Preface

I am an entrepreneur and small business consultant. I have been working in this field for more than fifteen years, and throughout that time I have crafted a number of different business plans for different customers. In addition to that, I have personal experience operating a modest enterprise of my own. I am familiar with both the difficulties and the potential rewards that come with being the owner and operator of a small business.

The Small Business Administration is a wonderful resource for people who operate small businesses and those who want to start their own businesses. I consider the services they provide to be of the highest possible value, and as a result, I wanted to compose a business plan that would assist them in securing the financial backing necessary to launch or expand their respective enterprises. The proprietors of small businesses and aspiring businesspeople who are interested in receiving money from the SBA make up the bulk of my intended audience.

My business plan will include a summary of the Small Business Administration and the services that they provide. In addition to that, I will go over the conditions for qualification that need to be met in order to receive funds from the SBA. I will offer assistance on how to get ready for the process of applying for a loan, as well as giving pointers on how to construct an effective business plan. I am of the opinion that the owners of small businesses who are interested in receiving money from the SBA will find this material to be of assistance.

I would want to express my gratitude to the SBA for the ongoing help it provides to the nation’s small companies. In addition, I would want to express my gratitude to my customers, who have been the driving force behind the development of this company plan.

Executive Summary

According to Dilger (2018), the United States Small Business Administration (SBA) is an agency of the federal government that assists small businesses with financial support as well as technical help. The agency’s objective is to “help, counsel, assist, and safeguard the interests of small business concerns, to preserve free competitive enterprise, and to sustain and strengthen the general economy of our nation.”

In 1953, the United States government established the Organization as an autonomous agency. The Organization’s main office is located in Washington, District of Columbia, but it also maintains regional offices throughout the United States. Small firms are eligible for a wide range of services from this agency, including financial help in the form of loans and grants, aid with contracting, and business coaching.

This Organization is also in charge of the administration of the Small Business Investment Company program, which is designed to give small enterprises access to venture to finance. This Organization helps small businesses that have suffered losses due to natural catastrophes by providing them with disaster aid.

This agency’s SBA website has a plethora of information about the agency’s various programs and services. A search option is also available on the website, enabling users to locate SBA-funded businesses in their immediate vicinity. In addition, the government organization provides a wide range of resources for small enterprises, such as publications, films, and various internet tools. In addition, the Small Business Administration (SBA) offers a wide range of financial choices to small firms, such as loans, grants, and venture capital (Small Business Administration, n.d.).

In addition, this Organization offers several programs designed to assist new and existing small businesses. The 7(a) loan program is the most prominent offering made available by this Organization. It enables small businesses to obtain financing for a wide range of needs, including working capital, equipment, and real estate, up to a maximum of $5 million.

The business plan of this agency also offers an overview of the agency’s objectives and priorities for the subsequent five years. The plan focuses on boosting outreach to underprivileged groups, increasing access to funding, extending counseling and training programs, and enhancing service capacity overall. The Organization also intends to support disaster relief and recovery initiatives aimed at the nation’s small businesses.

Access to funding, counseling and training, disaster assistance and recovery, and outreach are the four primary tenets around which the Small Business Administration bases its strategic business strategy. In the next five years, the agency’s activity will be guided by these pillars, which will also assist the SBA in helping small businesses and entrepreneurs.

Analysis of the company:

History of the Organization the United States Small Business Administration (SBA).

Since its founding in 1953, this Organization has functioned as an autonomous agency under the auspices of the federal government of the United States. Within the United States federal government, this agency primarily focuses on assisting small businesses and encouraging entrepreneurial endeavors. This agency does not offer grants or direct loans to small businesses; the only exception to this rule is the Disaster Relief Loan program. Instead, the Organization guarantees loans issued by banks and other lenders as long as they comply with their set regulations. In addition, SBA provides advice, instruction, and information to small business owners on launching and expanding their operations.

The Organization was initially established due to the passage of the Small Business Act in 1953. On July 30, 1953, President Dwight D. Eisenhower signed the Small Business Act into law. The Act was a response to the significant number of small business failures that occurred during the 1950s and was formed as a direct result of those failures. The purpose of this agency is to assist small businesses in securing loans from banks and other types of financial institutions, as well as to provide small business owners with counseling and training services.

Since it was first established, the Organization has been subjected to several reforms. During the Organization’s early stages, its primary mission was to make financial assistance available to proprietors of smaller businesses. In the late 1960s, the Organization, however, broadened the scope of its work to include providing aid in areas such as disaster relief, entrepreneurship, and the creation of businesses catering to minorities.

In the aftermath of the terrorist attacks that occurred on September 11, 2001, the Organization was instrumental in the response the federal government provided to those attacks. The Organization aided with the cleanup and recovery work at the World Trade Center site, providing loans totaling over one billion dollars to small businesses negatively impacted by the attacks.

In the years that have passed since the attacks of September 11, 2001, this Organization has continued to broaden the scope of its work. The government currently offers a plethora of assistance programs for smaller businesses, such as loans, counseling, and training. This agency provides small businesses that have been harmed by natural disasters with the opportunity to apply for disaster relief loans. Administrator Maria Contreras-Sweet serves as the head of this Organization at present.

Strategies, Mission, Vision and Metrics

According to Higgins et al. (2021), this Organization’s mission as a government agency is to “aid, counsel, assist, and protect the interests of small business concerns, to preserve free competitive enterprise, and to maintain and strengthen the overall economy of our nation.” The SBA also has a vision to be “the leading advocate” for small businesses

The Organization provides a wide range of programs and services, intending to assist local entrepreneurs in expanding their firms and achieving tremendous success. The provision of access to money, assistance with government contracting, and help with the recovery of enterprises following natural catastrophes are some of the primary goals pursued by the Organization. In addition, the SBA provides services, including training and counseling to assist small businesses in beginning their operations and expanding.

The Organization also evaluates its performance using a variety of metrics, such as the number of small businesses that it has assisted, the number of jobs that have been created or preserved, the amount of capital that has been infused into the economy, and the number of disaster loans that have been approved(Higgins et al., 2021). Additionally, the agency keeps track of the number of new small businesses that are established, the number of new small businesses that are awarded government contracts, and the number of new small businesses that are granted aid in the aftermath of a natural catastrophe.

Business Drivers

Seyoum & Mujtaba (2021) argue that this government agency collaborates with a wide range of organizations to support the growth of small enterprises. Small businesses in the United States have access to a network of over 14,000 Small Business Development Centers (SBDCs), which this Organization runs. These centers offer advice, training, and other assistance to local entrepreneurs. In addition, the Small Business Administration collaborates with several other organizations, such as the National Federation of Independent Business, the National Association for the Self-Employed, and the Small Business Majority, to supply small businesses with resources and support.

Small businesses can also receive financial support from this government agency through loan programs offered by the Organization. The 7(a) loan program is this Organization’s most popular loan program. This program provides short-term loans with low-interest rates to small businesses for various purposes, including working capital, expansion, and other business needs (Seyoum & Mujtaba, 2021). In addition, this government agency provides multiple loan programs, including microloans, disaster loans, and other loan options, to assist small businesses in meeting their financial obligations.

