Several companies are scattered or located in almost every region in the world. Some of these companies deal in similar commodities, as some deal in different entities. Most of these operate internationally, while others still developing carry out their operations or activities within specific regions or geographical areas. By coincidence, most of these largest are found or located within the first world nations, which are majorly found within Europe, Asia, North America, and South America. These companies deal in various products depending on their operation line as some carry out single businesses. In contrast, others multitask as they deal with more than one product. For our case, we will tackle or narrow our discussion to one of the largest companies, which is the BT Group.

BT The group is one of the British multinational telecommunication companies which was founded in the year 1846. BT Group has its headquarters in London and deals in a single business. The company has 106,700 employees divided among all its branches worldwide and is headed by the current CEO Philip Erick Rene Jansen. The company serves both local, regional, and international clients scattered worldwide. The BT Group company operates via various segments, including consumer, enterprise, global services, and open reach. The consumer segment deals with mobile, broadband, home phone, and television services. The enterprise segment deals with selling communications and information technology services to various businesses and organizations found within the public sector. The enterprise segment also deals with providing products and services to the communications sector.

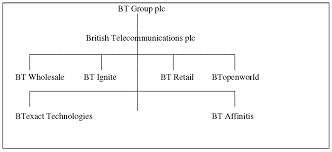

The global services segment deals with managed networks and information technology infrastructure services to its clients (Bilbao et al., 2018). The open reach sector deals with building and managing the fixed network connecting various homes and businesses. The structuring of the BT Group company has been done in several ways, including the BT retail sector, which deals with consumer-oriented retail telecommunications services. The wholesale structure is the leading trunk network for wholesale telecommunications. The BT operates the facility, which is majorly responsible for the rolling out and maintaining the I.P.-based fixed line of the network of BT Group. The BT design is responsible for the information technology designers from the other divisions (Steve Clayton, 2016).

BT Operation

Following the acquisition of compatriot transportable administrator EE, British telecom firm BT announced a new corporate structure. Beginning in April, the previously unused trade structure will be implemented. Customer; EE; trade and Open department; international Administrations; discount and Wanders; and Openreach are the six strains of change that BT can have within its current structure. BT’s consumer segment will provide broadband, voice, television, and flexible services to 10 million families in the United Kingdom. E.E. will focus on the customer experience and offer advanced mobile, broadband, and television services. It will also carry out the crisis administration set up an arrangement awarded to E.E. late last year. Commercial enterprise and Open Section are modern business units with around £5 billion in sales. It will benefit both small and large organizations and the open division between the United States and Ireland.

The worldwide Administrations change branch of BT will deliver communications administrations to multinational corporations and budgetary administrations organizations. At the same time, the bargain and Wanders division will provide communications suppliers with low-cost administrations. E.E.’s adaptable virtual arrange administrator business will be housed in this location. BT indicated that the reorganization would not affect Openreach. It will continue to give all companies ruin regardless of access to BT’s nearby get to arrange in outstanding Britain. Innovation, gain, and operations, which are currently capable for BT’s center systems in the United Kingdom and elsewhere, will strengthen the six divisions.

“The acquisition [of mobile administrator E.E.] provides us with an opportunity to revive our structure, and we’ve done so by creating a top modern-day division to focus on businesses and the open phase within the U.K. and Eire,” explained BT CEO Gavin Patterson in a statement. “We need to augment those segments by marketing clients extremely good administrations, whether it’s dedicated personal lines, arrange products with fiber broadband, flexible arrangements, I.T. administrations, or cyber capabilities to keep them secure.” In the third quarter of fiscal 2016, BT reported £4.6 billion ($6.57 billion), up to three percent from the previous year’s period. The telco’s earnings, costs, depreciation, and amortization for the area were £1.61 billion, a 3 percent year-on-year increase.

In the region, BT’s customer exchange saw an eleven percent increase in profits year over year. The administration stated that their fiber broadband plan is available to more than 24 million households and enterprises. In addition, the firm’s well-known flexible base had grown to 300,000 supporters at the end of December. “By the end of 2017, we hope to have fiber coverage in 95 percent of the country, with plans to expand further.” “Our G. speedy trials are moving very nicely,” Patterson said. BT announced last week that it had completed its £12.5 billion acquisition of E.E., which Deutsche Telekom and Orange previously held. Deutsche Telekom and Orange received £3.46 billion in cash and offered in exchange for their holdings in E.E. (Choi et al., 2017). Following the completion of the acquisition, the German telco now owns 12 percent of the underused organization, while the French corporation owns 4%.

