1.0 Executive summary

This report aims to critically evaluate various business models and other frameworks commonly used to analyze the business environment and successfully analyze the strategic alternatives accessible to firms regarding appropriateness, sustainability, and feasibility by studying the chosen case study of the BMW company. The introductory part introduces the company’s operations and product lines. Also, the article has outlined BMW’s proposed strategies. By studying the financial situation statistics, it is clear that the company’s revenue keeps rising in most annual periods. The report found that the major competitors of BMW include Audi, Mercedes, and Jaguar. The paper has used the PESTEL framework to help understand the company’s external environmental impacts. Porter’s five models helped analyze the competitive edge by studying the threats of new entrants and substitutes. The paper found that BMW has an excellent strategic position in the automobile industry regarding ranking and offering quality services. The VRIO framework examined the firm’s internal assets by assessing its valuables, scarcity, and imitability. By studying the Ansoff model, the paper found that the company has four options for achieving its targets.

Additionally, the SWOT analysis helped to examine and outline the company’s strengths and weaknesses in line with its opportunities and threats. Finally, the paper applies the SAF framework to help BMW make the decision-making process effective. The report concluded that BMW is the leading automotive company with a strong reputation, providing quality services globally and prioritizing customer satisfaction.

2.0 Introduction

The German automaker Bayerische Motoren Werke (BMW) produces and sells motorcycles, among other product lines. It conducts its daily operations across four divisions; Automobiles, Motorcycles, Financial Services, and Miscellaneous. Motorcycles cater to the high-end market, while the Automotive division handles the production, assembly, and sale of automobiles and off-road vehicles (Dobrin, 2021). The Financial Services division deals with things like leasing and credit lending. Holding and group finance are included in the other entities section. The BMW Group is the only automaker to focus on high quality across all its brands and market segments. This report will cover BMW’s proposed strategies, its financial situation, the general state of the company, and its major competitors. The report will also analyze BMW’s functioning using frameworks such as PESTEL analysis, Porter’s forces, the VRIO model, the Ansoff model, the BCG model, the SWOT analysis model, and finally, the SAF framework. Another aspect covered in the report is BMW’s strategic position. The report concludes with a logical summary of the body findings, and finally, the report has outlined the proposed future strategies in the recommendation section.

2.1 BMW’s proposed strategies

1. BMW AG aims to reduce Emissions of Co2 from manufacturing by 80 percent by 2030 by dispensing with fossil fuels in its manufacturing operations (Aicha & Abdelkader, 2022). That is the way to be environmentally, economically, and socially responsible.

2. Ensure that most of the plant’s energy needs will be met by on-site generation, with the remainder met by clean energy sources, mainly in the surrounding area. Where feasible, it will also recycle materials like metal scraps and milling shavings (Pozo & Carrió, 2013). Electric vehicles and rail services will meet the plant’s transportation needs.

3. BMW plans to utilize real-time data to reduce reaction times, increase transparency, and fine-tune production worldwide. To improve factory productivity and oversight, digital twins will be built using virtualization, predictive analysis, and artificial intelligence (Chesnokova, 2021).

4. BMW’s mission is to develop and manufacture cutting-edge motor vehicles that inspire a sense of emotional connection and contentment in its buyers (Chesnokova, 2021).

2.2 BMW’s financial analysis

Incomes for the BMW Group from 2009 to 2022 are discussed in the table below. For instance, the net income profit during the 2021 year was $129.45 B, and that of 2022 was $139.79 B higher than that of the previous year. The complete integration of BMW Brilliance Automobile Ltd., increased pricing, and favorable product-mix impacts are to thank for this upturn (Datta, 2010). During the yearly general meetings, the firm plans to recommend a dividend of € 8.50 per share of ordinary stock. The firm demonstrates resiliency, particularly in the face of adversity, and it can foresee and respond swiftly to changes in the economic climate (Hwee, 2015). The BMW Group overcame challenges and capitalized on chances for profitable expansion thanks mainly to its highly adaptable and efficient operations.

The firm’s most recent financial reports show that BMW’s current revenue (TTM) is $149.79 B.

