Introduction

A project appraisal of the immediate environment is vital for any successful organization. Corporate planners apply this to analyze prospects for and against the firm in question by keeping a watch on the factors such as rivalry, economics, government regulation, supply chains, technological advancements, and market conditions. The majority of firms do environmental analysis to obtain knowledge of the changes that might take place and to guarantee that they respond in a manner that is appropriate to what might be occurring in the economic environment. The results of an environmental analysis or assessment can be used to evaluate an existing strategy for viability and inspire new plans of action (Robinson & Simmons, 2018). Because of this, businesses place a premium on looking ahead and developing long-term plans that will help them deal with any challenges that might come their way due to their involvement in the operations of their respective industries. The subsequent case study report overviews business environment appraisal/methods, financial appraisal techniques, and project evaluation. The report includes supply chain, contract management, and dispute resolution sections. A summary containing findings and recommendations is also presented in the report. The report concludes with an appendix including a PESTLE and SWOT analysis and a completed Tiered Supply Chain Model Map.

Business Environment Analysis

Analysis of the external environment is increasingly important for today’s businesses. Business strategists use it to assess the market, competitors, economy, government regulation, supply chain, and technological landscape. Evaluation of the current strategy for efficacy and establishment of strategic goals are aided by conducting an environmental study or appraisal (Wheelen et al. 2018). Environmental assessment or analysis is essential for distinguishing between thriving and failing businesses in any industry (Hamilton and Webstar 2018). Yet academics can gain insight into what needs to change from any point of view by closely contrasting industrialized and developing nations’ business climates. The inadequacy of the management team’s comprehension of the external world impedes their ability to function effectively in an environment that they are intimately familiar with.

PESTEL Analysis

PESTLE analysis is an assessment or an external scan of the environmental effects that an organization is subjected to, and it assists in guiding the planning and strategic decision-making processes. It is sometimes referred to as offering a “broad picture” of the environment in which a firm operates (Simões, 2020). This is because it illustrates the overall context.

Political

These aspects are all concerned with how and the extent to which the government intervenes in the economy or a particular industry. This category could be used to classify all of the government’s effects on your company. The policy made by the government, political stability or instability, political corruption, tax policy, foreign trade policy, labor law, environmental law, and trade restrictions are all examples of this. In addition, the decisions made by the government can have a significant bearing on a country’s health regulations, infrastructure, and educational standards (Matović, 2020). When determining the attractiveness of a potential market, Aberfact should consider each one of these aspects as a factor

Economic

The performance of an economy is based on economic factors. Aberfact Company should consider economic factors such as the rate of economic expansion, inflation rate, interest rate, and amount of discretionary income households have. These factors may have direct or indirect long-term consequences on the company because they affect consumer purchasing parity and may alter demand/supply patterns in the economy (Pan et al., 2019). Therefore, it affects how organizations place value on their products and determine their prices.

Social

This facet of the environment encompasses the demographics, cultural norms, practices, and values of the people the business interacts (Cox, 2021). Aberfact should consider factors such as population growth, age structure, wealth inequality, values placed on personal safety, health awareness, work-life balance, and cultural obstacles. For marketers, these considerations take on added significance when focusing on a specific demographic of consumers.

Technological

These aspects deal with technological developments that could positively or negatively affect business and consumer activities. This includes a market’s technical incentives, innovation, automation, R&D activity, the rate of technological change, and the level of technological literacy among consumers (Pan et al., 2019). Aberfact should consider the above factors when deciding to enter or exit specific industries, introduce or delay specific goods, or offshore production as they affect business operations. By keeping abreast of technological developments, Aberfact Company can lessen the likelihood of investing heavily in a technology that will quickly become irrelevant due to disruptive technological advancements in other sectors.

Legal

Laws, such as those about discrimination, antitrust, employment, consumer protection, copyright, patents, and health and safety, are included in this category (Väisänen, 2022). Aberfact Business needs to know what is not permitted by law to conduct business successfully and responsibly. Every country has its own rules and regulations, so it may be extremely difficult for a global corporation to navigate. Aberfact should also be informed of any pending legislative changes and their effect on the company. Legal counsel or representation from an attorney is highly suggested in such situations.

