Executive Summary

This paper explores Zara’s marketing and sales development strategies in Nigeria and the UK, revealing a fascinating connection between standardization and adaptation. Zara tailors its product offerings, distribution channels, and promotional tactics to cater to each market’s unique needs and preferences, even though a consistent brand image and efficient supply chain enhance its global foundation. In Nigeria, aspirational youth and urban professionals seek on-trend clothing, prompting premium pricing and localized social media campaigns. Conversely, the UK’s mature market demands competitive pricing and a balanced online and offline presence, attending to a broader demographic with diverse budgets. Despite these contrasting landscapes, Zara’s focus on segmentation-targeted marketing and a commitment to sustainability allows it to expand and thrive across continents. Zara remains determined to conquer new frontiers in the ever-evolving fashion world by embracing agility and local consumer needs.

Section 1: Zara’s Global Profile

1.1 Overview

Zara is a multinational retail clothing chain distributor specializing in fast fashion whose primary target market is adults between 18 and 40 years old with a relatively high income (Jiang et al., 2019). They design, manufacture, distribute, and sell diverse clothing, accessories, shoes, beauty products, and perfumes. Zara’s mission is to offer its customers the latest fashion trends at affordable prices, with a critical focus on the ability to turn around and respond efficiently to current market preferences (Jiang et al., 2019). The company’s vision is to be the leader in the global fashion industry and be recognized for its innovative and fast-paced approach to design, production, and retail based on the market needs and requirements (Dai, 2018).

Zara’s aims and objectives include intentional efforts to maintain its fast-fashion model by continuously introducing new designs and collections to adapt to the rapidly changing trends. The second aim is to strengthen its vertical integration by increasing control over the production process to ensure quality, speed, and flexibility (Dai, 2018). Thirdly, the company aims to expand its online presence by establishing its website, zara.com, and promoting stability by investing in sustainable practices throughout the supply chain (Duoyan, 2021). At the time of this research, Zara has 2,000 stores in over 86 countries, making it the most prominent fashion retailer under its parent company, Inditex (Shabir and AlBishri, 2021). It enjoys high brand recognition and customer loyalty, particularly among younger demographics, which is likely linked to its ability to meet the fashion needs of diverse groups. It competes against several fast-fashion brands like H&M, Mango, Bershka, and Uniqlo (Duoyan, 2021), even though it leads fiercely in the competition, with each brand vying for market share and consumer attention.

