Executive Summary

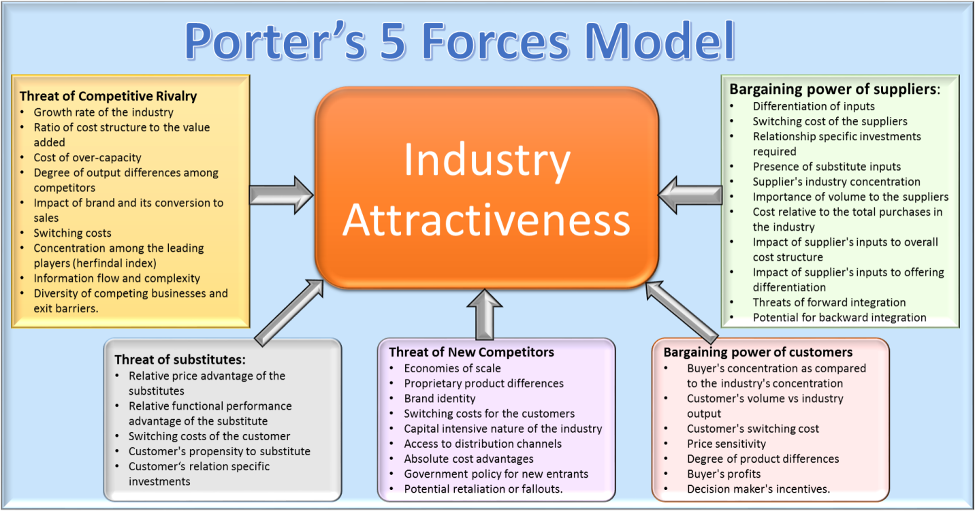

Michael Porter’s famous “Five Forces” paradigm is used in this consultant’s report to analyze the e-commerce sector thoroughly. The principal objective is to investigate the external and internal variables that impact the e-commerce industry’s competitive landscape. Research focuses on the market strength of suppliers and customers, potential new entrants, internal competition, complements and replacements, and other vital information to help educate strategic decision-making in the industry. Internal competition in the e-commerce sector is examined by closely examining factors, including switching costs, product differentiation, and competitiveness levels. The importance of information asymmetry, product differentiation, and price strategies are topics covered in this analysis of ways to stay profitable in the rapidly evolving e-commerce landscape. Potential players in the e-commerce space are analyzed regarding entry barriers, costs, and factors such as regulatory restrictions and economies of scale. The study intends to assist established companies in solidifying their market position by providing a thorough understanding of the opportunities and difficulties posed by new competitors. Government regulations, relationship-specific investments, supplier concentration, and other factors are considered when assessing the power dynamics between suppliers and e-commerce companies. The inquiry shed important light on the effects of input market uniformity and the industry’s susceptibility to supplier negotiating power. Examined is the effect of consumers on the e-commerce industry’s competitiveness, accounting for variables such as buyer concentration, switching costs, and regulatory environment. The study examines scenarios where buyer power is raised or lowered and offers businesses tactical solutions to customer-centric problems.

Introduction

E-commerce has evolved into a revolutionary force altering the traditional borders of trade and commerce due to the continuous flow of new technologies and improved global connectivity (Alcabes, 2021). Examined via the prism of Michael Porter’s ground-breaking “five forces” theory, this introduction offers a synopsis of the importance of e-commerce, the aim of this study, and its enormous influence on the contemporary business environment.

The E-Commerce Phenomenon

E-commerce, a driving force behind the digital age, has transcended time zones and geographic constraints to completely change how businesses engage with their clientele and transact business globally. E-commerce has evolved from a cutting-edge experiment to a ubiquitous phenomenon in a wide range of enterprises, from services to retail, thanks to the growth of the internet, safe online payment methods, and more effective transportation (Vargas-Hernández & Rosas, 2019). Because of the ease of use and accessibility offered by online platforms, businesses of all sizes may now more readily reach a global audience. These platforms have democratized market access for everyone, from small business owners to retail giants.

Significance in the Business Landscape

The e-commerce industry’s wide-ranging effects on traditional business models highlight its enormous relevance. The customer experience has been entirely transformed by e-commerce, which provides unmatched ease through personalized recommendations, hassle-free purchases, and 24/7 accessibility (Lin & Chollathanratanapong, 2022). Individuals now have more influence thanks to this change in consumer behaviour, which has also made it necessary for businesses to adjust their strategy to match changing expectations.

Furthermore, the e-commerce landscape has catalyzed the dismantling of physical trade barriers. The constraints of physical locations no longer constrain businesses; instead, they may move quickly around the global economy, reaching out to new markets and reacting to trends as they arise (Alcabes, 2021). As the e-commerce sector develops into a driver of economic growth and job creation, the globalization of commerce impacts economies and enterprises.

Furthermore, the sector has developed into a hotbed of innovation, with the development of e-commerce platforms being shaped by technology breakthroughs. Supply chain efficiency is improved through optimized user experiences and personalized marketing strategies through artificial intelligence, machine learning, and data analytics (Vargas-Hernández & Rosas, 2019). Because of this, the e-commerce sector acts as a testing ground for technical advancement, driving its development and more general trends in digital transformation.

