Introduction

According to Mazilu (2008), the idea of globalization implies the transition toward a more integrated and interdependent global economy and has been a “life savior” for international enterprises and economies. The idea of a “global market” has made it necessary to create international organizations like the World Trade Organization to encourage the creation of multinational treaties to regulate the global economic system. One well-known worldwide market will be discussed in relation to this assignment: The European Union, which encourages cooperation and communication among 27 independent nations. Of these 27 nations, Hungry is the one chosen as the discussion’s starting point, and Kuwait Steel Company is the company of choice.

Profiling Kuwait Steel Company On Hungary and Why I Believe It Is Geared to Exploit This Market

A consortium of Kuwaiti investors, notably Bukhamseen Holding, and the German company ASCOTEC formed the Kuwait Steel Company, also known as the United Steel Industry Corporation, in 1996 (Bukhamseen Holding, n.d.). About the assignment, the business wants to export its steel goods to Hungary, a member of the EU. Hungary is a member of the European Union, as was previously noted, and Kuwait Steel Company wants to export its steel goods there. The goal of Kuwait Steel Company to export its steel products is supported by the two countries’ current diplomatic ties as well as other considerations. Commendable progress has been made by Kuwait Steel Company in establishing the country’s first rolling mill in 2002 and a steel-making facility in 2011(Kuwait Steel, n.d.).

Currently, the company is a market leader in the manufacturing of structural and reinforcing steel bars of the highest quality, which are essential to the region’s building sector. In addition, the company works hard to produce and provide a variety of steel products with added value to meet the rising needs of both the local and worldwide steel markets. Because of its present and strategic growth objectives, Kuwait Steel Company is well-positioned and qualified to take advantage of the steel market in Hungary.

Furthermore, the fact that Hungary’s steel production has decreased recently is what leads me to assume that Kuwait Steel Company is ready to take advantage of the country’s steel market. Makszimov (2022) claims that Steel Plant Dunaferr, one of Hungary’s largest industrial manufacturing firms, was compelled to halt operations around the close of the previous year. According to EUROMETAL (2023), the only flat steel manufacturer in Hungary, Dunaferr, has so far this month been unable to resume production as scheduled because of a shortage of raw materials. This suggests that Hungary’s need for steel exports will rise soon and possibly in the long run.

Competitive /Comparative Advantage Kuwait Steel Company Steel Products has in Hungary

Regarding price, Kuwait Steel Company’s proposed export of steel products has a competitive advantage in Hungary. According to Trading Economics (2023), the country currently has a high inflation rate of 25.4%, which directly translates to higher domestic steel manufacturing costs because of the rising demand for high wages and other locally produced raw materials. Yet, because their steel goods are more expensive than those sold by domestic steel selling companies or dealers, Kuwait Steel Company has a competitive advantage over them. Due to the nearly comparable production costs in Kuwait, this competitive advantage does not line up with the benefit Kuwait has. No, this competitive advantage won’t last in the long run because the nation won’t always have high inflation rates.

Kuwait Steel Company’s External Environment in Hungary

External environment factors, as defined by Nagy-Molnar & Lendvay (2018), are components that exist outside of a firm’s internal environment and have the potential to have a positive or negative impact on the operations of that company. The following external circumstances, however, would have an impact on Kuwait Steel Company operations in Hungary, both favorably and unfavorably. I will utilize the PESTEL framework to properly examine Hungary’s external environment.

Political Environment in Hungary

Hungary’s political situation could have a favorable or negative impact on the Kuwait Steel Company. Hungary has the EU’s “safe” government, according to Fox (2022). Hungary is also a parliamentary democracy, according to Economist Intelligence (2022), with parliamentarians voted after 4-year terms under a fair and open electoral system and the president respects the wishes of the people. Because of this, the World Bank reported that the nation ranked in the 75.94% percentile in 2021 for its political stability and lack of terrorism and violent crime (Trading Economic, 2023). The operations of Kuwait Steel Company in Hungary benefited from this.

