Introduction

The effect of globalization has been the rise in the presence of multinational corporations (MNCs) in developing countries such as Nigeria. MNCs provide investments and employment, however; the result of how they impact income inequality in these nations is still unknown. Nigeria as a developing economy was chosen to be researched upon as a representative case; hence this research proposal seeks to investigate the effects of MNCs on income distribution in Nigeria. Thus, the impact of business operations from MNCs on income inequality levels in Nigeria shall be assessed. Gauging these dynamics may help to set policies that will provide a balance between the best use of FDI and inequitable growth. Generally, Nigeria has a promising environment due to its developmental status and a long history of MNC participation. The study will provide empirical evidence and suggestions to facilitate developing the knowledge of foreign investments to enhance equal opportunities.

Justification

The rationale behind the study selection of the MNCs’ influence on the Nigerian economy, as the subject of analysis, follows the current trends of the increased availability of these firms in developing countries. Within the African continent, Nigeria occupies a strategic position, not just because of its topography, but because of its central location and the effect it has on the interaction between multinational corporations and growth regions. The paper provides an analysis of the rationale behind the fact that the country was a host to different MNCs even before the independence period and continues facing issues with achieving socio-economic development (Alaye, 2023).

Nigeria has been reported to be one of the countries whose high levels of income inequality have stayed steadfast, with a Gini coefficient of 35.1, as obtained World Bank report (Chancel et al., 2022). This has been a reason for concern, notwithstanding policy, resource flows and economic reforms that have been years in the making since the 1990s when China embarked on its transition to a market economy. FDI Stocks increased around USD 94 billion from 1990-2015 from USD 1 billion, (Abdulkarim, 2023). Most of this FDI is from companies working with other MNCs in extractive industries such as petroleum and mining, and also from up-and-coming industries like financial services, mobile and home communications, and consumer products.

On the other hand, scholarly research on the consequences of MNCs’ investments in terms of income inequality remains controversial. There is a contrasting study on FDI in developing countries that posits, that economic growth brought by FDI has squashed income inequality (Blomstrom et al., 1994). Additionally, Oyinlola (1995) argues that the growth has entirely benefited the elite in Nigeria. So far, most studies of FDI have concentrated on looking at the effects on overall GDP growth but there are relatively few relating to income inequalities. For instance, Osuagwu & Ezie (2013) looked into the general effects of MNCs in Nigeria and they did not examine the distributional outcomes of incomes. On the same note, (Saucedo et al., 2020) noted that FDI contributes to higher inequality in wages between skilled and unskilled labour but did not link this to wider income disparities. Thus, there is a gap in understanding aggravating MNC investment and variation in patterns of income inequality in Nigeria.

This study seeks to provide some answers by looking at the impact of MNC business operations in several key sectors on the outcomes in income distribution. Do MNC recruitment processes create high-wage jobs among the elite? Have the sectors emerging into new firms made the labour division between skilled and unskilled labour greater? This approach will help in providing evidence to novel approaches to policymakers who are trying to balance the growth from FDI with equitable participation. It will also add essential background to MNCs’ effects on the development of inequalities in developing countries.

Aim

To measure the effect of income and market inequality due to multinational corporate business activities in Nigeria.

Objective

- To identify knowledge gaps regarding the specific effects of FDI, MNCs, and income inequality on the income distribution among developing countries, literature reviews conducted for these areas will also be analyzed.

- Analyze secondary data relating to the trends of MNC investments, income inequalities, and some relevant economic forces that have characterized Nigeria for the past 30 years.

- Explore the correlation between macroeconomic factors and income inequality in the sectoral composition of MNC investment by applying regression models.

- Conduct a study using primary data from surveys and interviews that look at how impacts of MNCs on the income differential between skilled and unskilled labor.

- Draw conclusions on how operations of the MNCs based in developed countries contribute to the inhibition of income inequality and provide recommendations for policymakers, as well as suggest directions for future research.

Literature review

The impacts and role of multinational corporations in the developing world have attracted scholars’ interest in academic literature. The emphasis of this review is the theoretical and empirical evidence on how MNC activity impacted on Nigeria’s economic growth trends and patterns of income distribution across households. About the market–seeking aspect, Dunning’s (2000) OLI paradigm and the view of Hymer (1976) on the exploitation of firm-specific advantages into foreign direct investment (FDI) can be used to provide context. Network effects and the role of government support are explored in the New Trade Theory (Krugman, 1979) as the factors that can help explain globalisation trends that foster the growth of MNCs. This analysis of the origins and impacts of the strengthening of MNC involvement in Nigeria has the underlying foundational frameworks.

