Introduction

Healthcare organizations require funds to operate effectively and provide quality care to patients. High-deductible health plans have forced healthcare systems to find modern and creative ways to increase their point-of-service collections. Many healthcare facilities have implemented comprehensive pre-service centers (PSCs) that provide help in navigation payment options and patients’ financial counseling services to increase overall collection and improve patient experience (Cahn et al., 2017). Healthcare organizations receive funds for their service from claims from insurance companies, copayments and out-of-pocket payments from patients. A significant number of Americans have no insurance and have to pay out-of-pocket for medical care. Souza & McCarty (2007) refute the claim that people who have no insurance cannot pay for medical care and insist that healthcare systems can improve their collection by asking them to pay. This paper will analyze the Sutter Health Approach to increase collection and provide alternative solutions to improving point-of-service collections

Summary of Sutter Health Case Study

Sutter Health’s Four-Step Approach

Sutter Health is one of the leading providers in Northern California that consists of more than two dozen acute care hospitals, medical research facilities, long-term care centers, physician organizations, hospice and occupational health networks and home health services. Sutter Health took several steps to increase point-service collections and improve the overall revenue cycle. The first step they took was to analyze its revenue management cycle. During the analysis, Sutter Health identified three problems. The first one was that the patient financial services (PFS) were unable to access real-time data on crucial financial and operational indicators like cash collection and accounts receivable (A/R days), which made managers and staff wait until the end of the month to track progress, set benchmarks or make essential business decisions (Souza & McCarty, 2007). The next challenge was the accounting systems of hospitals, mainly on specially trained programmers to develop reports, which led to delays in establishing and rectifying problems. The final issue was that staff at the central business office (CBO) did not have access to real-time information, which hindered the effective monitoring of the outstanding account’s progress. After reviewing the challenges, Sutter Health decided to focus on cash collections, gross A/R days, major plays A/R days, billed and unbilled A/R days and percentage of A/R over 90, 180 and 360 days benchmarks (Souza & McCarty, 2007). The second step that Sutter Health to improve collection and reduce A/R days was to empower PFS staff members. The provider gave each PFS staff member an account and gave them some tools to help them manage their businesses effectively. The tools enabled them to sort accounts in various ways, automate and prioritize account work lists and view the ranking of their accounts and areas they could improve. Managers had their receivable dashboard and tools that helped them conduct various tasks, including calculating average daily revenue by day and month, producing timely reports, and drilling down to the patient account level.

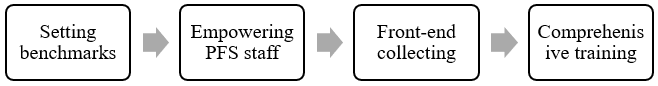

The third step that Sutter Health took was front-end collecting, which required analyzing every registration by a rule engine prior to the patient leaving the registration. This process aimed to establish potential problems or errors such as the missing of Medicare insurance plan despite the patient being 65 years and above, duplicate medical record numbers, errors in patient’s address, and invalidity of patient type for hospital service (Souza & McCarty, 2007). The process would help the PFS staff identify problems quickly and take action at the right time to reduce claims denials. The step was comprehensive training of staff members on point-of-service collection to avoid hiring a more formally educated staff or increasing wages. The training was for PFS and registration staff members. Registration staff received training on effective patient communication that would help them learn how to ask patients for money. On the other hand, PFS staff received training on how to take responsibility for their allocated accounts. Sutter Health’s steps were effective because it increased its collections by almost $ 80 million in the first three months (Souza & McCarty, 2007). It also reduced A/R days from 65 to 59 in the first three months for nine healthcare facilities in the area. Also, the CBO in 2006 received Sutter’s Business Processes Excellence Award for exceptional performance.

