| Size | Growth in 2020 | Economy share |

| Revenue estimation $230B | +5.0% | Not applicable |

| GDP $96.8B | +2.9% | 5.1% |

| Good Exports $9.3B | -22.1% | 2.0% |

| Service Exports $17.3B | +4.1% | 23.7% |

Table 1: Size of the tech industry in Canada

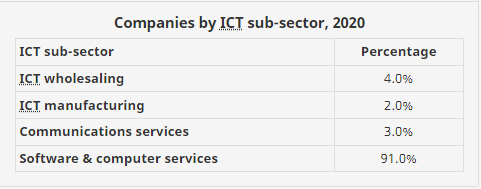

Software and computer services make up the vast majority of Canada’s Information and Communications Technologies (ICT) sector’s 44,000+ firms. Approximately 37,600 of the 37,600 enterprises in the ICT sector have less than 10 employees. There are just 119 significant enterprises in the country with over 500 employees, including local subsidiaries of overseas multinationals. The manufacturing industry has a higher percentage of major enterprises than any other sector. In 2020, just 9.7% of ICT manufacturing companies would have above 100 employees, compared to 1.9 percent for the entire ICT sector. Table 2 shows the companies according to the sub-sector of the tech industry (Certn Co., 2021).

Table 2: Tech companies by ICT sub-sector (Certn Co., 2021)

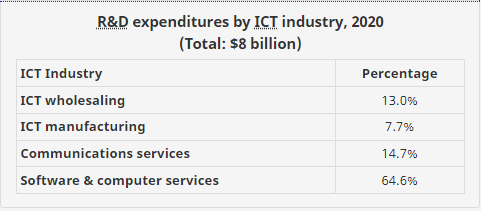

Due to the rise in the number of businesses in this industry, there is now stiff rivalry for the most qualified and skilled employees. Massive financing for company research and development helps companies innovate. Research and development expenditure increased by 6.8%, accounting for 42.1% of total GDP. Canada’s private sector is led by the information and communications technology (ICT) industry in terms of R&D expenditures. It will account for 42.1% of all private sector R&D spending in Canada by 2020 (Certn Co., 2021). ICT R&D spending will reach $8 billion in 2020, a 6.8% increase over 2019. ICT services showed the highest growth in R&D spending (+7 percent), while communications services saw the largest drop (-5.7%) (Certn Co., 2021).

Table 3: Sub-sector expenditure on R&D (Certn Co., 2021)

This industry employs a talented group of people, with 55% of them holding university degrees. Employment increased by 1.1% in 2020, from 671,109 people to 3.7 percent of the total workforce. The average yearly pay in the industry is $83,342. In addition, this number climbed by +2.0 percent (Certn Co., 2021). The rise of the tech industry has resulted in an average wage 46.2% greater than the national average in Canada.

More people are employed in information and communications technology than in other sectors, with an average annual growth rate of 2.7 percent vs 0.1 percent for the broader economy between 2015 and 2020. While the entire economy shrank by 3.2 percent, the ICT sector grew by 1.1% in 2020 (Certn Co., 2021). ICT will employ more than 671,109 people by 2020, making up more than 3.7 percent of all Canadian jobs.

The data processing, hosting, and related services sub-workforce sector’s increased by 10.4% in 2020, driving the sector’s performance. ICT manufacturing and communications services employment fell by 5.7% and 2.6%, respectively, while software and computer services employment expanded by 3.2% (Certn Co., 2021).

With all of the ICT services and some of the ICT manufacturing businesses outperforming the rest of the Canadian economy, the ICT sector has shown significant economic performance in recent years. COVID-19 pandemic has disrupted the decade’s tendencies, and its long-term effects are still uncertain. A large fall in sales is still projected in the ICT sector, despite the fact that it has fared better than most sectors throughout the epidemic. While not every company will see a drop in revenues, all will have to continue to adjust to changing demand, stressed supply networks, and new working arrangements (Serenko et al., 2020). With the worldwide semiconductor scarcity, growing practicality of remote work that could lead to increased rivalry for talent, and “buy local” rules being implemented in major export markets such as the U.S. and France, the Canadian ICT sector is experiencing considerable challenges.

