The cost-of-living crisis is a major issue in London, a city with skyscrapers and cultural variety. London’s affordability is at risk as housing and daily expenses rise. Housing tenure is central to this issue, affecting how Londoners live and the cost-of-living dilemma. This statistical study examines the complex relationship between home tenure and London’s high cost of living. It examines World Bank statistics on London’s housing market to address the question: “Will there be an end to the cost-of-living crisis in London, and what is the reason and result of this issue?” This study tries to understand housing tenure trends, which may help Londoners.

Data Analysis and Visualizations

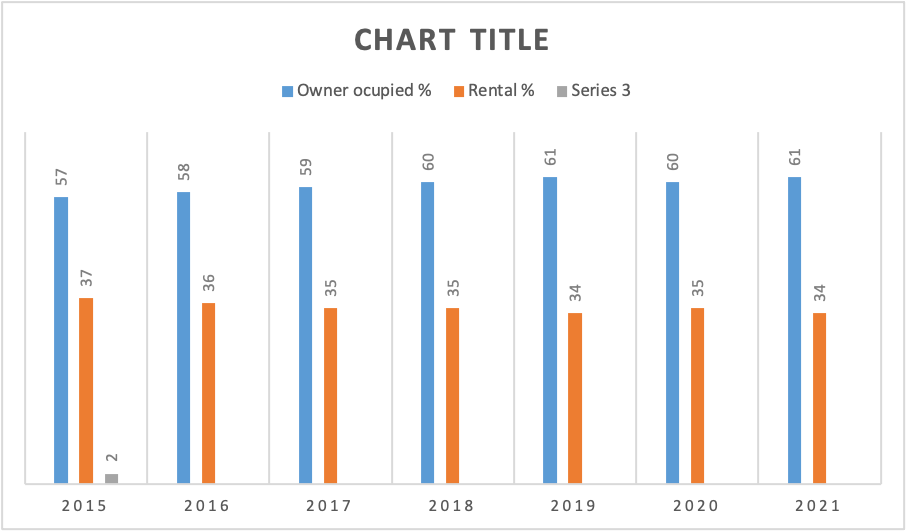

Chart 1: Housing Tenure Trends in London (2015-2021)

The chart shows London’s housing tenure patterns from 2015 to 2021. Over time, owner-occupied housing increased from 57% in 2015 to 61% in 2021. Rental housing fell from 37% to 34% throughout the same period. This trend implies Londoners’ home tastes are changing. The rising number of owner-occupied dwellings may indicate a growing desire for homeownership. Favorable mortgage rates, government incentives, and long-term stability of home ownership may explain this rise. Rising rental costs may make house ownership more tempting, which may explain the slight rental housing decline. To meet Londoners’ evolving requirements, politicians and housing authorities must understand tenure changes (Brill & Raco, 2021). It highlights the need to encourage first-time homebuyers, address housing affordability, and create housing policies that reflect these changing tastes.

