Greenhouse gases are gases in the atmosphere which trap and emit radiation into the atmosphere. They mainly include carbon dioxide, nitrous oxide, and methane. Greenhouse gas emissions have increasingly become a major concern as they have increased atmospheric pollution, which has caused some severe climate change on Earth. Increased emission of these greenhouse gases to the atmosphere increases trapping and emission of heat energy causing global warming. Additionally, some of these gases, like nitrogen dioxide, resulting from the oxidation of nitrous oxide, can cause respiratory diseases. Others like fluorinated and chlorinated gases have caused the depletion of the ozone layer. Therefore, greenhouse gas emissions are a negative externality that needs to be addressed. This essay explains the common measures like carbon tax and goals that address the issue and concludes why common measures, precisely the combination of taxations and subsidies, are the better solution.

Common measures to address the externality

The adoption of common measures by all countries worldwide is one of the two policies debated for application against this externality of pollution. “The common measures include taxation, subsidy alternatives, permits, and regulations” (Erickson 2017, 12599). How these measures reduce greenhouse gas emissions and pollution will be discussed in this section.

Taxation measures like carbon and petrol taxes

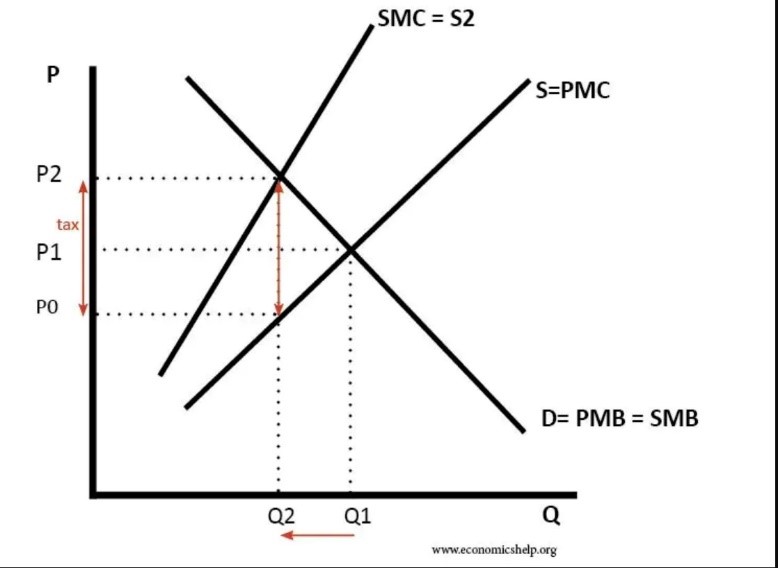

Taxation is an idea that involves imposing payment costs for pollution. Examples include carbon and petrol taxes. Such taxations are very influential in reducing pollution as they focus on increasing the costs incurred by producers, prompting them to reduce their production level. “For instance, a carbon tax involves imposing levies on the carbon contents released by emitters which raises the price of carbon emitted per unit of fossil fuel. This causes internalization of the externality because the prices reflect the actual cost of releasing carbon dioxide” (Erickson 2017, 12601). A graphical illustration of a carbon tax is attached at the end of this essay.

The distributional effects are determined by changes in the magnitude of carbon tax budget shares across revenue groups. The tax will be regressive if the budget portion reduces as we move up the income distribution, and will be progressive if the budget shares increase with income.

Pollution Permits

The requirement of having a pollution permit is another common measure that focuses on the market to set prices for permits that allow only the release of a specific quantity of greenhouse gases by industries. “An example is the emissions trading scheme, where enterprises buy and sell pollution rights” (Blackman and Harrington 2017). In theory, this is an effective reduction method as it involves the establishment of a maximum cap to regulate the number of pollutants a particular emitter can release. Achieving this cap means that the emitter cannot emit any more contaminants but has the right to buy an extra permit from another permitted firm or industry that has not achieved its pollution cap. Having to buy additional licenses increases production costs for industries and companies. It forces them to reduce the cost whereby the only quick way is by reducing pollution costs. Practically, it is challenging to implement this measure because pollution is difficult to be measured, and the economy can severely be affected if the government is not too generous with the permits.

