1.0 Introduction

The world’s leading chain of fast food restaurants, Subway, has to delve much deeper into its brand identity and positioning (Sandis et al., 2023, p. 2051). In a world that has been witnessing a growing shift in preference towards looking at healthy food choices and digital ordering, Subway must know the brand perception that is now surfacing, where against the competition, and what is really taking form in terms of trends within the market. This audit will look at the brand reputation that Subway has, the manner through which it talks to its customers, who its customers are, and what is happening in the market. This may help Subway in figuring out how to make itself more appealing and relevant to today’s people who might be trying to eat healthier in the fast lane. The key is to be able to conceive ways in which Subway can be an attractive proposition to grow and serve hungry customers everywhere.

1.1 Background

Subway was established in 1965 by Fred DeLuca and Peter Buck and has grown to be a world giant in fast food (Ko et al., 2022, p. 28). It was initially conceived as a modest sandwich shop in Bridgeport, Connecticut, from where it grew with incredible speed thanks to franchising. Particularly famous for its submarine-style sandwiches but also offering salads and wraps made to order, Subway boasts an extensive network of more than 41,000 outlets within over 100 countries. However, after all such glory, Subway did face problems—the consumers started making healthier choices. In contrast, other substitute goods and services began capturing market share, and the competition within the fast-food chain market got really intense. Other controversies that had a significant impact on the brand and its relation with the franchisee were issues of brand image. But Subway continues to be a leading player in the fast food landscape, proving that change and the ability to adjust are vitally important in a dynamic market.

2.0 Brand Inventory and Elements Analysis

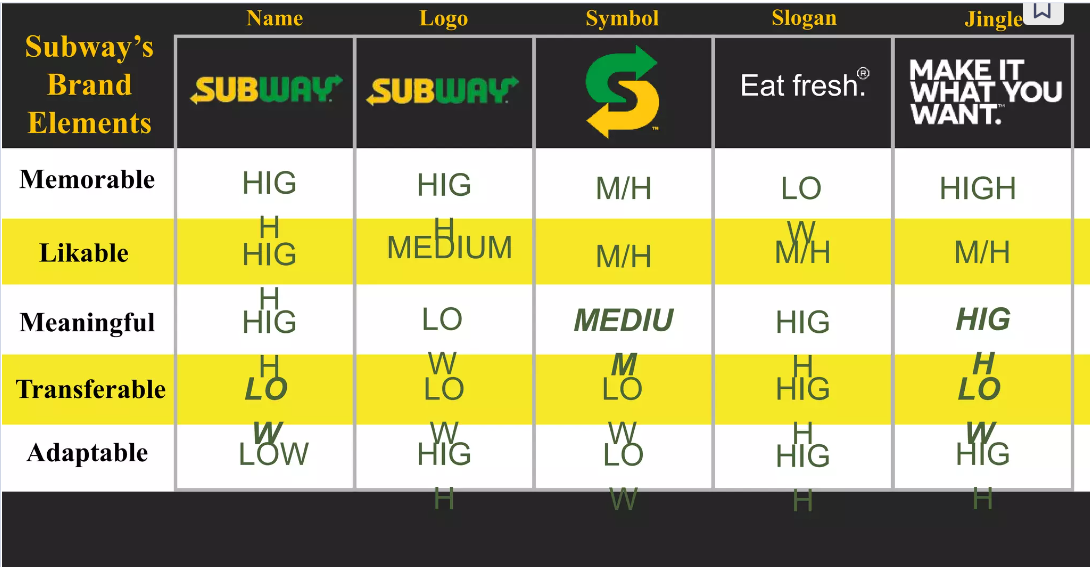

Figure 1: Subway’s Brand Inventory Analysis (source: Atherton, 2023: online)

2.1 Corporate Image, Identity, and Brand Mantra

Subway’s corporate image is that of freshness, healthfulness, and customizability (Adjoian et al., 2019, p. 9. This reflects a brand dedicated to service via fresh and quality ingredients, besides bringing customers access to healthier eating choices. Subways also reflect the image of commitment toward customer service, community involvement, and environmental sustainability.

Figure 2: A Subway Front Image Identity (source: Faubert, 2020: online)

The identity of Subway is bound by an iconic logo, colour theme, and images of fresh ingredients and happy customers (Tregidga et al., 2018, p. 89). The brand identity is an encouraging setting that is clean and quick with the facilities of convenience. The identity of Subway is based on global and cultural adaptability; its message will have to be heard by various audiences across the world.

