Background

Lehman Brothers was started in 1850 by three brothers, Mayer, Emanuel, and Henry Lehman, and started as a general store selling dry goods, utensils, and groceries to cotton farmers. The brothers also established a coffee and petroleum exchange in New York. In 1900, the brothers shifted to merchant banking from commodities, and in 1925, Lehman turned to an investment bank, which is well known. Lehman survived harsh economic times such as the great depression, the Russian debt default, and the American Civil War. In 2004 and 2003, the bank acquired mortgage lenders and became a key player in the housing sector.

The bank recorded profits from early 2000 to 2007, when subprime mortgages reached the highest level of defaults. On 13 March 2007, the bank recorded its one-day drop in stock in five years. In the second quarter of 2007, the bank recorded a loss of $2.8 billion, and the financial position continued deteriorating until September when Lehman filed for bankruptcy on the 15th day in 2008 after the bailout and takeover failed. These failures resulted from the executives’ unethical behaviors and ignorance of regulatory policies. Therefore, this essay will explain the unethical behavior of Lehman, provide quantitative and qualitative analysis of the bank, show alternatives available for Lehman, and develop an action plan of the recommended alternative.

Ethical Decisions

Moral values and principles guide financial decisions. However, in their aim to actualize their expansion strategy and various other objectives, dubious mechanisms were used together with unacceptable accounting practices, which resulted from disregard and ignorance of maintaining prudent corporate governance practices that acted as a catalyst to the bank’s failure.

One of the ethical decisions faced by Lehman was conflict of interest. Conflict of interest occurs when the personal interests of an individual compromise their professional or official decision, responsibility, actions, or judgment in the workplace (Velasquez, 2018). In the Lehman case, the executives had a conflict of interest regarding excessive bonus pay. Despite the challenges encountered before bankruptcy, directors in Lehman increased their bonuses to $480 million. Also, according to Kwaku and Mawutor (2014), Fuld was the CEO with high pay in the United States, having paid himself bonuses and pay totaling $300 million within eight years. This means they valued their interest in terms of finances over that of the organization, where they would have reduced their remuneration and focused on recovering the business. However, instead, they increased their pay during the business recession.

Another ethical decision faced by the bank was recording the financial statement or window dressing. Kwaku and Mawutor (2014), Lehman Bank used the repurchase agreement, also known as Repos 105, in manipulating the financial statement. Repos 105 is a measure firms use to raise short-term money at wholesale by placing their long-term financial assets as collateral to enhance their liquidity position (Kwaku & Mawutor, 2014). In regard to this unethical practice, Lehman did not use the appropriate accounting system to report Repos 105, hence failing to disclose it to its shareholders and stakeholders. The bank carried on this practice by getting a bond owed to the government from another bank using one of its units in the U.S. at a high interest rate. This manipulation aimed to make the bank’s financial position look healthy and sound to regulators, government, and investors. However, in the real position, it suffered hefty losses (Jeffers, 2011). However, this resulted in removing $50 billion from the financial statement (Jeffers, 2011).

Lehman’s leverage position was too high compared to the ideal level. To finance its assets, Lehman increased its leverage position. Leverage is the assets financing capability using securities with an interest rate that is fixed, hoping to increase the equity shareholders’ return (Taqi et al., 2020). It is considered an ideal financial leverage ratio of 1.5% to 2% (Nicholas et al., 2023). However, Lehman’s financial leverage increased from 20 in 2004 to 44 in 2007 (Nicholas et al., 2023). This implied that Lehman would give a loan of $44 for every $1 of cash, a very high ratio to maintain (Nicholas et al., 2023). The global financial crisis that led to a drop in prices with increasing interest rates greatly impacted the financial position of Lehman Brothers, leading to bankruptcy.

Analysis

Financial analysis entails using a company’s financial data to scrutinize its performance and recommend how to make improvements going forward. Therefore, this section will analyze qualitatively and also its financial performance for quantitative purposes.

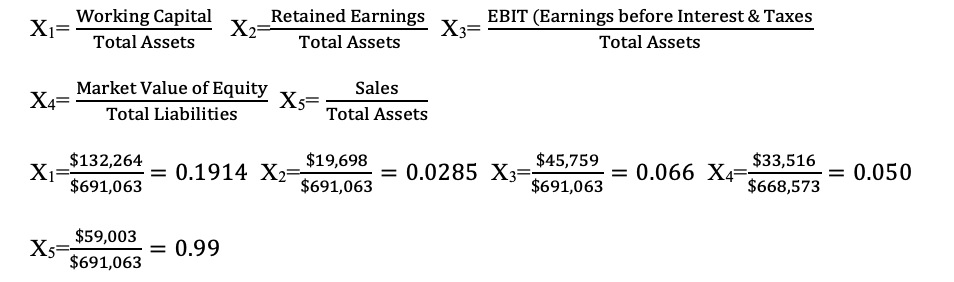

Altman Z-sore is a very important analysis tool used to assess corporate credit risk (Batchelor, 2018). Therefore, the following formula will be used in calculating Lehman’s Z-score. At the same time, all ratios are derived from data from Lehman Brothers’ consolidated statement of financial position, cash flow, and consolidated statement of income (Batchelor, 2018):