Since demand is projected to reflect accelerated adoption of numerous technological solutions and private and public investments in digital infrastructure, ICT is fortunate to be well-positioned to profit from the revival of the entire economy. Every direct job in the ICT industry supports an additional 1.3 jobs in the Canadian economy, and every $1 million in direct GDP generated by the ICT sector leads to an additional $832,000 in GDP generated for Canada (Serenko et al., 2020). The ICT sector has significant economic and employment repercussions on the economy. According to Serenko et al. (2020), when it comes to GDP effect multipliers, software and computer services lead the ICT industry, whereas communications services lead the field in terms of job growth (1.9 multiplier).

Certn Company

Certn is one of the country’s most rapidly expanding new companies. The company is proud of its accomplishments, such as the recent CAD43 million funding round and our inclusion in Deloitte’s Technology Fast 50TM Awards as one of Canada’s Companies-to-Watch (Certn Co., 2021). Canada has a large pool of software development talent, with 3.43 percent of the world’s developers working in the country, according to the 2020 Annual Developer Survey. This places Canada sixth in the worldwide developer talent pool. Software companies in Canada benefit from robust market growth in addition to having access to an extraordinary talent pool. The Canadian software and computer service businesses have had yearly operational revenue growth of 14.2 percent, according to the most recent figures (Certn Co., 2021).

Canada continues to draw worldwide talent and money with its 995 AI and machine learning firms and some of the world’s top minds in the industry. To access the best AI expertise, multinational corporations are choosing to establish headquarters in AI centers located all across the country. In addition to strong government support, low business expenses, and access to world-class AI clusters, businesses investing in Canada’s AI ecosystems also get these benefits.

By venture capital deals (2016-2020), Canada is now the world’s 6th largest cybersecurity innovation hub according to Pitch book data and has taken important steps to realize the significance of cybersecurity (Certn Co., 2021). Canada has committed to spending $507 million over the next five years as part of its new National Cyber Security Strategy. The Canadian tech talent market isn’t simply growing; it’s soaring to new heights. There’s a solid reason why Toronto, Vancouver, Montreal, and Ottawa are CBRE’s top 20 North American IT talent markets (Certn Co., 2021). With over 2.8 million STEM graduates and the best educated workforce in the world, Canada has a large and diverse pool of IT expertise. In an industry that’s expanding but running low on skilled personnel, though, homegrown talent isn’t always sufficient. Due to the Global Skills Strategy, Canadian ICT companies can hire highly trained workers in as little as two weeks from around the world.

PESTEL Analysis of Certn Company

Macro-environmental elements affecting an organization’s operations are investigated in PESTEL study. Political, economic, social, technological, environmental, and legal aspects are examples of macro-environmental influences (Williams & Green, 1997). The Certn Company in Canada is examined using a PESTEL analysis in this study. The tech industry in Canada will be assessed in light of the political, economic, social/cultural, and technological elements at play.

Political Factors

Legal concerns and government rules that define a certain industry and its various stakeholders are examples of political influences (Knight, 1989). Companies must abide by these laws and regulations if they are to conduct business effectively. With a stable administration in place in Canada, the federal government is less likely to interfere with Certn Company’s business activities. However, if the corporation does not follow the existing legal framework, the Canadian government may be required to intervene. In order to protect investors’ interests, Canada maintains strict intellectual property rules. They also promote rivalry, effectiveness, and efficiency in the workplace (McNally et al., 2017). In terms of Canadian company law, Certn Company is a lawfully registered entity that conforms to all state rules.