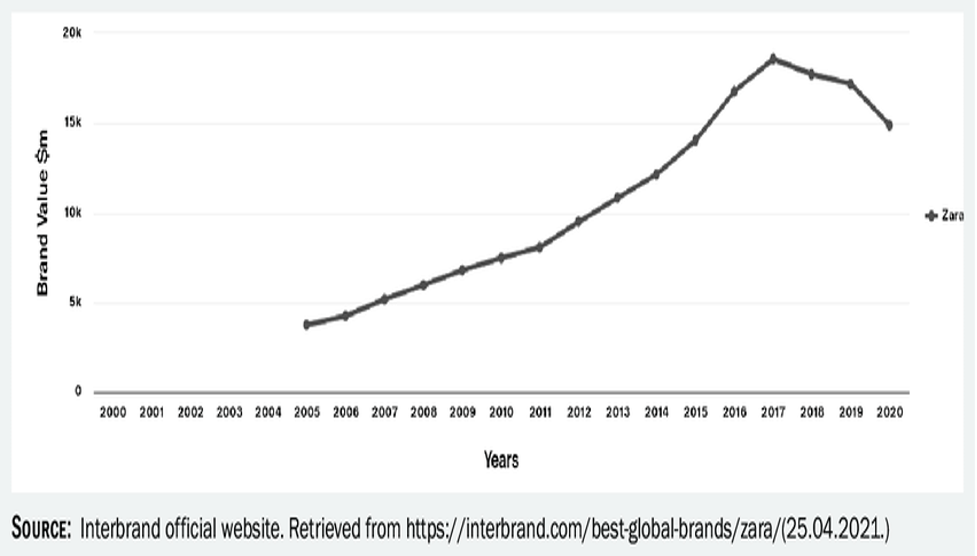

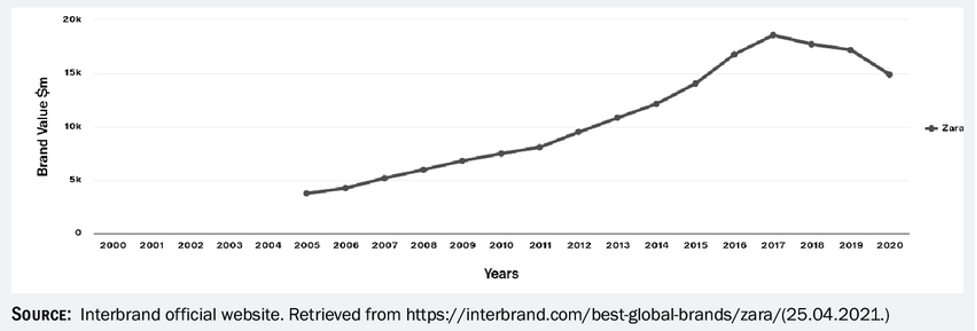

1.2 Environmental Analysis: The trends of the value of the ZARA brand from 2005 to 2020

Source: Popovic et al., 2021.

1.2.1 Macro Analysis (PESTLE Analysis)

1.2.2 Micro Analysis

Understanding Zara’s presence and performance in the United Kingdom and Nigeria is fundamental to completing this market analysis effectively. The issues surrounding consumer behaviour, purchasing power, and competitor landscapes in these regions are crucial for Zara’s continued success. In this case, consumer analysis focuses on buying behaviour and buying power juxtaposed between Nigeria and the UK. In Nigeria, Zara caters to style-conscious, aspirational middle-class and youthful urban dwellers, where value consciousness is high, with most consumers seeking trendy outfits at affordable prices (Samuel, 2022; TVC News, 2023). Social media trends and influencer endorsements significantly influence moderate brand loyalty, as is the case with most markets. On the other hand, Zara attracts a broader demographic in the United Kingdom, from trend-driven millennials to fashion-savvy professionals with moderate determinants of affordability and greater emphasis on quality and versatility (Su, 2020). However, brand loyalty is more robust, with established consumer trust in Zara’s favour due to her long-serving reliability and presence.

Buying power is also critical to this analysis since it unveils the company’s widespread presence and affordability in the country. In Nigeria, disposable income is rising despite its uneven distribution, pushing Zara to position itself as a premium brand compared to local alternatives (Ikechukwu et al., 2021). It thus caters to a smaller growing segment, contrary to the UK, since consumers enjoy higher disposable incomes and a more comprehensive range of clothing options across diverse price tags. The company competes directly with many high-street and online brands, requiring competitive pricing and intentional targeted marketing. Purchasing habits have also changed in Nigeria, with consumers turning to online shopping even though physical stores remain dominant due to concerns about product quality and delivery issues (Ogbuji and Udom, 2018). However, online shopping is well-established in the United Kingdom, with omnichannel experiences blending physical and digital touchpoints (Silva and Duarte, 2021). Consumers are also more research-oriented and highly active in comparing prices and checking reviews before purchasing.

Despite Zara’s effectiveness in obtaining an effective market globally, local brands such as Mide, Mai Atafo, and Orange Culture in Nigeria offer unique designs and cater to cultural preferences (Now, 2020), an aspect that Zara has not mastered yet. They also hold pop-up events and utilize social media effectively. In the United Kingdom, high-street giants like Primark and New Look offer extreme affordability and frequent new collections, with online pure-play brands like ASOS and Boohoo providing vast selections and catering to niche trends.

Section 2: Assessing Country Attractiveness and Entry Strategy

Zara has acquired numerous customers over the years across the globe, even though its journey in Nigeria and the UK reveals contrasting consumer behaviours. Its attractiveness and competitiveness differ in these two markets. Factors such as market size and growth, consumer purchasing power, fashion awareness and trends, retail infrastructure and distribution, competition, and market entry barriers and regulations determine its effectiveness in the UK and Nigeria (Bodolica, Spraggon, and Soueid, 2019). For instance, Nigeria presents a rising middle class and digital-savvy youth who crave trendy outfits and pickpocket-friendlies, making it possible for Zara to cater the steeds to aspirational dwellers who seek to emulate global fashion trends (Ruth, 2021). Social media’s influence on fashion is supreme, and influencer endorsements potentially impact consumer purchasing decisions and impulse purchases. However, there needs to be better infrastructure lags demand since physical stores are the primary shopping avenue, making its sales drive a bit low compared to more developed countries (Ogbuji and Udom, 2018). Competition from local brands also challenges Zara’s established presence and international cachet, especially in this digital age where consumers can shop freely and from various options available.

This contradicts the United Kingdom since Zara encounters a mature and diverse market with a broader range of fashion options. Consumers are more vibrant and conscious about their purchases, unlike in Nigeria, where purchases are sometimes centred on impulsivity (Jain and Kulhar, 2019). They are also research-oriented, comparing prices and reviews before making purchases. High-street giants and online pure-play brands pose fierce competition, pushing Zara to engage in continuous innovation and competitive pricing to keep up with this competition (Silva and Duarte, 2021). Despite these challenges, Zara’s strong brand recognition and established store network provide a solid foundation, keeping the company at a highly competitive level globally.

