Introduction

Flair airline is a low-cost carrier Canadian airline with headquartering in Edmonton, Alberta. It focuses on offering reasonably priced air travel services to its customers. The airline was first launched on August 19, 2005, using the name Flair and has since been known for its reasonably priced fares. Flair struck a ten-year deal with Shell Energy Canada on October 7, 2013, to offer air-leased transportation services across Canada (Hutton et al., 2020). It then rebranded to Flair Airlines in 2017 while obtaining more aircraft. Flair changes its color to acid green and black in 2019 which was a representation of its slogan “Plane and simple”. Through the years, Flair Airlines has broadened its route network to serve well-known towns and areas in Canada and the United States, as well as overseas locations. This essay examines Flair airline’s business strategy, SWOT analysis, the company’s main competitors, and duplication of Flair’s airline.

Flair’s business strategy

Flair airline uses the Ultra-low-cost carrier business strategy. The ULCC focuses on providing cost-effective fares to attract price-sensitive customers (Ovesy, 2023). The airline accomplishes this by using a low-cost operating technique at all levels of its operations. The mission of the company is to enable air travel to be inexpensive and easily accessible that connects people to the world. In addition, Flair airline uses route optimization as a low-cost business strategy by selecting routes depending on the season and demand. When compared to large airports, it frequently concentrates on underutilized or secondary airports, which can result in lower landing fees and operations costs.

Flair airline makes money through ancillary fees and services. According to Shaw et al., (2021), Ancillary services are sources of revenue other than the basic plane tickets. They include services such as bag check-ins, food, priority boarding, and better seats. With these services, Flair enables its clients to customize their traveling experiences by paying for the services and products they need. Additionally, Flair airline makes money through operational efficiency (Naik et al., 2023). The company operates by minimizing costs. This involves taking steps like sticking with a single kind of aircraft such as Boeing 737s to reduce maintenance and training, using digital and machine-learning techniques to expedite operations, and maximizing aircraft utilization to boost revenue production. Operational efficiency allows them to reduce costs and attract more customers.

The company’s sources of success come from its affordability. Flair’s cost-efficiency fares allow the company to attract more travelers compared to its competitors. Additionally, by providing a wide range of ancillary services that cater to a wide range of customers, Flair can make more revenue (Shaw et al., 2021). The company’s market demand is a solid source of its success. Today, Flair airline is among the top three airlines in Canada. Its strategy, the ultra-low-cost carrier business strategy aligns with the market demand allowing it to attract more customers (Taplin et al., 2023). In addition, the company’s operational efficiency helps it to maintain its competitive pricing edge.

Flair’s SWOT analysis

| Strengths | Weaknesses |

| Cost Efficiency– This enables the airline to maintain low expenses and provide affordable tickets.

Ancillary Revenue– These services act as a major source of income. Customer Segmentation– The ancillary services give customers the experience they want. Digital Operations-The company’s technology in checking-in and ticketing reduces costs and enhances the customers’ experience. |

Service Quality Concerns– From Flair’s business strategy, the quality of service can be a concern and can lead to customer dissatisfaction.

High dependency on Ancillary Revenue– if the ancillary fees are perceived as expensive by passengers, it can lead to dissatisfaction (Shaw et al., 2021). Concentration on specific Routes– This can limit Flair’s market reach, particularly from passengers traveling to other diverse destinations. |

| Threats | Opportunities |

| Competition– The Airline industry is expanding with more domestic airlines entering the market.

Regulatory challenges- Weather– Weather changes such as hurricanes and storms affect business operations. Instability in Fuel Price– The fluctuation in price can affect Flair’s operating costs and profits. |

Tourism industry growth– with the growth of social media and technology, people are more alluding to traveling.

New Partnerships– entering new partnerships with other Airlines will expand Flair’s market share. Enhanced Customer Experience– A good customer experience in all aspects of the airline can be different from other Airlines with the same business strategy |