Environmental

It has only been recently that environmental factors have gained prominence. Natural resource scarcity, pollution reduction goals, and carbon footprint quotas have contributed to their growing significance. Weather, climate, environmental offsets, and climate change are all ecological and environmental elements that may impact several economic sectors (Kairuz et al., 2020). In addition, as people become more conscious of climate change, it is changing how businesses function and the products they offer. As a result, many businesses are becoming increasingly engaged in initiatives like CSR and sustainability. Aberfact should consider all environmental factors for business sustainability and profitability.

SWOT analysis

The PESTLE analysis’s conclusions can be better understood through a SWOT analysis to identify the company’s opportunities and threats. A SWOT analysis before finishing a business plan is a crucial aspect of internal focus. This step is essential in managing risks. To better grasp SWOT analysis, it is useful to classify the company’s strengths and weaknesses as an internal assessment, focusing inward on variables within management’s purview (Teoli et al., 2019). The company’s growth trend is attributable to the thorough analysis of the market conditions.

Key Benefits

It is essential to the success of any organization to do in-depth analyses of the market and industry, customer preferences, the competitive landscape, and potential threats. By learning about these factors, business owners can improve their decision-making and devise methods to boost earnings (Çitilci and Akbalık, 2020). Doing a business environment study benefits Aberfact Corporation because it clarifies the nature and dynamics of the market and its constituent segments.

The owners of Aberfact businesses would do well to conduct an environmental scan of the area, as doing so may identify promising growth opportunities. Finding new ways to sell an existing product or a new market entirely are examples of this. Successful business owners do environmental evaluations to understand their markets better, recognize opportunities, and prepare for expansion (Tietenberg and Lewis, 2018). Business owners should analyze the market scenario to learn about competitors’ strategies.

Business owners in Aberfact would be wise to investigate their environment to better handle threats thoroughly. This will put them in a better position to deal with pricing swings and shifting consumer tastes. Aberfact business leaders can improve their chances of success by looking forward to possible challenges and developing solutions in advance. To better prepare for the future, business owners should analyze their environments.

Main Challenges

One of the most difficult aspects of analyzing the business environment is obtaining relevant, up-to-date data, which Aberfact Company must do. This can be challenging, especially considering macroeconomics, industry trends, and macro-political and sociocultural contexts.

Analysts also need the capacity to recognize current trends and foresee their potential impacts on the future of business. This is complex since so many aspects, from technological progress to changes in consumer taste, can affect the organization’s future (Christodoulou and Cullinane, 2019). Analysts also require the ability to assess extraneous elements’ influence on the business.

Analysts must be able to evaluate and manage internal elements, including the company’s finances, structure, and staff, in along with the external environment. This calls for an in-depth familiarity with the business and the capacity to spot places for development.

Financial Investment Appraisal Methods and Project Assessment

A project’s accomplishment can be ascertained through an investment evaluation as a performance metric. The owners of businesses can use the technique for evaluating financial investments to determine the time that will pass before they see a return on their capital investments (Hasanaj and Kuqi, 2019, p17). Since most investments include some form of monetary transaction, a financial report is also the factor that is given the most weight. To invest is to prepare to gain financial benefits in the future (Kliem & Ludin, 2019). The potential for a project’s financial return on investment is evaluated. The purpose of a financial investment appraisal is to help business owners estimate how long it will take for their initial investment to turn a profit (Shaturaev, 2022). Several components go into evaluating a financial investment, such as;

(i) Financial-One of the most sought-after aspects of this situation is financial. Making a profit is the reason for undertaking any activity.

(ii) Environmental considerations are always paramount whenever money is at stake.

iii) Legal-From a legal standpoint, a project’s worth may rest on its capacity to help the company comply with applicable laws.

- Social-Non-profits and social enterprises can approximate the value of their efforts by calculating the improvement in people’s quality of life due to the business’s efforts.

