1.0. Introduction

Assuring the accuracy, dependability, and relevance of financial statements and other important information through auditing is a critical component of business operations. Over time, the importance of audit quality has increased, especially in light of several high-profile accounting scandals (AL-Qatamin & Salleh, 2020). Such occurrences have sparked questions about the accuracy of audits, prompting a closer examination of audit procedures. The auditor’s competence, independence, and objectivity in carrying out the audit determine the audit’s quality. Good audit quality ensures businesses follow laws and regulations, give investors and stakeholders trustworthy financial information, and make wise financial decisions. So, companies, investors, and regulators must comprehend the significance of audit quality, and this study tries to explore it. Although audit quality is receiving more attention, there still needs to be more empirical evidence regarding how it affects corporate performance (AL-Qatamin & Salleh, 2020). The research will investigate the connection between audit quality and corporate performance and offer details on the factors influencing audit quality.

1.1 Background of the Research

In today’s business world, the relevance of audit quality cannot be emphasized, and several factors have contributed to this significance growing over time. Businesses are subject to additional scrutiny from regulators, investors, and other stakeholders as the business environment gets more complicated, who want transparency and accuracy in financial reporting (Najmatuzzahrah et al., 2021). Financial reporting and audits are important means companies show their dedication to truth and transparency. The caliber of audit reports significantly impacts the legitimacy and dependability of financial statements. Misstatements caused by subpar audits may impact creditors, investors, and othestakeholders’ choices. Poor-quality audits can have serious repercussions, and the ant may take years to repair the reputational harm.

Several high-profile financial crises have highlighted the value of an audit’s quality. The public’s confidence in financial reporting has been damaged by these scandals, which have also raised regulatory scrutiny of auditors. As an illustration, the Enron crisis in 2001 led to the company’s demise and highlighted the importance of auditors in spotting financial irregularities (Najmatuzzahrah et al., 2021). The 2008 financial crisis particularly underscored the necessity of audit quality. The failure of financial institutions to appropriately evaluate their assets and report their financial status contributed to the crisis (El Gharbaoui & Chraibi, 2021). Auditors were charged with failing to find and report financial irregularities, which raised concerns about the caliber of the audits conducted on major financial organizations.

As a result of these controversies and setbacks, regulators and other interested parties have called for stricter audit requirements, emphasizing audit quality. New laws and regulations have been developed to improve audit quality by groups like the ISA and the PCAOB in the United States (Zahid et al., 2022). In light of the significance of audit quality and its bearing on business success, this research looks at the connection between audit quality and monetary success. The study aims to shed light on the importance of audit quality and provide solutions for improving it by analyzing the existing literature and empirical research on the topic (Zahid et al., 2022). This research will also analyze the links between audit quality indicators and business outcomes. The findings of this research will aid companies, auditors, regulators, investors, and creditors in making better business decisions, improving the quality of audits, the dependability of financial statements, and the efficacy of regulatory oversight (Zahid et al., 2022).

1.2 Research Aim

This study aims to look at how vitally important quality audits are to the success of businesses. In today’s global business environment, businesses must maintain transparency, credibility, and accuracy in financial reporting (Odanga, 2016). The quality of audit reports plays a crucial role in achieving these goals, as they assure investors, creditors, and other stakeholders should be a realistic depiction of the company’s financial health in the financial statements (Sattar, Javeed & Latief, 2020). The research will explore the relationship between audit quality and various measures of business performance, including financial performance, firm value, and investor confidence. The study will analyze how the quality of audits affects business performance and how it can be improved to enhance the credibility and reliability of financial statements. The study will also examine the factors influencing audit quality, including auditors’ competence and independence, audit methodology quality, and the regulatory framework governing audits (Sattar, Javeed & Latief, 2020). Understanding these factors and their impact on audit quality can help businesses and auditors to identify areas for improvement and enhance the overall quality of audits.

1.3 Objectives

- To evaluate what is already known about the effects of audit quality on business performance.

- To examine the connection between audit integrity and corporate financial performance.

- To identify the factors that influence audit quality.

- To provide recommendations for improving audit quality.

1.4 Research Questions

- What is the empirical evidence on how audit quality affects different measures of business performance, such as profitability, growth, innovation, and reputation?

- What is the correlation between the quality of audit and performance, and how does it vary across different industries and types of firms?

- “What are the key determinants of audit quality and auditor-client relationship?”

- How can auditors improve their independence, expertise, and reputation and avoid conflicts of interest and litigation risks?

1.5 Significance

This study’s significance is complex since it addresses a crucial global corporate problem affecting numerous stakeholders. The study’s conclusions will have practical ramifications for organizations, auditors, regulators, legislators, and investors as they work to maintain and improve the financial system’s trustworthiness and openness (Salehi et al., 2022). The study will show how audit quality impacts various company success metrics, such as financial performance, firm value, and investor confidence, and how it may be improved to increase business performance (Al-Ansi, 2022).

