Introduction

For many countries that are committed to the 2015 Paris Agreement’s climate challenge, 2050 is a key deadline in the race to carbon neutrality. By 2050, the United Kingdom and several other European countries aim to achieve carbon neutrality, or net-zero greenhouse gas emissions (Griffin & Hammond, 2021). To reach this point, investors are considering different ways to create a net-zero economy with a strong focus on the energy sector.

Since the 1750s, 90 fossil fuel companies alone (i.e., those that mine oil, coal, gas, and other natural resources) have been responsible for at least 63% of the industrial carbon dioxide emissions produced (Nasiritousi, 2017, p. 623). Dependence on fossil fuel for energy has resulted in global crises including rapidly rising temperatures and extreme weather (Griffin & Hammond, 2021), which have taken lives around the world. To keep fossil fuel-induced climate change below the official target of 2°C, experts believe that at least one-third of oil and half of gas reserves must remain underground (Nasiritousi, 2017).

In this context, investors have increasingly faced decisions about how to reduce fossil fuel dependence. Two fundamental approaches these sustainable finance, or green finance, investors are using to weaken fossil fuel dependence are divestment and engagement with fossil fuel companies. Like all strategies, each approach has benefits and disadvantages for different stakeholders. In this analysis, data and findings from existing studies are used to argue in favour of divestment as the most effective method of transitioning toward a net-zero economy by 2050. Divestment activities by country, sector, and industry are analysed in this report to highlight where the most significant divestments are being made. Finally, this analysis also suggests how investors should carry out their divestment activities.

Approaches to Reducing Fossil Fuel Dependence

Divestment from Fossil Fuel

Divestment is a strategy that allows investors to reduce the power of individuals, companies, or sectors, typically through the sale of a business or cutting off investment funds (Cambridge Dictionary, 2022). In the past couple of decades, divestment has developed an especially close connotation with the fossil fuel industry. Among finance researchers, fossil fuel divestment is increasingly recognised as a vital strategy in the pursuit of a smooth transition to renewable energy sources (Guo et al., 2022). Many investors who support sustainable finance have chosen to strategically reduce the power of these companies by withdrawing their financial support and/or financing renewable energy projects instead (Halstead et al., 2019).

Benefits of Divestment

Currently, the main barrier to wider renewable energy adoption is that these sources have a higher levelised cost of energy (LCOE) than fossil fuel energy sources (Halstead et al., 2019). This higher LCOE for renewable energy sources, such as solar, water, and wind power, includes the perceived risks of investment. Benefits of fossil fuel divestment are a lower price differential between renewable and non-renewable energy projects. While divestment mainly serves to increase the cost of producing fossil fuel energy, the smaller resulting gap between the costs of financing the two types of projects makes it easier for investors to choose sustainable energy source projects.

In one financial analysis of perceived investor risk, there was no major difference between the risk perceptions of renewable energy (i.e., low carbon) and fossil fuel firms’ projects (Guo et al., 2022). As such, the authors of this study concluded that investors can and should choose to back renewable energy firms. In addition, investors are gradually gaining more financial incentives to divest from fossil fuel companies. Contrary to traditional beliefs, fossil fuel companies’ mutual funds are no longer more profitable than those of renewable energy companies. In fact, European investors’ portfolios have shown to perform better over time as they are rebalanced towards low carbon firms (Guo et al., 2022). This is a significant incentive for investors to choose sustainable finance, both in the short and long terms.

Challenges of Divestment

An obstacle for fossil fuel divestment that has been raised by companies like ExxonMobil is the limited access to renewable energy sources in developing countries. This ‘energy poverty’ issue is framed by such companies as a humanitarian problem (Nasiritousi, 2017, p. 637). While this rhetoric generally serves to protect fossil fuel companies’ interests, it is important to acknowledge the impacts that energy loss can have on underdeveloped communities that still rely on oil, coal, and natural gas. According to researchers, global population growth is driving ongoing demand for fossil fuel energy (Nasiritousi, 2017; Khan et al., 2021). Therefore, it is unrealistic that divestment alone will be able to achieve a net-zero economy in Europe or elsewhere by 2050.

Related to divestment is the threat of misinformation or ‘greenwashing.’ According to the course module on the EU Green Taxonomy, the European Union’s net-zero ‘Green Deal’ target has been complicated by false reports of carbon emission reductions. Banks and hotels alike are guilty of dramatically increasing their carbon footprints in recent years for the sake of profit. Likewise, efforts at divestment have spurred fossil fuel company lobbyists to spend over USD $1 billion on anti-climate action since the Paris Agreement (InfluenceMap, 2016). Such pushback against fossil fuel divestment by established industry leaders is a significant threat to emerging renewable energy firms and sustainable finance investors.