Economic Factors

Factors affecting the economy include the inflation rate and exchange rates as well as the amount of money saved and the amount owed (Knight, 1989). The current global pandemic crisis wreaked havoc on a number of different economic sectors. Certn, a Canadian firm, has also been hit hard. Even though products exports dropped during the Covid-19 pandemic, the company was saved via services exports thanks to the company’s excellent management. The rising rates of inflation, shifting currency exchange rates, and Canada’s income growth rate will all have to be taken into account by any corporation looking to invest in our nation. As a result of the global economic crisis, business investment has stalled and PC usage has declined (McNally et al., 2017). In any case, the Canadian government is focused on boosting the economy. The government seeks to attract foreign investors by offering advantages that make it worthwhile to start or expand a business in Canada in the first place.

Social and Cultural Factors

In making a purchase, consumers’ social/cultural influences impact their decisions. Attitudes, values, and beliefs are examples of social and cultural influences (Knight, 1989). People’s purchasing habits are influenced by social and cultural shifts. The rapid development of ICT in Canada is a sign of a society that values the technology. To reach as many customers as possible, Certn Company has developed market penetration techniques.

Computer games and consoles, for example, are widely accepted by Canadians (Moshiri, 2016). A strong commitment to computer industry development may be seen in the fact that the sector and country as a whole have made this investment. The Canadian computer industry would benefit from investment, especially as only a few corporations have made significant investments in the country’s computer hardware.

Technological Factors

In light of technological advancements, these variables pertain to how a business operates in a particular industry (Knight, 1989). Various sectors of the economy have been altered by technology, said Moshiri (2016). As a result, Canada’s ICT industry is dedicated to keeping the market competitive. So many R&D projects have been launched to help transform the industry as a result (The Conference Board of Canada, 2019). This will have a significant impact on the sector, encouraging additional investment. One of the company’s competitive advantages is its usage of cutting-edge technology. Application tracking systems and content delivery networks are a few of the most popular integrations and technologies used by this business.

Environmental Factors

There are numerous processes and activities in the Canadian economy that fall under the digital environment of the technology sector. The environmental media that these technologies are intended to protect or give data creation classify them. There are a variety of services offered by the Certn Company, including criminal background checks, background screenings, API International Background Checks on drivers and vehicles, credit checks, softchecks, oneID, instant verification, and education and employment verification services. For many years, Certn has aided a wide range of businesses in their quest to “surpass customer expectations via the employment of brilliant individuals who share in the passion of a firm committed to Safety and Service.”

Certn has had to stay on its toes because of the intense competition in the tech business. With 26 workers and $4.9 million revenue, Credit Retriever is one of the competitors. Credential Check is another with 57 employees and $10 million revenue (Certn Co., 2021). Choice Screening is another competitor with 26 employees and $6.3 million revenue. Certn continues to outperform its rivals, with 132 workers and a revenue of $27.7M.

Legal Factors

The PESTEL examination of Canada concludes with a discussion of the legal environment. It would be beneficial to have a discussion about a lot of key topics. In Canada, for example, employees’ legal rights are safeguarded. It’s the law that companies must adhere to certain minimal requirements in relation to the number of hours their workers work, the minimum wage, and the number of days off for illness or other reasons, and more. Gender, color, ethnicity, age, and a number of other factors are all prohibited by the Canadian Human Rights Act (CHRA).

In Canada, there are numerous ways to conduct business. Corporations, joint ventures, general or limited partnerships, trusts, single proprietorships, co-operatives, and Branch plant operations, for example, are the most frequent. Corporations are the most frequent form of Canadian entrance for foreign firms (The Conference Board of Canada, 2019).

Forces Analysis

At the very least, the forecast of a dearth of 200,000 programmers and other IT experts in Canada by 2020 may no longer be so dire. Canada’s IT workers are bucking the trend and remaining home, while their counterparts from the US and other countries are flocking to Waterloo and Toronto instead of Silicon Valley. Work permits are being made more readily available and approval visas are being shortened by the federal government to make it easier for Canadian and multinational tech firms to hire skilled foreign workers.