Purpose of the Report

In order to examine the intricacies of the e-commerce industry, this article will employ Michael Porter’s renowned “five forces” paradigm. As they manage this shifting environment, businesses must understand the elements driving industry profitability (Lin & Chollathanratanapong, 2022). The foundation of strategic management is the organized process Porter’s framework offers for assessing competitive dynamics and creating strategic solutions.

Relevance of Porter’s Framework

Because the e-commerce sector has distinct features and difficulties, implementing Porter’s framework is especially pertinent. Supplier power, buyer power, industry rivalry, entry, replacements and complements, and supplier power are the “five forces” that provide a thorough understanding of the competitive dynamics within the e-commerce ecosystem (Vargas-Hernández & Rosas, 2019). By utilizing this framework, interested parties can identify possible threats, determine factors that affect profitability, and create plans of action that will help them effectively navigate this competitive landscape.

Internal Rivalry within the Industry

1.1 Entry

The e-commerce business is a bustling marketplace driven by digital transactions, and the ease of entry for new players is influenced by a complex interplay of conditions (Alcabes, 2021). It is necessary to comprehend these dynamics to navigate the competitive environment typified by internal rivalry within the industry.

Entry Costs: Financial obstacles are associated with breaking into the e-commerce market. Although the company operates entirely digitally, there is still a requirement for substantial financial outlays for technology platforms, website creation, cybersecurity precautions, and marketing initiatives. A significant upfront financial commitment is required to compete with existing competitors and build a strong web presence (Lin & Chollathanratanapong, 2022). High entry barriers prevent prospective competitors from entering the market, protecting established firms from quick encroachment.

Speed of Adjustment: The speed at which new entrants can adjust to the dynamics of the e-commerce industry is a critical factor. Agility is required due to the rapid speed of technical improvements and shifting consumer tastes. Businesses that can quickly adapt to market changes, technology, and customer expectations will have a competitive advantage (Vargas-Hernández & Rosas, 2019). However, the learning curve can be high for newcomers, making it difficult to adjust and compete successfully swiftly.

Sunk Costs: An essential factor in determining an industry’s direction is the amount of money invested that cannot be recouped if a company decides to leave the market. Significant sunk costs are seen in e-commerce in areas like branding, client acquisition, and technology infrastructure (Alcabes, 2021). Since they have already incurred these expenses, established players have a competitive edge over prospective newcomers, who risk suffering substantial financial losses if their business endeavours fail.

Economies of Scale: Economies of scale constitute a formidable barrier to entry in the e-commerce sector. Big, well-established companies profit from low costs related to large purchases, effective logistics, and extensive client bases (Inkinen, 2022). It is difficult for smaller competitors to match their larger rivals’ cost efficiency, making it difficult for them to compete on price and sustain early operating losses.

Network Effects: In the e-commerce sector, network effects—the idea that a product or service’s value rises with its user base—are significant. Well-established platforms benefit from large user populations, attracting more users in a positive feedback loop. The difficulty of persuading users to move platforms, on the other hand, increases exponentially with the scale of current networks and is a significant obstacle for new entrants. (Hånell et al., 2020). The established players’ competitive edge is increased as a result.

Reputation: In the e-commerce industry, reputation is a precious currency. An obvious advantage belongs to well-known brands that have a track record of dependable customer support, safe online transactions, and satisfying client experiences. Creating and developing a reputation is difficult for newcomers and takes time, consistency, and frequently large marketing expenditures.

Switching Costs: For users, switching costs are the expenses associated with transferring from one platform to another, including travel time, effort, and money. High switching costs are produced by well-established e-commerce platforms’ loyalty programs, individualized services, and seamless user interfaces (Lin & Chollathanratanapong, 2022). This further solidifies the dominance of current players and presents a severe hurdle for new entrants hoping to draw users away from well-established platforms.

Government Restraints: Rules and policies from the government can help or hurt anyone who wants to enter the e-commerce industry. Regulations about taxation, consumer rights, and data protection can significantly impact how easy new competitors are to enter the market (Sarkar, 2022). After adapting to current regulations, established players can change or even influence regulatory frameworks to benefit them, strengthening their market positions.

Effect on Entry Ease: These variables produce a complex environment that affects how simple it is to enter the e-commerce sector. Although the industry’s distinct dynamics present new obstacles, the digital aspect of the business also lowers specific old barriers. New entrants face significant obstacles due to established players’ utilization of economies of scale, network effects, and well-established reputations (Alcabes, 2021). It is crucial for prospective entrants to properly plan and innovate in order to get a foothold in this competitive market because of the high entry costs, challenging learning curve, and government rules that further tip the scales in favour of incumbents.

1.2 Industry Rivalry

The dynamic and technologically advanced e-commerce sector is a hive of rivalry as businesses compete for customers’ attention and market share (Wang, 2019). Analyzing different aspects of industry competition reveals the complex processes that form this fiercely competitive arena.

Concentration: The degree of concentration within the e-commerce industry is a significant factor influencing the rivalry level in that sector. Despite the large number of players in this digital domain, there is a discernible concentration among a few leading platforms; industry heavyweights like Amazon, Alibaba, and eBay command significant market share because of their vast user bases and economies of scale (Hånell et al., 2020). Consolidating dominance among the top companies heightens competition, giving rise to tactical battles for market domination, creativity, and customer acquisition.

