Introduction

Last year, Alaska state governor, Mike Dunleavy, proposed a budget for the 2022 fiscal year that aimed to stabilize and strengthen the state’s economy following the adverse effects of the global pandemic that had affected virtually all aspects of Alaskan’s lives. Among the areas that the budget focused on include protecting Alaskan’s health and safety, with the focus being restoring the state’s residents to work and normalcy and infrastructural investments in public transportation to lay the foundation for creating jobs. Many of Alaska’s major challenges in the previous fiscal year resulted from the pandemic. Oil revenue declined significantly as the Alaska North Slope crude tumbled and the generated tax revenue failed to meet the projected record. Alaska’s fiscal year currently stands at $700 million less than what was projected at a time like this last year, necessitating strategic measures to balance the budget (Andreassen, 2021). Hence, this report provides informative proposals to help implement Alaska State’s budget for the current fiscal year, considering the current fiscal position and the longer 10-year plan.

Revenue Assumptions

As per the statutory requirement, Governor Mike Dunleavy has already published a 10-year fiscal outlook balancing the state expenditure and revenue sources while guaranteeing the state’s economic security and, at the same time, providing essential services to the citizens. The 2024 budget focuses on strategic investments for the public sector and portrays the governor’s vision for the state (Andreassen, 2021). However, amid making predictions for the state’s source of revenue, it is important to note that the past several years have shown volatile oil prices, creating a significant level of uncertainty (Townsend, 2021). The administration seeks to attain $3.4 billion for the fiscal year 2024, based on a price forecast of $81 per barrel for 503,700 daily.

One of the most significant state revenue sources is the Permanent Fund earnings reserve account, also known as a percentage of market value (POMV draw. Senate Bill 26, which the Trump Administration passed in 2018, provided the statutory framework allowing states to draw up to 5% of the average value of the past five years in the Permanent Fund (WARD & BRIDGE, 2019). Hence, Alaska’s Fund draw for FY2024 is $3.53 billion from the allowance.

10-Year Fiscal Outlook

The following tables present the state’s projected expenditure and revenue sources for ten years, from 2023 to 2033 (OFFICE OF GOVERNOR MIKE DUNLEAVY, 2022).

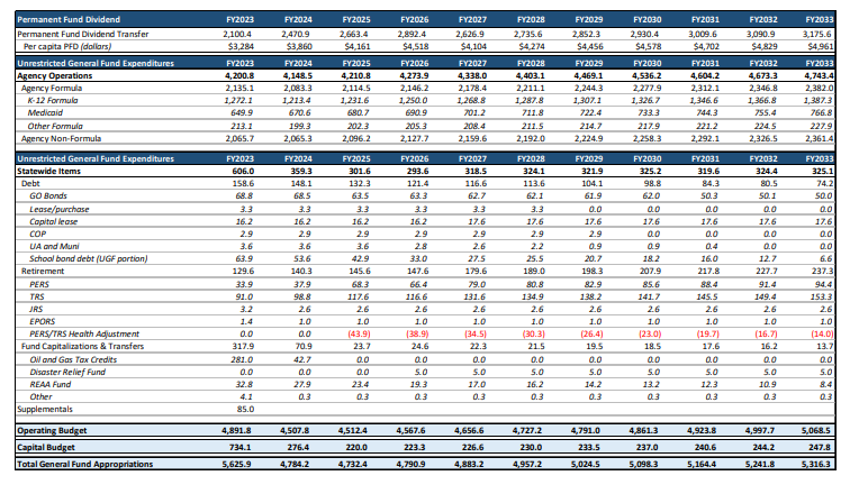

Table 1: Expenditure

The data shows that Alaska had to make changes where more funds were used to fund the healthcare system. The operating budget has been increasing in state departments that are more critical such as disaster relief funds (OFFICE OF GOVERNOR MIKE DUNLEAVY, 2022). The funds help the state manage financial emergencies when they emerge (Andreassen, 2021). The expenditure is organized to ensure the state can spend its resources effectively to ensure the resources that the state has meet the expenditure. The expenditure is based on the projected revenue that the state aims to raise during the financial year.

