Executive Summary

Netflix Inc. has grown exponentially since its establishment in 1997, expanding to 190 countries and becoming one of the biggest media and entertainment industry players. Its target market includes geographic, behavioural, demographic, and psychographic segments. Netflix has undergone several development phases, including launching, transitioning to streaming services, developing original programming, and expanding into international production and gaming. An evaluation using SWOT analysis reveals a strong brand reputation as a strength, opportunities for expansion into China, South Korea, and Syria, and weaknesses such as increasing finance costs and competition from companies like Amazon. Porter’s five forces analysis emphasizes competition from existing companies but notes that the threat of new entrants could be higher due to the capital-intensive nature of the media industry. Netflix also faces political and legal challenges in foreign countries that restrict foreign content, as well as environmental concerns but has employed technological changes to improve revenue and offer flexibility to customers. Netflix’s strategies for success include cost leadership and differentiating its products through unique content. Competition remains a major challenge, with companies like Amazon having a significant market share in the online streaming sector. Despite these challenges, Netflix has opportunities for the future, including the potential to enter the Chinese market.

Introduction

The media industry is one of the competitive industry in the world, which requires strategic management amidst fast-changing business dynamics. The covid-19 pandemic disrupted most businesses and forced some into receivership. The surviving companies are analyzing their competitive advantages and strategies on how to survive during this post-pandemic era. This requires a detailed analysis of past progress, gaps that need to be sealed, and opportunities to utilize available resources.

In light of the above, the board of management of Netflix Inc. tasked the CEO, Ted Sarandos, on 25th December 2022 to develop a management report for further discussion during the next board meeting. The terms of reference stipulated areas to be covered in the report, such as the company’s performance since its inception, capabilities, competitive advantages, and industry forces analysis using appropriate models, challenges, and recommendations.

Background of Netflix

Approximately a quarter of a century ago, the only way to view a film at home was to go to a Blockbuster and borrow a DVD. In 1997, the launch of Netflix completely altered this landscape.

Netflix, Inc. is an American corporation based in Los Gatos, California that provides streaming services and content production. It began with the idea that instead of travelling to rent a DVD, customers could order them online and have them delivered to their home for a small fee (Labato, 2019). Now, Netflix has become more than just a DVD delivery service but a widely used streaming service that has grown incredibly in over 190 countries (Hosch, 2022).