Abdulkarim (2023) provides empirical evidence that the impact of inward FDI flow has contradicting effects on the growth rate; some argue that FDI inflow stimulates GDP while others show limited or negative impacts. A more subtle position is presented by Ezeoha et al. (2022), who posit that it is not MNCs in themselves that provide the upward development potential, but suitable domestic policy creates the conditions for technological diffusion from foreign to local firms, thus creating wider spillovers. Nevertheless, most evidence indicates that capital accumulation and knowledge spillovers have been limited in Nigeria, which is holding the growth potential back.

Several analyses ascribe to entrenched MNCs the substantial level of regional and worker-based inequality of income growth and the gradual-growing inequality. Ibarra‐Olivo and Rodríguez‐Pose (2022) support this from broader studies of FDI presence in the widening of spatial disparities of fortune within countries. On the other hand, Saucedo et al. (2020) warn that high-skilled workers appear to enjoy more upside to the foreign presence than those in low-skill ones. It corresponds with the Nigerian context, which is characterized by the increasing divide between skilled and unskilled labour (Folawiyo 2022)

Thin capitalization measures that reduce the ability of MNCs to shift intra-firm lending to a lower-taxed territory have limited tax revenue collection in Nigeria a country that is crucial for development budgeting. Additionally, it is predicted that MNCs contributed about USD182 billion in illegitimate funds from 2006-2017 which reduced policy space for efficient investment (Gradín, 2021). These processes are indicative of the difficulties with the capability of Nigeria’s governance.

Methodology

Sampling Strategy

Stratified random sampling is used because the population of the Nigerian people in this model is broken into relevant strata by key demographics to ensure a proportional representation of different categories of people. The four strata of location will be created for the whole urban and rural Nigeria. In locations considered, representation quotas have been drawn for gender, age and income levels. This should result in a sample that looks similar to those of the population and hence enhanced generalization. Simple random sampling is based on proportional segmentation of 100 of the respondents; the sample selects respondents within each stratum. In stratified sampling, the groups with distinct demographic features are represented to reflect that diversified people may be affected by MNCs in various ways (Omolade et al., n.d.). Proportional quotas increase representativeness and allow us to draw a valid conclusion from our sample to the population from which it is drawn.

Data Collection Tools

Perceptions of MNCs’ impacts based on the survey questionnaires conducted online include structured questionnaires examining responses to MNCs’ contributions and prevalent concerns on a 5-point Likert scale. The question sequencing moves from large domains such as economic implications to specific issues ranging from equal pay, cultural influences and so forth. Standardized terms discourage fluctuations/biases of answers in responses to the hypothesis. Online administration gives access to parents from broader segments. Sequencing eliminates order effects and sets questions to the point.

In-depth semi-structured interviews offer a scope under which experts can elaborate on the nature of formal and informal policies and practices that were shaping the MNC-government engagement. A semi-structured interview protocol focuses on core issues, while still allowing participants to elucidate discussions from an insider perspective (Gabanatlhong et al., 2022). For the humanization of research using video call platforms, this type of engagement allows interactive and synchronous interactions between researcher and participants. Semi-structured interviews give experts the freedom to provide in-depth qualitative insights on difficult policy issues based on their knowledge. An interview protocol is designed in such a way that consistency is created among respondents.

Data Analysis Techniques

The descriptive statistics like frequencies, means and interrelationships of response patterns across the demographics will be derived from the numeric survey data analysis using IBM SPSS Statistics (Zhao et al., 2021). Data for qualitative analysis would include data from open-ended questions and interview transcripts subjected to thematic analysis to decode shared ideas. An iterative coding process elicits important themes that can help explain issues in MNC relationships and regulatory challenges. Methodological triangulation is done by comparing data derived from survey stats and qualitative patterns. Tendencies reflected in survey responses are quantified by statistical analysis. Within thematic analysis, it is used to systematically note recurring themes and explanations perceived by experts. Through this, the qualitative and quantitative findings combined can make method triangulation to gain a broad perspective.