Competition in Price, Quantity, Quality, or Service: The e-commerce landscape is complicated, with rivals fighting for clients based on the quantity, calibre, and services they provide. Price wars are not unusual as platforms vie to entice frugal users with exclusive deals and promotions. However, the market is expanding to encompass a broader range of goods, ensuring a diverse assortment to accommodate consumer preferences (Vargas-Hernández & Rosas, 2019). Superior customer service and quality control are becoming critical differentiators as platforms compete on products and customer experience.

Degree of Differentiation: From a strategic perspective, standing out in the e-commerce sector is essential. Platforms’ ability to differentiate themselves from competitors impacts market share and consumer loyalty. Differentiation strategies include user interface, product uniqueness, customized counsel, and customer service (Hånell et al., 2020). Being more distinctive and appealing increases a platform’s likelihood of attracting and retaining a loyal customer base and reduces its vulnerability to price-driven competition.

Switching Costs: The presence and magnitude of switching costs significantly influence industry rivalry. E-commerce firms deliberately employ exclusive memberships, loyalty schemes, and user-friendly interfaces to increase the cost of switching customers. As the costs associated with moving to a competing platform increase, customer retention becomes an increasingly important aspect of competition (Sarkar, 2022). High switching costs act as a barrier, strengthening the competitive position of established players.

Timing of Decisions: The competitive surroundings can be swayed by the timing of planned results. E-commerce companies must react quickly to changing consumer tastes and rapid technical improvements. Innovations like voice-activated commerce, augmented reality shopping, and one-day shipping have become competitive arenas where platforms compete to outperform one another (Vargas-Hernández & Rosas, 2019). The degree of competition and market leadership are influenced by one’s capacity for quick decision-making and trend-spotting.

Information: In the e-commerce sector, information is a crucial asset. Having the capacity to evaluate client information, forecast patterns, and customize interactions gives an edge over competitors. Platforms can customize marketing campaigns, improve user experiences, and maximize supply chain effectiveness through data-driven decision-making (Wang, 2019). The proper use of information affects rivalry dynamics by influencing customer satisfaction and the success of focused advertising and promotional initiatives.

Government Restraints: Laws and policies imposed by the government have the power to both curb and influence industrial rivalry. Taxation, antitrust, and data privacy regulations all impact how competitively e-commerce platforms operate. The goals of government action can be to protect consumer rights, avoid monopolistic tactics, or guarantee fair competition (Sarkar, 2022). The regulatory landscape can create barriers or level the playing field, affecting how e-commerce companies formulate their plans.

Assessment of Rivalry Intensity and Implications for Profitability: There is no denying the fierce competition in the e-commerce sector, which is fuelled by elements like consolidation, price tactics, efforts to stand out from the competition, and the tactical application of information (Hånell et al., 2020). The stakes are raised by consolidation among significant firms, but a complex battlefield is created by competition in price, quality, service, and differentiation.

There are complex ramifications for industry profitability. On the one hand, fierce competition may result in margin erosion and price wars, potentially harming profits in the near run. However, it also encourages innovation, service improvements, and quality improvement, which can lead to enduring prosperity and long-term client loyalty. E-commerce platforms need to negotiate this competitive environment strategically. To stand out, differentiation, innovation, and customer-centric strategies become essential (Mu, 2021). Although competition might present difficulties, it also encourages market participants to continuously develop, adjust, and expand their offers, which eventually helps customers by resulting in better goods and services.

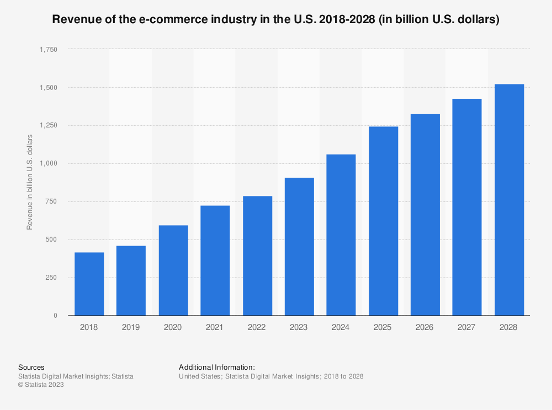

Revenue of the e-commerce industry in the U.S. 2018-2028(in billion U.S. dollars)

Potential Entrants into the Industry

The e-commerce sector is a dynamic and quickly changing field that draws in a wide range of prospective newcomers who want to take advantage of the enormous potential of the online market (Kulkarni, 2019). However, as Michael Porter’s seminal “five forces” concept outlines, there are obstacles to entry into this dynamic ecosystem. To evaluate the severe hurdles that impact the danger of new entrants, one must comprehend the interplay of elements, including economies of scale, sunk costs, and government regulations. Potential players in the e-commerce space include a wide range of entities, from enterprising start-ups with specialized products to well-established brick-and-mortar businesses looking to expand their online revenue sources (Wang, 2019). An extensive range of firms find the market appealing because of its global reach, accessibility, and potential for revenue.