The Accounting Practices that Sutter Health Used

Sutter Health used accountability and transparency to identify and solve its collection problems. The provider analyzed the previous revenue collection system’s accountability and transparency and identified several issues that hindered revenue maximization. Sutter Health responded to the challenges by setting benchmarks on several crucial areas. The previous system did not also ensure the responsibility and accountability of revenue collection staff. Sutter Health changed the method by assigning each PFS an account for which they would be responsible and accountable (Souza & McCarty, 2020). It provided PFS staff with tools to help them know how they are doing and what they can do to improve. Sutter Health also utilized cost reduction in solving its problems. It provided comprehensive training instead of hiring a more formally educated team or increasing the wages, which helped facilities reduce expenses. The steps taken by Sutter Health increased the efficiency and effectiveness of operations. For example, it used a rules engine to analyze every registration before the patient left the registration desk. This process helped the staff identify potential problems such as missing and address them in time to reduce claims denials (Souza & McCarthy, 2007). The comprehensive training provided by Sutter Health also increased effectiveness and efficiency because it made all PFS and registration staff members competent in revenue collection. For example, the training helped registration staff members develop effective patient communication skills.

Alternative Solutions

Sutter Health’s steps to improve their point-of-sale collections and improve the overall revenue cycle were effective. However, there are other solutions that healthcare facilities can use to enhance their collections. Enhancing pricing transparency is one alternative that healthcare organizations can use to improve point-of-service collection. According to Bohnsack & Hawig (2013), patients today have become more assertive and are requesting information that will assist them in establishing areas that they are spending their money. However, pricing transparency, which involves providing patients with accurate estimates of the money they should pay after the insurance has paid its portion, is one of the most significant challenges hospitals face. Lack of pricing transparency leads to a decline in patient satisfaction and point-of-service collection. Research indicates that patients are willing to pay when they have an estimate of what they will pay for the service. It is also easier to collect payment at the service point than tracking down patients after discharge. However, a survey conducted in June 2011 on healthcare finance professionals at ANI revealed that a significant number of hospitals collect less than 30% of patients’ balance upfront (Bohnsack & Hawig, 2013). The challenge healthcare organizations face with point-of-service collections is the unknown such as the actual services to be provided.

However, today healthcare facilities can use technology to enhance their pricing transparency. One of the tips that HFMA’s MAP Award winners use to have a successful revenue cycle is to push technology to work better for them. HFMA recognizes high-performance organizations in all revenue cycle areas and the most improved in particular regions (n.d, 2014). Claim-based and contract-based systems are the available systems for patient estimation in the market today. Healthcare organizations use claim-based systems to project payment patterns for specific services for particular health plans by using past paid claims data. The advantage of the system is that facilities can implement it quickly (Bohnsack & Hawing, 2013). However, the accuracy of the used data can be a drawback for the system. In contrast, facilities spend more time implementing contract-based systems, but their accuracy rate is higher than that of claim-based systems. Under this system, healthcare facilities model their managed care contract terms to accurately reflect the adjudication logic. Bohnsack & Hawing (2013) insist that regardless of the system that facilities choose, they should include benefit transactions and insurance eligibility in the calculated estimates. Experts have noted that enhancing pricing transparency can increase point-of-service collection from 1.2% to 1.8%.

The second alternative that healthcare facilities can use is recording discussions with patients at every level of the revenue cycle, such as scheduling and registration, to establish the accuracy and consistency of information communication. This process can help facilities identify and solve problems, which will improve customer service and point-of-service collections. Based in the Dallas-Fort Worth region, Texas Health Resources (THR) began recording patient conversations, whether it occurred by phone, technology, or in-person, in 2013 (Consolver & Phillips, 2014). The supervisor would then listen to the conversation of every employee and provide constructive feedback on the areas they were doing great and the areas they needed to improve. The supervisors noted that the employees focused on their work’s process and did not empathize with patients who needed it, which reduced patient satisfaction. The supervisors use the recordings of patient interactions with the staff in training how patients perceive information and how the employees should communicate with the patients (Consolver & Phillips, 2014). HFMA’s MAP Award winners encourage healthcare facilities to support learning in many forms to improve their revenue cycle (n.d, 2014). THR also merged scheduling, preregistration and insurance verification into one centralized process to ensure consistency and accuracy across the revenue cycle. This change resulted in the reduction in the number of calls and the elimination of duplication among functions. The steps that THR took had significant benefits. For example, the Press Ganey patient satisfaction rate increased from less than 50th percentile to above the 75th percentile in 5 years (Consolver & Phillips, 2014). THR started recording patients’ conversations to improve patient satisfaction, but it ended up improving patient financial communication, which led to the increase in point-of-service collections. Therefore, recording patient conversations with the staff is an effective solution to increasing collections.

