Executive Summary

The Centurion Super Fund (CSF) has received advice from a consultant about the asset allocation strategy for the fund as a consequence of the findings of this research. The factors taken into account in producing the recommendations include the current status of the market, the objectives that the CSF has set for its investments, and the data presented in the Investment Policy Statement (IPS). This paper covers the investigation of the Fixed Interest manager, the prospective enhancement of the global equity exposure, the discussion of the benefits and drawbacks of Tactical Asset Allocation (TAA), and the recommendation provided by CSF to replace the current property exposure. Another subject explored in this research is replacing the existing property exposure. It investigates a proposition made by CSF. Both the research’s conclusions and suggestions are meant to help CSF improve the profitability of its portfolio and allay its concerns about changes in interest rates and inflation.

Introduction

The goal of this study’s financial research is to solve the issues brought up by the prestigious Centurion Super Fund (CSF). Their concerns center on the likelihood of inflation in the Australian economy and the risk of interest rate increases by the esteemed Reserve Bank of Australia (RBA). Within the constraints of this well produced study, a thorough investigation of these important themes will be conducted.

It has been revealed that CSF is considering reducing its exposure to fixed-income assets, as explained by Chatterjee (2021). The fund seeks advice from seasoned specialists in order to make sensible decisions. As a result, this research will conduct a thorough examination of CSF’s current intended asset mix, going into great depth about its present portfolio. The final goal is to provide thorough suggestions that take into account CSF’s particular needs and goals.

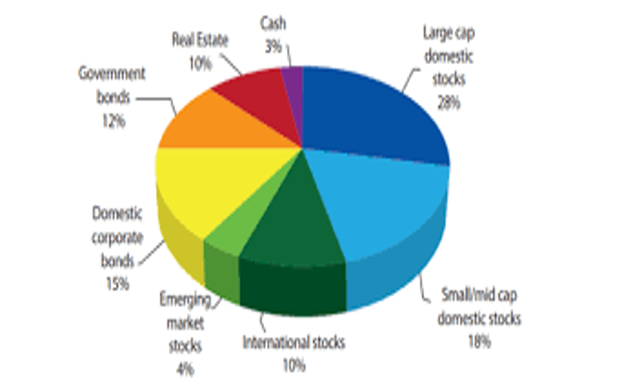

This project will include a variety of asset types, such as cash, fixed interest, international shares, and international real estate. The report must also take into account a number of important factors, including risk tolerance, total return objectives, yearly pension obligations, tax ramifications, strategic asset allocation (SAA), and rebalancing procedures. The research aims to provide comprehensive suggestions that cover the whole CSF investment environment by addressing these numerous characteristics.

The importance of recognizing CSF’s Investment Policy Statement (IPS) as the major source of data on which this analysis and the recommendations that follow are based must be emphasized, however. Although the IPS provides a solid framework, it is important to be aware of any possible restrictions. The application of the recommendations made here may be impacted by changing market circumstances and unforeseeable occurrences (Entry, 2019). Despite these inherent constraints, this study’s major goal is to provide informative advice that will help CSF make choices about its fixed income allocation and other important investment-related issues.

Analysis and Recommendations

2.1. Fixed Interest Allocation

An important component of this research is the assessment of Centurion Super Fund’s (CSF) plan to decrease its fixed interest allocation. The probable effects of increasing interest rates and inflation on fixed-income assets are acknowledged in the study and call for cautious assessment (Leketi, 2022). To assist CSF in making decisions, suggestions will be made after evaluating CSF’s risk appetite, total return objective, and the performance of the active fixed interest manager. The moderate risk appetite of the fund, which measures risk in terms of drawdowns rather than volatility, is taken into account in the study.

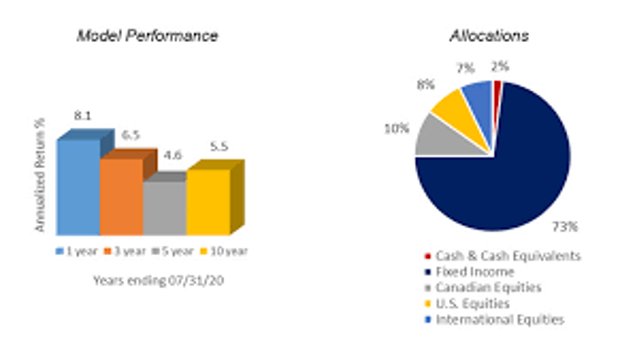

The CPI + 3% total return objective also serves as a benchmark for assessing the appropriateness of the suggested fixed-interest allocation decrease. The active fixed interest manager’s performance, which has a history of recent strong performance, will be compared against the prospective effects of shifting market circumstances. The report’s goal is to provide well-informed suggestions that are in line with CSF’s goals and aid in the optimization of its investment strategy by thoroughly examining these issues.