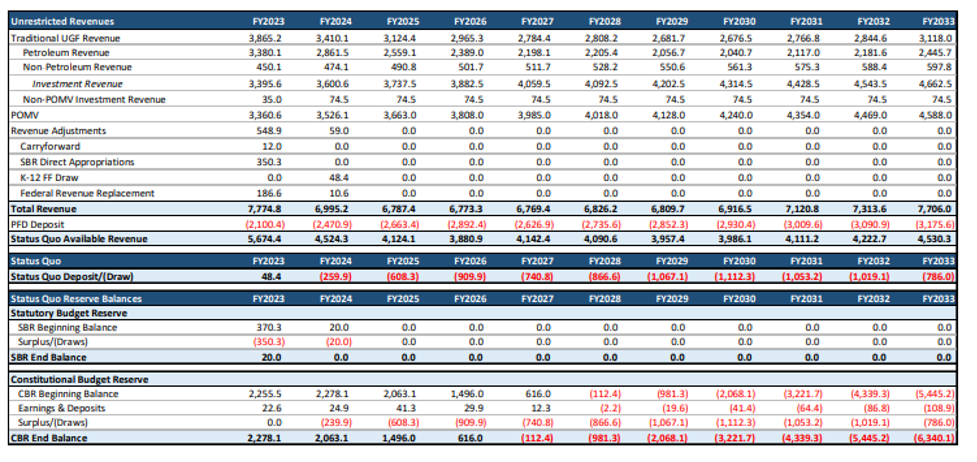

Table 2: Revenue Sources (Including Status Quo Revenues)

The table’s projections solely use savings to balance the state’s fiscal position (OFFICE OF GOVERNOR MIKE DUNLEAVY, 2022).

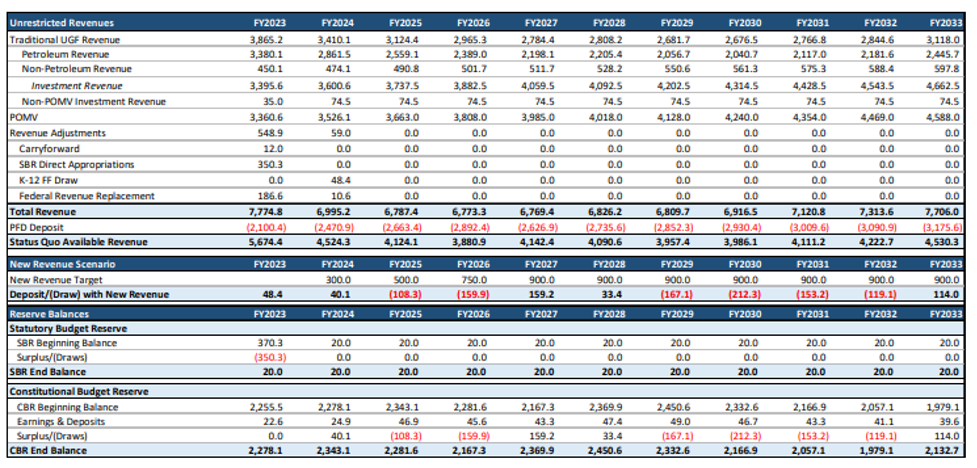

Table 3: Revenue Sources (New Target)

By implementing the new revenues all through to the fiscal year 2027, the projections bring balance to Alaska’s fiscal structure to ensure stability throughout the projected period. The state aims to increase its revenue through new tax interventions that will enable it to meet all its financial needs (OFFICE OF GOVERNOR MIKE DUNLEAVY, 2022). The revenues will be generated in areas with great potential to grow based on growth projections over the years (Townsend, 2021). The Alaska government has invested resources in rapidly growing areas, thus increasing the tax base. The budget process should adopt a long-term perspective beyond a single fiscal year. Taking into consideration the state’s strategic goals, economic forecasts, and anticipated challenges, this perspective will enable the government to develop sustainable budgets that address the long-term needs of Alaska and its citizens. Multi-year planning ensures consistency, stability, and greater alignment with the state’s overall vision.

