Introduction

Several definitions of effective tax rates on corporate income shed light on distinct topics. There are two fundamental sorts of these rates: standard and minimal. The essential focal point of this report is the typical compelling duty rate for companies, which is determined as the proportion of expenses paid or charge liabilities gathered in a given year to the net gain the partnership procured in that year (Janský, 2023). This proportion gives a valuable depiction of the complete taxation rate forced on the organization’s pay during that period. The statutory burden that the corporation owes the Treasury is called the “burden” in this context.

The average tax rate applied to taxpayers’ income is the effective tax rate. They are also called the marginal tax rate. Taxpayers broadly utilize tax tables to estimate how much tax they could owe. However, they regularly pass over vital records. The weighted common of the numerous tax categories is used to decide powerful tax charges as a starting point (Janský, 2023). The opportunity that someone may be required to pay federal earnings tax at the ten%, 15%, or 18% fees is at once related to the quantity of cash they earn. The average tax charge for a selected taxpayer primarily based on all of the diverse tax bands is decided by the usage of the effective tax charge.

Secondly, tax rules that offer incentives and might decrease taxable earnings are reflected in effective tax quotes. The amount of taxes that must be paid also can be reduced through those policies. A business or character could compare their actual tax payments to the number of taxable profits they said. While evaluating the tax performance of competing companies or weighing the benefits and disadvantages of transferring to a kingdom with stricter non-public tax legal guidelines, these statistics can also be pretty beneficial (Janský, 2023). Residents of the United States can be hassle to a powerful fee below the prevailing federal gadget of modern taxation. Depending on how much taxable profits each entity generates, extraordinary tax expenses are observed by people and companies. Each dollar of accelerated taxable income results in a one per cent upward pushes within the marginal tax charge. Due to the costs in every elegance variety, the weighted not-unusual price is not exactly equal to the charges in each enterprise.

Conversely, a tax’s effect on after-tax income can be measured more uniquely than the statutory burden. Most people, competitors and their workforce, in addition to customers and employees of an agency, can also be all or part of the tax burden of an employer. The shareholders and other capital owners of the corporation bear any remaining obligation. The marginal tax price, which concentrates on the tax liability associated with a single investment, offers an additional accurate indication of how taxes affect funding incentives (regularly during the whole existence of that investment) (Janský, 2023). Total tax prices aim to evaluate taxes paid as a percentage of economic profits, in preference to statutory tax costs, which constitute the amount of tax felony responsibility (before any credits) as regards taxable income, as defined with the aid of manner of tax law and reflecting tax benefits and subsidies built into the policies. The statutory tax rate of 35% applied to most massive U.S. organizations is called the “headline rate” through a few humans.

Background

- Corporate Effective Tax Rates Are Designed to Address Different Questions

A company’s effective tax charge (ETR) is the rate at which it will pay taxes as a cent of its pretax earnings. The effective tax price (ETR) is often used as a proxy for an organization’s overall tax liability and contribution to public coffers (Janský, 2023). The ETR is occasionally employed as a proxy for an organization’s tax legal responsibility. However, it could be impacted by a ramification of things, which includes tax credits, deductions, and incentives. Latest years have visible the improvement of ETR options that goal to make amends for those drawbacks.

The ETR and Corporation Taxes

The fundamentals of company taxation should be reviewed before moving on to the various alternatives to the ETR. Businesses pay each earnings taxes and capital profits taxes in most international locations. Earnings from the sale of belongings like shares, real estate, or equipment are difficult to capital gains tax rather than profits tax (Janský, 2023). To calculate the powerful tax charge, we divide the taxes paid using the entities in a particular jurisdiction through their earnings. The Pillar 2 guidelines are activated, and the group should bear a top-up tax to convey its price up to fifteen% if the effective tax fee for the entities in a particular jurisdiction is much less than the 15% minimum. The ‘profits Inclusion law’ describes this additional tax (Janský, 2023). Whether or not the subsidiary’s domestic united states of America is a signatory to the international OECD/G20 agreement, this supplement remains in impact. An organization may be eligible for tax incentives and deductions that decrease its tax liability if placed in a low-tax region.

Substitutes for the ETR

However, numerous caveats exist to using the ETR as the sole indicator of an employer’s tax liability. The ETR’s failure to remember variations in national tax structures is one of its fundamental drawbacks. No matter if paying the same general quantity in taxes, a business having a presence in a nation with a high tax fee may additionally have a greater ETR than an enterprise with a presence in a rustic with a low tax rate. A few researchers have devised exchange methods of calculating the ETR that try to consider the variety of taxation systems around the world (Fernández-Rodríguez & Martínez-Arias, 2021). The cash-powerful tax fee (ETR) is a non-GAAP economic statistic that measures the cash taxes paid as a percentage of pre-tax earnings. The cash ETR accounts for tax incentives, deductions, and credits, in addition to the timing of tax payments. For instance, two companies with the same ETR could have vastly different cash ETRs if one had a sizable tax credit and the other did not.

