Introduction

There is widespread agreement on the fundamentals of monetary policy, providing a common foundation for debates about the precise measures that should be used in different circumstances. The central tenets of this agreement are that monetary policy should be implemented, that emphasis should be placed on price stability, and that higher or short-term interest rates will help curb inflation (Gabrielyan, 2019). Monetary economists must reject the monetary quantity theory if they are to participate in debates in which these assertions are assumed to be true. This school of thought holds that inflation rates may be managed by limiting the money supply increase. It is difficult to dismiss the overwhelming body of data showing a correlation between economic authorities, inflation, and interest rates. This evidence points inexorably toward the conclusion that faster money growth rates are linked to higher inflation and interest rates.

Historically, when monetarism was at its height, “monetary policy” meant “inflation control” because of this widespread understanding of the term. Inflation targeting has been used as a response to low inflation rather than as the strategic tool that initially caused low inflation. The expansion of inefficient practices and the absence of increasing commodity prices are other plausible causes for this phenomenon. Divergent expectations among economic agents are just one source of the difficulty gauging the predicted inflation rate (Taylor, 2019). However, the calculation and evaluation of future inflation are outside the scope of this study, so it is treated as if there were no controversy surrounding the concept.

However, the money supply can only have a limited effect on inflation because interest rates are modified predominantly to affect demand today. A rise or fall in inflation may result from changes in interest rate policy, which is thought to influence economic activity. Policymakers can only use interest rates to combat inflation now (Gabrielyan, 2019). By adjusting the policy rate of interest monthly, policymakers can make adjustments closer to the fine-tuning possible with other instruments. This paper aims to investigate, explain and reflect on the correlation between interest rates and inflation in economics.

Literature review

There are two ways to look at a rise in overall prices within a certain period: inflation or a realistic price adjustment. Any correlation between the interest rate and the inflation rate will be lost if the ‘natural rate’ is unstable (Castillo-Martinez, Reis, Fazio, Ferreira, & Leonardi, 2019). There is a divide between entrepreneurs’ and savers’ ideal outcomes when the market interest rate is above or below the ‘natural rate. However, actual investment and savings are at the planned level. When the goal is to lower inflation, increasing the interest rate has the opposite impact and discourages spending. The currency’s price would certainly increase if interest rates were to rise (particularly if the increase was unexpected. There is no way to “catch up” and achieve the “ideal” pay or price level. New Keynesian Phillips Curve explains the relationship between inflation and GDP growth. As a recurrent phenomenon, inflation may be controlled by putting a cap on the growth of the money supply. The currency’s value would certainly increase if interest rates were to rise (particularly if the increase was unexpected) (Taylor, 2019). There is no way to “catch up” and achieve the “ideal” pay or price level.

Body

Although the (post-Keynesian) spontaneous supply of money approach would effectively flip the direction of causation, it is reasonable to anticipate a link between the rate of fluctuation of the financial stock and that of prices, as was the case in the monetarist theory. That view is challenged by the post-Keynesian school of thought, which contends that the interest rate, not the stock of money, should be used as the policy tool since the latter is an endogenous quantity that the central bank cannot control (Castillo-Martinez, Reis, Fazio, Ferreira, & Leonardi, 2019). It will be a computed inflation rate (which might be negative) during the period in question if there are reasons causing prices to change (relative to the prior period). An increase in general price levels within a certain period may be interpreted in two different ways: as inflation or as a regular price adjustment.

However, Wicksell was worried about a chain reaction where a low (high) interest rate would cause more significant (lower) prices. According to Wicksell, the underlying general principle is: At each time and in whatever economic condition, there is always a particular interest rate, where the exchange value of the currency and the overall level of commodity prices have no propensity to vary (Özen, Özdemir, & Grima, 2020). Although Wicksell may be discussing inflation in this line, the ‘natural interest rate is thought to remain stable even when prices rise. The price level, however, consistently goes up or down. The ‘natural interest rate is compatible with constant inflation in the current models.