The diplomatic ties between Kuwait and Hungary are also anticipated to be advantageous for the Kuwait Steel Company. According to Kuwait Times (2017), these two nations signed three memorandums of cooperation, which undoubtedly encourages the importation and exportation of goods across their borders. In addition, Hungary has the lowest corporate tax rate in the OECD, at 9%, and the participation exemption is not applicable (Tax Foundation, n.d.). A reduced corporate tax suggests that the export operations of Kuwait Steel Company are favored. The Kuwait Steel Company would be required to pay it on behalf of its Hungary-based customers/dealers, which would have a severe impact on its profit margins, according to the International Trade Administration (2022), which estimates a 27% VAT on all commodities with Hungary as their end location.

Economic Environment in Hungary

Hungary has a high inflation rate of 25%, which would benefit the Kuwait Steel Company’s export business there (European Commission, 2023). Importantly, a nation with high inflation rates has more expensive goods since local businesses must pay higher production costs including the cost of raw materials and labor (Lovasy, 1962). Because the steel products produced locally in Hungary would be more expensive than those imported, Kuwait Steel Company’s exports of steel to Hungary are advantageous in the short term. In the long run, nevertheless, exports to Hungary would suffer as a result of growing import demand outpacing exports, which would force import restrictions to be put in place to safeguard the balance of payments. Import quotas would limit the Kuwait Steel Company’s ability to export steel to Hungary.

Hungary’s economy is also expanding. According to Golya (2020), Hungary’s economy grew at a rate of 4.6% in 2019, ranking fourth in Europe. Additionally, the country’s real earnings have climbed by 6.2% while gross wages increased by 9.9%, giving households more buying power. Additionally, Trading Economics (2023) predicts that Hungary’s GDP would increase from $181.85 billion in 2021 to $185.12 billion at the close of 2023. That said, it is true to argue that these figures positively indicate that Kuwait Steel Company is assured of a sustained market in Hungary. The company’s steel products would have a ready market owing to the high amount of household disposable income.

Last but not least, due to Hungary’s depreciating currency, Kuwait Steel Company’s exports of steel goods are expected to perform poorly. Notably, since January 2022, the Hungarian forint has had one of the poorest performances in Central Europe, losing 11% and 23% of its valuation against the Euro and the dollar, respectively (Economic Research Portal, 2022). A weaker currency increases the cost of imports from an economic perspective, supporting Kang & Dagli (2018) while promoting exports by making them more affordable for customers outside. With this in mind, the cost of Kuwait Steel Company’s steel exports to Hungary would necessitate reporting a sliding profit margin until the Hungarian Forint stabilized.

Social Environment in Hungary

According to HO (2014), social elements that influence company success include linguistic preferences, consumer preferences, educational standards, gender roles, and living standards. In terms of actual individual consumption, Hungary has the second-worst living standards, according to Hajnalka (2022). This can be due to both the Covid19 pandemic and the nation’s high inflation rate. It is indisputable to claim that the Hungarians’ purchasing power is low given their low standard of living and this negatively affects Kuwait Steel Company exports to Hungary.

Macrotrends (2023) indicates that Hungary’s population is increasing, with a current population of 10,156,239, up from 9,967,308 in 2022 and 9,709,786 in 2019. Hungary is a ready market for the steel goods of Kuwait Steel Company due to the trend of rising population. Last but not least, a sizable portion of Hungarian consumers favor local goods, with only 30% of them having no inclination for the country of origin of goods (Golya, 2020). That said, Kuwait Steel Company exported steel products might perform poorly owing to this Hungarian consumer behavior.

Technological Environment in Hungary

Nonetheless, science and technology are among Hungary’s best-developed industries, according to Payne (2017). Also, the nation is placed 34th in the 2021 Global Innovation Index (WIPO, 2021). Furthermore, Hungary’s high-tech sector has profited from both the nation’s educated labor and the significant presence of overseas high-tech companies and research institutions. Notable statistics include the nation’s high rate of patent filings, the sixth-highest proportion of high- and medium-tech output in total industrial output, the 12th-highest FDI inflow for research, and the 17th-best global innovation efficiency ratio (GLOBAL INNOVATION INDEX, 2022).

