Executive summary

The real estate market in the UK is a dynamic and complex sector that contributes significantly to the country’s economy. Despite some uncertainties surrounding Brexit and the ongoing COVID-19 pandemic, the industry has shown resilience and remains attractive to domestic and international investors. In recent years, the UK has experienced a housing crisis, with demand outstripping housing supply, particularly in urban areas. This has led to a significant increase in property prices, making it difficult for first-time buyers to enter the market. The commercial real estate market in the UK has also been affected by the pandemic, with the shift to remote working leading to changes in demand for office space. However, the industrial and logistics sectors have experienced increased demand due to the rise of e-commerce. Institutional investors have traditionally dominated investment in the UK real estate market. Still, a recent trend has been toward more significant involvement by private equity firms and individual investors. The UK government has implemented several policies to address the housing crisis, including increased funding for affordable housing and measures to support first-time buyers. There are also plans to reform the planning system to increase the housing supply. Generally, while the UK real estate market faces challenges, it remains an attractive and resilient sector with significant potential for growth and investment.

Introductions

The concept of sustainability has become increasingly important in the real estate sector, as the environmental impact of buildings and their operations is recognized as an essential contributor to greenhouse gas emissions and other environmental problems. In the United Kingdom (UK), sustainability has become a focus for real estate professionals, policymakers, and investors, as the country seeks to transition towards a low-carbon economy and meet its climate change targets (Ionașcu et al., 2020, p. 78). This has led to various initiatives and regulations to promote sustainable real estate practices, including energy efficiency standards, green building certifications, and financial incentives for sustainable development. This essay will explore the current state of real estate sustainability in the UK, examining the key drivers and challenges and the opportunities and benefits associated with sustainable real estate practices.

Commercial real estate has recently realized that sustainable development is crucial for preserving natural environments and attracting tenants, investors, and consumers (Crosby et al., 2020, p. 90). This awareness came about as a consequence of coming to terms with the fact that sustainable development is vital for maintaining the natural environment and an essential component. This moment occurs as a direct consequence of the dawning comprehension that the preservation of natural habitats is inextricably linked to the practice of sustainable development (Ionașcu et al., 2020, p. 78). Many businesses implement corporate social responsibility (CSR) activities (Wilkinson et al., 2018, p.89).

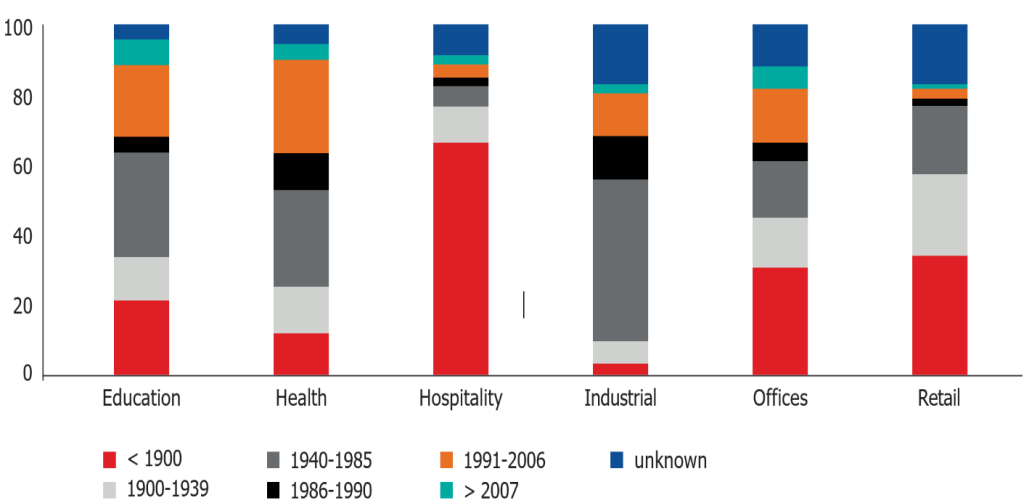

More than 1.8 million commercial and industrial businesses may be found in the United Kingdom. More than fifty percent of the total stock of non-residential buildings was constructed before 1985. The hospitality sector is home to most of the nation’s oldest buildings, with 67% of the store built in the 19th century (see Figure 1). The decades after World War II, namely between 1940 and 1985, saw the construction of almost half of the current stock of industrial buildings. The non-residential component accounted for 23% of the total floor space developed in 2013 (3,469.0 million square meters), while the residential segment accounted for 77%. Manufacturing and storage facilities comprise the most significant room in terms of floor area; nevertheless, the combined office and retail space account for 31% of the total area. The industries that use the most space are warehouses and distribution centers. Private offices account for 80.5% of the total floor area on the office level and are thus included in the office category. There were 128,550 transactions involving commercial or industrial real estate in 2017. It is crucial to remember that there is a vast diversity of ownership, decision-making processes, and geographic coverage when describing the industry as a whole. This is something that must be kept in mind at all times. It is possible to work with a commercial real estate business that is local, regional, national, international (with operations in many countries), or even global.