- Risk – Investing activities expose one to business and operational perils. The ability of an investment to limit losses is one metric to evaluate it.

- Operational – The project’s financial success is attributable to its positive effects on customers, employee morale, and the bottom line.

Based on the given information, it would be recommended that Aberfact pursue Project 1. This approach would involve building a wind turbine prototype and then selling the manufacturing rights to North Sea Infrastructure Renewals Limited (NSIRL) for £2 million. This would result in lower upfront costs and less risk than Project 2, which would also receive a royalty of 5% of the price of each unit sold by NSIRL and provide a steady stream of income to the company.

Any organization should use financial appraisal techniques to evaluate both project options properly. These techniques can provide a clear comparison between the two projects and enable Aberfact to decide which option to pursue. The ARR is the preferred method of calculating profitability relative to investment costs (Rosenbaum and Pearl, 2021). Net present value is an alternative method for evaluating a capital expenditure by a company. This approach uses the present value of cash flows to evaluate the feasibility of a potential investment. The net present value (NPV) must be favorable for a business to move forward with an investment.

The company should utilize the NPV and IRR appraisal approaches to determine the financial viability of the two project possibilities. By factoring in the cost of capital and the expected future cash flows, these methods can determine whether or not a given project is financially viable. The most financially beneficial project option can be selected by comparing the NPV and IRR against the cost of capital. Because of the importance of money to most investments, a financial evaluation is also essential. Investing implies making arrangements with a view toward future financial advantage. Several financial strategies are relevant to this evaluation. (Lai & Locatelli, 2021.). That is, how long it takes for the investment amount to be equivalent to the cash surplus generated by the project. That is the first thing to do while gauging how well an investment has fared. The ARR is the most accurate metric for calculating profit as a percentage of costs. This technique is excellent for assessing the worth of advantages and the relative merits of alternative delivery mechanisms. This method considers the present value of future cash flows to assess investment opportunities. (Lai & Locatelli, 2021). Discount is used in this calculation to show how the value of money decreases over time.

These two approaches can be compared for a large range of possibilities. Therefore, evaluating projects with significant capital expenditures should consider whole life costs covering the entire product life cycle. Some transactions have significant break-up fees that must be accounted for at some point. When deciding on the public sector, please save the greatest money over its lifetime (Lai & Locatelli, 2021). Efforts to improve morale may eventually result in lower turnover and recruitment costs.

Financial Appraisal Methods

The ARR

An investment project can be evaluated using a method known as the Annual Rate of Return approach of investment assessment (Drummond and Towse, 2019). There will only be a consideration for the investment if the accounting rate of return is higher than the target.

The Payback Period

The payback period is crucial since individuals and businesses invest primarily to receive a return. Both individual investments, like solar panels or property maintenance, and business investments, like machinery or other assets, have payback periods (Drummond and Towse, 2019). Despite the potential for the returns to fall short of expectations, investments that require a relatively higher amount of money upfront often produce stable or rising returns over time.

IRR

An investment’s internal rate of return (IRR) is the rate at which it begins to generate a profit. Knight (2019) claims that financial analysts routinely employ it in conjunction with NPV. That’s because, despite their similarities, the two approaches rely on distinct sets of inputs. The present value of an investment is determined using NPV by assuming a discount rate appropriate for the business. Instead, IRR compares the rate of return generated by the project’s cash flows to the company’s hurdle rate (Rosenbaum and Pearl, 2021). Investing is smart if the internal rate of return is high.

Nonetheless, a negative IRR is possible if the project’s cash flows fluctuate between positive and negative values throughout its predicted lifespan. A negative internal rate of return suggests a more convoluted cash flow stream, which could reduce the value of the statistic as a whole.