That said, Kuwait Steel Company is in an excellent position to gain from Hungary’s proven technology. By utilizing digital technologies and data analytics, the business will be able to employ a digital supply chain to inform decision-making and quickly adapt to changing circumstances in Hungary. By following the flow of its steel products from Kuwait to Hungary’s borders till they reach its receiving agents situated in Hungary, the company will be able to technologically manage its supply chain. By doing this, the business would have more control over how it organizes the delivery of its packaged steel products for shipment to Hungary, decreasing the likelihood of theft in transit.

Environmental Environment in Hungary

Buye (2021) claims that the PESTEL’s environmental dimension includes sections on raw resources, pollution, raw weather, and climate data, among other topics. The environment in Hungary is protected by several laws, including the Environment Act, the Waste Management Act, the Nature Protection Act, and the Environment Protection Product Fee Act, according to CMS Law-NowTM (1999). All of these actions will affect Kuwait Steel Company’s operations in Hungary.

According to the precaution and preventive principle, for example, one should aim to prevent or reduce environmental damage in addition to fixing it by making wise decisions and using current technologies (CMS Law-NowTM, 1999). In addition, under the “Polluter Pays” principle, Kuwait Steel Company would be responsible for all environmental effects resulting from its operations. As a result, Kuwait Steel Company operations would follow these established environmental requirements, and failure to do so would mean the end of Kuwait Steel Company in Hungary.

Legal Environment in Hungary

Adhering to the country’s existing rules and regulations is necessary to conduct business there (Buye, 2021). In line with this, Aranyi, Kutai & Szopko (2022) note that Hungary has stringent consumer protection laws, such as Act XLVII of 2008 on the Prohibition of Unfair Business-to-Consumer Commercial Practices (“Unfair Commercial Practices Act”) and the Price Decree, which implements Article 2(1) of the Omnibus Directive. While using online marketplaces and comparison websites that let users search and compare products supplied by various dealers, consumers are required by the Unfair Trade Practices Act to be informed of the criteria used to decide how the products are ranked.

Furthermore, the Price Decree Implements Article 2(1) of the Omnibus Directive and requires the merchant to state the “previous” price antecedent to the price cut, which is the lowest price they have imposed in the 30 days before the price reduction’s application (Aranyi, Kutai & Szopko, 2022). With this strict consumer protection laws/Acts, the operations of Kuwait Steel Company are subject to adhering to them and failure would land the company in a series of consumer violation law suites which ultimately would affect negatively its operations.

Cultural Differences Kuwait Steel Company would encounter while dealing with the EU

Caprar (2015) asserts that culture is one of the most resilient aspects of global business and that it revolves around critical topics like multinational corporations, globalization, and cross-border activities. The Kuwait Steel Corporation would encounter language difficulties as well as other common cultural differences while conducting business in the EU trade bloc. According to the EU (n.d.), the European Union has 24 official languages, however, Arabic is not one of them. Kuwaiti Arabic is the official language of Kuwait. Given that efficient communication is hampered, the Kuwait Steel Company may experience relationship issues with its clients and dealers in Hungary when exporting its steel goods to that country.

Also, another facet of cultural diversity—religion—would make it difficult for Kuwait Steel Company to export its steel goods to Hungary. Importantly, nearly all Kuwaiti citizens and over 75% of the population of Kuwait are Muslims (AFS, n.d.). Contrarily, the majority of the population in Hungary identifies as Roman Catholic (37.2%), followed by Calvinists (11.6%), Lutherans (2.2%), Greek Catholics (1.8%), those who identify with some other religion (1.9%), and those who do not identify with any religion (18.2%). (Scroope, 2017). That said, the operations of Kuwait Steel Company would be negatively affected or forced to cope with the new religious beliefs of the majority of Hungarians for it to grow its market size which is challenging owing to the strong Islamic beliefs and practices.