Types of Business Models Used by the SBA

This government agency employs a variety of business models, the most common of which are the Standard Business Model, the Customized Business Model, the Franchise Business Model, and the Self-Employed Business Model.

- Standard Business Model

Aboulamer (2018) asserts that the SBA extensively uses what it refers to as the Standard Business Model, which is one of the many business models available. Small firms are eligible for support from this Organization through financial assistance, counseling, training, and other services. This model may be found here. The Organization is responsible for establishing guidelines that smaller enterprises must adhere to, such as minimum size restrictions and regulatory guidelines.

- Customized Business Model

Although the Customized Business Model is not as widespread as the Standard Business Model, this Organization continues to use it. Small firms are eligible for support from this government agency through financial assistance, counseling, training, and other services. This model may be found here (Aboulamer, 2018). On the other hand, this Organization collaborates with small businesses to develop individualized business plans tailored to each company’s particular requirements.

- Franchise Business Model

Aboulamer (2018) argues that this government agency assists small businesses in their transition into the franchising industry by employing a business model known as the Franchise Business Model which enables small firms to be eligible for support from this Organization in financial assistance, counseling, training, and other services. The Organization not only assists local businesses in locating franchise opportunities but also offers advice on organizing and running a franchise business.

- Self-Employed Business Model

The Organization also offers assistance to self-employed people by utilizing a model known as the Self-Employed Business Model. Self-employed individuals are eligible for help from the Organization through financial aid, counseling, training, and other resources (Aboulamer, 2018). In addition, this government offers advice and assistance to people starting their businesses and those already running their own companies.

In conclusion, this Government agency is so prominent in offering a selection of several business models for proprietors of small enterprises to select from. The Standard Business Model is the type of business model the Organization employs most of the time. On the other hand, the Agency also provides the options of the Self-Employed Business Model, the Franchise Business Model, and the Customized Business Model.

Product and Services Delivery Model use by SBA

According to Orzechowski (2020), the Small Business Administration (SBA) provides a wide range of services and programs designed to facilitate the launch, expansion, and continued viability of new and existing small enterprises. The following are some examples of how the SBA provides its products and services:

- Loan Programs

This Government Agency provides financing programs that make it easier for small enterprises to access money. These lending programs are offered by the Small Business Administration:

7(a) Loan Program:The 7(a) Loan Program is the SBA’s primary program for providing financial assistance to small businesses. It was established in 1949. The 7(a) Loan Program makes loans available for various purposes, including working capital, equipment purchases, and real estate investments.

504 Loan Program: The 504 Loan Program is designed to provide small businesses with long-term financing at a fixed interest rate for the purpose of purchasing fixed assets such as real estate, machinery, and other such assets.

- Investment Programs

This Organization has a number of investment programs that are designed to assist small firms in gaining access to finance. These investment programs are offered by the Small Business Administration:

SBA Investment Program: Investment Program associated with agency offers small businesses the opportunity to acquire equity funding. Through its venture capital and private equity programs, the Organization invests directly in the stock of small enterprises.

Small Business Administration Microloan Program: The Organization’s Microloan Program helps small firms by providing them with small loans. Microloans are small loans given out by this Organization through a network of nonprofit organizations.

- Training and Counseling Services

The Organization provides assistance in the form of training and counseling services to help small businesses get started, expand, and achieve their goals. The following are some examples of the training and counseling services offered by this Government Agency:

Business Plan Development: The Organization provides small businesses with the opportunity to get assistance in the formation and improvement of their business plans through the use of its business plan development services.

Counseling for Financial Management: The Organization provides counseling for financial management as a means of assisting small businesses in the management of their financial affairs.

Marketing Counseling: The Organization provides small businesses with marketing counseling in order to assist those businesses in the development and implementation of marketing strategy.

- Government Contracting Assistance

Helping small companies connect with available government contracting opportunities is the mission of this Organization’s government contracting support program. Help with obtaining government contracts is offered by the SBA, and it includes the following:

8(a) Business Development Program: The 8(a) Business Development Program assists small enterprises in competing for government contracts. The 8(a) Program is a program that offers financial assistance to small businesses that are owned and controlled by individuals who fall into one or more of the categories of socially and economically disadvantaged individuals. This program is merit-based and operates based on a competitive application process.

HUBZone Program: The HUBZone Program assists small businesses situated in Historically Underutilized Business Zones (HUBZones) so that these businesses can better compete for government contracts. HUBZones are geographical regions that are located within communities that are experiencing economic hardship.

Small Business Ownership Opportunities for Veterans with Disabilities (SDVOSB) Program:The Service-Disabled Veteran-Owned Small Business Program assists small businesses owned by service-disabled veterans so that these businesses can compete for government contracts.

Tools that maybe used.

- SWOT Analysis

Strengths

Longhurst et al. (2020) argue that SBA’s various loan programs constitute one of its primary strengths. Direct and guaranteed loans are made available to small businesses by government agencies. These loans can be put to various uses, such as covering start-up expenses, providing working capital, or expanding the business. The Organization provides various training and counseling programs, in addition to its other services, to assist new and existing small businesses. These programs offer helpful information and resources on various topics, such as business planning, financing, marketing, and management, and they cover all of these subjects and more.

A further one of the Agency’s strengths is the advocacy role it plays. It is the mission of this Agency to protect and advance the interests of small businesses at the federal level by fostering the enactment of laws and regulations that are equitable and comprehensible. In addition, the Organization offers information and resources that can assist small businesses in navigating the red tape that is associated with dealing with the federal government (Longhurst et al., 2020).

In addition, this Government Agency offers various programs and initiatives focused on assisting small businesses that veterans, minorities, and women own. These programs make it possible for participants to gain access to capital, training, and other forms of assistance. In addition, the SBA collaborates with several other organizations to facilitate small businesses access to government contracts.

Small businesses can get assistance from the Organization’s vast network of Small Business Development Centers (SBDCs) located all over the country. This assistance can be obtained for little to no cost. Additionally, the Agency operates a network of Women’s Business Centers (WBCs) designed to assist women-owned businesses. In addition to the programs and services it offers, the Organization makes available a wide variety of publications and other resources on its website. These resources provide advice on starting a small business, growing an existing one, templates for business plans, information on financing, marketing tips, and more.

Weaknesses

Despite the Organization’s efforts to support small businesses, there are several weaknesses associated with the Agency. The Organization has come under fire for its part in the economic crisis that began in 2008. In particular, the Agency has been attacked for its part in guaranteeing loans that private lenders provide to smaller enterprises. These loans were made possible thanks to the 7(a) Loan Guarantee Program offered by the Small Business Administration. In addition, the Organization has come under fire for its role in the housing market. Developers of houses for low and moderate-income people can apply for financing and guarantees from this institution (Longhurst et al., 2020). Some people believe that the SBA’s engagement in the housing market was one of the contributing factors that led to the current crisis in the subprime mortgage industry.

Second, the Organization has been accused of needing more levels of transparency. Because the Small Business Administration needs to make the information regarding its loans available to the public, it might be challenging to hold the Organization accountable for its actions. In addition, the Organization has been accused of providing preferential treatment to particular lenders (Longhurst et al., 2020).