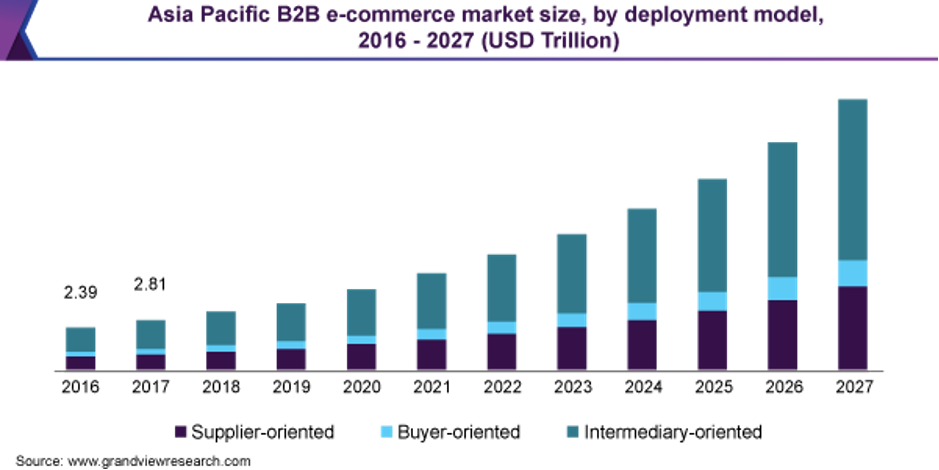

Asia Pacific B2B e-commerce market size

One significant obstacle to participation in the e-commerce sector is sunk costs. Building a solid online presence is necessary to make significant upfront investments in digital marketing, website development, and technical infrastructure. Potential entrants are discouraged by these sunk expenses, which create a financial commitment that carries a high risk (Inkinen, 2022). Because they have previously paid for these expenses, incumbents have a competitive advantage and can use their operational and financial might to continue dominating the market.

Economies of scale make matters much more difficult for prospective newcomers. Well-established e-commerce behemoths use their vast reach to cut costs in marketing, bulk purchasing, and effective logistics. Due to economies of scale, incumbents can provide more excellent services, various products, and competitive prices (Alcabes, 2021). It becomes difficult for new participants to accomplish comparable scale, making it challenging to match the cost-efficiencies of recognized firms.

The impact of government rules is a critical factor that influences the threat posed by new rivals in the e-commerce business. Regulatory frameworks about data protection, e-commerce taxation, and consumer rights bring about complicated regulations and high compliance costs. Governments have the authority to build entry barriers to protect consumers and uphold fair competition. This may entail adhering to licensing requirements, stringent data privacy policies, and consumer protection laws (Wang, 2019). The challenges newcomers face are compounded by the fact that navigating these regulatory environments requires additional resources and legal knowledge.

Collectively, these factors influence the potential for new entrants and shape the competitive environment in the e-commerce industry. Besides the most dedicated and well-funded newcomers, government regulations, economies of scale, and sunk costs provide significant barriers (Kusnindar et al., 2023). Even if the sector is now digital, some of the previous constraints are still there. However, the cost of other things like technological investments, customer acquisition, and brand building has increased.

Potential entrants must carefully consider their strategies to overcome the obstacles the e-commerce landscape presents. Unique value propositions, creative company strategies, and focused niche markets are necessary to set oneself apart from the competitors (Vargas-Hernández & Rosas, 2019). Entry barriers restrict the number of possible entrants who can effectively navigate the sector’s complexities, heightening the need to differentiate oneself from rivals.

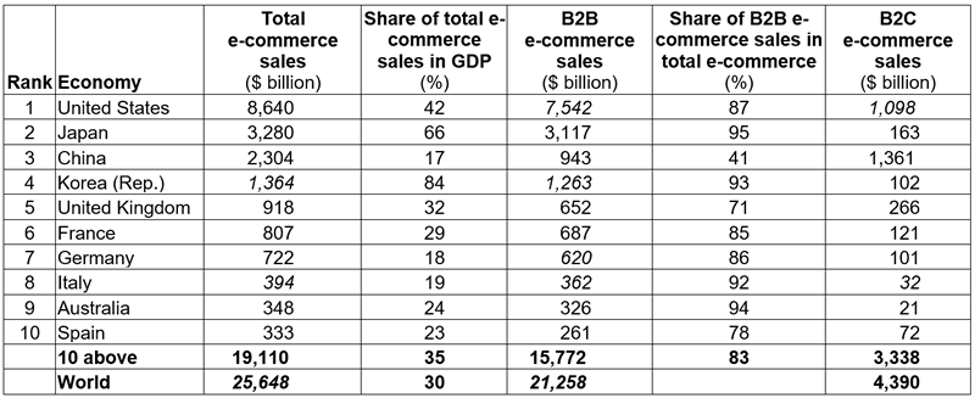

As the e-commerce industry grows, the entrance barriers identified by Michael Porter’s “five forces” idea will continue to shape the competitive environment. According to Hånell et al. (2020), economies of scale and sunk costs contribute to the power concentration among established enterprises, which determines the industry’s competitive structure. Furthermore, even if regulations are necessary to ensure moral behaviour and protect consumers, they also erect additional obstacles for new entrants. Global e-commerce hits $25.6 trillion – latest UNCTAD estimates

Suppliers’ Market Power

Because of their degree of power that has a substantial impact on market dynamics, suppliers play a critical role in the intricate dynamics of the e-commerce company (Wang, 2019). To evaluate the influence of suppliers in this scenario, a detailed examination is required, considering factors such as supplier concentration, substitute inputs, relationship-specific investments, switching expenses, and regulatory constraints.