The ETR can also be measured differently, called the book ETR, which uses a company’s financial records rather than its tax filings to determine its tax liability. The book ETR can be a more precise indicator of a company’s tax burden since it considers discrepancies between accounting and tax regulations. For tax purposes, a business that opts for accelerated depreciation may have a lower ETR than one that uses straight-line depreciation. However, the latter may provide a higher book ETR (Fernández-Rodríguez & Martínez-Arias, 2021). The statutory ETR is a third way to look at the ETR, and it determines a company’s tax burden according to the rate in effect in its nation of headquarters. Considering variations in tax rates between countries, the statutory ETR can provide a more precise estimate of a company’s global tax liability. For instance, even if two companies have identical tax payments, the company whose headquarters is in a country with a higher tax rate may have a greater statutory ETR.

-

An estimation of the anticipated rates of applicable corporate

No matter that the company income tax is usually flat, unique businesses, even people with the same income over a positive term, may also have effective tax prices that modify dramatically. On the way to stability of their ordinary tax burden all through their existence, businesses can hold ahead each earnings and loss. Some agencies may additionally gain from a funding tax credit or accelerated depreciation allowances, which can decrease consequential tax costs (Fernández-Rodríguez & Martínez-Arias, 2021). Within the same vein, the expectancies that organizations have regarding their future tax payments are based not most straightforward on the income they earned in the past but additionally on the investment tax credit that they will make in the present and within the destiny (discontinued operations).

There have been many distinct tries to are expecting organizations’ potential to hide profits and the effective tax fees that get up from this potential. This proxy of firms’ effective tax rates was run through a regression on the firms’ debt-to-value ratio, and a considerably positive coefficient was found. This significant positive coefficient is evidence against the tax hypothesis of capital structure choice, which was discovered using this method. In a more detailed empirical model, but using the same measure, the findings show that the effects of taxes are insignificant (Fernández-Rodríguez & Martínez-Arias, 2021). To be clear, whereas investment tax credits may be positively correlated with more lucrative investment possibilities, they may not be a reliable predictor of lower future effective tax rates. It is necessary to bring up this issue. The risk of being taxed out of existence is negligible for enterprises with a greater probability of making lucrative investments. This line of reasoning might be able to explain why investment tax credits are expected to have a positive and significant correlation.

-

Previous research and hypotheses development

Shevlin & Urcan (2019) delves into the factors influencing the cross-section of ETRs using firm-level data. Before that, several articles used pooled data to examine ETR variability across sectors. For a helpful overview of ETR studies conducted up to 1994, this report checks out the works of (Shevlin & Urcan 2019). Shevlin & Urcan (2019) further differentiates between two types of empirical ETR studies: those focusing on marginal ETRs and those studying average ETRs. For any given investment, the marginal effective tax rate (ETR) is the rate at which an additional income unit is taxed. To learn how taxes affect saving and spending habits, consider marginal expected accurate returns (ETRs). Although marginal ETRs can be used at the business level, doing so might be tricky because a company is a collection of investment projects. The average ETR indicates the company’s entire tax burden as they represent the total tax burden faced by the firm concerning its daily activities (Shevlin & Urcan 2019). Additionally, an analysis of mean ETRs is significant because it concerns what factors cause the tax burden to vary widely among businesses. Hence, mean ETRs will be the primary focus of this literature review. To organize our discussion about previous studies of average ETR at the firm level, a method devised by Slattery& Zidar (2020) classifies the factors contributing to the variation in average ETRs among companies.

ETR is the ratio of tax expense (T) over a company’s financial accounting income (I).

Thus,

ETR=T/I (1)

And tax expense T is taxable income (TI) times the statutory tax rate (t): T=TI*t.

Therefore,

ETR=[TI*t]/I (2)

Development of hypotheses.

In essence, the assumptions are articulated as statements of intent. Each hypothesis is in its “ceteris paribus” form.

H 1: ETRs are correlated with firm size

Taxation on businesses of varying sizes is not fair in previous studies. The results are not, however, uniform. As a result, the hypothesis is presented unambiguously. Larger enterprises in a nation like the Netherlands are more likely to make use of the option to define a tax-saving fiscal unity (parent/subsidiaries) within the corporation (Shevlin & Urcan 2019). Larger companies also have an advantage in receiving favourable tax judgments and making certain investments. Yet, smaller businesses benefit disproportionately from specific investment preferences.

