General Company Overview

NVIDIA is a leading innovator of computer graphics and AI technology. The company is famous for its AI computing (SoCs)system-on-a-chip units and (GPUs) Graphics Processing unit technologies, which are used in markets like automobiles, mobile phones, and computing. In the last three financial years, NVIDIA has shown strong financial results. The company showed improvement in its finances each year. It grew from $16.675 billion in 2021 to $26.974 billion in 2023. This shows its strength to change with changes in technology as technology advances. The profit margin for the company is a bit smaller but is still promising at 56.93% in 2023 (NVIDIA Corporation, 2023).

AMD is a computer chip maker that makes and creates processors for computers. It also creates graphics cards plus other tech kinds of stuff. The company is known for its new ideas and innovations in the chip business. It was behind some of the industry’s first best processors, like the first 64-bit processor, another one is the first dual-core processor and most recently, a tiny but powerful 7nm x86 chip processor. In the period of three years, AMD has had large growth. The company’s total income after costs went up from $9.763 billion in 2020 to $23.601 billion in 2022 (SEC, 2021). In 2022, the gross profit margin increased a lot. It got up to 44.93%. AMD’s new products and growing market share make it a strong rival in the chip industry (SEC, 2022).

Macro Environment Analysis (SWOT Analysis)

Strengths

NVIDIA has been showing Robust Financial results for a long time. Their income and profits have gone up each year. The company’s diverse product portfolios, like GPUs, SoCs, AI solutions, and gaming stuff, help keep income steady and give them a part of the market. NVIDIA is famous for its innovation leadership and being a top choice in technology changes. They are best known for making things that help with computer graphics and the use of smart machines called AI technologies (NVIDIA Corporation, 2023).

AMD has strengthened its position against competitors, getting more of the market share for CPUs and GPUs. It’s now competing hard with companies like Intel and NVIDIA. The business has improved a lot in technology, making new processors and graphics cards. These help many different customers. Getting Xilinx has helped AMD do more things (SEC, 2022). It has made them better at high-speed computing and getting computers ready for large amounts of data.

Weaknesses

Dependency on specific markets for NVIDIA in use of the gaming and data centre markets makes them vulnerable to changes in these areas. Like many technology businesses, NVIDIA has troubles because of worldwide problems with delivery lines (Cheng, 2023). This affects how fast they can make and send out products. On the other hand, AMD makes most of its money from the Computing and Graphics parts. This means they are risky because they rely heavily on certain product types. As demand for chips increases, AMD has trouble making enough products for many people, which could cause them to lose some of their market share if this reoccurs again.

Opportunities

The growing use of AI and machine learning gives NVIDIA a chance to sell its GPUs in data centres and edge computing. NVIDIA’s tech for self-driving cars and teaming up with car makers help the company gain from the rise in the auto industry. On the other hand, AMD has opportunities for data centre expansion: As more people need data centre solutions, AMD has a chance to grow and compete with top players in the industry (Leswing, 2023 ). As the gaming world keeps getting bigger, AMD can use its GPU and CPU goods to get more of that market.

Threats

NVIDIA’s lead in the AI market could be threatened by rising competition from other big tech companies. The changing rules for the tech industry could affect NVIDIA’s business and chances to grow. Intense AMD has to compete with big companies like Intel and NVIDIA. This could affect how much of the market they own, but also their prices for products. Economic doubts, fights over trade, and problems with supply chains and processors’ stability can harm AMD’s international business (BombeFR, 2022).

