Introduction

Nestlé MILO, a globally recognized chocolate malt beverage, has accurately handled the characteristics of global markets with marketing endeavors. The Nestlé Group came up to serve this much-loved brand, which can be traced back to the Anglo-Swiss Condensed Milk Company, founded in 1867. Currently, Nestlé MILO proves that the company is highly creative in its approach towards innovations, quality, and adaptability. Nestlé is the world’s largest food and beverage company, operating in 191 countries with over two thousand global brands (Forbes, 2024). The company’s global operations have their headquarters located in Vevey, Switzerland. Among its flagship products, the Nestlé MILO brand has retained an original formula and adapted to various adjustable markets. This sophisticated approach is seen in the case of Switzerland, where a plant-based variant was introduced to fit into the dynamics of growing preference for vegan alternatives, and in Nigeria, where a premium image is maintained through product standardization.

This critical review sheds light on Nestlé MILO’s strategic marketing approach, which is based on the balancing act of adaptation and standardization involving product pricing and place promotion strategies to appeal to localness while holding onto a global identity.

SECTION 1

Brief overview of the company

Nestlé Milo is a chocolate-flavored malted powder product produced by Nestlé, typically mixed with milk, hot water, or both, to produce a beverage. The Nestlé company’s history begins in 1866, with the foundation of the Anglo-Swiss Condensed Milk Company (Nestle, 2023). Henri Nestlé developed enough baby food in 1867; in 190,5, his company merged with Swiss to form what we know as the Nestlé Group. Nestlé is the world’s largest food and beverage company, with over 2000 brands and operations in 191 countries. Nestlé’s headquarters is located in Vevey, Switzerland. The company has a long history of innovation and has been involved in many mergers and acquisitions over the years, including the acquisition of Gerber Products Company in 2007 (Nestle, 2023).

Figure 1:nestle profits worldwide

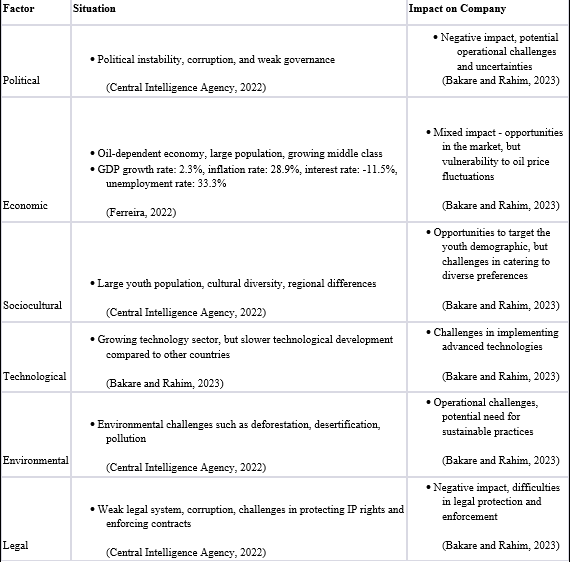

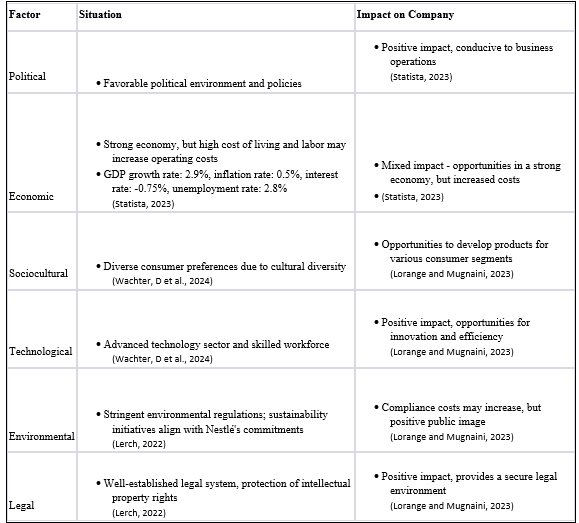

Analysis of External Environmental Factors and Their Impact on Nestlé Milo in Switzerland and Nigeria

The macro-environment comprises factors that affect the organization on a large scale, like economic, social-cultural landscapes, political leadership, and technological influence. It includes factors outside the control of a company that might affect its activities. However, the microenvironment mainly refers to particular elements directly influencing a firm, such as customers, buyers, suppliers, membership organizations, competitors, and other stakeholders (Aibpm et al., 2022). According to Cherunilam (2021), the macro-environmental assessment is based on PESTEL analysis, which simultaneously addresses political, economic, social, technological, and other factors, to mention a few. They assist in understanding the external influencing factors that command the organization’s industry and drive strategic decision-making and risk management.