Third, this Agency has been criticized for its role in the federal government’s shutdown in 2013. This Agency was one of the agencies that were closed down as a consequence of the government shutdown. Consequently, small businesses could not use many of the SBA’s services (Longhurst et al., 2020). As a result, proprietors of small businesses began to have less faith in the Small Business Administration.

Fourth place, the Organization has been criticized for the sluggish manner in which it responds to natural disasters. For instance, the Organization needed to react more quickly to Hurricane Katrina in 2005 or Sandy in 2012. Because of its slow response, the Organization has come under fire for its alleged inability to effectively assist small businesses when needed (Longhurst et al., 2020).

Opportunities

As per the study of Ahmadi et al. (2016), all different kinds of businesses are eligible to participate in the financial aid programs offered by the Small Business Administration. On the other hand, the Organization offers programs tailored to more minor companies’ needs. The 7(a) loan program run by the SBA is the most well-known and widely used program for small enterprises. The 7(a) lending program makes loans available for various uses, including working capital, equipment purchases, and real estate investments. In addition, the Organization offers a microloan program through which start-up companies and small firms can receive loans of up to $50,000.

All sizes of small enterprises can participate in this Organization’s counseling and training programs. This Organization also provides a wide range of counseling services, such as support with business planning and marketing, as well as financial analysis and management of finances (Ahmadi et al., 2016). In addition, the Organization provides training programs on various subjects, such as marketing, business management, and financing.

Ahmadi et al. (2016) also argue that all sizes of small businesses are eligible to participate in the programs designed to provide technical help by the Small Business Administration. This Government Agency provides its clients with a wide range of services under technical assistance. These services include aid with the creation of business plans, marketing plans, and financial statements. The Organization also assists firms during the process of registering and obtaining licenses.

Threats

Ahmadi et al., (2016) suggest that The Small Business Administration (SBA) is up against a number of obstacles, despite the significant role it plays in assisting with the support of small businesses. These include restrictions placed on the available budget, political pressure, and competition from other federal agencies.

- Market and Competitor Analysis

Budget Constraints

After considering the effects of inflation, Di & Pattison (2018) argue that the budget allocated to the Organization has been steadily decreasing over the past several years. The budget for the Organization was $826 million for the fiscal year 2015, which is a decrease of $42 million from the previous year’s total. Because the SBA’s budget is affected by the same sequestration cuts imposed on the budgets of other federal agencies, this pattern is anticipated to continue in the foreseeable future.

Due to cuts in funding, the Organization has been forced to lay off a portion of its workforce, which has resulted in a diminished capacity on the part of the Organization to assist small businesses in need of its assistance. For instance, since 2010, the Small Business Administration has been responsible for closing eight regional offices. In addition, the Small Business Development Center program has been scrapped by the government agency (Di & Pattison, 2018). This program offered guidance and instruction to newly established and existing small businesses.

Political Pressure

The SBA is on the receiving end of political pressure from various interest groups. These categories include companies and industries subject to the Organization’s oversight and regulation. Businesses that participate in Organization-sponsored programs fall under the first category. Businesses that profit from this Organization’s programs frequently campaign for modifications that would increase such programs’ potential returns on investment for the beneficiary businesses. For instance, financial institutions that already participate in the 7(a) loan program offered by the Organization have been lobbying for reforms that would make it simpler for them to meet the requirements necessary to be eligible for the program (Di & Pattison, 2018). This Government Agency is lobbied by several industries, including the payday lending business, which it oversees and regulates. These interests frequently work toward the goal of watering down rules that they see to be detrimental to their respective enterprises.

Competition from Other Federal Agencies

The Organization competes with other federal agencies for resources such as funding and personnel. These resources include financial support. Because of this competition, there is a risk of a splintering of services and duplication of efforts. For instance, the Organization and the United States Department of Commerce (US Department of Commerce) share the mission of assisting small businesses. The United States Department of Commerce maintains several initiatives, such as the Small Business Innovation Research program and the Small Business Administration, designed to lend a hand to proprietors of smaller companies (Di & Pattison (2018).

The Organization of Canada competes for funding like the United States Small Business Administration does. The Organization receives its funding from a combination of appropriations from Congress and user fees paid by the businesses it assists. After considering the effects of inflation, the budget for the Organization has been going through a period of steady decline in recent years. The budget for the Organization was $826 million for the fiscal year 2015, which is a decline of $42 million from the previous year’s total (Di & Pattison (2018). Because the SBA’s budget is affected by the same sequestration cutbacks imposed on the budgets of other federal agencies, this pattern is anticipated to continue in the foreseeable future.

Due to the intense competition for available resources, the Organization may occasionally find itself in a position where it cannot provide small businesses with the necessary support services. The ability of the Organization to carry out its mandate may be hindered due to this factor.

In conclusion, the Organization is confronted with several challenges, including restrictions on its budget, pressure from political parties, and competition from other federal agencies. These difficulties may make it more difficult for the Organization to assist small businesses in need of assistance.

Industry Environmental Scan

A yearly environmental scan of the small business environment is carried out by the Office of Advocacy of the Organization. A review of the current environment for small enterprises and an analysis of developments that could affect such organizations are included in the scan. Additionally, opportunities and difficulties that are specific to small firms are identified by the scan.

The results of the most current environmental scan, which was carried out by the Office of Advocacy of the Organization and published in December 2016, are as follows: According to the findings of the survey by Kobe & Schwinn (2018), the number of small firms operating in the United States has climbed for the sixth year in a row. Between 2014 and 2016, small enterprises rose from 28 million to 29 million. Since the beginning of the Great Recession, there has been an uptick in the number of newly established small businesses. Before that time, the number of newly established small businesses fell.

The analysis also discovered that the number of employment produced by small enterprises had climbed for the sixth year in a row, which was a significant finding. In 2016, small enterprises created 1.9 million new jobs, an increase from the 1.8 million jobs produced in 2015. Since 2011, there has been a gradual but steady increase in the number of jobs provided by small businesses. The Organization’s environmental scan is essential for start-ups, small enterprises, and independent entrepreneurs. The scan offers insightful knowledge regarding small businesses’ competitive environment (Kobe & Schwinn, 2018). The information contained in the scan can help assist small firms in identifying both opportunities and obstacles. The scan can also assist small firms in making well-informed decisions regarding where to situate their operations, what kinds of goods and services to provide customers, and how to expand their operations.

Major Competitors of SBA and Their Status in the Industry

This agency faces several organizations that assist newly established firms and individuals who have just started their own companies. There are various organizations, both government and non-government, that offer services analogous to those offered by the institution in question. This paper will research and offer findings on some of the most significant competitors to this Government Agency, as well as the standing of those competitors within the industry.

The United States Small Business Administration Office of Advocacy is the first significant Organization that may be considered a competitor to this Organization. Within the federal government’s framework, the Advocacy functions as an independent voice for the interests of small businesses (Girth & Brown, 2018). The Advocacy researches concerns and challenges are affecting small companies. This information is then sent to Congress and the President, along with a review of federal policies’ impact on small businesses.