Figure 3: A Subway Logo (source: Faubert, 2020: online)

The brand mantra “Eat Fresh, Live Green” for Subway defines the very nature of what it promises its customers. It communicates the very essence of Subway by providing fresh and wholesome ingredients meanwhile being environmentally responsible in all their promotions (Chen et al., 2018, p. 1310). Further, this mantra reflects the brand’s dedication to health, sustainability, and customer contentment.

Figure 4: Subway Slogan (source: Faubert, 2020: online)

2.2 symbols

These include its iconic ‘arrows’ logo of bright yellow forming an abstract ‘S,’ suggestive of freshness, speed, and direction pointing to making healthy selections (Milks et al., 2023, p. 287719). In addition, symbols like a green colour scheme and images of fresh vegetables also support the idea of health and sustainability. The sandwich artist speaks of the sense of customization and personalization, which emphasizes the entirety that represents Subway’s made-to-order meal. The same defines the decor, the packaging, and even advertisements to ensure that one visual identity strikes in the customers’ minds in pursuit of freshness, health, and customer service.

2.3 Characters

The most valuable asset of Subway is its personnel, which are called “sandwich artists.” They reflect the policy of individual approach and high quality in service. The service help is conducted by company staff to deliver the promise of serving fresh and ready meals according to the consumer’s orders (Milks et al., 2023, p. 287719). In addition, the marketing communication of Subway may be supported by brand ambassadors or brand spokespersons, which helps to strengthen the position and focus of the brand image and the target audience on the nature of the brand image and the values of life.

2.4 Packaging

Its packaging displays the freshness and greenness of Subway in a way that almost every material used is recyclable, with its designs being eco-friendly while packaging its products (Milks et al., 2023, p. 287719). The designed packaging is, however, convenient and portable enough for customers to have their food carried wherever they go rather than taking the same from a restaurant. It contains the freshness and crispiness of the freshly prepared sandwiches, salads, and wraps from Subway.

2.5 Trademarks

Trademark registration includes unique logos and slogans such as “Eat Fresh” that Subway uses, as well as any other distinct brand elements that may set them apart from others and protect their identity from the use of intellectual property by unauthorized persons. It comprises some aspects of the colour scheme, design and backgrounds, font styles, and even visual or auditory elements that constitute the Subway brand and contribute to enhancing brand uniformity.

3.0 Attributes and Marketing Activity

3.1 Target Market

Subway’s target market involves health-conscious customers on the lookout for easy, customizable, and value-driven meal options. According to demographic targeting, it targets consumers belonging to virtually every age group but, more importantly, focuses on healthier eating practices for millennials and Generation Z (Bekar et al., 2021, p. 223). It represents the urban and suburban environment in heavy human traffic settings, especially in and around school areas, office areas, and transportation hubs. Psychographics will have those in a hurry, preferring everything they buy to be convenient but retain its quality. Socioeconomics concerns all classes, and it has its everyday affordable menus along with premium ingredients for those customers who are willing to pay more (Maggioni et al., 2020, p. 1357). And Subway has made its target market families; thus, there are plenty of other kids’ opportunities in its menu and services, even serving at events and parties. So, altogether, the target market of Subway has to show features of health consciousness, convenience in selection, and dining that are customizable.

3.2 Market Share and Competitor Analysis

Subway operates in the fast-food environment, while McDonald’s, Burger King, and even Starbucks create strong alternatives. However, in such a competition, Subway has been able to continue enjoying a significant share of its own in the sandwich segment. But this position has been eroded somewhat by the advent of stiff competition from the likes of fast-casual chains Chipotle and Panera Bread, which offer a far healthier and varied menu to diners (Harrington et al.,2017, p. 570). Additionally, local sandwich shops and new delivery-targeted platforms create risk for Subway’s market share. Subway should keep and grow its market share by innovating on the menu, enhancing the customer experience, and using its brand strengths, including customization orders and the freshness of food, to keep the customers coming back. This would become a part of regular competitor analysis that will help to observe market dynamics, consumer choices, and opportunities for differentiation and growth.

3.2.1 Porter’s Five Forces Analysis

High Barriers to Entry: The fast-food business has very high barriers to entry. Very high capital requirements are necessitated by the need for one to establish a global franchise network. Furthermore, marketers have to spend heavily on brand-building and brand awareness; they also have to work with strict regulations (Mary et al., 2020, p. 19). Besides, economies of scale and supply efficiencies enjoyed by established players like Subway leave little room for new entrants. The trim level of differentiation in fast food could be something that new entrants look towards taking advantage of, given the evolving consumer tastes towards health and convenience. Therefore, the bargaining power of buyers in terms of Subway’s market share is considered moderate overall.