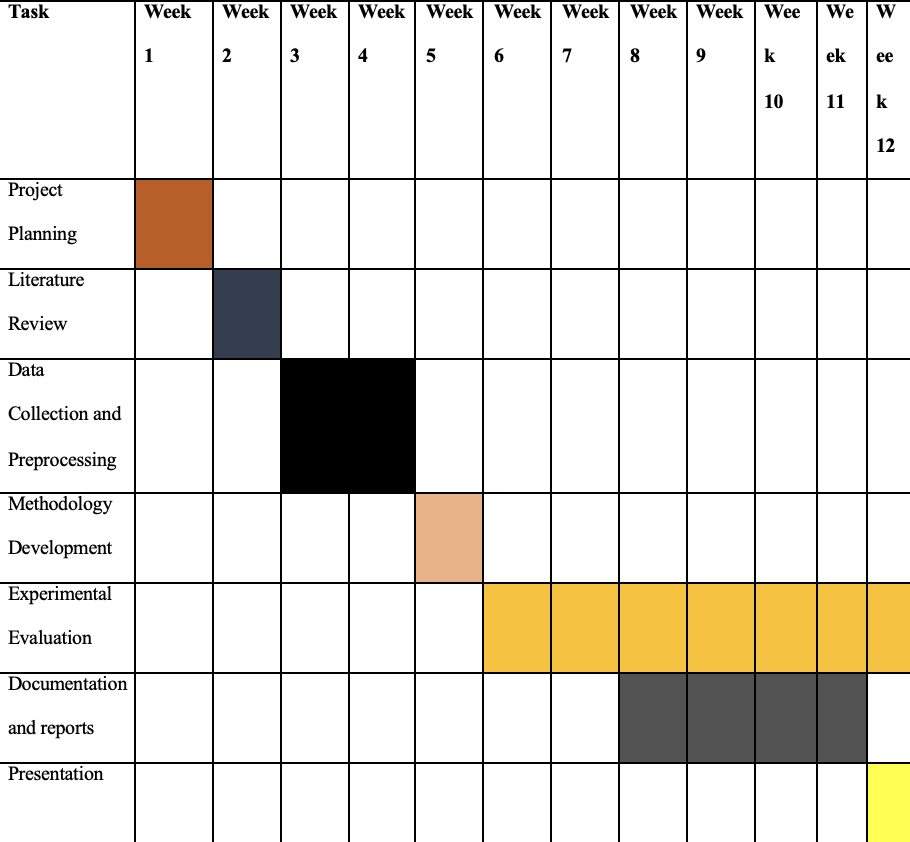

Gantt chart

References

Abdulkarim, Y. (2023). A systematic review of investment indicators and economic growth in Nigeria. Humanities and Social Sciences Communications, [online] 10(1), pp.1–13. doi:https://doi.org/10.1057/s41599-023-02009-x.

Agbai, E., Okafor, A. and Egbedoyin, F. (2021). Comparative Study of Education Funding in Nigeria. [online] Social Science Research Network. Available at: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3798642.

Alaye, A. (2023). Multinational Corporations and the Socio-Economic Unrest in the Niger-Delta Region of Nigeria. Wukari International Studies Journal, [online] 7(1), pp.15–15. Available at: https://wissjournals.com.ng/index.php/wiss/article/view/112 [Accessed 2 Feb. 2024].

Aworom, A. (2013). Multinational Corporation and Development in Nigeria. African Journal of Culture, Philosophy, and Society, 3(1), 62-67.

Chancel, L., Piketty, T., Saez, E. and Zucman, G. (2022). World Inequality Report 2022. [online] Google Books. Harvard University Press. Available at: https://books.google.com/books?hl=en&lr=&id=FQGWEAAAQBAJ&oi=fnd&pg=PA2&dq=%22The+Impact+of+Multinational+Corporations+on+Income+Inequality+&ots=yQxFOF_IOg&sig=t5317jxw2P0MFKgglHU71ohol6U [Accessed 2 Feb. 2024].

Eluka, J., Ndubuisi-okolo, P.U., & Anekwe, R.I. (2016). Multinational corporations and their effect on the Nigerian economy. European Journal of Business and Management, 8(9).