Zara’s entry strategies in Nigeria and the UK reflect these unique dynamics, boosting its influence in the global market. Localized social media campaigns and influencer partnerships amplify brand reach in Nigeria, significantly increasing sales pro, duct acceptability and knowledge in the market (Okonkwo et al., 2023). Products that adapt to local weather and cultural preferences, incorporating a more comprehensive range of accessories and beauty products, are widely acceptable in this market, and Zara’s products that fit this aspect have led to immense growth. Despite the two countries’ significant potential, they present distinct challenges where Nigeria’s rapid growth and youthful population (Ruth, 2021) are balanced against complex import regulations and developing retail infrastructure. In the United Kingdom, intense competition and consumer expectations (Silva and Duarte, 2021) also push Zara towards intentional and constant innovation and differentiation. Consequently, Zara must maintain its agility to navigate these evolving landscapes by embracing sustainability since it is a growing concern in both markets that can enhance brand image and attract new customer segments.

Section 3: Segmentation, Targeting, and Positioning

Zara conquers multiple segments through a multidimensional segmentation approach. For instance, it delves into global segmentation by considering the demographics of its target market, with 18-40-year-olds being its primary focus (Jiang et al., 2019). Zara intentionally targeting middle to upper-class consumers seeking trendy yet affordable clothing significantly influences its income-generating ability. The company also considers psychographics, where it segments its consumers based on fashion consciousness and trend adoption (Dai, 2018), where there are “Early adopters” and “fashion enthusiasts” as the primary targets, with some focus on value-conscious shoppers seeking trendy pieces at affordable prices. The company also considers behavioural segmentation, such as shopping frequency and brand loyalty, which are crucial in driving sales, especially in the fast-fashion industry. Zara segments frequent shoppers who embrace the fast-fashion model and those influenced by impulse purchases and social media trends (Feiglová, 2019). Similarly, Zara also focuses on geographical aspects of the target consumers where potential consumers dwelling in urban centres and with access to physical stores are highly recommended and a key segment, while online shopping expansion targets reach the suburban and rural areas (Su, 2020). Zara tailors product offerings and marketing to specific regions and countries, which is one of the significant aspects that has boosted its impact and reachability to the global market.

Notably, Zara utilizes a weighted approach to identify the most profitable segment. Despite age and income being essential, fashion consciousness, purchase frequency, and brand loyalty hold greater significance in this segmentation (Dai, 2018; Jiang et al., 2019; (Feiglová, 2019; Su, 2020). Early adopters who shop frequently and demonstrate brand loyalty offer the highest profit potential due to their ability to shop as often as possible and their likelihood of recommending other shoppers based on satisfaction. Therefore, Zara adopts a multi-targeting approach, focusing on several segments within each market, allowing for broad market reach, product diversification, operational efficiency, and global positioning. Notably, Zara’s ability to position itself as the leading fast-fashion brand that offers trendy and affordable clothing for fashion-conscious individuals enhances global positioning, resonating across diverse markets with specific advantages (Su, 2020; Gasamáns Gesto, 2023). These advantages include facilitating the effective development of markets, opening paths for emerging markets, and positioning map, which could place Zara alongside competitors such as H&M, Mango, and Uniqlo, with axes representing price and fashion trendiness.

Section 4: Marketing Mix Strategies.

4.1. Standardization vs Adaptation (Product Decision)

Zara thrives on standardization through the vertical integration of its supply chain and rapid turnaround times, allowing it to deliver trending clothes at affordable prices to different target markets. This standardized framework offers other advantages, including a consistent brand image that builds trust and recognition, cost-efficient production processes that drive profitability, and the operational agility to replicate successful designs globally quickly (Kumar and Kaushik, 2020). In Nigeria, the offering consists of clothing items, a more comprehensive range of accessories, and beauty products, again reflecting shifting trends but is now more culturally significant with what it means to adorn oneself. Marketing and communication are also localized, where influencer partnerships and targeted campaigns foster more profound engagement with specific audiences.