Z= 1.2X1+1.4X2+3.3X3+0.6X4+0.999X5. The variables used in the formula are defined below:

Z-Score= 1.2(0.191)+1.4(0.029)+3.3(0.066)+0.6(0.050)+0.99(0.085)= 0.604

According to Khaddafi et al. (2017), Altman’s Z-score gives three possible outcomes. One of them entails that a greater Z-Score than 3.00 implies that the risk of a company being bankrupt is low in the short term; hence, the company is healthy. Also, when the Z-Score is between 1.80 and 2.99, it implies that there is some bankruptcy risk exposed to the company, and caution is required. The third outcome dictates that a Z-Score less than 1.80 shows that a company is financially distressed and has a high potential of bankruptcy in the short term. Even with the supposed $50 billion not recorded in the books, Lehman’s Z-Score is 0.604, which implies it is within the financial distress range. A review of the going concern assumption ought to have been altered by the low score. Despite the fact that net income for Lehman was $4 billion in the range of 2006 and 2007, defaulting would be the real risk if it could not get loans to finance its activities (Nicholas et al., 2023).

In accounting, the assumption of the going concern is among the conditions for measurements to be done and to provide essential information to the investors. The assumption always held in preparing financial statements is that an organization is a going concern and will be in the running for the foreseeable future (Conmy, 2022). As per the law, the auditor is the only person given the authority to assume continuation or termination for an entity based on probability or doubts about continuing as a going concern for a reasonable time (Hurley R & Hurley E, 2015). Within the 2007 financial statements of Lehman Brothers, there were no disclosures about conclusions drawn on going concern or an opinion given relating to whether the organization was a going concern (Hurley R & Hurley E, 2015). This shows that Youngl and Ernst, the firm’s auditors, contributed to the bank’s bankruptcy by neglecting their roles and taking part in various financial statement frauds, hence their court charges by the attorney general.

The consolidated cash flow statement for the bank shows sources for the cash increase during the year ending 30 November 2007 (Hurley R & Hurley E, 2015). As a result of cash demand liquidity in the fiscal year, Lehman borrowed billions to cater to operational activities’ cash needs. The negative cash flow for 2005 was $12.5 billion, while for 2006 was $36.376 billion, a shocking increment of 300% in one year (Hurley R & Hurley E, 2015). Regardless of the 25% increase in 2007 in the previous year, the amount was still in billions (Hurley R & Hurley E, 2015). With the amounts in the cash flow being negative, it means that Lehman depended on borrowing extra operational activity funds for sustainability. The going concern of the bank depended on the success of continually finding lenders for operational activities. Therefore, to continue being operational, altering their way of doing business was the only way to get investors.

Additionally, another major issue in Lehman was its reward structure and culture. Risk-taking excessively was handsomely rewarded and openly lauded. A conquering hero treatment was given to the employees who made questionable deals. However, the questioning decision was overruled and ignored. For example, Oliver Budde, who was an associate general counsel for the bank for nine years, participated in preparing the public filings of the firm’s executive pay. The boss and Oliver argued about the matter for years without success (Nicholas et al., 2023). In another instance, Budde had a contrary opinion on a tax deal that entailed reshuffling various papers to remove an expense from the balance sheet since it was wrong. However, the boss of Oliver okayed the deal, which shows the unethical behavior in the organization as the deal of the day (Nicholas et al., 2023).

Alternatives

One of the alternatives that could be used in the Lehman brothers case is a bailout from the government. Lehman was the fourth largest investment bank in the United States, and being in operation for more than a century, it had grown to be a big firm employing 25000 employees (Belyh, 2019). Therefore, its collapse would have devastating impacts on the U.S. economy. Therefore, it was appropriate for the government to bail out the bank. Bailouts from the government would offer a big financial boost since they are not necessarily paid back, and if paid back, the bailout would be on favorable terms (Legal Information Institute, 2020).