Figure 2:PESTLE analysis Nigeria

Figure 3:PESTLE analysis Switzerland

Consumer behavior analysis

Consumer behavior Analysis is a method of Studying choices, preferences, and actions, s to understand that consumer behavior in Switzerland differs greatly from that of Nigeria obtained through different cultures, economic, and social statuses (Daniels et al., 2019). According to FRANCIS (2020), Swiss consumers prefer quality and sustainable products that are convenient to use, which can be attributed to their wealthy lifestyle and sustainability awareness. Swiss consumers conduct detailed research on products, making them informed decision-makers.

In Nigeria, consumer behavior is driven by price sensitivity, which focuses on affordability and value for money. This fact, including family, religion, and peers, influences determine what people buy (Kotabe & Helsen, 2022). Despite the challenges that had slowed down Nigeria’s economy during those years, people in this country still have a generally positive attitude towards life. Nigerians have increasingly become proficient in modern technologies; they use everyday digital platforms for shopping or product research. These observations highlight the need to appreciate diverse consumer dynamics to develop effective market strategies in Switzerland and Nigeria. It is crucial to emphasize that these observations are based on publicly available information for informational purposes only.

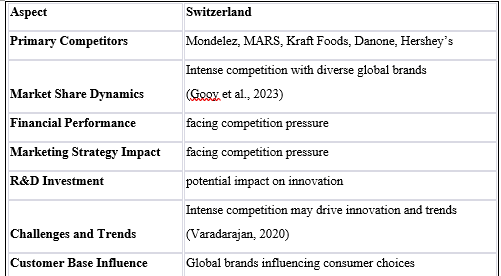

Competitor analysis of Milo Nestle in Switzerland and Nigeria

Switzerland

Nestlé Milo faces stiff competition in Switzerland from other multinational conglomerates such as Mondelez and MARS (Steenkamp, 2020). The antagonism evident is the competition in which brands compete to achieve consumer recognition and loyalty. In this competitive environment, the quality of products, innovation, a, and brand name are key areas to concentrate on. Purchasing power is relatively high in the Swiss consumer market, so product quality and environmental aspects become further elements of competition. The sustainability focus seems to fit snugly into the Nestlé Milo challenge of satisfying these needs while distinguishing itself from its competitors. The highly competitive market demands companies invest huge amounts of money in research and development. However, innovation becomes necessary not only in the direction of variety but also to respond accordingly, adapting to change. Thus, dynamic strategic agility and tenacity are needed in the Swiss market dynamics innovation by Nestle’s Milo to survive among these industry giants.

Figure 4:NESTLE Milo’s competitor analysis in Switzerland

Nigeria

Competitive forces are different in the Nigerian market of Nestle Milo. The consumer preferences, cost sensitivity, and cultural features define what type of Nigerian chocolate drink market it should be. This raises tricky problems; competitors like Boost and Mozart, found in a SWOT analysis using Whittington et al. (2020), make them compulsory jobs to the business venture. Still, global brands prevent Nestlé Milo’s customers from adding another problem. Significantly, Unilever Nigeria plc substantially increased its market share with high turn. The competition also includes the fact that the other has consistency issues in its food category. In order to be successful in this setting, Nestlé Milo should adapt to local consumers, enhance its marketing strategies, and fend for domestic and international competitors.

