Introduction

Tesla Inc. (formerly known as Tesla Motors Inc.). Its primary markets are the United States, China, and Norway, but it also has operations worldwide. The corporation is based in Palo Alto, California. The mission of Tesla is to accelerate the worldwide transition to renewable energy sources. Founded in 2003, Tesla is a leader in developing high-performance, zero-emission electric vehicles that are among the best-selling and most popular in the world. The market share of Tesla has been impressive. Tesla has a Net worth of over 1.3 Trillion Dollars as of 2021. It is also one of the world’s safest and most highly rated vehicles. In Port Harcourt, Nigeria, the researcher plans to present a Tesla internationalisation approach. Establishing a subsidiary operation in Port Harcourt, Nigeria’s wealthiest city, will enable the company to reach a wider audience (Anon, 2016).

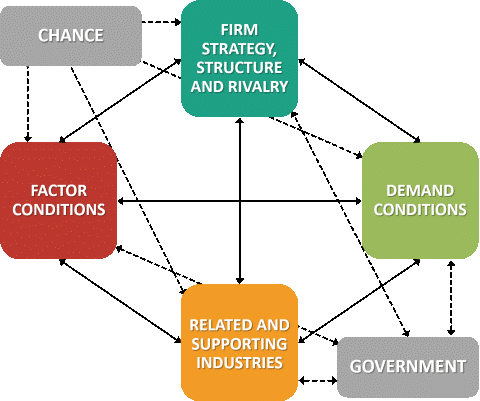

Porter’s Diamond Model

What makes one firm more efficient than another can be learned using Michael Porter’s Diamond Model. According to this theory, national competitive advantage can be found in a company’s ability to provide goods and services that are better than those produced in other countries. When it comes to innovation, some companies excel while others struggle (Afzal et al. 2019). Firm Policy, Composition and Competition; Demand Conditions; Market Structure; and Industry factors are just a few of the factors Porter cites as critical to an organisation’s ability to compete on a global scale. There is a constant need to develop and improve domestically if such conditions are suitable (Fainshmidt et al., 2016).

Figure 1: Porter’s Diamond Model

Source: Jarungkitkul et al. (2016)

How businesses are formed and run and their overall strategy and organisational structure are heavily influenced by the national setting in which they operate. Competing against one’s domestic rivals is an important part of being globally competitive, as it encourages firms to establish their own distinct and long-term advantages. As a result of the USA’s already-competitive automobile sector, competition is fierce (Tsiligiris et al., 2018).

Natural, capital and human resources constitute a country’s factors circumstances. Some countries, such as the United States, have a wealth of natural resources, such as oil, while others, such as China, are tremendously technologically advanced (Zhang et al., 2013).

The level of competitiveness of a country’s sectors has a significant impact on domestic demand. A bigger market means more problems, but it also offers more chances to improve and expand. To survive in today’s competitive market, companies must be flexible enough to meet the ever-evolving needs of their customers. The United States already has a high demand and market for automobiles, making the demand factor particularly robust (Kaczmarek et al., 2013).

The automobile industry thrives because of supporting and connected businesses. When it comes to adding value to customers and staying competitive, firms rely on forming strategic partnerships and alliances with like-minded companies. Tesla is a powerful and dominant firm because of the full chip and vehicle industry in the United States.

In Porter’s Diamond Model, the government serves as both a “catalyst” and a “challenger. Porter believes that there is no such thing as an “invisible hand” in the economy, where the authorities leave everything up to the market (Afzal et al., 2019).

Companies like Tesla have a leg up in the competition because of government support for tariff-based business empowerment. External events, such as conflict and natural catastrophes, can positively or detrimentally impact a country or business, depending on the degree of chance involved (Afzal et al., 2019). For example, in the wake of the global epidemic, demand for virtually every commodity fell precipitously.

Competitive Analysis

Tesla has been a major buzzword for a long time because it relates to innovation and growth that could change the world. In the past, traditional automakers have failed to sell electric vehicles, but that might all change as Ford ramps up competitiveness in the fast-paced electric-powered motor market. For Ford, the investment in electric vehicles has paid off.