Earning history for BMW Group between 2009 to 2022 is outlined as follows:

| Year | Revenue | Change |

| 2022 (TTM) | $139.79 B | 7.99% |

| 2021 | $129.45 B | 12.34% |

| 2020 | $115.23 B | -1.1% |

| 2019 | $116.51 B | 1.75% |

| 2018 | $114.50 B | 0.93% |

| 2017 | $113.45 B | 9.16% |

| 2016 | $103.93 B | 1.92% |

| 2015 | $101.97 B | -2.57% |

| 2014 | $104.67 B | 3.5% |

| 2013 | $101.12 B | 1.12% |

| 2012 | $100.00 B | 5.48% |

| 2011 | $94.80 B | 19.14% |

| 2010 | $79.57 B | 11.48% |

| 2009 | $71.37 B |

2.3 General state of the company

BMW cuts 2022 profit margins as Ukraine war worsens supply chain issues

In light of distribution network interruptions resulting from the war in Ukraine, BMW publicly stated that it is lowering its 2022 profit margin prediction. Due to a potential scarcity of Ukrainian-made wire harnesses, BMW warned that its 2022 vehicle production might be threatened (Chesnokova, 2021). As a result of the fight, BMW expects the margins before interest and taxes for its automobile division to fall between 7 percent and 9 percent. The carmaker had hoped to increase vehicle deliveries this year but now anticipates levels similar to 2021. BMW is working on new battery technology to have completely electric cars account for half of its worldwide sales by 2030 (Wimmer, 2014).

2.4 Competitors of BMW

Due to its high demand and widespread recognition, BMW faces stiff competition from many other automakers. Some of BMW’s main rivals in this piece.

- Audi

Audi, a major BMW rival, is a multinational automaker specializing in high-end automobiles. The firm started operations in 1910 and has its headquarters in Germany. Around eleven factories represent the firm’s output across nine different nations. Many high-end, luxurious vehicles are available, and their engines are rather powerful (Underwood, 2012). Audi automobiles are aimed squarely at affluent executives and professionals, giving them a premium market share. The organization has made enormous strides thanks to cutting-edge concepts and technology.

- Mercedes

Mercedes-Benz is a German automobile manufacturer that expanded internationally in 1926. It is a Daimler AG subsidiary with production sites in 27 different nations. It is well-known for its innovative products, stable finances, and focus on car safety. It is a formidable rival to BMW in the emerging market (Drobyazko et al., 2019).

- Jaguar

Jaguar has been producing high-end automobiles since 1935. Jaguar Land Rover is the manufacturer, and Tata Motors just acquired them. The designers and engineers at this organization have created a striking design that people cannot help but take a second to admire (Schindlbeck et al., 2020). After being acquired by Tata Motors, sales increased. The business moved to position 55 on the 2016 Auto 100—the most significant automobile on the market resulting from the corporation’s extensive research and development efforts.

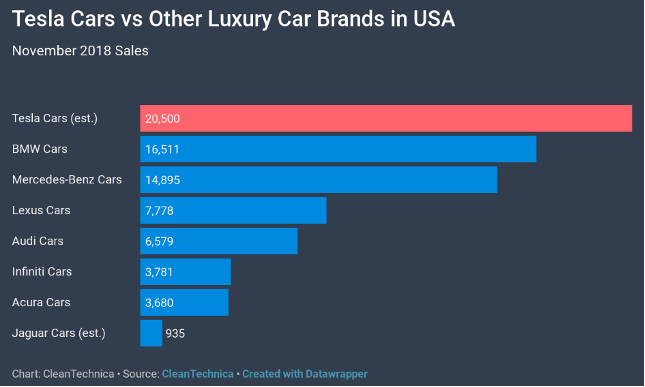

The graph below shows some of the major rivals of BMW, with Tesla Inc. being the leading and BMW is the second in terms of annual revenues (2021-2023), which was done by 2021 Consumer Electrics Shows (Schindlbeck et al., 2020). Mercedes Benz ranked third position, and from the observation, the difference in terms of annual revenue is low, meaning their brands are also valuable.

3.0 Review of Literature

3.1 Review of Domestic Literature Research

3.2 Discussion

3.21 BMW PESTEL Analysis Report

BMW’s PESTLE Study looks at the company’s strategies in light of legal and environmental considerations and political and economic aspects.

1. Political Factors

BMW is one of the highest global luxury automakers. However, it has been hit hard by the intensified trade dispute between the United States and China and Britain’s intention to leave the European Union. Taxes on European Union imports of aluminum and steel into the United States were raised, and tariffs on U.S. exports to China were raised as well (Kukkamalla et al., 2020). In other words, Brexit. As a result of tighter import restrictions, the firm may see higher expenses and lower volume if Britain leaves the European Union.