Figure 1 Distribution of non-residential buildings (%) by category and building period.

(Adopted from Janda, K., Kenington, D., Ruyssevelt, P., & Willan, C. (2021). Towards Net Zero in UK Commercial Real Estate: Key information, perspectives, and practical guidance.)

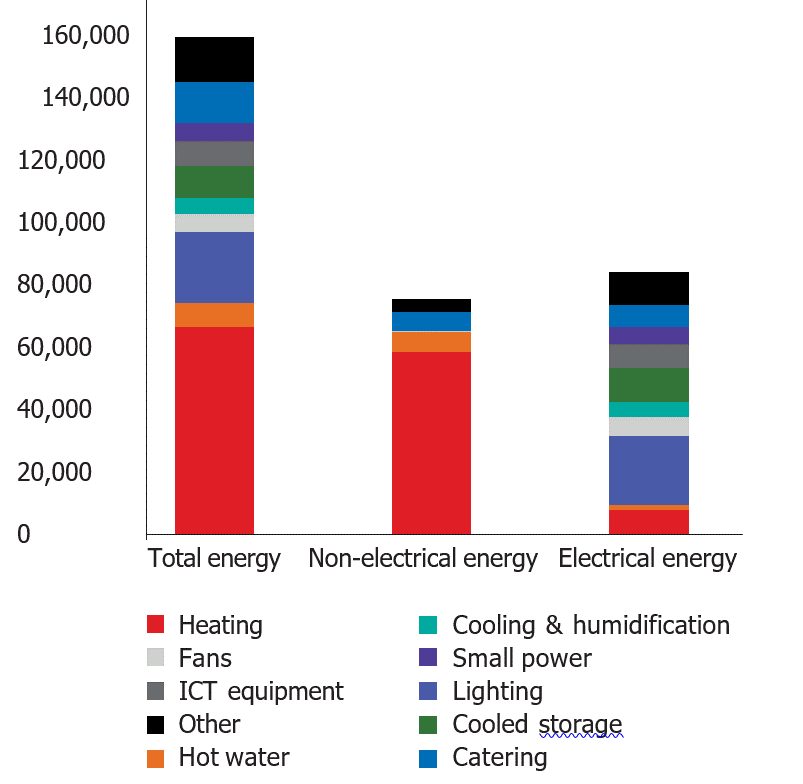

The Figure 3, which illustrates these findings, the demand for energy in non-residential buildings may be broken down into two categories: those that require the use of electrical equipment and those that do not involve the use of electrical equipment (Hiep et al., 2021, p. 36) The categories are established according to the purpose that the structure is eventually intended to fulfill. This demonstrates that most of the demand for non-electrical energy is used to heat spaces and provide hot water. In contrast, the applications for electrical power are much more varied and include things like lighting, heating, cooling (both space cooling and cooled storage), information and communication technology equipment, and catering, amongst other things.

Figure 2 Energy consumption in non-residential buildings by energy type and energy end use (England and Wales)

(Adopted from Janda, K., Kenington, D., Ruyssevelt, P., & Willan, C. (2021). Towards Net Zero in UK Commercial Real Estate: Key information, perspectives, and practical guidance.)

History and Context of Net Zero

The Paris Agreement and the United Nations Framework Convention on Climate Change (UNFCCC), finalized in 2015, have the United Kingdom’s signature. With the signing of the Paris Agreement, nearly two hundred countries have made a commitment to one another for the first time to hold the rise in global temperature to well below 2 degrees Celsius and to pursue measures to restrict the warming to 1.5 degrees Celsius (Wilkinson et al., 2018, p.89). This is a significant step forward in international cooperation. This promise was made in Article 18 of the Paris Agreement. To achieve the temperature goal for the long term, it is vital to make this commitment. The ability of countries that have signed the Paris Agreement to determine their contributions and plans to reduce or capture greenhouse gas emissions, which are the primary cause of climate change, is an essential component of the agreement. These contributions and plans are known as Nationally Determined Contributions or NDCs. The United Kingdom’s Nationally Determined Contribution (NDC) details the continuous efforts being made by the nation toward the goal of reaching Net Zero emissions.