Ezeoha, A., Akinyoade, A., Amobi, I., Ekumankama, O., Kamau, P., Kazimierczuk, A., Mukoko, C., Okoye, I. and Uche, C. (2022). Multinationals, Capital Export, and the Inclusive Development Debate in Developing Countries: The Nigerian Insight. The European Journal of Development Research, [online] 34. doi:https://doi.org/10.1057/s41287-021-00500-2.

Folawiyo, D.M. (2022). EVALUATION OF THE ROLE OF MULTI-NATIONAL CORPORATIONS, MNCs, ON NIGERIAN ECONOMY (A STUDY PZ CUSSONS NIGERIA PLC ILUPEJU, LAGOS and CABURY NIGERIA PLC IKEJA, LAGOS). ir.mtu.edu.ng. [online] Available at: http://ir.mtu.edu.ng/xmlui/handle/123456789/1061 [Accessed 2 Feb. 2024].

Gabanatlhong, B., Garcia-Bernardo, J., Iyika, P. and Palanský, M. (2022). Profit shifting by multinational corporations: Evidence from transaction-level data in Nigeria. [online] www.econstor.eu. Available at: https://www.econstor.eu/handle/10419/259392 [Accessed 2 Feb. 2024].

Gradín, C. (2021). WIID Companion (March 2021): integrated and standardized series. [online] Available at: https://www.wider.unu.edu/sites/default/files/Publications/Technical-note/PDF/tn2021-5-WIID-companion-integrated-standardized-series.pdf [Accessed 2 Feb. 2024].

Granger, C., & Newbold, P. (1974). Spurious regression in econometrics. Journal of Econometrics, 2(2), 111-120.

Ibarra‐Olivo, J.E. and Rodríguez‐Pose, A. (2022). FDI and the growing wage gap in Mexican municipalities. Papers in Regional Science. [online] doi:https://doi.org/10.1111/pirs.12707.

Nwidobie, B.M. (2021). Income inequality and tax evasion in Nigeria. International Journal of Critical Accounting, [online] 12(3), p.206. doi:https://doi.org/10.1504/ijca.2021.116345.

Odunlami, S.A., & Awolusi, O.D. (2015). Multinational Corporation and Economic Development in Nigeria. American Journal of Environment Policy and Management, 1(2), 16-24.

Omolade, O., Funmilayo, O., Isaiah, O. and Esther (n.d.). Environmental, Social, and Governance Disclosure and Financial Performance of Multinational Companies (MNCs) in Nigeria. [online] Available at: https://www.ijmsssr.org/paper/IJMSSSR00749.pdf [Accessed 2 Feb. 2024].

Onodugo, V.A. (2013). Multinational Corporation and employment and Labor conditions of Developing Countries: The Nigerian Experience. European Journal of Business and Social Science, 1(6), 67-76.

Osagwwu, G.O., & Ezie, O. (2013). Multinational Corporation and the Nigerian Economy. International Journal of Academic Research in Business and Social Science, 3(4).

Otuya, S., Omoye, A. and Article (n.d.). Thin capitalisation, effective tax rate and performance of multinational companies in Nigeria. [online] Available at: https://www.zbw.eu/econis-archiv/bitstream/11159/6195/1/1769385754_0.pdf [Accessed 2 Feb. 2024].

Saucedo, E., Ozuna, T. and Zamora, H. (2020). The effect of FDI on low and high-skilled employment and wages in Mexico: a study for the manufacture and service sectors. Journal for Labour Market Research, [online] 54(1). doi:https://doi.org/10.1186/s12651-020-00273-x.

Udensi, E.U (2015). The Impacts of Multinational Corporations to the Nigerian Economy. International Journal of Social Science and Humanities Research, 3(2), 107-115.

UNCTAD (2000). Capital flows and growth in Africa. UNCTAD/GDS/MDPB/7, New York and Geneva: United Nations.

Wagner, C. (2019). Deducing a state-of-the-art presentation of the Eclectic Paradigm from four decades of development: a systematic literature review. Management Review Quarterly. [online] Available at: https://link.springer.com/article/10.1007/s11301-019-00160-x [Accessed 2 Feb. 2024].

Zhao, S., Liu, X., Andersson, U. and Shenkar, O. (2021). Knowledge management of emerging economy multinationals. Journal of World Business, [online] 57(1), p.101255. doi:https://doi.org/10.1016/j.jwb.2021.101255.

write

write