4.2 Distribution Decision

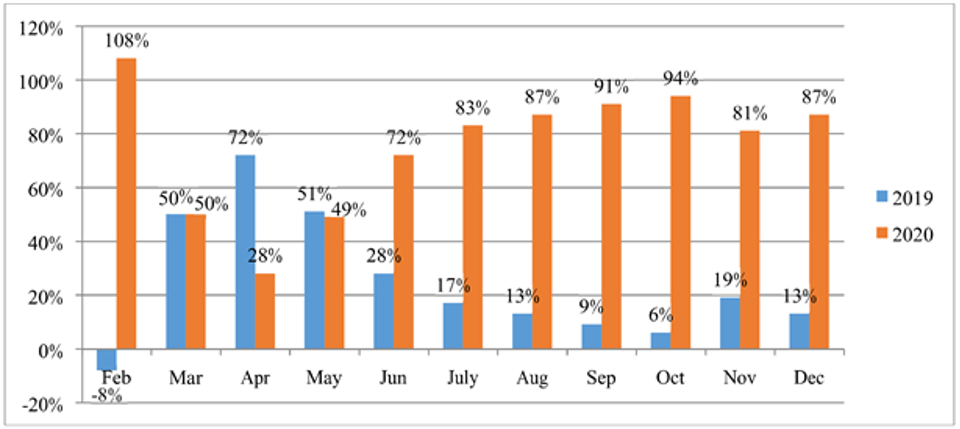

Zara recognizes the need to adapt its distribution strategies to the patterns of different markets to enhance a balanced availability in the market. This adaptation manifests in its channel mix, logistics network, and store location strategy. In Nigeria, for example, Zara has maintained physical stores to drive sales due to the low online shopping practices (Guillén, 2021). In contrast, the UK has a well-developed e-commerce infrastructure, prompting Zara to invest heavily in online channels (Kirby-Hawkins, Birkin, and Clarke, 2019). These strategies have worked in different market zones, leading to widespread growth, such as witnessed during the COVID-19 pandemic, when the company had an immense sales increase.

Source: INDITEX financial report. (Shabir and AlBishri, 2021).

In addition, local partnerships with distributors and transportation providers ensure efficient delivery in each region, mitigating infrastructure challenges in emerging markets like Nigeria (Okonkwo et al., 2023). This is a massive benefit despite the infrastructure challenges experienced in the country and has been an enormous boost to Zara’s increased competitiveness. The company has also capitalized on the store location strategy (Ha, 2021) since prime locations in major cities and shopping districts remain a priority, even though the specific areas targeted might differ based on local foot traffic patterns and competitor presence. These strategies have benefited and impacted Zara’s growth and expansion since. For instance, the focus on physical stores in Nigeria aligns with the experiential shopping preference in this market (Guillén, 2021), while partnerships with local distributors overcome infrastructure hurdles. This strategy has contributed to its intense market penetration in Nigeria. Similarly, the company’s online channel investment supports the UK’s established e-commerce culture, complementing its physical store network (Kirby-Hawkins, Birkin, and Clarke, 2019). This multi-channel approach minimizes customer friction while maximizing market reach and solidifies Zara’s position in a competitive market.

4.3 Pricing Decision

Zara has also mastered the need for and importance of efficient pricing based on specific markets, and this aspect has impacted its widespread growth and expansion globally. This section analyzes how Zara balances affordability and fashion ability while accounting for diverse market dynamics in Nigeria and the UK, exploring the effectiveness of its pricing decisions through the segmentation, targeting, positioning, and micro and macro environmental factors lenses. First, Zara’s price strategy rests on two fundamental notes: affordability and trendiness (Lee, 2023). It positions itself as a middle-ground option, offering on-trend garments affordably compared to luxury brands. However, the pricing differs in Nigeria and the United Kingdom since these two vary based on their people’’ income level and spending habits, especially on outfits. In Nigeria, Zara adopts a premium pricing strategy compared to local brands, catering to an aspirational middle class and capitalizing on its global brand image (Khurana and Kateryna, 2018). Affordability is highly considered, even though the emphasis leans towards trendiness and brand association. On the other hand, Zara faces intense competition from high-street giants and online pure-play brands in the UK, necessitating a more competitive pricing approach, with targeted promotions and flash sales taking the lead in its sales and pricing strategies (Aftab et al., 2018; Ha, 2021). In this context, trendiness remains crucial, but affordability takes centre stage to retain price-conscious consumers.

Zara’s pricing also aligns with Zara’s segmentation and targeting strategies, whereas, in Nigeria, the company primarily targets fashion-conscious youth and urban professionals with disposable income (Samuel, 2022). Thus, premium pricing meets their desire for on-trend pieces and aligns with their aspirations. In the UK, however, the target audience comprises a broader range from trend-driven millennials to value-conscious families, making more competitive pricing more favourable to meet the budgets while retaining trendy offerings and maximizing market reach (Su, 2020).