Tesla’s European Gigafactory in the suburbs of Berlin brought attention to the German auto industry’s lacklustre output, which had previously been overshadowed by its American equivalent (Cheong et al., 2016). Volkswagen has been quietly making advances into the market for a decade now, thanks to its ID series. When it comes to electric vehicles, Tesla has been around for longer than its rivals (Narins, 2017) and for a good number of years in the market, it has created a good name, loyal following, and substantial infrastructure for charging electric vehicles. All-electric vehicle sales in the United States have accounted for over 74% of Tesla’s total sales for the previous three years. Depending on the model, Tesla Model S can travel up to 412 miles per charge. The closest competitor is the Mustang Mach-E Extended Range, which is not a high-end vehicle.

From a financial return perspective, increased sales, and long-term value creation, Tesla was the top automaker at the start of 2020. (Sloan, 2020). There must be some logic to what so many consider to be crazy. Tesla has devised an ingenious multi-pronged strategy to transform an entire industry. Overturning product architecture, establishing themselves in key limiting components, and addressing system-level obstacles that hinder the technology adoption are all part of its basic approach. Meanwhile, they’ve employed a successful strategy for increasing their innovation capital, allowing them to secure the resources and backing necessary to carry out their mission. By entering an international market like India, the corporation can drive its own domestic success and demands while also attracting new Indian customers, especially people with high disposable income. Internationalisation in Bangalore, India, will be supported by the company’s well-known brand image, excellent product, and commercial idea (Sloan, 2020)

Strategy to Internationalise

The internationalisation strategy recommended Tesla’s possible growth in India is based on international strategy. A major cause for internationalisation has been highlighted as diversifying economic and occasionally political risks. Recessions in home markets are a catalyst for domestic enterprises to contemplate entering foreign markets that are not as impacted. Increased rivalry in the domestic market due to the introduction of major multinational brands might also encourage businesses to look for opportunities abroad. There is a strong correlation between the level of domestic competition and the internationalisation of emerging-market companies (Yiu et al., 2007).

Tesla has grown at a breakneck pace in the US market, and as a developed nation, the corporation possesses valuable abilities and expertise for capturing undeveloped or underdeveloped nations. India appears to be a more favourable location for internationalisation. Tesla can leverage its massive international market reputation and brand image to assist it in acquiring a favourable market share in India.

While incumbents have had years of trial-and-error experience, latecomers can take advantage of changing consumer preferences and emerging new technology without having to go through all that. Tesla will be largely benefitted from all these factors during internationalisation in India.

For a developed firm such as Tesla, international development presents both opportunities and challenges. Lack of experience, lack of knowledge and capabilities, the market dominance of well-established rivals, and customer retention to established brands are some of the obstacles new businesses face. According to research, few multinational corporations can claim to be wholly global or local, making it difficult to profit from an international strategy integrated across all regions fully. In addition to these issues, social, geopolitical, geographic, and economic differences (Ghemawat, 2001), trade obstacles, complex and expensive knowledge transfer, and a lack of economies of scale can all be mentioned. Tesla might face economic differences in the USA and India, affecting the demand and supply pattern. However, because of its strong brand image, the company will succeed.

PESTEL Analysis of India

Figure 2: Pestel analysis

Source: Wajid et al. (2021)

Political- In India, one of the world’s largest democracies, the federal government is in use. Many factors affect the political atmosphere, such as the policies of the government, the motivations of lawmakers, and the ideologies of different political parties, among many others. As a result, India’s business climate is affected by a variety of political challenges. The Indian government levies a variety of taxes, including octroi and utility levies, as well as income tax, service tax, and sales tax. Additionally, the government influences privatisation because it encourages free market capitalism through a variety of measures (Kumar et al. 2021).

Economic- India’s economy has been impressively stable since the implementation of industry structural reforms in 1991. Because of FIBP’s establishment, India’s business situation has continuously improved due to decreased economic liberalisation, growth of international capital, as well as other factors. The country’s GDP grew by 5% in 2014, from $4.35 trillion to $5.07 trillion, an increase from the previous year’s GDP of $4.35 trillion (Wajid et al., 2021).