Flair Airlines’ main competitors

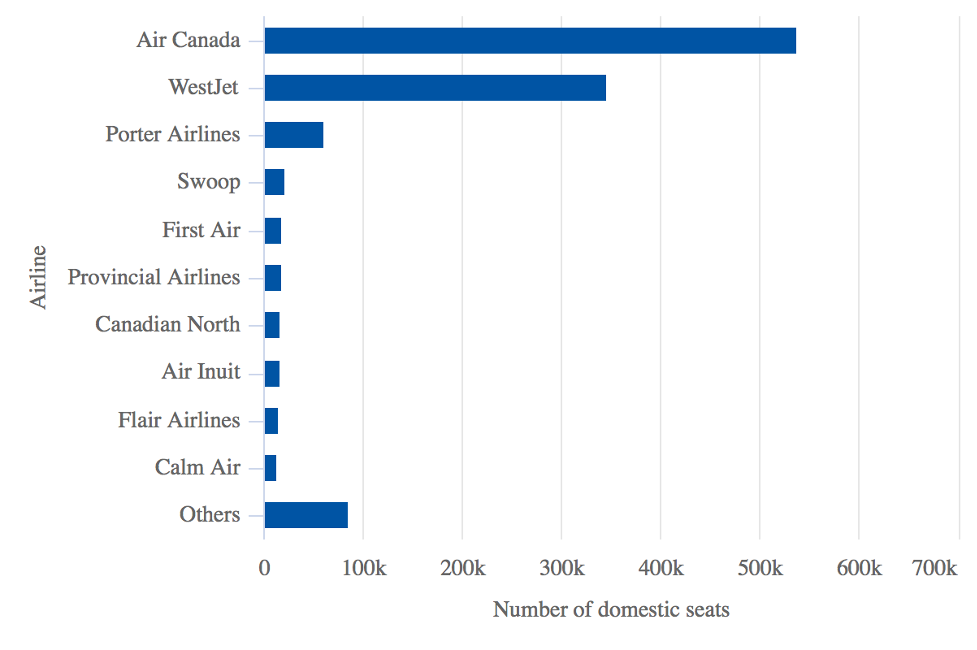

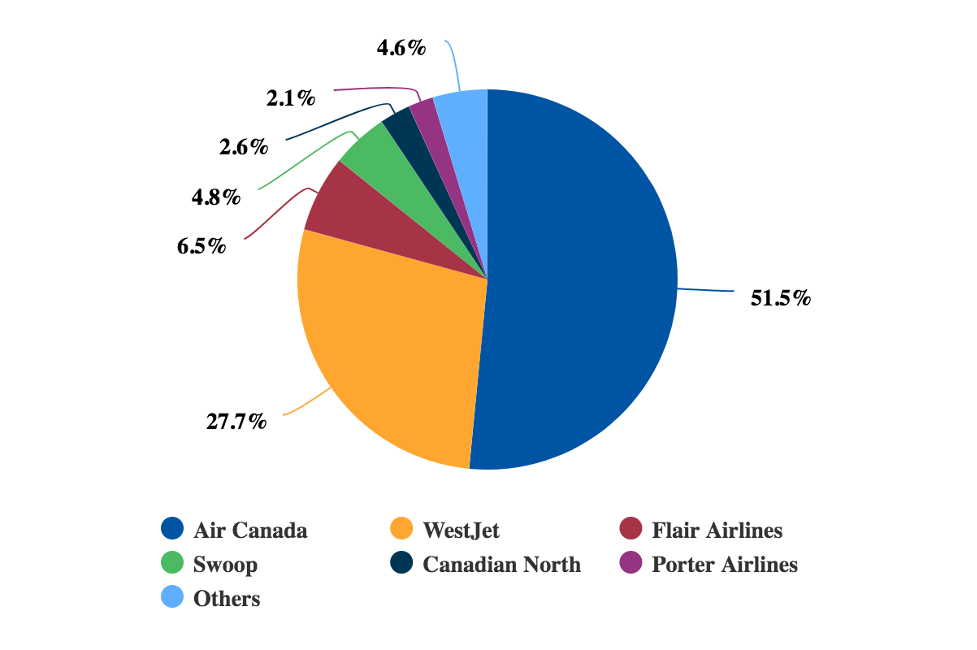

The company’s main competitors are those that offer the same low-cost services and a strategy based on routes, fare prices, and customer experiences in Canada. Flair’s main competitors in the Canadian market as shown in Appendix 1 include:

- WestJet- It is a Canadian Airline company that offers low-cost and full-service options to its customers.

- Canada Rouge- This airline has specific routes where it offers lower-cost fares that attract cost-sensitive travelers.

- Swoop Air- The Company uses an Ultra-low-cost business strategy and offers both ancillary and cost-effective services.

The foundations of Flair’s competitive advantages contribute to its position in the industry as an Ultra-low-cost carrier airline company. First, Flairs Airlines cost efficiency: The Company being able to operate at a low cost without incurring losses is a vital factor for its competitive advantage (Dresner et al., 2021). It emphasizes minimizing expenditures through an organized operation structure. It is difficult to imitate cost efficiency because, it requires a company to enhance several operational procedures, secure advantageous contracts, and uphold a price-sensitive culture.