Bargaining power from customers is high, mainly in the fast food business, for the reason that there is a wide choice to choose from, switching costs are low, and they are price-sensitive. This gets even higher due to Subway’s focus on a segment of health-conscious customers looking at value and customization (Joe et al., 2020, p. 104805). With many choices at their disposal, customers can easily be lost to such rivals, providing similar items on cost competitiveness. Subway needs to ensure, therefore, that it remains in the business through quality, innovation, and affordability.

The bargaining power of suppliers in the fast-food industry generally remains moderate. On the one hand, the global size and reach of Subway go away in terms of dictating to some extent the terms with the suppliers (Lu et al., 2020, p. 333). At the same time, there are issues such as fluctuating commodity prices and dependence on certain key ingredients, possibly resulting in supply chain disruptions. This factor is partially offset through the supplier concentration and the ability to switch.

The threat of substitutes is high in the fast food business, considering that it gets spurred by a host of available alternatives, from home-cooked meals and meal deliveries to other healthy dining options dished out by quick-service chains. Changing consumer preferences for more nutritious food and growing concerns about issues of obesity and nutrition lead to this more vital substitute threat. The intensity of competitive rivalry:

Subsequently, the fast-food industry has a highly competitive rivalry, with many players competing for a slice of the market. Subway competes with the likes of McDonald’s, Burger King, and Starbucks in the case of global majors. In contrast, it competes with Chipotle and Panera Bread under the category of fast casuals. Apart from this, the increased prevalence of delivery platforms is getting on the nerves in local sandwich shops (Su & Reynolds, 2017, p. 12). Competitors typically resort to price wars, aggressive marketing efforts, and new product innovations to carve out a more significant customer base for themselves. In other words, Subway has to focus on differentiation, customer experience, and dynamic improvisation of its offerings if it wants to stay afloat in a highly competitive market.

3.3 Direct and Indirect Brand Competitors

3.3.1 Direct

- MacDonalds:

Similarities: Global presence, fast-food format, customizable menu options.

Differences: More fresh vegetables and freshly baked bread focus than the other two.

- Burger King:

Similarities: Fast-food format, customizable menu options.

Differences: Fresh vegetables are emphasized; there is less customization of the sandwich than at Subway.

3.3.2 Indirect

- Chipotle:

Similarities: Emphasis on a changeable menu offering and use of fresh ingredients.

Differences: Mexican cuisine mainly includes burritos, bowls, and tacos.

- Panera Bread:

Similarities: Fresh emphasis.

Differences: Many soups, salads, and sandwiches are offered on its menu.

3.4 Current Consumer Perceptions of the Competitor Brands

From a consumer perception point of view, McDonald’s and Burger King would represent classic fast foods. At the same time, Chipotle and Panera Bread would be perceived as alternatives that hold a ‘healthier’ profile due to fresher ingredients (Chakraborti, 2023, p. 1031). Subway’s positioning, characterized as “the healthier” option for a fast-food restaurant, might resonate more with health-concerned consumers who would consider it closer to that of Chipotle and Panera Bread.

The line and product extensions, such as salads, wraps, and breakfast offerings by Subway, might be seen with favour through their variety and diversity of preference from consumers down to the distribution channels (Oliveira et al., 2023, p. 456). Sometimes, perception may turn out differently based on how these are executed and the quality of such extensions. In order to ensure positive perceptions among customers and distribution channels, there is a must-consistency in freshness and providing options for customization.

4.0 Establishing Points of Difference and Points of Parity

4.1 Points of Difference

Customization: Subway has its USP of “your own food,” where consumers make their sandwiches, salads, and wraps as they want.

Healthiness: Subway is always fresh and says that there is a healthier choice over most fast foods to attract health-seeking customers looking for an option for junk food.

Freshness: Subway creates an element of brand differentiation by talking about how fresh their goods are; they are prepared right in front of your eyes.

4.2 Points of Parity (POP) for Subway

Convenience: Above all, Subway is positioned as the convenient solution place. It is most suited for consumption occasions on the go, much like other competitors in its set.

Variety: The core product is sandwiching; Subway piles an array of items like salads, wraps, and sides to get multi-customer, multi-flavour penetration.