Figure 5: NESTE Milos competitor analysis in Nigeria

SECTION 2

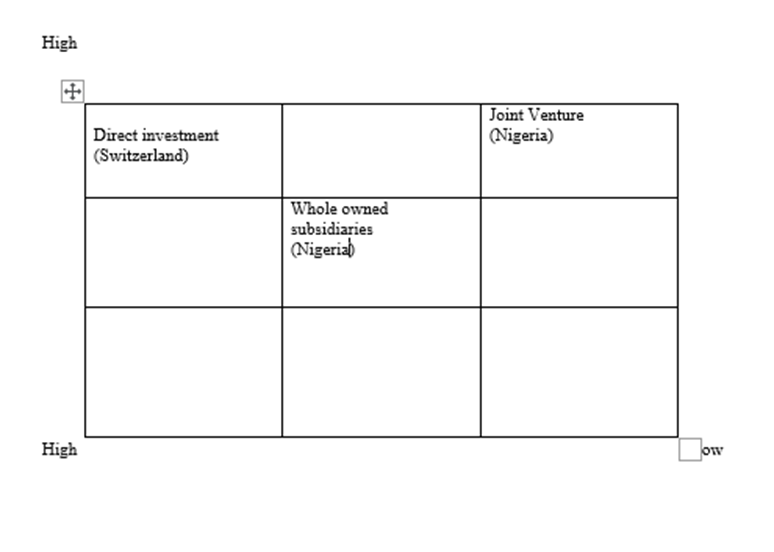

Evaluation of entry strategies

The entry strategy employed by Nestle Milo in Switzerland and Nigeria is market-sensitive. Taking advantage of the company’s history and sound infrastructure in Switzerland, it has adopted a foreign direct investment strategy. Over the last 150 years, Nestlé’s incredible investments in new factories and research centers have strengthened its market position. This approach aligns with the stable Swiss company atmosphere and Nestle’s determination to use pre-existing resources for perpetual development.

In the case of Nigeria, Nestlé Milo employs a hybridization approach consisting of wholly-owned subsidiaries and joint ventures. The fact, however, is that the establishment of Nestlé Nigeria Plc as a wholly-owned subsidiary underlines Nestle’s commitment to long-term operation in the Nigerian market. Moreover, engaging in joint ventures like merging with the Chi Limited Group means a step towards strategic cooperation among local firms to increase their product lines and distribution outlets. Such paired strategies contributed to Nestlé Milo’s success in Nigeria by using its brand power, distribution channels, and investment into R&D to complicate the Nigerian market.

Figure 6:Matrix country attractiveness

Analysis of segmentation, targeting, and positioning of Nestle milo in Switzerland and Nigeria

Segmentation

Market segmentation is a tactic of strategic marketing utilized by Nestlé Milo, in which markets are subdivided according to similarities among the needs, interests, or characters shared up and running its provision-related- product. It aims to pinpoint groups of consumers more likely to respond positively to their offering. Segmentation variables include demographics, psychographics, behavior, and geography. Nestlé Milo globally employs a three-fold segmentation approach: relates to demographics (age and life cycle), psychographics, lifestyle, and personality) behavioral type (occasions are benefits loyalty) (Steenkamp, 2020). It is aimed at children, teenagers, and young adults and promotes energy for athletes pursuing health.

A low demand for chocolate malt drinks challenges Nestlé Milo’s distribution in Switzerland. Nevertheless, it deliberately sets itself in specialty stores targeting expatriates and immigrants from regions where Milo is popular by partaking in location-based and ethnic segmentation (Al-Surmi et al., 2019). Segmentation is one of the key markets in Nigeria for Nestlé M, including income, education level, family size, and life cycle. Milo’s target consumers are those with sufficient resources who are also knowledgeable of the product as a source of health benefits, particularly families whose young children require energy and growth.

Nestlé Milo improves customer satisfaction, loyalty, and profitability by tailoring products to each segment’s pricing and distribution strategies (Aibpm et al., 2022). This localized strategy recognizes market differences and consumer preferences, thereby highlighting Nestlé Milo’s ability to adapt aptly across different markets on a global level.

Targeting

It is targeting aims to select and reach out to specific consumer segments for marketing purposes. Globally, Nestlé Milo practices focused targeting. This brand recognizes each country’s culture and preferences to carry out its marketing campaigns. In Switzerland, Nestlé Milo adopts a differentiated targeting approach. Understanding this low demand for chocolate malt drinks in the country, it positions itself strategically among specialty stores that serve expatriate and immigrant Asians, Africans, and Latin Americans. By doing so, Nestlé Milo targets a consumer group accustomed to enjoying the beverage as in their native nations. (Azeem et al., 2021) This strategy enables Nestlé Milo to adapt its marketing campaigns based on the desires of this corporate segment in Switzerland.