Engagement with Fossil Fuel Companies

Company engagement is another way that investors can reduce fossil fuel dependence. This approach can include discussions with members of senior management within fossil fuel companies and raising awareness through targeted campaigns. More recently, researchers have used these strategies to gather insights on the fossil fuel companies’ perceptions of their own activities and how they contribute to climate change (Nasiritousi, 2017).

Benefits of Engagement

Benefits of this approach can include the creation of a cooperative regional or global environment and understanding what shared values companies and investors hold regarding the state of the global environment. By now, most fossil fuel companies are aware of the environmental damage they cause, as well as some of the side effects of these changes. Within the European gas and oil company community, many representatives agree that Europe is currently need of affordable, secure energy. Along these lines, companies such as BP are calling for competitive and innovative energy solutions, though not necessarily low-carbon ones (Nasiritousi, 2017).

In addition, engagement with fossil fuel companies contributes to a culture of ethics that is necessary to pressure such companies into changing their modes of business. More and more, ethics ‘sells’ because the values and preferences of shareholders and consumers are shifting towards sustainability (Glomsrød & Wei, 2018).

Challenges of Engagement

In contrast, engagement with fossil fuel companies regarding their impact on the climate can be challenging when not all companies take accountability. Oil and gas companies in Europe, for example, have more readily acknowledged their role in climate change than their counterparts in America (Nasiritousi, 2017). U.S. company ExxonMobil is particularly notorious for deflecting responsibility for climate change (Nasiritousi, 2017, p. 630). All these companies continue to assert, however, that their economic interests should be balanced with emission reduction efforts.

Moreover, many fossil fuel companies have denounced programmes like the cap-and-trade system as ineffective. Fossil fuel companies have instead begun to argue that natural gas is a viable alternative fuel since it has lower carbon emissions than oil and coal (Nasiritousi, 2017), in efforts to sway investors. Considering the historic strength of these companies’ vested interests, it remains difficult to reach consensus through negotiation or call on fossil fuel producers to halt their activities. ‘Greenwashing’ is especially prevalent as fossil fuel companies seek more ways to make their businesses appear environmentally friendly to attract more capital (Ritchie & Dowlatabadi, 2015).

Fossil Fuel Divestment Movement

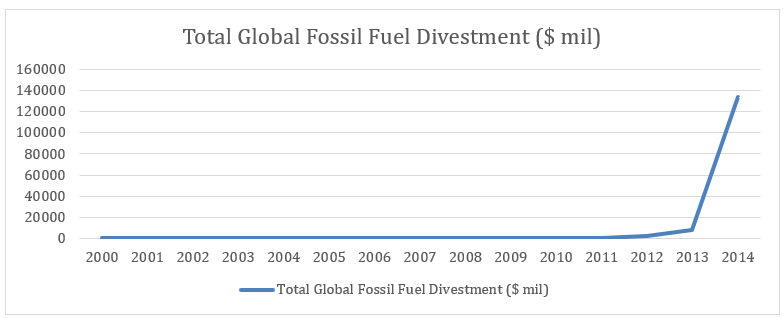

After evaluating the efficacy of both approaches, this section now turns to the fossil fuel divestment movement, particularly as it has unfolded in several countries and institutions between 2000 and 2014. The divestment movement began with activism in the 2010s and evolved into a corporate social responsibility programme that now guides many major investment firms including the Rockefeller Brother Fund (Glomsrød & Wei, 2018). Fossil fuel divestment began gaining support in 2012 and skyrocketed in 2014, as shown in Figure 1 below.

Figure 1

Total Global Fossil Fuel Divestment (USD $ mil)

Note. Data from the course dataset.

To assess the efficacy of divestment, this analysis focuses on which countries and sectors have made the strongest commitments to divesting from fossil fuels. Traditionally, fossil fuel companies have derived their funding from a combination of private and governmental sources including banks. In the United States, financial institutions like Citigroup and the Bank of America previously lent funds to the coal mining industry for projects including strip mining (Glomsrød & Wei, 2018). Government-managed funds, such as Norway’s Pension Fund, have also previously invested hundreds of billions of USD in coal energy production firms’ stocks (Glomsrød & Wei, 2018, p. 6). Until these institutions rebalance their portfolios, significant sums of money will continue to be held in stocks and mutual funds.