Government subsidies

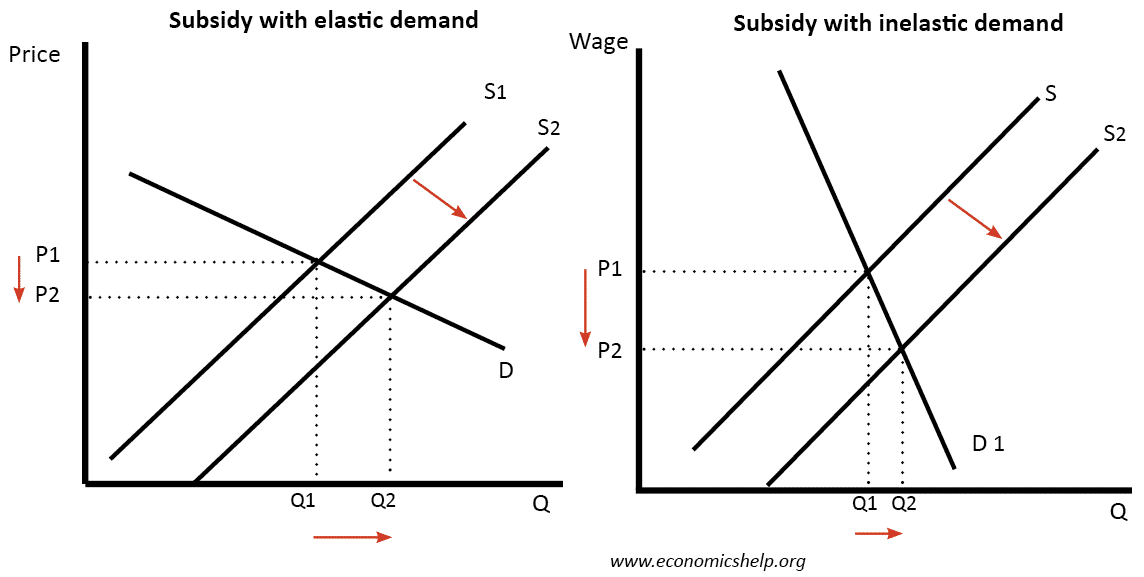

Government subsidies on alternative energy sources like renewable energy sources, for example, solar energy, to improve their affordability and competitiveness against fossil fuels. Governments can use this more practical and efficient measure as producers are more willing to participate in this policy than permits. This measure aims to reward reduced pollution rather than charging, as in the case of taxes and permits. “Examples of subsidies include low-interest loans for renewable sources of energy that act as alternatives to fossil fuels with high carbon contents” (Tampubolon and Setyoko 2019, 4). At the same time, high fossil fuel subsidies in some countries can be reduced to eliminate the increased use of fossil fuels by decreasing the supply and the demand owed to affordability.

Common goals for addressing greenhouse gas emissions

The major goal to address the externality is to reduce emissions per year according to the set targets. This follows the Paris Agreement that required countries to cut their carbon dioxide emissions from 2016 to 2019. “To reduce the effects of greenhouse gases, the emissions should be reduced to roughly 1.6 billion metric tons annually on a global scale. This is much greater than the achieved goal of 160 million tons annually” (Lindsey and Santos 2020, 100691). About 64 countries have been involved in the agreement, all working to achieve the reduction goal. However, practically this is quite difficult considering the economic implications on most countries should they enact reduction measures like taxations and pollution permits.