NVIDIA and AMD Financial performances analysis

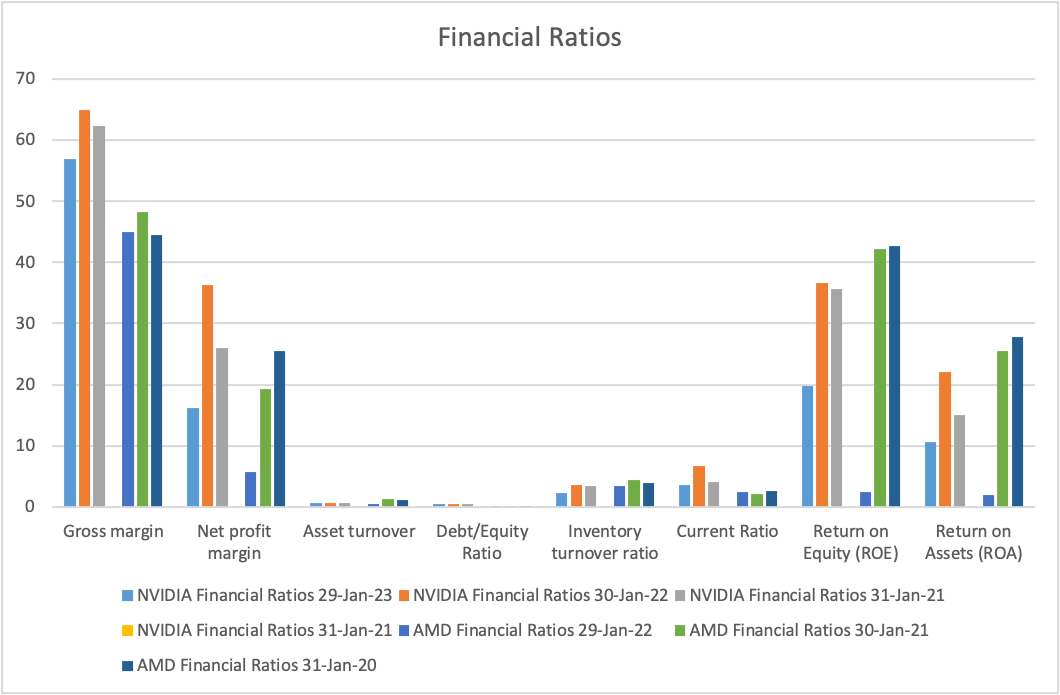

Figure 1: Graphical representation of financial ratios for both NVIDIA and AMD

Liquidity and Financing Ratios

Current Ratio

NVIDIA’s current ratio shows how well it can pay off short-term bills with its present resources. The company has a rising trend (Macrotrends, 2023). AMD’s financial situation has been getting better over time, even though it isn’t as good as NVIDIA’s, meaning it can now pay its short-term debts more easily than before.

Debt/Equity Ratio

NVIDIA’s debt/equity ratio has gone up a little. This means they are using more debt to pay for things, but it is still okay to handle. AMD’s careful handling of finances can be seen in its low ratio between debt and equity, showing it doesn’t rely much on borrowing from outside sources.

Activity Ratios

Inventory Turnover Ratio

NVIDIA’s changing stock levels might be due to shifts in production times. Less stock might mean better management of goods. AMD’s steady inventory turnover shows they are good at managing and selling their stock (Macrotrends, 2022).

Asset Turnover

NVIDIA’s growing ability to use its resources better shows that the company is making more money by using those assets. AMD’s asset turnover rate is fairly steady, which means they use their assets effectively in a constant way.

Profitability Ratios

Gross Margin

NVIDIA’s falling gross margin might be because of different reasons like changing the kind of products they make or higher costs to produce them. AMD shows better performance in making money, meaning they are doing a better job managing costs, maybe because of improved production methods.

Net Profit Margin

NVIDIA’s strong profit margin shows the firm can change money into gains even with a small drop. AMD’s steady money gain shows a good profit, but it saw a drop in 2023.

Investor Ratios

Return on Equity (ROE)

NVIDIA’s ROE was getting better, but it went down in 2023. However, the company still makes good money for people who own shares. AMD’s ROE has been changing, getting really high, but it showed a big drop in 2023.

Return on Assets (ROA)

NVIDIA’s ROA shows that the firm makes good money from its stuff, even if it dropped a bit in 2023. AMD’s ROA dropped, and this might mean problems with how they use their assets, possibly because of changes in the industry.

Overall, both NVIDIA and AMD have their financial points, but NVIDIA proves to be reliable in using resources well. It also shows good returns for investors. On the other side, AMD shows that it makes good profits and gives good returns to investors. However, these profits often go up or down quite a lot, which is alarming. All these differences between both companies might be because of the way they work and where they stand in the market.

References

BombeFR. (2022, 12 08). AMD EXPO stability Issues Ryzen 7000. Retrieved from AMD community: https://community.amd.com/t5/processors/amd-expo-stability-issues-ryzen-7000/td-p/564205

Cheng, E. (2023, November 10). Nvidia will reportedly sell new chips to China that still meet U.S. rules. Retrieved from CNBC: https://www.cnbc.com/2023/11/10/nvidia-will-reportedly-sell-new-chips-to-china-that-still-meet-us-rules.html

Leswing, K. (2023, January 31). Why AMD is faring much better than Intel in the same tough economy. Retrieved from CNBC: https://www.cnbc.com/2023/01/31/why-amd-is-faring-much-better-than-intel-in-the-same-tough-economy.html

Macrotrends. (2022). AMD Financial Ratios for Analysis 2009-2022. Retrieved from macro trends: https://www.macrotrends.net/stocks/charts/AMD/amd/financial-ratios

Macrotrends. (2023). NVIDIA Financial Ratios for Analysis 2009-2023. Retrieved from NVDA: https://www.macrotrends.net/stocks/charts/NVDA/nvidia/financial-ratios

NVIDIA Corporation. (2023). 2023 NVIDIA Corporation Annual Review; form 10-K. NVIDIA Corporation. Retrieved from https://s201.q4cdn.com/141608511/files/doc_financials/2023/ar/2023-Annual-Report-1.pdf

SEC. (2021). Advanced Micro Devices, INC. Washington, D.C.: sec.gov. Retrieved from https://www.sec.gov/ix?doc=/Archives/edgar/data/2488/000000248822000016/amd-20211225.htm

SEC. (2022). Advanced Micro Devices, INC. form 10-K. Washington, D.C.: sec.gov. Retrieved from https://www.sec.gov/ix?doc=/Archives/edgar/data/2488/000000248823000047/amd-20221231.htm

write

write