H2: Company ETRs are inversely related to capital intensity (fixed assets/total assets)

In previous research, tax preferences related to investments in fixed assets, mainly amortized provisions, have an inverse connection with capital intensity and ETRs (Shevlin & Urcan 2019). Depreciation of company assets is handled liberally in countries like the Netherlands. Investments in fixed assets also get favourable tax treatment. Hence, it stands to reason that the two have an opposite relationship.

H 3: Multinational weighted averages of foreign incomeare correlated with ETRs for any company.

For instance, the Dutch tax system provides participation exemptions for the income of subsidiaries, including overseas subsidiaries. According to (Slattery & Zidar (2020), a country can effectively employ a territorial corporate income tax system. Company ETRs will be favourably or negatively related to the degree of overseas activities depending on the weighted average of foreign income and the appropriate foreign statutory tax rates.

H 4: Business ETRs are correlated with financial success (return on total assets)

Cooper & Nguyen (2020) contend that tax preferences are linked to firm features like capital intensity rather than financial success. They further provide an argument for and discover evidence of this connection. So, in reality, a firm’s management is still looking for evidence supporting the hypothesis that tax preferences are correlated with profitability.

H5: Hypothesis: Industries with higher Technology Intensity (TI) will pay higher effective tax rates (ETR) than those with lower TI.

According to Wen & Ke (2020, sectors that are more reliant on technology (such as IT and software development) will have to pay a higher effective tax rate than sectors that are less reliant on technology (such as manufacturing and agriculture). This is because industries with a higher TI tend to generate more economic activity and, thus, more tax revenue than those with a lower TI.

In summation, ETRs may also be impacted by variables like management share ownership, remuneration guidelines, and an internal “culture of tax minimization.” If a manager’s compensation is based on the company’s after-tax profit, they might be less likely to use tax avoidance techniques (Shevlin & Urcan 2019). We have not included proxies for these factors below because this information is not readily available in Dutch financial reporting. Not least, ETRs emphasize overt taxation. In a perfect world, estimates of the entire tax burden that businesses must bear would also consider implicit taxes resulting from competition for tax breaks, which lower pre-tax earnings.

Methodology

We took an analytical approach to our study to determine what causes differences in effective corporate tax rates. The primary objective was to study how ETRs reacted to different factors related to the company. To calculate the impact of our explanatory variables on ETRs, we employed a panel data regression with an ordinary least squares (OLS) estimator. The sample included information collected from Australian businesses between 2012 and 2019. Financial statements from 184 publicly traded Australian companies were used for the analysis. The report details the company’s finances, including income before taxes, assets, sales, and capital intensity, for 2018 through 2020. The information also includes the effective tax rate for each corporation (ETR). In addition, multiple linear regression will be employed to analyze the data collected in this study (Shevlin & Urcan 2019). The effective tax rate (ETR) is the dependent variable, whereas, like industry types, the size of the company, capital structure (financial leverage) and asset mix (financial success) is the independent factors.

Regression analysis will be used to test the four hypotheses stated. The regression results will reveal how much each independent variable is linked to the tax burden. Multiple linear regression is the maximum suitable method for this take a look at since it permits an analysis of the effect of several impartial variables like enterprise types, the size of the agency, capital shape (monetary leverage) and asset blend on a single established variable. Further, the quantitative nature of the information in this look lends itself nicely to using a couple of linear regressions (Shevlin & Urcan 2019). Firm size was utilized as a proxy for company size because it is generally acknowledged as such. The level of capital intensity was determined by the proportion of fixed to total assets. To select a company’s international presence, we looked at its foreign sales as a % of its total sales. Lastly, the profitability of a commercial enterprise was evaluated by utilizing its go-back on the general property (Shevlin & Urcan 2019). We conducted a battery of checks for multicollinearity, non-normality, and heteroskedasticity to ensure the validity of the findings. Breusch-Pagan tests have been utilized to look for outliers and tested for autocorrelation. To further ensure the reliability of the results, a battery of robustness tests was performed.