NPV

NPV is a crucial capital budgeting technique that can give project managers critical knowledge beyond its usual applications in operational efficiencies, new venture launches, capital investments, and business valuation. When figuring out a project’s net present value (NPV), the initial investment is the sum of money spent immediately on the endeavor (Nanda and Faturohman, 2023). The cash flow projections outline the continuing costs and the returns of the enterprise. While calculating NPV, the interest rate may be called the discount rate, used to adjust future cash flow for current economic conditions. The present value of money is greater than that of future potential. Money saved for the future loses purchasing power over time due to inflation and the loss of interest earnings made on deposits made today.

Evaluation of Aberfact’s Projects using NPV technique

| Project 1 Cashflow | |||||||||

| Year 0 | Year 1 | Year 2 | Year 3 | Year 4 | Year 5 | Year 6 | Year 7 | Year 8 | |

| Sales | 2,000,000 | ||||||||

| Add: Loyalty | 500,000 | 500,000 | 500,000 | 500,000 | 250,000 | 250,000 | 250,000 | 250,000 | |

| Less: Fixed Costs | (40,000) | (40,000) | (40,000) | (40,000) | (40,000) | (40,000) | (40,000) | (40,000) | |

| Capital expenditure | (3,000,000) | ||||||||

| Net cash flow | (3,000,000) | 2,460,000 | 460,000 | 460,000 | 460,000 | 210,000 | 210,000 | 210,000 | 210,000 |

NPV calculation

| NPV for Project 1 | |||

| Year | Cashflow | Discounting factor (5%) | Present value (PV) |

| Year 0 | (3,000,000) | 1.0000 | (3,000,000) |

| Year 1 | 2,460,000 | 0.9524 | 2,342,857.56 |

| Year 2 | 460,000 | 0.9070 | 417,233.56 |

| Year 3 | 460,000 | 0.8638 | 397,365.30 |

| Year 4 | 460,000 | 0.8227 | 378,443.14 |

| Year 5 | 210,000 | 0.7835 | 164,540.49 |

| Year 6 | 210,000 | 0.7462 | 156,705.23 |

| Year 7 | 210,000 | 0.7107 | 149,243.08 |

| Year 8 | 210,000 | 0.6768 | 142,136.27 |

| NPV | 1,148,524.21 | ||

Project 1 as it has a positive Net Present Value of 1,148,524.21

Project 2

| Project 2 Cashflow | |||||||||

| Year 0 | Year 1 | Year 0 | Year 1 | Year 0 | Year 1 | Year 0 | Year 1 | Year 0 | |

| Revenue | 1,500,000 | 1,500,000 | 1,500,000 | 1,500,000 | 1,500,000 | 1,500,000 | 1,500,000 | 1,500,000 | |

| Less: Costs | |||||||||

| Staff costs | (250,000) | (250,000) | (250,000) | (250,000) | (250,000) | (250,000) | (250,000) | (250,000) | |

| Leasing costs | (150,000) | (150,000) | (150,000) | (150,000) | (150,000) | (150,000) | (150,000) | (150,000) | |

| Decommissioning | (850,000) | ||||||||

| Capital expenditure | (7,500,000) | ||||||||

| Net cash flow | (7,500,000) | 1,100,000 | 1,100,000 | 1,100,000 | 1,100,000 | 1,100,000 | 1,100,000 | 1,100,000 | 250,000 |

| NPV for Project 2 | |||

| Year | Cashflow | Discounting factor (5%) | Present value (PV) |

| Year 0 | (7,500,000) | 1.0000 | (7,500,000) |

| Year 1 | 1,100,000 | 0.9524 | 1,047,619.05 |

| Year 2 | 1,100,000 | 0.9070 | 997,732.43 |

| Year 3 | 1,100,000 | 0.8638 | 950,221.36 |

| Year 4 | 1,100,000 | 0.8227 | 904,972.72 |

| Year 5 | 1,100,000 | 0.7835 | 861,878.78 |

| Year 6 | 1,100,000 | 0.7462 | 820,836.94 |

| Year 7 | 1,100,000 | 0.7107 | 781,749.46 |

| Year 8 | 1,100,000 | 0.6768 | 744.523.30 |

| Year 9 | 1,100,000 | 0.6446 | 709,069.81 |

| Year 10 | 250,000 | 0.6139 | 153,478.31 |

| NPV | 472,082.16 | ||

Project 2 has a Net Present value of 472,082.16. The value is lower compared to that of project 1. Aberfact should reject project two and pursue project one since it has a higher NPV.