Canada’s tech sector is one of the country’s largest and is only expected to get bigger. Governments and businesses alike understand that bringing in top-tier talent from around the world helps make Canada more globally competitive. This is particularly valid in the IT industry. Canada’s position as a rising, significant tech economy is more crucial than ever as the tech sector expands and emerging innovations from across the world become more mainstream.

When assessing an industry’s attractiveness, Porter identified five main forces that must be considered. An industry’s profitability to a new entrant is what it means to be “attractive.” The decision to enter or stay out of a particular industry should be based on the profitability. In this particular market, the stronger these five pressures are, the lower the profit margins can be, and thus the less appealing this industry is to a potential entrant (Porter, 1979). The threat of new entrants, buyer negotiating power, supplier bargaining strength, and replacement products or services are the five competitive factors.

The threat of new entrants

When determining an industry’s profitability and attractiveness, Porter looks at the threat of new entrants. He makes the assumption that there are six key causes of entry barriers to the sector (Porter, 1979). When gauging the threat of new entrants, the considerations of economies of scale, product or service differentiation, and capital requirements all come into play This is why Porter (1979) believes industry competition is fueled by this factor. In the context of Certn Company, the threats of new entrants is low since the company is well informed of the new technological advances, and adapts it as soon as it is rolled out. The current new technologies that the company is adopting include human augmentation, Xaas, Cyberscurity and AI. These new technologies makes it to win the trust of many companies seeking for their services.

Bargaining power of buyers

The level of power buyers can exert over industry players is known as their bargaining power. Different methods can be used to achieve this, such as lowering prices, requiring higher quality, and pitting competitors against one another (Porter, 1979). The volume of purchases and the degree of differentiation in products or services are two well-known sources of buyer power (Porter, 1979). With the marketing strategy in Certn Company, buyers are exposed to privileges of services offered at relatively lower prices, while the quality of services are maintained at professional levels (Certn Co., 2021).

Bargaining power of suppliers

Instead, the amount of suppliers’ bargaining strength indicates how much influence they have over other industry actors. Certn Company collaborates with business partners to develop a win-win solution. To maintain the suppliers’ aspirations, being adaptable and imaginative is important because no two partnerships are the same.

Threat of substitute products or services

As a result of substitutability, replacement products or services pose a danger because they are interchangeable with those of other companies in the same industry (Porter, 1979). A new entrant will have a harder time establishing a profitable position in an industry if customers can easily identify alternatives to the products or services offered by the incumbent (Porter, 1979). Certn Company has an assorted myriad of services which keeps it at the top of its competitors. It took advantage of including many services in its operations to seal up the threat that replaceable products would pose on the company’s progress. To date, Certn is still the world’s most trusted data platform for doing background checks on employees and contractors all across the world in real time. It’s used by major companies, staffing firms, as well as those in the gig economy, and it provides instant results for background checks such as criminal history and credit reports as well as education and employment verification.

Rivalry among Existing Competitors

Finally, knowing the preceding four elements, Porter (1979) says the final force is competition among existing competitors. In a nutshell, the more the interaction between the preceding forces, the greater the rivalry will be among the currently existent competitors. Also known as the “jockeying for position” by Porter (1979, p. 7), this force focuses on strategies such as price competition, aggressive promotion, and product innovation in order to gain an established position within the industry. In Certn Company, a lot of factors influence pricing, including the scope and number of background checks required. Low-volume packages start at $10 and include up to 100 checks each year. Over 100 checks per year are included in high volume packages. This pricing is tactical and way affordable as compared to the company’s competitors like Health Suite Advantage, PX3000, Engagedly, eCoordinator, and Calmari. While these companies operate on a subscription pricing model, in Certn Company there isn’t a recurring fee. It’s a pay-as-you-go arrangement. For low-volume users, this background check is far less expensive than the alternatives. They also have a great customer service team that is always available to address questions.