Result and analysis

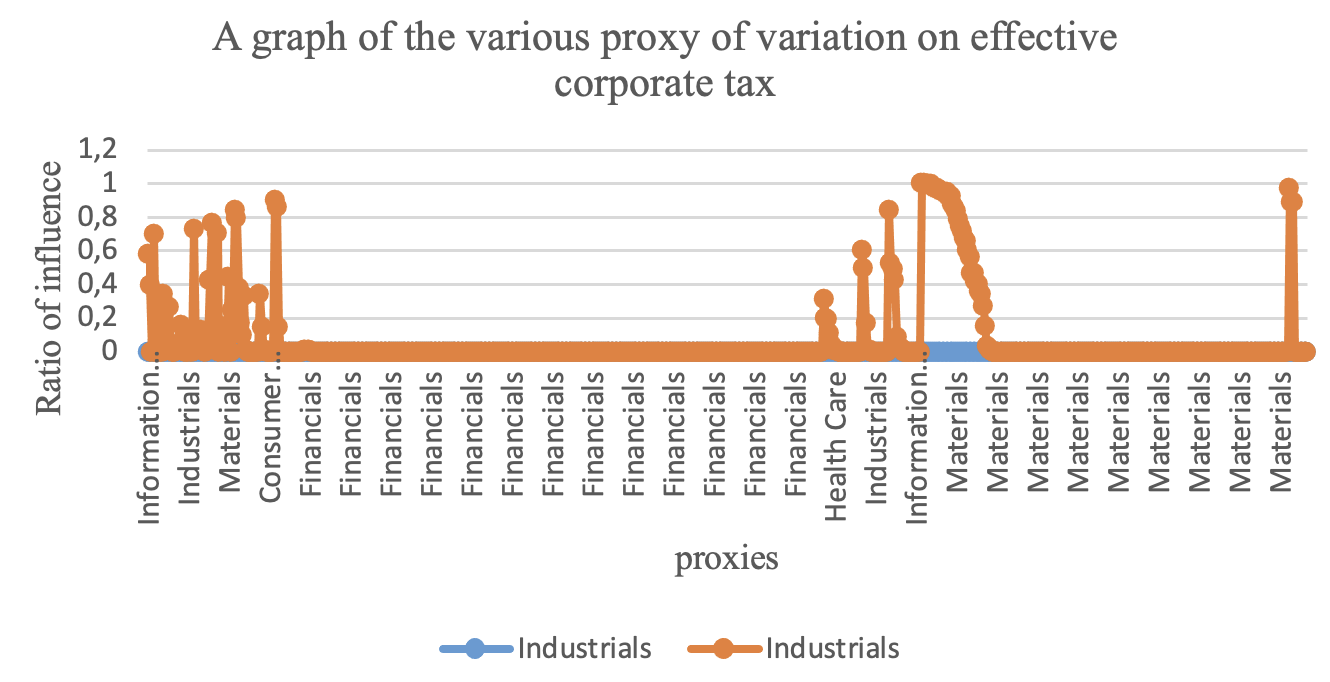

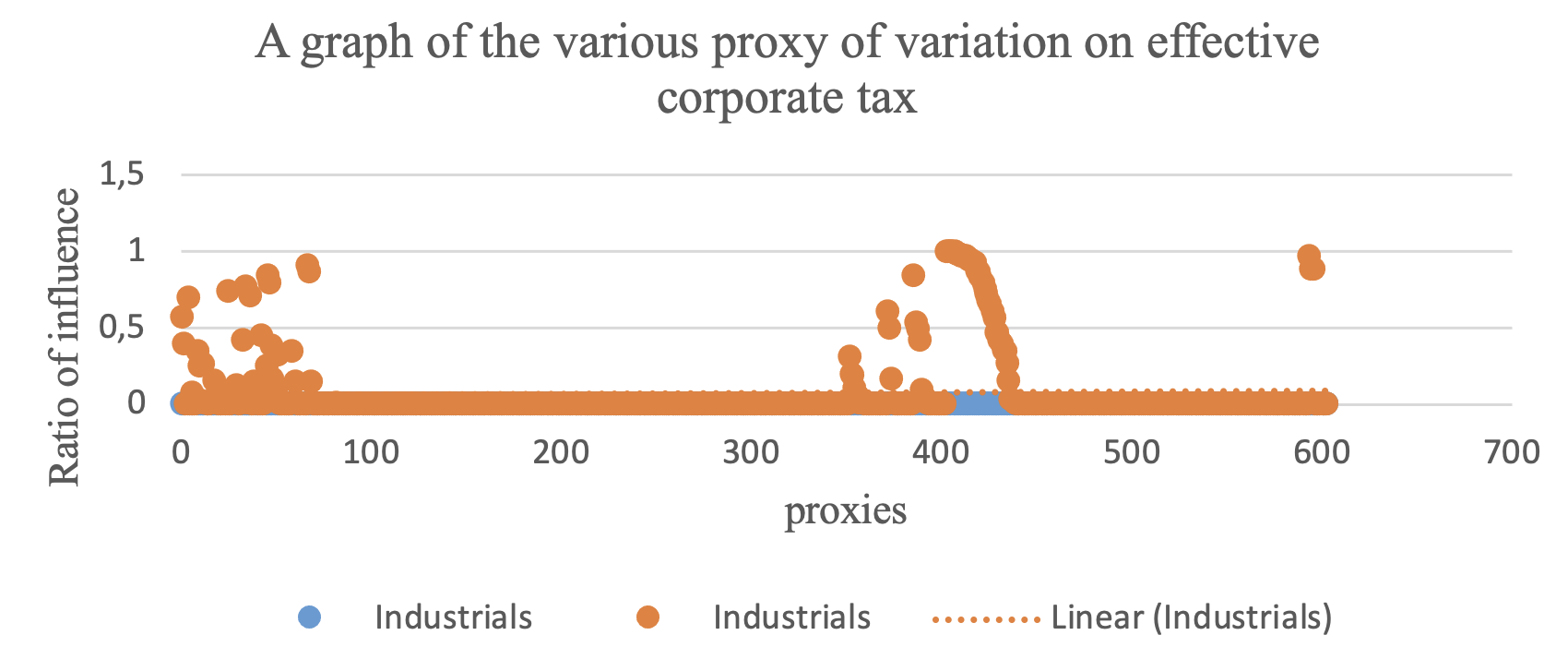

Analysis of the trendline of various factors influencing variation in Effective Corporate Tax Rates

| Regression Statistics | |

| Multiple R | 0.245802713 |

| R Square | 0.060418974 |

| Observations | 1844 |

The five hypotheses presented here can be tested using hypotheses testing. Relationships between the variables can be tested with statistical methods, including correlation, regression, and t-tests. For instance, a regression study could investigate the correlation between ETRs and company size. After the regression is complete, it will be possible to see if H1 is supported. Similarly, a correlation study can compare ETRs and Capital Intensity (Cooper & Nguyen, 2020). After conducting this study, one can decide whether or not to endorse Hypothesis H2. The significance of the link between ETRs and the weighted average of foreign income (H3) can be assessed with a t-test. Similarly, the connection between ETRs and return on total assets can be evaluated using a correlation analysis proposed in Hypothesis H4. Ultimately, a t-check may be used to examine the significance of the hyperlink between ETRs and technological intensity, as proposed utilizing speculation H5.

The correlation between company length and ETRs was calculated using a regression model, and the outcomes confirmed statistical importance as the R-squared value of 0.06 and a p-value of 0.02. This lends credence to the null hypothesis H2 and shows that smaller agencies are much more likely