2.2. Fixed Interest Manager Investigation

An important part of this study is the evaluation of the effects of the investigation of the Fixed Interest manager for illicit trading activities. The section carefully considers a number of factors, including the manager’s prior performance, risk management techniques, and any possible legal repercussions related to the probe. The report’s goal is to provide recommendations on whether to keep or replace the exposure to the Fixed Interest manager by carefully analyzing these elements. The study takes into account both quantitative and qualitative factors such as consistency, adherence to investing criteria, and total risk-adjusted returns when evaluating the manager’s prior performance.

The study also examines the manager’s risk management procedures in detail to judge how well they mitigate possible hazards. The legal aspects of the probe are also carefully assessed, taking into account any possible reputational harm or legal repercussions for CSF (Wohlmuth, 2019). Based on these conclusions, suggestions will be made to help CSF make an educated choice on whether to keep the Fixed Interest manager or replace him or her, assuring alignment with the fund’s goals and risk tolerance.

2.3. Global Equities Exposure

The study examines the improvements that may be made to CSF’s exposure to international equities by taking a thorough replication approach into account. This section contrasts the advantages and disadvantages of a full replication strategy with the stratified sampling technique that is presently in use (Little, 2019). This paper analyzes both strategies in order to provide recommendations that are consistent with the objectives and amount of risk tolerance stated by CSF. The assessment takes into account a number of factors, such as tracking inaccuracy, cost-effectiveness, and the capacity to accurately replicate the performance of the selected index.

We focus on the benefits of complete replication, which include reducing tracking mistakes and enhancing the precision of market change detection. A thorough investigation of the drawbacks is now being done, including the possible liquidity constraints and increased transaction fee costs. Based on the results of this research, suggestions will help CSF determine if switching to a full replication method is the best course of action, ultimately maximizing their exposure to international stocks while taking into account their specific goals and degree of risk tolerance.

2.4. Property Exposure and Income Generation

This section thoroughly assesses the plan to replace the present Property exposure with an active manager using a value-based approach in light of CSF’s difficulties in delivering its yearly pension promise and the goal of enhancing portfolio income. The research examines the possible advantages and dangers of such a move critically while taking CSF’s investing objectives and limitations into account. The predicted income production, risk-adjusted returns, the advantages of diversification, and compatibility with CSF’s long-term investment plan are all examined.

The report’s thorough analysis seeks to provide well-informed suggestions that will help CSF make a wise choice. These suggestions will take into account the proposed change’s acceptability in the context of CSF’s entire investment portfolio, income needs, risk tolerance, and the active manager’s capacity to create value using their value-based approach (OBADE, 2019). Through this research, CSF may learn important information that will help them decide whether to replace the Property exposure in the future, maximizing portfolio income while taking their unique investment objectives and limitations into account.

2.5. Tactical Asset Allocation (TAA)

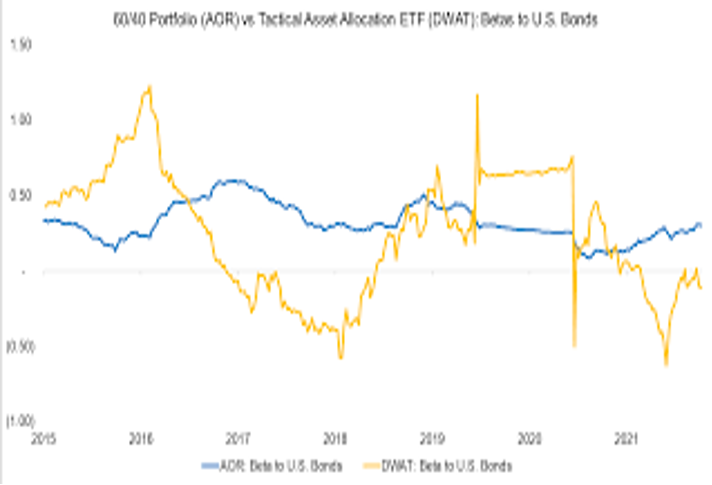

This portion of the paper carefully analyzes the many advantages and disadvantages of Tactical Asset Allocation (TAA) using up-to-date research results as the foundation. TAA entails actively modifying asset allocations in the portfolio in response to shifting market circumstances, with the main goal of improving the portfolio’s overall results. The research thoroughly assesses the TAA’s potential benefits, demonstrating its amazing capacity to profit from momentary market inefficiencies, adapt to changing market trends, and perhaps provide larger returns than a static asset allocation strategy. The paper also looks at several possible negative aspects of TAA, including as the possibility for rising transaction costs, the enormous difficulty in accurately predicting market moves, and the inherent risk of underperformance in certain market circumstances.

