Introduction

The availability of goods and services is essential in enabling stable prices and mitigating price inflations. Recent advancements in multiple facets, including technology, communication, and transportation, have eased the movement of goods and services in the global market (Ghobakhloo & Fathi, 2019). Due to increasing rivalry in domestic and foreign markets, many organizations have been forced to rapidly improve and integrate effective strategies to advance their sustainability. Multinational corporations (MNCs) in multiple sectors are introducing new mechanisms to advance their product and service delivery. Organizations have recognized the importance of strong engineering, design, and manufacturing in enabling their competitiveness. Companies are developing and supplying new products to meet their consumers’ needs and maximize their revenue. Unfortunately, despite significant transitions and developments, the global supply chain crunch has become a severe concern to multiple market players, including organizations and customers. The recent coronavirus coupled with restriction measures has caused supply chain disruptions and a decline in certain products, thus enabling product shortages and higher prices (Bala, 2022). These disruptions in the supply chain following the coronavirus pandemic have negatively impacted several companies in various sectors due to their inability to avail products at affordable prices. Multinational corporations in multiple economies such as the United States and Europe have reported severe shortages in their inventories. For instance, inadequate semiconductors have influenced Volkswagen to cut back on the production of automobiles (Carey et al., 2021). The current paper explores the causes supply chain crunch and how these disruptions linked to the pandemic continue to influence various MNCs in diverse sectors.

Causes of a supply crunch

Indeed, the global supply chain crunch can be attributed to multiple variables at organizational and market levels. For instance, the emergence and consequential spread of coronavirus created disruptions in the global supply chain. The novel COVI-19 was first detected in Wuhan, China, in late 2019 before World Health Organization (WHO) declared it a pandemic in early March 2020. The rapid spread of the virus and growing fatalities across the globe influenced governments to introduce and implement restriction measures to curb the spread of the virus at national and international levels. Developed nations such as China, the United States, and the United Kingdom issued travel bans and introduced quarantine measures to mitigate the spread of the virus. With the international market reporting over 19.8 million confirmed cases and more than 729,000 COVID-19 fatalities by early august 2020, governments implemented travel restrictions, border shutdowns, business discontinuity, and quarantine to contain the spread of the virus (Yu et al., 2021).

Several companies in multiple industries temporarily ceased operations while some organizations, especially in the service sector, adopted work from home strategy to enforce safety measures against the pandemic. Accordingly, supply chain disruptions following the COVID-19 outbreak and restrictions enabled a supply chain crunch. With several companies closing operations, the market experienced a decline in available commodities, thus causing a surge in prices. Severely, the implications of the pandemic on the Chinese economy enabled ripple effects in the global market. With China being considered as the “world’s factory,” a decline in various operations, including shipping and manufacturing, due to restriction measures slowed the supply of products in the international market. According to Bala (2022), COVID-19 cases in key port cities including Shenzhen, Tianjin, and Ningbo and in Xi’an industrial hub resulted in lockdowns in such areas. With China maintaining a zero-tolerance Covid policy, the country sometimes shutdown entire factories or ports due to a single coronavirus case, thus exacerbating the global supply chain crisis by disrupting manufacturing and shipping operations (Bala, 2022). Accordingly, economic disruptions due to the coronavirus pandemic and resulting restriction measures enabled a supply chain crunch.

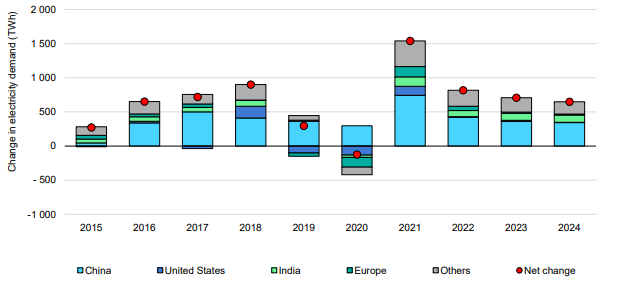

Growing demand, especially in the post-pandemic period, has exacerbated the global supply chain crunch. In the last couple of months, various governments have initiated vaccination programs to mitigate the spread of the pandemic. The availability of Covid vaccines has encouraged the resumption of multiple outdoor activities and influenced governments to ease Covid restrictions. Accordingly, the resumption of socio-economic operations at national and international levels has fueled demand, thus enabling a mismatch between supply and demand (Jun, 2021). For instance, the energy sector has reported inclining energy demand, as indicated in figure 1. According to International Energy Agency (2022), demand for electricity increased in 2021 to match similar demand levels in 2019, before the pandemic. The closure of numerous production facilities and organizations during the pandemic reduced the demand for energy in 2020. However, with governments introducing Covid vaccines, easing restrictions, and reopening their economies in 2021, the electricity demand has increased. Consequently, the increasing demand in the global market has enabled a supply crunch since available supply cannot effectively sustain the growing demand, leading to higher prices.