Overview of the Media Industry

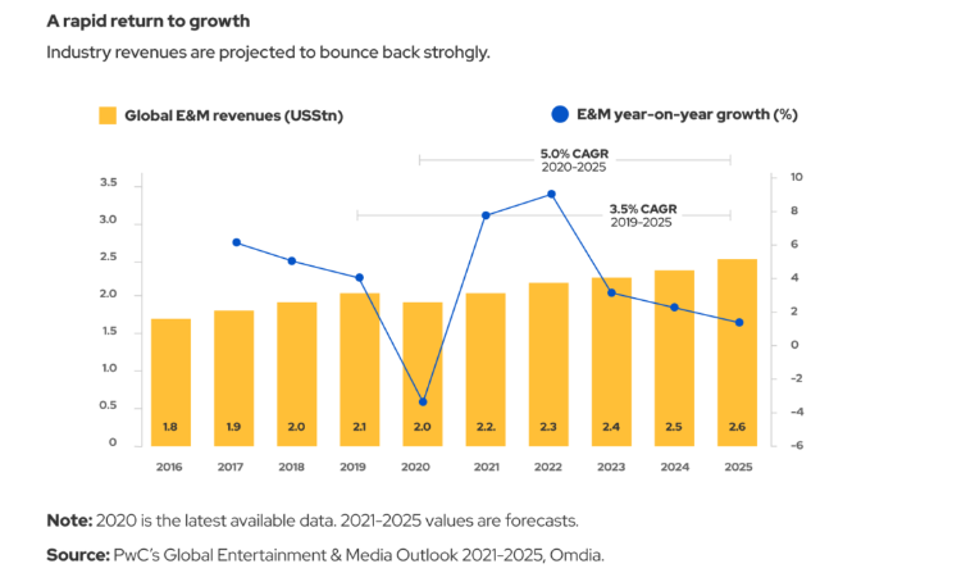

The Deloitte report of 2022 suggests that the media and entertainment industry is on the road to recovery following the repercussions of the Covid-19 pandemic, which had a major impact on the advertisement and in-person entertainment. The lockdown measures imposed during the pandemic made it impossible to have in-person activities, and people sought media and entertainment at home. Subsequently, a report by Market research future contends that 2030 the media and entertainment sector is projected to attain USD 5,099.2 million by 2030, with a CAGR of about 8.9% (Market Research, 2021). It is important to note that this industry has the most significant share and popularity in the U.S. It is also observed that despite the impacts of the Covid-19 pandemic, the E&M industry is showing signs of a rapid return to growth. Therefore, trends in the E&M industry are changing. PWC firm examined the repercussions of the pandemic on the industry, which uncovered that the industry experienced the most extreme harm in 2020 and experienced a huge decline (PricewaterhouseCoopers, 2021).

Netflix is one of the largest firms in the E&M industry in terms of market share and geographical coverage; that has survived various economic downturns, including the 2007-2008 global economic recession, and is changing the lives of millions worldwide.

Market Target of Netflix

Netflix is accessible in almost 190 countries globally. Most Netflix consumers are typically younger people from Generation Z or millennials with an income bracket ranging from $25 to $50. The female users are about 52% in contrast to males, who are 48% (Adrian, 2021). According to recent census data, in the U.S., the average user of a Netflix user profile was found to have a strong correlation with the average U.S. citizen (Rainie, 2017). The target market of Netflix is very diverse and broad and can be categorized into various segments.

Netflix Demographic segmentation

It is widely accepted that Millennials and Gen Z are the primary demographic of Netflix users, with 65% and 70%, respectively (“Start.Io” 2022). However, 2020 demographics demonstrated that Gen X and Baby Boomers also form a considerable portion of the streaming service’s audience, at 54% and 39%, respectively (“Start.Io” 2022). Hispanic Americans are more likely to be Netflix subscribers in America, with at least 70% claiming they were pledged, equating to 61% of White Americans (“Start.Io” 2022). According to the Census, the typical Netflix consumer needs to be more educated, with almost 70% with either some or no college education (“Start.Io” 2022).

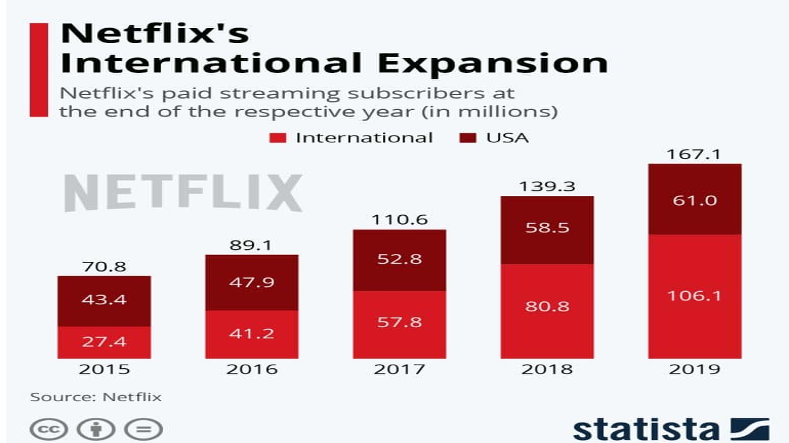

Netflix Geographic Segmentation

Initially, most consumers of Netflix were located in the U.S., but this has changed. Currently, the number of Netflix subscribers is fairly divided between Africa and the Middle East, North America, and Europe, while Latin America and the Asia Pacific have fewer customers. In the past few years, The Asia Pacific has proven as the most remarkable growth for Netflix users at a 65% rise combined with a 62% augmentation in income in 2020 (“Start.Io” 2022).

In contrast, Netflix is already widely used in the U.S., having been adopted in around 70% of households with broadband internet (Munson, 2019). This indicates that the U.S. market is already fully matured and thus has limited prospects for expansion compared to Asian countries, which still possess the potential for expansion.