Price: The price at Subway remains competitive with other chains; hence, the reasonable cost is low for the customers and is a good value for their money.

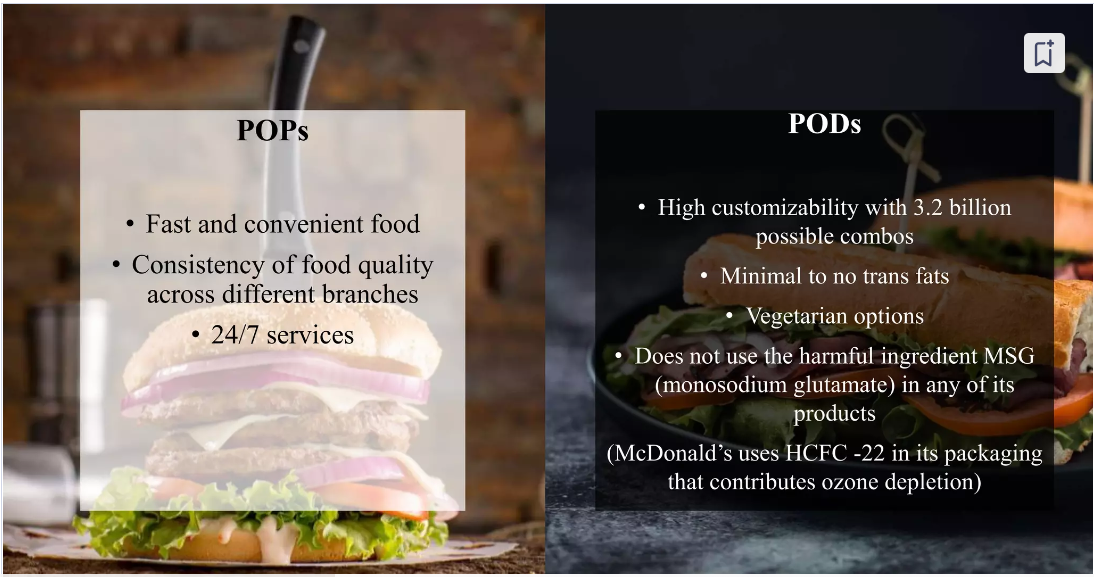

Figure 5: POPs and PODs Representation (source: Vidya, 2019: online)