The National Association of Independent Businesses is the second most significant Organization competing with the Small Business Administration (NASE). The National Association of Self-Employed Those (NASEP) is an essential resource and advocate for people who work for themselves or run small enterprises. For the convenience of its members, the NASE makes available a wide range of resources and services, such as advice for running a business, health insurance, and filing taxes (Girth & Brown, 2018).

The Association of Small Business Development Centers is the third major competitor of the Small Business Administration (ASBDC). The American Small Business Development Centers Association, is a national network of approximately one thousand Small Business Development Centers (SBDCs). SBDCs offer small businesses and entrepreneurs research, training, and counseling services.

The National Small Business Association is the fourth important competitor to the Small Business Administration (NSBA). The National Small Business Association (NSBA) is the nation’s first and most established Organization dedicated to defending the interests of the nation’s small businesses (Girth & Brown, 2018). Members of the NSBA have access to a wide range of tools and services thanks to the Organization, such as professional counseling for their businesses, health insurance, and help with their taxes.

The United States Chamber of Commerce (USCC) is the fifth most significant Organization that competes with this Organization. The Chamber of Commerce is considered one of the largest business federations in the world, which outlines the interests of over three million companies in size, industry, and geographic location. The Chamber provides its members with a wide range of resources and services, such as Advocacy on their behalf, business counseling, and networking opportunities (Girth & Brown, 2018).

In conclusion, the SBA is one of many agencies that offer support to small businesses and individuals who have started their firms. There are various organizations, both government and non-government, that offer services analogous to those provided by the institution in question. Even though it is up against intense competition from other organizations, the Organization continues to be the most critical source of help for new and aspiring business owners.

Tools Used: Porter’s 5 Forces

Threat of new entrants

Kreutzer, R. T. (2019) argues that This Government Agency offers a variety of beneficial programs and amenities to small businesses, many of which can be utilized to the small business owner’s advantage. On the other hand, new recruits need to be aware of a few potential dangers that could arise in the future. The following is a brief review of some of the potential challenges posed by new entrants to the Organization:

- Filling out an application for a loan from the Organization can be a time-consuming and difficult process. In order to be eligible for a loan from the SBA, one must first satisfy a number of the Organization’s eligibility conditions, and the application process itself can be quite difficult.

- Because this Organization only offers a guarantee for a portion of the loan, the borrower is still liable for repaying the remaining balance of the loan in the event that they fail to make their payments. Even if a borrower on an Organization loan fails on their payments, the borrower is still responsible for repaying the remaining balance of the loan.

- The interest rates that are associated with this Organization loans are often higher than those associated with traditional loans. The Organization will charge you interest on any loan you take out through them, and the interest rates on these loans will normally be greater than those on regular loans.

- For one to meet eligibility for a loan from the Organization, one must first satisfy a number of the Organization’s eligibility conditions. Borrowers need to satisfy a number of criteria before the Organization will consider them eligible for a loan.

- Even if all of the criteria for receiving a loan are satisfied, there is no assurance that the loan application will be approved. The Organization does not provide any kind of guarantee that each and every loan application will be accepted.

This government agency can be a beneficial resource for small enterprises, despite the fact that there are risks that may be involved. In order to assess whether or not an SBA loan is appropriate for their company, new entrants should give serious consideration to the programs and services provided by the Organization and speak with a loan officer who has prior industry experience.

Bargaining power of suppliers

A recent study by Petrakis & Skartados (2022) asserts that this Government Agency is an influential government body that can serve as a resource for expanding and developing small enterprises. Because of its size and the volume of business it does with smaller companies; the government agency possesses a significant degree of bargaining leverage with its various suppliers. The Organization can leverage its influence with suppliers to negotiate better rates, terms, and conditions. This has the potential to assist small businesses in improving their bottom lines by reducing their expenses and saving money.

The Organization delivers access to a wealth of information and other valuable tools, which can be utilized to the benefit of individual small enterprises. The Organization can offer helpful insights and direction to small firms, allowing them to navigate the complex business world better. Small businesses can also receive assistance from the SBA in establishing connections with other organizations, both private and public, that can assist them in expanding their operations and achieving greater levels of success (Petrakis & Skartados, 2022).

In a nutshell, the Organization is a powerful organization that can work to the benefit of individual companies that fall within its purview. The agency has a great deal of negotiating power with the various suppliers and can provide helpful information and services to smaller enterprises.

Operating Plans

Operating Plan

- Value Analysis of the Plan

Dilger (2019) states that the budget for this Government Agency’s operating plan for the 2016 fiscal year is $905 million. The Organization intends to put these monies to use to support its various programs and services, such as providing financial aid, training, and counseling to company owners. The Organization intends to put this money toward supporting its information and resource projects, including the Small Business Resource Center and the Small Business Development Center Network, among others.

The Organization’s budget for the fiscal year 2016 shows a rise of $25 million from the previous fiscal year, FY 2015. The Organization attributes this rise to the continuous demand for its programs and services and the requirement to invest in new initiatives that assist small businesses. The requested budget for the SBA’s fiscal year 2016 contains $723 million for the agency’s entire programs and services and $182 million for the agency’s information and resource efforts (Dilger, 2019). The Organization intends to put these funds toward the maintenance of its existing programs and services, as well as the establishment of brand-new initiatives that are geared toward assisting small businesses.

- Risk Analysis

The Small Business Administration (SBA) is fraught with a great deal of potential danger. These dangers can be broken down into three different categories: financial, operational, and reputational.

Financial risks

According to Higgins et al., (2022), a significant portion of support for small firms comes from the Organization. As a result of this, the Organization is put in a position where it faces the possibility of loan defaults. There is also assurance loans of loans by this agency through the participation of lenders henceforth Organization takes responsibility for loan repayment in the event borrower does meet terms and conditions in paying back of loan as per agreement. The Organization has implemented a number of programs, including the 7(a) Loan Guaranty program and the 504 Loan Guaranty program, in order to reduce the likelihood that borrowers will default on their loans. However, there is a possibility of harm coming from participating in these programs. In the event that there is a significant slowdown in economic activity, the Organization may be forced to deal with a significant number of loan defaults, which may place the Organization in a precarious financial position. By placing a greater emphasis on risk management, the Organization can reduce the possibility that borrowers will default on their loans. In addition to this, the agency can carry on with the process of formulating and enacting programs that will assist smaller businesses in weathering economic downturns.

Operational risks

Wang & Cheng (2021) argues that This Government Agency is an enormous and intricate government agency. As a consequence of this, the Organization is vulnerable to a wide array of hazards related to its operations. The risk of fraud, the risk of disruptions in information technology, and the risk of natural disasters are all included in these hazards. By placing a greater emphasis on fraud prevention and detection, the Organization will be able to reduce the likelihood of fraudulent activity. Investing in redundant systems and making preparations for adverse events are two other ways for the government agency to reduce its vulnerability to disruptions in information technology services.