The supply chain of Project 1, Contract Management and Dispute Resolution Techniques

When business partnerships end in conflict, the end outcome is often the resolution of a contract dispute. To simplify processes, businesses must have a high level of trust, mutual benefit, and communication between businesses and their most important suppliers and customers (Tziner and Rabenu, 2018). A few key players can influence the direction of trade within an industry in the supply chain. To that objective, it’s important to keep up the kind of rapport that may help out business when times are tough.

Suppliers and other businesspeople can collaborate, cutting costs and boosting product quality by sharing information and better understanding one another’s strengths and weaknesses. Maintaining a win-win partnership with your suppliers is essential in today’s business world when looking for a supplier (Chen, 2022). For instance, a supplier may be able to afford to provide supplies valued at up to $1,000,000. This is another method for boosting a company’s confidence in its sector.

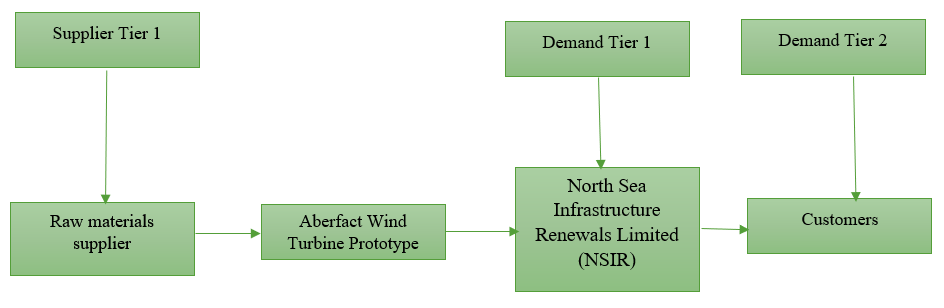

Aberfact’s Project 1 Tiered Supply Chain

Aberfact’s Project 1 tiered supply chain consists of three tiers: Aberfact, NSIRL, and the customers. At the top of the chain is Aberfact, the company responsible for designing and building the wind turbine prototype. Next, NSIRL will purchase the manufacturing rights to the prototype, manufacture the turbines, and subsequently sell them to customers. Finally, customers will purchase the turbines from NSIRL.

The tiered supply chain established by Aberfact’s Project 1 will provide revenue for the company while also allowing them to diversify its business into the renewable energy sector. The arrangement ensures that Aberfact will remain involved in the production of their turbines and will benefit from their continued development and sales.

Importance of Sustaining Effective Supply Chain Relationships

Maintaining effective supply chain relationships is essential for businesses to remain competitive and profitable. Maintaining strong ties along the supply chain is crucial. They assist businesses to keep running smoothly and save money, and guarantee that their goods and services are up to par with consumer standards (Hong et al., 2018). Supply chain relationships provide companies with a competitive advantage. This can ultimately lead to increased profitability.

Contract Management and Dispute Resolution Methods

Conflict is practically inevitable whenever there is a supply chain involved. All the people in a company who are in charge of a specific part of getting a product to market should be the first to be considered. Then there is the extensive network of third-party suppliers, manufacturers, designers, logistics managers, wholesalers, and retailers that contribute to a finished product’s success (Ulhaq et al. 2017).

Disputes Resolution Techniques

Resolution methods

Conflicts can be settled amicably in several ways. Different people would feel more comfortable with different tactics, but ultimately, they all help bring two warring sides together. Lipsky (2020) identified the following conflict resolution methods as being utilized by businesses to boost their chances of success.