Netflix Behavioural Segmentation

The most prominent demographic of the Netflix target market is in the $35K – 50K income level, yet the streaming service also appeals to those who are more well-off, making $75K or more. Furthermore, 7 out of 10 people share their Netflix login details. Moreover, the subscription uptake rate is relatively high, with a maximum of 93% of trial customers deciding to subscribe (“Start.Io” 2022).

Furthermore, for Netflix subscribers, animals are a vital element of their viewing experience; 22% of patrons that view Netflix programs with their animals confess that they entice them with a reward to keep viewing together, whereas 12% state that they changed programs because their animals seemed to dislike it (“Start.Io” 2022).

Netflix Psychographic Segmentation

Netflix has a broad consumer base comprising people of different backgrounds and ages. The streaming service is attempting to reach a wide array of psychographic markets, including children’s shows, romantic comedies, action-adventure films, documentaries, and comedies. Due to the pandemic-related restrictions, there has been a significant boost in Netflix viewership, with the platform claiming the biggest chunk of streaming minutes in the U.S. at 34% (Daniel, 2022).

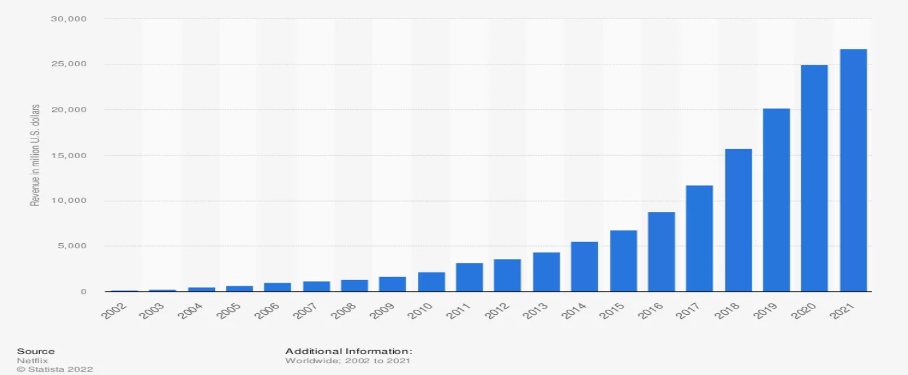

Revenue

Netflix has been registering steady growth in its revenue which can be attributed to good management and marketing. This has earned the company confidence from the shareholders making the prices of its common stock remain robust. The company realized growth in its revenue even in 2020 amidst the pandemic at a value of about $ 25 billion (“Start.Io” 2022).

History and Development of Netflix

Launched as a mail-premised rental business; 1997 – 2006

Marc Randolph and Reed Hastings conceived and implemented the idea of starting Netflix Inc. on 29th August 1997 in California. They were stimulated by the initial launch of DVDs in the U.S. on 24th March 1997, which prompted them to try out renting or selling DVDs through the postal service by sending a compact disc to Santa Cruz, Hastings’ residence. The success of that trial drove them to begin Netflix in August of the same year (Mier & Kohli, 2017).

At first, Netflix proposed a rental charge for each DVD, yet in 1999, they replaced it with a monthly subscription. After that, they discontinued the rental fee option and focused on a flat-rate, limitless rental program that had no deadlines. In May 2002, Netflix initiated its public offering by releasing 5.5 million ordinary stock shares at $15.00 each (Hosch, 2022). The U.S. Patent and Trademark department awarded Netflix with a patent in the same year. In 2003, the company posted its first profit, bringing in a total of $6.5 million in revenue (Hosch, 2022).

Transitioning to streaming services; 2007- 2012

In January 2007, Netflix introduced an on-demand streaming video service. This concept was inspired by the success of YouTube in 2005. The organization developed the “Netflix Player,” which allowed users to watch streaming content on their television rather than on a computer or laptop (Tyron, 2015). In January 2008, DVD rental subscribers were given access to unlimited streaming without any extra charges due to the emergence of Hulu and Apple’s new video rental services. By late 2008, the company had stopped selling used DVDs and had begun to offer Blu-ray rentals. In 2009, Netflix streaming surpassed DVD shipments. In 2010, the company extended its streaming services to the international market outside America. It marked a significant milestone in its growth and development. Later that year, it began to offer separate streaming programs apart from DVD rentals (Tyron, 2015).

