Introduction

Microblogging is posting brief pieces of digital material – whether text, photographs, links, short videos, or other media – on the Internet (Zhou et al., 2019). An example is Weibo which is popular among friends and professional colleagues who constantly update material and interact with one another, forming an online community. Twitter is by far the most popular microblogging site. Its popularity is bolstered by a rising number of extra programs that enable varied and often intriguing microblogging innovations, such as setting up TwitterPic for images or purchasing and selling PollyTrade shares.

Competition in the Industry

The microblogging competition ended when Instagram created a clone of Snapchat Stories, stifling the momentum of newcomers and knocking the startup environment to its knees. While the copy function is inherently anti-competitive, the effect of Facebook’s copy is tremendous (Srinivasan, 2019). The snap culminated in a long-running fear, with prospective entrepreneurs and investors informed that Facebook was attempting to purchase or clone any existing social platform, significantly restricting its prospects of success. As a consequence of this, investment is dwindling. Following Twitter’s Periscope app’s popularity, Facebook replicated its real-time video features, and excitement for both applications seems to be dwindling. When the group’s live video became famous under the Housepart moniker, Facebook replicated it, and Epic Games ultimately acquired Housepart for an undisclosed sum (Wan et al., 2019). Many observers feel that allowing Facebook to acquire Instagram and WhatsApp was a mistake in this stagnating market. The first became the social network for the younger generation, while the second consolidated Facebook’s worldwide communication supremacy.

In 2021, Facebook’s primary opponent will be TikTok, which has absorbed chiefly Facebook’s family of services since its 2018 debut in the United States. TikTok began by making it easy for individuals to produce intriguing films, share fame and riches through a mainstream, regardless of whether they knew or watched the person, and eventually evolved into a combination of audio notes, graphics, and community humor. For Facebook, TikTok’s growth is a legitimate issue, and workers often challenge CEO Mark Zuckerberg during question and answer sessions. The startup faces competition from Reels on Instagram, which may triumph (Rach and Peter, 2021). However, Facebook must now compete with TikTok or risk losing the next generation despite the odds. Facebook asserts that it is revising the language after years of investment in a technologically demanding medium that incorporates video, augmented reality, and virtual reality. Over the last year, the emergence of the substack has resulted in the production of an increasing number of artists based on text messages from billionaires while simultaneously dragging millions from their social media sources into relatively quiet email inboxes.

Entry into the Industry

Social media has gone from obscurity to a multibillion-dollar business in a brief period. This is partially due to the ease with which mobile technologies can be developed and how applications can be used. The rapid success of some of these applications has piqued the attention of businesses seeking to replicate the astounding rise of Facebook, Twitter, Snapchat, and Instagram. However, these advancements reflect a small percentage of the enterprises that entered the market, most of which failed (Ahmad et al., 2021). Even large corporations like Google attempt to succeed (Google+’s first social media component could not make a substantial impact).

Three significant impediments may be highlighted to offer some context: To begin, there are network effects, which refer to the concept that some items acquire value due to the number of people who use them. This indicates that it is worthless if a single individual only utilizes a social media application. As a result, fully equipped social media programs have a considerable advantage, explaining why early Facebook users were so resistant to criticism and competition. The most significant impediment for new apps is their inability to efficiently establish sufficient user networks (Banerjee et al., 2020). This relates to the next obstacle, luring consumers away from based offerings. Prominent players possess formidable marketing resources and can profit from word-of-mouth marketing. Without initial financial solid support, it is difficult for a business to compete with it. The third impediment is the time, expense, and expertise necessary to create and maintain applications and the infrastructure required to expand. For instance, a network on the scale of Facebook or Twitter would need hundreds of millions of dollars in server capacity.