Aggregate Divestment

Internationally, the most widely adopted legislation on fossil fuel divestment to date is the Kyoto Protocol. The Protocol put the United Nations Framework Convention on Climate Change into effect to limit greenhouse gas emissions on a country basis. This agreement was established by the United Nations in 1997 and enforced in 2005, with 192 countries signed on in 2022 (UNFCCC, 2022). Although both developed and developing countries have signed onto the agreement, only developed ones have so far committed to reducing their emissions. This is partially because these countries produce significant amounts of pollution. OPEC countries, for instance, hold more than 80% of global oil reserves (Nasiritousi, 2017). In turn, though, developing countries also face growing pressure to reduce their dependence on fossil fuels (Nasiritousi, 2017).

Aside from the Kyoto Protocol, meetings such as the UN Climate Summit of 2014 and the 21st Conference of the Parties (COP21) in Paris in 2015 have further reaffirmed and extended nations’ commitments to sustainable energy investment (Glomsrød & Wei, 2018). International summits such as this have the power to refocus attention on climate-friendly policy as well as strengthen legal protections against fossil fuel companies. Legislation is especially needed to carry out the transition to cleaner energy. By adopting these policies, nations are also divesting from fossil fuel companies.

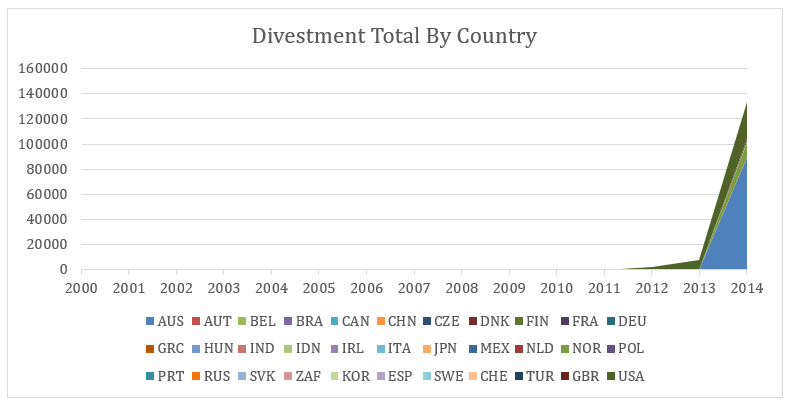

On a regional level, Europe has been identified as the most proactive region in terms of divesting from fossil fuels (Nasiritousi, 2017). Regional contexts are important because there are strong distinctions in culture, business, and investment structure. For comparison, total divestment by country is shown in Figure 2.

Figure 2

Divestment Total by Country

Note. Data from course dataset.

Trends in country-level divestment include significant efforts by Western countries in 2014. Australia made the largest divestment in 2014, followed by the U.S., the U.K., Norway, France, Sweden, Canada, and Switzerland. The U.S. was the earliest to begin divesting, with initial divestment recorded in 2008. Scholars note that fossil fuel divestment is easier for countries with cleaner alternative energy sources to begin with, especially those in Northern Europe. In contrast with other European nations, Norway and Sweden have smaller populations and more established nuclear energy resources (Griffin & Hammond, 2021). These factors are cited as some of the benefits that can help countries shift towards net-zero economies.

Governance activities at the country level include raising public awareness about climate change, adapting to renewable energy sources, and proposing new solutions (Nasiritousi, 2017). These activities can also take place at the institutional level, although they tend to be funded by the government. Overall, the trend has been for countries to increase their divestment year-by-year once they begin. The next section explores institutional divestment, in general and in detail.

Institutional Divestment

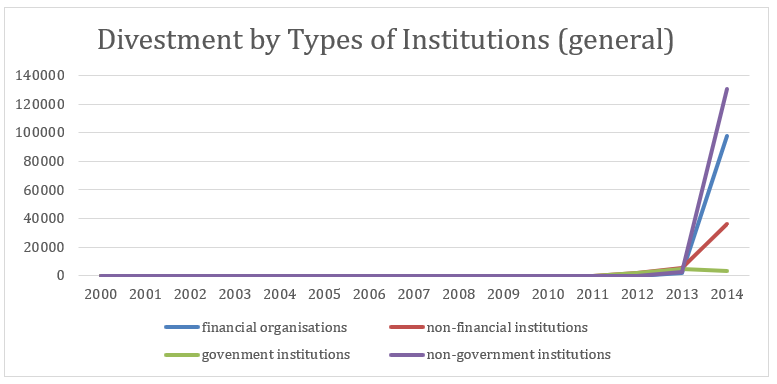

Institutional Divestment by General Sector

Institutional divestment refers to fossil fuel divestment by a range of local-level organisations. In this analysis, these funding sources are separated into four general categories: financial institutions, non-financial institutions, government institutions, and non-government institutions. The first recorded divestment activities occurred in 2008 under non-financial and non-government institutions, with a brief break before 2011. This trend suggests that early divestment occurred as part of the grassroots divestment movement. Government institutions joined in divesting in 2012, and the following year financial institutions followed.