2. Economic Factors

BMW relies heavily on sales in the U.S. and China, making the corporation vulnerable to economic instability in both regions. BMW is decreasing its earnings before taxes and return on capital employed due to investments in electric drivetrain technologies and increasing manufacturing sites (Scott & Burton, 2013). The car industry is also predicted to contract in 2023, with both the United States and China showing signs of contraction.

3. Social Factors

More than 150 countries worldwide are represented by the three distinct branches of the BMW Group; automobiles, motorbikes, and financial services. Its primary goal is to boost client satisfaction by providing ancillary services like BMW CarData and BMW Connectivity (Jun & Park, 2016). The Mini employs the “BMW Connectivity” service, while the Cardata service enables custom solutions.

4. Technological Factors

BMW Group has established a complex dedicated to autonomous vehicles in Germany and a new structure in Beijing, China, to investigate and incorporate technology such as machine learning into its solutions. Modern electronic services and cutting-edge architecture will benefit from these workspaces (Kauerhof, 2017). BMW should keep working to improve the security of their systems and the data they save for their clients since cyber threats are likely to persist.

5. Legal Factors

BMW Group has had a number of legal issues, such as those involving faulty engines, 3,000,000 vehicles produced between 2007 and 2011, and unexplained fires in parked BMWs (Dobrin, 2021). The South Korean federal levied a hefty punishment of $9.8 million on the BMW Group for allegedly covering up engine fire issues.

6. Environmental Factors

The BMW Group has long been well-known for its positive impact on the environment. Since 2000, the organization has funded the United Nations Environment Programme. The Group pioneered the establishment of the position of environmental officer within the automotive industry. The carbon dioxide emissions of BMW Group cars sold in Europe have been cut by 45% (Shtal et al., 2018).

3.22 SWOT Analysis of BMW

The SWOT framework may evaluate a firm’s opportunities, challenges, strengths, and weaknesses. In this way, a corporation may aim to improve its weak spots and capitalize on its strengths, reducing its risk exposure.

1. Strengths

- Global Reach

BMW is a German automaker that produces three distinct lines; the BMW, the MINI, and the Rolls-Royce. BMW produces automobiles, motorbikes, and airplane engines (Madsen, 2017).

- Strong R&D Department

Recent technological developments have established it as a frontrunner in the upscale market. It has distinguished itself in the market by constantly improving and innovating its processes (Torquati et al., 2018).

- Brilliant Advertising

With clever advertising, the corporation has established itself as a premium name in the car sector. BMW is also quite active on social media platforms like Instagram and Youtube. They have amassed a significant following, and they put it to good use by sharing information about their business via engaging posts (Sathe, 2022). Learn cutting-edge social media marketing methods with our Facebook and Instagram advertising courses.

2. Weakness

- Limited Market Size

The company’s high prices make its commodities unaffordable in countries such as India that are developing, yet the developed ones can buy them. BMW’s potential client base in India is lower due to the country’s large middle class (Sathe, 2022).

- Increasing debt

Due to massive spending on autonomous driving technology and electric cars, the company’s debt is above €60 billion. High amounts of debt prevent businesses from adjusting to long-term investments in sectors like research and development, which stunts their growth (Subhash, 2022).

- Reducing Market Share

Purchases of MINI and Rolls-Royce are diminishing behind those of BMW. The industry plays a crucial role in the firm’s management. The corporation may incur losses if competitors introduce superior items or customers adopt new preferences (Subhash, 2022).

3. Opportunities

- Newer Models

To grow, BMW must expand into new areas and use technological advances to develop groundbreaking products. The addition of new series allows the organization to diversify its offerings (Dobbs, 2014).

- Lower Price Segment

With some creative pricing, the corporation may attract a broader range of customers by making automobiles within the middle class’s reach.

- Increasing Affluence

BMW has a fantastic chance to significantly boost its earnings and sales due to the shifting customer preference for higher-end brands (Dobbs, 2014).

4. Threats

- Tough Competition

Regarding automobiles, BMW’s luxury brand rivals include Audi and Benz. Audi, Mercedes-Benz, Lamborghini, Toyota Motor Corporation, Nissan Motor, Honda, Hyundai, Daimler, and Porsche are some of BMW’s main rivals (Omsa et al., 2017).