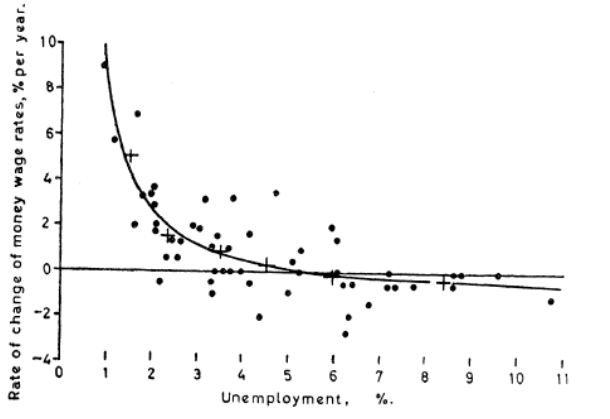

He considers the ‘natural rate of interest to be fluid. Any time the market rate deviates from the natural rate, like in Wicksell’s model, prices go up or down respectively. He suggests that if the market rate deviates from the ‘natural rate,’ prices will increase, and this pattern will be repeated in succeeding periods as long as the market rate deviates from the ‘natural rate (Özen, Özdemir, & Grima, 2020). As long as the gap between the natural rate’ and cost price persists, the amount of variation in price level is expected to be repeated, at least in theory. That is, the expectations enhanced Phillips curve unemployment and inflation have an inverse effect on one another.

Figure 1 Phillip curve

Any slight difference between the currency rate of interest and the ‘natural rate’ in Wicksell’s formulation would result in a continually increasing or falling price level. Therefore it was called the “knife edge” characteristic (Gabrielyan, 2019). It is essential to keep in mind that although the currency rate of interest tends to be sticky,

In the General Theory, Keynes explicitly opposed the concept of a unique ‘natural rate of interest, and in impact, argued that there is a normal interest rate relating to every level of quantity demanded that could bring investment and savings into balance (Gabrielyan, 2019). Keynes accepted the concept of the ‘natural rate of interest. Any equilibrium or ‘natural rate of interest would only be defined for a prescribed value of the fiscal stance, world demand, and set of ‘animal spirits influencing the investment. According to the models of the ‘new consensus in macroeconomics, there is no consistent ‘natural interest rate since it depends on many different variables. If the ‘natural rate’ constantly changes, any connection between the interest rate and the market price (or the inflation rate) will be obscured.

Even though the Wicksellian method stipulates roughly that a market interest rate above the ‘natural rate’ would result in reduced prices and possibly lower inflation, as investigated further below. A continuum of ‘natural rates’ is also implied by the neo-Wicksellian approach. The model shows that under policy rules of these sorts, equilibrium inflation relies purely upon the course of the difference between the natural rate of interest and the intercept term. They are showing the severity of central-bank policy (Tatliyer, 2017). If inflation were at the target rate, the output gap would be zero, and the difference between the lag in the interest rate and the lag in the ‘constant term would be zero. Therefore the corresponding Central Bank rate would equal the intercept term. ‘

However, the central bank controls fast nominal interest rates, and the actual variables that influence the normal rate of interest interact to determine the inflation rate. To the extent that the stance of fiscal policy is adjusted to account for exogenous fluctuations in the normal rate of interest caused by actual disruptions and is not adjusted in any other way, inflation will be stable; otherwise, it will fluctuate. The market equilibrium level is determined by the present and future actual interest rates and the present and future norms of monetary policy (Tatliyer, 2017). However, he notes that the conclusions of his study are ‘reminiscent of Wicksell’s recommendations.

Wicksell argued that policymakers’ inability to account for normal interest rate fluctuations accurately was the root cause of price fluctuation. When the current interest rate deviates from the ‘natural rate,’ as occurs in this theory when equilibrium is disrupted, there is a gap between investors’ and savers’ preferred outcomes. However, real investment and savings match the target investment level (Castillo-Martinez, Reis, Fazio, Ferreira, & Leonardi, 2019). Wanted investment is projected to be smaller than desired savings whenever the interest rate is above the ‘natural rate.’ Thus, even though the amount saved is less than the amount invested, the latter still takes place, and there remains, in fact, a savings gap.

Though it has been argued that the short end of the market is dominant when it is out of equilibrium, in this situation, investment is considered dominant. A simple explanation is that investment spending can only occur if banks are ready to make the required loans at the current interest rate. Consequently, banks play a pivotal role in this scenario by meeting the expected increased demand for loans to fund investment spending (Castillo-Martinez, Reis, Fazio, Ferreira, & Leonardi, 2019). Two things should be noted about this subject. To start, the idea that an interest rate below optimum would result in low savings and, by extension, low investment contradicts the loanable fund’s concept and an argument commonly given in the money demand literature.

Moreover, A higher interest rate to reduce inflation would have the opposite effect and reduce investment and capital creation under this theory. In this case, this would mean that the decrease in inflation is paid for by a heavy loss of investment and, by extension, productive capacity (Tatliyer, 2017). Second, if the investment is higher than savings, production and jobs will be higher than in a stable economy. The Phillips curve, which shows how an increase in economic activity predicts a rise in inflation, is Wicksell’s model one way this occurs.