The investigation will also pinpoint variables that affect audit quality, such as methodology, independence, and auditor competency. Knowing these elements and how they affect audit quality can help organizations and auditors spot opportunities for development and raise the overall standard of audits (Salehi et al., 2022). The study results will be very important to firms as they look to improve their financial reporting and decision-making procedures. Businesses looking to maintain the trust and confidence of their stakeholders and access to capital markets will find the recommendations for increasing audit quality helpful (Al-Ansi, 2022). The study’s results will shed light on the significance of audit quality and the variables affecting it for auditors. This information can assist auditors in improving their audit methodology, expertise, and training, as well as the overall standard of their audits.

Regulators and policymakers in charge of creating and implementing regulations and policies that support excellent audits and financial reporting will find great value in the study. The study’s conclusions can shed light on the efficacy of current regulatory frameworks and the areas that need more attention to improve audit quality and support the legitimacy and dependability of financial statements (Al-Ansi, 2022). The study’s conclusions will be useful to investors since they will help them understand the significance of audit quality and how it may affect their decision-making processes. Investors may make more informed investment decisions and uphold confidence in the financial reporting of the companies they invest in by being aware of the connections between the effectiveness of audits and financial results, company value, and investor confidence (Ghafran & O’Sullivan, 2017). The significance of this work rests in its potential to strengthen financial reporting, enhance audit quality, and support the expansion and stability of the global economy (Ahmeti & Iseni, 2022). The study’s conclusions will offer practical information and suggestions for companies, auditors, regulators, politicians, and investors, and they can support keeping stakeholders’ faith in the financial reporting system.

LITERATURE REVIEW

2.1 Introduction

This chapter provides a review of the literature that is pertinent to the study. This chapter presents a theoretical review, empirical findings, a conceptual framework, and a literature review.

2.2 Overview

The firm’s performance is examined in research studies concerning audit quality. Some of these studies employed the size of the audit company, the experience of the auditors, audit fees, auditor rotation, and the independence of the auditors as indicators of audit quality (for instance, Yasser & Soliman, 2018; Rajgopal et al., 2021; Ilemena & Okolocha, 2019). Sing et al. (2019) investigated the relationship between audit fees, which gauge auditor independence, and the caliber of firms’ audits in New Zealand. The study found that the auditor’s independence is compromised when they perform non-audit activities for a company. The impact of audit quality on the financial performance of listed cement manufacturers in Nigeria was studied by Ado et al. in 2020.

Using multiple regression analysis, they sought to ascertain the influence of auditor independence and firm audit size on financial performance as a proxy for audit quality. Results demonstrate the importance of audit firm size and auditor independence. However, auditor independence has a greater impact on a company’s financial performance than auditor size. Using proxies such as auditor independence, auditor size, audit team qualities, auditor experience, and net profit margin of Kenyan listed companies, Mathuva et al. (2019) test the association between audit quality and financial performance. The study used multiple linear regression analysis to analyze the data. According to the results of this study, audit quality has a favorable and significant impact on financial performance, and the more independent the auditor, the more likely it is that the organization will be more profitable. Ismail et al. (2020) use multivariate regression analysis to examine the connection between financial statement analysis and indirect metrics of audit quality.

They found no evidence to support the association between auditor size, tenure, or industry expertise with audit quality. The relationship between audit quality and financial performance was examined by Xiao et al. in 2020. Auditor size was used to gauge audit quality. The study’s findings demonstrate that audit quality affects financial performance directly and indirectly through audit size. The relationship between auditor size and financial performance was examined by Kalai and Sbais (2019) using a sample of 26 Tunisian companies listed on the Tunis Stock Exchange. The results demonstrate that auditor size significantly affects a company’s financial performance regarding Return on Assets (ROA) and Return on Equity (ROE). The relationship between auditor size, auditor tenure, and auditing firm rotation was investigated in the study of Martani et al. (2021). The information they acquired from 2,148 listed Asian companies demonstrates that major audit firms provide high-quality audits because they are seen as more conservative than smaller ones. Roszkowska (2021) defines auditor independence as the limited likelihood that the auditor will find any financial statement inaccuracy. Moreover, the AICPA and the International Ethical Standards Board for Accountants (IESBA) consider independence as consisting of two elements: independence of appearance and independence of thinking. While independence in appearance depends on how others perceive the auditor’s independence and their subsequent trust in them, independence of mind exists when the auditor can retain an objective attitude throughout the audit (Setiawan et al., 2020).