The aim for the net UK carbon account has been changed from “at least 80% lower than the 1990 baseline” to “at least 100% lower by 2050″20 according to an amendment that was made to Section 1 of the Climate Change Act (2008). Following the Intergovernmental Panel on Climate Change (IPCC) Special Report on 1.5 °C, which warns of dangerous impacts from an additional half a degree of global warming, this target was changed to strengthen the United Kingdom’s commitment to limiting global temperature rises to 2 °C. This change was made in response to the IPCC report.

There has yet to be an effort made to transform the lofty goals established for the CRE business in the UK into legally enforceable standards. As a direct consequence, there has yet to be an official government rating system with an acceptable degree of quality assurance and a verification requirement for those who claim that they have Net Zero carbon emissions. Even with this, BEIS was surveyed on the topic in March 2021; however, the consultation results still needed to be made public when this article was written (Wilkinson et al., 2018, p. 90). This framework will be introduced as part of the government’s plans to introduce a national performance-based policy framework for rating commercial and industrial buildings’ energy and carbon performance. These proposals were prepared in close conjunction with representatives from the industry, and their overarching goal is to build upon the successful strategies used in other contexts.

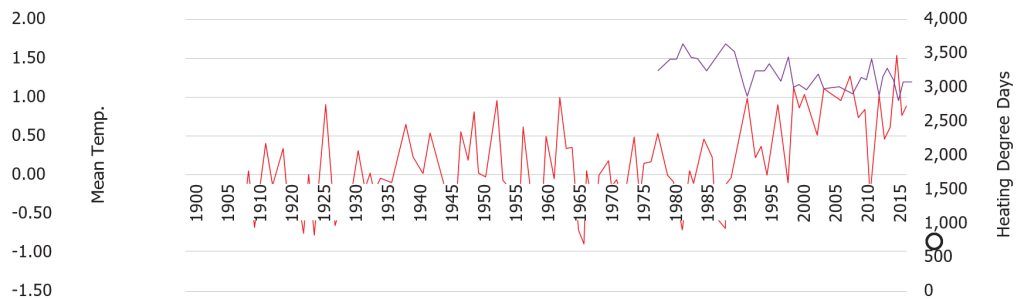

Figure 3 Trends in annual mean temperature divergence from the mean of 1961–1990

(Adopted from Janda, K., Kenington, D., Ruyssevelt, P., & Willan, C. (2021). Towards Net Zero in UK Commercial Real Estate: Key information, perspectives, and practical guidance.)

Drivers for Net Zero

Building retrofits are crucial to achieving net-zero emissions in commercial real estate. Retrofitting refers to upgrading or modifying an existing building to improve its energy efficiency and reduce its carbon footprint. Retrofitting can include upgrading HVAC systems, insulation, lighting, and windows and incorporating renewable energy sources like solar panels (Devine et al., 2022, p. 45). Commercial buildings account for a significant portion of global carbon emissions, with estimates suggesting that they contribute around 20% of global greenhouse gas emissions. Retrofitting these buildings can help reduce these emissions by improving energy efficiency and reducing energy waste. In addition to the environmental benefits, retrofitting commercial buildings can yield significant financial savings for building owners and occupants. Energy-efficient buildings require less energy, lowering energy bills and operational costs. Additionally, retrofitting can increase the value of a building and make it more attractive to potential tenants, leading to higher occupancy rates and rental incomes (Wilkinson et al., 2018, p.89). Governments can implement policies and incentives to encourage building retrofits and achieve net-zero emissions to encourage building owners to undertake retrofit projects. This can include financial incentives, such as tax credits or rebates, and regulatory measures, such as building codes and standards requiring new buildings to meet specific energy efficiency criteria.

Government Initiatives

The government of the United Kingdom has indeed declared its intention to achieve net zero carbon emissions by the year 2050. This effort is known as the Energy Savings Opportunities Scheme (ESOS), and it was one of the most important things that have been done. Also, businesses need to study the myriad of opportunities available to them to reduce the energy they use. The federal government has started providing several financial incentives, such as the Green Homes Grant and the Renewable Heat Incentive, to stimulate financial investments in energy-saving technology further.

Increasing pressure from investors

There has been increasing pressure from investors in the UK to take action on climate change and support the transition to a low-carbon economy. In recent years, investors have become more aware of the financial risks associated with climate change, including the physical dangers of extreme weather events and the transition risks related to the shift to a low-carbon economy.