- COVID-19

Since the epidemic began, the corporation has experienced significant financial losses, customer preferences have shifted significantly, and fewer people are buying expensive automobiles. Because it relies on the luxury market, BMW faces serious danger from this development.

- Increasing Petroleum Prices

People are shifting away from gas-powered automobiles, a concern for the corporation because of rising gas prices. Maintaining the firm’s market dominance requires constant innovation (Omsa et al., 2017).

3.23 BMW’s critical evaluation using SAF framework

The suitability, acceptability, and feasibility framework may help you make your decision-making process more transparent by allowing you to evaluate potential courses of action in light of these three factors. In this context of BMW’s business practices, the specifications are outlined as follows:

1. Suitability

Suitability refers to how well the planned techniques work in practice, specifically how well they meet the target audience’s needs. BMW uses cutting-edge research and development to produce distinctive and elegant vehicles. BMW’s continued success as a global leader in the car market proves that the company’s current strategy is working (Tanwar, 2013). Its marketing techniques, such as the widespread use of the internet, have helped the company expand its share of the minicar industry and secure its position within that sector. Its industry development approach has been well received since it is based on a broad search of markets in established and emerging nations (Sathe, 2022).

2. Acceptability

It includes potential outcomes, consumer response, financial gain, and danger. Despite the company’s excessive investment in developing a distinctive model, BMW’s financial results are still promising. However, BMW must reevaluate its development plan to reduce manufacturing costs and potential financial concerns (Subhash, 2022). So that they may keep or increase their profit, BMW would be wise to do an extensive market penetration study.

3. Feasibility

A plan’s feasibility depends on whether the necessary assets and abilities are readily available. At BMW, the business’s market shares and sales have been rising for a number of years. This indicates that the growth tactics were carefully laid out, which speaks well for its financial success (Madsen, 2017). BMW has to improve its completion approach if it wants to keep its current share of the market and its high sales numbers.

3.24 Analysis of BMW using Porter’s Five Forces Model

According to Porter’s Five Forces study, the competitive environment and industry considerations that BMW must contend with are broken down as follows.

I. Threat of New Entrants

Due to significant entrance and exit restrictions, substantial capital expenditure, highly qualified human personnel, and in-depth expertise in research and development, BMW needs more competition in the luxury automotive market (Hussain et al., 2019). Existing businesses are teaming together to stay afloat, and federal oversight is increasing. As BMW is already well-established in terms of both research and sales, this is likely to deter any upstart competitors from joining the market (Gurcaylilar & Aksoy, 2018).

II. Threat of Substitutes

Apart from the fact that alternative forms of transportation may replace BMW luxury automobiles, the most crucial information in this article is that most individuals who buy in this category do so to preserve a symbolic value and class in society (Dawes, 2018). On the other hand, because of this, BMW has a dedicated fan base and a little popularity edge over other luxury automakers. Substitutes pose a slight problem because of the firm’s strong loyalty and widespread recognition (Loredana, 2016).

III. Bargaining Power of Customers

Consumers, encouraged by new rules imposed by the government, are doing more online searches before committing to a purchase. BMW’s after-sale care and attention to detail are considerable contributors to the brand’s popularity. Because of the company’s great worth, every player in the market matters. BMW must innovate and enhance all areas of contact with customers to keep them happy and the brand relevant (Loredana, 2016). Because of its premium status, shifting costs are reduced, and demand is low.

IV. Bargaining Power of Suppliers

Since BMW is so particular about the quality of the materials it employs, the company takes great care in selecting its vendors. To maintain their association with the firm, they must accept and comply with its conditions of employment and its conduct standards (Clarissia, 2020). Because of the cheap shifting costs and the need for more differentiation in the given goods, suppliers that do not follow corporate procedure risk losing business. Forward integration is possible, although it is unlikely to impact the organization majorly (Chintalapati, 2020).

V. Competitive Rivalry

BMW’s rivals are spending money on R&D and enhancing their customer service to gain market share and win over new clients. Several of the world’s largest corporations are banding together to pool their resources and develop superior goods (Darroch & Darroch, 2014). The price tag of advertising and promotion matters since it is how consumers learn about and form opinions about a business. Businesses in the luxury automobile industry should enhance their reputation so buyers feel good about their purchases (Gurl, 2017).