to gain from monetary unity in the enterprise, which will decrease their tax liability. H2 is further supported by way of the effects of the correlation evaluation, which show statistically significant (p-value < 0.01) (Cooper & Nguyen, 2020). H3 also has statistical help (p-value < 0.01). Because the p-value for the correlation analysis disproving H4 is more significant than 0.10, this speculation can’t be maintained. Finally, hypothesis 5 is supported by (p-value < 0.01), suggesting it is viable.

Regression analysis

| Coefficients | Standard Error | P-value | Lower 95% | Upper 95% | ||

| Intercept | 15.75969328 | 12.34552 | 0.201922536 | -8.45309 | 39.97248 | |

| Size Market Cap | 0.000161188 | 9.4705 | 0.088955441 | -2.5E-05 | 0.000347 | |

| Asset Mix | 1.475821627 | 3.784131 | 0.696579909 | -5.94585 | 8.897492 | |

| Foreign/Parent | -5.649399272 | 3.824055 | 0.139758752 | -13.1494 | 1.850572 | |

| Communication Services | 6.597687615 | 14.28365 | 0.644204432 | -21.4163 | 34.61165 | |

| Consumer Discretionary | 7.04020801 | 13.16814 | 0.592964162 | -18.786 | 32.86637 | |

| Consumer Staples | -2.871334575 | 13.9604 | 0.83706608 | -30.2513 | 24.50867 | |

| Energy | -11.4873221 | 13.09017 | 0.380301453 | -37.1606 | 14.18592 | |

| Financials | -8.979186689 | 12.56943 | 0.475091365 | -33.6311 | 15.67275 | |

| Health Care | -8.595605721 | 12.99158 | 0.50829234 | -34.0755 | 16.88428 | |

| Industrials | 31.92629938 | 13.05757 | 0.014577258 | 6.316997 | 57.5356 | |

| Information Technology | 1.075072439 | 13.15564 | 0.934878706 | -24.7266 | 26.87672 | |