For the time being, higher interest rates at specific points would result in lower prices at those points and then examine whether or not this would also result in reduced inflation. We build an introductory scenario to follow through on how the interest rate could affect inflation. The inflation rate is assumed to be, and it is assumed that the predicted inflation rate is also (Matheson, 2017). Maintaining the present nominal interest rate of r is anticipated to keep inflation at its current pace. As a result, the real interest rate r – is in line with a steady inflation rate and an actual price level that conforms to expectations. We provide a scenario that serves as a baseline.

The policy interest rate influences the economy in four ways. Lower interest rates influence demand since they increase the value of assets (after discounting for inflation). The wealth impact will remain if interest rates stay low (Castillo-Martinez, Reis, Fazio, Ferreira, & Leonardi, 2019). There is a level-to-level dynamic at play here, and we have yet to see how the demand level translates into inflation’s pace of change. The correlation between interest and currency exchange rates is seen in two ways.

First, a rise in interest rates (wildly unexpected) would likely boost the currency’s value. The rising inflation interest rate would have been affiliated with a deflationary exchange rate, leading to steadily increasing import prices (Matheson, 2017). The Phillips curve has no “catch-up” mechanism for getting wages or prices to the “optimal” level. Price changes are a reaction to other shifts in inflation and market activity, but they may also be the result of random shocks, errors, or expectations. The interest rate-demand relationship is somewhat tenuous, but in this context, we are more concerned with whether or not the demand is legitimate (the inflation connection). The New Keynesian Phillips Curve describes the correlation between inflation and GDP growth (NKPC). What follows is a breakdown of the main components of this strategy.

However, there is continuous inflation. Inflation of quantity demanded each firm’s unique product. The company figures in the possibility of future pricing changes in response to fluctuating marginal costs. Simply assuming that M is the markup of price P over estimated marginal costs, MC reveals this method’s important characteristic (Matheson, 2017). Prices seem cost-driven since nominal marginal costs change the ideal price level. Modest is the impact of interest rate shifts on inflation.

Conclusion

Inflation is a cyclical process, so it can be managed by limiting the money supply increase. By adjusting the policy rate of interest every month, policymakers can adjust closer to the fine-tuning possible with other instruments. Wicksell was worried about a chain reaction where a low (high) interest rate would cause more significant (lower) prices. When interest rates shift, it is expected that they will affect purchases and investments sensitive to interest rates. A rise in interest rates (wildly unexpected) would likely boost the currency’s value. If interest rates stay low, the wealth impact will remain. There is no “catch-up” mechanism for getting wages or prices to the “optimal” level. However, there is a continuous inflation of quantity demanded each firm’s unique product.

References

Castillo-Martinez, L., Reis, R., Fazio, M., Ferreira, J., & Leonardi, E. (2019). How do central banks control inflation? A guide for the perplexed *. Retrieved from https://personal.lse.ac.uk/reisr/ECFINweb/Readings/class3-perplexed.pdf

Gabrielyan, D. (2019). Forecasting inflation using the Phillips curve in inflation-targeting countries. International Review of Applied Economics, 33(5), 601-623. https://www.tandfonline.com/journals/cira20

Matheson, T. (2017). The Link Between Interest Rates and Inflation in Brazil. Retrieved from https://www.imf.org/external/np/blog/dialogo/091217.pdf

Özen, E., Özdemir, L., & Grima, S. (2020). The Relationship between the Exchange Rate, Interest Rate, and Inflation: The Case of Turkey. Scientific Annals of Economics and Business, 67(2), 259–275. https://doi.org/10.47743/saeb-2020-0014

Tatliyer, M. (2017). Inflation targeting and the need for a new central banking framework. Journal of Post Keynesian Economics, 40(4), 512–539. https://www.tandfonline.com/doi/full/10.1080/01603477.2017.1368026?casa_token=YnnvwwZNvr8AAAAA%3AyqLIrL_6W7q2sFP08zJY_E0T0dhYoVqNKDVI34zJ9PydWWnpHP6NYMqJAvekqFsymJxSNz8LtEI9U_CLAA

Taylor, J. B. (2019). Inflation targeting in high inflation emerging economies: lessons about rules and instruments. Journal of Applied Economics, 22(1), 102–115. https://doi.org/10.1080/15140326.2019.1565396

write

write