Figure 1: Global demand for electricity

Source: International Energy Agency (2022)

Examples of industries and firms affected by a supply crunch

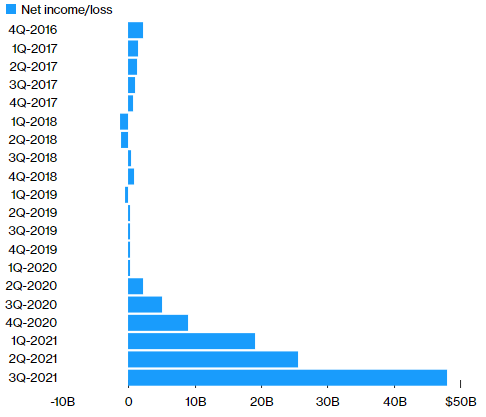

Undoubtedly, supply chain crises have influenced multiple industries, thus posing severe concerns to firms operating in or relying on such sectors. For instance, the shipping industry has reported dramatic shifts and severities due to shipping delays and inadequate shipping containers to meet shipping demand. Since the coronavirus outbreak, shipping rates have increased, thus benefiting cargo carriers at the expense of consumers and companies using cargo services. Since 2020 2Q, container carriers have reported increased net income, as shown in figure 2. Between 2Q-2020 and 3Q-2021, the net income among the largest container carriers grew from nearly $2.2 billion to over $48 billion (Etter & Murray, 2022). According to Smith (2021), Maersk, one of the largest container shipping companies, has reported increased earnings due to rising demand and shipping rates. Between 2020 and 2021, Maersk reported a 200% surge in its earnings before interest, tax, depreciation, and amortization, following an increase from $1.7 billion to $5.1 billion. The company’s revenues also increased by 60% to reach $14.2 billion, thus indicating the influence of higher shipping rates on Maersk’s revenue (Smith, 2021). These inclining shipping rates can be attributed to post-pandemic demand recovery and container shortages.

Figure 2: Profits by major container carriers

Source: Etter and Murray (2022)

Importantly, rising consumer demand has influenced retailers such as Walmart and Costco to increase their inventory. This has stimulated companies to intensify importation and exportation operations at national and international levels. Temporary closure of major shipping ports, especially in Asia, has also contributed to higher shipping rates. The pandemic forced nations such as China and United States to temporarily suspend shipping activities to mitigate the spread caused delays in shipping operations. China, for example, closed one of its largest ports for over a week, thus hindering shipping operations (Smith, 2021). As a result, the post-pandemic demand recovery coupled with relaxation of restrictions has fueled the demand for cargo shipping leading to higher shipping prices. Improved performance among shipping companies has further benefited their stocks. Major players such as Maersk and Hapag-Lloyd AG have reported significant improvements in their stock performance, with their shares hitting new record highs (Etter & Murray, 2022). Accordingly, increased shipping rates have benefited Maersk’s profits and revenues following the rising demand for transportation of commodities at national and international levels.

Unfortunately, while cargo companies are realizing significant revenues, corporations using shipping and freight are experiencing severe challenges in terms of costs and delays. Elevated ocean shipping rates have increased the cost of transporting or acquiring necessary inventory. According to Etter and Murray (2022), the spot rate for a 40-foot container from Asia to the US has increased to $20,000, thus proving exorbitantly costly to customers of large sea-borne cargo. They added that the tight container capacity coupled with congestion in ports had compounded the severity of supply chain disruptions. These increased expenses have impacted major organizations such as Walmart Inc. and Ikea that rely on sea-borne cargo (Etter & Murray, 2022). The scarcity of containers has intensified the cost of shipping cargo to different destinations. With Walmart operating in 24 countries and sourcing products from over 100 countries, cargo shipping is critical in its supply chain. During the pandemic, a large portion of container ships was stuck in the wrong destinations, thus contributing to container shortage for sea-cargo operations.