The attractiveness of the Hungarian and Global Steel Markets in terms of Market Size and Growth

With a market size growth of 9.2% in 2023, Hungary’s iron and steel manufacturing sector will rise by €2.2 billion and be ranked 12th in Europe out of 18 total EU nations (IBIS World 2023). It is important to note that between 2018 and 2023, the market size for the Iron & Steel Manufacturing industry in Hungary increased by 5.3% year on average. In addition, Take-Profit.Org (2023) reports that Hungary’s steel production declined to 90 000 tons in December 2020 from a maximum of 272 000 tons and a minimum of 37 000 tons. A comprehensive review of these numbers reveals that Kuwait Steel Company is positioned to take advantage of the steel market in Hungary, which has significant room for expansion.

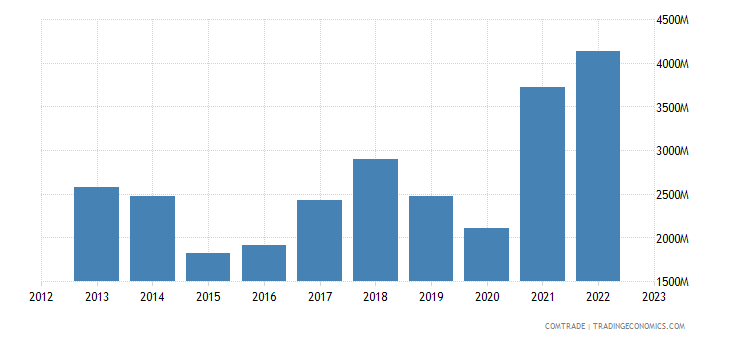

From a global perspective, the structural steel market will expand at a 6.4% annual pace between 2021 and 2023 (VANTAGE, 2022). This is a result of the rising demand for premium steel in construction projects for buildings, bridges, and other types of infrastructure. In the EU economy, the steel sector has long played a crucial role in promoting innovation, expansion, and employment. According to the European Commission (2023), the EU produces more than 177 million tons of steel annually, or 11% of the world’s total output, making it the second-largest producer of steel in the world after China. With such high production rates, Hungary is a profitable venture for Kuwait Steel Company to enter and begin exporting to. According to Trading Economics, Hungary’s steel import in 2022 was $4.14 billion, up from roughly $3.7 billion in 2021

Figure 1: Hungary Steel 2012-2022 Imports

Source: Trading Economics (2023)

The attractiveness of the Hungarian Steel Market in terms of legal dimensions influencing contracts and intellectual property rights

According to the European Commission (n.d.), the development and exploitation of inventions and other intangible assets are the foundation for the formation and utilization of intellectual property rights. Due to this, international corporations take it into account when exporting their products. Several intellectual property rights protection make the Hungary market, in general, a desirable one. According to the International Trade Administration (2022), has a patent under the Hungarian Patent Act, a patent under the EU Copyright/Information Society Directive, and a patent under the Council Regulation 1383/2003 Patent Act. These laws govern customs actions against goods that may be breaching intellectual property rights. Customs duty was also formed by government regulation to receive allegations from manufacturers whose copyrights were violated. That said, Kuwait Steel Company operations in Hungary are favored as the company is assured of the protection of its intellectual property for the design and production of its steel products.

The attractiveness of the Hungarian Market in terms of real or perceived trade barriers

According to Barrios et al. (2009), more businesses are establishing overseas operations as a result of globalization and the gradual reduction of trade obstacles. Businesses must decide between creating items domestically for export and producing abroad to reach foreign markets. According to World Integrated Trade Solution (2020), Hungary’s trade barriers consist of a simple average tariff across all products of 2.08% and a trade-weighted average tariff of 1.02%. It’s also important to note that, with just a few exceptions, such as materials like explosives and some industrial goods, the majority of goods imported into Hungary do not require import permits (International Trade Administration, n.d.).