BT is single commerce made up of various hierarchical devices. Customers are at the heart of the business, and it is built around them, satisfying their needs and demonstrating respect for them. The company achieves this by rapidly developing and delivering inventive plans and providing products and services that are essential in modern living. Consumer, venture, global, and Openreach are the four customer-facing strains of change. Internal advantage devices, superiors, and structures are used to strengthen them.

BT Group Organizational Structure

BT Client as the U.K.’s largest ISP, BT The client will serve ten million households with a mix of superfast broadband, communication, television, and flexible administrations. John Petter will continue to be the company’s CEO. E.E. – E.E. will focus on the customer show while keeping its logo, layout, and hundreds of high-street stores. It will provide advanced portable administrations, broadband, and television to its clients. It will also continue to provide the disaster administrations agreement granted to E.E. late last year. Marc Allera is the company’s CEO.

Commercial enterprise and open section will be a modern division with around £5 billion in sales. It will serve both large and small businesses and the open division across the U.K. and Ireland. It will be made up of traditional BT trade, E.E.’s trade department, and those parts of BT Global Administrations aimed at the U.K. Graham Sutherland is the company’s CEO.

Global Administrations: The communications need of established organizations and the services will meet financial administrations associations in the U.K. and across the world. It will also serve major open and personal division clients outside the U.K. Luis Alvarez will continue to lead the company as CEO.

Wholesale and Ventures – This division, which provides wholesale administrations to more than 1400 communication providers, might be expanded to include E.E.’s successful MVNO exchange as well as a few master companies such as Armada, Payphones, and Registries. Gerry McQuade, who is now the Chief Offers and Promotions Officer at E.E., will be the company’s CEO.

Openreach – operating independently of BT’s relaxation, Openreach may be unaffected by the re-enterprise. It allows all businesses access to BT’s neighborhood access set up in the United Kingdom and is intensively directed, with more than 90 percent of its income coming from value-directed administrations. Clive Selley is the new CEO of the company. Innovation, benefit, and Operations, which is already successful for BT’s ‘middle’ structures in the U.K. and abroad, its I.T. degrees, and its global inquire about, and development arm may be subsidized for the six divisions. In recent years, Howard Watson has taken over as CEO, succeeding Clive Selley. In addition, Fotis Karonis of E.E. can help drive a present I.T. and mobile commerce unit within TSO. Fotis will join Howard’s management team and lower back Marc Allera, who will serve as E.E.’s chief information officer.

Fotis Karonis of E.E. will charge a new I.T. and multifunctional trade unit under TSO. Fotis will liaison between Howard’s administration and E.E.’s CIO, Marc Allera. The company will use a multi-brand strategy, with U.K. clients having the option of combining BT, E.E., or Plusnet services, depending on which best suits their needs. The acquisition enables us to provide incredible value packages of administrations, and customers will be the winners as we compete for their business (Larsen et al., 2018). In addition, the securing presents the company with an opportunity to resurrect our shape, which we have done by establishing a primary modern division to focus on organizations and the open sector in the U.K. and Ireland.

BT Group Marketing Strategy

A company brand refers to any image and the personality of a given product that a business or an organization provides to its clients. Several company brands are involved in various activities of the BT Group company. The multiple brands of the BT The group engaged in its activities includes the BT Broadband, the BT Superfast Fibre, BT sport, BT mobile, and BT Wi-Fi, among others. The planned move of retrenching by the BT Group management would adversely affect almost all the company brands, which would hugely impede the company’s operations. Furthermore, the planned retrenching activity would affect the company’s service delivery, especially in the output sector, as there would be insufficient labor supply to conduct the company’s various activities (BT Group, 2020).

Financial Performance of the Company

BT Group plc’s earnings fell three percent to £10.31 billion in the six months ending September 30, 2021. Profits from the internet fell by 50% to £431 million. Earnings reflect a 14% drop in the global administration’s section to £1.65 billion, a 5% drop in the challenge segment to £2.52 billion, and a £4.82 billion drop in the shopper phase. Net pay also shows a 77 percent drop in global administration’s portion income to £22 million, as well as a 15 percent drop in customer element wage to £376 million.

Competitive Environment

BT has finally made the mild visible. It has abandoned plans to create a complex joint wander to aid in deploying full-fiber broadband. That conditional proposal reeked a board of directors fixated on the short-term share price and worrying excessively over viable acquisition offers. It’s preferable to keep things simple by burrowing Britain and getting the unit into channels as quickly as feasible. The change of heart appears to have been prompted by the revelation that, while concentrating on the task at hand, BT can take a cut of fees and, as a result, fund the expansion to 25 million premises by 2026 under its own steam. Ordinary assembly expenses have been reduced by £50 to £250-£300 per premises, which is a significant saving. Capital consumption spending, which has been making speculators nervous, will now peak at £4.8 billion in 2023, rather than £5 billion.