Social- Changing societal trends can have an impact on a business environment. India’s pension expenditures have risen significantly due to an ageing population, which means more senior workers are being hired. In addition, India has a population of 1.2 billion individuals, the majority of whom are aged 15 to 65. In order to account for this, there seem to be percentages for each age group. There is a wide range of flexibility within these systems, including educational attainment, work attitudes, wealth distribution, and so forth (Kumar et al., 2021).

Technology- New cost-cutting methods have been introduced due to technological advancements in product creation. India has access to both 3G and 4G networks, which has made it easier for them to carry out several technical initiatives (Kumar et al. 2021). As a result, software creation, updates, and other technical advances are all supported by the country’s thriving IT sector. In recent years, India has also sought to launch satellites into space (Wajid et al. 2021).

Legal and Environmental- Businesses in India are feeling the effects of a slew of recent legislative changes, from higher minimum wages to a ban on handicap discrimination. Due to industrialization and urbanisation, India’s pollution levels have worsened, resulting in numerous health problems. The result is that environmental pressure organisations have been founded, as well as noise limits and rubbish disposal rules.

Five Forces Analysis on India

Figure 3: Five forces analysis

Source: Vining et al. (2011)

| Bargaining Power of Buyers | Low, as Tesla has high-end pricing for its car models |

| Bargaining Power of Sellers | The bargaining power of Tesla is high because of the product quality |

| Threat of Substitutes | The threat of new substitutes is low, as Tesla provides quality products with patent technologies. |

| Rivalry Among Competitors | It is high because of the similarity in products |

| Entry Barriers | It is high because of the high price of setting manufacturing units. |

Mode of Entry as Licensing

Another typical method for businesses to enter new markets is through licencing agreements. In this arrangement, your company pays another company in your target market to use or sell its intellectual property under a licence or sale agreement (Cabaleiro-Cerviño et al. 2020). Licensing agreements are popular in the hospitality industry when restaurants and cafes licence their brands to third parties to operate in other countries.

Tesla can swiftly break into a new market with the help of licencing. Using this method, Tesla can establish a following for its goods and services without having to fork over big sums of money. Licensing might be a solution for companies who are not confident in their ability to advertise themselves in a new market right away (Cabaleiro, 2019).

There are, however, several possible drawbacks. Getting a licence in India can be difficult because of complicated licencing laws, delaying the procedure, and adding legal fees. It is more common for a corporation to licence its pipeline and infrastructure to another company in exchange for a tiny percentage of the money generated (Gregoric et al. 2020). Licensing an overseas firm to produce a proprietor’s product in a given market, either solely or nonexclusively in the home country, offers less power or finances to the licensees in that country under this international market entry strategy to internationalisation (Hosseini et al. 2019). A product comparable to the one the licensor currently produces and sells in the native country can be produced in the host country using proprietary information, copyrights, management know-how, and other resources without requiring the licensor to start up a new foreign operation.

One-time, technology, and licence fees (typically expressed as a percent of revenue) are the most prevalent revenue streams for the licensor (Yang et al. 2019). Licensing has a lot of appeals to break into and expand into new markets worldwide. License agreements are most often entered into so that licensors can take advantage of improved manufacturing capabilities, bigger distribution channels, local experience, and management skills. As a result, the licensor can more easily and effectively expand its market reach through the licensee. It is a win-win situation for Tesla, which will benefit immensely from the licencing plan (Gregoric et al. 2020).

Three Organisational Issues

Tesla has been accused of not managing employees well and imposing beliefs and ideologies. Also, the company has people from various cultures and managing them is often challenging. Therefore, these problems need to be analysed and assessed from cultural and organisational perspectives. A clear analysis of the cultural differences is presented as follows in the US and Indian context.