Reputational risks

As a consequence of this, the agency is exposed to a significant amount of scrutiny from the media, Congress, and the general public. Additionally, the agency is vulnerable to the possibility of receiving unfavorable press. In the event that the Organization is found guilty of misconduct or experiences a severe defeat, the government agency’s reputation may take a significant hit as a result. By enhancing the level of transparency in its operations and the amount of communication it has with the general public, the SBA can reduce the likelihood of receiving unfavorable public attention (Wang & Cheng, 2021). The possibility of the agency being scrutinized by Congress can also be reduced if the agency has a solid working relationship with the legislative body and provides information that is both timely and accurate.

- Process Value Analysis

It is feasible to gain a more clear idea of the potential usefulness of this type of business improvement approach by thinking about the ways in which outsourcing might help or impede Organization procedures. In particular, process value analysis can be of assistance in determining which of the Organization’s procedures are the most significant, as well as how those functions might benefit from being outsourced.

Bliss (2019) examines that there are a variety of ways in which procedures at this government agency could benefit from outsourcing, including ways in which these could help to increase their efficiency and effectiveness. One possible application of outsourcing would be to:

Create new or better business processes and put them into action

The process of developing new business processes can benefit from the new views and ideas that can be gained through outsourcing. In many instances, external providers will already have a large amount of expertise devising and putting into effect processes that are very similar for other companies. Because of this, they are frequently in a position to provide helpful insights and suggestions regarding how procedures should be improved.

Offer the staff of the SBA your specialized skills and help

Many companies that outsource their work also provide specialized expertise and various support services. This might be especially helpful for the Organization, which might not have the resources necessary to sustain all of its activities if it were to rely solely on its own resources. Through the use of outsourcing, the Organization was able to gain access to specialized talents and information on an as-needed basis, without having to pay the cost of employing these resources full-time.

Manage and run the most important company procedures.

The Organization has the potential to get access to high-quality process management and operational skills through outsourcing. It is possible that this may be utilized to help the delivery of essential business activities, such as the processing of loans or the provision of counseling services.

Provide goods or services to medium and small-sized enterprises

If the circumstances are right, the Organization may be able to contract out to a third party the supply of goods or services directly to individual small enterprises. This might make it possible to improve the effectiveness of service delivery while also lowering expenses.

Before coming to any kind of conclusion, it is important to keep in mind the fact that outsourcing is connected to a variety of possible dangers on the job. The following are some examples of these possibilities:

A lack of command over fundamental aspects of the company’s operations

It is possible that the Organization will lose some degree of control over its most important business processes if it chooses to outsource these functions. In the event that the external provider is unable to supply the needed level of service, this could result in complications.

Reliance on services and resources provided by third parties

It’s possible that outsourcing will lead to an unhealthy dependence on third-party service providers. Because of this, it might be difficult for the Organization to cancel the arrangement if it is dissatisfied with the quality of the service that is being delivered.

An increase in associated expenses

It’s possible that outsourcing won’t always be the most cost-efficient option. When certain conditions are met, it is possible that the costs associated with outsourcing a procedure will be higher than the costs associated with performing the activity in-house.

A decline in the overall quality of the items or services offered

When a task or activity is contracted out to a third party, there is always the possibility that the quality of the product or service will suffer. This may have an adverse effect on the reputation of the Organization.

In general, this Government Agency stands to gain access to a variety of possible benefits through the utilization of outsourcing. However, prior to making any decisions, it is essential to give careful consideration to both the risks and the benefits that are associated with outsourcing.

- Key Assumptions and Options Analysis

A number of fundamental presumptions serve as the foundation for the business plan developed by the Organization. Because of these presumptions, the government agency is able to direct its attention and resources toward those aspects of the economy that are most likely to have a beneficial effect on small companies. The following is a list of the four most important presumptions that lie at the foundation of the Organization’s business plan:

Organization will have success through acquiring finances from this Government Agency as it serves as the first supposition. The Organization is a government body that aids in helping small businesses by providing them with financial assistance in the form of loans. The Organization will require the company to submit an application and details regarding the company’s finances. The Organization will then conduct an investigation into the request and determine whether or not the loan will be granted. The second premise is that the corporation will have the financial resources necessary to satisfy the terms of the SBA loan within the allotted period of time. The Organization will require the corporation to make payments to them on a monthly basis. The loan will carry an interest rate, and the business will need to determine whether or not it is able to pay back the principal as well as the interest on a monthly basis.

The third supposition is that the Organization will make use of the loan for the objective that has been outlined, which is to broaden the scope of the corporation. The Organization will require the company to present evidence to demonstrate how the loan will be utilized before approving the request. The loan can only be utilized for the one goal that has been outlined, and the company will not be able to use the money for anything else. The increase of the company’s operations will allow for the generation of a profit for the company, which is the fourth premise that we are working off of. Before the Organization will approve the expansion, the company will need to demonstrate that it will be profitable. The Organization will need the corporation to present financial statistics in order to demonstrate that the expansion will result in a profit for the business.

The possibility of the company receiving finance from the Organization is the one that has the greatest degree of promise for the business. The government agency will require the company to submit an application and details regarding the company’s finances. The Organization will then conduct an investigation into the request and determine whether or not the loan will be granted.

The corporation has the option of reimbursing the loan received from the Organization within the allotted amount of time, which is another opportunity for the business. The Organization will require the corporation to make payments to them on a monthly basis. The loan will carry an interest rate, and the business will need to determine whether or not it is able to pay back the principal as well as the interest on a monthly basis. The most likely course of action for the company is to pursue the possibility of putting the money from the loan toward the objective that has been outlined, which is to grow the company. The Organization will require the company to present evidence to demonstrate how the loan will be utilized before approving the request. The loan can only be utilized for the one goal that has been outlined, and the company will not be able to use the money for anything else.

The company’s best bet would be to apply for a loan from the Organization and put that money toward expanding the company. This would be the loan’s sole aim. The Organization will require the company to submit an application and details regarding the company’s finances. The Organization will then conduct an investigation into the request and determine whether or not the loan will be granted. The Organization will require the company to present evidence to demonstrate how the loan will be utilized before approving the request. The loan can only be utilized for the one goal that has been outlined, and the company will not be able to use the money for anything else.

- Leadership and Management Styles

This Agency has a variety of programs and services that can help small businesses succeed, and one of the most important is the agency’s leadership and management training.

The Organization offers a number of different leadership and management training programs, each of which is designed to teach skills to owners and managers of small businesses on how to be successful. The agency also offers a variety of resources on its website, including articles, webinars, and podcasts that can help small business owners and managers learn more about leadership and management. SBA (n.d.) argues that owners and managers of small business is essential for them to understand that there is no one “right” way to lead and manage a business (SBA, n.d.). Depending on the nature of the situation at hand and the people they are working with, the most effective leaders and managers will use a variety of different styles.

The Administrator, who serves as the head of the agency and is appointed to that position by the President of the United States, is in charge of the Organization. The Administrator serves as the agency’s chief executive officer and is accountable for the overall management and leadership of the Small Business Administration. The Organization employs a group of regional administrators, each of whom is responsible for managing the agency’s programs and services within their own geographic region. The Administrator delegated authority to the regional administrators, who are then accountable for the administration, management, and execution of the SBA’s programs and services within their respective regions (SBA, n.d.).