Negotiations

Listening attentively to the other party’s concerns is crucial to developing the negotiating and dispute-resolution skills necessary for effective conflict management. One systematic mistake is automatically assuming that if one person benefits, the other must suffer. When negotiators consider what they stand to lose, they become unduly competitive. Conflict settlement and negotiation are often fraught and ineffective (Goldberg et al., 2020)

Leaders constantly engage in internal and external negotiations. Customers, suppliers, investors, and other outside parties are part of their external stakeholder network. They negotiate among themselves for time, money, and backing. This means that leaders need to be adept at negotiating and mediating conflicts. Understanding the structural and interpersonal parts of negotiations is key to successfully negotiating and managing disagreement, whether you’re negotiating a company budget internally or with external suppliers.

Mediation

Mediation is a relatively unstructured, improvised approach to conflict resolution. Mediation aims to have an impartial third party assist the parties in reaching their own agreement (Sabela, 2022). A trained mediator does not impose a solution but helps the disputing parties discover their shared interests and work toward a mutually agreeable one. Effective mediation facilitates the emotional release and the thorough examination of issues by all parties involved. The mediator’s role is to facilitate the parties coming to a mutually agreeable, voluntary, and nonbinding agreement by meeting individually and in small groups (Gautam et al., 2021). This method is valuable in contractual disputes since it may address many concerns simultaneously.

Thus, issues between partners with an ongoing business relationship are also addressed in this approach to resolution. The issues are relatively minor, so the approach is not combative. Since mediation is supposed to bring parties together, working relationships may survive. Because of its focus on ensuring a positive financial outcome for all parties, mediation is sensitive to the needs of businesses. Thus, this commercial conflict resolution technique supports making the most of the firms’ potential by assuring adequate recompense to everyone involved.

Litigation

Litigation is commonly understood to be the judicial process by which rights-based disputes are resolved, beginning with filing a suit and continuing through the arguments on legal motions, the discovery phase in which formal exchanges of information take place, the trial itself, and any possible appeals. When establishing legal rights and settling conflicts, litigation also includes administrative or regulatory proceedings (Pattjoshi, S. and Ghosh, This approach of resolving differences may not be the optimum because the underlying costs can raise the amount that might be involved in the case. Investment plans and daily operations of businesses are equally exposed to these hazards. In addition, it can disrupt business relationships and endanger a company’s most valuable assets (Singer, 2018). The procedure is difficult and lengthy enough to threaten even the strongest long-term relationships’ health. The parties also need help to prevent the strategy’s inevitable outcome.

The judge has a substantial say over the proceedings and the case results because the court retains ultimate authority. Furthermore, the created court arbitrarily decides who will decide and how the case will be handled. This strategy works well when one party wishes to prevent the others from doing business with the dominant party (Menkel-Meadow, 2021). Because of the time commitment involved, this method is best reserved for less urgent issues. However, different methods can be employed when an immediate solution is required.

Contract management Procurement

There are always reasons to be optimistic and promises of financial rewards associated with every corporate involvement, yet, disagreements in the future are unavoidable. Even though the contracts were carefully structured, disagreements could still arise. Unanticipated events in the business world can sometimes result in predicaments in which different parties cannot understand one another. Internal methods of conflict resolution may also fail, necessitating the involvement of an impartial third party. (Changalima et al., 2022). Thus, the parties reach an agreement through formal dispute resolution. When disagreements are resolved, commerce can pick up where it left off. If the two parties cannot agree on who would fund a solution, there is always the risk of a relationship breakdown.

Dispute Resolution does not Maximize Opportunities.

The resolution of conflicts often results in missed opportunities. The affected party stops doing business with the other, and their friendship is severed. Furthermore, the conclusion of one discipline may pave the way for yet another, none likely to boost commercial possibilities. Businesses typically have preexisting communities that work well together (Lipsky, 2020). If one of them has to go to court, the other might also opt to cease working. This behavior interferes with the ability to have fruitful commercial interactions. Long-term commercial partnerships could also be affected if the current contracts were to be canceled. Hence, a successful corporate transaction only sometimes necessitates the absence of legal issues.