In addition, Hungary has low corporate income tax rates of 9%, branch taxes of 9%, and capital gains taxes of 9%, according to Deloitte (2022). Moreover, tax losses can be used to offset up to 50% of the relevant financial year’s profit before taxes. VAT is subject to a 27% regular tax as well as a 5% and 18% reduced rate. Last but not least, tax credits might be offered for supporting particular sports or movie organizations. These taxes are beneficial and make the Hungarian market alluring to international investors, according to a detailed examination.

Tax Issues to deal with while exporting to an EU country

A variety of levies will apply to exports to Hungary and every other EU member state. By exporting to the EU trade bloc, Kuwait Steel Corporation has to cope with taxes such as import tax, VAT, and excise duty. He noted the VAT and import tariffs issues must be resolved by Kuwait Steel Company. Hungary’s import tax is 27% of the total value of the imported goods, according to International Trade Administration (n.d.). In addition, if Kuwait Steel Company decides to construct a depot or warehouse in Hungary for its steel goods, it will be responsible for paying land and construction taxes, with a maximum tax rate of HUF 1,100 per square meter of the facility’s net floor space, stated in square meters (PWC, 2022).

Avoiding Currency Exchange Rate Risk

According to Papaioannou (2006), currency exchange rate risk includes translation, transaction, and economic risks. It refers to the risk that assets and earnings may be subjected to as a result of fluctuations in exchange rates across currencies. Kuwait Steel Company can reduce its vulnerability to significant exchange rate fluctuations by assessing and controlling its exposure to exchange rate risk as follows;

To protect against exchange rate risks, Kuwait Steel Company can use currency mitigation strategies. I advise the company to choose currency risk sharing. Importantly, Kharvi, Pakkala & Srinivasan (2019) note that it is a strategy for managing currency risk in which the two parties involved in a transaction or trade consent to share the risk associated with fluctuations in exchange rates. In essence, Hungary-based buyers/dealers of Kuwait Steel Company would not be allowed to pay the firm according to the current exchange rate, but rather according to a contractually agreed-upon price that is within a range of shifting exchange rates.

Under currency risk sharing, Kuwait Steel Company and its buyers in Hungary would share any gains or losses resulting from the exchange rate volatility. Kuwait Steel Company also can use the forward exchange rate strategy. With this tactic, it would decide on a specific date in the future to transact with its consumers and dealers in Hungary. By doing this, the ambiguity surrounding the Hungarian Forint may be avoided.

Conclusion

A global economic structure that is linked and integrated is replacing isolated national economies across the world. Trade tariffs were a hindrance to international trade in the past. Yet, this problem has been alleviated thanks to international organizations like the World Bank and the development of trade blocs. Today, multinational corporations can pick which nations to invest in profitably, especially those where they have a competitive or comparative edge. Also, the nation chosen for globalization must be advantageous and supportive of its development. The concept of fluctuating currency values, however, is a new problem in international trade that is causing market uncertainty. Several economic tactics can be employed to increase the likelihood of losses resulting from instances of currency devaluation or weakening that expose an exporting company to currency exchange rate risk. By utilizing a variety of hedging techniques, such as forward trades and currency risk pooling, this problem can be avoided.

References

AFS. (n.d.). Kuwait. https://www.afsusa.org/countries/kuwait/

Barrios, S., Huizinga, H., Laeven, L., & Nicodème, G. (2012). International taxation and multinational firm location decisions. Journal of Public Economics, 96(11-12), 946-958.

Benjamin Fox. (2022). Orban’s Hungary EU’s most ‘stable’ government, says new research. EURACTIV. https://www.euractiv.com/section/elections/news/orbans-hungary-eus-most-stable-government-says-new-research/

Bukhamseen Holding. (n.d.). UNITED STEEL INDUSTRY COMPANY Controlling Shareholder. https://www.bukhamseen.com/companies/united-steel-industry-company/

Buye, R. (2021). Critical examination of the PESTEL Analysis Model. Project: Action Research for Development. https://www.researchgate.net/publication/349506325_Critical_examination_of_the_PESTEL_Analysis_Model

Caprar, D. V., Devinney, T. M., Kirkman, B. L., & Caligiuri, P. (2015). Conceptualizing and measuring culture in international business and management: From challenges to potential solutions. Journal of international business studies, 46, 1011-1027.