Furthermore, to ensure a thorough investigation of the issue, the research carefully takes into account CSF’s risk tolerance, return targets, and current market circumstances. The paper expertly constructs suggestions on whether TAA could be seen as a feasible path for CSF by combining these important elements with the unique qualities and consequences of TAA (Mullon & Ngoepe, 2019). These suggestions carefully consider the potential advantages TAA might have in enhancing portfolio results, the practicality of putting into place and maintaining a TAA strategy given CSF’s available resources and capabilities, and the appropriateness of TAA within the broader framework of CSF’s investment approach. This thorough evaluation intends to provide CSF with insightful information and a thorough knowledge of the possible benefits and drawbacks of TAA, enabling them to make an intelligent and well-informed choice about using TAA as a strategy to improve the results of their whole portfolio.

Conclusion

The investment strategy of Centurion Super Fund (CSF) has been looked at, assessed, and suggestions have been given based on the results. The study took into account the performance of the active fixed interest manager as well as the prospective effects of increasing interest rates and inflation while analyzing CSF’s plan to cut its fixed interest allocation (Vavra & Rozgus, 2020). It is advised to go forward with decreasing the fixed interest allocation, taking into account the possible advantages of controlling future risks. This recommendation is based on the evaluation of CSF’s risk tolerance, total return objective, and manager’s track record. The analysis assessed how the investigation into the Fixed Interest manager’s alleged illicit trading actions would affect CSF’s portfolio.

It is advised to keep the exposure, given that suitable precautions are taken to monitor and reduce any hazards, after evaluating the manager’s performance, risk management procedures, and legal issues. The investigation considered whether switching from the current stratified sampling strategy to a full replication approach in order to address the global equities exposure. It is advised to stick with the present strategy since it better suits CSF’s objectives and investing strategy, as well as its risk tolerance and the advantages and disadvantages of complete replication. The paper looked at the advantages and disadvantages of replacing the current Property exposure with an active management who employs a value-based approach. It is advised to go through with the proposed modification since it may boost portfolio income and is in line with CSF’s investment objectives after carefully examining and taking into account its aims.

The paper ends with a cautious suggestion for CSF to take tactical asset allocation (TAA) into account to improve portfolio results. It underlines how crucial it is to weigh the advantages and difficulties of establishing and sustaining a TAA strategy while taking CSF’s risk tolerance, return goals, and market circumstances into account. The main aim is to match CSF’s objectives and risk tolerance with its investing strategy. Continuous observation, analysis, and alterations are essential. CSF may successfully traverse the complicated financial environment for positive and sustainable development by carefully considering the advice and using a watchful and flexible investing strategy.

Appendices

References

Blake, D., MacMinn, R., Tsai, J. C., & Wang, J. (2020). Longevity Risk and Capital Markets: The 2017–2018 Update. North American Actuarial Journal, 25(sup1), S280-S308.

Chatterjee, P. (2021). Analytics in the Age of Artificial Intelligence: The Why and the How of Using Analytics to Unleash the Power of Artificial Intelligence. Atlantic Publishing Company.

Entry, E. D. (2019). Air Safety Through Investigation APRIL-JUNE 2019.

Leketi, G. F. (2022). An economic evaluation of the impact of the Petroleum and Liquid Fuels Charter on BEE participants (Doctoral dissertation, University of Johannesburg).

Little, D. K. (2019). Exploring the Impact of Nearly Complete Market Data on Small Businesses in the Government Professional Services Market. Temple University.

Mullon, P. A., & Ngoepe, M. (2019). An integrated framework to elevate information governance nationally in South Africa. Records Management Journal, 29(1/2), 103-116.

OBADE, F. (2019). Influence of Risk Management Strategies On Completion, Cost And Quality of Road Infrastructure Development Projects In Nairobi City County, Kenya.

Vavra, C., & Rozgus, A. (2020). Under Forty: These 2020 40 Under 40 winners have what it takes to lead the building industry to a higher level. Consulting-Specifying Engineer, 57(4), 9-20.

Wohlmuth, K. (2019). Technological Development, Structural Change and Digital Transformation in Africa. IWIM-Institut für Weltwirtschaft und Internationales Management, Universität Bremen, Fachbereich Wirtschaftswissenschaft.

write

write