Surprisingly, by 2014 financial institutions were responsible for the largest divestment from fossil fuel energy. This shows that the financial sector has traditionally made the largest investment in fossil fuel companies. These trends are shown in Figure 3 below.

Figure 3

Divestment by Types of Institutions (General)

Note. Data from course dataset.

Scholars of the divestment movement also note that financial institutions have been motivated to divest because of consumer pressure. Fear of negative publicity and attacks on institutions that lend to mining companies have influenced the sector to avoid fossil fuel investments (Ayling & Cunningham, 2015).

Institutional Divestment by Detailed Sector

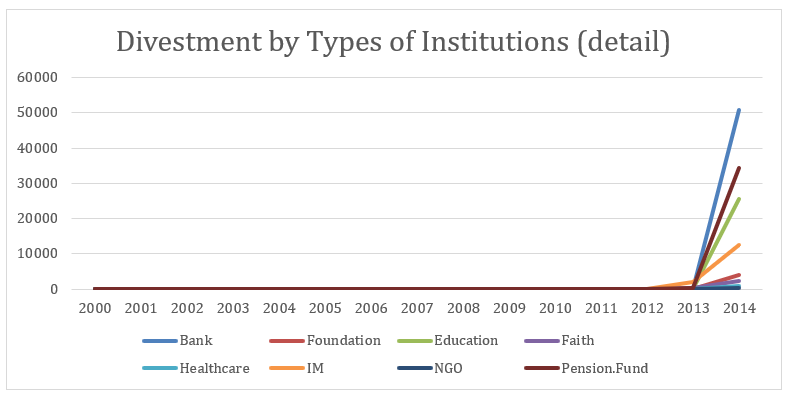

At the industry level, several institutions are divesting from fossil fuel companies including religious groups, NGOs, pension funds, foundations, and financial and healthcare institutions. Educational institutions such as universities and internal marketing (IM) organisations are listed here as well.

As Figure 4 shows, NGOs were the first to divest from fossil fuel energy in 2008. However, the education sector made the first noticeable divestment shift of USD $84 million in 2011. Students at hundreds of university campuses in the U.S. alone led divestment initiatives leading up to 2014 (Ritchie & Dowlatabadi, 2015). In 2012, foundations and NGOs were the only sectors to record divestments. By 2014, banks suddenly made a tremendous divestment of USD $50 billion. Every other sector also marked divestments in 2014, signalling a major shift towards sustainable finance.

Figure 4

Divestment by Types of Institutions (Detail)

Note. Data from course dataset.

By sector, following banks, the largest divestments in 2014 were made by pension funds, educational institutions, and the IM sector. As observed in the general institutional analysis above, financial institutions have typically held the greatest power to invest or divest in an industry. In 2013 and 2014, support was won from major global financial institutions including the World Bank and related organisations including the OECD (Ayling & Cunningham, 2015). In 2014-2015, Deutsche Bank and the Bank of England also released investor statements that warned against fossil fuel companies as a poor long-term investment (Ayling & Cunningham, 2015), encouraging the shift toward sustainable finance. In these ways, specific sectors have played a greater role in the overall divestment movement.

Strategic Divestment with Supporting Activities

While most effective when combined with engagement with fossil fuel companies and other types of financing efforts, divestment is recommended here as the best course of action for sustainable finance activists and investors. Divestment from fossil fuel projects raises the cost of producing non-renewable energy. In turn, higher costs cause investors to withhold funding. When divesting is combined with competitive investment activities like bidding for new energy projects, investors can lower the price of renewable energy as well (Halstead et al., 2019).

This dual pricing strategy is essential to achieve a net-zero economy. One analysis found that Europe’s high sensitivity to financing costs has made the transition to renewable energy sources more difficult (Halstead et al., 2019). This is especially paradoxical for Norway, which derives most its pension fund from its domestic petroleum industry (Ayling & Cunningham, 2015). Thus, it follows that divestment must be combined with other efforts to lower the capital costs for new energy projects. Encouraging countries to start building their renewable energy sectors now could create comparable profits and lower production costs over time.