During the onset of the pandemic, priority was afforded to hospital supplies, including protective gear, with China shipping these products to several locations, such as West Africa, North America, and Europe (Goodman, 2021). As a result, empty containers remained in such destinations, thus creating container shortened in major Asian shipping ports. This scarcity facilitated increased prices, thereby allowing shipping companies to realize significant returns at their customers’ expense. For instance, container shipping from Shanghai to Los Angeles increased from $2000 in the pre-pandemic period to $25,000 in early 2021 (Goodman, 2021). Congestion at the ports has further intensified supply chain challenges due to delays offloading shipments. The heavy influx of ships has proven overwhelming in North America and European ports. According to Goodman (2021), congestion in Los Angeles and Oakland ports has forced arriving vessels to anchor in the ocean before loading or unloading, leading to delays.

Semiconductor crunch has also impacted automobile and technology companies, with tech giants such as Apple and major car manufacturers including Volkswagen and Stellantis reporting reduced production. The current semiconductor shortage can be attributed to increased demand for electronics and intelligent technologies during the pandemic. With governments introducing travel bans at local and international levels and suspending particular firm operations, companies in multiple markets introduced work-from-home to mitigate the spread of the pandemic. This work-from-home culture increased the demand for particular technological devices, especially personal computers. According to Stewart et al. (2021), the sales for personal computers increased by over 50%, thus indicating a significant rise in demand. This increased demand for smart technologies fueled the need for additional semiconductors which are central in manufacturing such devices. The wide application of chips in various products, including automobiles and appliances, has motivated many companies to compete in acquiring semiconductors, thus forcing suppliers to work towards increasing production. Dunn and Leibovici (2021) reported that semiconductors are used in multiple sectors, with nearly 26% of the manufacturing industries relying on these components as a direct input.

Taiwan Semiconductor Manufacturing Company (TSMC), one of the leading suppliers of chips plans to invest nearly $20 billion in its two Ohio companies to bolster production (Zimmerman, 2022). Currently, the tight supply of semiconductors due to supply chain disruptions major players, including Apple and Volkswagen, from securing adequate chips for their production. Shipping disruptions due to coronavirus outbreaks and government restrictions hindered the production and supply of these critical components. With shipping operations in Asia being temporarily suspended to limit the spread of the virus, companies such as Apple relying on chips to make electronics experienced inadequate supply to meet their demand. Prolonged chip shortages have influenced Apple to potentially reduce its projected iPhone 13 production targets by nearly 10 million units (Ghazanchyan, 2021). The company planned to produce 90 million new iPhone models in late 2021 but has since informed its manufacturing partners to lower production due to challenges securing adequate components. Given Apple’s significant market base, reduced production may negatively impact its global market sales and revenues. Li (2021) reported that more than 50% of Apple’s net sales come from iPhones thus indicating the significance of this product line in the company’s market performance. With chipmakers such as TSMC predicting supply shortages beyond 2022, reduced production at Apple due to the semiconductor crunch can severely compromise the availability of Apple products. According to Leslie (2021), Apple announced an approximately 10% cut on its iPhone production due to semiconductor shortages.

Simultaneously, the supply crunch has negatively affected auto companies such as Volkswagen. Specifically, inadequate semiconductors have induced production challenges, as these companies lack the necessary component to finish their vehicles. With car manufacturers reporting a decline in demand and sales due to the pandemic, the demand recovery in the post-pandemic period offers market opportunities for them to realize higher sales. Unfortunately, the global semiconductor chip shortage has cost auto companies, with Volkswagen and Stellantis reducing their production by 800,000 and 600,000, respectively in Q3-2021 (Carey et al., 2021). This decline in output following semiconductor chip shortages has compromised companies’ revenues. According to Carey et al. (2021), Stellantis’ quarterly revenues declined by 14% following the 600,000 reduction in automobile production. The company also anticipates that existing supply chain complexities can significantly reduce its revenues following fluctuating capacity utilization. Accordingly, semiconductor shortages have negatively impacted several companies in the tech and automobile industries, with companies such as Apple, Volkswagen, and Stellantis reducing their production due to inadequate semiconductors.