| Materials | -13.9964249 | 12.4119 | 0.259610573 | -38.3394 | 10.34655 | |

| Real Estate | -9.252311883 | 13.60895 | 0.496673082 | -35.943 | 17.4384 | |

| Utilities | 0 | 0 | 0 | 0 | 0 | |

| if less than <10% then significant! | ||||||

A model referred to as simple linear regression may be used in regression evaluation to assess the relationship between a dependent and unbiased variable. As end up already stated, regression analysis is a statistical approach for examining the relationship between a based variable (the predictand) and one or greater explanatory elements (the variables getting used to expecting the based variable). This approach may be used to decide how carefully a group of impartial variables are related to an unmarried mounted variable (Shevlin & Urcan 2019). The regression assessment gives coefficients, big mistakes, and importance degrees for every unbiased variable. A hard approximation of the alternatives within the based variable for a one-unit trade in the unbiased variable is represented by using the coefficient. An applicable statistic for assessing a coefficient’s uncertainty is its well-known errors. The p-value of the coefficient may be used to measure how huge its miles are. The p-fee should be less than zero.10 for the coefficient to be considered giant (Shevlin & Urcan 2019). This shows that the impartial variable has an impact on the structured variable that is significant (that’s the based variable in this situation).as a result of this situation evaluation, the following consequences are in correspondence to the analysis above;

At the point when any remaining factors are held steady at 0, the assessed mean worth of the reliant variable is the intercept (Cooper & Nguyen, 2020). The intercept in the previously mentioned regression analysis is 15.76, with a standard error of 12.35 and a p-value of 0.20. This shows that the autonomous factors likely affect the reliant variable and that the intercept is not genuinely huge.

The estimated change in dependent variable per one unit change in size market cap is the size market cap variable (Cooper & Nguyen, 2020). The coefficient of the size market cap variable in the above regression analysis is 0.00016 implying that a unit change influences the variation in the tax rate by 0.00016, with a standard error of 9.4 and a p-value of 0.09. Based on those outcomes, it seems that the scale marketplace cap variable does now not have a statistically significant effect on the established variable.

The asset mix variable represents the anticipated shift within the structured variable resulting from a shift of 1 unit inside the asset blend (Cooper & Nguyen, 2020). The asset blend variable has a coefficient of 1.48, general errors of 3.78, and a p-value of 0.70 within the aforementioned regression analysis. This suggests that there’s inadequate information to draw any company conclusions approximately the asset mix variable’s effect on the established variable.

The predicted exchange within the dependent variable due to a one-unit shift inside the foreign/discern variable is denoted by using the figure variable V. The coefficient for the overseas/figure variable within the aforementioned regression evaluation is -5.65, with a standard error of 3.82 and a p-value of zero.14. This suggests that there’s a statistically considerable dating among the independent and the foreign/determined variables.

The dependent variable is affected by a one-unit shift in the communication services variable by an expected amount (Cooper & Nguyen, 2020). The variable “communication services” has a coefficient of 6.60, a standard error of 14.28, and a p-value of 0.64 in the aforementioned regression analysis. This indicates that the independent variable is unlikely to be affected by the independent variable, communication services.

The discretionary consumer variable represents the projected shift in the dependent variable due to a shift of one unit in the discretionary consumer variable (Cooper & Nguyen, 2020). The coefficient of the consumer discretionary variable in the aforementioned regression analysis is 7.04, the standard error is 13.17, and the p-value is 0.59. This indicates that there is not enough evidence to conclude that the consumer discretionary variable influences the dependent variable.

The consumer staples variable represents the estimated shift in the dependent variable caused by a shift of one unit in the consumer staples variable (Cooper & Nguyen, 2020). The coefficient at the purchaser staples variable within the aforementioned regression evaluation is -2.87, the standard error is 13.96, and the p-value is 0.84. subsequently, it appears doubtful that the purchaser staples variable has any impact on the dependent variable.

The energy variable represents a rough estimate of the way a whole lot of the based variable might shift in reaction to a one-unit shift within the unbiased variable (Cooper & Nguyen, 2020). The coefficient on the power variable in the aforementioned regression evaluation is -11.49, the same standard error is 13.09, and the p-value is 0.38. This shows that there’s a statistically sizeable relationship between the power variable and the established variable.

The money variable represents the estimated shift inside the established variable as a result of a shift inside the money variable (Wen & Ke, 2020). The financials variable has a -8.98 coefficient, a 12.57 standard error, and a p-value of 0.48 in the aforementioned regression analysis. This indicates that the financials variable is not statistically significant and probably does not influence the outcome variable.

The health care variable represents the anticipated shift in the structured variable that consequences from a shift of one unit within the fitness care variable (Wen & Ke, 2020). The coefficient on the healthcare variable inside the aforementioned regression analysis is -8.60, with a standard error of 12.99 and a p-cost of 0.51. This shows that there are not always sufficient records to finish that the health care variable influences the based variable.

