Land Rover, a prominent entity listed on the London Stock Exchange, understands the significance of transparency and accountability in fostering trust among its stakeholders. Hence, the company diligently produces comprehensive annual reports and accounts. These documents serve as essential tools for stakeholders to make well-informed decisions and assess Land Rover’s financial health and performance. Mainly, stakeholders direct their attention to critical financial statements, including the statement of profit or loss, the statement of financial position, and the cash flow statement. The statement of profit or loss, commonly referred to as the income statement, is a focal point for stakeholders seeking insights into Land Rover’s revenue generation and profitability. Shareholders meticulously analyze revenue, expenses, and net income to evaluate the company’s ability to generate returns on their investment. Prospective investors scrutinize these figures to assess Land Rover’s earning potential and growth prospects before committing their capital. Financial analysts delve into the income statement to discern operating performance trends and project future earnings, providing valuable insights for investment decision-making.

Equally crucial is the statement of financial position, also known as the balance sheet, which offers a snapshot of Land Rover’s financial standing at a specific point in time. Creditors, including banks and bondholders, closely examine the balance sheet to gauge the company’s economic stability and its capacity to meet debt obligations (Gutiérrez-Ponce, 2023, p.178). They assess liquidity ratios and the composition of assets and liabilities to ascertain Land Rover’s short-term solvency and overall financial health. Company management utilizes the balance sheet to make strategic decisions regarding investments, financing, and resource allocation, leveraging insights gleaned from the company’s financial position.

Moreover, stakeholders turn their attention to the cash flow statement, which provides a comprehensive overview of Land Rover’s cash inflows and outflows from operating, investing, and financing activities. Investors and creditors analyze cash flow patterns to assess the company’s ability to generate cash and manage liquidity effectively. Management utilizes this statement to monitor cash flows, identify trends, and make informed decisions regarding capital expenditures, dividend payments, and financing activities. Financial analysts scrutinize the cash flow statement to evaluate the quality of earnings and forecast future cash flows, aiding stakeholders in assessing Land Rover’s economic viability and resilience.

In addition to these critical financial statements, stakeholders may explore supplementary sections of Land Rover’s annual reports, such as management discussion and analysis, notes to the financial statements, and auditor’s reports. These sections provide deeper insights into the company’s operations, risks, and economic performance, enhancing stakeholders’ understanding and enabling them to make well-rounded assessments. Overall, Land Rover’s annual reports and accounts play a pivotal role in fostering transparency, allowing the stakeholders to make informed decisions, and ensuring accountability in corporate governance.

An essential instrument for stakeholders evaluating Land Rover’s financial performance and profitability is the income statement, also known as the statement of profit or loss. The company’s revenue generation, expenses, and net income are all important indicators of its financial health and possible returns on investment. Therefore, investors, potential investors, and financial analysts closely examine this statement to learn more.

Due to their ownership stake in the business, shareholders have a stake in Land Rover’s financial success. To evaluate the company’s capacity to produce a profit and provide investors with a return on their investment, they meticulously scrutinize the income statement. Through an examination of revenue patterns, cost control, and net income, shareholders are able to assess how well Land Rover runs its business and how much wealth it can generate for its owners.

In a similar vein, prospective investors assess Land Rover’s earning potential and growth prospects prior to making a capital investment by consulting the income statement. Investors can evaluate the attractiveness of purchasing Land Rover stock by looking at revenue growth rates, cost structures, and profitability margins. Strong revenue growth and healthy profit margins on an income statement can indicate potential investment opportunities and entice investors to put money into the business (Fernandes, 2022, p.455). When analyzing the income statement to give investors advice and insights, financial analysts are essential. They examine operational performance in detail as well as profitability trends, looking at things like net income, operating expenses, and gross profit margins. Financial analysts can determine Land Rover’s business operations’ strengths, shortcomings, and areas for improvement by tracking these measures over time and comparing them to those of other companies in the industry. Future earnings projections and client investment suggestions are based on this analysis.

Stakeholders also closely monitor non-financial elements of the income statement, such as the breakdown of expenses and the composition of revenue. Gaining knowledge about the revenue streams and types of expenses will help you better understand Land Rover’s cost structure, market positioning, and business model. A varied revenue base, for instance, can suggest resilience to market swings, while high operating costs in relation to revenue might raise questions about operational sustainability and profitability. The statement of profit or loss is an integral part of Land Rover’s annual reports since it gives interested parties the data they need to assess the profitability and financial performance of the business. In order to appraise Land Rover’s capacity to produce returns on investment, appraise earning potential, and make well-informed investment decisions, stakeholders, prospective investors, and financial analysts examine revenue, expense, and net income numbers. Stakeholders can obtain critical insights into Land Rover’s business operations and financial health by comprehending the subtleties of the income statement and its underlying components. This will empower them to make well-informed decisions about their investment in the firm.