In Nigeria, Nestlé Milo adopts a differentiated targeting strategy. The brand’s target market consists of children aged between 5 and teenagers and young adults. Therefore, Nestlé Milo is targeting consumers who are well educated and rich enough to maintain the quality of their lives by the market differentiation strategy adopted by Nestlé Milo in Nigeria supports the heterogeneous socioeconomic landscape that allows it to reach specific user groups and respond to various needs and preferences of Nigerian consumers (Azeem et al., 2021and; Bakare & Rahim, 2023).

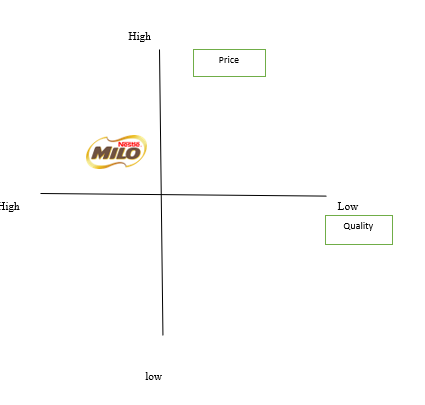

Positioning

Positioning is a marketing phenomenon that involves building either an image or identity for a commodity in the minds of consumers. Globally, Nestlé’s Milo has a consistent branding strategy and slogan, “The energy to go further.” The beverage is associated with sports events and athletes, thus connecting it with physical movement and health (Chang et al., 2023). The brand utilizes digital channels for customized interaction to create a united global image and message.

As for Switzerland, Nestlé Milo repositions itself as a plant-based drink that satisfies the growing demand for vegans and vegetarians. Nestlé Milo got a plant-based version in 2020, made from soy and oats, as proof that it is ready to meet changing consumer preferences (Cherunilam, 2021). The brand also emphasizes its Swiss origin, quality, and sustainability approach to create interest in consumers oriented towards environmental friendliness and local production.

In Nigeria, Nestlé Milo targets itself as a premium and dream brand that allows people to taste luxury. According to Ponte (2019), The brand communicates its availability, affordability, and versatility using the slogan “MILO every day everywhere.” Through sponsoring school sports and providing scholarships, Nestlé Milo targets the youth segment while capitalizing on cultural orientation by deploying local celebrities in adverts.

Figure 7:Nestle Milos Perception map in Switzerland

Figure 8:NESTLE Milos perceptual map in Nigeria

SECTION 3

Evaluation of the marketing strategies

Product

NESTLE MILO, an internationally celebrated chocolate malt beverage, has skillfully responded to the unique requirements of different markets by using a combination of an adaptation strategy in Switzerland and a standardization approach for Nigeria country.

In Switzerland, NESTLE MILO adopts a product adaptation strategy to accommodate this country’s consumers’ ever-changing needs (Singh et al., 2021). The company considered the increased demand for vegan and vegetarian products in Nigeria when it introduced the plant-based version of its famous beverage, released in 2020. This variant, formulated with soy and oats, maintains the nutritional integrity of traditional MILO by offering an equivalent amount of calcium and protein. By following the trend for plant alternatives, NESTLE MILO places itself as a brand adapted to Swiss market needs and preferences (Varadarajan, 2020). The method also makes the brand dynamic and sensitive since it attracts more people who care about health – and environment-oriented ones in Switzerland.

The product standardization strategy employed by Nigeria NESTLE MILO is a premium brand associated with luxury and a high amount of consumption level. The company uses the same formulation and package of MILO without any type of changes such as quality or taste (Singh et al., 2021). The brand is marketed with the slogan “MILO every day, everywhere,” which underlines its convenience and affordability by advertising it as a beverage that one can choose anytime. This strategy demonstrates that NESTLE MILO offers a reliable and superior product for Nigerian consumers (Steenkamp, 2020). Using such standardization, the brand acquires a positive image and promotes commitment among consumers, as everyone knows what kind of offer they will have.

Nestle MILO has employed two approaches: Its marketing intelligence, which is an adapted product in Switzerland, and a standardized one in Nigeria. The capacity of the brand to customize its products to various specific niches and maintain a premium image throughout Nigeria demonstrates knowledge or know-how gained regarding various consumers in different parts of the globe (Nickels et al., 2019). Using such approaches, NESTLE MILO assures the relevance to world market establishment of a connection between consumers and a product position affected by local distinctive.