3.25 BMW VRIO Analysis

BMW’s VRIO Study will examine the company’s in-house assets one by one to determine whether or not they provide a sustainable competitive advantage. Here is an explanation of what each means:

a. Valuable

According to their VRIO analysis, BMW has several vital resources, including money, local food items, people, copyrights, distribution channels, cost structures, and R&D. Capital is critical for investing in new prospects, local food items are distinctive, skilled workers are on hand, copyrights create licensing income, a robust distribution system expands market reach, but the expensive expenditure is a handicap and R&D is not worth the investment (Benzaghta et al., 2021).

b. Rare

BMW has access to resources that are scarce in the same way that locally grown food is, has people who are highly educated and skilled, and has patents that are difficult to get. A competition would require significant effort and money to replicate their distribution system. BMW is free to utilize these facilities without intervention from other companies.

c. Imitable

It would be expensive to replicate BMW’s monetary resources, local food items, workers, copyrights, and supply chain. As BMW’s supply chain has been refined over time, imitating it would require a significant financial investment on the part of BMW’s rivals (Yüksel, 2012). Rivals may learn about local food goods via R&D, and workers can learn new skills through training.

d. Organization

BMW’s finances are well-organized for value capture, and the company invests strategically in the correct areas. BMW’s copyrights could be more organized, but the company may turn that weakness into a competitive edge if it sells intellectual items far before their expiration dates (Sammut & Galea, 2014). BMW has a well-organized distribution system that reaches consumers and keeps inventory at all its stores. BMW maintains a significant edge in the market because of these assets.

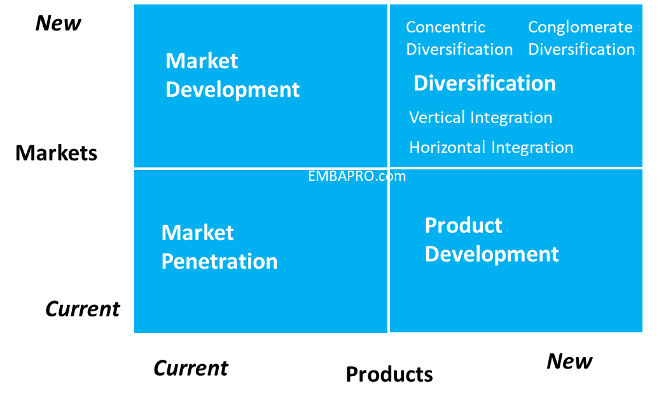

3.26 Analyzing BMW’s strategic direction using the Ansoff matrix

The Ansoff matrix was created as a strategic tool to aid companies in making expansion choices. It provides four options for achieving business goals, including expanding into new markets, creating new products, or diversifying existing offerings (Ho, 2014). Many internal and external variables will influence the strategy or mix of strategies a business decides to pursue.

The explanation of the Ansoff model is as follows:

1. Market Penetration Strategy

A method of market penetration is employed to boost market share. Enhancing the dealership network, expanding sales contact points, contacting consumers directly, maximizing the lifetime value of clients, and boosting the proportion of sales coming from inside the client’s shopping basket are all part of the plan (Chatzoglou et al., 2018). BMW Inc. uses the Ansoff Matrix to analyze competitive strategies to learn about competitors’ tactics for increasing profits.

2. Market Development

Creating new markets and supply networks for existing goods is at the heart of Bmw Ic’s market growth plan. This might include a variety of strategies, such as expanding into new local and oversea markets to increase demand for existing offerings (Chen & Kodono, 2014).

3. Product Development

Through user feedback, BMW develops new goods for established markets or improves existing ones. Microsoft’s regular release of new versions of Windows Office at a given interval is an excellent example of how brand innovation methods can help a business succeed (Lin et al., 2012). The product’s core audience and selling points have stayed the same over time, yet the corporation continues releasing new and better iterations to keep selling to them.

4. Diversification strategy

When a commodity and the market are unfamiliar to BMW Inc., the firm might benefit from diversification methods. When a firm spots a gap in a market that is closely related to its own, it might decide to diversify its activities. Take Microsoft’s entrance into the video game industry with the Xbox, for instance (Geraldes et al., 2019). As the company still needed to gain experience with either the item or the consumer market, it was forced to devise an entirely new distribution and income strategy to compete successfully in the Consumer productivity market.