In 2011, Netflix launched a special remote control that allowed users to begin streaming on compatible devices right away (Given, 2016). The company achieved a major breakthrough in September when it extended its services to 43 countries in Latin America (Tyron, 2015).

In January 2014, Netflix began its journey into the European market by launching in the U.K. and Ireland (Blair et al., nd). That same month, the company got the domain name DVD.com. A month later, Netflix signed a deal with Time Warner’s Bros and Turner Broadcasting System, allowing them to stream Warner Bros animations, Cartoon Network, TNT’s Dallas, and Adult Swim as of March 2013. These shows would be available for viewing through Netflix.

Development of original programming (2013-2017)

Several activities took place between 2013-2017. Netflix collaborated with DreamWorks Animation to produce Turbo Fast, which is grounded on the film Turbo. In 2013, the company also reinstated the “profiles” feature, allowing profiles to host up to five user profiles. That year, Netflix also initiated operations in the Netherlands (Planes et al., 2022). In 2014, a fresh logo and a re-designed website were unveiled. In the same year, Netflix set its foot in other European countries such as France, Germany, Belgium, Austria, Switzerland, and Luxembourg. Netflix further expanded in 2015 to other countries such as New Zealand, Australia, Spain, Portugal, and Italy (Planes et al., 2022). This year, Netflix first set foot in Asia by investing in Japan. The company became ambitious and aggressive in 2016, where it became available worldwide except in Syria, North Korea, China, and Crimea. (Planes et al., 2022) However, it temporarily stopped its operation in Russia in 2022 due to the Ukraine-Russia war.

Other developments during the period include signing a licensing deal with iQiyi in 2017, a contract with BMG Rights Management for music publishing, an acquisition of Millar world, and a contract with Shonda Rhimes (Planes et al., 2022). Netflix further signed an agreement with Orange Is the Black creator, which was actually an exclusive multi-year deal.

Expansion into global productions; 2017 – 2020

Netflix Inc. secured the rights to the Cloverfield Paradox from Paramount Pictures for $50 million and premiered its streaming programs in the beginning of 2018. Other films that Netflix procured include Universal’s News of the World and global supply for Paramount’s Annihilation, among others (Brennan, 2018).

In 2018, former U.S. president Barack Obama entered into a contract with Netflix to create content under the banner of their freshly-founded production firm, Higher Ground Productions (Michael, 2018). Later that same year, Telltale Games and the streaming giant collaborated to port their adventure games to a video format that could be easily navigated using just a television remote (Brennan, 2018). Netflix also signed a five-year agreement with Harlan Coben and sealed a deal with Gravity Falls, among other partnerships. To complete the year, the company acquired Albuquerque Studios to form one of the biggest film studios in North America.

In 2019, Netflix was granted permission to enter the MPA (Motion Picture Association of America). This was a remarkable accomplishment, as it became the initial streaming service to be accepted as a part of the association. At the conclusion of the year, Netflix declared that it had entered into a rental contract to secure the Paris Theatre. Netflix company was tasked to oversee numerous renovations at the theatre, comprising a concession stand and new seats (Kumar et al., 2020).

In 2020, a new agreement was struck with Adam Sandler for an estimated $275 million and then, in the following month, Netflix collaborated with six Japanese creators to craft a unique Japanese project (Fung & Chik, 2022). The year closed with Netflix entering into a lucrative business pact with the Duchess and Duke to foster the production of movies, television programs, and programs for children.

Extension into gaming, Squid Game; 2021-Present

This period saw Netflix win at least seven awards. Sony Pictures Entertainment announced in 2021 of acceptance for Netflix Inc. to hold the U.S. pay television window rights. Later in the year, Netflix launched the Netflix Book Club and acquired Scanline VFX, which deals with animation and visual effects . Netflix Inc. acquired Next Games in March 2022 as part of its goal of expanding into the gaming sector. Several contracts and procurements were completed during the year to enable it to accomplish its ambitions more productively (Raemont, 2022).