The Organization also employs a group of district directors, each of whom is responsible for monitoring the implementation of Organization services and programs within their own geographic regions. The regional administrators are in charge of the district directors, who are accountable for the management and operation of the SBA’s programs and services within their respective districts. The district directors report to the regional administrators.

In addition, the Organization has a Chief Operating Officer, a Chief of Staff, and a Deputy Administrator on its leadership team. The Administrator is in charge of overseeing the everyday operations of the Organization, and the Chief Operating Officer is accountable for those activities (SBA, n.d.). The Administrator relies on the Chief of Staff for guidance and support across a wide range of issues; in addition, the Chief of Staff reports directly to the Administrator. The Deputy Administrator is the agency’s second-in-command and reports directly to the Administrator. The Administrator is responsible for overseeing the activities of the agency.

For the purpose of directing the work of the Organization, the agency’s leadership team employs a wide range of distinct leadership and management styles. The Administrator, for instance, employs a participatory leadership style, which denotes that he or she engages with employees at all levels of the agency in order to get input on decision-making and that this style encourages a sense of community within the Organization. Additionally, the regional administrators employ a style of leadership known as participatory management, and they maintain close relationships with the district directors in order to guarantee that the programs and services provided in their region are catering to the requirements of the local small businesses (SBA, n.d.).

The Chief Operating Officer of the Organization exercises a more autocratic style of leadership, which means that he or she makes decisions without seeking the opinions or advice of others. The Chief of Staff employs an autocratic style of leadership and offers the Administrator advice and guidance over a variety of matters. In addition, the Chief of Staff is responsible for the day-to-day operations of the Organization. The leadership style of the Deputy Administrator is described as being more hands-off, and he or she offers assistance to the Administrator on a wide range of topics (SBA, n.d.).

- Organizational Chart

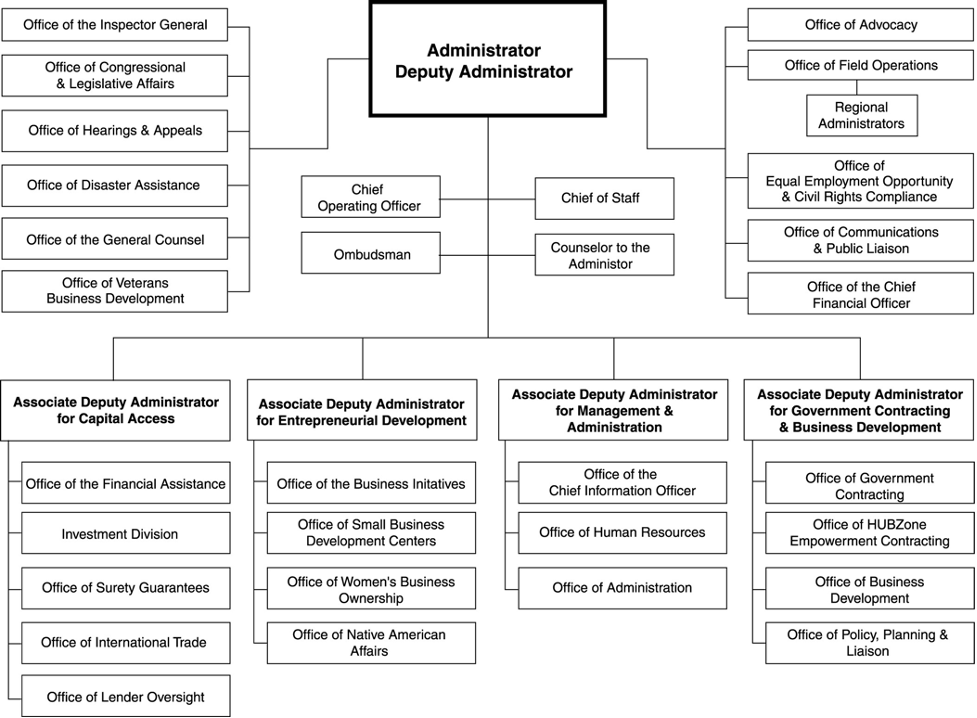

According to report of the month of May in the year 2001 SBA (2001), this agency had a total of 2,859 workers. The Organization has about ten regional offices and over a hundred smaller field locations across the country, and these offices are home to approximately three-quarters of the agency’s workforce. In addition to its staff of government employees, the SBA has an infrastructure consisting of over a thousand resource partners situated across the country. These resource partners offer small companies both advising and technical help. According to the Organization, the government agency is permitted to have a total of up to sixty appointees on its staff. This includes four vacancies reserved for presidential appointees, an allowance from the Personnel Management Office specific for eighteen noncareer Senior Executive Service appointees, and thirty-eight are entitled for positions are appointed.

As can be seen in the figure, the management structure of the agency’s headquarters is relatively flat. A total of 19 offices are accountable to the Office of the Administrator.

- Information Technology Governance Model

Lines of Ownership for Business and Technical Teams

The Organization is served by centralized leadership for the strategic planning and direction of information technology (IT), which is provided by the Office of the Chief Information Officer (OCIO) (SBA). The Office of the Chief Information Officer (OCIO) collaborates with other federal agencies and business units within the Organization to develop and deploy cutting-edge technology that will allow the SBA to improve its ability to assist individual citizens.

The Lines of Ownership for Business and Technical Teams (LOBs) of the Organization describe the roles and responsibilities for making decisions about business and technical matters within the agency. The LOBs offer a structure that is both clear and concise for the business and technical teams to utilize when making decisions regarding the technologies that they use to support their mission.

The LOBs are not a set document; rather, they are a live document that will be modified over time to accommodate the shifting requirements of the agency. In order to guarantee that the LOBs continue to fulfill their intended purpose and are adaptable to the evolving requirements of the agency, they will be examined and revised on a regular basis.

The LOBs can be broken down into the following four primary categories:

Technology Governance

The Technology Governance LOB is responsible for defining the roles and responsibilities that are implemented in the process of decision regarding technologies that are used to support the Organization. The following responsibilities fall under the purview of the Technology Governance LOB:

Technology Owner: The Technology Owner is entitled outlining general strategy and directives of the technology that is used to support the Small Business Administration. Additionally, it is the Technology Owner’s duty to see to it that the technology in question caters to the requirements of both the Organization and the Organization’s clients.

Technology Manager: The Technology Manager is accountable for the day-to-day management of the technology that is utilized to support the Organization. The Technology Manager is also accountable for ensuring that the technology is utilized in a manner that is in line with the policies and procedures of the Organization.

Technology User: The Technology User is accountable for ensuring that the Organization’s mission is met through the effective utilization of all available technological resources. The Technology User is also responsible for ensuring that the technology is used in a manner that is compliant with the policies and procedures of the SBA in whatever capacity they may serve.

- Enterprise Architecture

The Enterprise Architecture Line of Business is in charge of defining the many roles and duties that are involved in the decision-making process regarding the SBA’s enterprise architecture. The following responsibilities fall under the LOB of Enterprise Architecture:

Enterprise Architect: The Enterprise Architect is in charge of the Organization’s overall architecture and is responsible for its design. The Enterprise Architect is also accountable for ensuring that the design satisfies the requirements of the Organization and the requirements of its clients.