Lessons from the supply crunch

Consequently, the ongoing supply chain crunch has exposed the extent to which supply chain challenges impact various players in the demand and supply sides. In particular, inadequate supply to meet market demand has facilitated price increases in various sectors, including shipping, technology, and automobile. Major companies such as Apple and Volkswagen have noted inadequate semiconductors to meet their production capacities. With semiconductors being essential components of technological devices and cars, inadequate supply of these semiconductors following supply chain disruptions have influenced some manufacturers to lower their production. For instance, prolonged chip shortages have impacted Apple to potentially reduce its projected iPhone 13 production targets by nearly 10 million units (Ghazanchyan, 2021). Volkswagen also declined its car units due to inadequate semiconductors necessary in producing automobiles. These severities highlight the extensive nature of the supply chain crunch in multiple sectors and the severe implications this can have on consumers. Currently, multiple sectors, including healthcare, technology, and automobile industries, leverage require technological innovations to avail quality products and services. With semiconductors being utilized in diverse industries such as healthcare and tech, inadequate supply of these critical components hinder corporations from providing superior products and services. Within the healthcare sector, the growing use of chips in health care devices such as wearables and smart patches necessitates an adequate supply of semiconductors (Stewart et al., 2021). Accordingly, the current supply chain crunch has exposed the severe extent and implications of supply shortages of companies and consumers.

More so, the supply chain crunch has exposed negativities associated with inter-industry linkages. Industries are interconnected within the supply chain network due to various operations linking these industries. For instance, the shipping sector and car industry demonstrate linkages, as the latter utilizes cargo shipping to transport raw materials and end products. Unfortunately, the supply chain crunch has indicated that complexities in one sector can extend to other industries linked to a particular industry. With the pandemic affecting the shipping industry, several corporations relying on this sector for cargo transport experienced severe repercussions due to delays and higher costs. In 2020, major shipping ports in Asian markets suspended operations, thus inconveniencing companies relying on see-borne cargo (Etter & Murray, 2022). According to Etter and Murray (2022), the spot rate for a 40-foot container from Asia to the US has increased to $20,000, thus proving exorbitantly costly to customers of sizeable sea-borne cargo. These increased cargo prices emanated from inadequate ship containers, thus causing companies in other sectors significant revenues. Delays due to congestion in ports have further impacted Walmart Inc. and Ikea. According to Goodman (2021), congestion in Los Angeles and Oakland ports has forced arriving ships to anchor in the ocean before loading or unloading, leading to delays. Therefore, the current supply chain crunch has revealed the negativities associated with inter-industry linkages as challenges in the shipping sector negatively impacted companies and industries relying on the industry for cargo transport.

Recommendations and conclusion

Therefore, the supply chain crunch has exposed several international corporations to severe challenges, including delays securing critical raw materials and higher costs. These severities necessitate innovative strategies to prevent future recurrence of supply chain crunch. For instance, governments should bolster local supply to limit overreliance on foreign economies on particular products. With coronavirus impacting diverse international economies, nations imposed travel bans and ceased certain manufacturing and cargo shipping operations. Within the shipping industry, the temporary closure of certain ports in Asia and China compromised freight transport, thus impeding corporations relying on shipping from securing key raw materials. China, for example, closed one of its largest ports for over a week, thus hindering shipping operations (Smith, 2021). Accordingly, improving local supply can prevent overreliance on certain economies for key raw materials. The current shortage of chips can be mitigated by improving local supply, thus bolstering supply and ensuring tech and motor companies. According to Stewart et al. (2021), a significant portion of semiconductors in the global market are manufactured in Taiwan and South Korea. This has contributed to the supply crunch for semiconductors as a significant rise in the demand for semiconductors in various markets overwhelmed the current production of such vital components. Major economies, including the US, Europe, and China, have committed to enhancing their semi fabricating capacity (Stewart et al., 2021).

In addition, corporations can mitigate supply chain crunch by replenishing their inventory to ensure they have adequate products to meet fluctuations in demand. Due to the ongoing supply chain crunch, companies are spending considerably to acquire their inventories on time. Increased freight costs and delays following concentration in ports are disadvantaging several multinationals and retailers. To overcome these limitations by increasing their inventories. For instance, Costco is mitigating the extremities associated with the supply chain crunch by increasing its inventory and chartering its own ships (Stein, 2021). With Costco experiencing product shortages in 2020, the company has increased its merchandise to mitigate the supply crunch. Chartering its ships has allowed Costco to avoid high freight costs. These adjustments have favored Costco’s performance, with the company reporting a 17% and 9.4% surge in revenues and sales, respectively (Stein, 2021)

Furthermore, intensifying investments in the digital supply chain can help corporations tackle supply chain issues and disruptions. Economies are witnessing significant technological advancements which can be leveraged to complement supply chain management. The recent pandemic and its consequences on social and economic dimensions have communicated the need for organizations to recognize and adapt to market transitions. Digital supply chain management can bolster organizational agility and response to market changes, thus advancing corporate performance (Büyüközkan & Göçer, 2018). With the digital supply chain unifying all systems, applications, and processes, managers and organizational leaders are better positioned to identify emerging complexities and mount effective responses that propel their companies’ performance.