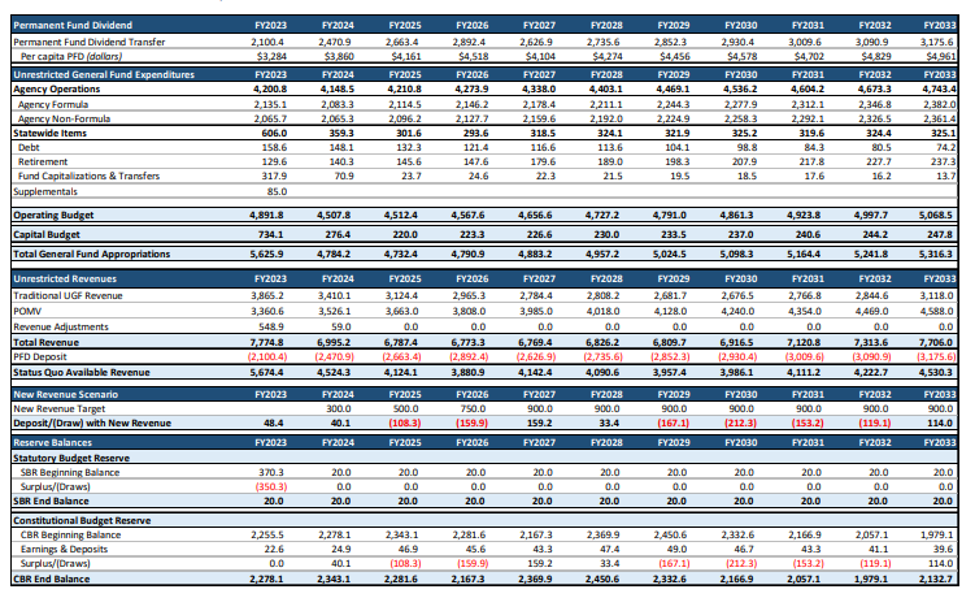

10-Year Summary

(OFFICE OF GOVERNOR MIKE DUNLEAVY, 2022)

Public participation is ideal for the successful implementation of any state project as it provides avenues for the creation of awareness on the various aspects of the project and encourages its support. Likewise, public interaction will be essential in both the creation of awareness of the state’s budget and its implementation (Andreassen, 2021). Many of the state’s projected sources of revenue require active participation by the state residents, hence the need for their inclusion. For instance, revenue sources such as savings from pension systems provide the state government with the necessary funds to keep the economy running while at the same time building the necessary infrastructure for the creation of more jobs (Seifert et al., 2013). In such instances, the resident’s participation in the pension programs is essential in securing their future, but its successful implementation requires the full participation of every citizen. Ultimately, Alaska requires extra funding to balance its fiscal year, and many of the increased revenue sources demand higher taxation of the citizens and businesses. Hence, the successful implementation of the tax programs will require public participation, hence the need for their inclusion in the budgeting process.

Assessing Participation in the Budget Process

One could identify several components when assessing the presence and effectiveness of any public participation in the budgeting process (Andreassen, 2021). Such components include the existence of a participatory mechanism in any stage of the budget process, such as public expenditure tracking surveys, the inclusivity of the participatory mechanism, the extent of the mechanism’s formal institutionalization, the adequacy of the resources allocated to the citizens and civil society stakeholders, the intensity of the deliberations, and the extent to which the process loops back to the participants by informing them on how their views influenced the decision-making process (Pino, 2013).

One of the main benefits of public participation in the budget decision-making process is that it guarantees openness and transparency in the process. Effective participation is marked by the presence of legal frameworks through which legislature or civil society members can express their viewpoints on the budgeting process and gain consideration (Townsend, 2021). While the presence of legal frameworks provides a broad assessment methodology for the public’s participation in the budget process, there are other tools that would be more effective at assessing the participation and providing a more detailed assessment of the same (Townsend, 2021).