The day-to-day operations of the Organization’s architecture are the responsibility of the Architecture Manager, who also goes by the title “Architecture Manager.” The Architecture Manager is also accountable for ensuring that the architecture is utilized in a manner that is in line with the guidelines and protocols established by the Organization. This responsibility falls under the broader category of “architecture governance.”

Architecture User: The role of the Architecture User is to ensure that the architecture is used effectively to achieve the mission of the agency. The Architecture User is also responsible for ensuring that the architecture is used in a manner that is in line with the Organization’s rules and procedures in the same way that they are responsible for ensuring that the architecture is used correctly.

- Information Security

The duties and responsibilities that need to be filled in order to make decisions on the information security of the Organization are outlined in the Information Security LOB. The following jobs fall under the purview of the Information Security LOB:

Officer of Information Security: The Information Security Officer is in charge of ensuring that all of the SBA’s information is kept private and secure. The Information Security Officer is also responsible for ensuring that the information owned by the Organization is used in a manner that is in line with the policies and procedures owned by this agency.

Information Security Manager: The Information Security Manager is in charge of ensuring that all of the SBA’s information is kept private and secure on a day-to-day basis. The Information Security Manager is also responsible for ensuring that the information held by the Organization is used in a manner that is in accordance with the rules and procedures of the Organization.

User of Information Security the User of Information Security is accountable for utilizing the SBA’s information in a manner that is in line with the policies and procedures established by this Agency.

- IT Portfolio Management

The IT Portfolio Management LOB is responsible for defining the roles and duties that are involved in the decision-making process for the Organization’s IT portfolio. The following positions fall under the purview of the IT Portfolio Management line of business:

IT Portfolio Manager: The IT Portfolio Manager is accountable for the overall management of the information technology portfolio held by the Organization. The IT Portfolio Manager is also accountable for ensuring that the Organization’s information technology portfolio is used in a manner that is in line with the Organization’s rules and procedures at all times.

IT Portfolio User: The IT Portfolio User is accountable for making use of the Organization information technology (IT) portfolio in a manner that is in line with the agency’s policies and procedures.

Technology Owner: The Technology Owner is responsible for the overall strategy and direction of the technology that is used to support the Organization. Additionally, it is the Technology Owner’s duty to see to it that the technology in question caters to the requirements of both the Organization and the Organization’s clients.

Technology Manager: The Technology Manager is accountable for the everyday management of the technology that is utilized to assist the Organization. The Technology Manager is also accountable for ensuring that the technology is utilized in a manner that is in line with the policies and procedures of the Organization.

Technology User: The Technology User is accountable for ensuring that the Organization’s mission is met through the effective utilization of all available technological resources. The Technology User is also responsible for ensuring that the technology is used in a manner that is compliant with the policies and procedures of the Organization in whatever capacity they may serve.

The Lines of Ownership for Business and Technical Teams provides a clear and straightforward framework for business and technical teams to use in order to make decisions regarding the technologies that they employ in order to accomplish their goal. The LOBs are not intended to be a static document; rather, they are intended to be a live document that will develop over time in response to the requirements imposed by the Organization. The LOBs are going to be analyzed and improved upon on a consistent basis in order to guarantee that they continue to fulfill the agency’s requirements in an effective manner despite the fact that those requirements are always shifting.

Service Delivery Requirement for Business and IT

The Agency’s standards for the delivery of services related to business and information technology can be broken down into four main categories, namely the following:

The Organization is required to have procedures in place to correctly identify and authenticate users, authorize and control access to resources, audit and log activity, and protect data in order to guarantee the delivery of services in a secure and efficient manner.

Identification and Authentication

For the Organization to be in a position to appropriately grant access to resources, users need to be able to be identified as well as authenticated. This objective may be accomplished through the application of user names and passwords, data based on biometric characteristics, or any number of other methods.

Authorization and Access Control

After individuals have been correctly identified and authenticated, the Organization is responsible for authorizing and controlling access to the resources. This can be performed through the utilization of role-based access controls, access control lists, or any number of other possible methods.

Audit and Logging

The Organization is required to implement mechanisms that audit and log activity in order to maintain the confidentiality and authenticity of the services it provides. The use of audit logs, event logs in the system, or any number of other methods are all viable options for achieving this goal.

Data Protection

The Organization is required to have safeguards in place to protect data in order to maintain the secrecy and accuracy of the information it stores. Encryption, data masking, or any of a variety of other methods, along with other approaches, are all viable options for achieving this goal.

Customization Policy

The Customization Policy is a voluntary initiative that gives small businesses the opportunity to request that the SBA modify the requirements of specific federal licenses and permits so that they are more aligned with the specific requirements of their own enterprises. As long as the small business meets the criteria for participation in the program, the Organization will collaborate with the business owner to modify the prerequisites for obtaining the necessary licenses and permits so that they are appropriate for the particular operations of the small business.

To be considered a small business and so qualified for the Customization Policy, an organization must consist of five hundred workers and less than seven million dollars in yearly revenue. In addition to this, the company must be involved in a practice that is within the jurisdiction of a federal agency and it must be able to provide evidence that it has a demand for the rules to be tailored to its specific needs.

After it has been established that a particular small business meets the criteria necessary to participate in the program, the Organization will collaborate with the business to devise specific conditions for the acquisition of the necessary licenses and permits. When customizing the requirements, the Organization will take into account the size, nature, and location of the business, in addition to the particular requirements that the business has. In addition to this, the Organization will collaborate with the federal authorities that are in charge of regulating licenses and permits in order to make certain that the individualized requirements are suitable and appropriate, as well as that they fit the requirements of the small business.

The Customization Policy is an invaluable resource for locally owned and operated companies that are subject to the oversight of federal agencies. The policy has the potential to assist companies in obtaining the necessary licenses and permits for their enterprises in a manner that is adapted to meet the specific requirements of each company.

Site Management Storage and Lifecycle Policies

Part 34 of the Federal Acquisition Regulation (FAR) offers direction for the administration of storage and lifecycle policies for records pertaining to contractors working for the federal government. In addition, the National Archives and Records Administration (NARA), as a branch of the United States Department of the Interior, has published guidelines for the disposal of records pertaining to federal contractors (Etemadi & Kamp, 2022).

For small firms that are eligible for financial assistance from the federal government, the Organization has a number of regulations that must be met regarding the management of records. The requirements for the management of records for small businesses that receive assistance from the federal government have been outlined in a legal memorandum that was issued by the Office of General Counsel for the Organization.

Small firms that are eligible for federal assistance must comply with a requirement imposed by the Organization that mandates they keep records documenting the use of federal funds and the performance of work under contracts awarded by the federal government. Both the Federal Acquisition Regulation (FAR) and the Organization’s own regulations stipulate that records must be kept in compliance with their respective requirements.

In addition, the Organization mandates that companies with fewer than 500 employees must create and keep records to demonstrate that they are in compliance with the mandates of the Small Business Act, the Small Business Investment Act, and the SBA’s own regulations. The Organization mandates the strict observance of certain guidelines for the maintenance of records that show the expenditure of federal monies. Documents attesting to the utilization of federal funds are required to be kept on file by small businesses for a period of three years following the date of the most recent expenditure of those funds.