SWOT Analysis

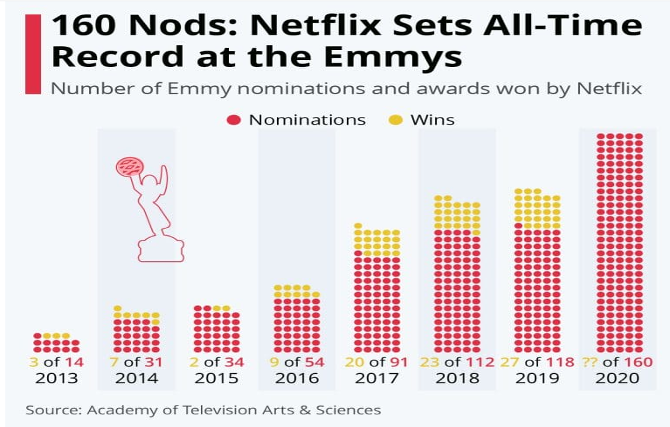

Strengths

According to an article by Business Hub, Netflix has a number of internal strengths. Firstly, it has a brand reputation enabling it to rise very fast. According to Interbrand, the company is ranked Number 36 with a brand value of at least $15.0 billion. The second strength is seen in drastic growth (Parker, 2019). The company has attained a prominent brand worldwide in online streaming in the past decade. Another important aspect is the award-winning shows where the company has won a number of awards in the media sector, making it grow its brand.

Additional internal strength is the global customer base, where Netflix serves over 190 countries, with subscribers estimated at 167 million (Parker, 2019).

Affordability in pricing is another strength that Netflix uses to penetrate markets and uses both offensive and defensive marketing strategies (Parker, 2019).

Weaknesses

The first weakness is the increasing debt. Due to the enormous capital outlay the company requires, its gearing ratio is increasing, making it incur a substantial financial cost. As of April 2020, the company reported a debt of $ 14.17 billion and had the plan to raise $1 billion more. This growth in debt each year is a weakness (Parker, 2019). An additional area for improvement is the need for green initiatives. Netflix has not adopted the application of renewable energy and has not created a corporate strategy to advance ecological responsibility. Another weakness is limited copyrights. The company doesn’t own a number of its contents, which adversely affects its operations (Parker, 2019).

Netflix’s Opportunities

Netflix still has potential to broaden its reach in other nations, such as China, Crimea, North Korea, and Syria, where it has not yet been introduced. The Chinese economy is growing quickly, and Netflix can tap from this (Parker, 2019). Additionally, the company can introduce cheaper annual subscriptions. This will ensure that it increases the number of its subscribers. Niche marketing is another opportunity available to Netflix. This entails producing region-specific content in the local language. Niche marketing has been confirmed to be profitable for Netflix. Moreover, it can refresh its content library to ensure steady growth (Parker, 2019).

Netflix’s threats

Competitive pressure from companies such as Disney+ and Apple TV+, among others, made Netflix lose some of its market shares (Parker, 2019). The second threat is piracy, where a number of people make illegal downloads of videos. The third threat is the strict government regulations. This has restricted its expansion to China due to restrictions on foreign content. There is also an aspect of market saturation which is slowing the growth of Netflix.

Another threat is the account hacking, where the number of hacked Netflix user account increased sharply in Q1 and Q2 of the year 2020 (Parker, 2019). Lastly, carbon emission is a threat and can restrict Netflix’s operations.

PESTEL Analysis

Political Factors

The content of Netflix has been available in some countries due to government rules and regulations. This makes the company face considerable loss. Even where the brand agrees, restricted access has blocked Netflix from reaching some countries. Some company content cannot be allowed in countries like China (Gregory, 2021).

Economic Factors

Unfavorable changes in the exchange rate make Netflix incur a considerable loss. Additionally, increased competition in streaming services eats into the market share of Netflix. Another concern is the content piracy which reduces the profitability of Netflix (Gregory, 2021).

Social factors

Netflix must consider various social factors for its future growth and development. First, a splendid work environment that promotes a company’s performance must be considered. The company’s corporate social responsibility has benefited it, especially its generosity towards the black community and students. Lastly, flexibility has immensely profited the company; Netflix has made it possible to watch a live stream on mobile (Gregory, 2021).