The statement of financial position, which is also commonly known as the balance sheet, is an essential document for stakeholders who are interested in gaining an understanding of Land Rover’s financial standing and stability. Among the most critical stakeholders, creditors, firm management, and regulators are mainly dependent on the balance sheet for a variety of reasons. Each of these reasons highlights the sheet’s paramount significance in terms of decision-making, strategic planning, and regulatory compliance. In the eyes of Land Rover’s creditors, the balance sheet is a window into the company’s financial stability and its ability to meet its responsibilities regarding its debt (Zhong et al., 2022, p.9472). By doing a thorough analysis of the company’s assets, liabilities, and equity, creditors are able to determine whether or not the business is capable of producing sufficient cash flows to ensure that its obligations are paid. Creditors are particularly interested in liquidity ratios, such as the current ratio and the quick ratio, because these ratios offer insights into Land Rover’s capacity to satisfy its immediate financial obligations and its ability to remain solvent in the short term. A healthy balance sheet, which is characterized by a solid asset base relative to liabilities, instills trust in creditors, thereby reducing the risk of default and making it easier to get favorable financing terms.

Similarly, the management of the company relies on the balance sheet to acquire a complete understanding of Land Rover’s financial condition and to provide information that is useful for making strategic decisions. The management team is able to evaluate the investment portfolio and capital structure of the company by analyzing the asset composition. This allows them to find chances for optimization and growth. A thorough examination of liabilities, which includes debt obligations and accounts payable, is carried out in order to guarantee responsible financial management and to reduce the possibility of excessive leverage. Equity indicators, which include retained earnings and shareholders’ equity, offer valuable insights into the capitalization of Land Rover as well as the company’s capacity to deliver sustainable returns for its owners. Having access to this information enables management to devise strategic initiatives, effectively allocate resources, and successfully navigate hurdles in order to improve Land Rover’s financial performance and ensure the company’s continued sustainability over the long term.

To add insult to injury, regulators play a significant part in maintaining compliance, accountability, and transparency inside the financial markets (Buallay et al., 2022, p.124). The balance sheet of Land Rover may be examined by regulatory authorities in order to confirm that the company complies with accounting standards, regulatory obligations, and principles of corporate governance. Regulators can evaluate the accuracy and reliability of financial reporting through the examination of asset valuations, debt classifications, and equity disclosures. This helps to protect the integrity of financial information as well as the interests of investors. In addition, authorities may keep an eye on critical financial parameters, such as leverage ratios and liquidity measurements, in order to identify systemic risks and reduce any threats to market stability. Regulators maintain the integrity of the financial system through stringent oversight and enforcement, which in turn helps to cultivate trust and confidence among participants, including investors and stakeholders.

In essence, the balance sheet acts as a linchpin in the system of financial reporting that Land Rover employs. It provides stakeholders with significant insights into the company’s financial condition, stability, and performance. The balance sheet is utilized by creditors in order to evaluate the creditworthiness of a company and to manage the risk associated with financing. In contrast, the management of the company uses it to inform strategic decision-making and resource allocation. The balance sheet is utilized by regulators in order to guarantee compliance with accounting standards and regulatory obligations, hence protecting the integrity of the financial markets. When taken as a whole, these stakeholders highlight the paramount significance of the balance sheet in terms of its ability to facilitate transparency, accountability, and informed decision-making within the financial ecosystem.

Stakeholders carefully examine Land Rover’s cash flow statement in addition to the statement of profit or loss and the statement of financial position in order to learn more about the company’s cash flow dynamics and liquidity management. A thorough summary of the cash inflows and outflows from financing, investing, and operating operations is given in this statement, which provides stakeholders with vital information to evaluate Land Rover’s capacity to create cash and efficiently manage its cash flows. Creditors and investors use the cash flow statement to assess Land Rover’s financial flexibility and liquidity situation. Investors and creditors can determine the company’s capacity to earn cash from its primary business operations by examining cash flows from operating activities. Similar to this, Land Rover’s capital expenditures, investment activities, and financing choices can be understood through the cash flows from its financing and investing activities. Stakeholders can evaluate Land Rover’s ability to satisfy its short- and long-term financial obligations, explore development opportunities, and weather economic crises by evaluating these cash flow components.

The cash flow statement is a tool used by company management for both strategy and cash flow management. Management can see trends, foresee changes in cash flow, and make well-informed choices about capital expenditures, dividend payments, and debt repayments by keeping a close eye on cash inflows and outflows. The cash flow statement also helps management by assessing how well cash flow management programs are working and by maximizing cash flow creation across various corporate divisions and geographic areas. In order to evaluate the quality of earnings and project future cash flows, financial analysts are essential in the interpretation of the cash flow statement. Analysts can determine the underlying cash production capabilities of Land Rover’s business operations and the sustainability of its profitability by examining patterns in operational cash flows. Analysts may offer investors and stakeholders insightful information about Land Rover’s financial performance and prospective future cash flow streams by using cash flow predictions that are based on past trends and future projections.