Proposal of the best policy

Various considerations will be made to determine the best policy for addressing the externality, such as the policies’ economic impact, effectiveness, and equitability. Combining government subsidies and taxation is the best policy for addressing the externality based on this criterion. All the discussed policies have a high potential to reduce pollution and the effects of greenhouse gas emissions. However, they all have disadvantages and projections of severe adverse consequences, thus eliminating them from being the best policies. Pollution permits have a major challenge of implementation and execution, which prove ineffective compared to other policies. This challenge involves measuring pollution created by a particular firm, and therefore, it would be difficult to determine how effective it is in reducing emissions. Economically, firms can complain about issuing permits if they feel it is insufficient to meet their profit goals. This is a challenge as different firms are more likely to have different opinions on the right cap.

Regarding taxation specifically, carbon tax, one of the major advantages is that governments have a revenue-generating scheme that could be used to finance other environmental policies like subsidies. Additionally, this policy promotes industries to offer more environmentally friendly engines due to market incentives. For example, “the petrol tax has provided a channel for consumers to seek other less polluting fuels and machines that do not need petrol specifically” (Lindsey and Santos 2020,100671). One of the major disadvantages, although not that significant, of this policy is compliance with taxation. Erickson (2017) argues that firms may shift production to other countries, a major economic issue associated with this policy. However, with the combination of government subsidies, this potential financial implication can be averted as the firms can focus on the incentives offered to generate renewable energy sources and at the same time help in innovations which lead to more profits and fewer emissions to the atmosphere.

Another significant advantage of combining the two policies to generate the best policy is that the process becomes equitable. This is because all firms will be taxed complying with the taxation rules, and therefore no company will be favored by the government. Additionally, for companies that shift to the application of renewable energy sources, incentives from governments will be offered as they try to promote the use of energy sources that have a reduced effect on the environment.

Unintended consequences of combining taxation with subsidies

Petrol and other fossil fuels emit carbon dioxide and nitrous oxides into the atmosphere in transportation emissions. The combination of the two policies focuses on taxing petrol and “providing ethanol incentives, which would cause a large shift to agriculture, causing unexpected social costs” (Herath and Tyner 2019, 109342). In addition, according to Jensen et al. (2017), disparities are likely to arise due to the procedure used to provide incentives leading to shifts of firms to other countries leading to reduced revenue to the government affecting the economy of that particular country.

Conclusion

This essay has discussed the common measures and goals to reduce greenhouse gas emissions externality. Moreover, graphs are attached to explain the emission trends over the years and how a carbon tax is used to reduce the emission of gases with carbon content. In addition, the advantages and disadvantages of each policy were used to determine the best effective policy in reducing the externality and its effects. The best policy to reduce the emission of greenhouse gases and pollution is the combination of taxes like petrol and carbon taxes with government subsidies. This is based on the above-discussed criterion of identifying the best policy for reducing the externality. Also addressed in this essay are the various unintended consequences of the combination of subsidies and taxation, like the large shift into agriculture.