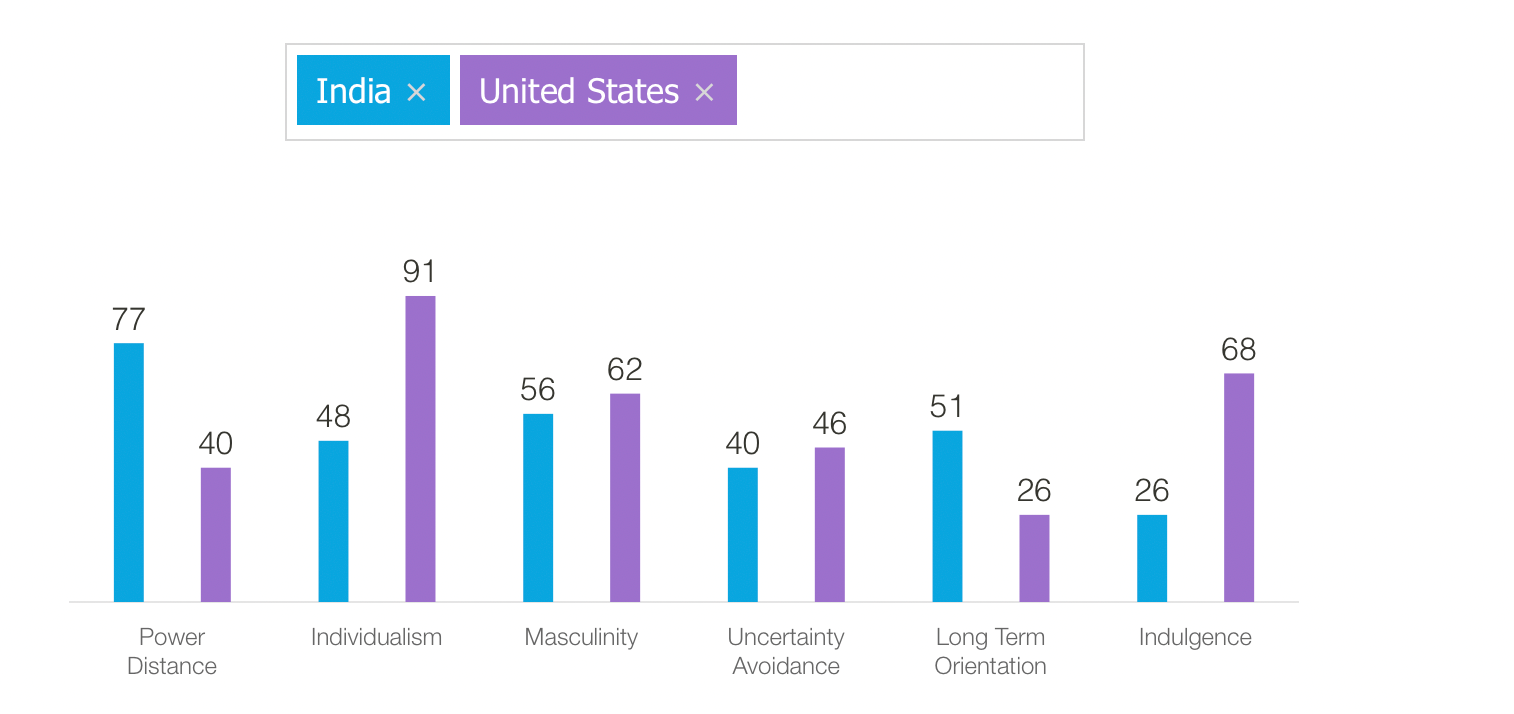

Hofstede Cultural Analysis

Figure 4: Hofstede cultural analysis

Source: Hofstede (2022)

The country’s high score of 77 suggests that India strongly prefers top-down structures in society and organisations. There are a number of terms and expressions that could be used to describe the Indian mindset: A paternalistic manager is one that controls, rationalises, and rewards their employees’ allegiance in exchange for their own commitment. In need of instruction from the employer or the person in charge. Unconditional acceptance of uneven rights for those in positions of power and those below them (Hofstede Dimension, 2022).

“Freedom and liberty for everyone” is the American ideal. Equality for all persons in society and government is clearly a priority in the United States. American workers may easily interact with their bosses, and managers rely on the expertise of their teams as well as individual employees to guide them through their workdays. People would expect to be well-informed at work, and so knowledge is frequently shared. Unconventional and interactive communication is still prevalent (Hofstede Dimension, 2022).