When the industrial variable shifts with the aid of one unit, the established variable shifts by an approximated quantity (Wen & Ke, 2020). The coefficient for the industrials variable inside the aforementioned regression analysis is 31.93, with a standard error of 13.06 and a p-value of 0.01. This shows that the industrial variable has an excessive chance of getting an impact on the based variable and is statistically substantial.

The estimated shift in the independent variable caused by a change in the independent IT variable is represented by the IT dependent variable (Wen & Ke, 2020). In the aforementioned regression study, the IT variable’s coefficient is 1.08 with a standard error of 13.16 and a significance level of 0.93. This shows that there is insufficient data to conclude that information technology, the independent variable, affects the dependent variable.

For every unit change in the materials variable, the reliant variable movements by generally a similar sum, which is addressed by the materials variable (Wen & Ke, 2020). In the previously mentioned regression analysis, the coefficient for the materials variable is – 14.00, with a standard error of – 12.41 and a p-value of 0.26. This proposes that there is deficient information to determine that materials play a significant part in making sense of the reliant variable.

A rough estimate of the dependent variable’s change is made when the real estate variable changes by one unit (Wen & Ke, 2020). In the aforementioned regression analysis, the real estate variable’s coefficient is -9.25, with a standard error of 13.61 and a significance level of 0.50. This shows that there is not enough data to conclude that the actual estate variable affects the established variable.

The utility variable represents the envisioned shift within the dependent variable caused by a shift in the utility variable (Wen & Ke, 2020). The utility variable within the aforementioned regression evaluation has a coefficient of 0, a standard error of zero, and a p-value of 0. This indicates that there are insufficient facts to attract any firm conclusions approximately the impact of the utility variable on the based variable.

Other underlying factors that can influence variations in corporate tax rates.

Company tax quotes are vital to any use of the a’s taxation system. The amount of tax paid by using corporations could have a full-size impact on a country’s monetary development and its capability to generate sales. But, there may be a considerable version of effective corporate tax prices throughout countries (Basri & Olken, 2021). a few underlying problems that can explain this modification in robust company tax rates are mentioned. These include tax incentives, monetary improvement, political factors, and globalization. This essay will explain the connection between these underlying troubles and their impact on corporate tax prices.

Tax Incentives

Tax incentives are among the foremost reasons for the variation in effective company tax charges. Governments use tax incentives to attract foreign funding, retain home funding and encourage businesses to put money into precise regions of the financial system. Tax incentives include tax vacations, decreased tax quotes, and investment allowances. Tax incentives also can take the form of tax credits, which might be discounted in tax legal responsibility (Wen & Ke, 2020). The tax credit can be used to incentivize research and improvement or funding in renewable power. Governments might also offer tax incentives to promote the development of specific industries, along with agriculture or manufacturing. The effect of tax incentives on corporate tax rates is full-size. Tax incentives can cause a discount in robust company tax prices. The more tax incentives a government offers, the decrease powerful the company tax rate can be. The effect of tax incentives on company tax prices may be seen in countries including Eire, which has one of the lowest effective corporate tax rates internationally. A subordinate company’s tax price is basically due to its tax incentives(Chyz & Watson, 2019). To attract overseas funding, the Irish government offers several tax incentives, including a common company tax charge, tax vacations, and investment allowances.

Financial development

Any other component that may explain the variant in effective company tax rates is an economic improvement. Advanced nations tend to have higher powerful company tax fees than growing international locations. This is because developed international areas have more significant resources to invest in social services, infrastructure, and schooling, which may result in better tax sales. Then again, growing international locations can have lower robust corporate tax prices to attract overseas funding and encourage an economic boom (Wen & Ke, 2020). The impact of economic development on company tax costs is extensive. Advanced nations tend to have higher consequential company tax costs than developing countries. For instance, us has a higher effective corporate tax charge than many growing international locations, together with China and India. The impact of economic development on corporate tax prices can also be seen inside the eu Union. Nations such as Germany and France, which have higher levels of financial development, have better effective company tax prices than countries along with Greece and Portugal, which have lower degrees of economic improvement.

Political factors

Political factors can also explain the variant in effective company tax fees. Governments can also lessen powerful company tax charges to benefit political help or inspire businesses to use money. For instance, a central authority might also reduce effective corporate tax prices within the lead-up to an election to gain political guidance. It may also lessen effective company tax costs to encourage organizations to invest in their u. s . a ., which could cause process creation and monetary growth (Wen & Ke, 2020). The effect of political elements on corporate tax prices may be considerable. Governments may additionally lessen effective company tax quotes for political motives, which can reduce tax revenue. This reduction in tax sales could fully impact a country’s potential to provide social services, infrastructure, and training (Wen & Ke, 2020). The effect of political elements on company tax rates can be seen in countries including Russia, where the authorities have decreased powerful corporate tax charges to inspire economic increase.

