In the New York Times article, “The Stock Market’s Covid Pattern: Faster Recovery from Each Panic,” Russel and Hadi (2021) address the devastating effects of the pandemic on the global economy. Since the outbreak Omicron variant of the coronavirus, concerns have been raised about the possibility of another global economic recession. The emergence of the Omicron variant is the latest cause of the stock market upheaval after the Delta variant. Since the pandemic outbreak, various news outlets have been shifting their assumptions about whether employees should show up for work, whether product demand will increase or whether people should travel abroad. With each phase of the pandemic, new requirements have been introduced for border closings, testing, vaccine administration, and warnings regarding physical distancing. Much, however, remains widely unknown about the new Omicron variant, including; the rate of spread of the virus and if existing vaccines provide sufficient protection. Due to the effects on the economy, the stock market has taken a hit, becoming highly volatile and unstable.

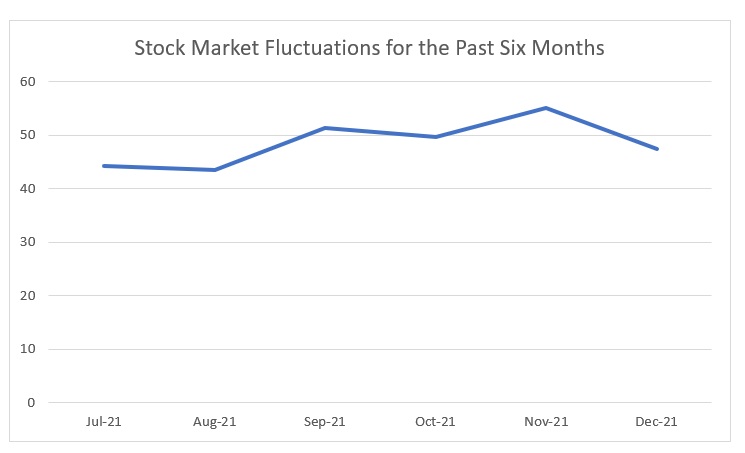

Due to its high sensitivity to economic changes, the stock market is considered a barometer for the pandemic’s path, plummeting after announcements and skyrocketing on introducing vaccines and other treatments. Each phase of the pandemic has brought its unique volatility in the stock market, with the trend being; a shorter low, followed by a higher recovery. The S&P Index indicates that since the beginning of December, the stock market has recovered approximately all financial losses that occurred after the announcement of the Omicron variant on 26th November (Russel & Hadi, 2021). Nevertheless, the stock market and the pandemic have not always moved together since other factors such as government spending and low-interest rates can drive corporate profits. This means that despite the pandemic shocks followed by increased reported cases, the stock market does not necessarily plummet with a significant increase in the spread of the virus. The figure below illustrates the pandemic-induced fluctuations of the stock market for the past six months.

Source: (The New York Times, 2021)

Russel and Hadi’s (2021) comparison between the stock market decline and the Covid-19 daily reported cases shows that the stock market and the pandemic do not necessarily move in a locked step. For instance, in February 2020, the pandemic reached a global scale, the global economy entered into a recession, and millions of people lost their jobs. The S&P lost more than 33.9% of its value from its peak. In September and October, the exponential increase in case counts and global death tolls fueled concerns about new and more stringent restrictions that would bring the economy into a new historical low. Along with the political uncertainty surrounding the United States presidential elections, the stock market speculations seemed bleak.

Nevertheless, the S&P neared a correction to the peak experienced in February and after that declined by 9% (Russel & Hadi, 2021). This was a worrisome yet symbolic improvement in the stock market. Other factors thought to have contributed to the slight improvement in the stock market performance are government spending (stimulus checks) and lowered interest rates.

In the period between March and April 2021, although case counts reached an all-time high, the stock market steadily climbed due to market optimism surrounding the vaccination rollouts. The emergence of the Delta variant between September and October threatened the stock market recovery (Russel & Hadi, 2021). Meanwhile, high inflation rates raised concerns about whether the Federal Reserve would cut back on stimulus injections into the economy. Between November and December, the coronavirus’s Omicron variant has again caused declines in the stock market, but the signs of recovery remain strong. The stock market’s recovery after economic dips caused by pandemic shocks is underpinned by the Federal Reserve’s efforts to cut interest rates (reducing borrowing costs), thus keeping capital in circulation throughout the financial system. Therefore, the Federal Reserve has played a significant role in sustaining the stock market ever since the outbreak of the pandemic.

In the past few weeks, economists have downsized their economic growth forecasts, citing the potential impacts of the Omicron variant on the rate of economic recovery. The main concern is that the variant will shutter global supply chains, reducing corporate activity and profit earning capacity, ultimately sending the stock market tumbling into a new low. The issue here is uncertainty; a lot is yet to be uncovered about the novel Omicron variant. Projections are, if the variant results in tighter restrictions and lockdowns, it could force companies to reduce productivity and factories to shutter (Russel & Hadi, 2021). This will increase the shortage of goods from building materials to cars. Previously, with each phase of the pandemic, reduced economic activity and the consequent product shortages have been the key reason behind inflation (the rise of commodity prices). Therefore, there is a possibility that the Federal Reserve will have to increase the interest rate (which will increase borrowing costs) to pump down inflation (reduce commodity prices). This scenario is likely to cause more turbulence in the stock market.

Bibliography

Russel, K., & Hadi, M. (2021, December 8). The stock market’s Covid pattern: Faster recovery from each panic. The New York Times – Breaking News, US News, World News, and Videos. https://www.nytimes.com/interactive/2021/12/07/business/omicron-stock-market-covid.html

write

write