Labour Market Analysis

Firms in the technology sector function as change agents in a wide range of industries and enterprises. Their ground-breaking technologies are transforming entire sectors and changing people’s lives. In order to meet client demand, they must expand into new sectors while improving operational efficiency and risk management (Szabó-Szentgróti, Végvári & Varga, 2021). For this reason, Certn Company must constantly foster creativity while also being able to respond quickly and efficiently to evolving markets and economic circumstances.

A robust Canadian economy and a well-functioning labor market are both reliant on current and accurate data on employment. For instance, Certn Company aongside other organizations have done recent work emphasizing the wide range of job skills required to achieve these goals (Certn Co., 2021). More and more companies are on the lookout for employees with a diverse set of skillsets, including “soft skills” like collaboration and teamwork, problem-solving, building relationships, and being open to new ideas, in addition to technical knowledge. All stakeholders receive clear signals from labor market information at its best, guiding them to the optimal options. In figuring out what skills companies need and where to find them, it helps enterprises.

People are no longer treated as if they were dumb machines or assembly-line gears, and cognitive and soft skills are becoming increasingly vital for workers as a result. There were four top competencies recognized in a 2015 Business Council of Canada survey of 90 large Canadian companies with a total workforce of 800,000 people: collaboration, communication, problem-solving, and people skills (Conway et al., 2016).

Workers in the OECD have a strong link to employment in Canada. Only the United Kingdom has a higher percentage of employees who believe they are either overqualified or underqualified for their current job. When measured against the total work force, the number of unfilled jobs isn’t very high. According to ESD Canada’s 2012-2014 survey, supply and demand were roughly balanced in 88 percent of the 292 occupations studied, which accounted for 90 percent of total employment (Conway et al., 2016). New hires are generally satisfied, according to a research done by the Business Council of Canada. Companies in general have faith in their abilities to handle impending employee retirements. Newly graduated college students, for the most part, are happy with their positions and pay. It’s true that the vast majority of employees are happy in their existing jobs at this time. In contrast to the United States, real wages in Canada have improved for the majority of employees.

People’s brains are predisposed to certain abilities. The majority of these abilities, on the other hand, can be acquired via practice. With greater education and work experience comes more productivity for employees. More education takes several years after high school, but work experience can take three to four decades to accumulate (Berger & Frey, 2016). Skills also help workers be more adaptable in a society where many people have multiple jobs during their careers. No matter how one acquired their skills, the more they have, the better positioned they will be in the job market. At its most basic level, a skills agenda tries to better match employees with available employment (The Conference Board of Canada, 2019). A lack of employment options (or employment opportunities that are commensurate with people’s talents) reduces production, which hurts everyone. The most effective approaches to talent matching rely on making well-informed decisions based on labor market data.

Data on the “local” labor market is sometimes cited as being essential since it gives context for a particular geographic place. This requires thorough consideration in light of the benefits and drawbacks it offers (Szabó-Szentgróti, Végvári & Varga, 2021). Unless exceptionally large samples are employed, the accuracy suffers when more granular data is used. The only way to guarantee local data reliability is to increase the sample size, but this is expensive and complicates surveys. An increase in the sample size does not result in an increase in knowledge of 20% on average, hence expanding the population has a declining return.

The Labour Force Survey, which Statistics Canada uses to compute unemployment insurance payouts, can be improved by oversampling select locations (The Conference Board of Canada, 2019). One important concern is whether the new Job Vacancy and Wage Survey sample size should contain the same degree of information as the Labour Force Survey, in order to compare unemployment rates with vacancy rates in the same market. To be able to answer this issue, one must look at the local labor market as a whole. A provincial or federal labor information officer, on the other hand, may get a strong feel of local realities by focusing on just one community. The official only needs a phone and a consistent set of questions to compare the Cape Breton Island responses.