The company also centres on positioning the perfect pitch with its pricing strategies, which complements its global positioning. For example, Zara is a premium yet accessible brand in Nigeria, catering to customers seeking an international fashion experience (Samuel, 2022), a significant selling point in the state. Nigerian people also love trendy fashion, especially with a global touch, where the higher price reinforces this image while maintaining affordability. On the contrary, the emphasis shifts towards trendiness and value while retaining an international brand image in the UK since competitive pricing allows Zara to stand out amongst budget-conscious consumers without compromising its fashion edge (Su, 2020). These pricing strategies have been instrumental since they have met the micro and macro needs of the Nigerian and UK markets, where they lead to strong brand recognition and profitability, create a broader customer base, and ensure market share despite fierce competition, respectively.

4.4 Promotion Decision

As a fast-fashion global company, Zara dresses the world and orchestrates a mesmerizing advertising symphony across diverse cultures. Exploring the company’s advertising strategies in Nigeria and the UK reveals insightful lessons in effectiveness and public relations. It embraces microtunes in its advertising strategies by recognizing that one size doesn’t fit all in advertising. For instance, In Nigeria, online campaigns are intense and more pronounced due to the popularity of social media and the high influencer marketing aspects (Santana, 2022). On the other hand, it can be observed that in the case of the United Kingdom, they opt for a balanced approach with a combination of online and also traditional print media as well as TV channels due to diversity among the audiences (Nash 2019; Singh. The tone and manner of the adverts’ messaging also differ. Nigerian adds stress aspiration and brand association, whereas UK advertisements concentrate on trendiness and value as an indication of contrasting consumer interests. Visual adverts and marketing tools also differ because local models and cultural references influence advertising strategies even though their main goal remains to establish connection or relevance in every situation. Results revealed that these strategies could effectively improve brand recognition, drive web traffic and foot traffic to stores, and ma, and media engagement (Nash 2019). Zara realizes the importance of appropriate practices regarding CSR and strives for good public relations. It has incorporated sustainability initiatives into its international story, for instance, joining the “Better Cotton Initiative”, which supports sustainable cotton growing methods to appeal to eco-conscious consumers (Zulfiqar and Thapa, 2018). It also collaborates with NGOs and local communities on various social levels, strengthening its positive image. All these initiatives have helped Zara’s PR to improve tangibly as well; some of the positive media they got highlighted its CSR activities, giving them more amplification for their brand message, and it also increased loyalty and trust among customers oriented on environmentally friendly social commitments. Due to its good reputation and responsible practices, the company can attract talent and partners more easily.

Section 5

Conclusion

Zara’s growth through Nigeria and the UK, two very different landscapes, reveals his capability to grow and flourish in varying markets. The company’s success is driven by its ability to balance standardization and adapt to local variations; this ensures that it remains true to some global branding while creating an impact with cultural differences and specific consumer preferences. Zara has been successful in these markets by attracting fashion-conscious individuals worldwide, and segmentation, targeted marketing and an unwavering commitment to sustainability has played a significant role. Zara has managed to use its flexibility and adaptability in navigating the changes and various trends that have emerged over time, as it continued riding on the waves of the global fashion industry with other giant companies while continuing gracefully dominating the market. The company leads the streets of Lagos and even those avenues full of fashionistas in London, adapting its aptness to merge into each market.

Bibliography

Aftab, M.A., Yuanjian, Q., Kabir, N. and Barua, Z., 2018. Super responsive supply chain: The case of Spanish fast-fashion retailer Inditex-Zara. International Journal of Business and Management, 13(5), pp.212-227.

Agbloyor, E.K., 2019. Foreign direct investment, political business cycles and welfare in Africa. Journal of International Development, 31(5), pp.345-373.

Bodolica, V., Spraggon, M. and Soueid, M.A., 2019. Innovation drivers and trends in the retail industry: an application to emerging markets and the case of the Gulf region. International Journal of Comparative Management, 2(1), pp.51-66.

DAI, H., 2018. Strategy CSR brand communication. Fast fashion industry.

Dell’Ariccia, G., Rabanal, P. and Sandri, D., 2018. Unconventional monetary policies in the euro area, Japan, and the United Kingdom. Journal of Economic Perspectives, 32(4), pp.147-172.

Duoyan, H., 2021, April. Research on ZARA strategy from the perspective of the SWOT analysis method. In 2021, the 6th International Conference on Social Sciences and Economic Development (ICSSED 2021) (pp. 201-205). Atlantis Press.

Dwivedi, Y.K., Ismagilova, E., Hughes, D.L., Carlson, J., Filieri, R., Jacobson, J., Jain, V., Karjaluoto, H., Kefi, H., Krishen, A.S. and Kumar, V., 2021. Setting the future of digital and social media marketing research: Perspectives and research propositions. International Journal of Information Management, 59, p.102168.