Conclusion and Recommendations

Establishing and validating measures, in particular, observable and measurable indicators inside the research environment will be important to gain the methodological expertise needed to research the relationship between the research environment and integrity in research. This will require the development of measures. For instance, the pre-existing methods of conceptualization and measurement of the organizational context will need to be adapted to the specific context of the assessment of the environmental analysis inside the research setting to be useful.

Bibliography

Carter, CR, Kosmol, T & Kaufmann, L 2019, ‘Toward a supply chain practice view,’ Journal of Supply Chain Management, vol. 53, no. 1, pp. 114-122.

Changalima, I.A., Mchopa, A.D. and Ismail, I.J., 2022. Supplier development and public procurement performance: does contract management difficulty matter? Cogent Business & Management, 9(1), p.2108224.

Chen, W., 2022. Dell and FedEx’s Cooperation Business Negotiation and Business Strategy Research. Highlights in Business, Economics and Management, 2, pp.491-496.

Christodoulou, A. and Cullinane, K., 2019. Identifying the main opportunities and challenges from implementing a port energy management system: A SWOT/PESTLE analysis. Sustainability, 11(21), p.6046.

Çitilci, T. and Akbalık, M., 2020. The importance of PESTEL analysis for the environmental scanning process. In Handbook of Research on Decision-Making Techniques in Financial Marketing (pp. 336-357). IGI Global.

Cox, J., 2021. The higher education environment driving academic library strategy: A political, economic, social and technological (PEST) analysis. The Journal of Academic Librarianship, 47(1), p.102219.

Drummond, M. and Towse, A., 2019. Is rate of return pricing a useful approach when value-based pricing is not appropriate? The European Journal of Health Economics, 20, pp.945-948.

Du Toit, AS 2019, ‘Using environmental scanning to collect strategic information: a South African survey’, International Journal of Information Management, vol. 36, no. 1, pp. 16-24.

Gautam, R., Kulshrestha, P. and Goswami, M.A.K., 2021. Mediation And Family Dispute Resolution Mechanism: A Case Study On Clinical Legal Education. Elementary Education Online, 20(3), pp.2490-2490.

Goldberg, S.B., Sander, F.E., Rogers, N.H. and Cole, S.R., 2020. Dispute resolution: Negotiation, mediation, arbitration, and other processes. Aspen Publishing.

Hamilton, L & Webster, P 2018, The international business environment, Oxford University Press, Oxford.

Hasanaj, P. and Kuqi, B., 2019. Analysis of financial statements. Humanities and Social Science Research, 2(2), pp.p17-p17.

Hong, J., Zhang, Y. and Ding, M., 2018. Sustainable supply chain management practices, supply chain dynamic capabilities, and enterprise performance. Journal of cleaner production, 172, pp.3508-3519.

Kairuz, A.R.P., Ruiz, D.V.P., Pita, G.F.V. and Mena, F.S.B., 2020. PESTEL analysis of environment state responsibility in Ecuador. Neutrosophic Sets and Systems, 34, pp.70-78.

Kliem, RL & Ludin, IS 2019, Reducing project risk, Routledge, Abingdon-on-Thames.

Lai, C.S. and Locatelli, G., 2021. Economic and financial appraisal of novel large-scale energy storage technologies. Energy, 214, p.118954.

Lipsky, D.B., Avgar, A.C. and Lamare, J.R., 2020. Organizational conflict resolution and strategic choice: Evidence from a survey of Fortune 1000 firms. ILR Review, 73(2), pp.431-455.

Matović, I.M., 2020, September. PESTEL Analysis of External Environment as a Success Factor of Startup Business. In ConScienS Conference Proceedings (pp. 96-102). Scientia Moralitas Research Institute.

Menkel-Meadow, C., 2021. What is an appropriate measure of litigation? Quantification, qualification and differentiation of dispute resolution. Quantification, Qualification and Differentiation of Dispute Resolution (July 29, 2020). Oñati Socio-Legal Series, 11(2), pp.2020-54.