EVP Insights

The managerial ideas behind the EVP have been shown to be out of date by persistent engagement and attraction issues, as well as the human crises of 2020. Employee value propositions.This old-school approach to employee value proposition is clearly failing. 5,000 employees and 85 interviews with HR leaders on EVP practices, issues, and solutions were recently conducted by Gartner. This suggests that the issue could be an emphasis on “what we provide people” instead of “why.” Traditional EVP appears to be deteriorating, as evidenced by the following warning signs in Certn Company (Certn Co., 2021):

- Engagement – Since 2016, the level of engagement, which influences both performance and retention, has been stable.

- There are just 29% of functional leaders who report having all the talent necessary to satisfy current performance objectives. This is especially true in the most competitive fields of the job market, such as information technology (IT) and data science.

- There are just 23% of HR leaders that think the vast majority of employees will stay with their present company once the epidemic is over.

- The satisfaction rate with the EVP is only 31% among HR leaders, and 65% of candidates say they have stopped the hiring process because of an ugly EVP.

A more human deal built on the full person, geared to create an amazing life experience for employees, and focused on the feelings and features that fit their requirements must be delivered by HR executives in order to advance their EVP management. Deeper connections, extreme flexibility, personal growth, holistic well-being, and a common purpose make up the new human deal.

The new EVP has a more human feel to it. People experience emotional worth in employment in the business by enabling them to feel more understood, independent, invested, cared for and cherished when delivering on all parts of this human agreement. Because of this reimagined EVP, which aims to provide employees with an extraordinary life experience as opposed to merely a job experience, Certn Company should consider implementing the following actions:

- Create deeper ties – The Company should not only focus on professional relationships, but also help employees feel understood by increasing their ties to their families and communities as well.

- Empower employees to feel self-sufficient by allowing them to choose how and when they want to work.

- Help the staff grow as people, not simply as professionals, by making sure they feel valued.

- Make sure that employees actively use holistic well-being offerings instead of merely making them available to ensure that they feel cared for on a holistic level. To ensure that employees feel invested in the firm, support organizational action on societal and cultural challenges (and don’t merely make pronouncements about “purpose.

Recommendations

Some significant activities that Certn company leaders can do to create a new human-centric EVP include the following:

- Integrate inclusion goals into daily work and talent processes, focus on direct family benefits that match employee and business needs, and train managers on how to detect employees’ trust through empathic discussions to build stronger ties with their workforces.

Annotated Bibliography

Moshiri, S. (2016). ICT spillovers and productivity in Canada: provincial and industry analysis. Economics of Innovation and New Technology, 25(8), 801-820.

Researchers in industrialized nations have previously done a lot of work on how information and communication technology (ICT) affects productivity. However, the spillover and time-varying effects of ICT investments across economic activities have just recently been examined. ICT and its spillovers on industry are the subject of this article. There are 10 provinces in the panel data estimate model, each with a different economic activity, and two-digit level industries for the years 1981–2008. According to the findings, information and communications technology (ICT) improves labor productivity, although the impacts vary widely between provinces, industries, and time periods. Provincial GDP shares dominated by manufacturing and services have reaped the benefits of ICT investment, while areas heavily reliant on natural resources and agriculture have not.

McNally, M. B., Rathi, D., Evaniew, J., & Wu, Y. (2017). Thematic analysis of eight Canadian federal broadband programs from 1994 to 2016. Journal of Information Policy, 7, 38-85.

This article examines eight federal government broadband programs in Canada from a historical and thematic perspective. A review of the program’s documentation revealed a number of recurring themes. As a result of these themes, it was possible to identify trends in federal programs over the course of time. Trend analysis based on Dwayne Wineck’s theory of political economics shows that federal broadband projects in general have not fully achieved the democratic potential of broadband.