CEIC. (2020). Hungary household income per capita. https://www.ceicdata.com/en/indicator/hungary/annual-household-income-per-capita

Chara Scroope. (2017). Hungarian Culture: Religion. https://culturalatlas.sbs.com.au/hungarian-culture/hungarian-culture-religion

Çitilci, T., & Akbalık, M. (2020). The importance of PESTEL analysis for environmental scanning process. In Handbook of Research on Decision-Making Techniques in Financial Marketing (pp. 336-357). IGI Global.

CMS Law-NowTM. (1999). Review of Hungarian environment law. https://cms-lawnow.com/en/ealerts/1999/11/review-of-hungarian-environment-law

Daniel Aranyi, Gabor Kutai & Rebeka Szopko. (2022). Omnibus Directive Strengthens Consumer Protection Rights in Hungary. Bird & Bird. https://www.twobirds.com/en/insights/2022/hungary/omnibus-directive-strengthens-consumer-protection-rights-in-hungary

David Payne. (2017). Investing in science in Hungary. https://blogs.nature.com/naturejobs/2017/03/08/investing-in-science-in-hungary/

Deloitte. (2022). International Tax: Hungary Highlights 2022. https://www2.deloitte.com/content/dam/Deloitte/global/Documents/Tax/dttl-tax-hungaryhighlights-2022.pdf

Economic Research Portal. (2022). HUNGARIAN FORINT: UNDER SELLING PRESSURE. BNP PARIBUS. https://economic-research.bnpparibas.com/ecotvweek/en-US/Hungarian-Forint-under-selling-pressure-10/21/2022,c38640

ECONOMIST INTELLIGENCE. (2022). Hungary: Political Stability. https://country.eiu.com/article.aspx?articleid=1262065909&Country=Hungary&topic=Summary&subtopic=Political+forces+at+a+glance&subsubtopic=Political+stability

(n.d.). Languages. https://european-union.europa.eu/principles-countries-history/languages_en

EUROMETAL. (2023). Hungary’s Dunaferr steel mill remains idled amid lack of materials. https://eurometal.net/hungarys-dunaferr-steel-mill-remains-idled-amid-lack-of-materials/

European Commission. (2023). Economic forecast for Hungary. https://economy-finance.ec.europa.eu/economic-surveillance-eu-economies/hungary/economic-forecast-hungary_en

European Commission. (n.d.). Benefits of intellectual property rights. https://policy.trade.ec.europa.eu/enforcement-and-protection/protecting-eu-creations-inventions-and-designs/benefits-ipr_en

European Commission. (n.d.). The EU Steel industry. https://single-market-economy.ec.europa.eu/sectors/raw-materials/related-industries/metal-industries/steel_en

European Commission. (n.d.). Value added tax. https://trade.ec.europa.eu/access-to-markets/en/content/value-added-tax-0

Gellert Golya. (2020). Exporter Guide: Hungary. https://apps.fas.usda.gov/newgainapi/api/Report/DownloadReportByFileName?fileName=Exporter%20Guide_Budapest_Hungary_12-31-2020

Gertrud Lovasy. (1962). Inflation and exports in primary producing countries. https://www.elibrary.imf.org/view/journals/024/1962/001/article-A002-en.xml

GLOBAL INNOVATION INDEX. (2022). EXPLORE ECONOMY BRIEFS FROM THE GII 2022. https://www.globalinnovationindex.org/analysis-economy

Ho, J. K. K. (2014). Formulation of a systemic PEST analysis for strategic analysis. European academic research, 2(5), 6478-6492.

