Introduction

The credit rating vested within major syndicates is a critical parameter of consideration when undertaking funding activities granted in a firm. Moreover, the disposition stems from the need to hold a subtler fiscal position where the firm’s leverage imbalance is essential. The proportionate level of external financing needs to be reviewed before allocating any form of debt. The debt burden undertaken by the firm will often be anchored on the brand equity and precariously determine the forecasted profitability index. A synopsis of two articles authored by Rauh J. & Sufi and Mauer, D attempt to factor in detail the role of corporate debt. Rauh points to how the current debt burden will often affect the net yield output accrued. In addition, Mauer further capitalizes on the role of brand equity captured by the existing debt burden. Intermittent parameters are, however, in greater detail on each set review as minted out below.

Rauh, J. & Sufi, A. (2010). “Capital Structure and Debt Structure,” Review of Financial Studies, Society for Financial Studies, vol. 23(12), pages 4242-4280, December.

https://ideas.repec.org/a/oup/rfinst/v23y2010i12p4242-4280.html

Economic Question Summary

The set case study explores the economic question of how the influence of capital may hold on the underlying performance of the firm. It is pertinent to note that capital composition is anchored on debt and equity funding. The article exposes the cost of capital as the core driving factor of returns hence its performance. A higher equity stake may constrain shareholders, resulting in low ROE. The move fosters the need to adopt external funding in the form of debt. The financing option allows for a subtler level of turnover if the debt burden is coherently low due low-interest rate, which is the cost of capital.

Data Details

A fiscal review of the adopted data of the set case article highlights various factors. The data adopted under the ascribed study was from controlled experiment data vested under three major databases, including Reuters LPC Deals, Mergent’s Fixed Income Securities Database, and Thompson’s SDC Platinum. The set data is awarded in field experiments where multivariate data is captured dependent on enlisted trending patterns across the set databases. The dataset represents the existing performance of various debts vested across different industries. The data reflected under the enlisted databases comprises time series and cross-sectional data, respectively. Cross-sectional data is majorly anchored on selected periodic observations—for example, fixed interest securities interest rates over a five period. However, time series data reflect the trending patterns of the rates over the past decade (Rauh, 2010). The unit of observation is, however, both the firm and the industry. Individual firms fixed interest securities are reflected with the aggregate performance anchored on the niche industry. The duration of the selected periods majorly arrives on the last twenty fiscal trading periods with the more accessible databases as mentioned above. However, the control experiment was mainly undertaken for ten years of budgetary observations. The number of observations was relatively selected under clustering sampling due to the observations unit being anchored on the firm or industry.

Policy Relevance

The selected policy is relevant due to the critical turnover under which the net output is anchored (Le, 2017). The credibility of the observation is hence impertinent to ensure the yield margin is dependable.

Estimation Methods

The simulation was coherently adopted as the database was relatively bulk, with trending patterns relatively invariable across the period. Moreover, future trends could be asserted through simulated output.

The critical results anchored under the paper point that adopting debts as a funding option is a vital variability parameter that may need to be considered. An optimal debt mix would reduce the cost of capital, allowing the firm to accrue a higher margin and maintain a stable liquidity index. The move is reflected in firms’ performance, signifying the debt’s pivotal role in the firm’s performance.

Policy Implications and Relevance

The enlisted results’ policy implications imply that trading activities need to be readjusted to factor in the debt attested to the firm. Fiscal policies may need or inculcate debt funding to ensure more turnover is attainable and sustainable. The adopted policies ensure that cost of capital is relatively low and spread over a long duration to provide a more profitable turnover.

Article Relevance

The paper responds to the initial research question as the underlying observations offer the correlation between external debt funding and its impact on the firm’s financial performance. The trending debt and critical turnover patterns may therefore be reflected under the set debt policy indices.

Strengths

The various internal strengths include the role of debt that may need to be procured to deter the firm from being exposed to adverse leverage disposition. The cost of capital presents a more feasible trading outcome to match the yield margin on demand.

Weaknesses

The weaknesses are, however, anchored on the observational outcome that changes in interest rates due to inflationary forces are not reflected. Therefore, the disposition may not offer the firm’s actual financial position and performance, reducing the reliability level.

Mauer, D. C., Villatoro, N., & Zhang, Y. (2022). Brand equity and corporate debt structure. Journal of Business Finance & Accounting, 49(7–8), 1077–1112. https://ideas.repec.org/a/bla/jbfnac/v49y2022i7-8p1077-1112.html

Economic Question Summary

The predetermined case study investigates the economic query of how the firm’s underlying corporate debt structure may be impacted by brand equity. Recognizing that brand equity is the foundation of capital composition is vital. Firms holding substantial brand equity have been enlisted to present a subtler level of trading credit rating. The article reveals that brand equity is the core determinant of returns and corporate debt structure.