3.27 Strategic analysis of BMW using the BCG matrix

BMW organization may use the BCG Matrix to classify their goods into four categories—”cash cows,” “stars,” “question marks,” and “dogs”—to determine which ones will be the most lucrative and which ones pose the most risk. Exemplifying the BCG matrix, we have:

1. Cash Cows

Rolls Royce, one of BMW’s cash cow goods, is in great demand and contributes significantly to the company’s bottom line. In 2016, the firm’s net earnings increased by more than 10 percent thanks to the increased demand for Rolls Royce. According to Min et al. (2016), Rolls Royce had its best-ever financial year in 2016, with the United States seeing the most demand for its premium vehicles (Min et al., 2016).

2. Stars

In the BCG Matrix, “Stars” occupy the second sector since they represent promising new products. Sales of BMW’s Sedan model have risen dramatically in recent years, according to BMW Group (2016), indicating strong interest. BMW Mini also belongs in this sector because of its strong financial performance and promising future development (Mohajan, 2017). BMW has improved the performance of its flagship vehicle by increasing the number of available models and introducing fresh designs.

3. Question Marks

Items in the quotation mark sector have a significant level of ambiguity and are thus classified there. BMW’s SUV model is a source of profit, but it has lost ground in the premium vehicle market due to declining income potential. Financial results for the SUV division could increase in the following months, and a greater need for SUVs might help the firm gain market share (Mohajan, 2017). The business has room for expansion, which bodes well for the SUV’s chances of becoming the dominant brand in the international auto market.

4. Dogs

Items classified as Dogs fall under the fourth quadrant of the BCG Matrix. There is no profit to be made from these activities, and the firm needs to do better regarding sales, earnings, and outlook. It is common knowledge that the BMW Z3 and Z4 are duds since they have yet to be as successful as the firm’s other models (Madsen, 2017). Consumers feel their vehicles’ functionality could have been better than what they had expected from previous BMW models.

4.0 Analyzing BMW’s strategic position using sales revenue as one of the KPI

Ranking of top six automotive companies in 2022 in terms of their annual revenues

| Rank | Brand | Country | REVENUE |

| 1 | Mercedes-Benz | Germany | 150 billion euros |

| 2 | Tesla | United States | 81.5 billion euros |

| 3 | BMW | Germany | 42.6 billion euros |

| 4 | Audi | Germany | 36.8 billion euros |

| 5 | Lexus | Japan | 23.3 billion euros |

| 6 | Jaguar | United Kingdom | 18.3 billion |

From the table above, BMW has strategically ranked the third valuable brand in the automobile business (revenue of 42.6 billion euros) after the Mercedes brand (revenue of 150 billion euros) and Tesla (second: revenue of 81.5 billion euros). Despite experiencing stiff competition from its rivals in terms of sales, BMW is thriving well with excellent prospects in today’s dynamic industry. Consumers want luxury vehicles, and BMW Group updated them (Namugenyi et al., 2019). The U.K.’s Society of Motor Manufacturers and Traders released research claiming that the company’s recent growth may be attributed to the country’s propensity for innovation to produce luxury cars to suit customers’ needs. Strategic support and customer engagement have helped the company attract new customers and earn more revenue than Lexus, Audi, and Jaguar (Helms & Nixon, 2010). The company’s revenue has kept rising to that of the previous year, meaning the firm is effectively using its opportunities. Other rivals like Jaguar could be performing better as compared to BMW.

5.0 Conclusion

In conclusion, BMW is the undisputed leader in the automobile sector, so the firm is well-recognized for its high-quality commodities and services. The brand’s reputation has been built up over a century, giving it a leg up in the marketplace. Yet as it faces significant competition, the company must also prioritize on its spending on R&D to thrive. Despite stiff competition from its rivals, the company thrives well compared to other brands, such as Mercedes and Jaguar. To stay ahead of the competition and secure its place in the car business, BMW needs to expand and diversify its operations, as explained in the Ansoff model. BMW’s SWOT analysis shows that only some of the most recognizable brands are impervious to problems. The PESTLE analysis also exposes the many factors that affect the company’s success. The various models and concepts covered in this report have provided critical understanding to help a variety of organizations to understand their functionality and thus determine their strategic position in the specific industry.

6.0 Recommendation

- BMW, despite its success, has to deal with a number of obstacles, including rivalry and a need for more sales outlets. Hence, BMW has to take steps to address these difficulties. Producing distinctive automobiles that appeal to consumers and meet their needs in terms of comfort and convenience is one strategy, as is offering services over the Internet.