Technological factors

It is well said that innovation shapes a healthy business. There are technological factors that influence Netflix. First is the Hermes, an automatic translating software that is quite popular with the users of Netflix (Gregory, 2021). Another concern is the ever-changing algorithm which confuses the users. An excellent example of this is the content rating system. It is also noteworthy that one of the numerous merits of Netflix is that a person can avail high-quality videos with very little data spent.

Environmental factors

These factors entail low carbon emission, reusable resources, and environmental-friendly service. Certain environmental factors influence the business of Netflix. For example, Netflix’s recent investment supporting EPA ideologies demonstrated its willingness to use renewable energy, which will promote its growth. Additionally, the media firm operates nearly online, leaving no direct environmental effect. Other strategies for achieving a sustainable future include decreasing the amount of paper used in the workplace, which the company is following (Gregory, 2021).

Legal factors

These factors are connected to the rules of a nation or state that the company must comply with if they want to conduct their business there. There are lawful elements that have an effect on the operations of Netflix business. For example, the unexpected surge in price has caused a rift between the company and its customers. Some customers have taken legal action against Netflix Company (Gregory, 2021). Additionally, unceasing copyright claims have caused a problem with a part of its customers. The company has to come up with a suitable plan for dealing with the situation.

Porter’s Five Forces

Competition

New entrants encounter significant barriers due to high costs and low profitability. Nevertheless, it is relatively easy for companies that are already playing in the industry, such as HBO or Amazon, who are also venturing into this sector (Bobmanuel, 2022). It is, therefore, accurately said that competition is a serious and major threat to Netflix in its operations.

Threat of New Entrants

The risk posed by new companies entering the Netflix industry is comparatively low due to the capital-intensive nature of it. Furthermore, it has an extensive international reach with a highly esteemed reputation, which is a formidable obstacle (Bobmanuel, 2022).

The Bargaining Power of Suppliers

There are a few suppliers since Netflix trades on content that is an expensive commodity to produce. The suppliers have huge dominance in the market due to their small size (Bobmanuel, 2022).

Bargaining Power of Customers

The switching cost is less for customers, with nearly all services being offered at a small price difference. The main factor is the content and not the price. Moreover, Netflix’s five forces cannot depend on annual contracts since customers make monthly payments. These factors make Netflix’s five forces strong (Bobmanuel, 2022).

Threat of Substitute Products or Services

There are few acceptable alternatives to the material produced in the business, causing the danger to be mild. Netflix encounters this peril from companies that make similar content on streaming or DVDs (Bobmanuel, 2022). The principal hazard here is the existence of other recreational pursuits and other entertainment options.

Challenges of Netflix

From the foregoing, Netflix faces a number of challenges in its operations. The first challenge is competition from other companies, such as Amazon, which also offers online streaming services. The increased competition threatens that Netflix will lose a significant portion of its market share and must spend a lot of resources on marketing (Budzinski et al., 2021).

Additionally, Netflix needs to have a user-friendly strategy to enable customers to stream videos onto television sets (Labato & Lots, 2020). Another challenge that the giant company is facing is the geopolitics. Netflix stopped its operations in Russia due to the Russia-Ukraine war and the strained relationship between U.S. and Russia. Netflix has also been unable to launch its operations in countries unfriendly to the U.S., such as China, North Korea, and Syria.

An unfavourable exchange rate makes Netflix lose a lot in foreign currency translation. A number of countries have been worst hit by inflation. U.K. pounds are weakening daily, and this is a loss that Netflix is desperately staring at (Maistre, 2022). An additional challenge is the increasing cost of debt. This makes the company incur considerable financial charges, and the increased gearing ratio above the optimal level lowers the company’s value. A high gearing ratio also puts the company at a risk of liquidation or conflicts with its creditors. Another challenge is the account piracy, which reduces the revenues available to Netflix.

Strategies for Success

Netflix has made use of various strategies for its success. In fact, it has changed the manner content transmission was viewed a few years ago with significant technological innovation.