The auditor must be in a mental condition that enables the expression of an opinion without being affected by any factors that could impair professional judgment. This mental state must also allow the auditor to behave honestly, objectively, and with professional skepticism. Despite maintaining appearances of independence, the auditor must avoid situations that could lead others to believe they are not acting fairly (Wahyuni, 2022). The impact of ownership structure on firm performance is examined by Kao et al. (2019), Rohrbeck and Kum (2018), and Ibhagui and Olokoyo (2018).

According to Singh et al. (2018), Tobin’s Q is also used to gauge business performance. The study’s findings indicated that managerial ownership significantly impacted athletic success. Also, as managerial shareholdings rise, agency issues develop and impact business performance. Ownership concentration and owner identity represent ownership structure in the study by Alqirem et al. (2020), while ROA, ROE, and dividend yield represents company performance. Kling et al. study .’s from 2021 examines 137 listed companies using panel data and regression analysis. The studies consider institutional ownership, ownership concentration, and institutional ownership concentration factors from 2001 to 2006. The findings indicate that institutional control greatly benefits business performance, institutional ownership with concentrated ownership has a major negative impact on firm performance, and ownership concentration has no significant impact on firm performance. Wooldridge (2019) employs a single equation framework and an imbalanced panel data analysis.

According to empirical findings, institutional ownership affects company performance, particularly in the mature stage. Ownership concentration and managerial ownership affect the success and value of non-financial enterprises listed on the Istanbul Stock Market (ISE). After adjusting for investment intensity, leverage, growth, and size, findings reveal that managerial ownership negatively impacts company value. In contrast, ownership concentration has a significant favorable impact on both firm value and profitability. Wang (2019) examines the corporate annual reports of 31 companies from 2006 to 2010. The methodologies of multivariate multiple regression analysis are used in the investigation. The results demonstrated that institutional ownership significantly improves firm performance. Also, foreign ownership and company performance have a strong positive correlation. Also, between 2008 and 2010, Managerial Ownership and Concentrated Ownership characteristics were examined.

Analysis of Panel Data is used in the study. The results demonstrate that Managerial ownership has a significant inverse association with Business Performance, whereas Concentrated Ownership has a negligible effect. After considering leverage, the authors discover a substantial inverse link between firm performance and assets turnover but no significant relationship between assets turnover and firm performance. Pearson’s product-moment correlation and logistic regression were applied in Gurcay and Ferah’s (2018) investigation. A sample of 42 listed companies was investigated using primary and secondary data. Cronbach’s Alpha was utilized to assess the consistency of the data, while tolerance and variance-inflation factors were employed to assess multicollinearity. The findings show that foreign possession, diffuse possession, corporation ownership, and manager possession were discovered to have significant positive relationships with firm performance.

In contrast, concentration and government ownership have serious negative relationships with firm performance. 73 companies were chosen as a sample in the study to investigate these data, which covered the years 2001 to 2007. According to empirical findings, insider ownership is inversely connected to firm performance, while dominant shareholding, concentrated ownership, and foreign ownership structures have no discernible impact.

In 2020, Puni and Anlesinya used the board size, independent board director, dual chief executive officer, audit committee board, and firm value to measure corporate governance, while ROA and ROE were used to gauge company success. Mbah and Anichebe (n.d.) characterize the firm’s performance using ROE, Net profit margin, sales growth, dividend yield, and stock prices/values. Corporate governance is measured by factors such as ownership, audit independence, board independence, the board size, and the company’s progressive policies. Shan (2019) considered the proportions of expert supervisors and independent directors on the company board, as well as the degree of concentration in any ownership of the firms. Tobin’s Q gauges the performance of a company.

The relationship between board size, board composition, CEO/chairman duality, and the audit committee, which represent corporate governance systems, and ROE and profit margin, which represent firm performance measurements, is examined by Merendino and Melville (2019). The study will examine 93 non-financial companies listed on the Dhaka Stock Exchange (DSE) during the 2006 fiscal year. The Ordinary Least Squares (OLS) approach is used in the investigation. Results indicate a strong positive correlation between ROA and the duality of the board’s chief executive officer and independent directors. Also, a strong positive correlation exists between ROE and the board’s independent directors and the CEO duality. However, there was no clear correlation between the ROA and ROE and the board’s or audit committee’s size. For the fiscal year 2010, non-financial listed enterprises are examined in Raimo et al. (2020) .’s study. According to statistical findings, the size of the audit committee is highly correlated with business performance. However, the CEO’s dual role, the board’s size, the audit committee’s independence, and the frequency of audit committee meetings are not.