With a total score of 48, India is a nation that demonstrates both collectivism and individualism tendencies. A sense of responsibility and belonging are important in a collectivist society because people are expected to do things to enrich their own in-group (s). Behavior in the U. S. shows a high Masculinity rating of 62. Masculinity and Individualism go hand in hand, which explains a lot about why men act the way they do. American men display their Masculine drive in their unique way, and British culture is similar to that of the United States in this regard (Hofstede Dimension, 2022).

According to this criterion, India has a Masculine society with a score of 56. When it comes to the public display of power and wealth, India seems to be quite Masculine. In the fashion industry, showcasing one’s accomplishments in a manner that is both bright and ostentatious is usual. Behavior in the U. S. demonstrates a high Masculine score of 62. This phenomenon can be explained by the combination of a strong Masculinity drives with one of the most Idealist drive in the world (Hofstede Dimension, 2022).

In terms of eliminating ambiguity, India ranks 40th out of 100 countries. In India, none of it must be flawless or go exactly as planned; mistakes are tolerated. It is said that Indians enjoy the unexpected since it gives them a break from the monotony of daily life. On the Avoiding Uncertainty dimension, however, the United States comes in last, scoring a meagre 46 points. A person’s behaviour will be impacted more by what they perceive to be their current condition than by the culture’s overall score (Hofstede Dimension, 2022).

This dimension has a score of 51 in Indian culture, which indicates that there is no great preference for it. India’s religious and philosophical thought is dominated by the concept of “karma.”

Unlike in western society, where time moves in a single direction, while this is less significant in eastern cultures. As an example, India’s openness to religions from throughout the world has made it a popular tourist destination. There is a greater willingness in the U. S. for fresh information to be tested for accuracy. Americans are pragmatic, yet their “can-do” mentality is a manifestation of the “can-do” ethos that permeates the country (Hofstede Dimension, 2022).

With a score of 26, India falls into the category of a conservative society. Hopelessness and negativity have been linked to low scores on this scale. It is also less important in a restrained culture to have a lot of free time and a lot of self-restraints in their materialistic desires. The United States is characterised as an Eudaimonism (68) society on the sixth dimension.

This is demonstrated by a normative score and the following contradictory attitudes and behaviours. Play hard and work hard at the same time. A greater prevalence of drug addiction in the US than in most other affluent countries persists despite decades of drug prohibition and enforcement. For a conservative nation, many people question the morality of numerous well-known Christian televangelists (Hofstede Dimension, 2022).

Possible Solutions

When India lowered its goods and services tax imposed on electric vehicles from 12 per cent to 5% in 2019, it did so far less than other automakers, who faced penalties of up to 28 per cent and were criticised by Toyota Motor Corp. When the FAME plan was first announced in 2015, the government has pledged Rs 900 crore in subsidies for everything from electrical rickshaws to buses (Anon, 2022). If customers want to buy a Tesla, they will not get much support from India’s FAME initiatives because the maximum subsidy amount for an EV is Rs 15 lakh. Tesla will be ineligible since they will price more than that. The typical price of a car in India is $10,000 or less, roughly 50% the price in China and 25% of the price in the US (Anon, 2022). This means that even Tesla’s entry-level model will only appeal to a minuscule 1% of the market. According to a Centre for Energy Finance report, the Indian EV market might be worth over $206 billion in the next decade, with an expenditure of more than $180 billion needed by 2030 to achieve that (Anon, 2022). The high level of brand recognition that Tesla enjoys among India’s wealthy and environmentally sensitive population means that even a product with a modest percentage of the market might be profitable for the corporation. Luxury car sales in India are expected to expand at roughly 15% within the next 5 to 7 years, which is about twice the rate of the overall market growth. It will remain a niche product until a local production line is established (Anon, 2022).

When Tesla opens its licencing facility in Bangalore and enters the Indian market, it will draw in the 1% of people prepared to pay for the luxury. A 1% share of India’s population would be a great incentive to expand and improve in a highly competitive Indian market. Finally, an organisation’s culture can help it remain competitive in an ever-changing business market. To create a significant impact culture, Tesla must have a high level of trust among its employees and top management (Jun Hao & Yazdanifard, 2015). Tesla needs a culture that is receptive to change to stay competitive in an ever-changing business environment.