Cost leadership

Netflix has achieved a strong competitive advantage by reducing its operational costs and passing the savings on to its customers. This has allowed the company to offer more affordable prices than its competitors, while still maintaining high quality services. This has enabled Netflix to have a strong presence in the streaming industry and remain ahead of its competitors.

Differentiation

Netflix’s decision to explore more content creation and video publishing platforms has enabled the company to expand its reach and gain access to a wider variety of audiences. This has allowed Netflix to create and distribute content that appeals to different demographic groups, as well as to create new content that appeals to its existing customer base (Iordache, 2022). Additionally, the expansion of content and video publishing platforms has enabled Netflix to build a more diverse library of content, ensuring that there is something for everyone.

Focus

Netflix’s focus is on creating high-quality original content to differentiate itself from its competitors. The streaming giant is investing heavily in developing original films and television series, as well as acquiring the rights to popular films and television series from other studios (Iordache, 2022). This allows them to offer an extensive library of content that is not available anywhere else. Furthermore, Netflix is also experimenting with interactive media, such as interactive films, which will provide viewers with a new type of viewing experience. All of these efforts are designed to give Netflix an edge over its rivals in the streaming industry.

Recommendations

The debt and gearing ratio challenge can be addressed by issuing more common stock. Paying dividends to common stockholders is optional and will not object Netflix to financial obligation. Another strategy available to gain market share is to target and retain the young demographic as a means of diversity with a strong presence.

According to Taylor (2021), Netflix needs to develop a better customer profile and enhance the quality of data sources. For instance, Netflix can link up with social platforms such as Google, Facebook, and Twitter to access and exchange data. Separately, there are various ways of hedging against risks that emanate from exchange rate losses. Measures include entering into future and forward contracts.

Conclusion

The media and Entertainment industry has made a significant milestone aided by the current sophisticated technology. Netflix, a giant player in the industry, has used the technology to evolve from selling DVDs to offering online streaming services. Despite the challenges the company has encountered, it has made remarkable achievements and still has endless opportunities to exploit. This exploitation will be effectively done using the strengths that Netflix enjoys in the current market

References

2022 Media & Entertainment Industry Outlook. (n.d.). Deloitte United States. Retrieved 29th December, 2022, from https://www2.deloitte.com/us/en/pages/technology-media-and-telecommunications/articles/media-and-entertainment-industry-outlook-trends.html

Adrian, P. (2021). Podcasts Are Hot, News is Not and GenZ is All About Netflix and TikTok. NAB Amplify. https://amplify.nabshow.com/articles/podcasts-are-hot-news-is-not-and-genz-is-all-netflix-and-tiktok/

Blair, T., Burrer, T., Garcia, J., Hernandez, A., Li-Southwick, Q. Y., Logar, K., … & Porter, L. NETFLIX.

Bobmanuel, A. A. (2022). THE STRATEGIC ANALYSIS OF NETFLIX, INC.

Brennan, L. (2018). How Netflix expanded to 190 countries in 7 years. Harvard Business Review, 12.

Budzinski, O., Gaenssle, S., & Lindstädt-Dreusicke, N. (2021). The battle of YouTube, T.V. and Netflix: an empirical analysis of competition in audiovisual media markets. S.N. Business & Economics, 1(9), 1-26. https://doi.org/10.1007/s43546-021-00122-0

Daniel, A. (2022). Streaming viewership overtakes cable T.V. for the first time. NBC News. https://www.nbcnews.com/business/consumer/streaming-viewership-overtakes-cable-tv-first-time-rcna43704

Fung, A., & Chik, G. (2022). Netflix, the Digital West in Asia: New Models, Challenges and Collaborations. In Media in Asia (pp. 41-52). Routledge.

Given, J. (2016). “There Will Still Be Television but I Don’t Know What It Will Be Called!”: Narrating the End of Television in Australia and New Zealand. Media and Communication, 4(3), 109-122. https://doi.org/10.17645/mac.v4i3.561

Gregory, A. (2021). Complete Analysis of Netflix, Inc.