As described earlier in the analysis, investors should also be mindful of how population growth contributes to environmental deterioration. In populous nations like the U.S., high energy consumption drives fossil fuel dependence even though divestment activities are ongoing (Glomsrød & Wei, 2018). The harmful effects of population growth likewise motivate a shift towards renewable energy sources. Along with divestment, investors should appeal to policymakers in support of sustainable lifestyle legislation and the control of excess natural resource usage (Khan et al., 2021).

Finally, research shows that investors across sectors have power to influence the most powerful divestment actors: banks. By strategically coordinating investment activities and putting pressure on banks to divest, sustained divestment is possible. Investors must also keep in mind that climate progress is still threatened by fossil fuel lobbyists and greenwashing. Therefore, persistence and resistance are key to creating a global culture of sustainable finance.

Conclusion

Cleaner energy sector investment is essential for Europe and other regions to achieve their net-zero targets by 2050 (Halstead et al., 2019). By comparing the merits and disadvantages of divesting versus engaging with companies, this analysis suggests that investors can make a bigger impact by divesting from non-renewable energy companies. With Western countries and financial institutions leading current fossil fuel company divestment activities, there are many ways that investors can continue to contribute to the divestment movement. Pressuring banks to withdraw financial support for mining companies and strategically rebalancing investment portfolios has made a significant difference since the mid-2010s. Such activities have proven that investors at all levels are able to create industrial change.

Yet, there is still more to do. Even some of the largest climate action NGOs including the World Wildlife Fund continue to have fossil fuel companies’ stocks in their mixed asset portfolios (Ayling & Cunningham, 2018). Investors must take more initiative to carefully research the companies they are investing in and what stakes these organisations have in fossil fuel energy. In the long term, however, rebalancing portfolios with clean energy companies has proven to be more profitable.

Finally, the analysis found that shifting to a net-zero economy also requires investing in companies that reduce the cost of low-carbon technology. Bringing down the price of renewable energy sources will ultimately make this a more viable alternative to fossil fuel. Spreading awareness of the low risk associated with sustainable resource investment is also important for gaining the support of pension and fund managers (Ritchie & Dowlatabadi, 2015; Guo et al., 2022). Divestment is most effective when combined with other carbon reduction goals and sustainable finance decisions.

References

Ayling, J., & Cunningham, N. (2017). Non-state governance and climate policy: The fossil fuel divestment movement. Climate Policy, 17(2), 131-149.

Cambridge Dictionary. (2022). Divestment. https://dictionary.cambridge.org/us/dictionary/english/divestment

Glomsrød, S., & Wei, T. (2018). Business as unusual: The implications of fossil development and green bonds for financial flows, economic growth and energy market. Energy for Sustainable Development, 44, 1-10.

Griffin, P. W., & Hammond, G. P. (2021). The prospects for ‘green steel’ making in a net-zero economy: A UK perspective. Global Transitions, 3, 72-86. doi.org/10.1016/j.glt.2021.03.001

Guo, X., Liang, C., Umar, M., & Mirza, N. (2022). The impact of fossil fuel divestments and energy transitions on mutual funds performance. Technological Forecasting and Social Change, 176, 121429. doi.org/10.1016/j.techfore.2021.121429

Halstead, M., Donker, J., Dalla Langa, F., & van der Zwaan, B. (2019). The importance of fossil fuel divestment and competitive procurement for financing Europe’s energy transition. Journal of Sustainable Finance & Investment, 9(4), 349-355.

InfluenceMap. (2016, April). An investor enquiry: How much big oil spends on climate lobbying. https://influencemap.org/report/Climate-Lobbying-by-the-Fossil-Fuel-Sector

Khan, I., Hou, F., & Le, H. P. (2021). The impact of natural resources, energy consumption, and population growth on environmental quality: Fresh evidence from the United States of America. Science of the Total Environment, 754, 142222. doi.org/10.1016/j.scitotenv.2020.142222

Nasiritousi, N. (2017). Fossil fuel emitters and climate change: Unpacking the governance activities of large oil and gas companies. Environmental Politics, 26(4), 621-647.

Ritchie, J., & Dowlatabadi, H. (2015). Divest from the carbon bubble? Reviewing the implications and limitations of fossil fuel divestment for institutional investors. Review of Economics & Finance, 5(2), 59-80.

UNFCCC. (2022). What is the Kyoto Protocol? https://unfccc.int/kyoto_protocol

write

write