Conclusion

In general, the company’s intended plan to establish a subsidiary in Bangalore, India, will benefit from reaching out to a diverse consumer base. Additionally, by utilising licencing as a means of internationalisation, as indicated by the international model, the corporation will develop through the use of power and control. As of now, the electric vehicle segment in India is growing steadily, with a potential market required to be penetrated. Overall, Tesla should establish a subsidiary in Bangalore because of the city’s favourable political and economic climate and its favourable business environment and future growth prospects.

References

Anon, 2016. The recipe for success at Tesla is strong leadership. ATZelektronik worldwide, 11(1), pp.24–27.’

Anon, (2021) Explained: Tesla’s challenges in India as it gears up to sell EVs. [online] Available at https://www.indiatoday.in/business/story/explained-tesla-s-challenges-in-india-as-it-gears-up-to-sell-evs-1761082-2021-01-20. [Accessed March 24, 2022]

Agwu, M.E. & Onwuegbuzie, H.N., 2018. Effects of international marketing environments on entrepreneurship development. Journal of innovation and entrepreneurship, 7(1), pp.1–14.

Afzal, M., Lawrey, R. & Gope, J., 2019. Understanding national innovation system (NIS) using porter’s diamond model (PDM) of competitiveness in ASEAN-05. Competitiveness Review, 29(4), pp.336–355.

Abubakar, YA et al., 2019. What specific modes of internationalisation influence SME innovation in Sub-Saharan least developed countries (LDCs)? Technovation, 79, pp.56–70

Clarke, J.E. & Liesch, P.W., 2017. Wait-and-see strategy: Risk management in the internationalisation process model. Journal of international business studies, 48(8), pp.923–940.

Cabaleiro-Cerviño, G. & Burcharth, A., 2020. Licensing agreements as signals of innovation: When do they impact market value? Technovation, 98, p.102175.

Cabaleiro, G., 2019. Sources of appropriation capacity in licensing agreements. Technovation, 86-87, pp.48–61.

Chaudhry, A.Q., & Javed, H. (2012) Impact of transactional and laissez faire leadership style on motivation. International Journal of Business and Social Science, 3, 258-264.

Crane, D.A., 2016. Tesla, dealer franchise laws, and the politics of crony capitalism. Iowa law review, 101(2), p.573.

Cheong, T., Song, S.H. & Hu, C., 2016. Strategic Alliance with Competitors in the Electric Vehicle Market: Tesla Motor’s Case. Mathematical problems in engineering, 2016, pp.1–10.

Dow, D., Liesch, P. & Welch, L., 2018. Inertia and Managerial Intentionality: Extending the Uppsala Model. Management international review, 58(3), pp.465–493.

Fatehi, K. & Choi, J. (2019). Introduction: The management of the international business. K. Fatehi & J. Choi (Eds.)., International business management: Succeeding in a culturally diverse world (2nd ed, pp. 3–35). Springer.

Fox, E. 2021. Tesla Is Growing its BEV Market Share Annually, Like Clockwork. [online] Available at https://www.tesmanian.com/blogs/tesmanian-blog/tesla-annually-increases-its-share-in-the-bev-market. [Accessed March 09, 2022]

Forsgren, M. & Holm, U., 2021. Complementing the Uppsala model? A commentary on Treviño and Doh’s paper “Internationalisation of the firm: A discourse-based view.” Journal of international business studies, 52(7), pp.1407–1416.

Forsgren, M., 2016. A note on the revisited Uppsala internationalisation process model – the implications of business networks and entrepreneurship. Journal of international business studies, 47(9), pp.1135–1144.

Fainshmidt, S., Smith, A. & Judge, WQ, 2016. National Competitiveness and Porter’s Diamond Model: The Role of MNE Penetration and Governance Quality. Global strategy journal, 6(2), pp.81–104.