The Small Business Administration requires that businesses with fewer than 25 employees keep records documenting their use of federal funds for a period of three years after the date on which those funds were last spent, regardless of whether or not the business received an audit from the Organization. In addition, the Organization mandates that companies with fewer than 500 employees keep records attesting to the fact that they have complied, including mandates of the Small Business Act, the Small Business Investment Act, and the Organization’s regulations. The records that are required to be maintained by the agency may be maintained in either paper or electronic form, or a combination of both paper and electronic form.

Education and Training Plan

The major objective of the agency is to promote and increase the competitiveness of SBs in the marketplace, as well as to assist in the success of these businesses. To accomplish this goal, the Organization runs a variety of programs and offers a variety of services, some of which include education and training.

The education and training programs offered by the Organization are intended to facilitate the establishment, expansion, and achievement of goals set by small businesses. The Organization hosts a number of different classes, workshops, and seminars that cover a wide range of issues, including government contracting, company development, financing, and marketing. In addition, the SBA collaborates with a variety of different organizations to offer SBs various educational and training opportunities.

The Education and Training Plan of the Organization is an all-encompassing plan designed to provide SBs with the information and capabilities necessary for them to launch, expand, and realize their full potential. The plan consists of the following four essential components:

Availability of high-caliber educational and vocational programs 🙁 SBA, n.d.) Presents that Small businesses have easier access to a wide range of educational and training opportunities. Organization hosts a number of different classes, workshops, and seminars that cover a wide range of issues, including government contracting, company development, financing, and marketing. In addition, the SBA collaborates with a variety of different organizations to offer SBs various educational and training opportunities.

Provision of training and educational programs: The Organization works in collaboration with a wide range of other organizations to provide training and educational programs to small businesses. Small businesses can access free or low-cost business counseling and training through collaboration with Small Business Development Centers (SBDCs), which are also known as SBDCs, United States Chamber of Commerce, the National Association of Manufacturers, and the National Federation of Independent Businesses in order to deliver educational and training programs.

Assessment of the effectiveness of training and education programs: The Organization conducts assessments of the efficiency of training and education programs to ensure that they are catering to the requirements of SBs. In order to evaluate the effectiveness of the educational and training programs, the Organization solicits feedback from participants by way of questionnaires and interviews. In addition, case studies and focus groups are carried out by the Organization in order to evaluate the efficiency of certain programs.

Research on the training and education needs of small businesses: The Organization carries out research on the training and education needs of small businesses in order to locate areas of weakness and establish new programs. In order to determine the training and education requirements of SBs, the agency performs needs assessments. These assessments consist of surveys and interviews with SBS. In addition to using data from the Census Bureau and other sources, the SBA analyzes the data to detect patterns in the education and training requirements of small businesses.

Marketing and Manufacturing Plans

The SBA’s Standard Manufacturing Plan

The Standard Manufacturing Plan is an all-encompassing manual that was developed by the Organization to assist companies in developing a business plan, registering their company with the state, and acquiring the appropriate licenses and permissions. The Standard Manufacturing Plan also contains information on how to build a manufacturing process, how to advertise and sell products, and how to finance a manufacturing business (De Silva et al., 2017).

The SBA’s Green Manufacturing Plan

The Green Manufacturing Plan developed by the Organization assists businesses in cutting costs and conserving resources by recommending and facilitating the adoption of environmentally responsible manufacturing methods. The Green Production Plan offers information on how to select equipment that is efficient in terms of energy use, how to reduce waste, how to recycle materials, and how to apply other practices that are environmentally friendly in manufacturing (Shmeleva et al., 2018).

The SBA’s Sustainable Manufacturing Plan

Through its Sustainable Manufacturing Plan, the Organization assists businesses in developing a production method that is more environmentally friendly, one that also helps them save money on energy and generates less waste. The Sustainable Manufacturing Plan offers advice on how to build a sustainable manufacturing process, how to select equipment that is energy efficient, how to reduce waste, how to recycle materials, and how to adopt other sustainable manufacturing practices (Shmeleva et al., 2018)..

The SBA’s Made in America Plan

The Made in America Plan is an initiative of the Organization that provides assistance to firms in the development of products that are manufactured in the United States as well as the creation of jobs in those same states. Shmeleva et al., (2018) argue that the Made in America Plan offers information on how to comply with export requirements, how to sell products abroad, how to finance exports, and how to ship items overseas. Additionally, this plan includes information on how to promote products globally.

The SBA’s National Export Initiative Plan

The goal of the National Export Initiative Plan (NEIP) of the Organization is to assist American firms in expanding their exports and so producing a greater number of domestic job openings. The National Export Initiative Plan contains information on how to comply with export regulations, how to market products internationally, how to finance exports, and how to ship products internationally (Shmeleva et al., 2018). Additionally, this plan includes information on how to market products internationally.

Every one of these production strategies comes with its own unique set of prerequisites and advantages, both of which are open to companies to take advantage of. For instance, in order for a company to comply with the requirements of the Standard Manufacturing Plan, the company must first develop a business plan, then register their company with the state, and then get all relevant licenses and permissions. Through the use of environmentally responsible manufacturing techniques, businesses can cut costs and preserve valuable resources with the assistance of the Green Manufacturing Plan. The Sustainable Production Plan provides assistance to companies in the development of environmentally responsible manufacturing procedures that cut down on waste and make more efficient use of energy. The Made in America Plan provides assistance to businesses so that they can produce goods that are manufactured in the United States of America and so that they can provide jobs in the United States of America. The National Export Initiative Plan assists American businesses in expanding their exports, which in turn serves to improve the number of jobs that are available in the United States.

Financial Analysis

Operating Expense Proposed Budget

For the fiscal year (FY) 2021, the budget that is being requested for the Organization to cover operating expenses is $950 million. From the level that was authorized for FY 2020, this represents a reduction of $108 million, which is equivalent to a 10% decline. The focus that the Organization is putting on providing assistance to small businesses and entrepreneurs as they continue to recover from the pandemic and rebuild their companies is reflected in the budget that has been presented.

The level of funding allotted for Salaries and Expenses (S&E) in the proposed budget of $736 million represents a decline of $109 million, or 13 percent, when compared to the level that was actually approved for Fiscal Year 2020. A total of $214 million has been allocated for Small Business Development Centers (SBDCs) in the proposed budget. This is a drop of $1 million, or less than 1 percent, from the level that was actually approved for Fiscal Year 2020.

The priority that the SBA places on cutting costs and increasing productivity is reflected in the budget that has been proposed for S&E. The proposed budget calls for cuts to be made in a variety of areas, including travel, supplies, and equipment, as well as employees and services provided under contract. Additionally, investments in information technology (IT) are planned to be made as part of the projected budget in order to make the SBA’s operations more efficient.

The dedication of agency in assisting small businesses and entrepreneurs recover from the epidemic and rebuild their companies is reflected in the funding that has been requested for SBDCs. The proposed budget allots funds to Small Business Development Centers (SBDCs) so that they can assist small firms with advisory services, training opportunities, and technical assistance.

Capital Expense Proposed Budget