Profitability in the Industry

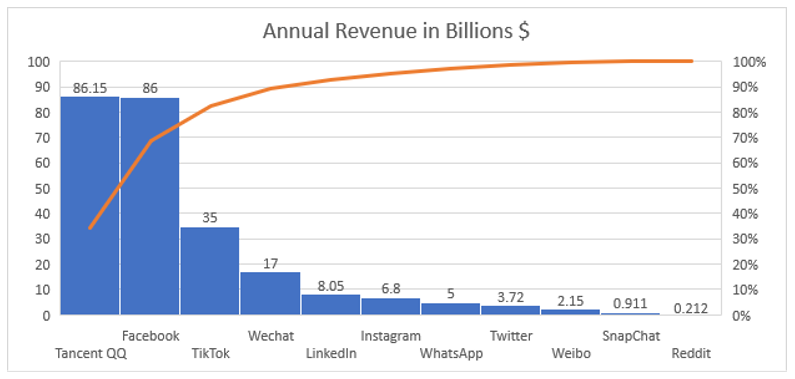

Social media firms gain from venture capitalists and investors betting on the success of their initiatives, and they expect to benefit from the revenue eventually. However, social media networks generate revenue from their users. If the consumer does not purchase the product, the user becomes the product. Facebook’s reach is undeniably enormous, with an estimated 2.8 billion monthly active users by 2021 (Cunningham and Craig, 2019). Additionally, it gives advertising chances to over 200 million businesses, making it one of the most lucrative social media and Weibo enterprises. Venture capitalists and investors are a significant source of revenue for most social networks, as is advertising. Online advertising is a developing sector, and with the assistance of artificial intelligence (AI), targeted advertising has become very user-focused – Google search monitoring and user online searches enable companies to be followed and subsequently targeted similarly. Facebook’s income has increased year after year – it reached £27.6 billion in 2016 and quadrupled to $55.8 billion by 2018 (Dance et al., 2018). The figure below demonstrates huge social media companies’ global revenue gained in 2021.

Figure 1: Huge Microblogging Companies Revenue in 2021

Social networks must prioritize the enjoyment of customers and users. Social networks vary from specific businesses that sell things to customers in that they are often accessible to users but generate revenue through investors and advertisements. However, if a user is unsatisfied with the product and chooses to unsubscribe or erase their profile, the product network is no longer required (Ma et al., 2022). As a result, it is critical to maintain a positive relationship with social media users. For instance, Snapchat’s stock fell $1.3 billion in 2018 when Kylie Jenner said she would no longer use the service (Vasquez, 2018). Due to Kelly Kenner’s enormous reach across several social media platforms, many of her followers and admirers have deleted or unsubscribed from the app. Facebook is another example. In 2018, Facebook lost 1 million daily and monthly active users in only three months. Following the Cambridge Analytica incident in March 2018, social media platforms have been the subject of hackers and have been at the heart of data privacy issues (Cao et al., 2021).

Conclusion

Microblogging companies have an online interface, SMS, or a variety of mobile-friendly apps that allow users to send videos, audios, texts, and photographs. It enables users to discuss and exchange information about their activities, views, and status. Huge revenues are made in this industry, which leads to stiff competition making it difficult to enter. Huge microblogging companies like Facebook and Twitter remain popular despite competition from various microblogging services, some of which are open source and many of which are aimed at specific stakeholders. However, several dangers are inherent in owning and investing in social networks. Because user attitudes online may change instantaneously, the web must always stay one step ahead of people. Constantly considering the latest technological trends, methods to strengthen their communication inside the app, and ensuring that users are satisfied with everything.

References

Ahmad, S., Srivastava, A. and Sharma, S., 2021. Customer sentiment towards freebies in telecom sector: a social media mining approach. International Journal of Business Information Systems, 38(2), pp.240-253.

Banerjee, A., Ries, J.M. and Wiertz, C., 2020. The impact of social media signals on supplier selection: insights from two experiments. International Journal of Operations & Production Management.

Cao, G., Jin, G.Z., Weng, X. and Zhou, L.A., 2021. Market‐expanding or Market‐stealing? Competition with network effects in bike‐sharing. The RAND Journal of Economics, 52(4), pp.778-814.

Cunningham, S. and Craig, D., 2019. Creator governance in social media entertainment. Social Media+ Society, 5(4), p.2056305119883428.

Dance, G.J., LaForgia, M. and Confessore, N., 2018. As Facebook raised a privacy wall, it carved an opening for tech giants. The New York Times, 18.

Gorjón, S., 2021. Bigtechs and financial services: some challenges, benefits and regulatory responses. Banco de Espana Article, 39, p.21.

Ma, D., Zhang, C., Hui, Y. and Xu, B., 2022. Economic uncertainty spillover and social networks. Journal of Business Research, 145, pp.454-467.

Myllylahti, M., 2020. Paying attention to attention: A conceptual framework for studying news reader revenue models related to platforms. Digital Journalism, 8(5), pp.567-575.

Rach, M. and Peter, M.K., 2021, June. How TikTok’s Algorithm Beats Facebook & Co. for Attention Under the Theory of Escapism: A Network Sample Analysis of Austrian, German and Swiss Users. In Digital Marketing & eCommerce Conference (pp. 137-143). Springer, Cham.

Srinivasan, D., 2019. The anti-trust case against Facebook: A monopolist’s journey towards pervasive surveillance in spite of consumers’ preference for privacy. Berkeley Bus. LJ, 16, p.39.

Vasquez, J., 2018. In one tweet, Kylie Jenner wiped out $1.3 billion of snap’s market value. Bloomberg, February, 22.

Wan, W.S., Dastane, O., Mohd Satar, N.S., Ma’arif, D. and Yusnorizam, M., 2019. What WeChat can learn from WhatsApp? Customer value proposition development for mobile social networking (MSN) apps: A case study approach. Journal of Theoretical and Applied Information Technology.

Zhou, M., Cai, X., Liu, Q. and Fan, W., 2019. Examining continuance use on social network and micro-blogging sites: Different roles of self-image and peer influence. International Journal of Information Management, 47, pp.215-232.

write

write