One of the critical factors influencing supplier power in the e-commerce industry is supplier concentration. The degree to which numerous suppliers dominate the market can significantly influence their bargaining power. Situations where a limited number of suppliers control a significant market share and can thus control parameters like pricing and contract conditions can lead to higher supplier power (Mu, 2021). Conversely, a competitive and varied supplier environment may lessen the influence of particular suppliers, giving e-commerce platforms the ability to negotiate better terms.

Accessibility to alternative inputs is another factor that affects supplier power. In the e-commerce industry, where various goods and services are offered, multiple suppliers for comparable or interchangeable inputs might act as a check on supplier power (Kulkarni, 2019). If the terms with a particular provider become unfavourable, e-commerce platforms can switch to another supplier, reducing supplier power’s impact on their operations.

Relationship-specific investments further impact the supplier power dynamics in the e-commerce industry. When e-commerce platforms invest in one source, like installing proprietary technology or relying on a specific set of services, they may become relatively dependent on that source (Hånell et al., 2020). An issue for e-commerce platforms trying to grow their supplier network is that suppliers that own essential parts or technologies required for the platform’s operation may leverage this reliance to bolster their bargaining position.

It is imperative to consider switching costs while assessing a supplier’s electricity. If e-commerce sites incur significant costs to transfer providers, they may be compelled to remain in a relationship even if the terms are harsher. Suppliers could benefit from this and get more control over the terms and cost of the contract (Kusnindar et al., 2023). However, if switching costs are low, e-commerce platforms can look into other suppliers more efficiently, reducing any supplier’s power.

Government restrictions also influence supplier power in the e-commerce industry. The strength or weakness of supplier dominance can be influenced by regulations governing pricing, competition, and supplier behaviour. In regions where governments impose strict rules on supplier behaviour, ensuring fair competition and protecting the interests of e-commerce platforms, supplier influence may be curtailed (Kulkarni, 2019). On the other hand, in environments with lax regulations, suppliers can have more freedom to manage e-commerce platforms.

Supplier power in the e-commerce industry has a complicated impact on industry earnings. Strong supplier power, characterized by highly concentrated supplier marketplaces, few substitute inputs, relationship-specific investments, and high switching costs, may pressure on the profit margins of e-commerce platforms (Inkinen, 2022). Powerful suppliers may demand more excellent prices for their products or services, which would reduce the profitability of e-commerce companies.

Furthermore, since e-commerce platforms heavily rely on specific suppliers, the prospect of growing costs or supply chain disruptions poses a direct danger to profitability (Hånell et al., 2020). Relationship-specific investments may exacerbate this susceptibility, as it may be difficult for platforms to transfer providers without incurring significant losses.

Conversely, e-commerce platforms exhibit greater bargaining flexibility where supplier power is diminished, as may be the case with a diverse supplier base, readily available substitutes, and inexpensive switching costs. This may lead to favourable terms for pricing, enhanced supply chain resilience, and higher profitability (Sarkar, 2022). E-commerce sites and the industry’s profitability are benefited by government regulations that support free competition and forbid monopolistic behaviour. These regulations also contribute to the creation of a more fair power dynamic.

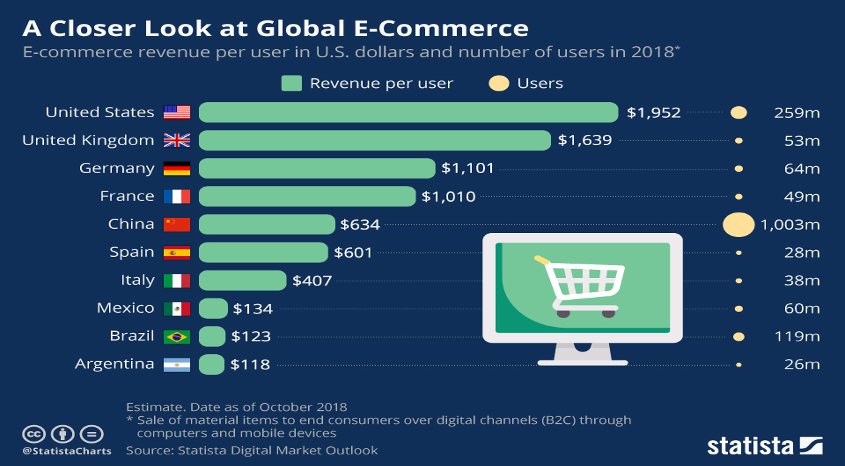

A Closer Look at Global E-Commerce

Buyers’ Market Power

Consumer purchasing power is a critical factor in defining the competitive dynamics of the dynamic e-commerce market. To ascertain the purchasing power of consumers, a thorough examination of several factors is required, such as buyer concentration, replacement availability, relationship-specific investments, customer switching costs, and regulatory restraints (Danemo, 2018). Knowing buyer power is crucial to comprehending industry dynamics and how they impact profitability.

Buyer Concentration: In the e-commerce area, purchasers’ concentration significantly influences their collective bargaining power. When a few consumers control a large portion of the market, they can significantly impact e-commerce sites. The profitability of e-commerce businesses is put under increased strain when these powerful purchasers negotiate better terms, such as price, delivery dates, and extra services (Sarkar, 2022). On the other hand, a broad and dispersed customer base reduces the influence of lone purchasers and gives e-commerce platforms greater leeway in determining conditions.