5.0 Brand Exploratory

5.1 Customer-Based Brand Equity Model (CBBE)

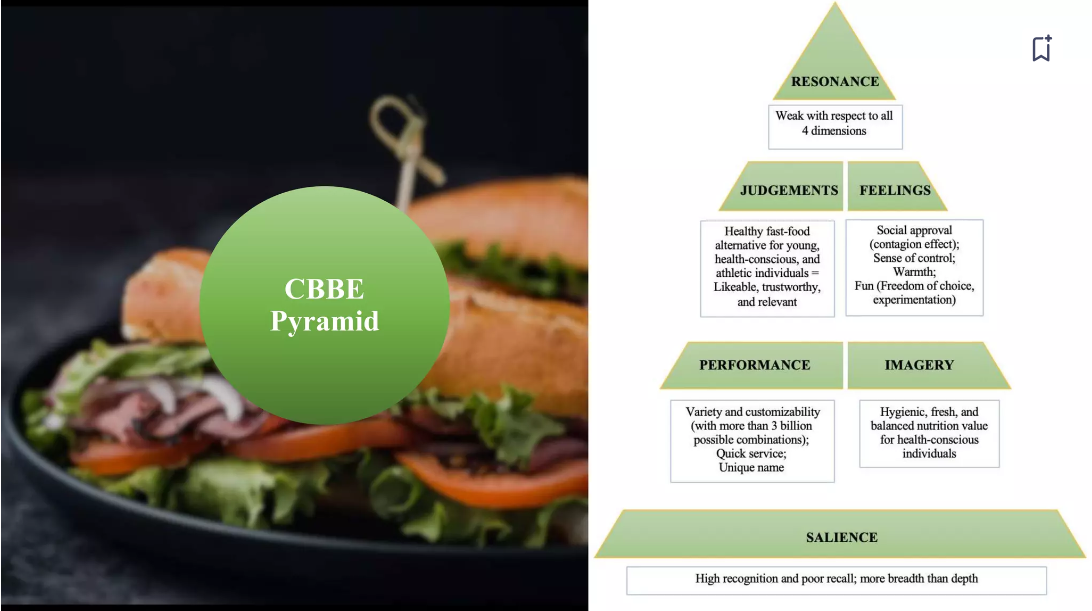

Figure 6 demonstrates the Customer-Based Brand Equity (CBBE) model, developed by Kevin Lane Keller, is one of the most accepted frameworks for understanding and managing brand equity from the customers’ perspective (Foroudi et al., 2018, p. 462). It outlines a set of steps, hierarchically followed by customers, to develop a strong brand association that eventually leads them to be loyal and prefer that brand. Brand Identity — At this stage, the salience of the brand must be established, meaning the brand has to be noticed and recognized by customers. Through marketing efforts and maintaining brand messaging, Subway has built strong brand awareness, especially of freshness and customization within its sandwich offerings.

Figure 6: The CBBE (customer-based brand equity) approach for Subway (source: Cinar,2020: Online)

5.1.1 Brand Meaning

Associations take place where the customer sees the brand as being associated with specific attributes, benefits, or values (Yazdanparast & Alhenawi, 2022, p. 86). Subway’s brand messaging, revolving around healthier food, customization, and freshness, resonates with the modern consumer who is always on the go but with an eye on maintaining a healthy lifestyle.

5.1.2 Brand Response

This level of response looks into how the consumers respond to the brand strictly based on perception and experience. Subway tries to seek a positive response with its brand promises of freshness, variety, and affordability (Ozdemir et al., 2020, p. 661). Perceptions can differ due to the quality-of-service differences, and intermittent negative publicity noticed at certain places.

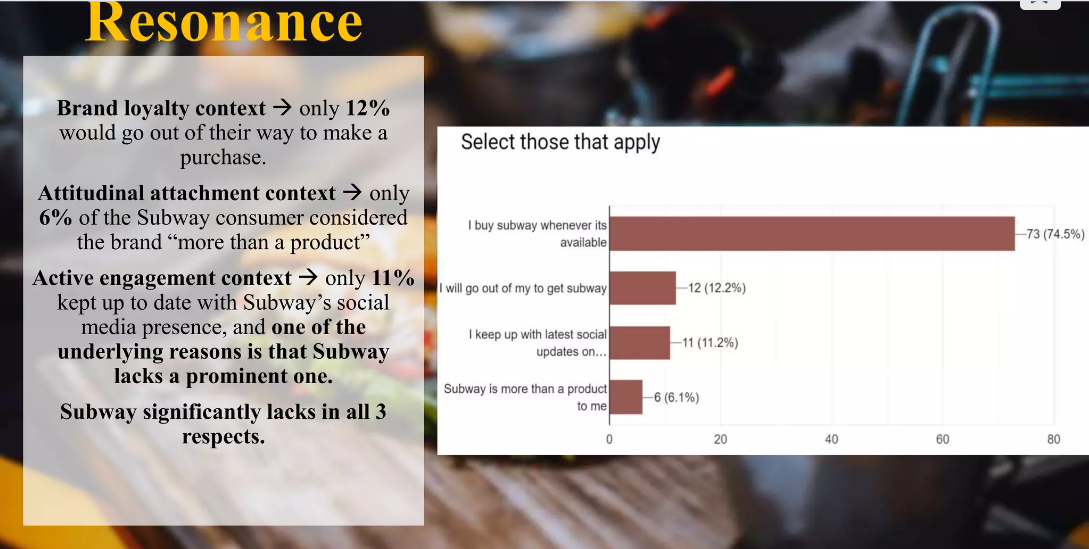

5.1.3 Brand Resonance

This is the highest level at which the brand reaches the customer and, therefore, emanates loyalty to the brand as a consumer who will buy the brand all their life, and they become brand evangelists (Oliveira et al., 2023, p. 456). Subway has built up a loyal customer base. Still, the desire to keep up the brand resonance is constant in such an environment through innovation, evolving consumer tastes, and enhancing customer involvement.

Figure 7: Resonance Illustration (source: Forest, 2021: online)

5.1.4 Critique

While the CBBE model provides a systematic framework through which to understand brand equity, the linear progression at times trivializes the multifaceted nature of the brand-customer relationships. The model overemphasizes the cognitive aspects of brand building, which can put the emotional and experiential dimensions of the brand and its consumer touchpoints at risk.

Significantly, such things as market trends, competitor activities, and sociocultural changes are not defined or highlighted in the model, but still, they affect brand equity to a large extent. The model applies differently in industries and settings of culture, and it has to be tailored for individual brands and markets (Surucu et al., 2019, p. 114). Overall, while the CBBE model does provide valuable insights for building and managing brand equity, its effectiveness can only be judged based on the extent to which it is adaptable to real-world situations and can be implemented in practice as part of broader marketing strategies.