Feiglová, M., 2019. Attitudes of Generation Y to Fashion Consumption: The Zara Case.

Gasamáns Gesto, L., 2023. A change beyond fast fashion: An analysis of Zara’s positioning and communication.

Guillén, M.F., 2021. The platform paradox: How digital businesses succeed in an ever-changing global marketplace—University of Pennsylvania Press.

Ha, J., 2021. Zara Strategic Analysis.

Hood N, Urquhart R, Newing A, Heppenstall A. Sociodemographic and spatial disaggregation of e-commerce channel use in the grocery market in Great Britain. Journal of Retailing and Consumer Services. 2020 Jul 1;55:102076.

Ikechukwu, O.F., Christopher, E.O., Justice, A.E. and Osaremen, E.I., 2021. Direct Taxes and Income Redistribution in Nigeria. GATR Global Journal of Business Social Sciences Review, (2), p.9.

Jain, R. and Kulhar, M., 2019. Barriers to online shopping. International Journal of Business Information Systems, 30(1), pp.31-50.

Jiang, J., Lu, J.L., Wang, Z.A. and Yu, H.L., Marketing Management Dr. Chritian Kim Marketing Plan 10/17/2019.

Kirby-Hawkins, E., Birkin, M. and Clarke, G., 2019. Investigating the geography of corporate e-commerce sales in the UK grocery market. Environment and Planning B: Urban Analytics and City Science, 46(6), pp.1148-1164.

Kumar, V. and Kaushik, A.K., 2020. We are building consumer–brand relationships through brand experience and brand identification. Journal of Strategic Marketing, 28(1), pp.39-59.

Khurana, K. and Kateryna, R., 2018. Sustainable Business Strategies for Local Fashion Communities (small and medium scale enterprises) in Ethiopia and Ukraine. Fashion & Textile Research Journal, 20(1), pp.22-33.

Lee, T.H., 2023. ZARA, FAST FASHION, AND THE NEW GLOBAL PARADIGM FOR MARKETING COMMUNICATION by Ting Hsuan (Vivian) Lee (Doctoral dissertation, Purdue University Graduate School).

Nash, J., 2019. Exploring how social media platforms influence fashion consumer decisions in the UK retail sector. Journal of Fashion Marketing and Management: An International Journal, 23(1), pp.82-103.

Now, F. A. (2020) ‘Safari revolution collection from Nigerian fashion designer Mai Atafo’, Fashion Africa Now. Available at: https://fashionafricanow.com/2019/11/do-not-look-under-my-skirt-fashion-designer-orange-culture-shot-by-jesse-navarre-vos/ (Accessed: 13 May 2020).

Ogbuji, C.N. and Udom, A.O., 2018. A holistic presentation of online shopping in Nigeria. Researchers World, 9(3), pp.22-33.

Okonkwo, I., Mujinga, J., Namkoisse, E. and Francisco, A., 2023. Localization and Global Marketing: Adapting Digital Strategies for Diverse Audiences. Journal of Digital Marketing and Communication, 3(2), pp.66-80.

Olomu, B., Alao, D.O. and Adewumi, E., 2019. Border security issues and challenges of the Nigeria customs service. International Journal of Latest Research in Humanities and Social Science, 2(3), pp.10-19.

Popović, Š.N., Jeremić, A., Slijepčević, M. and Ilić, M., 2021. Marketing focused on the online brand community: The example of Zara. Marketing, 52(1), pp.32-42.

Rice, Erin. “The Pattern of Modernity: Textiles in Art, Fashion, and Cultural Memory in Nigeria since 1960.” PhD diss., 2020.

Ruth, P.A., 2021. Fiscal Aspects of the Fashion Industry: The Big Four Global Capitals and the Nigerian Equivalent. Open Journal of Social Sciences, 9(9), pp.232-242.

Samuel, K.C., 2022. Optimizing the Internet Despite Threat to IP: How Fashion Designers in Nigeria Leverage Digital Media Platforms for Market Entry and Growth. Advanced Journal of Social Science, 10(1), pp.1-13.

Santana, C.L., 2022. Social media marketing on Instagram: influences on female millennials’ purchase intentions (Doctoral dissertation, University of Johannesburg).

Shabir, S., AlBishri, N.A. (2021) ‘Sustainable Retailing Performance of Zara during COVID-19 Pandemic’, Open Journal of Business and Management, Vol. 9, No. 3.

Singh, M.S., 2020. A STUDY ON SUPPLY CHAIN AND SOCIAL MEDIA PLATFORMS WITH SPECIAL REFERENCE TO THE CLOTHING BRAND ZARA. Towards Excellence, 12(5).