Ifinedo, P. (2011). An empirical analysis of factors influencing Internet/e-business technologies adoption by SMEs in Canada. International Journal of Information Technology & Decision Making, 10(04), 731-766.

Worldwide, SMEs use ecommerce and e-business to assist their business operations as well as increase revenue from unconventional sources. Small and medium companies (SMEs) These technologies, along with the Internet, provide the backbone of e-commerce and online business. The adoption of IEBT by SMEs has been reported to be influenced by contextual imperatives despite its universal appeal. This study’s goal is to find out what influences the adoption of IEBT among Canadian Maritime SMEs. The discussion was guided by a research model based on diffusion of innovation theory (DIT) and the Technology–Organization–Environment (TOE) frameworks. Relative advantage, compatibility, complexity, management support, organizational readiness, external pressure, and government backing were all aspects considered while coming up with hypotheses that were relevant.

Berger, T., & Frey, C. B. (2016). Structural transformation in the OECD: Digitalization, deindustrialization and the future of work.

To find out more about how contemporary breakthroughs in digital technology – such as machine learning and robotics – may affect future employment, we looked into the impact of technological change on labor market outcomes starting in the 1980s. In recent decades, the workforce composition has changed considerably, in part due to technological progress, although it is far from apparent how digitalization will affect future job opportunities. Anecdotally, it appears as though the possible scope of automation has grown beyond ordinary employment, making technological development possibly more labor-saving. Recent estimates suggest that 47% of US jobs are vulnerable to automation in the next few decades. Yet data suggests that digital technologies have not produced many new employment to replace old ones: an upper bound estimate is that roughly 0.5% of the US workforce works in digital industries that emerged during the 2000s.

The Conference Board of Canada. (2019). Building connections: Platforms for the future of education and skills in Canada. Ottawa, ON: The Conference Board of Canada.

Canadian advanced skills and education are examined by the Conference Board of Canada in this report. More than 40 outputs and events held as part of the process were re-examined in order to come up with this report, which is the outcome of five years of collaboration between public and private sector partners to research educational topics and concerns – particularly post-secondary education. The report is divided into six sections, each of which has a set of goals. The goal of increasing access to postsecondary education is to ensure that it reflects Canada’s rich cultural variety. “Skills for All” means that all Canadians should have access to high-quality education and training in order to compete in the global economy. Aspirations for learner paths include seamless transitions between all educational levels. Creating adequate and flexible financial regimes that allow institutions to fulfill all of their tasks is the ambition for institutional sustainability. We want all stakeholders to have access to high-quality, uniform statistics on the effectiveness of Canada’s postsecondary education system. It is hoped that Canada would become a world leader in knowledge mobilization by connecting their work to new breakthroughs that create value for Canadian society on a variety of fronts. In addition to the issues and disruptors highlighted for each platform, a list of specific objectives has been developed.

Conway, S., Campbell, C., Hardt, R., Loat, A., and Sood, P. (2016). Building the workforce of tomorrow: A shared responsibility. Toronto, ON. Government of Ontario.

A government-appointed group of experts has produced a report outlining a comprehensive plan to help Ontario’s workforce keep up with the needs of a knowledge-based economy powered by new and emerging technologies. Members of the group contributed their knowledge and expertise, as well as consultations with stakeholders from the education, skills development, and training sectors. The panel’s findings were then presented to the whole Senate. Older workers, new Canadians, Indigenous peoples, and people with disabilities were all given special attention during the course of the project’s course of action. Among the report’s 28 suggestions are those pertaining to partnerships and local leadership, labor market information, experiential learning and mentorship, promoting multiple career paths, strategic human capital investment, and skills and competencies.

Serenko, A., Bontis, N., Palvia, P., & Turan, A. H. (2020). Information Technology Issues in Canada. In The World IT Project: Global Issues in Information Technology (pp. 57-68).