In general, stakeholders rely heavily on the cash flow statement to evaluate Land Rover’s liquidity situation, cash flow trends, and financial flexibility. The company’s management uses this statement for cash flow management and strategic decision-making. At the same time, investors and creditors rely on it to assess the company’s capacity to create cash and manage its cash flows. Financial analysts use the cash flow statement to estimate future cash flows and evaluate the quality of earnings, giving stakeholders and investors important information. In addition to these critical financial statements, stakeholders may delve into other sections of the annual report, such as management discussion and analysis, notes to the financial statements, and auditor’s report, to gain a deeper understanding of the company’s operations, risks, and financial performance. Overall, the annual report and accounts serve as indispensable tools for stakeholders to assess Land Rover’s financial health, make informed investment decisions, and ensure transparency and accountability in corporate governance.

Conclusion:

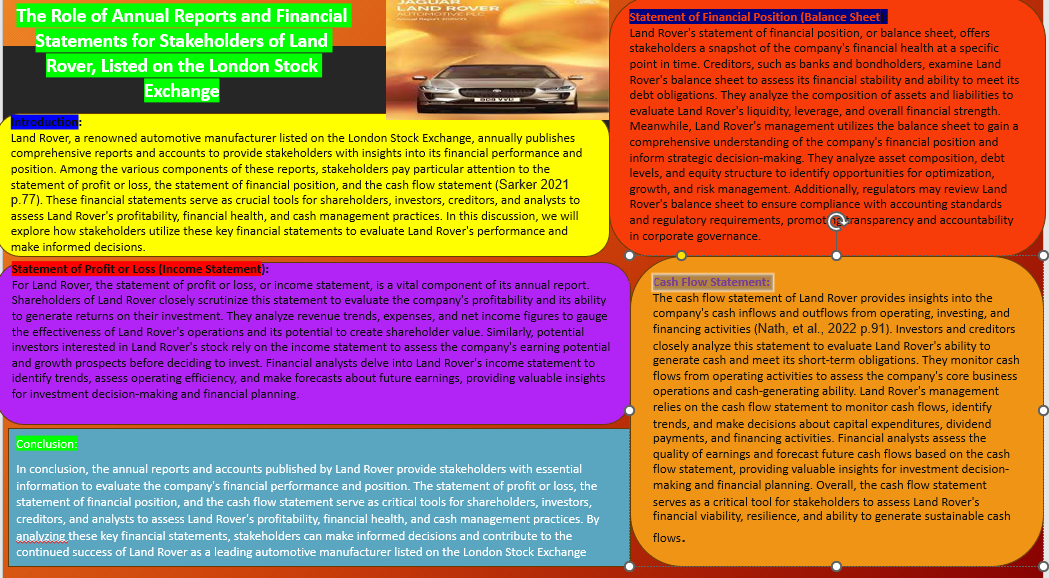

In conclusion, the annual reports and accounts published by Land Rover provide stakeholders with essential information to evaluate the company’s financial performance and position. The statement of profit or loss, the statement of financial position, and the cash flow statement serve as critical tools for shareholders, investors, creditors, and analysts to assess Land Rover’s profitability, economic health, and cash management practices. By analyzing these critical financial statements, stakeholders can make informed decisions and contribute to the continued success of Land Rover as a leading automotive manufacturer listed on the London Stock Exchange.

Poster

References

Fernandes, R.B. and Barbosa, A., 2022. Factors associated with the voluntary disclosure of the integrated report in Brazil. Journal of Financial Reporting and Accounting, 20(3/4), pp.446-471.

Buallay, A., Hamdan, R., Barone, E. and Hamdan, A., 2022. Increasing female participation on boards: Effects on sustainability reporting. International Journal of Finance & Economics, 27(1), pp.111-124.

Gutiérrez-Ponce, H., González, J.C. and Al-Mohareb, M., 2023. Examining the readability of accounting narratives derived from earnings management. Journal of Business Economics and Management, 24(6), pp.1080-1101.

Zhong, N. and Ren, J., 2022. Using sentiment analysis to study the relationship between subjective expression in financial reports and company performance. Frontiers in Psychology, 13, p.949881.

Nath, K. and Dwivedi, R., 2021. Aesthetic exploration of organizational theatrics: a case of Tata Motors’ Jaguar Land Rover acquisition. Philosophy of Management, 20(3), pp.369-386.

Sarker, A. and Mike-Hana Fongang, M., 2021. THE IMPORTANCE OF FORMULATING A UNIFORM STRUCTURE FOR NON-FINANCIAL REPORTING: A quantitative study based on the evidence from the automotive industry.

write

write