Data Details

The underlying data is mainly observational data, where multivariate analysis was adopted to reflect the existing trademarks, including the United States Patent and Trademark Office and the Centre for Research and Security Prices. The listed databases reflect data mostly comprised of cross-sectional and time series data. The majority of cross-sectional data is based on chosen frequent observations. For instance, lending rates on fixed-interest securities over five years. However, time series data displays the rates’ trending trends over the last ten years. But the firm and the industry together make up the unit of observation. Fixed-income securities from particular companies are shown along with overall results based on a specific speciality market.

The last thirty fiscal trading periods using the more convenient databases, as mentioned earlier, serve as the primary foundation for the duration of the defined sampling. The control experiment was primarily conducted for ten years of financial observations. Due to the observations unit being anchored on the firm or industry, the number of observations was substantially determined under clustered selection.

Policy Relevance

Due to the crucial transition that the net production is anchored under, the chosen policy is significant. Therefore, it is vital to consider the observation’s legitimacy to ensure that the return margin may be trusted.

Estimation Methods

The study also uses content analysis to examine the relationship between brand equity and firms’ risk and performance. Additionally, the study utilizes firms’ stock of trademarks and the corresponding ages to compute the firms’ proxies for brand equity. The article uses panel regression models to achieve these goals, which help determine the inverse relationship between brand equity and leverage while evaluating the relationship between brand equity and debt maturity (Mauer, 2022). The firms also use the 1996 Federal Trademark Dilution Act (FTDA) to develop credible exogenous variations in the trademark values to determine the causality between brand equity and leverage relationships.

Key Results

Given the study estimation models, the research findings posit that firms with more brand equity have lower equity and asset volatility and inclined cash flows. Nevertheless, despite some of these firms having high brand equity in the market, there is a notable desire to operate on lower debt levels. Ideally, the study also posits that brand equity level –high or low, does not influence debt maturity in the firm. According to the 1996 FTDA, the study proves that the relationship between brand equity and leverage is causal. In the long run, this results in an exogenous value increase for big brands. In this context, the increase in the causal relationship between brand equity and leverage results in a significant decline in the leverage ratios for these big brands in the market; this trend is relatively lower for firms with higher business risks and common information asymmetry. This trend tends to increase among firms operating with collateralized trademarks.

Policy Implications and Relevance

The study aims to investigate brand equity and its relationship with firms’ leverage / corporate debt structures. The study implies an inverse relationship between brand equity and leverage, where big brands tend to operate with low debts. As such, this study informs the financial policymakers on the relationship between brand equity and leverage and profitability levels concerning brand equity while informing on the non-consequential influence of collateralized trademarks on the debt capacity of brand equity.

Article Relevance

The article is crucial to my study topic as it informs more on how well brand equity and leverage can be used to improve firms’ overall performance, including fiscally.

Strengths

The authors in this article have utilized exceptional academic writing skills by structuring the paper from the introduction to the conclusion part. Additionally, the authors have consulted preceding related and relevant literature to build on their arguments, making the study more academically sound and authentic. The authors also utilized hypotheses to partially achieve the research objective with a followed-up explicit explanation of the estimation methods and results.

Weaknesses

One of the key weaknesses observed in the article is the use of old literature works in the study. Given that economic trends constantly change, the authors should have utilized more recent studies to keep the arguments more relevant to 21st-century economic trends. Ideally, the study should have been more region and industry oriented to provide more robust recommendations for firms in the same industry or area, for example, the food industry in China or Asia.

Ozkan, A. 2001, “Determinants of Capital Structure and Adjustment to Long Run target: Evidence from UK Company Panel Data,” Journal of Business Finance andAccounting, 28, pp.175-198.

https://ideas.repec.org/a/bla/jbfnac/v28y2001i1-2p175-198.html

Economic Question Summary

In this article, Ozkan 2001 aims to determine the empirical determinants of the target capital structure of the firm and the processes involved in the adjustment towards these targets. To achieve these goals, the author focuses on the dynamics of capital structure decisions and the implicit nature of the targeted capital market adjustment process. As such, the article estimates the dynamic capital structure model used to identify features of corporate borrowing behaviours in the industry, which are identified as follows; in the long run, firms have an optimal target debt ratio, and there is an adjustment process that takes place resulting in a lag in adapting to shifts in the optimal target debt ratio.

Data Details

This article utilizes a partial adjustment model to accurately capture data and characterize firms’ financial behaviours as a partial adjustment to the long-term target debt ratio, which translates to using panel data in the study. The author also utilizes the general method of moments (GMM) to estimate the dynamic model consistently from the short and unbalanced panel adopted for the study. These approaches are adopted to collect data from UK companies which helps provide in-depth insights into the ultimate research objective. Using panel data and GMM, the study was able to include firm-specific effects and time dummies, which could have been a challenge if cross-sectional and time-series data were used. More precisely, the study focused on financial sector firms, including banks, insurance companies, and utility companies, such as gas and telephone companies. The study focused on 12 years (1984-1996), resulting in a total of 390 firms as a sample and 4132 observations.