Structural equation modeling is used by Asiaei et al. (2018) to analyze 304 publicly traded companies for the fiscal years 2003–2005. The results indicate that ownership concentration has a considerable impact on governance and a negative impact on company performance. For the fiscal years 2007 to 2011, 42 enterprises are examined by Tsiapa and Batsiolas (2019). The empirical findings show a strong correlation between ROA, ROE, and corporate governance. Earnings Per Share (EPS), however, did not demonstrate any appreciable change due to corporate governance. This study discovered that corporate governance generally improves firm performance. Olalekan (2018) applies the Pooled Data approach to five publicly-traded insurance companies from the 2005–2010 fiscal year. The findings indicate that no significant relationship exists between corporate governance as measured by industry performance, ownership concentration, CEO position, staff count, some shares traded, and firm performance as measured by ROE.

On the other side, board size and firm size greatly impact the ROE, which measures how well a company is doing. Panel data analysis was used by Dash (2019) for the financial years 2002–2004. Results indicate that all internal factors, except management ownership and board and audit committee size, relate to business success. Panel data analysis is used by Shan (2019) for the financial years 2001 to 2005. The results show that ownership concentration is crucial to defining business success. Although important, the level of board independence only seems to benefit larger organizations’ performance. The supervisory board’s experience has little bearing on financial performance. El-Bassiouny and El-Bassiouny (2019) analyzed 30 listed companies from the years 2008 and 2009.

The study’s findings demonstrate a strong positive correlation between ROE, profit margin, the board size, board makeup, and audit committee. Nevertheless, the study could not show a meaningful connection between ROE and profit margin, which stands for strong performance indicators and CEO/Chairman duality. Our readings indicate that no research has been done on the relationship between company success (as evaluated by ROA and ROE) and audit quality (as measured by audit experience and rotation) in the Egyptian business climate.

2.3 Empirical Review

The audit committee serves two purposes in banks. On the other hand, the contributors are in charge of keeping an eye on financial revenue generation, protecting bank wealth, ensuring the effectiveness of governance measures, and addressing conflicts of interest arising from bank capacity. Nonetheless, it serves as a governance tool that balances the interests of stakeholders and executives. The audit committee sometimes fails to function effectively in a challenging economic climate, which puts it at risk for a governance disaster. As a result, the need for this organization to be established within banks has significantly increased, especially since the economic crisis. Banks and indexing corporations must have an audit committee (Majiyebo et al., 2018).

A large audit committee provides effective oversight, enhanced governance, increased disclosure, and increased openness, according to Soobaroyen et al. (2019). Similarly, Oussii and Boulila Taktak (2018) found that readers of financial statements have access to more information on governance quality the larger the audit committee. Earnings consequently immediately and favorably increased. Another study found that the impacts would be less adjusted the larger the ACs (Muskiet et al., 2018). Due to its responsibility for overseeing and administering control procedures, the audit committee responds to fraud by taking the appropriate corrective action. Alderman and Jolineau (2020) contend that having an audit committee did not make the auditor feel more independent. Except for Alqatamin (2018) and Dakhlallh (2020), who criticized the creation of an audit committee, none had any power within the organization. If there are many auditors, this will cause them to lose interest in their work and stop working together to make educated decisions. Therefore, their expertise and skills are not fully utilized (Griffith et al., 2018).

The size of the audit committee will be determined by the organization’s existing needs and culture, as well as the extent to which the board delegates tasks and obligations to the audit committee, according to Buallay and Al-Ajmi (2020). The quality of the discussion and the presentation’s outcome may suffer with many attendees. Similarly, if someone had enough information and viewpoints to make an informed judgment, very few people would approach the audit committee chair. When it comes to the effective execution and fulfillment of tasks, which results in a decrease in fraud, the size of the audit committee is a crucial issue to consider.

Some company governance evaluations advised the appointment of at least three audit committee directors, according to (Velte et al., 2018). According to the text, a sizable committee has much power, is well-liked inside the business, and has access to many ideas. Expanding too much can be susceptible to inefficiencies, slow processes, and authority fragmentation. It could aid in avoiding falling victim to a scam. In this situation, the audit committee’s brief duration is more practical and green in carrying out their jobs because their techniques are quick and effective.