Gregorič, A., Rabbiosi, L. & Santangelo, G.D., 2020. Diaspora ownership and international technology licensing by emerging market firms. Journal of international business studies, 52(4), pp.671–691.

Hosseini, S.H., Gray, R. & Torshizi, M., 2019. Cross‐licensing agreements in the presence of technological improvements. Canadian Journal of agricultural economics, 67(1), pp.115–130.

Hatonen, J., 2010. Outsourcing and licensing strategies in small software firms: evolution of strategies and implications for firm growth, internationalisation, and innovation. Strategic direction (Bradford, England), 26(11), pp. Strategic direction (Bradford, England), 2010–10-19, Vol.26 (11).

Hetzner, C., 2016. TESLA ENVY; Irritated by the upstart’s success, German carmakers are racing to respond. Automotive News, 90(6741), pp. Automotive news, 2016–09-05, Vol.90 (6741).

Hofstede Insights, 2022. Country Comparison between US and Nig. [online] Available at https://www.hofstede-insights.com/country-comparison/india,the-usa/ [Accessed March 03, 2022]

Jarungkitkul, W. & Sukcharoensin, S., 2016. Benchmarking the competitiveness of the ASEAN 5 equity markets. Benchmarking: an international journal, 23(5), pp.1312–1340.

Jun Hao, M., & Yazdanifard, R. (2015). How effective leadership can facilitate change in organisations through improvement and innovation? Global Journal of Management and Business Research: An Administration and Management, 15(9), 1-15.

Kaczmarek, S. & Ruigrok, W., 2013. At the Deep End of Firm Internationalization: Nationality Diversity on Top Management Teams Matters. Management international review, 53(4), pp.513–534.

Mangram, M. (2012). The globalisation of tesla motors: A strategic marketing plan analysis. Journal of Strategic Marketing, 20(4), 1-24.

Moritz, M., Redlich, T., Krenz, P., Buxbaum-Conradi, S., & Wulfsberg, J. (2015). Tesla motors, inc.: Pioneer towards a new strategic approach in the automobile industry and the open-source movement? In: Proceedings of PICMET ’15: Management of the Technology Age.

Narins, T.P., 2017. The battery business: Lithium availability and the growth of the global electric car industry. The extractive industries and society, 4(2), 321–328.

Perkins, G. & Murmann, J.P., 2018. What Does the Success of Tesla Mean for the Future Dynamics in the Global Automobile Sector? Management and organisation review, 14(3), pp.471–480.

Schweizer, R. & Vahlne, J.-E., 2022. Non-linear internationalisation and the Uppsala model – On the importance of individuals. Journal of business research, 140, pp.583–592.

Schellenberg, M., Harker, M.J. & Jafari, A., 2018. International market entry mode – a systematic literature review. Journal of strategic marketing, 26(7), pp.601–627.

Tsiligiris, V., 2018. An adapted Porter Diamond Model for the evaluation of transnational education host countries. International journal of educational management, 32(2), pp.210–226.

Vahlne, J.-E. & Johanson, J., 2017. From internationalisation to evolution: The Uppsala model at 40 years. Journal of international business studies, 48(9), pp.1087–1102.

Vahlne, J.-E. & Johanson, J., 2013. The Uppsala model on the evolution of the multinational business enterprise – from internalisation to coordination of networks. The international marketing review, 30(3), pp.189–210.

Vahlne, J.-E. & Johanson, J., 2019. The Uppsala model: Networks and micro-foundations. Journal of international business studies, 51(1), pp.4–10.

Vining, A.R., 2011. Public Agency External Analysis Using a Modified “Five Forces” Framework. International public management journal, 14(1), pp.63–105.

Wajid, MA & Zafar, A., 2021. PESTEL Analysis to Identify Key Barriers to Smart Cities Development in India. Neutrosophic sets and systems, 42, pp.39–48.

Yang, F., Jiao, C. & Ang, S., 2019. The optimal technology licensing strategy under supply disruption. International journal of production research, 57(7), pp.2057–2082.

Zhang, P. & London, K., 2013. Towards an internationalised sustainable industrial competitiveness model. Competitiveness Review, 23(2), pp.95–113.

write

write