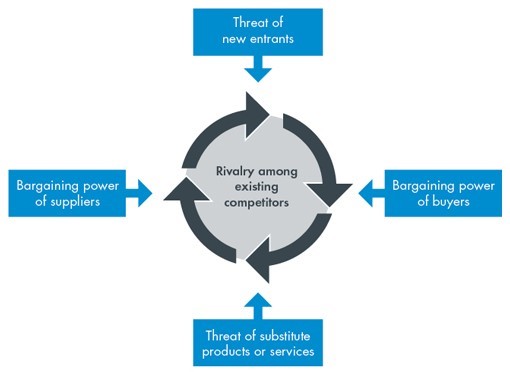

The Porter’s five forces is a simple structure developed to help business organizations and industries appraise and evaluate their strength and position. The Porter’s five forces were given the name based on the concept that five forces can determine industries’ competitive power and enticement. These forces help to know where the strength of an enterprise lies. This is very important both in understanding the power of an organization’s present competitive position and the power an industry is likely to move into. The strategists use this simple structure of five forces to know if the new item or services are likely to bring profit. A good understanding of the strength of an organization will also help to understand areas of strength, boost weakness, and avoid any mistakes that might happen. In my research, I have used two different companies: The food industry and telecommunication companies in Kenya, to understand Porter’s five forces.

These forces or factors that determine the company’s competitive advantage or industry, like the food industry in Iran and telecommunication in Kenya, are determined using Porter’s five forces. This model includes five axes possibility chipping in of a new competitor, competition between the competitors, bargaining power of the buyers, threats on the appearance of the substitute product, and the companies’ bargaining power in buying of raw materials. According to research from the internet and articles, direct interviews with many food industries in Iran, Porter’s rule displayed an essential role in determining the competitiveness of this food industry. (Eskandari, et al., 2015) Competition between two competing companies is the most critical determinant for the company or industry that can be used to generate opportunities in the firm and plays good performance compared to the competitor in the competing field.

Despite implementing Porter’s five forces, the essential factors that led to the success of food countries are a good quality and reasonable prices of their items, use of modern technology in production and management, having skilled and expert managers, strong investors, and also support from the government. These factors also boost on the profitability of the food industry in Iran and many countries in general.

Bargaining power of the buyers

The strong buyers who are on the other side of the strong suppliers. These buyers can achieve more excellent value by being pressured to lower the price, request better quality, or increase their services in conjunction with other actors. If the buyers are strong, they will have high bargaining power, mostly when they are price sensitive. This factor will lower the company’s profitability, in the part of bargaining power of suppliers. In a competitive industry, both the buyer and supplier possess bargaining power. This ability can either increase or decrease the quality of items purchased, and services will impact the industry. Strong suppliers that involve labour supply will boost the industry’s profitability.

Threats of substitute goods or services

The interest in sometimes might look different in nature, but they serve the same purpose as the substitute goods that attract the customer’s satisfaction. According to Porter, the substitute products will limit the potential importance to the company. This will increase the price of the product and determine its profitability. In the food area, the products are diverse, and price differences will alternate the purchasing strength of the buyers before their income or social class. One of the forces is the threat of new entrants. New intruders into the industry will develop the unique capacity for their industry, and they will gain market share. This will impact on the cost, the price. They can also expound their existing services and use their profit to cause competition. This will make them to gain market share and gain many customers. This will make the old industry to lose its customers, and its profitability will definitely fall.

Rivalry among existing competitors

The competitive strength defines the strength of domestic and international competition. When the match between domestic firms is saturated, there will be many and driving impacts for the internationalization of industries, and there will be the concentration of local markets. Competition is among many different sectors, and this competition will be determined by the industry’s competitiveness (Guo, et al.,.2021, December). For example, the match between Coca-Cola and Pepsi brands has higher sales than other competitors because they are famous globally. Competition in price is not exceptionally stable and in any way will affect the entire industry in terms of its profit

Competition between competitors

The telecommunication company in Kenya is a profitable competitive company with positive influences after implementing on Porter’s five forces. This research was done in Kenya to determine how Porter’s five cases influence the competitive advantages of the telecommunication company in Kenya. In the study, Telecommunication in Kenya has dramatically improved its performance just after implementing Porter’s five forces. The presence of many competing firms in Kenya brought threats of other entrants in telecommunication firms. Due to this entrance of competing firms lowered the profitability of the telecommunication industry in Kenya because of unhealthy competition.