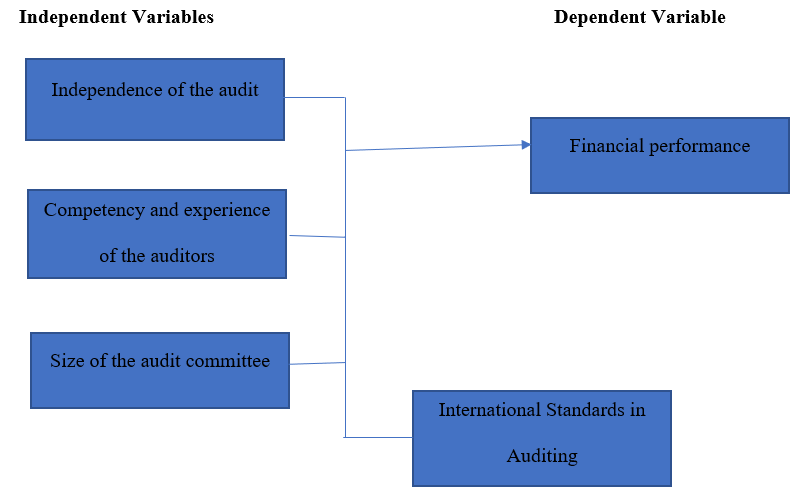

2.4 Conceptual Framework

The conceptual framework for this study demonstrates the relationships between the dependent and independent variables. The definition of financial success is a success as measured by ROA. The audit’s independence, the audit committee’s size, the qualifications and expertise of the auditors, and the use of international auditing standards were among the independent criteria.;

2.5 Literature Summary and Research Gaps

According to research on the impact of audit quality on corporate performance, high-quality audits can give stakeholders useful information, strengthen the validity of financial statements, and lessen information asymmetry. According to several studies that have examined the relationship between audit quality and financial performance measures like stock prices, cost of capital, and profitability, there is a clear correlation between audit quality and corporate performance. Research has also demonstrated that audit quality can benefit non-financial performance metrics, including business social responsibility and reputation.

There are still some gaps in the literature despite much research examining the connection between audit quality and corporate performance. These gaps include the following:

- Lack of uniformity in audit quality measures might make it challenging to compare findings across research since there is a lack of consistency in the definition and measurement of audit quality. Researchers have utilized a range of metrics, including audit committee composition, auditor tenure, and independent auditor characteristics.

- There has been little research on how audit quality affects non-financial performance measures. Further study is required in this area, despite some studies’ findings that audit quality can positively affect non-financial performance measures. Future studies should examine the connection between audit quality and metrics such as employee engagement, customer happiness, and other non-financial performance factors.

Chapter 3: Research Methodology – The survey method, data collection procedures, sampling strategies, and data analysis strategies will all be covered in this chapter. It will describe the justification for the research design selection as well as the data collecting and sample strategies used and how they relate to the goals and objectives of the study. The chapter will also describe the data analysis techniques, such as regression analysis, factor analysis, and descriptive statistics, and how they will be used to analyze the data. The chapter will also discuss the study’s limitations and how they may affect the validity and generalizability of the research findings.”

“Chapter 4: Results – The study findings based on the data gathered and examined are presented in this chapter. Descriptive data on sample variables, including business size, industry, and audit tenure, will be provided in this chapter. The findings of regression and factor analysis will also be presented in this chapter to explore the connection between audit quality and business success, as well as the impact of key constructs such as auditor independence, auditor reputation, auditor expertise, and auditor-client relationship. The research findings will also be compared to the body of prior knowledge in the chapter, and its implications for policymakers, auditors, and stakeholders will be discussed.”

“Chapter 5: Discussion – The implications of the study’s findings regarding the significance of audit quality on business performance are covered in this chapter. Also, it will provide recommendations for additional studies and how the results might be applied to better business performance and audit quality. The limitations of the study and how they might affect the reliability and applicability of the findings will also be covered in this chapter. The chapter’s conclusion will provide an overview of the major discoveries, the study’s contributions, and the consequences of the research.”

“Chapter 6: Conclusion – This chapter will outline the research findings along with the study’s contributions and recommendations for policymakers, auditors, and stakeholders. The limitations of the study and how they might affect the reliability and applicability of the findings will also be covered in this chapter. The chapter will conclude by recommending other studies that could expand on the current investigation and further our understanding of the significance of audit quality on corporate performance.”

References

Ado, A. B., Rashid, N., Mustapha, U. A., & Ademola, L. S. (2020). The impact of audit quality on the financial performance of listed companies in Nigeria. Journal of Critical Reviews, 7(9), 37–42. https://www.researchgate.net/profile/Umar-Mustapha/publication/341611343_Journal_of_Critical_Reviews_THE_IMPACT_OF_AUDIT_QUALITY_ON_THE_FINANCIAL_PERFORMANCE_OF_LISTED_COMPANIES_NIGERIA/links/5ecadb00458515626cc9e1c4/Journal-of-Critical-Reviews-THE-IMPACT-OF-AUDIT-QUALITY-ON-THE-FINANCIAL-PERFORMANCE-OF-LISTED-COMPANIES-NIGERIA.pdf

Ahmeti, Y., & Iseni, E. (2022). The Impact of Auditing on the Performance of Insurance Companies in Kosovo. European Journal of Business and Management Research, 7(2), 124-129.