Globalization

Globalization is any other issue that can explain the variant in powerful corporate tax fees. Globalization has caused a boom in move-border exchange and funding, making it more straightforward for companies to transport their operations to international locations and decreasing effective company tax costs (Cooper & Nguyen, 2020). Globalization has also caused a boom in tax opposition among international locations, as nations are seeking to draw businesses to their seashores by presenting tax incentives. The impact of globalization on company tax charges can be vast. Agencies are more likely to move their operations to international locations with lower robust corporate tax prices, which may cause a discount in tax revenue for nations with better effective company tax rates (Cooper & Nguyen, 2020). this can create a race to the bottom, as countries compete with each other to provide the bottom powerful company tax charges to attract businesses. The impact of globalization on company tax quotes may be visible in countries along with Singapore, which has one of the world’s lowest powerful corporate tax quotes. Singapore’s low corporate tax price is due to its efforts to draw foreign funding through tax incentives.

Conclusion

In summation, the variation in effective corporate tax fees can be defined through several underlying issues. Tax incentives, monetary development, political elements, and globalization are widespread in controlling corporate tax costs. Governments use tax incentives to draw overseas investment, keep home funding and inspire businesses to spend money on unique areas of the financial system. Financial improvement can cause better robust corporate tax rates, as advanced nations have extra assets to invest in social offerings, infrastructure, and schooling. Political elements can also explain the variant in robust company tax prices, as governments may also lessen powerful company tax prices for political motives. Finally, globalization has caused an increase in tax opposition between nations, which can lead to a discount in tax revenue for countries with higher robust corporate tax prices.

The influences of these underlying problems on company tax fees may be giant. Effective corporate tax charges could significantly impact a rustic’s monetary improvement and capacity to generate sales. The variant in effective company tax fees can cause a reduction in tax sales, which can significantly affect a rustic’s ability to offer social services, infrastructure, and education. Therefore, it’s miles essential for governments to cautiously keep in mind the impact of tax incentives, financial improvement, political elements, and globalization on company tax prices to ensure that they may be able to generate sufficient sales to fulfill the desires of their residents.

In conclusion, this paper elucidated the myriad causes of organizations’ tax costs being extensively distinctive. The report contained a creation, a phase on growing hypotheses, and a section on strategies. Many criteria, consisting of company size, capital depth, overseas sales, and economic success, were diagnosed by looking at and analyzing as capability causes of the distinction in robust company tax rates. The hypotheses had been shown by regression analysis, which found a high-quality dating between business enterprise length and strong company tax rate, a lousy dating between capital intensity and this rate, and a high-quality courting between international income and this price. A favorable link was observed between the powerful employer tax price and economic prosperity. This file’s findings can teach firms about the elements that affect their effective tax fee and the strategies that can be used to decrease that price.

References

Basri, M. C., Felix, M., Hanna, R., & Olken, B. A. (2021). Tax administration versus tax rates: Evidence from corporate taxation in Indonesia. American Economic Review, 111(12), 3827-71.

Baudot, L., Johnson, J. A., Roberts, A., & Roberts, R. W. (2020). Is corporate tax aggressiveness a reputation threat? Corporate accountability, corporate social responsibility, and corporate tax behavior. Journal of business ethics, 163, 197-215.

Chyz, J. A., Gaertner, F. B., Kausar, A., & Watson, L. (2019). Overconfidence and corporate tax policy. Review of Accounting Studies, 24, 1114-1145.

Cooper, M., & Nguyen, Q. T. (2020). Multinational enterprises and corporate tax planning: A review of literature and suggestions for a future research agenda. International Business Review, 29(3), 101692.

Fernández-Rodríguez, E., García-Fernández, R., & Martínez-Arias, A. (2021). Business and institutional determinants of Effective Tax Rate in emerging economies. Economic Modelling, 94, 692-702.

Janský, P. (2023). Corporate effective tax rates for research and policy. Public Finance Review, 51(2), 171-205.

Shevlin, T., Shivakumar, L., & Urcan, O. (2019). Macroeconomic effects of corporate tax policy. Journal of Accounting and Economics, 68(1), 101233.

Slattery, C., & Zidar, O. (2020). Evaluating state and local business incentives. Journal of Economic Perspectives, 34(2), 90-118.

Wen, W., Cui, H., & Ke, Y. (2020). Directors with foreign experience and corporate tax avoidance. Journal of Corporate Finance, 62, 101624.

write

write