Second, Flair’s Ancillary revenue such as food and beverage fees, change of seats, luggage, and check-in fees acts as a foundation for the company’s competitive advantage. This approach enables the airline to offer low-cost fare prices and makes additional revenues while enabling travelers to get the experience they want (Dresner et al., 2021). It is difficult to imitate because the success of ancillary services depends on the passengers’ willingness to pay additional fees and their market preferences. In addition, dependency on ancillary revenue also requires airlines to establish a balance between ancillary fees and flight fares

Third, Flair focuses on specific route selections that are underserved which reduces its operation costs and reduces competition from its main competitors. Other Airlines might find it difficult to imitate this approach because it limits a company’s market size for those passengers with diverse destinations. In addition, securing routes and airport agreements takes time (Dresner et al., 2021). Fourth, the company caters to its customer segment giving it a competitive advantage. Flair’s market preferences are those passengers who are cost-sensitive allowing it to establish loyal customers. This is difficult to imitate because customers’ preferences can change

Duplication of Flair’s business model

Flair’s competitors can duplicate its business model. However, the extent of their success in the duplication process depends on several factors such as:

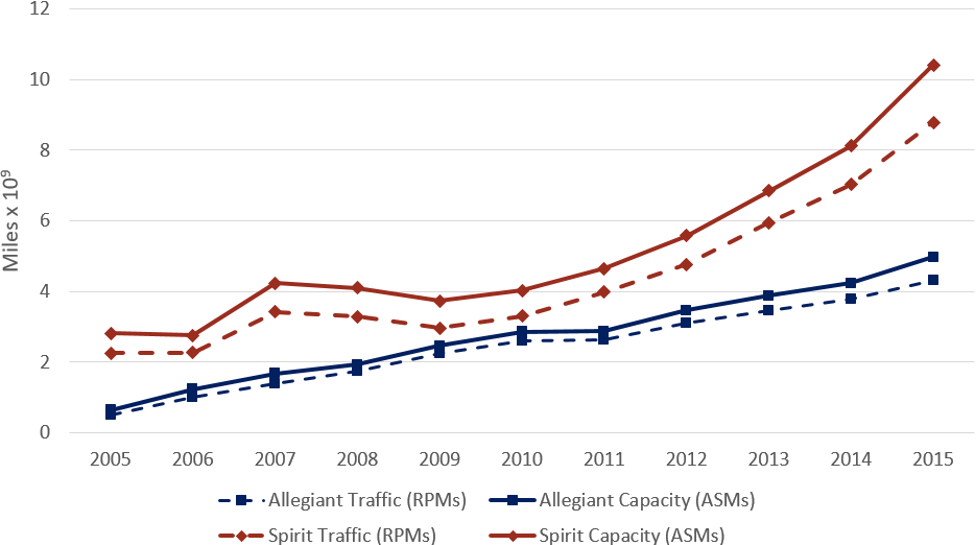

- The complexity of Flair’s cost structure: The ULCC business strategy of Flair is based on strict cost management and operational effectiveness. According to Figure 1 below, duplicating this cost structure requires streamlining numerous airline activities, negotiating deals with vendors, and upholding a cost-conscious mentality. Competitors may find it difficult in cases where their current cost structure is different from that of Flair Airline.

Figure 1: The effects of the Ultra-Low-Cost Business model in US airline industry

https://www.google.com/url?sa=i&url=https%3A%2F%2Fwww.semanticscholar.org%2Fpaper%2FThe-emergence-and-effects-of-the-ultra-low-cost-in-Bachwich-Wittman

- Ancillary Revenue Strategy: Flair highly depends on Ancillary revenue. Other competitors can duplicate this strategy; however, its success will depend on the airline’s customers’ preference and acceptance of additional fees (Wang et al., 2021). It will also depend on their ability to balance between ancillary services pricing and low travel fares.