To address these risks, investors are increasingly calling on companies to take action on climate change and to disclose their plans for managing these risks. This has led to the growth of several initiatives in the UK aimed at promoting sustainable investment and encouraging companies to take action on climate change (Kaklauskas et al., 2021, p. 12). One such initiative is the Task Force on Climate-related Financial Disclosures (TCFD), established in 2015 by the Financial Stability Board. The TCFD provides a framework for companies to disclose their climate-related risks and opportunities to investors, enabling investors to make more informed decisions about the companies they invest in.

Another initiative is the UK Sustainable Investment and Finance Association (UKSIF), a membership organization for sustainable and responsible investment in the UK. UKSIF promotes sustainable investment practices and encourages companies to take action on climate change. In addition to these initiatives, there has been a growing trend of investors divesting from fossil fuel companies and other high-carbon industries. This has been driven by concerns over the financial risks associated with climate change and the need to align investment portfolios with the goals of the Paris Agreement (Kaklauskas et al., 2021, p. 12). The shift in investor mood toward investing in initiatives that may assist in accomplishing sustainability goals can be attributed to several factors. The growing knowledge of climate change’s effects on the environment and the economy is one of the primary causes of this. Investors are becoming increasingly concerned about the long-term risks associated with climate change. These risks include the physical risks of extreme weather events, the transition risks related to the shift towards a low-carbon economy, and the reputational risks of being associated with companies that are not taking action to reduce the number of carbon emissions they produce.

The real estate industry is one of the most significant contributors to worldwide greenhouse gas emissions and energy consumption. As a result, real estate leaders are responsible for revaluing assets, decarbonizing, and creating new business opportunities that address climate change and sustainability challenges (Kaklauskas et al., 2021, p. 12). Real estate leaders should revalue their assets to reflect the actual cost of their carbon footprint. This means accounting for the environmental impact of the building’s energy consumption, waste generation, and water usage, among other factors. Real estate companies can better understand the risks and opportunities associated with climate change by valuing assets based on their environmental impact. Additionally, it can help them identify opportunities for improvement, such as investing in renewable energy, retrofitting buildings to be more energy-efficient, and implementing sustainable waste management practices.

Decarbonization is the process of reducing or eliminating the carbon footprint of a building or a portfolio of buildings. Real estate leaders can achieve this through various measures, including investing in renewable energy, retrofitting existing buildings to be more energy-efficient, and adopting sustainable design practices for new developments. By decarbonizing their assets, real estate companies can reduce their greenhouse gas emissions, lower energy costs, and create healthier and more sustainable environments for occupants. The real estate industry can be critical in addressing climate change by creating new business opportunities that promote sustainability (Kaklauskas et al., 2021, p. 12). For example, real estate companies can develop green buildings designed to minimize their environmental impact while providing a healthy and comfortable living or working environment. Additionally, they can invest in renewable energy projects, such as solar and wind farms, which can generate revenue while reducing their carbon footprint. The circular economy is an economic system that seeks to eliminate waste and maximize resource efficiency. Real estate companies can adopt circular principles by using recycled materials in construction, repurposing old buildings, and adopting sustainable waste management practices. By doing so, they can reduce their environmental impact, create new revenue streams, and differentiate themselves from their competitors.

Increasing energy costs

UK energy prices have skyrocketed; economic and political forces caused this surge. This rise has hurt the nation’s economy. Consequently, firms in many industries are pressured to minimize their energy usage and research more efficient and sustainable energy sources. Oil and gas prices have risen, which has raised UK energy prices. Awareness of fossil fuels’ environmental impacts has increased pressure on governments to switch to greener energy sources. This has increased pressure on fossil fuel businesses and governments to minimize their dependency on them (Kaklauskas et al., 2021, p. 12). Due to this pressure, the UK government has implemented many programs to promote renewable energy and energy efficiency (Patrick et al., 2018). These policies and initiatives are categorized. The Clean Growth Plan aims to cut UK carbon emissions and promote low-carbon technologies. The strategy promotes low-carbon technologies. The plan includes building energy efficiency requirements and incentives for firms to invest in renewable energy and energy efficiency. These are only two instances of plan measures. Commercial firms are financially rewarded for energy-saving investments under the scheme. In response, several firms have invested in renewable energy and energy efficiency (Muldoon-Smith and Greenhalgh, 2019, p .90). Businesses have installed solar panels or wind turbines to generate renewable energy. Nonetheless, some companies have cut energy usage by improving their facilities or buying environmentally friendly equipment. These actions will minimize the company’s carbon impact and long-term energy costs. Consumer and investor demand for climate change action has increased.