Silva, A.M.A. and Duarte, V., 2021. Online Shopping Behaviours during Quarantine: Zara case study (Doctoral dissertation).

Su, Y.Z., 2020. The Internationalization Strategies of Fast Fashion Clothing Retailer Brands: A Case Study of ZARA, H&M, UNIQLO, and Gap. Wenzao Ursuline University of Languages.

TVC News Nigeria. (2023 December). ZARA FX Opens Nigeria Office In Lagos. YouTube. Available at: https://www.youtube.com/watch?v=52x9YL4Y2y0 (Accessed: 8th January 2024).

Zulfiqar, F. and Thapa, G.B., 2018. Determinants and intensity of adopting “better cotton” as an innovative cleaner production alternative. Journal of cleaner production, 172, pp.3468-3478.

Appendix

The trends of the value of the ZARA brand from 2005 to 2020

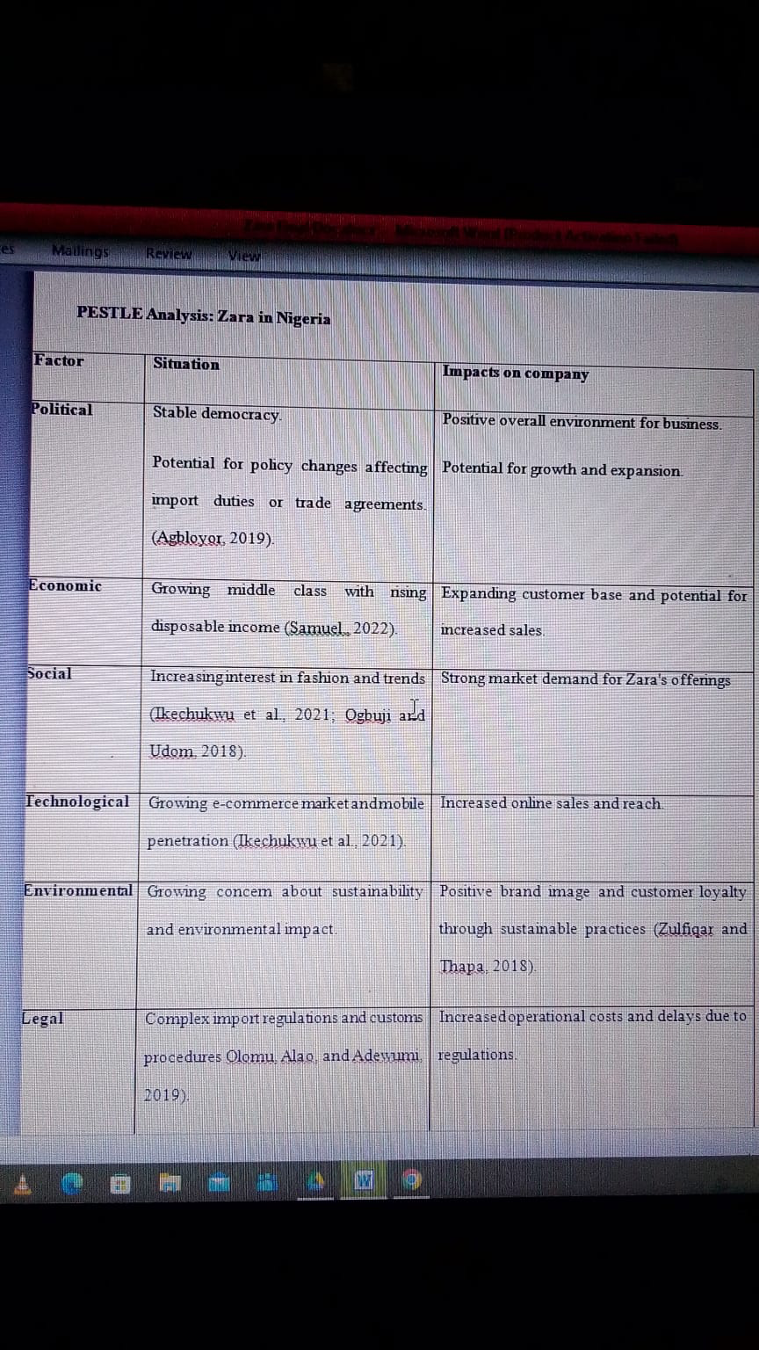

PESTLE Analysis: Zara in Nigeria

| Factor | Situation | Impacts on company |

| Political | Stable democracy.

Potential for policy changes affecting import duties or trade agreements. (Agbloyor, 2019). |

The positive overall environment for business.