The proximity of Patrick Drahi, whose Altice group sold a 12 percent share in BT earlier this year, is most likely exacerbating the situation. Drahi’s eagerly live ambiguously, but you could probably say this: a takeover offer that relied on slashing work by evacuating difficult-to-reach locations would be a political non-starter. The modern national security and venture act appear to have been written almost entirely with BT in mind. In any event, a steady percentage fee may be the most effective defense against a takeover. Based on that rating, Jansen’s extra nitty-gritty financial estimates prompted an eleven percent upward push to 158p. There’s still a way to improve the 200p observed inside the strength after Drahi’s entrance, but the path appears to be more precise. Forget the distractions and get to work on the fiber.

The opposition, as well as Markets experts, are unyielding: Foot asylum should be saved for the United States, or at the very least for its consumers, who, it claims, would “pay more for less preference, more regrettable advantage, and worse high-quality” if J.D. Sports’ ownership was allowed to stand. The £90 million takeover occurred in 2019, and the CMA normally runs the data at the same time. As a result, J.D. should probably give up on trying to get around the decision and just do what the authorities ask and hand over the chain. The wrath of the J.D. leader, decrease Cowgill, on the other hand, is inexpensive. The administration puzzles me. Foot asylum morphed into a little aggressive chomp on the coaching and sportswear industry when its board relented — the agency was sold for half of its 2017 buoyant valuation. In the meantime, the juggernaut is Nike and Adidas’ direct-to-customer operations, which Foot asylum appears to be more likely to encounter under J.D.’s warranty.

Regulatory Challenges

BT is a self-contained network made up of one-of-a-kind authoritative units. Its business is based on servicing the customers’ requirements and demonstrating respect for them. The company accomplishes this by rapidly inventing and delivering creative arrangements and providing products and services essential to slicing side lifestyles.

The BT organization is a communications administrations company. Fixed-voice administrations, broadband, portable and television objects, and administrations, as well as other communications administrations ranging from telephone and broadband to overseen organized statistics innovation (I.T.) preparations and cyber security protection, are all core competencies of the company. International Administrations, Assignment, Purchaser, and Openreach are the company’s four divisions. Its global administrations are focused on providing well-managed, well-organized I.T. administrations. Its parent company offers communications and information technology administrations in the United Kingdom and Ireland (RoI) (Weng et al., 2017). In the Joined Collectively nation, the customer section could be a constant-voice and broadband administrations dealer. Between its trades, Openreach provides administrations, including copper and fiber institutions and households and agencies.

In the range of nations, the legitimate gadgets and trains aren’t lively enough to ensure the intellectual assets rights of a business enterprise. Therefore, a company must carefully check some time currently getting into such markets because it may result in burglary of business enterprise’s mystery sauce subsequently the typically aggressive edge.

Portus Five Forces Analysis of Strategic Management

Political Factors

Political components play an essential element in identifying the variables that may affect Bt accumulate %’s long-term productiveness in a sure nation or show off. Bt Bunch percent is running in Broadcast communications in additional than dozen countries and finds itself to diverse kinds of political environment and political framework risks. The accomplished victory in one of these active Broadcast communications enterprises over particular international locations is to increase the orderly chances of political surroundings. As a result, Bt Bunch p.c can carefully analyze the taking after additives currently coming into or contributing in an upbeat commercial.

Economic Factors

The vast scale surroundings variables include swelling price, reserve price range price, intrigued rate, out of doors alternate rate, and economic cycle decide the total request and complete task in a financial system. At the same time, smaller-scale environment variables and opposition standards affect the aggressive gain of the company. Bt accumulate % can utilize united states of America’s monetary parent consisting of improvement rate, swelling & industry’s economic markers together with Broadcast communications enterprise improvement rate, purchaser making an investment and so on to figure the improvement direction of not as it has been –sector name– department but moreover that of the agency. Economic variables that Bt Bunch % needs to recollect while carrying out PESTEL research are.

Social Factors

Society’s lifestyle and manner of doing things affect the tradition of a business enterprise in its surroundings. Shared convictions and demeanors of the population play a first-rate part in how marketers at Bt Bunch % will get the clients of a given exhibit and plan the showcasing message for Broadcast communications industry shoppers.

Technological Challenges of the Company

Technology is short, worrying extraordinary groups over the board. Transportation enterprise may be an exceptional case to illustrate this point. Over the last five years, the industry has been reworking briefly, no longer certainly giving the users the risk of managing with the adjustments. The taxi industry is presently crushed through gamers like Uber and Lyft. Automobile enterprise is brief transferring in the direction of mechanization driven by innovation firms, including Google & fabricating, disturbed by Tesla, which has expressed a digital automobile revolution. A company must not because it has been doing a mechanical exam of the industry; however, the speed at which innovation disturbs that industry. Mild velocity will supply more significant time, while the quick rate of revolutionary disturbance may additionally deliver a company a short time to manipulate and be effective.