Substitutes: One important factor influencing buyer power is the presence of alternatives. Given the size and diversity of the e-commerce market, consumers frequently have a wide range of options for comparable goods and services. Customers’ negotiating leverage is increased by how simple it is to move across platforms or replace one product with another (Alcabes, 2021). In order to draw and keep customers, e-commerce platforms must compete not just on price but also on attributes like product quality, variety, and user experience.

Relationship-Specific Investments: Both e-commerce platforms and buyers impact buyer power through relationship-specific investments. These investments bring a degree of interdependence, including exclusive alliances, loyalty plans, and customized services. E-commerce platforms focusing on customer relationship management seek to maintain customer loyalty and reduce the likelihood of customers defecting to rival businesses (Kusnindar et al., 2023). Buyers may, however, commit to particular platforms by mastering the user interface or signing up for loyalty schemes, which could raise the cost of moving.

Customer Switching Costs: One of the most critical factors in calculating buyer power is the price customers must pay to switch from one e-commerce platform to another. Exorbitant switching costs reduce buyer power because they require more time, effort, or money. Customers are more likely to continue with a well-known platform even when there are few pricing variations because they believe switching to a new provider will be difficult (Wang, 2019). On the other hand, minimal switching costs enable consumers to consider other options freely, improving their capacity to bargain with e-commerce platforms.

Government Restraints: Government laws and policies can raise or lower customers’ purchasing power in the e-commerce industry. Regulations about pricing methods, consumer rights, and data security may impact buyers’ ability to influence e-commerce platforms. In places where there are stringent regulations aimed at protecting consumers and fostering fair competition, customers might have more influence (Wang, 2019). Loose regulations, however, would provide e-commerce platforms more freedom to define words, weakening customers’ influence.

Impact of Buyer Power on Industry Profitability: Buyer power significantly impacts industry profitability in e-commerce. Because it is characterized by concentrated buyer markets, easily accessible alternatives, and low switching costs, high buyer power can exert downward pressure on e-commerce platform prices and profit margins (Hånell et al., 2020). Customers may search for better deals, cheaper pricing, and better services due to their plethora of options and ease of switching platforms, which would decrease the profitability of e-commerce companies.

Buyer power also affects matters unrelated to talks about prices. E-commerce platforms are driven to enhance their products through expedited delivery, personalized experiences, and superior customer service (Inkinen, 2022). While these investments increase customer satisfaction, they also impact operating expenses, which could affect profitability.

In contrast, in a situation where buyer power is reduced—for example, because of a fragmented client base, few replacements, and high switching costs—e-commerce platforms have greater control over price and operating terms (Jinbo, 2022). This can lead to steady profit margins and prudent investments that enhance long-term profitability.

The link between consumer power and industry profitability in the e-commerce sector is finely balanced. Although strong buyer power can promote innovation, competitiveness, and quality improvements, it can also make maintaining sustainable profit margins more difficult (Mu, 2021). E-commerce platforms must continually adapt to shifting consumer preferences, invest strategically in customer relationships, and search for non-price strategies to differentiate themselves from the competition if they hope to thrive in this dynamic industry.

Substitutes and Complements

The competitive dynamics that impact customer decisions, market strategies, and industry structure are determined by the presence and impact of substitutes and complements in the dynamic e-commerce landscape (Hånell et al., 2020). The intricate relationships that define the e-commerce ecosystem become clear upon closely examining these elements, which consider network effects, governmental regulations, and the price/benefit of complementary and replacement goods and services. Substitutes and Complements

Presence and Impact of Substitutes

Substitutes in e-commerce are products or services that meet a similar need or purpose. Customers have a wide range of options due to the extent of the digital market, making alternatives well-known and easily accessible (Alcabes, 2021). Things like their cost and worth determine the influence of surrogate goods and services on e-commerce enterprises.

The price/value dynamic of replacements is critical for e-commerce systems. If rivals offer a similar or better value proposition at a more enticing price, customers can shop elsewhere. E-commerce businesses must strategically prioritize cost, quality, and the whole customer experience to attract and retain customers. Their antagonism is heightened by this circumstance (Chandra & Kumar, 2018). The frequency of replacements emphasizes the value of uniqueness, branding, and client loyalty as tactics to resist the allure of competing goods and services.

The range of e-commerce offerings emphasizes the significance of substitutes even more. When purchasing electronics, consumers may compare options based on brand loyalty, price, or product features (Danemo, 2018). E-commerce platforms must constantly assess and tweak their offerings to cater to consumer tastes to remain competitive despite many other options.

Presence and Impact of Complements:

Complements are products or services that enhance or supplement one another in the e-commerce industry, creating beneficial customer synergy. By finding and advertising relevant products and services, e-commerce platforms can expand their offerings, boost customer satisfaction, and create a more robust ecosystem (Kusnindar et al., 2023). By analyzing the price and value of complimentary goods and services, one can learn more about the impact of compliments on the e-commerce industry.

E-commerce platforms strategically consider the cost and value of complementary goods and services to create a seamless and integrated consumer experience. For instance, a platform selling smartphones might consciously collaborate with software, add-ons, or subscription service suppliers. Customers’ value proposition is improved when they can easily find and purchase relevant goods or services on the same platform (Kulkarni, 2019). E-commerce platforms benefit from this connection by increasing income streams and customer happiness.