Potential for growth and expansion. |

| Economic | Growing middle class with rising disposable income (Samuel., 2022). | We are expanding our customer base and potential for increased sales. |

| Social | Increasing interest in fashion and trends (Ikechukwu et al., 2021; Ogbuji and Udom, 2018). | Strong market demand for Zara’s offerings |

| Technological | Growing e-commerce market and mobile penetration (Ikechukwu et al., 2021). | Increased online sales and reach. |

| Environmental | Growing concern about sustainability and environmental impact. | Positive brand image and customer loyalty through sustainable practices (Zulfiqar and Thapa, 2018). |

| Legal | Complex import regulations and customs procedures Olomu, Alao, and Adewumi, 2019). | Increased operational costs and delays due to regulations. |

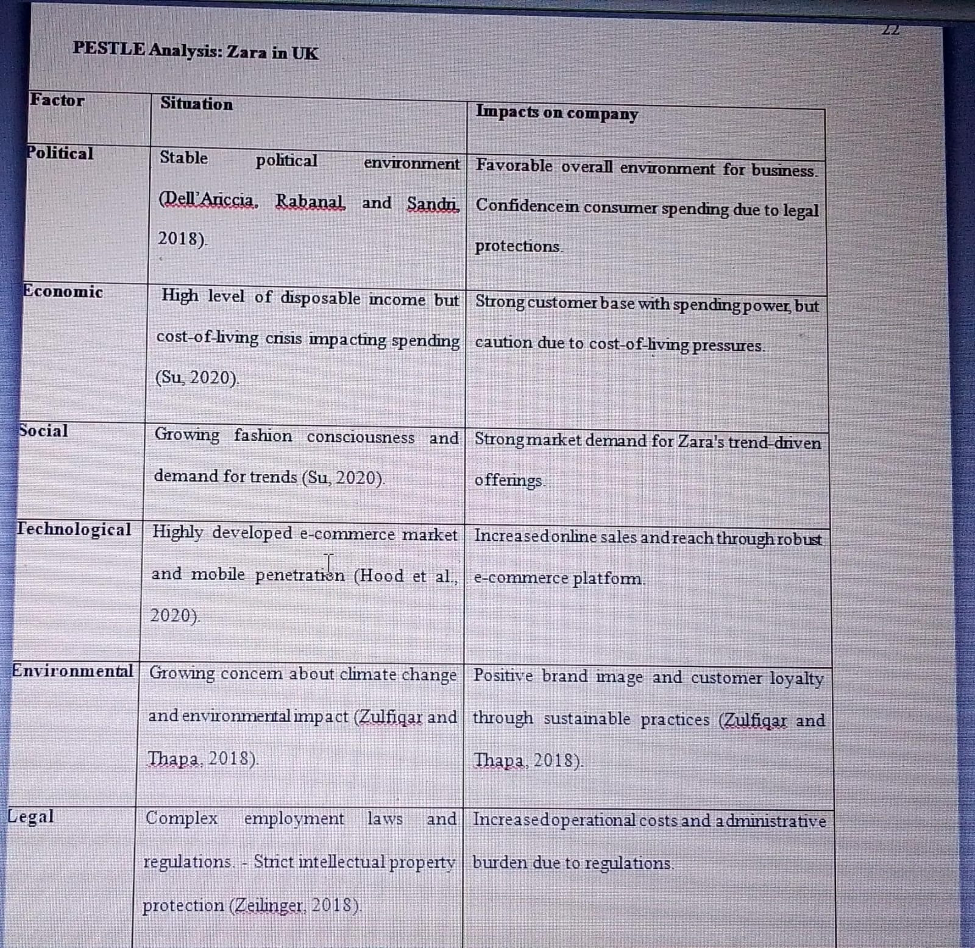

PESTLE Analysis: Zara in the UK

| Factor | Situation | Impacts on company |

| Political | Stable political environment (Dell’Ariccia, Rabanal, and Sandri, 2018). | Favorable overall environment for business. Confidence in consumer spending due to legal protections. |

| Economic | High disposable income but cost-of-living crisis impacting spending (Su, 2020). | Solid customer base with spending power but caution due to cost-of-living pressures. |

| Social | Growing fashion consciousness and demand for trends (Su, 2020). | Strong market demand for Zara’s trend-driven offerings. |

| Technological | Highly developed e-commerce market and mobile penetration (Hood et al., 2020). | Increased online sales and reach through a robust e-commerce platform. |

| Environmental | There is growing concern about climate change and environmental impact (Zulfiqar and Thapa, 2018). | Positive brand image and customer loyalty through sustainable practices (Zulfiqar and Thapa, 2018). |

| Legal | Complex employment laws and regulations. – Strict intellectual property protection (Zeilinger, 2018). | It increased operational costs and administrative burdens due to regulations. |

write

write