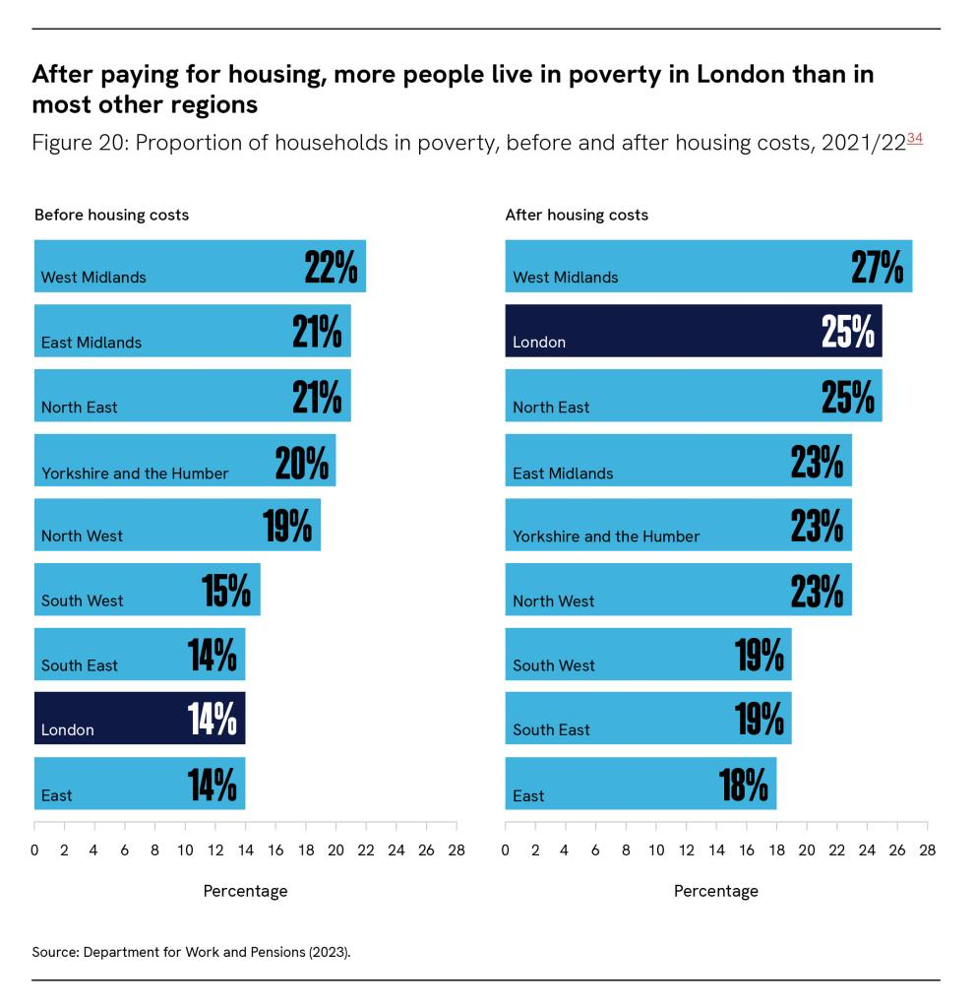

Chart 2: Poverty Rates in London by Age Group (2022)

Harding, C., Cottell, J., Tabbush, J., & Mahmud, Z. (2023, August 17). Homes fit for Londoners: London’s homes today. People, Places.

The chart shows 2022 London poverty rates by age group. It shows how much housing expenses affect city poverty. Housing prices significantly boost poverty rates for working-age individuals and children. The poverty rate for working-age individuals rises from 14% to 27% after housing costs. Children’s poverty rate rises from 18% to 33% when housing expenditures are considered. These data demonstrate the financial impact housing costs place on these two demographic groups. Pensioners with lower housing costs due to mortgage completion or reduced living space requirements have a smaller pre- and post-housing cost poverty gap. Policymakers must understand differences in housing costs and poverty rates by age (Boeing et al., 2021). This highlights the need for specific housing affordability strategies for working-age adults and children, particularly vulnerable to poverty due to high housing expenses. It emphasizes the need for affordable housing for families and individuals to raise living standards and alleviate poverty in London.

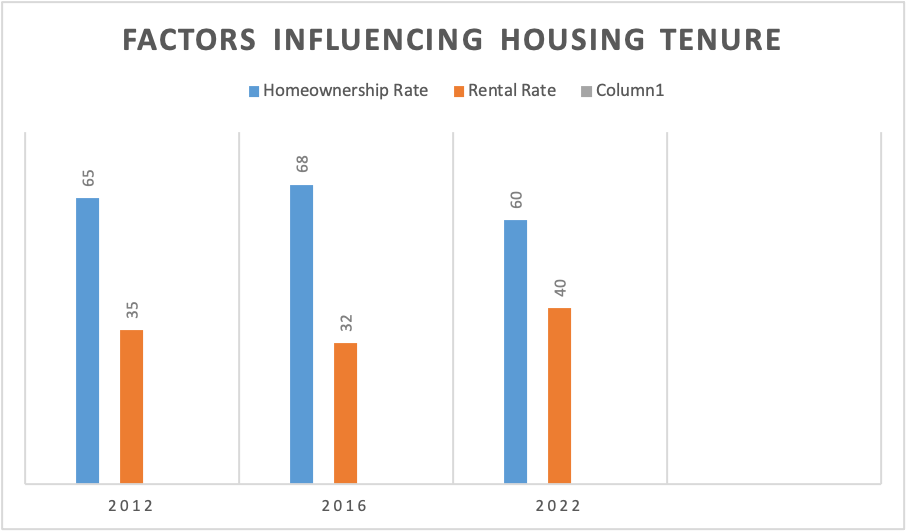

Factors Influencing Housing Tenure

Income Levels: The chart shows that income affects housing tenure. Higher salaries are connected with 65% homeownership, while lower incomes prefer renting (35%). The London housing market’s affordability issue is well-known. High property prices and living costs make housing a luxury for the wealthy. Renting is more affordable for many, especially younger generations (Li, 2023).

Employment: Employment stability affects housing tenure. Stable work is associated with 68% homeownership, while economic swings and job uncertainty are associated with 32% rent. London’s economy and housing market are interconnected. As job markets shift, people may prefer renting to homeownership. Financial stability is crucial for homeownership in London due to its high cost of living.