IBIS World. (2022). Iron & Steel Manufacturing in Hungary – industry statistics 2008-2026. https://www.ibisworld.com/hungary/industry-statistics/iron-steel-manufacturing/1395/

International Trade Administration. (n.d.). Hungary – Import Tariffs. https://www.trade.gov/country-commercial-guides/hungary-import-tariffs

International Trade Administration. (n.d.). Hungary – Protecting Intellectual Property. https://www.trade.gov/country-commercial-guides/hungary-protecting-intellectual-property

International Trade Administration. (n.d.). Hungary – Trade Barriers. https://www.trade.gov/country-commercial-guides/hungary-trade-barriers

International Trade Administration. (n.d.). Hungary-import tariffs. https://www.trade.gov/country-commercial-guides/hungary-import-tariffs

Kang, J. W., & Dagli, S. (2018). International trade and exchange rates. Journal of Applied Economics, 21(1), 84-105. https://www.adb.org/sites/default/files/publication/202841/ewp-498.pdf

Kharvi, S., Pakkala, T. P. M., & Srinivasan, G. (2019). Ordering policies under currency risk sharing agreements: a Markov chain approach. OPSEARCH, 56, 945-964.

Kuwait Steel. (n.d.). About US. https://www.kwtsteel.com/about

Kuwait Times. (2017). Kuwait, Hungary ink 3 cooperation memos. https://www.kuwaittimes.com/kuwait-hungary-ink-3-cooperation-memos/

Macrotrends. (2023). Hungary Population 1950-2023. https://www.macrotrends.net/countries/HUN/hungary/population

Mazilu, M. (2008). The dynamics and manifestations of globalization.

Nagy-Molnár, M., & Lendvay, E. New method to support decision making process in the local economic development of Hungary.

Papaioannou, M. G. (2006). Exchange rate risk measurement and management: Issues and approaches for firms.

PRESSBOOKS. (n.d.). 2.3 THE INTERNATIONAL MARKETING ENVIRONMENT. https://opentext.wsu.edu/marketing/chapter/2-2-the-international-marketing-environment-3/

PWC. (2022). Hungary: Corporate – other taxes. https://taxsummaries.pwc.com/hungary/corporate/other-taxes

Statista. (2022). Gross domestic product (GDP) per capita in Hungary 2027. https://www.statista.com/statistics/339875/gross-domestic-product-gdp-per-capita-in-hungary/

Szijártó Hajnalka. (2022). Second-lowest standard living in Hungary in the entire EU.

TAKE-PROFIT.ORG. (2023). Steel Production in Hungary. https://take-profit.org/en/statistics/steel-production/hungary/

Tamas Csonka. (2022). Hungary scrambles to save country’s largest steelworks. https://www.intellinews.com/hungary-scrambles-to-save-country-s-largest-steelworks-265384/

TAX FOUNDATION. (2022). Taxes in Hungary. https://taxfoundation.org/country/hungary/

Trading Economics. (2021). Hungary GDP. https://tradingeconomics.com/hungary/gdp

Trading Economics. (2023). Hungary Imports of Iron and Steel. https://tradingeconomics.com/hungary/imports/iron-steel

Trading Economics. (2023). Hungary- political stability and absence of violence/terrorism: Percentile Rank. https://tradingeconomics.com/hungary/political-stability-and-absence-of-violence-terrorism-percentile-rank-wb-data.html

VANTAGE. (2022). Structural Steel Market – Global Industry Assessment & Forecast. https://www.vantagemarketresearch.com/industry-report/structural-steel-market-1980

Vlad Makszimov. (2022). Hungarian steel plant stops production. EURACTIV.https://www.euractiv.com/section/politics/short_news/hungarian-steel-plant-stops-production/

WIPO. (2021). Global Innovation Index 2021: Tracking Innovation through the COVID-19 Crisis. https://www.wipo.int/global_innovation_index/en/2021/

World Integrated Trade Solution. (2020). Hungary Trade. https://wits.worldbank.org/CountrySnapshot/en/HUN/textview

write

write