Al-Ansi, A. A. (2022). Is the impact of audit effort on the quality of auditors’ performance contingent on virtual audit proficiency? An auditors’ perspective during the COVID-19 pandemic. Cogent Business & Management, 9(1), 2144704.

Alderman, J., & Jollineau, S. J. (2020). Can audit committee expertise increase external auditors’ litigation risk? The moderating effect of audit committee independence. Contemporary Accounting Research, 37(2), 717-740. https://onlinelibrary.wiley.com/doi/abs/10.1111/1911-3846.12549

AL-Qatamin, K. I., & Salleh, Z. (2020). Audit quality: A Literature overview and research synthesis. IOSR Journal of Business and Management (IOSR-JBM), 22(2), 56-66. https://www.researchgate.net/publication/339377503_Audit_Quality_A_Literature_Overview_and_Research_Synthesis

Alqatamin, R. M. (2018). Audit committee effectiveness and company performance: Evidence from Jordan. Accounting and Finance Research, 7(2), 48. https://www.researchgate.net/profile/Rateb-Alqatamin/publication/322685676_Audit_Committee_Effectiveness_and_Company_Performance_Evidence_from_Jordan/links/5b288f00aca2727335b70b33/Audit-Committee-Effectiveness-and-Company-Performance-Evidence-from-Jordan.pdf

ALQIREM, R., ABU AFIFA, M., SALEH, I., & HANIAH, F. (2020). Ownership structure, earnings manipulation, and organizational performance: The case of Jordanian insurance organizations. The Journal of Asian Finance, Economics, and Business, 7(12), 293-308. https://www.koreascience.or.kr/article/JAKO202034651879192.page

Asiaei, K., Jusoh, R., & Bontis, N. (2018). Intellectual capital and performance measurement systems in Iran. Journal of Intellectual Capital. https://www.emerald.com/insight/content/doi/10.1108/JIC-11-2016-0125/full/html

Buallay, A., & Al-Ajmi, J. (2020). The role of audit committee attributes in corporate sustainability reporting: Evidence from banks in the Gulf Cooperation Council. Journal of Applied Accounting Research, 21(2), 249-264. https://www.emerald.com/insight/content/doi/10.1108/JAAR-06-2018-0085/full/html

Dakhlallh, M. M., Rashid, N., Abdullah, W. A. W., & Al Shehab, H. J. (2020). Audit committee and Tobin’s Q as a measure of firm performance among Jordanian companies. Jour of Adv Research in Dynamical & Control Systems, 12(1), 28-41. https://www.academia.edu/download/61729313/Audit_Committee_and_Tobins_Q_as_a_Measure_of_Firm_Performance_among_Jordanian_Companies20200109-80047-jfqynw.pdf

Dash, S. K. (2019). Has the Feldstein-Horioka puzzle waned? Evidence from time series and dynamic panel data analysis. Economic Modelling, pp. 83, 256-269. https://www.sciencedirect.com/science/article/pii/S0264999317313937

El Gharbaoui, B., & Chraibi, A. (2021). Internal audit quality and financial performance: A systematic literature review of new research opportunities. Revue Internationale des Sciences de Gestion, 4(2).

El-Bassiouny https://www.emerald.com/insight/content/doi/10.1108/MEQ-12-2017-0150/full/html

Ghafran, C., & O’Sullivan, N. (2017). The impact of audit committee expertise on audit quality: Evidence from UK audit fees. The British Accounting Review, 49(6), 578–593.

Griffith, E. E., Nolder, C. J., & Petty, R. E. (2018). The elaboration likelihood model is a meta-theory for synthesizing auditor judgment and decision-making research. Auditing: A Journal of Practice & Theory, 37(4), 169-186. https://publications.aaahq.org/ajpt/article-abstract/37/4/169/6075

Gurcay, D., & Ferah, H. O. (2018). High School Students’ Critical Thinking Related to Their Metacognitive Self-Regulation and Physics Self-Efficacy Beliefs. Journal of Education and training Studies, 6(4), 125-130. https://eric.ed.gov/?id=EJ1174338

Ibhagui, O. W., & Olokoyo, F. O. (2018). Leverage and firm performance: New evidence on the role of firm size. The North American Journal of Economics and Finance, 45, 57-82. https://www.sciencedirect.com/science/article/pii/S1062940817302620

Iliemena, R. O., & Okolocha, C. B. (2019). Effect of audit quality on financial performance: Evidence from a developing capital market. International journal of recent research in commerce economies and management (IJRRCEM), 6(3). https://www.academia.edu/download/63374831/EFFECTOFAUDITQUALITY-1404120200520-115154-196jzmt.pdf