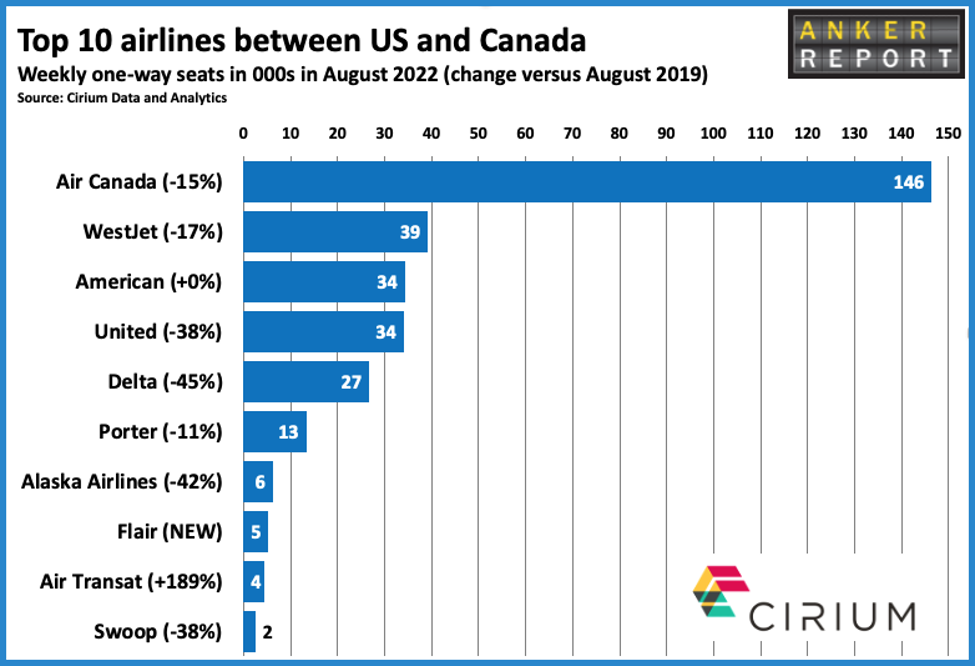

Figure 3: Flair’s market position between US and Canada

https://www.google.com/url?sa=i&url=https%3A%2F%2Fairserviceone.com%2Fcanadian-carriers-now-have-67-of-us-canada-market-jetblue-and-sun-country-newest-airlines

- Brand positioning strategy and customer loyalty: Flair Airline has positioned itself as a cost-friendly carrier and focuses on customer preferences. According to Figure 3, Flair has earned a position in the United States and Canada markets. Other competitors can duplicate this business model. However, they will need a well-planned and researched strategy to build the same brand identity and customer loyalty (Zaki & Rodriguez, 2020). In addition, the level of competitive threat here hinges on how well rivals can appeal to consumers looking for low-cost travel options.

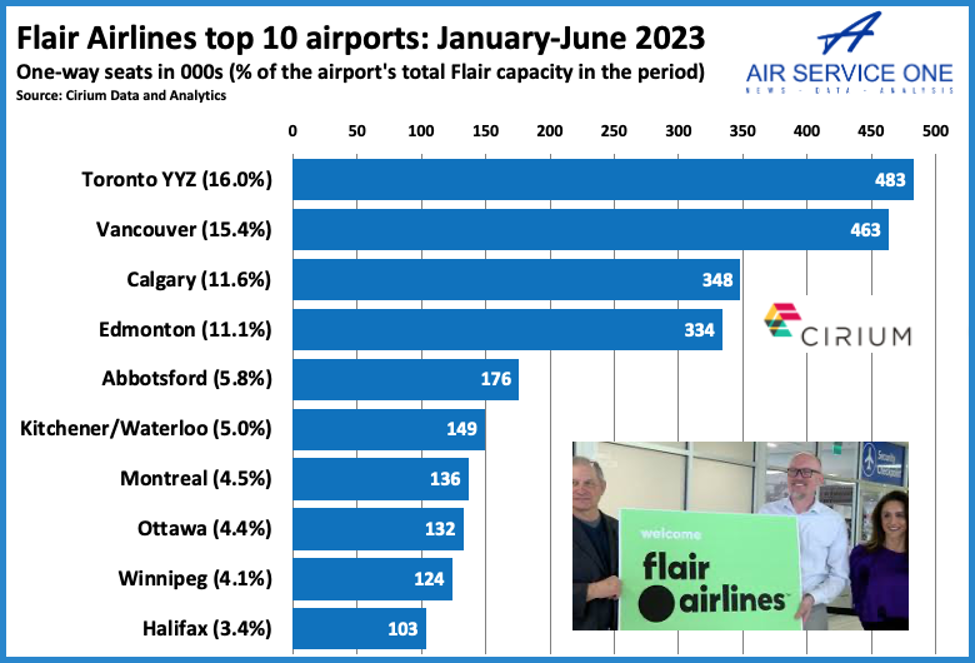

Figure 2: Flair Airline Route selection

- Specific route selection model: According to Figure 2, the Company has specific routes that are not well diverse in terms of overseas destinations. This can be challenging for competitors to duplicate. This is because, entering and securing agreements with airports for new routes takes a lot of time and resources (Safety & Region, 2021). However, any competitor that wants to venture into Flair’s routes strategy and it aligns with their customer’s preference and enter the market and compete.