In the e-commerce industry, network effects play a significant role in determining the presence and importance of compliments. People’s interactions with related commodities and services increase the value of the ecosystem. When consumers embrace these applications, an e-commerce platform that offers a variety of complimentary applications, for example, may create a network effect that adds value to the ecosystem overall (Mu, 2021). Because of this interdependence, the platform is more appealing to consumers and maintains its competitive edge.

Government regulations may impact the impact and presence of alternatives and complements in the e-commerce industry. Regulations may affect e-commerce platforms’ capacity to cooperate or link to particular supplemental services or products (Jinbo, 2022). On the other hand, regulations designed to foster competition may keep some complements or substitutes from controlling the market, giving various industry players a more fair playing field.

Impact on Industry Structure and Profitability

The presence and impact of alternatives and complements significantly impact the structure and profitability of the e-commerce business. E-commerce platforms are pressured to differentiate themselves, enhance their pricing strategies, and invest in client retention due to heightened competition from the proliferation of alternative offerings (Kusnindar et al., 2023). Fierce competition may compress profit margins, but innovation, product diversification, and improved customer experiences are also encouraged.

On the other hand, it complements work to build an ecosystem where users benefit from more than just single transactions. Customers who shop on e-commerce platforms that strategically use complements get a more integrated and engaging experience (Chandra & Kumar, 2018). This increases customer retention and provides opportunities for upselling and cross-selling, which increases revenue and profitability.

Network effects created by complementary goods or services are how dominant businesses in the e-commerce industry are built. Platforms can create a positive feedback loop that attracts more users and improves their standing in the market by skilfully integrating and marketing related goods (Kulkarni, 2019). Although domination by leading platforms could have advantages, it could raise concerns about market concentration and potential antitrust difficulties.

Recommendations

Key Findings

Michael Porter’s “five forces” approach has been used to analyze the e-commerce industry and provide essential insights into its profitability dynamics. The intricate dynamics influencing industry structure have been clarified by examining the relationships between entry barriers, buyer power, supplier power, alternatives, and complements (Hånell et al., 2020). Among the key findings are the importance of economies of scale, the impact of buyer power on costs and customer satisfaction, the role of substitutes in promoting competition, and the capacity of complements to create valuable ecosystems.

Strategic Recommendations

Embrace Digital Innovation: To thrive in e-commerce, industry players should prioritize digital innovation. Modern technology may speed up processes, increase personalization, and enhance the shopping experience for customers. These technologies include artificial intelligence, machine learning, and augmented reality (Inkinen, 2022). Platforms will gain a competitive edge from innovative technologies, attracting and retaining tech-savvy customers.

Diversify Product and Service Offerings: Online retailers should look for ways to increase the variety of goods and services they provide. The analysis emphasizes how crucial differentiation is in a market of options (Islami et al., 2018). Platforms that offer a wide variety of items cultivate partnerships with various suppliers and curate unique and exclusive offerings that can appeal to a more extensive customer base and lessen the impact of direct replacements.

Strengthen Customer Loyalty Programs: With the growing impact of buyer power, business players ought to concentrate on enhancing customer loyalty programs. Personalized rewards, exclusive offers, and easy-to-use loyalty programs can all help retain customers (Chandra & Kumar, 2018). Prioritizing client loyalty on a platform not only ensures a loyal customer base but also puts obstacles in the way of competitors by raising the cost of customer switching.

Encourage Strategic Supplier Relationships: E-commerce platforms should strategically manage supplier relationships in light of suppliers’ power. Long-term contracts, cooperative collaborations, and advantageous arrangements can reduce the risks related to supplier power (Danemo, 2018). Platforms that emphasize innovation, fair business practices, and transparency will suppllikelyably negotiate better terms, boosting profitability.

Promote Complementary Ecosystems: Industry participants should aggressively encourage complementary ecosystems within their platforms, building on the analysis of complements and alternatives. Encouraging a network effect by smoothly integrating complementary products and services can improve the value proposition (Mu, 2021). Platforms that enable complementary solutions to work together more effectively can improve user engagement and customer satisfaction.

Areas for Collaboration

Cross-Platform Collaborations: E-commerce platforms should look into possibilities for collaborating across platforms. Innovative ideas, increased customer reach, and shared resources can result from collaborative initiatives (Kusnindar et al., 2023). Platforms can benefit from synergies created by strategic alliances, especially in areas like logistics, technical infrastructure, and customer data exchange (as long as they stay within ethical and legal bounds).

Supplier and Platform Collaboration: Cooperative efforts between suppliers and e-commerce platforms can generate profitable partnerships. The influence of strategic alliances can be increased through joint ventures, co-branding opportunities, and cooperative marketing initiatives (Kulkarni, 2019). Platforms may have an advantage over competitors in obtaining innovative products, negotiating advantageous terms, and raising consumer satisfaction levels when collaborating with suppliers.

Competitive Differentiation

Emphasis on Sustainable operations: By prioritizing moral and environmentally friendly business operations, e-commerce platforms can differentiate themselves. Customers who value social responsibility may be drawn to businesses that adopt eco-friendly policies, encourage ethical work practices, and publicly disclose their efforts (Chandra & Kumar, 2018). This uniqueness attracts a more significant market share and long-lasting brand loyalty.