- The majority of BMW’s initiatives have been implemented, and the company has assessed its progress; however, BMW should improve its performance by expanding into new markets, particularly in some of the world’s emerging nations.

- Fourth, it should evaluate its performance in the electric motor sector to compete effectively with Tesla and progress toward its corporate social responsibility (CSR) goals, such as lowering carbon emissions.

7.0 References

Aicha, L. A. K. A. F., & Abdelkader, B. O. U. K. E. R. D. I. D. (2022). Implications of the Coronavirus (Covid-19) for financial reporting, BMW case study. Revue Organisation & Travail Volume, 11(1).

Benzaghta, M. A., Elwalda, A., Mousa, M. M., Erkan, I., & Rahman, M. (2021). SWOT analysis applications: An integrative literature review. Journal of Global Business Insights, 6(1), 55-73.

Chatzoglou, P., Chatzoudes, D., Sarigiannidis, L., & Theriou, G. (2018). The role of firm-specific factors in the strategy-performance relationship: Revisiting the resource-based view of the firm and the VRIO framework. Management Research Review, 41(1), 46–73.

Chen, F., & Kodono, Y. (2014). Fuzzy VRIO and SWOT Analysis of Chery Automobile. Journal of Advanced Computational Intelligence and Intelligent Informatics, 18(3), 429-434.

Chesnokova, T. (2021). ANALYSIS OF MERCEDES-BENZ AND BMW COMPETITORS IN THE RUSSIAN CAR MARKET.

Chintalapati, S. (2020). BankBuddy. Ai—Business Expansion and Marketing Dilemma: A Case Study to Discuss the Ansoff Growth Matrix Concepts Combined with Business Expansion Strategies for Expanding into Emerging Markets. Emerging Economies Cases Journal, 2(1), 44–53.

Clarissia, S. M. S. (2020). A study on Ansoff Matrix Technique: As a growth strategy and an adaptive learning technique adopted in the leading brand of products. BIMS Journal of Management, 18.

Darroch, J., & Darroch, J. (2014). Ansoff’s Growth Matrix—In Detail. Why Marketing to Women Does not Work: Using Market Segmentation to Understand Consumer Needs, 131-147.

Datta, Y. (2010). A critique of Porter’s cost leadership and differentiation strategies. Chinese Business Review, 9(4), 37.

Davidson, H. Delivering Customer Value Through Marketing.

Dawes, J. (2018). The Ansoff matrix: A legendary tool, but with two logical problems. But with Two Logical Problems (February 27, 2018).

Dobbs, M. E. (2014). Guidelines for applying Porter’s five forces framework: a set of industry analysis templates. Competitiveness Review, 24(1), 32–45.

Dobrin, G. I. (2021). Analysis of risks and opportunities in the BMW Group. Journal of Public Administration, Finance and Law, 10(22), 164-168.

Dobrin, G. I. (2021). Analysis of risks and opportunities in the BMW Group. Journal of Public Administration, Finance and Law, 10(22), 164-168.

Dobrin, G. I. (2021). BMW Group Economic Position Analysis in the Situation Created by COVID-19 Pandemic. Journal of Public Administration, Finance and Law, 10(20), 189-193.

Drobyazko, S., Okulich-Kazarin, V., Rogovyi, A., Goltvenko, O., & Marova, S. (2019). Factors of influence on the sustainable development in the strategic management of corporations. Academy of Strategic Management Journal, 18, 1-5.

Geraldes, R., Lopes Da Costa, R., & Geraldes, J. (2019). VRIO FRAMEWORK STATIC OR DYNAMIC? Exploring the Future of Management. Lisbon: EURAM.

Gurcaylilar-Yenidogan, T., & Aksoy, S. (2018). Applying Ansoff’s growth strategy matrix to innovation classification. International Journal of Innovation Management, 22(04), 1850039.

GURL, E. (2017). SWOT analysis: a theoretical review.

Helms, M. M., & Nixon, J. (2010). Exploring SWOT analysis–where are we now? A review of academic research from the last decade. Journal of Strategy and Management, 3(3), 215–251.

Ho, J. K. K. (2014). Formulation of systemic PEST analysis for strategic analysis. European academic research, 2(5), 6478–6492.

Hussain, S., Khattak, J., Rizwan, A., & Latif, M. A. (2013). ANSOFF matrix, environment, and growth-an interactive triangle. Management and Administrative Sciences Review, 2(2), 196–206.