Nanda, R.I.M. and Faturohman, T., 2023. Investment Project Analysis of PT. Berau Coal Block 5-6 Binungan Using Discounted Cash Flow Method. International Journal of Business and Technology Management, 5(1), pp.50-54.

Pan, W., Chen, L. and Zhan, W., 2019. PESTEL analysis of construction productivity enhancement strategies: A case study of three economies. Journal of Management in Engineering, 35(1), p.05018013.

Pattjoshi, S. and Ghosh, P., 2020.Third Party Funding for Litigation in Dispute Resolution Mechanism and its Recent Developments in International Commercial Arbitration.

Robinson, CV & Simmons, JE 2018, ‘Organising environmental scanning: exploring information source, mode and the impact of firm size’, Long Range Planning, vol. 51, no. 4, pp. 526-539.

Rosenbaum, J. and Pearl, J., 2021. Investment banking: valuation, LBOs, M&A, and IPOs. John Wiley & Sons.

Sabela Gayo, A.S., 2022. The Use of Mediation as an Alternative Health Dispute Resolution. Hong Kong Journal of Social Sciences.

Shaturaev, J., 2022. Efficiency of Investment Project Evaluation in the Development of Innovative Industrial Activities. ASEAN Journal of Science and Engineering, 3(2), pp.147-162.

Simões, E.N., 2020. A decision support system application module for PESTLE analysis-competitive intelligence algorithm (Doctoral dissertation).

Singer, L 2018. Settling disputes: Conflict resolution in business, families, and the legal system. Routledge, Abingdon-on-Thames.

Teoli, D., Sanvictores, T. and An, J., 2019. SWOT analysis.

Tietenberg, T. and Lewis, L., 2018. Environmental and natural resource economics. Routledge.

Tziner, A & Rabenu, E 2018, Improving performance appraisal at work: evolution and change, Edward Elgar Publishing, Northampton, MA.

Ulhaq, I, Khalfan, MM, Maqsood, T & Le, T 2017, ‘Development of a conceptual framework for knowledge management within construction project supply chain,’ International Journal of Knowledge Management Studies, vol. 8, no. 3-4, pp.191-209.

Väisänen, J.M., 2022. Case Study on Expanding Value PLC PV Technology Business Into GCC Countries.

Wheelen, TL, Hunger, JD, Hoffman, AN & Bamford, CE 2018, Strategic management and business policy, Pearson, Boston, MA.

Appendix

Strategic planning for any company can benefit greatly from using analysis methods like PESTLE and SWOT. They each have their strengths and may be used independently, but together they shine. An organization’s performance can be affected by the environmental factors it faces. Hence PESTLE analysis takes these factors into account, along with any shifts in them. This information is then analyzed using the SWOT framework to identify the company’s best and worst scenarios. When done together, PESTLE analysis is typically done first to set the stage for the SWOT analysis.

Appendix 1: PESTLE Analysis of Aberfact’s Wind Turbine Industry

| Political

Government Policies Tax policies Promotion of renewable energy |

Economic

Financial Market Structure Demand and supply forces Inflation Rate High research and development cost |

Social

Demographic Trend Social acceptance towards turbines Cultural issues Rising living standards |

| Technological

Cost of Production Likelihood of Technology Disruption Research and Development Investment Levels Empowerment of Supply Chain Partners |

Legal

Regulatory Practices Health & Safety Laws Laws regarding Monopoly and Restrictive Trade Practices |

Environmental

Influence of Climate Change Corporate Social Responsibilities Culture Business sustainability |

Appendix 2: SWOT Analysis

The following table illustrates the SWOT analysis: (Table 1);

| Strengths

Low labor cost Strong specialization in oil and gas Well-organized national brand name A good relationship with major investors Effective internal leadership and communication processes |

Weaknesses

Lack of interaction with major stakeholders and policymakers Lack of industry partners |

| Opportunities

Government subsidies Fast growing sector High social acceptance |

Threats

Potentially high R&D expenses High waste management fee Large competitors get the majority of the share market |

Appendix 3: Supplier and Customer Mapping Exercise

write

write