The IT industry has become an integral element of the Canadian economic landscape. It’s done a good job of meeting the demands of the worldwide market, too. Organizations prioritize safety and privacy as top priorities. This isn’t unexpected, given how important it is for IT goods and services to be widely used. The present survey found that Canadians are concerned about their privacy, as seen by the high turnout. After virtualization and enterprise application integration, networks and telecommunications are the most important technology concerns today. There is a high level of job satisfaction among Canadian IT workers, who also report that they have an acceptable work–life balance, a sufficient workload, and aren’t burned out. There will be those who stay, but the majority will depart. Some IT workers may choose to leave the field despite the increased demand for IT positions.

Knight, R. M. (1989). Technological innovation in Canada: A comparison of independent entrepreneurs and corporate innovators. Journal of Business Venturing, 4(4), 281-288.

Innovation, meaning bringing innovation to market, is vital to a country’s economic prosperity. Witness the robust development of the United States. In order for Canada to have the same atmosphere for innovation as the rest of the world, the country should take a number of initiatives, such as increasing tax benefits for innovative industries, increasing capital cost allowances for high-tech corporations, increasing the usage of stock options, and allowing small businesses to carry losses forward for at least ten years. It’s also important to work on the human side of things. To avoid being stuck in a rut, Canada needs to look for new solutions and strategies.

Szabó-Szentgróti, G., Végvári, B., & Varga, J. (2021). Impact of Industry 4.0 and Digitization on Labor Market for 2030-Verification of Keynes’ Prediction. Sustainability, 13(14), 7703.

One of the study’s goals is to look at how technical unemployment has changed over time and analyze Keynes’ theory in light of a literature review on the fourth industrial revolution. An analysis of 86 publications published between 2011 and 2020 on subjects relating to Industry 4.0, the labor market, and technological unemployment was employed as a technique in this study. With Industry 4.0 procedures expected to cut labor requirements, we’ll be one step closer to Keynes’ goal of a three-hour workday. Increasing economic efficiency through more intensive work may be the result of fewer working hours, according to the analysis. The level of technological unemployment varies each country based on its digitalization strategy and the speed at which it is implemented.

References

Berger, T., & Frey, C. B. (2016). Structural transformation in the OECD: Digitalisation, deindustrialisation and the future of work.

Certn Comapny. (2021, September 19). About Certn. Certn. https://certn.co/about-certn/

Conway, S., Campbell, C., Hardt, R., Loat, A., and Sood, P. (2016). Building the workforce of tomorrow: A shared responsibility. Toronto, ON. Government of Ontario.

Ifinedo, P. (2011). An empirical analysis of factors influencing Internet/e-business technologies adoption by SMEs in Canada. International Journal of Information Technology & Decision Making, 10(04), 731-766.

Knight, R. M. (1989). Technological innovation in Canada: A comparison of independent entrepreneurs and corporate innovators. Journal of Business Venturing, 4(4), 281-288.

McNally, M. B., Rathi, D., Evaniew, J., & Wu, Y. (2017). Thematic analysis of eight Canadian federal broadband programs from 1994 to 2016. Journal of Information Policy, 7, 38-85.

Moshiri, S. (2016). ICT spillovers and productivity in Canada: provincial and industry analysis. Economics of Innovation and New Technology, 25(8), 801-820.

Porter, M. E. (1979). The structure within industries and companies’ performance. The review of economics and statistics, 214-227.

Serenko, A., Bontis, N., Palvia, P., & Turan, A. H. (2020). Information Technology Issues in Canada. In The World IT Project: Global Issues in Information Technology (pp. 57-68).

Szabó-Szentgróti, G., Végvári, B., & Varga, J. (2021). Impact of Industry 4.0 and Digitization on Labor Market for 2030-Verification of Keynes’ Prediction. Sustainability, 13(14), 7703.

The Conference Board of Canada. (2019). Building connections: Platforms for the future of education and skills in Canada. Ottawa, ON: The Conference Board of Canada.

write

write