Bargaining power of suppliers

In addition, despite the suppliers in the telecommunication industry creating associations to talk about the price with providers, the bargaining power of the buyers was also high. The company had to plan on how to retain customers to avoid going from one company to the other. The company also spent a lot of money and energy trying to protect their customers so that they can stick themselves to using their mobile network. Comparably, locating on the intensity of competitiveness indicates that to plan and win in this competitive firm, differentiation in the product, innovation processes, and differentiation in the product innovation in the development and technology are the plan that the industries must use to move ahead. Investigating the threat on product substitute shoes that the company has many substitutes that will impact the profitability of these industries.

The food manufacturing firms are among the most performing industries in Iran. The market structure, performance interaction in the food and related promising manufacturing industries. The research investigated whether the structural design of initiatives can change their performance over time, various measures of profit and industry price cost margins to determine profit performance in Iran. In sometimes back, most Iran industries in the food industry sector were using traditional performance structure (SCP), which entailed three equations; the structure (S), conduct (c) and performance(P). According to Welles, each variable will influence the other variable as time goes. Also, the industry’s structure is affected by straggled conduct, and both straggled behaviour and the present performance. The old behaviours constituted a hindrance to the entry.

Furthermore, when the past and the current performance is better, the structure will also be more concentrated (Gholami, et al.,.2015). The past structure performance will affect the present conduct. In essence , the more profit reaped in the past, the more the promotion outlays. The factors determining the performance will remain contemporary as the payoff is calculated in the current time. The structure of the food industries in Iran was improved, and this change improved the performance and profitability of the drives. This increased the profitability of the enterprises. Also, the production and supply structure in Coca Cola company was changed. Due to this change, the company ventured and expanded globally, increasing the number of consumers, the expansion of products produced to increase the company’s profitability.

In my study research, Porter’s five forces structure actually changes the telecommunication network’s performance in Kenya. Besides the significant advantages, the threats of new competing firms in Kenya are due to the availability of many competing firms. These firms offer the same item or services such as money transfer tasks, handheld gadgets, airtime services, and accessories. The diagrams below the reference help to understand how Porter’s five case forces bring profitability to those two different industries.

References

Eskandari, M. J., Miri, M., Gholami, S., & Nia, H. R. S. (2015). Factors Affecting the Competitiveness of the Food Industry By Using Porters Five Forces Model Case Study in Hamadan Province, Iran. Journal of Asian Scientific Research, 5(4), 185-197. Retrieved From: https://archive.aessweb.com/index.php/5003/article/view/3719

Guo, X., & Wen, M. (2021, December). Research on Competitive Strategy of Coca-Cola Company. In 2021 3rd International Conference on Economic Management and Cultural Industry (ICEMCI 2021) (pp. 2879-2885). Atlantis Press. Retrieved from: https://www.atlantis-press.com/article/125965872.pdf

Mugo, P. (2020). Porter’s five forces influence competitive advantage in Kenya’s telecommunication industry. European Journal of Business and Strategic Management, 5(2), 30-49. Retrieved from: https://www.iprjb.org/journals/index.php/EJBSM/article/view/1140

Eskandari, M. J., Miri, M., Gholami, S., & Nia, H. R. S. (2015). Factors Affecting the Competitiveness of the Food Industry By Using Porters Five Forces Model Case Study in Hamadan Province, Iran. Journal of Asian Scientific Research, 5(4), 185-197. Retrieved from: https://archive.aessweb.com/index.php/5003/article/view/3719

Appendix

Fig 1. A figure showing the porters five competitive and profitability of telecommunication company.

Fig 2. A figure showing the factors affecting competitiveness and profitability of food industry.

Fig 3. A graph showing porters five forces determining competitive advantage of an industry.

write

write