Policy Relevance

The key focus of this article is to provide in-depth insights relating to the empirical determinants of the target capital structure of the firms and other related target adjustment processes (Ozkan, 2001). As such, the study informs on firms’ fiscal and investment policies, particularly concerning boosting financial performance and meeting investor needs in the firm.

Estimation Methods

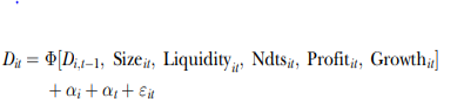

Panel data adopted for the study was utilized by incorporating the dynamic effects and the controlling observable firm-specific effects and firm-in-varied time-specific effects. The author controlled the firm-specific impact by estimating the dynamic capital model from a different perspective rather than a level approach. On the other hand, time-specific effects in the study were controlled by including dummies in the estimated models. Through this approach, the author guaranteed more robust, stable results while holding endogeneity in the survey in the study. In this, the following model was used.

Key Results

Study results suggest that firms operate with a target leverage ratio, and in the long run, these firms adjust to these ratios relatively fast. As such, the cost of missing out on the target debt ratios and the adjustment costs to these target ratios are crucial to the firm. Moreover, profitability closely relates to improper firms borrowing decisions even though there is a positive link between profitability and the debt ratio. On the other hand, a firm’s non-debt tax shield and growth opportunities are observed to influence the eventual leverage decisions.

Policy Implications

The study provides robust implications relating to the theorized argument that there is an inverse relationship between non-debt tax shields and a firm’s borrowing ratios. As such, the study shows how profitability, liquidity and growth opportunities impart pressure on firms’ capital.

Article Relevance and Implications

This article informs more on a firm’s target capital structure and the adjustment process’s role towards these targets. As such, this article provides crucial information on my research topic by informing on how firms’ capital structures influence firms’ performance and the responsiveness of firms when these target capital structure change.

Strengths

This article has systematically organized the ideas from the beginning to the end, including the in-depth analysis of past empirical evidence relating to the study focus. Ideally, the author has established an explicit research objective that has been pursued throughout the study, with eventual data analysis to outline the research findings. The author has used a strong command of standard-level language suitable for all readers.

Weaknesses

The article has not utilized numerous independent variables. Additionally, the author’s presentation of results did not include graphical representations, which could have served best for the reader’s easier comprehension.

Conclusion

A summary review of the ascribed trading activities points out that debt is the fundamental driving factor of the existing capital structure and the underlying performance of the firm. Each of the presented drafted articles has exposed the trending activities that the debt will affect dependent on the enlisted observations. The implication is that sound debt mitigation accompanied by strategic policies may yield sustainable long-dated out for the firm. The debt burden significantly influences the profitability of the firm and its capital structure. Despite the enlisted conclusions, a research gap exists relative to other external factors that may affect the prevailing capital structure. The economies of scale, corporate governance structure and other emergent business opportunities are crucial in assessing debt and equity funding. The move would allow for a comprehensive outlook of the existing market threshold, hence adopting more adept decisions. Firms will therefore accrue more positive and gradually accruing turnover.

References

Le, T. P. V., & Phan, T. B. N. (2017). Capital structure and firm performance: Empirical evidence from a small transition country. Research in International Business and Finance, 42, 710–726. https://doi.org/10.1016/j.ribaf.2017.07.012

Mauer, D. C., Villatoro, N., & Zhang, Y. (2022). Brand equity and corporate debt structure. Journal of Business Finance & Accounting, 49(7–8), 1077–1112. https://ideas.repec.org/a/bla/jbfnac/v49y2022i7-8p1077-1112.html

Mubeen, R., Han, D., Abbas, J., & Hussain, I. (2020). The effects of market competition, capital structure, and CEO duality on firm performance: A mediation analysis incorporating the gmm model technique. Sustainability, 12(8), 1–18. https://ideas.repec.org//a/gam/jsusta/v12y2020i8p3480-d349886.html

Ozkan, A. (2001). Determinants of capital structure and adjustment to long run target: Evidence from uk company panel data. Journal of Business Finance & Accounting, 28(1‐2), 175–198. https://ideas.repec.org/a/bla/jbfnac/v28y2001i1-2p175-198.html

Rauh, J. D., & Sufi, A. (2010). Capital structure and debt structure. Review of Financial Studies, 23(12), 4242–4280. https://ideas.repec.org/a/oup/rfinst/v23y2010i12p4242-4280.html

write

write