Appendix

Graphs used for Illustrations

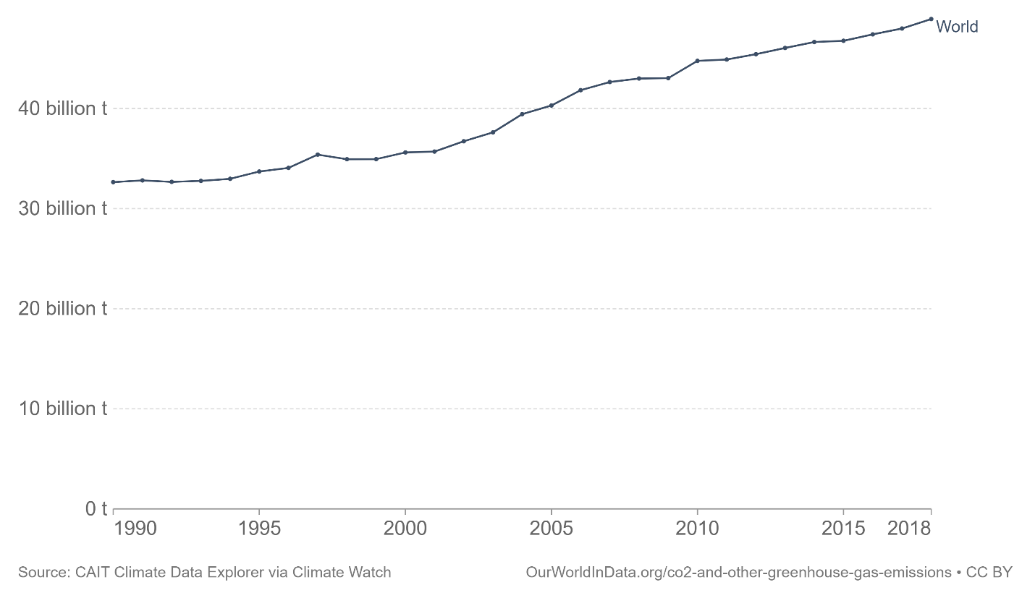

The graph below shows the world’s trend of emission of greenhouse house from 1990 to 2018. As a result, the observed trend emphasizes the need to reduce the emission of greenhouse gases, especially carbon dioxide, which is the most released of all greenhouse gases. The graph is obtained from Greenhouse gas emissions – Our World in Data.

| Table: Carbon Tax Implementation in OECD countries | |||

| Country | Year of Implementation | Gini at Implementation | status |

| Finland | 1990 | 21.0 | in place |

| Sweden | 1991 | 22.6 | in place |

| Norway | 1991 | 22.8 | in place |

| Denmark | 1992 | 23.4 | in place |

| Switzerland | 2008 | 29.5 | in place |

| Iceland | 2010 | 26.0 | in place |

| Australia | 2012 | 32.7 | repealed |

| France | 2014 | 29.8 | in place |

The main source is the Carbon Pricing Dashboard from the World Bank. Gini coefficients are taken from the SWIID database.

Carbon tax graph: The social marginal cost (SMC) of manufacturing the good is higher than the private marginal cost in this situation (PMC). The difference is the pollution’s external cost. Because the tax moves the supply curve to S2, customers must pay the full social marginal fee. This reduces consumption to Q2, which is the most socially optimal result.

If demand is elastic, a subsidy will result in a greater percentage increase in demand. The price has only dropped somewhat. Producers benefit from the subsidy in this situation because their production surplus grows faster than the consumer surplus. If demand is price inelastic, a subsidy provides a significant drop in price but only a minor increase in demand.

References

Blackman, Allen, and Winston Harrington. 2017. “The Use Of Economic Incentives In Developing Countries: Lessons From International Experience With Industrial Air Pollution”. The Journal Of Environment &Amp; Development 9 (1): 5-44. doi:10.1177/107049650000900102.

Erickson, Larry E. 2017. “Reducing Greenhouse Gas Emissions And Improving Air Quality: Two Global Challenges”. Environmental Progress &Amp; Sustainable Energy 36 (4): 982-988. doi:10.1002/ep.12665.

Herath, N., and W.E. Tyner. 2019. “Intended And Unintended Consequences Of US Renewable Energy Policies”. Renewable And Sustainable Energy Reviews 115: 109385. doi:10.1016/j.rser.2019.109385.

Jensen, Svenn, Kristina Mohlin, Karen Pittel, and Thomas Sterner. 2017. “An Introduction To The Green Paradox: The Unintended Consequences Of Climate Policies”. Review Of Environmental Economics And Policy 9 (2): 246-265. doi:10.1093/reep/rev010.

Lindsey, Robin, and Georgina Santos. 2020. “Addressing Transportation And Environmental Externalities With Economics: Are Policy Makers Listening?”. Research In Transportation Economics 82: 100872. doi:10.1016/j.retrec.2020.100872.

Tampubolon, Biatna Dulbert, and Ajun Tri Setyoko. 2019. “Controlling Policies On Fossil Fuels Subsidies To Overcome Climate Change”. Energy Economics Letters 6 (1): 1-16. doi:10.18488/journal.82.2019.61.1.16.

write

write