The sustainability of a business is dependent on multiple factors such as financial resources, revenue turnover, brand equity, and product quality. The toy industry is highly dynamic, with different organizations manufacturing the same products. The financial data determine the sustainability of the business. The generic porter’s strategy defines the ideal approach the institution can adopt to foster its sustainability. The generic strategy includes cost leadership, differentiation, and focus strategy (Steenkamp, 2017). Porter’s industrial forces allow businesses to analyze how external industrial factors such as ease of entry, industrial rival, substitutes availability, and buyers’ and suppliers’ bargaining power influence their competitiveness. Hasbro, Jakks, and Mattel operate in a similar sector.

Financial Data

| Companies | Revenue, growth | Profit | P/E Ratio | Stock Growth |

| Hasbro | 5.1 billion (8.5%) | 367 million | 18.6 | -1.24% (83.83) |

| Mattel | 4.58 billion (5%) | 126 million | 16.3 | -0.39% (22.63) |

| Jakks | 600 million | -42 million | 10.7 | -2.75% (14.17) |

The research shows that Hasbro has vas financial resources than other companies in the toy industry. The high financial resources arise from its strong brand equity, which increases its share value and margin generation. Hasbro has the highest share value of $83.83 compared to Jakk’s $14.17 or Mattel’s $22. The high stock values show that the companies achieve higher operational stability than other institutions. Hasbro is, therefore, the most sustainable company among the three due to its high profit-to-earnings ratio. The company has a P/E ratio of 18.6, above S&P 500 companies that post between 13 and 15 PE. Mattel has a fairly higher market positioning with ideal PE and high revenue and net profits. Mattel posted revenue of $4.58 billion, showing it has considerable market equity. The sustainability of Jakks company is under threat due to its lower revenue and negative profits. In 2020 the company lost 42 million with a revenue of $600 million. Thus, the finding shows Hasbro has strong financial sustainability, followed by Mattel, while Jakks lacks competitiveness.

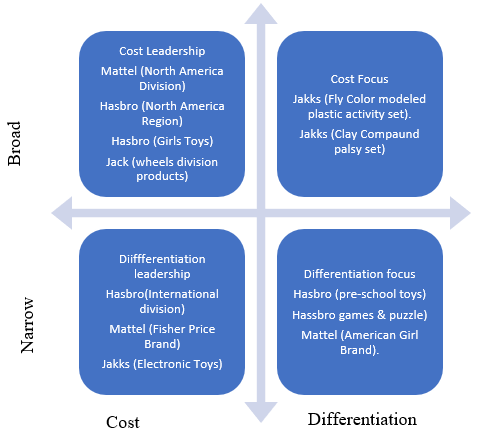

Generic strategy diagram

The finding shows that the companies do not rely on the same generic strategy to achieve market sustainability. The business employs different approaches based on the market segments they target. For instance, Hasbro adopts a cost leadership strategy in its girl toys and North American region. However, the company also utilizes differentiation leadership and differentiation focus to develop products with high-value propositions to attract new customers. The differentiation focus strategy involves developing products with unique features that separate them from the competitors’ products (Dees, 2019). Hasbro and Mattel have high market share and turnover because they extensively invested in differentiation leadership and focus strategies. The differentiation focus strategy has enabled the two companies to diversify their product portfolio by including American Girl (Mattel) and Puzzles and games (Hasbro) to expand the market share. The table shows that Jack relies on cost leadership and cost focus strategy, which affects its revenue generations. Cost leadership involves selling products below market price to attract price-conscious customers.

Most important Porter’s Five forces

The first important part of the five forces is the industrial rivalry amongst the companies in the toy industry. Hasbro, Mattel, and Jakks face significant industrial rivalry, which affects their sustainability and revenue generation. Customers are loyal to organizations that develop products that offer high-value propositions. Industrial rivalry affects a company’s market share as they have to invest in robust marketing strategies to maintain and attract new customers. Industrial rivalry incorporates the tussle between price sensitivity and brand loyalty (Hitt et al., 2017). For instance, Hasbro has high brand equity, which means more customers purchase corporate products due to its value proposition. However, some companies like Jakks sell their products at a lower price to attract price-conscious customers.

The second significant force that affects the toy industry is the availability of substitutes. Numerous substitutes mean customers can easily switch from corporate’’ products to the rival’s brand. High substitute availability implies companies with low brand loyalty face higher switching to institutions that invest in the differentiation strategy. Or offer products at lower costs. The product substitute requires institutions to invest extensively in research and development to identify contemporary toys that appeal to children.

Toy Industry Components

The toy industry is witnessing exponential growth in technological, automatic, and electric toys. With the advancement in technology, most children prefer electric equipment. Thus, the electronic toy market continues to increase as parents provide their children with ideal toys to enhance their technological curiosity. The clay toy products and building blacks are growing at a standard rate considering most institutions still encourage their students to use blocks and clay for different mold products. Besides, gender-based toys such as dolls and cars also operate at a standard rate. The slowest toy market is mechanical car toys which are play, do not inspire contemporary tech-savvy children.

Competitive Position

Hasbro is the most competitive toy company, followed by Mattel, with Jakks being the least developed firm. Hasbro is the most competitive in terms of past performance Because, over the last three years, the company posted a cumulative revenue of $16 billion. Over the same period, Mattel made a revenue margin worth $13 billion. Jakks has made less than $3 billion over the last three years showing its slow market response. Mattel shows a more promising trajectory than Hasbro and Jakks in terms of future competitiveness. Jack has a stock growth rate of -0.39%, which is higher than the two companies. The high stock growth shows the company is increasing its market position.

In conclusion, companies in the toy industry face significant competition, threatening their sustainability. The companies must provide superior satisfaction to customer needs to achieve market competitiveness. Hasbro has greater market sustainability and brand equity, evidenced by its high revenues, profit, and P/E. Mattel has more promising competitiveness considering its higher stoke growth. The sustainability of Jakks is threatened due to its low revenue and consistent loss.

References

Dees, G. (2019). Strategic Management: Text and Cases. (9th Ed.). McGraw-Hill.

Hitt, M. A., Ireland, D., & Hoskisson, R. E. (2017). Strategic Management: Competitiveness & Globalization Concepts and Cases 12e. Centage Learning.

Steenkamp, J. B. (2017). Global brand strategy: World-wise marketing in the age of branding. Springer.

write

write