Invest in Customer Education: Platforms that sponsor customer education initiatives differentiate themselves by providing users with helpful information and guidance. Users can build trust and credibility on platforms by accessing content that informs them about product features, benefits, and applications (Jinbo, 2022). This tactic enhances the whole customer experience by fostering brand loyalty and affiliation.

Conclusion

Finally, applying Michael Porter’s “five forces” paradigm to the e-commerce industry analysis has produced a thorough understanding of the intricate dynamics affecting its landscape (Jinbo, 2022). These pressures, which also offer opportunities, substantially impact the sector’s sustainability and profitability. These forces include complements, substitutes, buyer power, supplier power, and entry barriers. Due to significant entry barriers, such as economies of scale and network effects, established firms must respond tactically. E-commerce platforms must prioritize innovation, create distinctive brand identities, and foster cooperative partnerships to sustain a strong market presence and long-term profitability (Inkinen, 2022). These pre-emptive measures serve as a deterrent to potential new entrants, thereby supporting a strong industry structure.

Supplier power is a significant aspect that influences operational effectiveness and input costs. To lower associated risks, e-commerce platforms should invest in transparent, cooperative, and ethical supplier relationships (Islami et al., 2018). By doing this, they may negotiate favourable terms, ensuring a robust and cost-effective supply chain—essential to boosting overall resilience and profitability. Due to the enormous influence of buyer power, paradigm shifts in favour of customer-centric strategies are necessary. In order to build and maintain customer loyalty, personalized interactions, loyalty programs, and distinctive products become crucial elements, which in turn helps reduce the impact of buyer power on pricing (Hånell et al., 2020). Additionally, investments in customer education and the creation of interconnected ecosystems, which aid in customer retention, support long-term profitability.

The abundance of complements and alternatives highlights the need for distinction and strategic partnerships. E-commerce platforms must embrace innovation and provide distinctive value propositions that set them apart to fight substitutes successfully (Danemo, 2018). Concurrently, incorporating supplementary goods and services into a cohesive ecosystem improves client involvement and allegiance, supporting a solid and successful business plan. E-commerce sites should embrace digital innovation to improve consumer experiences and operational efficiency when planning for increased profitability and sustainability. By appealing to a broader range of customers, the ongoing diversity of product and service offerings helps to lower vulnerability to direct alternatives. Enhancing client relationships with loyalty plans and top-notch support builds a foundation of devoted clients and acts as a deterrent to rival businesses. Lastly, initiatives are amplified by strategic partnerships with suppliers and other industry members, which result in increased reach, pooled resources, and creative solutions (Chandra & Kumar, 2018). These insights and strategic recommendations operate as a compass, steering stakeholders toward a future marked by sustained profitability, resilience, and a proactive approach to the ever-changing digital marketplace as the e-commerce industry plots its route forward.

References

Alcabes, S. S. (2021). Strategies E-Commerce Entrepreneurs Use to Achieve and Maintain Sustainability Beyond the First 5 Years of Operations (Doctoral dissertation, Walden University).

Chandra, S., & Kumar, K. N. (2018). Exploring factors influencing organizational adoption of augmented reality in e-commerce: an empirical analysis using a technology-organization-environment model—journal of electronic commerce research, 19(3).

Danemo, J. (2018). How is AI influencing industry competition? An exploration of online retailing using Porter’s Five Forces Framework.

Hånell, S. M., Rovira Nordman, E., Tolstoy, D., & Özbek, N. (2020). “It is a new game out there”: e-commerce in internationalizing retail SMEs. International Marketing Review, 37(3), 515-531.

Inkinen, K. (2022). Entering the Finnish e-commerce market as a new consultancy agency.

Islami, X. A., Mulolli, E. S., & Mustafa, N. (2018). The effect of industrial and internal factors on the firm’s performance. Acta Universitatis Danubius. Œconomica, 14(5).

Jinbo, l. (2022). Research on the strategic choice of cross-border e-commerce enterprises (doctoral dissertation, Siam University).

Kulkarni, s. (2019). A study on the benefits of e-commerce applications for business operations at Spectrum Ventures, Bangalore.

Kusnindar, A. A., Ahadiat, A., & Rosidah, A. (2023). SMEs in E-Commerce Market Structure. Valid: Jurnal Ilmiah, 20(2), 62-73.

Lin, J., & Chollathanratanapong, J. (2022). Research on the strategic choice of cross-border e-commerce enterprises. The Eurasian’s: journal on global socio-economic dynamics, (6 (37)), 36-45.

Mu, H. (2021). Impact of E-commerce on Economic Production and Operation Mode Under the Background of Big Data. In Frontier Computing: Proceedings of FC 2020 (pp. 1435–1442). Springer Singapore.

Sarkar, S. N. (2022). The significance of customer experience in the e-commerce industry.

Vargas-Hernández, J. G., & Rosas, D. I. P. (2019). Policy recommendations for the current relationship between electronic commerce and Mexican SMEs: Theoretical analysis under the vision based on the industry. Jurnal Perspektif Pembiayaan dan Pembangunan Daerah, 6(4), 377-388.

Wang, S. (2019). The Innovative Study of Marketing Strategy for E-commerce Case Taobao.

Wellner, S., & Lakotta, J. (2020). Porter’s Five Forces in the German railway industry. Journal of Rail Transport Planning & Management, 14, 100181.

write

write