The final alternative healthcare organizations can use to solve collection issues is to compare expected collections to actual collections from health plans and patients to determine the problem. For example, a healthcare facility might have predicted to collect $ 80 million and end up collecting $ 60 million. These figures indicate that there must be a challenge in the collection because even though actual collections may differ from the estimated collection, they should not vary with such a vast margin. Facilities should go further to investigate the cause of the difference. Sisters of Charity of Leavenworth Health (SCL) in Broomfield, Colorado, developed a price-estimate-reporting tool enhanced by change management to ensure its collection activities are timely, accurate and incomplete while improving the patient experience (Cahn et al., 2017). The system uses the price-estimation tool side-by-side with other tools to monitor patients’ payment activities to analyze the difference between the actual and estimated collections. Adopting the price-estimation-reporting tool and related processes has led to a significant increase in point-of-service collections. For example, one hospital increased their monthly point-of-service collections from $ 4000 to $ 11000. Cahn et al. (2017) insist that comprehensive and continuous training is required to increase collections. The use of technology is also essential in collection improvements.

Informed Opinion of California Sutter Health’s Approach

Sutter Health took four steps to increase its point-of-service collection and improve the overall revenue cycle. The first step was setting benchmarks, which began in analyzing the revenue management cycle. This step indicated that the system was willing to make amends by taking the first step, usually analyzing the system. The provider identified several problems and set benchmarks to solve them. Sutter Health displayed accountability in handling the challenges because they did not blame the staff and other members. For example, the provider would have blamed managers and the staff for waiting until the end of the month to set benchmarks. Instead, they recognized that the problem was due to the lack of access to real-time data of crucial financial and operational indicators (Souza & McCarty, 2007. The choice of training and empowering staff members was an excellent one. First, the system reduced the expense of hiring a more qualified team, who would require higher pay. It also made all PFS and registration staff members accountable and competent in revenue collection. This approach had a significant impact on the revenue collection of Sutter Health, and other healthcare organizations can use the method because it is easy and inexpensive to implement.

Conclusion

Healthcare organization require funds to operate effectively and provide quality care to patients, which is why they need to increase their point-of-service collection and reduce losses from claims denial. Sutter Health took four steps to increase its point-of-service collection and improve its overall revenue cycle. The steps included setting benchmarks of the issue they established from the analysis of its revenue management cycle, empowering PFS staff to take responsibility for accounts, front-end collection and comprehensive training of PFS and registration staff members. Other alternatives that healthcare facilities can use to increase revenue collection include pricing transparency, recording patients’ conversations with staff members to identify and solve problems and comparing actual and estimated collection to establish and solve collection problems. However, healthcare organizations should not overcharge patients to maximize their revenue collection.

References

Bohnsack, Jim, and Scott Hawig. (2013). Choosing the Right Strategy for Point-of-service Collections: Technologies Enhance Revenue, Patient Satisfaction. Healthcare Registration

Cahn, Joshua, Peter Johnson, Kevin Driesen, and Laurie Hindson. (2017) Tools to Improve Point-of-service Collections: High-deductible Health Plans Have Health Systems Seeking New, Innovative Ways to Increase Patient Collections at the Point of Service. Healthcare Financial Management

Consolver, Patti, and Scott Phillips. (2014). Enhancing the Revenue Cycle Experience for Patients: Texas Health Resources Recorded Patient Encounters with Revenue Cycle Staff to Provide Feedback to Staff on the Quality of Their Customer Service-and Improved Both Patient Satisfaction and Point-of-service Collections. Healthcare Financial Management

N.d. (2014). Ideas and Inspiration from HFMA’s MAP Award Winners: 25 Tips for Revenue Cycle Success. Healthcare Financial Management

Souza, M. & McCarty, B. (2007). From bottom to top: How one provider retooled its collections [Electronic version]. Healthcare Financial Management, 61(9), 67-73.

write

write