Executive Summary

To come up with this report, research was done to gather more information about the Nike Company. The methodology used was the administration of questionnaires to several stakeholders. Apart from the questionnaire, more information was retrieved from the Nike 2021 Annual Report (10-K report). Nike uses various strategic resources to set itself unique in the industry. It uses advertisements and considers crucial business factors. To assess its current and future goals, Nike, Inc. has made excellent use of strategic management. Nike company is said to have several red flags of critical ethics. Nike is said to have employed underage individuals in Vietnam. In addition, the company is said to have practiced gender discrimination and forced labor. There is a lack of information in the sin-Dex index of Nike. Inc. If a company keeps most of its information secret, it can be difficult to use the data collected in the Sin-Dex According to Nike (2021), Nike Company has six capitals. These capitals include; financial, cultural, human, social, political, and natural capitals that are essential to its success.

In terms of sustainability, Nike has pioneered eco-friendly technologies. Nike plans to sustain athletics by eliminating carbon emissions and trash. Join us as we explore different ways to start. Nike’s Material Sustainability Index considers the environmental impacts of textiles and component materials. Nike MSI scores rise with environmental impact performance. This system has 0–100 points. Nike created a Manufacturing Index to evaluate its outsourcing factories’ ethics. Create your accountability structure for long-term success. The company’s long-term goals include increasing its market share in the sports equipment sector by introducing new products and extensively revising existing ones. Vanguard Group Inc. (at 8.21%) and Black Rock Fund Advisors (at 4.78%) are just two of the many well-known investors who have been the subject of numerous profiles (Huber, 2020).

Introduction

Nike, Inc., a global leader in athletic footwear, apparel, and accessories, was founded in 1964 and is headquartered in Beaverton, Oregon. Bill Bowerman and Phil Knight founded Nike, Inc. on May 30, 1971, having previously operated under the name “Blue Ribbon Sports” since the company’s inception on January 25, 1964. For the fiscal year 2020, the company brought in more than US$37.4 billion, making it the largest athletic footwear and apparel provider and a major sports equipment producer. In 2020, it had more than 76,000 employees across the globe (Nike, 2021). Forecasts put its value at over $32 billion in 2020, making it the most valuable sports organization brand. Nike had a value of $29.6 billion at the end of 2017. Among the 500 largest American corporations in annual revenue, Nike ranked 89th in Fortune’s 2018 list. Nike, Inc. hopes to revolutionize sports in every way (Bingaman et al., 2022). Numerous hypotheses are tested to enhance athletic performance, reduce injury risk, heighten sensory perception, and provide cutting-edge tools and gear. This report analyses Nike’s Sin-Dex Index, NIKES six capitals, and the absence or presence of “red flags” indicating problematic ethical practices to determine whether or not they are among Nike’s unique strategic assets.

Methodology Used to Gather Information About Nike

As mentioned above, Nike has more than seventy thousand employees across the globe. The research used a questionnaire to gather information from randomly chosen employees,, some long-time customers, and some federal government agencies like ITEP. Also, some information was retrieved from Nike Report 10-K (Nike, 2021). The main reason for administering the questionnaire was to know more about the company. Based on the information obtained, the researchers interpreted information in the following ways.

The Strategic Resources that Set Nike. Inc Apart

NIKE’s advertising campaigns are a major contributor to the company’s success. They have prominent athletes act as brand ambassadors, create groundbreaking new products, and use state-of-the-art technology in every facet of their operation. Their ads have made their logo and brand name ubiquitous. In 2016, the firm spent $3.3 billion of its own money on advertisements.

To assess its current and future goals, Nike, Inc. has made excellent use of strategic management. This greatly improves management’s ability to predict and guide the company’s future (Almazrouei et al., 2021). Words and phrases like “vision,” “environmental analysis,” “strategy development,” “strategy implementation,” and “strategy assessment” are all part of the administration’s lexicon when it comes to strategic management.

Nike has elaborated on their strategic plans after carefully considering crucial business factors. The Nike report 10-K delves into how managers devise strategies to motivate their staff (Nike, 2021). The only way to succeed is to study the tactics used by the rivals in the past, present, and the predicted future. In order to assess the current state and future direction of the company, strategic management tools were employed. A company’s strategic plan can be compared to a road map that points the way to the C-suite. Strategic managers utilize mission statements, SWOT analyses, SMART goals, and benchmarking.

Whether the company has red flags of critical ethics

Life Magazine photographers captured shocking images of children working in a Nike factory in Indonesia in the late 1990s. The children were seen assembling soccer balls despite the risk of injury. During a public audit, workers at a Vietnamese factory were allegedly exposed to toxic chemicals, leading to health problems; however, this was never verified (Hanson & Epstein, 2021).