In Switzerland, NESTLE MILO relied on a product adaptation strategy to deal with the growing preference for plant-based alternatives among health-conscious consumers. The introduction of a vegetarian version embeds MILO into the sustainability framework in Switzerland, positioning it as innovative and eco-friendly. In contrast, the brand agrees to standardize products in Nigeria but retains its original formula and packaging. This type of positioning reinforces the status of MILO as a trustworthy and premium beverage via its “MILO every day, everywhere” slogan that indicates broad availability and low-cost pricing (Nickels et al., 2019). This strategy harnesses consumer demand, ensuring credibility and brand image for Nigerian consumers. The latter case represents a real-life example of adaptation and standardization performed by NESTLE MILO in the world where all benefits are covered within the “The energy to go further” slogan. MILO captures the world of liveliness and health globally through its marketing campaigns targeting various cultures while sport-sponsoring.

The product strategies of NESTLE MILO for the Swiss and Nigerian markets reveal a level of localization that is high not only in terms of non-linear adaptation to market needs but also differentiation, which is justified against an array of situations where it becomes applicable. Luckily, MILO is still an authentic chocolate malt drink, whether it follows local flavors or maintains its international identity.

Price

When it comes to NESTLE MILO as a chocolate malt beverage brand on the global stage, the pricing strategy was effectively implemented in Switzerland and Nigeria. These approaches are adapted to each country’s market situation, consumer behavior, and competitive environment, thus emphasizing pricing adaptation-standardization.

NESTLE MILO is such an app-location situation of the consideration-based price strategy that depends on quality and heterogeneity demand in Switzerland. On the other hand, the mode of functioning is also related to increasing health and environmental concerns among Swiss consumers. It can be seen that after finding this pattern, NESTLE MILO reacted with a vegetarian and vegan version of its product. There is a seen strategy in positioning plant-based products toward particular consumers, who prefer spending higher prices on variations. The above value-based pricing strategy reveals Milo’s flexibility because its price offers normal acceptance despite an abnormal product. So, NESTLE MILO stands for a smart approach based on the critical analysis of customers’ needs and the features of markets to make Switzerland more attractive.

This approach, however, can be based upon a knowledge base that mirrors the socioeconomic profile of Nigeria, where affordability determines consumer behavior. If there is better availability, Nestle MILO has ready-to-go single-serve sachets that can be consumed at will. They are cost-cutting, and their target market is consumers with significantly larger income levels. That pricing strategy is universal in the case of Nigeria, for Nestle Milo uses that method in other developing markets like India and Indonesia(FRANCIS, 2020). Uniform penetration pricing is applied to all marketplaces, which guarantees an equal reaction to the given economic situation and customer preferences.

Finally, Nestle Milo’s pricing strategies in Switzerland and Nigeria show how the company appreciates changing market situations. This has been done through adaptive pricing, such as in Switzerland or uniformity, which worked well for Nestle MILO worldwide. These approaches demonstrate the power of market research and consumers’ insights to determine or formulate pricing tactics that entice customers and promote value creation while fostering business growth (Lerch, 2022and; Gooy et al., 2023). The differences in strategy demonstrate the responsive nature of an approach that NESTLE MILO adopts to change its market and apply broad-based methods whenever possible. NESTLE MILO’s international success is based on the central strategic balance of adaptation and standardization.

Place

NESTLE’s famed chocolate malts are sold through various distribution channels in Switzerland and Nigeria. This kind of market forces changes in consumer choice and competitiveness for each country, as shown by distribution adoption besides standardization.

NESTLE MILO utilizes selective distribution in Switzerland because of the market context and consumer wishes. Targeted product distribution to specific channels ensures effective delivery to the target population. The distributional intermediaries for NESTLE MILO are supermarkets, hypermarkets, popular online platforms Coop, and Migros Amazon. By choosing these carriers, the brand establishes its distribution that best satisfies what Swiss people love – vegan and vegetarian products (Azeem et al., 2021). This target-based approach for distribution reveals that Nestlé Milo can modify its strategies depending on the Swiss market’s peculiarities. Cases like emphasizing large outlets ensure successful market penetration, which leads to brand awareness that can attract unique clients in Switzerland seeking vegan alternatives.