Changing customer attitudes

Buyers and lessees have been more ecologically conscious in recent years. Nowadays, more people want corporations to minimize carbon emissions. In the UK, people are becoming increasingly environmentally conscious. Commercial real estate firms must cut their carbon emissions to meet client needs. A corporation might do this by improving the energy efficiency of its facilities. Solar panels, wind turbines, energy-efficient lighting, insulation, and heating systems may accomplish this (Wilkinson et al., 2018, p. 90). These may include financial incentives for renters who use energy-efficient lighting, appliances, and public transportation or carpool with other residents. Renters who take public transport or carpool might get cash incentives. Businesses may also provide renters financial incentives to recycle, compost, and save water.

UK initiatives and policies assist commercial real estate sustainability. The UK Green Building Council also promotes green business practices in the industry. Several commercial real estate firms have started seeing the benefits of greenness and meeting consumer needs. Reducing energy use and emissions may lower electricity costs. Nevertheless, sustainable design may attract renters and increase a building’s worth (Muldoon-Smith and Greenhalgh, 2019, p .90). Companies and customers prioritize environmentally friendly activities, and organizations are responding to this demand by moving toward sustainability in the commercial real estate business.

Challenges

Even though several motivations encourage the commercial real estate industry in the UK to cut its emissions to reach the Net Zero Carbon goal, several problems also need to be addressed. In this sense, some of the most significant issues that the industry is now confronting are as follows:

A shift in business models

UK energy companies are becoming green and energy-efficient. This modification aims to combat climate change and reduce carbon emissions (Scofield, 2013). This aim requires enterprises in this sector to invest in cutting-edge technology and knowledge, change their business operations, and change their energy source. Renewable energy sources, including wind, solar, and tidal power, are crucial to this revolution and its significant effects. It will need to spend heavily on new infrastructure, technology, and energy production and delivery to achieve this goal. Companies in this sector must also prioritize energy efficiency. They include improving infrastructure energy efficiency. Innovative grid technology, reducing waste and pollution, and New skills and competencies are needed to move to more environmentally friendly activities. This may include retraining current staff, hiring renewable energy and energy efficiency experts, and working with university institutions to create new training programs. This may entail employing new workers. Energy business paradigms are changing. Reducing emissions and meeting the UK’s legally bound climate change objectives drive this trend. The energy industry is crucial to the UK’s 2050 net-zero emissions goal. Greener and more energy-efficient businesses demand a significant transformation in company structures and operations. To adapt to this transformation, businesses need new technology, skills, and energy supplies.

Lack of Technological Expertise and Data

The achievement of Net Zero Carbon objectives is becoming an increasingly pressing need for businesses in every industry, as is the reduction of emissions, which is one of the essential goals that can be pursued. The industry or field to which you are referring might be anything, including but not limited to agriculture, transportation, energy, or manufacturing, to name a few examples. Reducing emissions involves a mix of methods and technology, which often calls for specialist knowledge and access to data, which is true regardless of the industry. Increasing energy efficiency is a crucial component of many emission reduction strategies. This might entail adapting buildings and equipment to consume less energy, as well as switching to technologies that are more energy efficient. The transition to low-carbon or renewable energy sources, such as solar, wind, or geothermal energy, is another critical policy that should be implemented. In addition, businesses could have to adjust their operational models, supply networks, or manufacturing procedures to cut emissions.

For organizations in this sector to develop effective strategies for lowering emissions, they will require access to data and expertise in various areas, including energy management, carbon accounting, and technologies for renewable energy sources. This may require entering into a partnership with professional consultants, engaging with research institutes, or investing in the knowledge of employees inside the organization (Devine et al., 2022, p. 45). In addition to having technical skills, a commitment to establishing and attaining aggressive emissions reduction objectives is required to decrease emissions. This might entail defining objectives for specific departments or facilities and creating overall goals for the firm. It is essential to ensure that significant activities and investments support these goals. Some examples of such actions and investments are using renewable energy, implementing energy efficiency measures, and converting to low-carbon fuels. Ultimately, reaching the Net Zero Carbon objectives will need a concerted effort from all parts of the economy (Pike, 2020). By lowering their emissions and investing in environmentally friendly business methods and technology, companies operating in this industry have the potential to play a pivotal part in the movement toward a low-carbon economy.