Housing Policies: Government actions strongly impact London’s housing tenure. The statistic shows that 60% owned and 40% rented due to housing policies. These policies may support or discourage homeownership with incentives, subsidies, or regulations. Government activities can alter housing supply and affordability, affecting whether people rent or buy. Housing policies shape the housing scene in a city when demand exceeds supply.

Income inequality exacerbates the city’s high rent and housing costs. Low-income and unemployed people struggle to become homeowners, which can be more stable and cost-effective. Housing strategies that alleviate these discrepancies are crucial. Affordable housing programs can help more people become homeowners. However, tackling London’s cost-of-living crisis while keeping housing affordable for renters and future homebuyers is essential (Saiz, 2023).

Current Situation and Projections

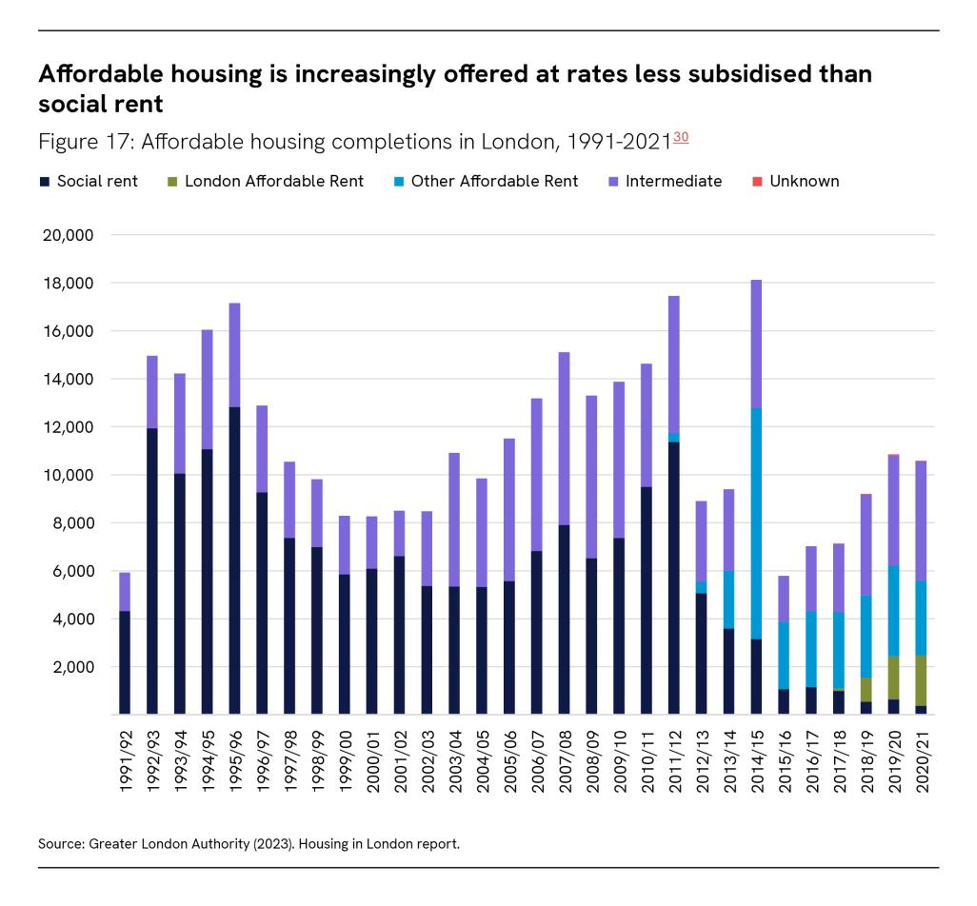

Harding, C., Cottell, J., Tabbush, J., & Mahmud, Z. (2023, August 17). Homes fit for Londoners: London’s homes today. People, Places.

Reflecting the cost-of-living crisis, municipal housing tenure has changed significantly recently. London’s property sector faces rising rental demand. According to recent data, London’s rental industry has grown, with more homes privately rented. From 16% in 2002 to nearly 30% in 2021, private rental housing has grown significantly. Social rentals, which make up 22% of all residences, have stayed consistent. Londoners own less than half their homes, highlighting ownership discrepancies. London’s housing issues are highlighted by its low homeownership rate (Jacoby & Alonso, 2022). Several worrying issues emerge from cost-of-living crisis projections. The rise of rental units, high property prices, and living costs exacerbate housing affordability concerns. Rent and housing costs can worsen the cost-of-living crisis by straining households’ budgets. Income inequality and job insecurity make homeownership difficult, especially for younger and lower-income people. Future outcomes depend on London’s housing policies. This situation requires comprehensive initiatives to reduce housing inequities, increase affordability, and secure Londoners’ long-term housing security (Dianati, 2022). As the city’s population grows and the cost-of-living crisis persists, effective housing policy and affordability measures are needed to create a fairer future.

