Primary data is Information obtained for the first time and is specific to the study. This survey design would be the primary source of Information. A survey form is an example of an information-gathering tool that consists of a sequence of inquiries and other stimuli designed to elicit Information from the respondents. It was chosen because it has cheaper expenses, minimizes interviewer bias, gives respondents time to reply to questions, and, in cases where confident respondents are challenging to reach, the questionnaire is convenient for them. The questionnaire will consist of structured and survey questionnaires that employ the Linkert rating system. The questionnaire would be divided into five parts: Part one for primary data; part two to four addressing inquiries regarding research objectives, evaluation of competitiveness in property investments, the impact of management, technologies & organization structures on \suse of Information in the organization to achieve success. The survey will not demand any individual such as contact data, and the participants will not be compelled to reveal identities responding inside the questionnaire.

3.7 Time Horizon

This study will be undertaken over a cross-sectional investment horizon, allowing researchers to observe and characterize the Proptech phenomenon in a single instant. The cross-sectional temporal horizon supports the exploratory case study technique chosen and indicates a short data gathering timeframe.

3.8 Population & Sample

Throughout this systematic quantitative review, the participants would be UAE property investment executives who have effectively achieved competitiveness in enhancing revenues amid severe market instability or decline. Although UAE’s primary economic resources are oil and gas; nevertheless, the global financial crisis prompted the government to diversify into other industries to minimize its reliance on the oil-based industry, with real estate becoming one of the most important. I will utilize a purposive sampling strategy to identify four real estate industry leaders who have effectively acquired and maintained a competitive edge in this study. From an empirical study, saturating is indeed the frequent basis for assessing whenever an appropriate sampling number has been attained; thus, more isn’t always good, and less isn’t always better.

3.8.1 Qualitative approach

This research will use a qualitative technique. A qualitative researcher employs conversational dialogues to understand better judgment processes and social life through the subject’s experiences and views. Due to the apparent exploratory character of something like the particular research. A mixed-methods researcher uses interviewing & data analysis to combine qualitative and quantitative methodologies.

3.8.2 Quantitative approach

A quantitative researcher uses numerical, statistical, other statistical approaches to investigate the patterns in the data. Since I didn’t incorporate statistical analysis for variable correlations or variances, I won’t be eligible to utilize quantitative and qualitative approaches. It would not be looking for quantitative interpretations of behavior, so a quantitative research approach would not be applicable.

3.9 Research framework

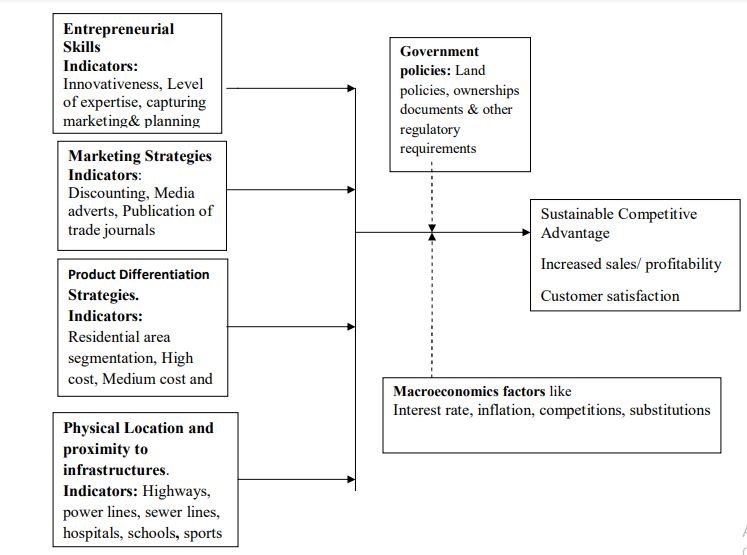

3.9.1 Conceptual Framework

Figure 3. 1 Conceptual framework

3.9.2 Research hypothesis

1st Hypothesis (H1). Profitability is thought to serve a favorable impact in boosting the overall competitiveness of massive real estate investment

2nd Hypotheses (H2). Investment ability is thought to play a favorable influence in boosting the overall competitiveness of UAE real estate companies.

3 hypothesis (H3). Real estate investment can improve their competitiveness by enhancing their governance capabilities.

3.10 Ethical consideration

Ethics are rules that govern human actions that prominent influence people. It entails deciding what is and is not acceptable behavior. It’s the study’s obligation to the standard of quality this same potential harm to research subjects, and the extent to which this is possible; the potential harm must be minimized. The team leads that the topic under investigation was delicate because it implicated the statement of one form of income regarding the value of a client. As a result, the respondents’ identities needed to be protected as often as possible. As a result, its questionnaire survey certainly didn’t ask again for participants’ names and every other Information that could reveal their identity. The researcher also acquired a letter authorizing research as well as an introductory note informing the study’s purpose, as well as all participants’ secrecy, has been maintained.

Reference

Alfaraj, Q. (2019). Attaining and Sustaining Competitive Advantage in Dubai’s Real Estate Industry.

Ansari, A. (2013). What is the scope of competition law in the UAE ? – A comparative study with developed and developing nations. November.

Barasa, C. (n.d.). ASSESSMENT OF THE ATTRACTIVENESS OF THE REAL ESTATE MANAGEMENT INDUSTRY IN KENYA BY :

Bratu, A. (2016). A REAL ESTATE INDUSTRY ANALYSIS IN A MACROECONOMIC CONTEXT. IV(10), 148–158.

Jonasson, A. H., & Prick, C. (n.d.). The investment decision process of real estate owners.

Kau, L., & Geipele, I. (2017). The integrated approach of real estate market analysis in sustainable development context for decision making. Procedia Engineering, 172, 505–512. https://doi.org/10.1016/j.proeng.2017.02.059

Kihumba, M. K. (2017). A Prototype for predicting real estate investment performance in Kenya.

Li, B. V. (2011). A Methodology to Assess the Competitiveness of Real Estate Developers in China.

Li, B., Yi, R., & Li, M. (2021). Factors Influencing Large Real Estate Companies ’ Competitiveness : A Sustainable Development Perspective.

Management, R. E., & Services, F. (2011). Analysis for Real Estate Investment of China. Xxx, 1–49.

Pillai, R., & Bhatti, M. I. (2021). Assessing Institutional Dynamics of Governance Compliance in Emerging Markets : The GCC Real Estate Sector.

Sultan, S. S. (n.d.). The Competitive Advantage Of Small and Medium-Sized Enterprises : The Case of Jordan’s Natural Stone.

Talmatchi, M. (2020). The implications of Proptech on the real estate brokerage. The Dubai, United Arab Emirates Maxim Talmatchi MSc Real Estate Investment and Finance case study. June.

Zhang, X. (2016). Competitiveness for real estate developers : a China study. January 2010.

Zhang, X., Tian, Y., & Shen, L. (2011). An alternative approach of competitiveness evaluation for real estate developers. 15(1), 10–25. https://doi.org/10.3846/1648715X.2011.565911

write

write