5.2 Media Analysis and Technology

Media and technology have strategic roles in the marketing and operations at Subway. The usage of digital platforms provides excellent convenience to customers, allowing them to make orders, enjoy promotions of their choice, and even create room for Subway in customer communication. Social media enhances brand visibility and customer relations through interactions (Oliveira et al., 2023, p. 456). Operationally, technology ensures efficiency through the use of data analytics in inventory management systems and mobile payment solutions to guarantee frictionless operations on the retail front.

Figure 8: Subway’s Social media analytics (source: Atherton, 2023: online)

5.3 Position Map and SWOT Analysis

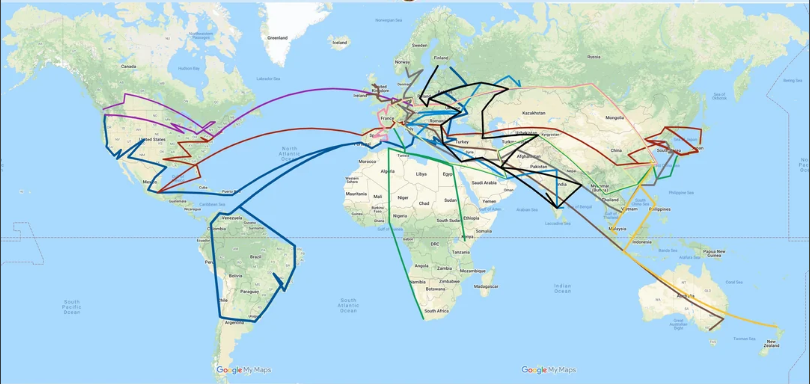

Figure 9: Subway Locations around the Globe (source: Kaneko, 2022: online)

Figure 10: Subway brand map positioning (source: Cinar, 2020: online)

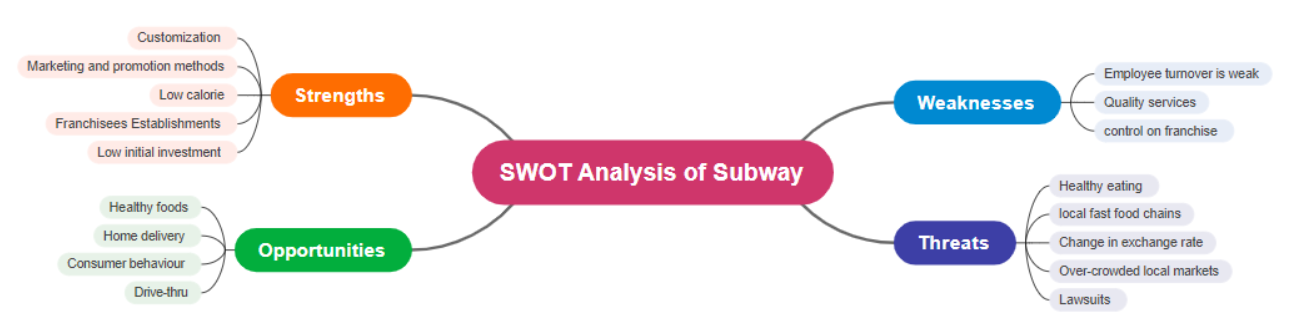

Figure 11: SWOT analysis for Subway (source: Alexander, 2023:online)

6.0 Important Distinctions between Brand Exploratory and Brand Inventory

6.1 Explanation of the Key Differences

6.1.1 Tangible vs. Intangible Elements

Where the brand inventory assesses the tangible elements of the brand, e.g., logos or products of the company, the brand exploratory studies the intangible issues related to consumer perceptions and attitudes.

6.1.2 Current State vs. Underlying Motivations

In the brand inventory, the current state of branding is studied, while in brand exploratory, the underlying motivations or moods showing consumer behaviour are elaborated.

6.1.3 Objective vs. Subjective Analysis

Brand inventory consists of an objective study of complex brand elements, whereas brand exploratory is subjective, studying the consumer’s opinion and feelings.

6.2 Customer Perception and Appeal

Brand inventory or brand exploratory has a lot of significance to the customer’s perception and the appeal that the brand carries (Oliveira et al., 2023, p. 456). Brand inventory ensures that each brand message and visual identity is uniform and impactful for the first impression. In contrast, brand exploration helps obtain a deeper insight into the perception or preference of consumers as a long-term effect on brand loyalty.