The basic approach that NESTLE MILO uses for distributing in the Nigerian market is highly progressive, with much evidence of understanding socioeconomic issues. Since this entails such an approach, the supply-side products find their way into all potential markets for there is demand. It should be noted that there are differences in consumption and preferences among the different Nigerian consumers; NESTLE MILO intermediates through wholesalers, retailers, or hawkers, as well as kiosks to sell their products in various outlets where they are more accessible. Moreover, online avenues such as Jumia Konga reflect the growing e-commerce phenomenon Intervening. This nature of distribution is one form of standardization since NESTLE MILO does not apply different methods in all emerging markets in which it operates. It makes the process of simplifying points easy, hence making more people its consumers.NESTLE MILO’s distribution policies have undergone some modifications based on the nature and features within developing countries such as Switzerland and Nigeria, implying that it can recognize markets demanding adaptation on their own. This can be achieved by adapting either the distribution or standardization as in Switzerland and Nigeria; NESTLE MILO has succeeded in creating various entry barriers on the world market beneficial for consumers. These perspectives also emphasize the importance of market research and consumer insights to inform distribution strategy shapers that are effective in how consumers respond. Several approaches are mentioned that NESTLE MILO is generic, yet it has standardized procedures where possible. The NESTLE MILO’s success results from its balanced strategy between adaptation and standardization globally. This NESTLE MILO market evaluation strategy analysis place learning tool serves well in demonstrating how global brands can adjust their operations to different markets for profitability purposes.

Promotion

NOSTLE MILO is one of the most popular international brands. A chocolate malt drink used everywhere in the world by people has shown that they can utilize several promotional tools, not only in Switzerland and Nigeria. These strategies are adapted to each country’s specific market contexts, consumption behaviors, and competitive nations by highlighting promotional adaptability while focusing on standardization.

NESTLE MILO, in Switzerland, applies the pull promotion strategy. This method fits in perfectly with the quirks of the Swiss market since their consumers become more health and eco-aware. Faced with this move, NESTLE MILO offers a plant-based version of the product. Using the Swiss heritage, quality, and principles of environmental awareness, NESTLE MILO establishes a favorable “I am going to age image” in the advertisement for the brand name (Matović, 2020; Lorang; Lorangeni, 2023). They interact with their consumers via digital platforms and social media to offer more personalized experiences. This strategy clearly shows an understanding of the distinctiveness of value proposition appealing to Swiss consumers, which implies a responsive approach to local tastes. Therefore, the pull promotion strategy in Switzerland can be considered an adaptive one since it is based on certain market dynamics.

NESTLE MILO employs a push promotion strategy in Nigeria, considering that country’s socioeconomic situation. This approach involves consumers’ direct persuasion and catalysis during personal selling through sales promotional campaigns. NESTLE MILO heavily relies on the youth market and thus supports sports competition in schools that see it have further reach to its target audience (Needle and Burns, 2019). By offering scholarships and prizes for talented students, the brand can properly align its promotional activities with Nigerian consumers’ aspirations and values (Farhan, 2019). Moreover, NESTLE MILO leverages Nigerian cultural diversity by employing local celebrities and influencers in its advertisements. This integration keeps the brand close to its target audience and embraces its cultural values. This push promotion strategy can be described as a standardization factor because NESTLE MILO utilizes the same promotional material and media channels in emerging markets, creating a uniform brand image of communication.

Worth realizing through NESTLE MILO’s promotion strategies in Switzerland and Nigeria is the firm’s competence in identifying diverse market aspects. Both through the path of promotion adaptation as it is shown in Switzerland, and also through promotional standardization displayed by Nigeria

NESTLE MILO has been able to survive through the global market maze, attracting its consumers with its innovative ways of operations. These approaches focus on market research and consumer insight in developing promotional strategies targeting consumers as they drive business growth (Ajayi & Udo, 2019). The different methods represent the flexible process of taking into account local market conditions while deploying standardized ways, if possible, in NESTLE MILO’S case. This strategic balance between evolution and uniformity sums up the international success of NESTLE MILO. This NESTLE MILO’s promotion analysis helps one understand what it takes for a global brand to succeed in even the most competitive market environment.

Conclusion

The achievement of Nestlé MILO’s global success in its chocolate malt beverage market indicates that the phenomenon has been strategically using adaptation and standardization across different dimensions. Nestle MILO has various strategic approaches, such as product formulation, distribution, and price promotion. The fact that the brand comes up with a plant-based variant in Switzerland immediately after observing local developments while implementing some standardization strategies for Nigeria implies uniformity and affordability, thus implying its flexibility. Similarly, Nestlé MILO’s SWOT analysis illustrates a comprehensive understanding of the behaviors of consumers in Switzerland and Nigeria through its segmentation targeting position approaches. In both markets, Nestle MILO successfully applies differentiated targeting as it applies product position adaptation to the environmentally conscious Swiss consumers and a strategy like that for Nigerian customers.