Environmental Factors

Numerous markets have different standards or natural suggestions, which can affect the gain of an agency in one’s demands. Indeed, the internal state often will have various herbal laws and dangerous legal guidelines. For illustration, in Joined collectively, Texas and Florida have different obligation clauses in disasters or natural fiasco. Additionally, a parcel of ECU international locations donates strong assess breaks to organizations that work within the renewable area. Therefore, earlier than coming into current markets or beginning a recent trade-in existing showcase, the firm has to carefully investigate the herbal requirements required to feature in the one’s demands.

Risks Associated with BT Group Company

There are lots of risks involved with the BT Group company’s various planned activities, with each activity having varied troubles as far as its effect on the organization and the clients are concerned. For our case, we would major on one of the BT Group’s planned activities, especially the commencement of working from home and the shedding of jobs to cut costs (Larsen et al., 2018). This kind of activity has a lot of weight as it would have far much effect on the company and society as it exposes to quite a lot of risks that mainly affect the company’s reputation.

Risk refers to the uncertainty involved in the outcome of the BT The group’s planned activities may have adverse effects if not looked at very keenly. The scheduled commencement of working from home and the shedding off of jobs or retrenching among the BTC employees. Group company’s management risks suffering from various outcomes that may hugely affect its operation. These risks may include the creation of disunity among the employees. Employees’ planned retrenching would cause disharmony as those who would be retrenched or stopped from their jobs would feel infuriated. They might end up hating those who shall have been retained together with the management. They may also fail to understand the initiative’s fact hence may view it as a parallel operation organized by a few individuals within the administration.

The retrenchment activity may also surfer the opposition from the BT Group company’s employees as none of the employees would be willing to go home or would be happy seeing his or her friend being interdicted without any reason. The planned activity of retrenching by the BT Group’s management also risks causing disruption or deviation of the company’s reputation, which would be evident in the views of various individuals who are its loyal clients. The clients would view that a company of such quality should not be incapable of dealing with challenging economic situations to the extent of engaging itself in unheard-of activities such as laying off employees.

The BT Group company also risks being weighed out by the stiff competition posed by the other telecommunication companies such as Vodafone. Once the retrenching of the employees would have been done within the B.T, group branches across the globe, the company’s operations would be curtailed or limited to some regions, which would allow its competitors to surpass it. Some of its clients would also abandon the company once the retrenching activity shall have been carried out as planned; this would happen because some clients are attached to the company due to their relationship with some of the employees who might be affected by the plan (Larsen et al., 2018). The company would also risk losing its core or central employees who are part and parcel of the company due to their technicality and professionalism. This would result in a reduction in the deliverance of quality services to the clients.

Recommendations

Several recommendations can be incorporated to cater to the adverse effects or risks accompanied by the various planned activities of the BT Group company. These recommendations include the need to reverse the planned action of retrenching and replace it with a suitable option that every member of the organization would endorse. There is a need for the management to involve all the company’s employees in the various decisions affecting the company’s various activities. There is a need to adjust its risk management system to cater to multiple emerging issues that are pretty arguable. The company’s management should also align with the various measures that would ensure the safety of the employees that would be affected by the planned activity of retrenching in case the action would succeed.

Reference

Bilbao-Terol, A., Arenas-Parra, M., Alvarez-Otero, S., & Cañal-Fernández, V. (2018). Integrating corporate social responsibility and financial performance. Management Decision.

Bloomberg, (2020), BT launches a new generation of software-defined network service with VMware. From https://www.bloomberg.com/press-releases/2020-11-12/bt-launches-new-generation-of-software-defined-network-services-with-vmware

BT Group, (2020), BT Group Business. From https://www.bt.com/about/bt/our-company/group-businesses

Choi, S. (2017). Processing and learning of enhanced English collocations: An eye movement study. Language Teaching Research, 21(3), 403-426.

Larsen, S. B., Masi, D., Feibert, D. C., & Jacobsen, P. (2018). A manufacturer’s perspective is how the reverse supply chain impacts the firm’s financial performance. International Journal of Physical Distribution & Logistics Management.

Steve Clayton, (2016), what are the prospects for BT? From https://www.hl.co.uk/news/articles/archive/what-are-the-prospects-for-bt-group-shares

Weng, P. S., & Chen, W. Y. (2017). Doing good or choosing well? Corporate reputation, CEO reputation, and corporate financial performance. The North American Journal of Economics and Finance, 39, 223-240.

write

write