Since Nike has not taken a stance on using pesticides and herbicides in farming, the organization Ethical Consumer gave the company a failing grade for its cotton sourcing policy. However, some questionable chemicals are used to prolong the leather’s life (Almazrouei et al., 2021).

Additionally, Nike, there have been in instances of misleading advertising. While not as serious as using children in hazardous jobs, false advertising is still a problem that needs to be addressed (Wang et al., 2020). It has also been suggested that Nike is not paying its full tax obligation. ITEP estimates that Nike made $44.5 billion in 2021 but had no federal income tax liability at that time. All or nearly all of that money almost certainly came from the United States.

Is there Nike’s Enough Information to use in the Sin-Dex Index

There is a lack of information in the sin-Dex index. If a company keeps most of its information secret, it can be difficult to use the data collected in the Sin-Dex (Wang et al., 2020). Nike is shown to be sexist, to use forced labor in its supply chain, and to pay less than the minimum wage to a significant portion of its workforce, according to the majority of the leaked documents. This index plays an essential role in making company stakeholders aware of the perils of unethical behavior and the gravity of their individual responsibility in the event of wrongdoing. Greater corporate wrongdoing necessitates greater efforts to mitigate threats. From what we can tell, the company bears moral responsibility for the threats that have arisen under its watch.

The Six or Seven Capitals, as Discussed in the NIKE, INC. ANNUAL REPORT ON FORM 10-K

Nike’s financial, cultural, human, social, political, and natural capitals are essential to its success (Nike, 2021). The company’s capital expenditures appear to be about par after reviewing the fiscal year’s final numbers. However, it is important to remember that the capital has a high equity capital related to debt with a debt-equity ratio of 0.66, despite projections that the ratio will rise sharply in 2020 due to store closures. It is impossible to assess the brand’s relative worth in the market without accounting for the firm’s cultural capital. Relationships with Nike’s customers, employees, the local community, and other businesses are discussed here in light of Nike’s Values. Consists of the trust placed in us by our customers, business partners, and the general public and the repercussions of Nike’s actions.

The 10-K Annual Report by Nike (2021) also demonstrates Nike’s commitment to investing in technology, which allows it to provide a world-class human resource with customized policies that are vital to creating a productive and satisfied workforce. Additionally, the company has been known to make significant profits by exploiting political opportunities presented by the oriented policies of the U.S. government. The firm’s expansion and product and service quality improvement have been greatly aided by financial support from the U.S. government in the form of low-interest loans and a globally advantageous tax arrangement. The term “corporate social responsibility” describes a business’ commitment to improving society through economic and social means.

Nike’s Sustainability Practices: Are they measured?

Nike has always been ahead of the curve in developing environmentally friendly technologies. Eliminating carbon emissions and trash is one way Nike plans to ensure the continued success of athletics. Join us as we explore a variety of routes to the starting point. The Material Sustainability Index from Nike considers the significant environmental impacts of a wide range of processed materials, including textiles and component materials. Improved performance in the selected areas of environmental impact is typically reflected in higher Nike MSI scores. The possible range of points in this system is from 0 to 100. Nike created a new Manufacturing Index to rate the ethical practices of the factories it uses for outsourcing. To achieve long-term viability, one must create one’s accountability structure.

How Does Nike Create Long-term Growth or Sustainable Value for its Stakeholders or Shareholders/investors?

The Nike product development team deserves a lot of credit for the company’s success. The company’s long-term goals include increasing its market share in the sports equipment sector by introducing new products and extensively revising existing ones. To create long-term value for Nike, it’s important to satisfy the shareholders who currently own a piece of the company. Similarly, the company’s goals are set by management. When these goals are accomplished, Nike will have a model with lasting potential. Nike, Inc.’s long-term financial plan calls for a 2.7% increase in EPS and a 20% hike in ROE for stockholders (Bingaman et al., 2022). Once this is implemented, the share price and bottom line will increase in tandem with the growth of the business. In order to satisfy its ever-expanding customer base, Nike Inc. has implemented a worldwide plan to enhance the standard of its wares. This ensures the company will always be at the forefront of its field.

Does the enterprise discuss stakeholder or sustainable investing in its [management discussion and analysis] in its filings with the SEC or other regulatory agencies? Does it provide sustainability disclosures in its filings? Does it compare year-over-year filings and discuss improvements or valuation decreases [expropriation of assets, geopolitical issues, lawsuits]?