Planning restrictions

The UK’s planning restrictions may limit ecologically friendly building and refurbishment projects. These rules typically limit energy efficiency and carbon reduction possibilities by limiting materials, designs, and building methods. These rules limit construction projects’ materials, plans, and building methods. These rules frequently specify the materials, plans, and construction techniques allowed in building and infrastructure projects. According to planning rules, new structures may need environmentally friendly materials (Muldoon-Smith and Greenhalgh, 2019, p .90). Examples include low-carbon concrete and responsibly obtained timber. Similarly, some policies may require specific construction processes or building materials to meet minimum insulation or energy efficiency requirements. Certain building materials or procedures may be needed to fulfill specific insulation or energy efficiency standards. These guidelines aim to preserve nature and promote environmentally friendly behaviors. It is important to remember this aim even when it is hard to meet these criteria. With local authorities and industry experts, one may design and build environmentally friendly buildings that meet planning rules and have excellent energy efficiency and emission reductions.

Conclusion

In this study, we outlined some of the most significant statistics, offered the viewpoints of CRE enterprises operating in the UK as well as those based in other countries, and provided insights into some of the practical difficulties that the UK commercial real estate market will confront on the route towards Net Zero. The commercial real estate industry in the United Kingdom will face several significant challenges over the next ten years. On the other hand, there will be a wealth of opportunities to reduce the sector’s overall carbon footprint and improve its general sustainability. Amid this age marked by uncertainty and transition, it is essential to focus more on workplaces to ensure economic productivity for the Kingdom, protect the environment, and foster social well-being.

Bibliography

Brooks, M. & McArthur, J.J. (2019). Drivers of Investment in Commercial Real Estate Sustainability: 2006–2018. Journal of Sustainable Real Estate, 11(1), 130–155. doi https://doi.org/10.22300/1949-8276.11.1.130.

Crosby, N., Devaney, S., Lizieri, C. and Mansley, N., (2022). Modeling sustainable rents to estimate long-term or fundamental values of commercial real estate. Journal of Property Research, 39(1), 30–55.

Devine, A., Sanderford, A. & Wang, C. (2022). Sustainability and Private Equity Real Estate Returns. The Journal of Real Estate Finance and Economics. doi:https://doi.org/10.1007/s11146-022-09914-z.

Hiep, P.M., Tien, N.H., Dana, L.P., Kuc, B.R., Van Tien, N. and Ha, V.X., 2021. I am enhancing Social Responsibility and Sustainability in Real Estate Industry. Turkish Journal of Computer and Mathematics Education (TURCOMAT), 12(14), pp.4999-5013.

Hopwood, B., Mellor, M. and O’Brien, G., (2005). Sustainable development: mapping different approaches. Sustainable development, 13(1), 38–52.

Ionașcu, E., Mironiuc, M., Anghel, I. and Huian, M.C., 2020. The involvement of real estate companies in sustainable development—An analysis from the SDGs reporting perspective. Sustainability, 12(3), p.798.

Kaklauskas, A., Zavadskas, E.K., Lepkova, N., Raslanas, S., Dauksys, K., Vetloviene, I. and Ubarte, I., 2021. Sustainable construction investment, real estate development, and COVID-19: a literature review. Sustainability, 13(13), p.7420.

Muldoon-Smith, K. and Greenhalgh, P., 2019. Suspect foundations: Understanding climate-related stranded assets in the global real estate sector. Energy Research & Social Science, 54, pp.60-67.

Patrick, J., Bright, S. and Janda, K.B., (2018). Energy upgrades in commercial property: minimum energy efficiency standards, compliance pathways, and leases in the UK. Routledge.

Pike, J. (2020). The future of sustainable real estate investments in a post-COVID-19 world. Journal of European Real Estate Research, 13(3), 455–460.

Scofield, D. (2013). Time to completion liquidity in UK commercial real estate investment: 2000‐2008. Journal of European Real Estate Research, 6(1), 34–47. doi https://doi.org/10.1108/17539261311313004.

SHIMIZU, C. (2021). Sustainability and Property Market. The Japanese Journal of Real Estate Sciences, 35(1), 57–61. doi https://doi.org/10.5736/jares.35.1_57.

Wilkinson, S., Dixon, T., Norm, D., Miller, D. & Sayce, S. (2018). The Routledge Handbook of Sustainable Real Estate.

Wilkinson, S., Dixon, T., Sayce, S. & Miller, N. (2018). Sustainable real estate: Where to next? In Routledge Handbook of Sustainable Real Estate (pp. 395–409). Routledge.

write

write