Flexibility is also demonstrated through the firm’s entry strategies that use foreign direct investment in Switzerland and a hybrid strategy involving joint ventures for Nigeria. This adaptability ensures that Nestlé MILO has a competitive advantage in the global business world. Since Nestlé MILO’s analysis is very specific, it implies a brand including some local orientation and stability on the global level. A strategic equilibrium of this type places Nestlé MILO as the leading market in Switzerland, Nigeria, and other parts of the world.

References

Aibpm, E., Tze, X.C., Zhe, X.C., Sin, C.C. and Shieh, H.C. (2022) ‘Mr. A Study on Marketing Strategy of Nestle in Asia’. Advances in Global Economics and Business Journal 3(1), pp. 1–14. Available at: http://www.agebj.org/index.php/agebj/article/view/46.

Ajayi, J.F.A. and Udo, R.K. (2019) ‘Nigeria | Culture, History, & People.’ Encyclopædia Britannica. Available at: https://www.britannica.com/place/Nigeria.

Al-Surmi, A., Cao, G. and Duan, Y. (2019) ‘The impact of aligning business, I.T., and marketing strategies on firm performance.’ Industrial Marketing Management 27. doi https://doi.org/10.1016/j.indmarman.2019.04.002.

Azeem, M., Ahmed, M., Haider, S. and Sajjad, M. (2021) ‘Expanding competitive advantage through organizational culture, knowledge sharing, and organizational innovation.’ Technology in Society 66(1), p. 101635. Available at: https://www.sciencedirect.com/science/article/pii/S0160791X2100110X.

Bakare, R.D. and Rahim, A.G. (2023) ‘NICHE MARKETING AND OPERATIONAL PERFORMANCE IN THE NIGERIAN MANUFACTURING INDUSTRY: A STUDY OF NESTLE NIGERIA PLC. LAGOS’. UNILAG Journal of Business 9(2), pp. 1–15. Available at: http://ujb.unilag.edu.ng/article/view/1844.

Central Intelligence Agency (2022) Nigeria – The world factbook. Available at: https://www.cia.gov/the-world-factbook/countries/nigeria/.

Chang, P.L., Chang, Y.Y., Chinnappan, C.C.A., Chai, M.H. and Ladeuth, L.M.A. (2023) ‘Marketing Strategies in Delivering Customer Satisfaction: A Case Study of Nestlé.’ International Journal of Tourism and Hospitality in Asia Pacific (IJTHAP) 6(2), pp. 26–39. Available at: http://www.ejournal.aibpmjournals.com/index.php/IJTHAP/article/view/2321.

Cherunilam, F. (2021) BUSINESS ENVIRONMENT TEXT AND CASES. Available at: http://dspace.vnbrims.org:13000/jspui/bitstream/123456789/4950/1/business%20environment.pdf.

Clarke, T., Klettner, A. and Atherton, A. (2019) Multinational Corporations and their Subsidiaries 2019. Available at: https://opus.lib.uts.edu.au/bitstream/10453/136598/1/MNCs%20and%20their%20subsidiaries%20FINAL%2023%20Oct%202019.pdf.

Daniels, J.D., Radebaugh, L.H. and Sullivan, D.P. (2019) International business: environments and operations. Pearson.

Doole, I., Lowe, R. and Kenyon, A. (2019) International marketing strategy: analysis, development and implementation. Cengage Learning.

Farhan, N. (2019) ‘A study on confectionery product distributor’s activities compared with compliance issues and standards set by Nestlé Bangladesh Ltd.’’. dspace.bracu.ac.bd. Available at: http://dspace.bracu.ac.bd/xmlui/handle/10361/14870.

Ferreira, J. (2022) Nigeria Inflation Rate Falls Further in February. Available at: https://tradingeconomics.com/nigeria/inflation-cpi.

Forbes (2024) Nestlé | Company Overview & News. Available at: https://www.forbes.com/companies/nestle/?sh=443055551210 (Accessed: 19 January 2024).