According to the report by Bingaman et al. (2022), customers, shareholders, corporate executives, and government officials are just some of the groups with that Nike maintains a steady dialogue. This report will analyze the company’s formal partnership and stakeholder engagement initiatives to determine how this strategy fits into the bigger picture. The company is very thorough in terms of tracking who owns how many shares of stock.

Vanguard Group Inc. (at 8.21%) and Black Rock Fund Advisors (at 4.78%) are just two of the many well-known investors who have been the subject of numerous profiles (Huber, 2020). The company appears to have done its due diligence by consulting with the SEC and other relevant regulatory bodies regarding the potential for investment in its stock. Although these values’ presence provides strong evidence for the safety of suitability investing, their precise meaning is still up for debate.

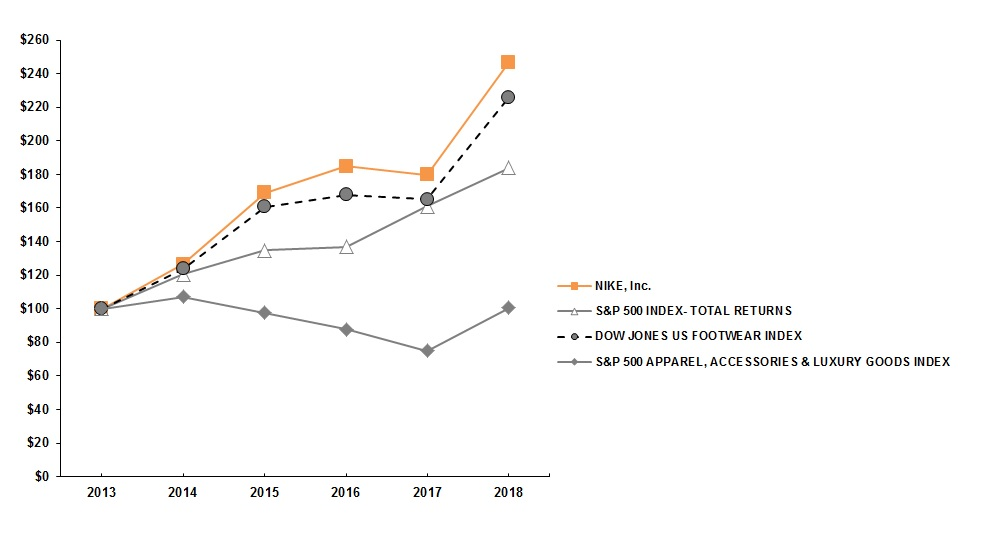

Bars in the following chart below compare the cumulative total returns of Nike Class B Common Stock, the S&P 500, the S&P Apparel, Accessories, and Luxury Goods Index, and the Dow Jones U.S. Footwear Index over five years. There is a hypothetical $100 investment in Nike’s Class B common stock, the S&P 500, the S&P Apparel, Accessories, and Luxury Goods Index, and the Dow Jones U.S. Footwear Index as of May 31, 2013. Each index’s performance is computed based on the assumption that all dividends were reinvested on the index’s base date.

Form To-K(Nike, 2021)

Does Nike Company Discuss its Enterprise Risks? What Risks Were Identified?

As recorded in the company’s report 10-K, Nike discusses the enterprise risks. According to Huber (2020), three main risks are faced by Nike Company. They include; Counterfeit Products, Increased competitive pressure, and Marketing Budget Pressure.

The widespread distribution and sale of knockoffs seriously threatens Nike’s reputation and bottom line. The company’s global reach has made it more likely to be targeted for selling counterfeit goods. Fake Nike products are widely available in many shops and markets. The Nike brand is associated with high quality, but this merchandise is of low quality even by Nike standards. A negative perception of Nike could result from consumers noticing a steady decline in product quality.

Despite its market dominance, Nike faces intense competition from established and emerging brands. Nike has increased its advertising spending in response to the proliferation of its competitors. Nike spent $3.5 billion on marketing and demand generation in the 2020 fiscal year. Putting athletes’ needs first in product development is key to Nike’s continued commercial success.

Marketing Competition from brands like Under Armour, Adidas, and Lululemon, among others, has increased marketing and advertising budgets, which has put a strain on Nike’s resources.

As customers’ tastes and expectations evolve, so must a business adapt to meet them. Other factors, including national employment laws, currency regulations, and taxation systems, impact Nike’s business operations worldwide.

Suppose you were a fiduciary or steward of Nike. What would you do to strengthen this organization’s behavior, activities, and reporting to make it even stronger, healthier, and more vibrant?