IBP’s Open Budget Survey

The IBP’s pen Budget Survey is an effective method to assess the extent of public participation in the budgeting process and its effectiveness in the process. The methodology would be effective in the Alaska budgeting process as it would provide insights into the level of transparency in the process and the availability of the budget information to the public (Pino, 2013). The IBP Open Budget Survey has been effective in the past, having successfully assessed the level of public participation in other countries, hence its viability for the Alaska state budgeting process (Seifert et al., 2013). Using the methodology, the researchers would set the survey questions with the intention of identifying whether the budgeting process considered the public’s voice, whether the government shared the feedback it received and its application in the decision-making process, and whether the process generally embedded participation in the budget process, thereby allowing input into the process.

The improved budget process for the State of Alaska should align with its fiscal year, commencing on the first day of the fiscal year. This annual cycle will enable better planning, timely execution, and effective management of the state’s financial resources (Seifert et al., 2013). By adhering to a consistent timeline, stakeholders will have clear expectations and can prepare the necessary information and data for budget development.

V-Dem Indicators

Public participation is a sign of democracy, as it guarantees that everyone’s voice is heard and included in the decision-making processes. The V-Dem indicators allow researchers to test public participation in any democratic process by measuring performance against an established range of democratic principles (Coppedge, 2016). While assessing the level of public interaction in the Alaska budgeting process, right from the awareness creation stage to the more active participatory stages in the decision-making processes, the V-Dem indicators will provide an effective tool for the assessment process.

Improving the annual budget process for the State of Alaska requires a systematic and comprehensive approach. The state can enhance transparency, efficiency, and effectiveness in budget development by following the annotated process improvement plan presented in this essay. Regular measurement, assessment, and iteration will ensure that the budget process remains responsive to the state’s strategic goals and development.

References

Andreassen, N. (2021, November 3). Increased revenues are bringing Alaska’s budget back to baseline. Anchorage Daily News. https://www.adn.com/opinions/2021/11/02/increased-revenues-are-bringing-alaskas-budget-back-to-baseline/#:~:text=It%20means%20that%20the%20state%20can%20inflation-adjust%20its,and%20matching%20grants%20for%20water%20and%20sewer%20projects.

Brooks, J. (2022, February 28). Expecting an influx of oil money, Alaska lawmakers say they’re interested in saving for later. Yahoo! News. https://news.yahoo.com/expecting-influx-oil-money-alaska-230100224.html?guccounter=1&guce_referrer=aHR0cHM6Ly93d3cuYmluZy5jb20v&guce_referrer_sig=AQAAABvgEam9-6RFxPxFN5cEkWG92muOnkYnZ9tDAPUfxlSXqp4CWo1JlUz_nZ9_wDI2z7PnznnlC5miiE9_MixdLAzLYo8XBehxQaSis7ZOAyohvz0rf4Ed1OVvgMCTiY4JOfblEe51tZljBQH2gOMxWsbRmnRSaO57HnY9MfxSbEuW

Coppedge, M., Lindberg, S., Skaaning, S. E., & Teorell, J. (2016). Measuring high level democratic principles using the V-Dem data. International Political Science Review, 37(5), 580-593.

OFFICE OF GOVERNOR MIKE DUNLEAVY. (2022). (rep.). FY2024 Budget Overview and 10‐Year Plan (pp. 1–10).

Pino, H. (2013). The Impact of the International Budget Partnership’s Open Budget Survey and Its Partner Institutions’ Advocacy on Budget Transparency in Honduras. International Budget Partnership Impact Case Study.

Seifert, J., Carlitz, R., & Mondo, E. (2013). The Open Budget Index (OBI) as a comparative statistical tool. Journal of Comparative Policy Analysis: Research and Practice, 15(1), 87-101.

Townsend, Q. (2021, May 10). Alaska Policy Forum. It’s Time for a Responsible Alaska Budget. https://alaskapolicyforum.org/2021/05/its-time-for-a-responsible-alaska-budget/

WARD, B., & BRIDGE, B. (2019). BUREAU OF BUSINESS AND ECONOMIC RESEARCH.

write

write