FRANCIS, C. (2020) INTERNATIONAL BUSINESS, Sixth Edition. PHI Learning Pvt. Ltd. Available at: https://books.google.com/books?hl=en&lr=&id=bbDrDwAAQBAJ&oi=fnd&pg=PP1&dq=international+business+environment&ots=lfX8BcoFi3&sig=yTIn4wt3_EOgs5ewW_acD2I9Ae0 (Accessed: 19 January 2024).

Gooy, S.Y., Gong, P.S., Gong, W.K., Han, R. and Rana, V. (2023) ‘A Study of Nestlé Financial Analysis’. International Journal of Accounting & Finance in Asia Pacific (IJAFAP) 6(1), pp. 82–95. Available at: https://ejournal.aibpmjournals.com/index.php/IJAFAP/article/view/2200.

Kotabe, M. (Mike) and Helsen, K. (2022) Global Marketing Management. John Wiley & Sons. Available at: https://books.google.com/books?hl=en&lr=&id=doCFEAAAQBAJ&oi=fnd&pg=PA19&dq=+regional (Accessed: 19 January 2024).

Lerch, M. (2022) ‘The end of urban sprawl? Internal migration across the rural‐urban continuum in Switzerland, 1966−2018’. Population, Space, and Place. Doi: https://doi.org/10.1002/psp.2621.

Lorange, P. and Mugnaini, K. (2023) ‘Practice Insights from Peter Brabeck-Letmathe, Chairman Emeritus, Nestlé Group.’, pp. 371–374. doi https://doi.org/10.1007/978-3-031-45090-7_36.

Matović, I.M. (2020) ‘PESTEL Analysis of External Environment as a Success Factor of Startup Business.’ ConScienS Conference Proceedings, pp. 96–102. Available at: https://www.ceeol.com/search/chapter-detail?id=1022070.

Needle, D., and Burns, J. (2019) An Introduction to Business and its Environment 7th Edition Business in Context. Available at: http://elib.vku.udn.vn/bitstream/123456789/3021/1/2019.%20Business%20in%20ContextAn%20Introduction%20to%20Business%20and%20its%20Environment%20%287th%20Edition%29.pdf.

Nestle (2023) Milo. Available at: https://www.nestle.com/brands/drinks/milo.

Nestlé (2023) Nestlé reports nine-month sales for 2023. Available at: https://www.nestle.com/media/pressreleases/allpressreleases/nine-month-sales-2023.

Nickels, W.G., McHugh, J.M. and McHugh, S.M. (2019) Understanding business. McGraw-Hill. Available at: https://thuvienso.hoasen.edu.vn/handle/123456789/10761.

Ponte, S. (2019) Handbook on Global Value Chains. Edward Elgar Publishing. Available at: https://books.google.com/books?hl=en&lr=&id=GIC4DwAAQBAJ&oi=fnd&pg=PR1&dq=+regional (Accessed: 19 January 2024).

Shen, Y. (2022) SWOT Analysis and Strategy Selection of Nestle. Available at: https://www.atlantis-press.com/proceedings/icssed-22/125973930.

Singh, P. et al. (2021) ‘A Study on Nestle Promotion Strategy.’ International Journal of Accounting & Finance in Asia Pacific 4(1), pp. 60–70. Available at: https://www.researchgate.net/publication/349794894_A_Study_on_Nestle_Promotion_Strategy.

Statista (2023) Switzerland – Gross domestic product (G.D.P.) 2021. Available at: https://www.statista.com/statistics/263589/gross-domestic-product-gdp-in-switzerland/.

Steenkamp, J.-B.E.M. (2020) ‘Global Brand Building and Management in the Digital Age’. Journal of International Marketing 28(1), pp. 13–27. doi https://doi.org/10.1177/1069031×19894946.

Varadarajan, R. (2020) ‘Customer Information Resources Advantage, Marketing Strategy, and Business Performance: A Market Resources Based View.’ Industrial Marketing Management 89, pp. 89–97. doi https://doi.org/10.1016/j.indmarman.2020.03.003.

Wachter, D, Egli, Emil, Diem, Aubrey and Maissen and Thomas (2024) Switzerland. Encyclopedia Britannica. Available at: https://www.britannica.com/place/Switzerland.

Whittington, R., Regnér, P. and Angwin, D. (2020) Exploring strategy: text and cases. Pearson. Available at: https://thuvienso.hoasen.edu.vn/handle/123456789/12693.

write

write