6.3 If Few/Little Differences are Found

In situations where the differences emerging between brand inventory and brand exploratory become minimal, there is no fit between tangible brand elements and consumer perceptions. In this situation, customer perceptions will only reflect part of the brand image of the intended brand, further explaining the necessity of undertaking a complete brand exploration to reveal the roots of factors that are affecting consumer behaviour. It additionally brings out reasons as to why there is a need to continuously maintain and adjust brand strategies for them to be in line with ever-changing consumer preferences and market trends.

7.0 leveraging of Subway

7.1 Proposal

Lejson came up with a menu plan to leverage the brand power of Subway, its brand equity, fresh, customizable menu range, and its commitment to new products in increasing its exposure and presence within the expanded partnership base—schools, health-focused organizations, and corporate wellness programs (Chakraborti, 2023, p. 1031). This will entail offering tailor-made, ready-sponsored meal solutions, promotions, and publicity needed to boost consumers’ awareness and reap a healthy return for the company.

7.2 Rationale

With the strengths of the brand and market positioning, it strategically aligns itself with health-conscious initiatives to stimulate brand relevance, extend market reach, and, at the same time, embody and strengthen the values of Subway towards healthier living and community involvement.

7.3 justification

Besides, the strategic alliance with health organizations and corporate wellness schemes shall help derive more value from its brand credibility and product flexibilities in meeting the changing lifestyle and preference of consumers to eat healthily. It serves as an effort to strengthen the image of the Subway brand and extend its market presence to newer customer demographics, reaching new customers while re-energizing the existing customer base with positioning towards well-being.

7.4 Tactical Considerations

Develop targeted marketing campaigns for Subway’s health offerings. Develop custom meal packages and events with the partner organization. Development of digital platforms for uninterrupted order and delivery (Chakraborti, 2023, p. 1031). Training of staff to bring freshness and customization Subway has to offer. Keep checking and suggesting changes as to how the strategies are required for the same to be in alignment with evolving consumer preferences and market trends.

8.0 Conclusion

Retaining relevance in the market, Subway is one of the major players in the fast-food chain. In order to emerge successfully amidst tough challenges thrown at them by competitors and to survive in the changing dynamics of the market, a strategic analysis of its core strengths would help Subway do so (Chakraborti, 2023, p. 1031). Additionally, the areas of focus could be innovation, customer-centric focus, and adaptation to newer trends, which could allow Subway not just to sustain but also to enhance market share and brand loyalty. However, success is premised on agility and ongoing reassessment of strategies to evolve with the ever-changing consumer demands. Only such critical introspection and proactive measures can truly help Subway position itself as a resilient and dynamic player in the fast-food landscape.

9.0 References

Adjoian, T., Dannefer, R. and Farley, S.M., 2019. The density of outdoor advertising of consumable products in NYC by neighbourhood poverty level. BMC Public Health, 19, pp.1-9.https://link.springer.com/article/10.1186/s12889-019-7821-y

Chakraborty, D., 2023. Purchase behaviour of consumers toward GSAs: A longitudinal assessment. Journal of Computer Information Systems, 63(5), pp.1031-1056.https://doi.org/10.1080/08874417.2022.2123065

Chen, K.J., Yeh, T.M., Pai, F.Y. and Chen, D.F., 2018. Integrating refined kano model and QFD for service quality improvement in healthy fast-food chain restaurants. International journal of environmental research and public health, 15(7), p.1310.https://www.mdpi.com/1660-4601/15/7/1310

Dandis, A.O., Wallace-Williams, D.M., Ni, A.K., Wright, L.T. and Abu Siam, Y.I., 2023. The effect of brand experiences and relational benefits on loyalty in fast-food restaurants. The TQM Journal, 35(7), pp.2028-2051.https://doi.org/10.1108/TQM-03-2022-0091

Foroudi, P., Jin, Z., Gupta, S., Foroudi, M.M., and Kitchen, P.J., 2018. Perceptional components of brand equity: Configuring the Symmetrical and Asymmetrical Paths to brand loyalty and brand purchase intention. Journal of Business Research, 89, pp.462-474.https://doi.org/10.1016/j.jbusres.2018.01.031

Harrington, R.J., Ottenbacher, M.C. and Fauser, S., 2017. QSR brand value: Marketing mix dimensions among McDonald’s, KFC, Burger King, Subway and Starbucks. International Journal of Contemporary Hospitality Management, 29(1), pp.551-570.https://doi.org/10.1108/IJCHM-06-2015-0300