If I were in charge of the company, I would make several adjustments to the way that data is reported to make the organization stronger, healthier, more holistic, and more dynamic to appease the growing group of interested parties known as “stakeholders.”

I would also plan to make effective use of the Human Resources team. To keep the business running efficiently, the H.R. division is crucial. If I were in charge of Nike, my first order of business would be to ask the human resources department to develop new approaches to running the company. By helping to fill open positions, human resources play a crucial role in the company’s overall success. If I were in charge of making changes at work, I’d consult with H.R. before implementing any major shifts.

The company’s technological and centralized data assets are crucial to its continued efficiency and prosperity, so I would also work to maximize their use. I intend to increase output at work by encouraging the use of technological tools like computers, tablets, and smartphones so that data can flow from the company to the stakeholders and back to the company. The use of updated technology will help those who aren’t actively working on a project can still be kept up-to-date on its progress thanks to software and other collaboration software. In collaboration with I.T. experts, I would develop a strategy to keep Nike’s data secure without breaking the bank. Because of this, I believe it is important for businesses to adopt productivity-oriented software. Spreadsheets and networks are powerful resources for any business, whether used for external communication with clients or internal purposes within the company.

By employing effective organizational practices, corporations can increase their output volume without compromising quality. I hope to grow as a leader and develop creative solutions to problems like reducing costs while maintaining or increasing product quality and customer satisfaction by collaborating with experts from a wide range of disciplines.

Conclusion

The research carried out by administering questionnaires to Nike stakeholders revealed one thing, “Importance of positive publicity.” Putting itself in a unique position to capitalize on opportunities has been crucial to Nike, Inc. Extensive advertising, improved brand recognition, a broader range of products, and a dogged determination to better compete with rivals have all contributed to this result. Nike employs various business strategies, including strategic management models, product differentiation, and well-established distribution channels. The Swoosh logo and the slogan “Just Do it” have become synonymous with the high quality of Nike’s products in the minds of many. Ingenious advertising and top-notch goods are what keep customers coming back for more. Everything that Nike does is meant to protect its reputation in the industry. Many secrets and red flags hidden by the company are meant to keep its clean image before the public and its customers.

Recommendations

- Nike should strive hard to clear the doubts in their customer’s minds about the use of forced labor and gender discrimination. Such allegations may not harm the enterprise today, but in the future, they may become a big deal that would affect the company’s image.

- Strategic management tools assess the company’s current and future state. Strategic plans are like roadmaps to the C-suite. Strategic managers use mission statements, SWOT analyses, SMART goals, and benchmarking.

- The company should file a case that would protect it from copycats. This will help to overcome the problem of Counterfeit Products. If not controlled, such products may flood the market within a few years, and the original brands will lose their authenticity. Most people might go for cheap fake brands.

References

Almazrouei, A., Yassin, A. M., & Memon, A. H. (2021). Strategic Management Indicators for Sustainable Road Traffic Management. International Journal of Sustainable Construction Engineering and Technology, 12(3), 88–95. https://publisher.uthm.edu.my/ojs/index.php/IJSCET/article/view/9840

Bingaman, J., Kipkoech, G., & Crowley, J. P. (2022). Inoculation & Greenwashing: Defending Against Misleading Sustainability Messaging. Communication Reports, 87(5), 1–13. https://doi.org/10.1080/08934215.2022.2048877

Hanson, K. O., & Epstein, M. J. (2021). Amazon.com: Rotten: Why Corporate Misconduct Continues and What to Do about It: 9781735336114: Epstein, Marc J., Hanson, Kirk O.: Books. Amazon.com. https://www.amazon.com/Rotten-Corporate-Misconduct-Continues-about/dp/1735336114

Huber, W. D. (2020). Corporate Law and the Theory of the Firm: Reconstructing Corporations, Directors, Owners, and Investors. SSRN Electronic Journal, 78(34). https://www.academia.edu/42119710/Corporate_Law_and_the_Theory_of_the_Firm_Reconstructing_Corporations_Directors_Owners_and_Investors

Nike. (2021). FORM 10-K (Mark One) ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(D) OF THE SECURITIES EXCHANGE ACT OF 1934 FOR THE FISCAL YEAR ENDED. https://s1.q4cdn.com/806093406/files/doc_downloads/2021/08/Nike10k2021.pdf

Wang, Y., Tang, C., Wang, Z., & Chen, H. (2020). Yandex. Proceedings of the 11th ACM SIGOPS Asia-Pacific Workshop on Systems, 7(8). https://doi.org/10.1145/3409963.3410496

write

write