Ismail, A. H., Merejok, N. M., Dangi, M. R. M., & Saad, S. (2020). Does audit quality matters in Malaysian public sector auditing?. Journal of Academia, 7, 102-116. https://myjms.mohe.gov.my/index.php/joa/article/view/8257

Kalai, L., & Sbais, Y. (2019). The impact of corporate social responsibility disclosure in terms of quantity and quality on the financial performance of companies in Tunisia. International Review of Management and Marketing, 9(3), 9-18. https://www.academia.edu/download/67618880/pdf.pdf

Kao, M. F., Hodgkinson, L., & Jaafar, A. (2019). Ownership structure, board of directors and firm performance: evidence from Taiwan. Corporate Governance: The international journal of business in society, 19(1), 189-216. https://www.emerald.com/insight/content/doi/10.1108/CG-04-2018-0144/full/html

Kling, G., Volz, U., Murinde, V., & Ayas, S. (2021). The impact of climate vulnerability on firms’ capital cost and finance access. World Development, 137, 105131. https://www.sciencedirect.com/science/article/pii/S0305750X20302588

Majiyebo, O. J., Okpanachi, J., Nyor, T., Yahaya, O. A., & Mohammed, A. (2018). Audit committee independence, size and financial reporting quality of listed Deposit Money Banks in Nigeria. IOSR Journal of Business and Management, 20(2), 40-47. https://www.academia.edu/download/76356783/C2002044047.pdf

Martani, D., Rahmah, N. A., Fitriany, F., & Anggraita, V. (2021). Impact of tenure and rotation on audit quality: Big 4 vs non big 4. Cogent Economics & Finance, 9(1), 1901395. https://www.tandfonline.com/doi/abs/10.1080/23322039.2021.1901395

Mathuva, D. M., Tauringana, V., & Owino, F. J. O. (2019). Corporate governance and the timeliness of audited financial statements: The case of Kenyan listed firms. Journal of Accounting in Emerging Economies. https://www.emerald.com/insight/content/doi/10.1108/JAEE-05-2018-0053/full/html

Mbah, A. N., & Anichebe, A. S. Effect of Dividend Payout on Market Value of Selected Brewery Firms in Nigeria. https://www.iiardjournals.org/get/IJEBM/VOL.%204%20NO.%206%202018/EFFECT%20OF%20DIVIDEND.pdf

Merendino, A., & Melville, R. (2019). The board of directors and firm performance: empirical evidence from listed companies. Corporate Governance: The international journal of business in society. https://www.emerald.com/insight/content/doi/10.1108/CG-06-2018-0211/full/html

Muskiet, M. H., Tonneijck, L., Huang, Y., Liu, M., Saremi, A., Heerspink, H. J., & van Raalte, D. H. (2018). Lixisenatide and renal outcomes in patients with type 2 diabetes and acute coronary syndrome: an exploratory analysis of the ELIXA randomised, placebo-controlled trial. The lancet Diabetes & endocrinology, 6(11), 859-869. https://www.sciencedirect.com/science/article/pii/S2213858718302687

Najmatuzzahrah, N., Winarningish, S., Mulyani, S., & Akbar, B. (2021). Research Audit Quality and its Impact on an Organization’s Reputation. Utopía y praxis latinoamericana: revista internacional de filosofía iberoamericana y teoría social, (1), 207-221.

Odanga, H. (2016). The Impact of Audit Firm Tenure, Client Importance and Auditor Reputation on Audit Quality: Evidence From Listed Firms in Kenya (Doctoral dissertation, University of Nairobi).

Olalekan, L. I. (2018). Effect of liquidity risk, premium growth on the performance of quoted insurance firms in Nigeria: A panel data analysis. American Finance & Banking Review, 2(1), 44-53. http://www.cribfb.com/journal/index.php/amfbr/article/view/128

Oussii, A. A., & Boulila Taktak, N. (2018). Audit committee effectiveness and financial reporting timeliness: The case of Tunisian listed companies. African Journal of Economic and Management Studies, 9(1), 34-55. https://www.emerald.com/insight/content/doi/10.1108/AJEMS-11-2016-0163/full/html

Puni, A., & Anlesinya, A. (2020). Corporate governance mechanisms and firm performance in a developing country. International Journal of Law and Management, 62(2), 147-169. https://www.emerald.com/insight/content/doi/10.1108/IJLMA-03-2019-0076/full/html

Raimo, N., de Nuccio, E., Giakoumelou, A., Petruzzella, F., & Vitolla, F. (2020). Non-financial information and cost of equity capital: An empirical analysis in the food and beverage industry. British Food Journal, 123(1), 49-65. https://www.emerald.com/insight/content/doi/10.1108/BFJ-03-2020-0278/full/html