Another option for Lehman to continue operating was a takeover by another bank. On 22 August 2008, the Korea Development Bank announced plans to buy the Lehman Brothers. On 16 September, Barclays Bank showed interest in purchasing Lehman’s U.S. capital market division at $1.75 billion (Nicholas et al., 2023). This would help the entities to pool their liabilities and assets and share technology, resources, and debts. Additionally, the entities would consolidate their existing risk management and infrastructure to keep the bank in operation.

As bailout and acquisition failed, the other alternative was dissolving the organization through bankruptcy. Several banks, including Bank of America, Barclays, and Korea Development Bank, decided to acquire the bank. However, time was running out fast for Lehman, with $1 billion left by the end of 13th September week and stock plunging 93% in one day; the business was unsustainable and with no going concern (Nicholas et al., 2023). Therefore, the only option was to file bankruptcy to stay out of creditors whose debts were overwhelming for the bank.

Preferred Alternative

Among the above alternatives, my preferred alternative is the bailing out by the federal government. Just as the federal bank bailed out supported JP Morgan’s financial injection to Bear Stearns, offered a bailout of $182 billion to AIG, and a $700 billion bailout of the Trouble Asset Relief Program, the government would come in and save Lehman (Nicholas et al., 2023). Bailing out Lehman would save the country and the world from economic crisis. Being the fourth biggest investment bank in the U.S., bailing it out would provide finances to clear debts and help in operations, which would help in economic growth and reduce unemployment (Belyh, 2019). However, a takeover by another bank would not be the best decision since the activities of the stronger bank would be hampered by the negative influence of Lehman. Also, the problem of bad loans would not be solved since the healthy bank would take over it. On the other hand, filing bankruptcy would not also be the best option since that means the death of the bank’s existence, and if it went back into operation, Lehman would lose its market superiority.

Action plan

For a bailout, the government will assess the situation at Lehman by evaluating the liability, assets, risk exposure, and capital adequacy to know its impact on the financial sector and financial health. It will also ensure temporary stabilization measures through temporary liquidity support to prevent run-on deposits. The action will also include identifying the capital needs to know the amount needed for bank stability and solvency restoration. After that, the government provided capital injection and asset clean-up to Lehman to enhance its financial position by issuing government bonds, purchasing shares, or through recapitalization loans. Finally, while preparing an exit strategy of returning the bank to private ownership, restructuring of managerial and operations will be done, setting up a reimbursement strategy, and monitoring and supervising the bank’s progress regularly to assess its performance for long-term viability.

References

Batchelor, T. (2018). Corporate bankruptcy: Testing the efficacy of the Altman Z-Score. International research journal of applied finance, 9(9), 404–414.

Belyh, A. (2019, September 9). The collapse of Lehman Brothers: A case study. Cleverism. https://cleverism.com/the-collapse-of-lehman-brothers-a-case-study/

Conmy, S. (2022). What is a going concern? The Corporate Governance Institute. https://www.thecorporategovernanceinstitute.com/insights/lexicon/what-is-a-going-concern/

Hurley, P., & Hurley, R. E. (2015, 2 November). Warning signals of the impending Lehman brothers’ bankruptcy filing. Social Science Research Network. https://papers.ssrn.com/sol3/Delivery.cfm/SSRN_ID2685314_code2312856.pdf?abstractid=2685314&mirid=1

Jeffers, A. (2011). How Lehman Brothers used Repos 105 to manipulate their how lehman brothers used repo 105 to manipulate their financial statements. https://digitalcommons.montclair.edu/context/acctg-finance-facpubs/article/1008/viewcontent/How_Lehman_Brothers_Used_Repo_.pdf

Khaddafi, M., Heikal, M., & Nandari, A. (2017). Analysis of Z-score to predict bankruptcy in banks listed on the Indonesia stock exchange. International Journal of Economics and Financial Issues, 7(3), 326-330.

Kwaku, J., & Mawutor, M. (2014). The failure of Lehman brothers: Causes, preventive measures, and recommendations. Research Journal of Finance and Accounting Www.iiste.org ISSN, 5(4), 2222–2847. https://core.ac.uk/download/pdf/234629813.pdf

Legal Information Institute. (2020). Bailout. LII / Legal Information Institute. https://www.law.cornell.edu/wex/bailout

Nicholas, Tom, Chen, & David. (2023). Ivey Publishing – ivey business school. Iveypublishing.ca. https://www.iveypublishing.ca/s/product/lehman-brothers/01t5c00000CwgHiAAJ

Taqi, M., Khan, R., & Anwar, I. (2020). Financial leverage and profitability: Evidence from oil and gas sector of India. GIS Business, 15(4), 665-587.

Velasquez, M. G. (2018). Business ethics: Concepts and cases. Pearson.

write

write