Figure 4: Canadian ULCCs

https://www.google.com/url?sa=i&url=https%3A%2F%2Fcentreforaviation.com%2Fanalysis%2Freports%2Fcanadian-ulccs-2020-to-be-the-shakeout-year

The competitive threat level is high as its main competitors are using the same business strategy (ULCC) as shown in Figure 4. Additionally, competition in the Airline industry depends on the pace at which Flair’s main competitors can adapt, their organizational structure, and the overall market dynamics (Campan, 2020). Flair has competitors who are constantly enhancing their services and taking advantage of opportunities to expand their market share. The Ultra-low-cost strategy has become popular with an increase in customer preference. As a result, more airlines are considering adapting this strategy to attract more passengers and offer affordable travel options (Hutton et al., 2020).

Conclusion

Flair Airlines has broadened its route network to serve well-known towns and areas in Canada and the United States, as well as overseas locations. The company uses an Ultra-low-cost carrier business strategy that focuses on providing cost-effective fares to attract price-sensitive customers. Flair’s ancillary services allow it to make money and give sit a competitive edge advantage from its competitors. The company’s success and competitive edge also stem from its affordability and operations efficiency and focus on customer preferences. As competition continues to increase among ultra-low-cost carrier airlines, Flair Airlines will continue to enhance its technology, innovate and improve customer experience to maintain its position in the industry.

References

Campan, G. (2020). A Sound Competition Approach Supports Air Canada’s Acquisition of Air Transat. Montreal Economic Institute.

Dresner, M., Gualini, A., Martini, G., & Valli, M. (2021). Airline competition and LCCs in the North Atlantic market. Journal of Transport Economics and Policy (JTEP), 55(4), 261-282. https://www.ingentaconnect.com/content/lse/jtep/2021/00000055/00000004/art00002

Hutton, S., Rowe, L., & Stirling-Moffet, S. (2020). Year in Review 2019: Competition Law in the Digital Age. CCLR, 33, 111. https://heinonline.org/hol-cgi-bin/get_pdf.cgi?handle=hein.journals/cacmplr33§ion=8

Naik, S., Sony, M., Antony, J., McDermott, O., Tortorella, G. L., & Jayaraman, R. (2023). Operational excellence framework for sustainability in the organisation: a design science approach. Production Planning & Control, 1-17. https://www.tandfonline.com/doi/abs/10.1080/09537287.2023.2165188

Safety, D., & Region, N. (2021). Transport Canada. Online at: www. tc. gc. ca/pacific/marine/marine. safety/menu. htm (accessed 1 December 2003). https://www.prrd.bc.ca/board/agendas/2011/2011-18-5648944685/pages/documents/06-D-3TransportCanMgrRailSafety.pdf

Shaw, M., Tiernan, S., O’Connell, J. F., Warnock-Smith, D., & Efthymiou, M. (2021). Third-party ancillary revenues in the airline sector: An exploratory study. Journal of Air Transport Management, 90, 101936. https://www.sciencedirect.com/science/article/pii/S0969699720305196

Taplin, D., Kuby, M., Salon, D., & King, D. (2023). Analysis of Airports Served by Ultra Low-Cost Carriers. Transportation Research Record, 03611981231164081. https://journals.sagepub.com/doi/abs/10.1177/03611981231164081

Ovesy, N. (2023). An empirical examination of the Canadian air passenger market: distinguishing the impact of LCC and ULCC market entry (Doctoral dissertation, University of British Columbia). https://open.library.ubc.ca/soa/cIRcle/collections/ubctheses/24/items/1.0433750

Wang, K. K., Wittman, M. D., & Bockelie, A. (2021). Dynamic offer generation in airline revenue management. Journal of Revenue and Pricing Management, 20, 654-668. https://link.springer.com/article/10.1057/s41272-021-00349-4

Zaki Ahmed, A., & Rodríguez-Díaz, M. (2020). Analyzing the online reputation and positioning of airlines. Sustainability, 12(3), 1184. https://www.mdpi.com/2071-1050/12/3/1184

Appendices

Appendix 1

https://www.google.com/url?sa=i&url=https%3A%2F%2Fcentreforaviation.com%2Fanalysis%2Freports%2Fflair-porter-air-transat-to-be-a-force-for-change-in-canada-

write

write