Rajgopal, S., Srinivasan, S., & Zheng, X. (2021). Measuring audit quality. Review of Accounting Studies, 26, 559-619. https://link.springer.com/article/10.1007/s11142-020-09570-9

Rohrbeck, R., & Kum, M. E. (2018). Corporate foresight and its impact on firm performance: A longitudinal analysis. Technological Forecasting and Social Change, 129, 105-116. https://www.sciencedirect.com/science/article/pii/S0040162517302287

Roszkowska, P. (2021). Fintech in financial reporting and audit for fraud prevention and safeguarding equity investments. Journal of Accounting & Organizational Change, 17(2), 164-196. https://www.emerald.com/insight/content/doi/10.1108/JAOC-09-2019-0098/full/html

Salehi, M., Ibrahim Jebur, M., Orfizadeh, S., & Abbas Aljahnabi, A. M. (2022). The Relationship between Audit Adjustments and Audit Quality in Iraq. Journal of Risk and Financial Management, 15(8), 330.

Sattar, U., Javeed, S. A., & Latief, R. (2020). How to audit quality affects firm performance with the moderating role of the product market competition: Empirical evidence from Pakistani manufacturing firms: Sustainability, 12(10), 4153.

Setiawan, S., Carolina, Y., & Kristiani, A. (2020). The Effect Of Auditor’s Competence And Independence On Information System Audit Quality. Asia Pacific Fraud Journal, 5(2), 183-190. http://apfjournal.or.id/index.php/apf/article/view/155

Shan, Y. G. (2019). Do corporate governance and disclosure tone drive voluntary disclosure of related-party transactions in China?. Journal of International Accounting, Auditing and Taxation, 34, 30-48. https://www.sciencedirect.com/science/article/pii/S1061951818300818

Singh, A., Singh, H., Sultana, N., & Evans, J. (2019). Independent and combined effects of audit partner tenure and non-audit fees on audit quality. Journal of Contemporary Accounting & Economics, 15(2), 186-205. https://www.sciencedirect.com/science/article/pii/S181556691930075X

Singh, S., Tabassum, N., Darwish, T. K., & Batsakis, G. (2018). Corporate governance and Tobin’s Q as a measure of organizational performance. British journal of management, 29(1), 171-190. https://onlinelibrary.wiley.com/doi/abs/10.1111/1467-8551.12237

Soobaroyen, T., Ntim, C. G., Broad, M. J., Agrizzi, D., & Vithana, K. (2019, October). Exploring the oversight of risk management in UK higher education institutions: The case of audit committees. In Accounting forum (Vol. 43, No. 4, pp. 404-425). Routledge. https://www.tandfonline.com/doi/abs/10.1080/01559982.2019.1605872

Tsiapa, M., & Batsiolas, I. (2019). Strong resilience in regions of Eastern Europe during the period 2007–2011. Post-Communist Economies, 31(1), 19-35. https://www.tandfonline.com/doi/abs/10.1080/14631377.2018.1443250

Wahyuni, N. (2022). Determination Of Audit Quality: Auditor Gender Stereotype Study In South Sulawesi Province, Indonesia. Journal of Positive School Psychology, 6(11), 569-586. http://repository.umi.ac.id/1664/1/DOCUME~1.PDF

Wang, X. (2019). Compliance over time by Australian firms with IFRS disclosure requirements. Australian Accounting Review, 29(4), 679-691. https://onlinelibrary.wiley.com/doi/abs/10.1111/auar.12267

Wooldridge, J. M. (2019). Correlated random effects models with unbalanced panels. Journal of Econometrics, 211(1), 137-150. https://www.sciencedirect.com/science/article/pii/S0304407618302392

Xiao, T., Geng, C., & Yuan, C. (2020). How audit effort affects audit quality: An audit process and output perspective. China Journal of Accounting Research, 13(1), 109-127. https://www.sciencedirect.com/science/article/pii/S1755309120300034

Yasser, S., & Soliman, M. (2018). The effect of audit quality on earnings management in developing countries: The case of Egypt. International Research Journal of Applied Finance, 9(4), 216-231. https://www.researchgate.net/profile/Sarah-Yasser/publication/328137663_The_Effect_of_Audit_Quality_on_Earnings_Management_in_Developing_Countries_The_Case_of_Egypt/links/5bbb05864585159e8d8be733/The-Effect-of-Audit-Quality-on-Earnings-Management-in-Developing-Countries-The-Case-of-Egypt.pdf

Zahid, R. A., Khan, M. K., Anwar, W., & Maqsood, U. S. (2022). The role of audit quality in the ESG-corporate financial performance nexus: Empirical evidence from Western European companies. Borsa Istanbul Review.

write

write