Conclusion and Implications

London’s housing tenure and cost-of-living issue data is complex. Londoners have affordability issues due to rising rents and restricted homeownership. London’s housing policies have changed, yet borough and ethnic group inequities require focused measures. Unfortunately, the evidence implies that London’s cost-of-living crisis may deteriorate without comprehensive affordability and housing security measures. Policymakers must understand housing’s vital role in socio-economic concerns and engage communities to find educated, community-driven solutions. London must promote equitable housing to alleviate the cost-of-living crisis and ensure a sustainable and prosperous future for all citizens.

Reflection

To answer the main questions in the Data Analysis Report on London’s housing tenure and the cost-of-living crisis, I followed a process. Data and information sources were thoroughly studied to start the journey. Starting with World Bank statistics on London’s housing tenure was helpful for my research. The World Bank data provided important metrics on London housing, including homeownership rates, renting patterns, conditions, and regulations. This material helped me grasp London’s housing tenure concerns and challenges.

This study is intended for several audiences. This research might interest individuals and organizations engaged with London’s housing and cost-of-living issues, including lawmakers, housing experts, researchers, and government entities. Moreover, I intended to create a resource that is both inclusive and informative for a wide audience, encompassing London residents with a vested interest in understanding their housing circumstances (Byrne, 2020). The study endeavored to establish a link between data research and its practical ramifications for many individuals, ensuring its comprehensibility and transparency.

In the data inclusion phase, I had a lot of World Bank data and background knowledge. Selecting important data while removing irrelevant data was difficult. I focused on homeownership and rental rates since these were crucial to housing tenure. To complete the picture of housing tenure factors, I included income, employment, and housing policy data. I wanted the data to be instructive and relevant to the London cost-of-living crisis.

Charts and visualizations were specifically created to enhance clarity and optimize effectiveness. Bar charts are commonly utilized to compare rates of homeownership and rental; hence, I opted to employ them in my analysis. Charts must possess clarity and visual appeal. The selection of color palettes, labels, and titles was meticulously deliberated. I have acquired knowledge that employing a straightforward and uniform format for charts can enhance the understanding of information.

I encountered challenges with the availability of data. Including specific data points increased the quality of the study. Additional demographic information about homeowners and renters, encompassing age, income, and ethnicity, could have provided valuable insights into the factors influencing housing tenure in London. The availability of data for this investigation was limited.

Potential future surveys and research endeavors may consider gathering data from the populace of London to delve into the concerns elucidated within this report. This facilitates a more comprehensive examination of housing tenure and the issue of escalating living expenses. A more comprehensive perspective could be achieved through collaboration with local housing organizations and governmental agencies to get more datasets.

Finally, writing the Data Analysis Report on London’s housing tenure and the cost-of-living crisis was instructive. Data collection, chart design, and audience consideration were crucial. While the paper sheds light on London’s housing tenure issues, more research is needed to comprehend them fully. The purpose is to inform decision-making, help Londoners find affordable and acceptable housing, and create a more sustainable and equitable urban environment.

References

Boeing, G., Besbris, M., Schachter, A., & Kuk, J. (2021). Housing search in the age of big data: smarter cities or the same old blind spots? Housing Policy Debate, 31(1), 112-126. https://doi.org/10.1080/10511482.2019.1684336

Brill, F., & Raco, M. (2021). Putting the crisis to work: The real estate sector and London’s housing crisis. Political Geography, 89, 102433. https://doi.org/10.1016/j.polgeo.2021.102433

Byrne, M. (2020). Generation rent and the financialization of housing: A comparative exploration of the growth of the private rental sector in Ireland, the UK, and Spain. Housing Studies, 35(4), 743-765. https://doi.org/10.1080/02673037.2019.1632813

Dianati, K. (2022). London’s Housing Crisis: A System Dynamics Analysis of Long-term Developments: 40 Years into the Past and 40 Years into the Future (Doctoral dissertation, UCL (University College London)). https://discovery.ucl.ac.uk/id/eprint/10146380

Harding, C., Cottell, J., Tabbush, J., & Mahmud, Z. (2023, August 17). Homes fit for Londoners: London’s homes today. People, Places.

Jacoby, S., & Alonso, L. (2022). Home use and experience during COVID-19 in London: problems of housing quality and design. Sustainability, 14(9), 5355. https://doi.org/10.3390/su14095355

Li, B. (2023). The realization of class-monopoly rents: Landlords’ class power and its impact on tenants’ housing experiences. Journal of Urban Management. https://doi.org/10.1016/j.jum.2023.08.002

Saiz, A. (2023). The Global Housing Affordability Crisis: Policy Options and Strategies. MIT Center for Real Estate Research Paper, (23/01). http://dx.doi.org/10.2139/ssrn.4402329

write

write