Hosch, W. L. (2022, November 4). Netflix. Encyclopedia Britannica. https://www.britannica.com/topic/Netflix-Inc

Iordache, C. (2022). Netflix in Europe: Four markets, four platforms? A comparative analysis of audio-visual offerings and investment strategies in four E.U. states. Television & New Media, 23(7), 721-742. https://doi.org/10.1177/15274764211014580

Kumar, J., Gupta, A., & Dixit, S. (2020). Netflix: SVoD entertainment of next gen. Emerald Emerging Markets Case Studies.

Lobato, R. (2019). Netflix nations. In Netflix Nations. New York University Press.

Lobato, R., & Lotz, A. D. (2020). Imagining global video: The challenge of Netflix. JCMS: Journal of Cinema and Media Studies, 59(3), 132-136. https://doi.org/10.1353/cj.2020.0034

Maistre, R. L. (2022, April 20). Netflix suffers a subs rewind as inflation hits consumer wallets. TelecomTV. https://www.telecomtv.com/content/digital-platforms-services/netflix-suffers-a-subs-rewind-as-inflation-hits-consumer-wallets-44221/

Market Research, F. (2021, 26th October). Entertainment and Media Market to Expand at 8.9% CAGR to Reach USD 5,099.2 Million by 2030—Report by Market Research Future (MRFR). GlobeNewswire News Room. https://www.globenewswire.com/fr/news-release/2021/10/26/2321109/0/en/Entertainment-and-Media-Market-to-Expand-at-8-9-CAGR-to-Reach-USD-5-099-2-Million-by-2030-Report-by-Market-Research-Future-MRFR.html

Michael, S. (2018, 21st May). Coming to Netflix: The Obamas Sign Deal to Produce Shows (Published 2018). https://www.nytimes.com/2018/05/21/us/politics/barack-obama-netflix-show.html

Mier, J., & Kohli, A. K. (2021). Netflix: reinvention across multiple time periods, reflections and directions for future research. AMS Review, 11(1), 194-205.

Munson, B. (2019). Nearly 75% of U.S. households have either Netflix, Hulu or Amazon Prime Video | Fierce Video. https://www.fiercevideo.com/video/nearly-75-u-s-households-have-either-netflix-hulu-or-amazon-prime-video

Netflix Porter’s Five Forces Analysis | EdrawMax Online. (n.d.). Edrawsoft. Retrieved 29th December, 2022, from https://www.edrawmax.com/article/netflix-porters-five-forces-analysis.html

Parker, B. (2019, 6th January). Netflix SWOT Analysis 2022 | SWOT Analysis of Netflix. Business Strategy Hub. https://bstrategyhub.com/swot-analysis-of-netflix-2019-netflix-swot-analysis/

Planes, J. A., García, A. N., & Pérez-Morán, E. (2022). Flashbacks in Netflix Original TV Series (2013–2017): Predominant Categories, Formal Features, and Semantic Effects. International Journal of Communication, 16, 27.

PricewaterhouseCoopers. (2021). Entertainment & media revenues rebounding strongly from pandemic slump; shift to streaming, gaming and user-generated content is transforming the industry. PwC. https://www.pwc.com/gx/en/news-room/press-releases/2021/global-entertainment-media-outlook-2021.html

Raemont, N. (2022). Netflix Is Turning “Squid Game” Into a Real-Life Competition With a $4.56M Prize—CNET. https://www.cnet.com/culture/entertainment/netflix-is-turning-squid-game-into-a-real-life-competition-with-a-4-56m-prize/

Rainie, L. (2017). About 6 in 10 young adults in the U.S. primarily use online streaming to watch T.V. Pew Research Center, 13.

Shear, M. D. (2018, 21st May). Coming to Netflix: The Obamas Sign Deal to Produce Shows. The New York Times. https://www.nytimes.com/2018/05/21/us/politics/barack-obama-netflix-show.html

Start.io | Netflix Target Market & Consumer Segmentation. (2022, 6th June). Start.Io – A Mobile Marketing and Audience Platform. https://www.start.io/blog/netflix-target-market-consumer-segmentation-the-complete-brand-analysis/

Tryon, C. (2015). T.V. got better: Netflix’s original programming strategies and the on-demand television transition. Media Industries Journal, 2(2).

write

write