Hwee, E. Q. C. (2015). Building& Sustaining Strategy of Bayerische Motoren Werke (BMW)–Automotive Industry. TMC Academic Journal, 10(1), 29–46.

Jun, S., & Park, S. (2016). Examining technological competition between BMW and Hyundai in the Korean car market. Technology Analysis & Strategic Management, 28(2), 156-175.

Kauerhof, A. (2017). Strategies for Autonomous, Connected and Smart Mobility in the Automotive Industry. A Comparative Analysis of BMW Group and Tesla Motors Inc. GRIN Verlag.

Kukkamalla, P. K., Bikfalvi, A., & Arbussa, A. (2020). The new BMW: business model innovation transforms an automotive leader. Journal of Business Strategy, 42(4), 268-277.

Lin, C., Tsai, H. L., Wu, Y. J., & Kiang, M. (2012). A fuzzy quantitative VRIO‐based framework for evaluating organizational activities. Management Decision.

Loredana, E. M. (2016). The use of Ansoff matrix in the field of business. In MATEC Web of Conferences (Vol. 44, p. 01006).

Madlani, J., & Ulvestad, J. C. A. (2012). Fundamental Valuation of the BMW Group (Doctoral dissertation, Master Thesis, Copenhagen Business School).

Madsen, D. O. (2017). Still Alive: the rise, fall, and Persistence of the BCG Matrix. Problems and Perspectives in Management, 15(1), 19-34.

Min, B. S., Min, J. H., Jang, W., Han, S. H., & Kang, S. Y. (2016). VRIO Model Based Enterprise Capability Assessment Framework for Plant Project. Korean Journal of Construction Engineering and Management, 17(3), 61-70.

Mohajan, H. (2017). An analysis of BCG growth sharing matrix.

Namugenyi, C., Nimmagadda, S. L., & Reiners, T. (2019). Design of a SWOT analysis model and its evaluation in diverse digital business ecosystem contexts. Procedia Computer Science, 159, 1145-1154.

Nobanee, H., Altayr, F., Alhosani, M., Alshamsi, F., Ali, D., Mubarak, N., … & Mohammed, M. (2021). Financial Analysis of BMW & Daimler (Mercedes-Benz). Available at SSRN 3766088.

Omsa, S., Abdullah, I. H., & Jamali, H. (2017). Five competitive forces model and implementing Porter’s generic strategies to gain firm performances.

Pozo Cardenal, A., & Carrió Garcia, F. (2013). Qualitative and quantitative financial analysis of BMW GROUP.

Sammut-Bonnici, T., & Galea, D. (2014). PEST analysis.

Sathe, M. (2022). Global Supply Chain Imputations of Russia-Ukraine War. Journal of Supply Chain Management Systems, p. 11.

Schindlbeck, R. J., Müller, J. M., & Störmer, A. O. (2020). Unified requirements for suppliers’ production sites of high voltage electric and electronic components-a case study from BMW. International Journal of Automotive Technology and Management, 20(3), 275-296.

Scott, P., & Burton, M. (2013). The new BMW i3. Hg. v. BMW AG.

Shtal, T. V., Buriak, M., Ukubassova, G., Amirbekuly, Y., Toiboldinova, Z., & Tlegen, T. (2018). Methods of analysis of the external environment of business activities.

Subhash, B. (2022). Causes and Consequences of Global Supply Chain Disruptions: A Theoretical Analysis. IUP Journal of Supply Chain Management, 19(4), 7–24.

Tanwar, R. (2013). Porter’s generic competitive strategies. Journal of Business and Management, 15(1), 11–17.

Torquati, B., Scarpa, R., Petrosillo, I., Ligonzo, M. G., & Paffarini, C. (2018). How can consumer science help firms transform their dog (BCG Matrix) products into profitable products? In Case Studies in the Traditional Food Sector (pp. 255-279). Woodhead Publishing.

Underwood, R. L. (2012). Automotive foreign direct investment in the United States: Economic and market consequences of globalization. Business Horizons, 55(5), 463–474.

Wimmer, C. (2014, July). The electronic chassis of the new BMW i8–influence and characterization of driving dynamics. In 5th International Munich Chassis Symposium 2014: chassis. Tech Plus (pp. 57–73). Wiesbaden: Springer Fachmedien Wiesbaden.

Yüksel, I. (2012). Developing a multi-criteria decision-making model for PESTEL analysis. International Journal of Business and Management, 7(24), 52.

write

write