Joe, M., Lee, S. and Ham, S., 2020. Which brand should be more nervous about nutritional information disclosure: McDonald’s or Subway? Appetite, 155, p.104805.https://doi.org/10.1016/j.appet.2020.104805

Kılıç, B., Bekar, A. and Yozukmaz, N., 2021. The new foodie generation: Gen Z. In Generation Z Marketing and Management in Tourism and Hospitality: The Future of the Industry (pp. 223-247). Cham: Springer International Publishing.https://link.springer.com/chapter/10.1007/978-3-030-70695-1_9

Ko, Z.K., MUHAIMIN, A., AKMAL, M.A. and DAHLAN, A.R.A., 2022. A CONCEPTUAL ICOOKIES MULTI-SIDED BUSINESS MODEL: BUILD-UP SKILLS, ENHANCE JOB OPPORTUNITIES & ENTREPRENEURSHIP FOR B40 COMMUNITY IN GLOBAL COOKIES BUSINESS. Journal of Information Systems and Digital Technologies, 4(1), pp.28-45.https://journals.iium.edu.my/kict/index.php/jisdt/article/view/297

Lu, C., Li, H. and Xu, T., 2020. Do profitability and authenticity co-exist? A model of sales promotion stereotype content and its perception differences among groups. Journal of Contemporary Marketing Science, 3(3), pp.333-363.https://doi.org/10.1108/JCMARS-08-2020-0033

Maggioni, I., Sands, S.J., Ferraro, C.R., Pallant, J.I., Pallant, J.L., Shedd, L. and Tojib, D., 2020. Consumer cross-channel behaviour: is it always planned? International Journal of Retail & Distribution Management, 48(12), pp.1357-1375.https://doi.org/10.1108/IJRDM-03-2020-0103

Mary, E.U., Kong, T.I.W. and Wan, Y.K.P., 2020. Senior travellers to integrated resorts: Preferences, consuming behaviours and barriers. Journal of Quality Assurance in Hospitality & Tourism, 21(3), pp.297-319.https://doi.org/10.1080/1528008X.2019.1659209

Milks, A., Lehmann, J., Leder, D., Sietz, M., Koddenberg, T., Böhner, U., Wachtendorf, V. and Terberger, T., 2023. A double-pointed wooden throwing stick from Schöningen, Germany: Results and new insights from a multi-analytical study. PloS one, 18(7), p.e0287719.https://doi.org/10.1371/journal.pone.0287719

Oliveira, M.O.R.D., Heldt, R., Silveira, C.S. and Luce, F.B., 2023. Brand equity chain and brand equity measurement approaches. Marketing Intelligence & Planning, 41(4), pp.442-456.https://doi.org/10.1108/MIP-06-2022-0222

Ozdemir, S., Gupta, S., Foroudi, P., Wright, L.T. and Eng, T.Y., 2020. Corporate branding and value creation for initiating and managing relationships in B2B markets. Qualitative Market Research: An International Journal, 23(4), pp.627-661.https://doi.org/10.1108/QMR-12-2017-0168

Su, N. and Reynolds, D., 2017. Effects of brand personality dimensions on consumers’ perceived self-image congruity and functional congruity with hotel brands. International Journal of Hospitality Management, 66, pp.1-12.https://doi.org/10.1016/j.ijhm.2017.06.006

Sürücü, Ö., Öztürk, Y., Okumus, F. and Bilgihan, A., 2019. Brand awareness, image, physical quality, and employee behaviour as building blocks of customer-based brand equity: Consequences in the hotel context. Journal of Hospitality and Tourism Management, 40, pp.114-124.https://doi.org/10.1016/j.jhtm.2019.07.002

Tregidga, H., Kearins, K. and Collins, E., 2018. Kapai New Zealand: Eat Your Greens! 1. In Case Studies in Social Entrepreneurship and Sustainability (pp. 89-109). Routledge.https://www.taylorfrancis.com/chapters/edit/10.4324/9781351278560-9/kapai-new-zealand-helen-tregidga-kate-kearins-eva-collins

Yazdanparast, A. and Alhenawi, Y., 2022. Impact of COVID‐19 pandemic on household financial decisions: A consumer vulnerability perspective. Journal of Consumer Behaviour, 21(4), pp.806-827.https://doi.org/10.1002/cb.2038

write

write