References

Bala, S. (2022). Disruptions in China can lead to ‘ripple-effects’ across global supply chain, says HSBC. Retrieved March 14, 2022, from https://www.cnbc.com/2022/01/31/china-covid-zero-disrupts-supply-chains-impacts-global-recovery-hsbc-.html

Büyüközkan, G., & Göçer, F. (2018). Digital supply chain: literature review and a proposed framework for future research. Computers in Industry, 97, 157-177. https://libkey.io/libraries/451/articles/190626990/full-text-file?utm_source=api_174

Carey, N., Steitz, C. & Piovaccari, G. (2021). Europe’s top carmakers count mounting cost of chip crunch. Retrieved March 14, 2022, from https://www.reuters.com/business/autos-transportation/europes-top-carmakers-count-cost-chip-crunch-2021-10-28/

Dunn, J., & Leibovici, F. (2021). Supply Chain Bottlenecks and Inflation: The Role of Semiconductors. Economic Synopses, (28).

Etter, L., & Murray, B. (2022). Shipping Companies Had a $150 Billion Year. Economists Warn They’re Also Stoking Inflation. Retrieved March 14, 2022, from https://www.bloomberg.com/news/features/2022-01-18/supply-chain-crisis-helped-shipping-companies-reap-150-billion-in-2021

Ghazanchyan, S. (2021). Apple set to cut iPhone production goals due to chip crunch. Retrieved March 14, 2022, from https://en.armradio.am/2021/10/13/apple-set-to-cut-iphone-production-goals-due-to-chip-crunch/

Ghobakhloo, M., & Fathi, M. (2019). Corporate survival in Industry 4.0 era: the enabling role of lean-digitized manufacturing. Journal of Manufacturing Technology Management.

Goodman, P. (2021). How the Supply Chain Broke, and Why It Won’t Be Fixed Anytime Soon. Retrieved March 14, 2022, from https://www.nytimes.com/2021/10/22/business/shortages-supply-chain.html

International Electricity Agency. Electricity Market Report. Retrieved March 14, 2022, from https://iea.blob.core.windows.net/assets/d75d928b-9448-4c9b-b13d-6a92145af5a3/ElectricityMarketReport_January2022.pdf

Jun, H. (2021). What’s Causing the Global Supply Crunch? Retrieved March 14, 2022, from https://supplychaindigital.com/procurement/whats-causing-global-supply-crunch

Leslie, M. (2021). Pandemic scrambles the semiconductor supply chain. Engineering. https://libkey.io/libraries/451/articles/512524642/full-text-file?utm_source=api_174

Li, Y. (2021). Apple Inc. Analysis and Forecast Evaluation. Proceedings of Business and Economic Studies, 4(4), 71-78.

Smith, E. (2021). The world’s largest container shipping firm posts soaring second-quarter earnings. Retrieved March 14, 2022, from https://www.cnbc.com/2021/08/06/maersk-q2-2021.html

Stein, S. (2021). Costco Addresses Supply Chain Pains By Chartering Their Own Ships. Retrieved March 14, 2022, from https://www.forbes.com/sites/sanfordstein/2021/09/24/costco-addresses-supply-chain-pains-by-chartering-their-own-ships/?sh=6fba515b6c4f

Stewart, D., Hamline, D., Bucaille, A. & Crossan, G. (2021). My kingdom for a chip: The semiconductor shortage extends into 2022. Retrieved March 14, 2022, from https://www2.deloitte.com/xe/en/insights/industry/technology/technology-media-and-telecom-predictions/2022/semiconductor-chip-shortage.html

Yu, Z., Razzaq, A., Rehman, A., Shah, A., Jameel, K., & Mor, R. S. (2021). Disruption in global supply chain and socio-economic shocks: a lesson from COVID-19 for sustainable production and consumption. Operations Management Research, 1-16. https://libkey.io/libraries/451/articles/451499792/full-text-file?utm_source=api_174

Zimmerman, S. (2022). Semiconductors expected to be in tight supply throughout 2022. Retrieved March 14, 2022, from https://www.supplychaindive.com/news/semiconductor-tight-supply-shortage-2022/617371/

write

write