1.0 Introduction

This essay entails evaluating the marketing strategies of MUJI and UNIQLO within emerging and developing countries. In this case, the UK was adopted as a representative of a developed country, while India represented the developing country. Founded in 1980, MUJI originated from the rationalisation of simple, good-quality and low-cost products in Japan (Toda, 2019). MUJI began operations with 31 food and nine household products in 1980, after which apparel products were included in the portfolio in 1981. since then, the brand has experienced exponential growth, resulting in its listing on the Tokyo Stock Exchange in 2000. Toda, 2019). The minimalist and quality, i.e. self-restraint, humility, moderation and simplicity of MUJI’s products, especially apparel and stationary, contributed to the award of the five-gold product design in 2005. MUJI ventured into the US market in 2003 and the Indian market in 2016 as a retailer with a market cap of 1.1 billion USD in 2022 Sabanoglu, 2022. In contrast, founded in 1984, UNIQLO rationalisation was based on a unique business model, i.e. the SPA “manufacture-retailer” model. Like MUJI, UNIQLO is also a Japanese brand with a focus on controlling the process of retail planning, production and retailing under the stewardship of Fast retailing. UNIQLO began operations as an apparel company and has grown to become a global brand. UNIQLO ventured into the US market in 2005 (Matsuyama & Huang, 2023) and 2019 to the Indian market (HANADA, 2023). The company was worth 9.6 billion USD in 2022 (Sabanoglu, 2022).

In order to provide a critical assessment of the international marketing strategies of the two brands, this essay adopts the theories and concepts of STP marketing strategies, the 4Ps of marketing and the market entry mode. The market entry modes adopted by the two brands when entering the respective countries are critically assessed in the final section of the essay to determine their success or otherwise failure.

2.0 Marketing Mix

2.1 Product

UNIQLO

UNIQLO offers a wide range of apparel products to the US market. The products of UNIQLO focus on the concept of “Made for All”. By developing products for all consumers, UNIQLO focuses on connecting local customers to the modern Japanese image, hence (Nagasawa, 2020) the standardisation of the marketing approaches and the retail formats for its products in the US. Standardisation of products to suit the needs of the local market highlights the extension of the modern Japanese image of the brand to the consumers based on the sale of limited-stock items, including Anime. In this case, standardisation provides UNIQLO with the ability to present a consistent image to the consumers in the market (Nagasawa, 2020). The approach of UNIQLO to the Indian market also emphasises standardisation. The standardisation of the clothing remains a key issue for UNIQLO in the US and Indian markets. The prototypes are based on “typical Asian” body figures, hence the need to fit and adjust the sizing (Zhao, 2017). The different body types in the US and India highlight the limitations of the standardisation strategy.

MUJI

MUJI retails a variety of products in the US market, including food products, learning products, home accessories and apparel products (Nagasawa, 2020. In appealing to local customers in the US, MUJI selects products that align with the needs of the local market while retaining the simplicity, quality and minimalist concepts of the brand (Zou & Zou, 2020). MUJI recognises the importance of adapting its products to the US and India. Product adaptation explains the similarity in the self-restraint, humility, moderation and simplify of MUJI’s products while conforming the products to local sizes (Nagasawa, 2020). The minimalist products of MUJI focus the quality of the products towards functionality rather than the distinctive brand characteristics that focus on the attention of the consumers.

2.2 Place

UNIQLO

UNIQLO retails its products in the US market through offline and online channels. The offline channels of UNIQLO comprise speciality stores strategically located in the urban areas where the brand runs up to 54 stores in the US (Lawler, 2023). The strategic location of UNIQLO stores in urban areas supports the target of consumers who require long-lasting casual clothing with a desire to invest more compared to the typical fashion products. UNIQLO also runs online stores in the US where customers are able to purchase products through its website. The sales from the online channels 2022 in the US amounted to US$2723.1m emphasising the growth in online sales (ECDB, 2024). Since venturing into the Indian market in 2016, UNIQLO has run 13 stores (UNIQLO India, 2023). The brand also has online stores in India, indicating the adoption of a mix of physical stores and e-commerce channels in the US and India.

MUJI

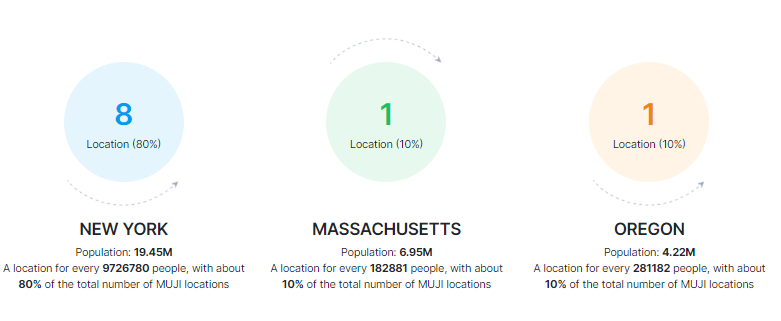

MUJI retails a wide range of products in the US through a combination of online and offline channels like UNIQLO. MUJI runs ten physical stores in the US, with 80% of the stores located in New York (See Appendix 2) (SmartScrapers, 2023). In contrast, MUJI runs four physical stores in India, three of which are located in Mumbai. The analysis provided indicates that MUJI’s physical stores are located within the major cities in the US and India. MUJI also operates e-commerce platforms in the US and India where customers can purchase the products and door delivery.

2.3 Price

UNIQLO

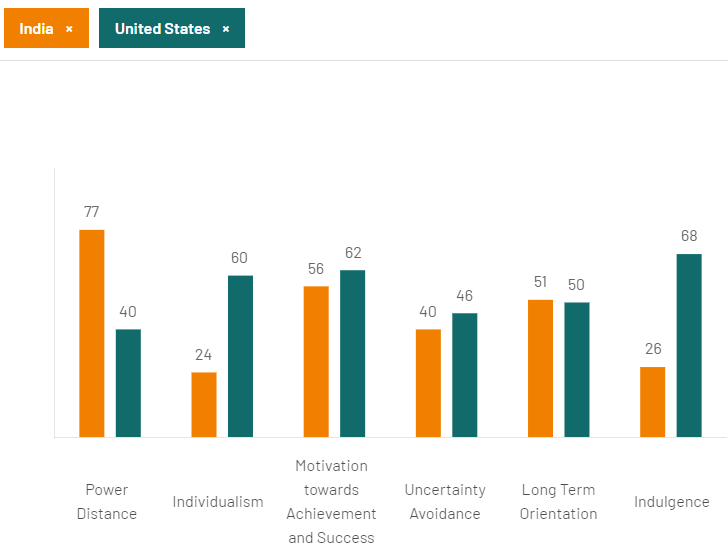

In the US market, UNIQLO adopts a mid-range pricing based on the competitive pricing strategy (Nagasawa, 2020). UNIQLO adopts bright colours and simple designs for high-quality products in order to appeal to price-conscious consumers. Based on Hofstede’s cultural dimensions, the US market is characterised as a high-indulgence culture where consumers are more inclined towards gratification and having fun. In this case, US consumers purchase products based on uniqueness and functionality, which increases the consumption of limited edition products (Ackerman & Tellis, 2001). The mid-range pricing, though, provides an advantage in enhancing the competitiveness of UNIQLO in a dense market. When venturing into the Indian market, the brand increased its prices by 25% (Bailay, 2023) even though India is considered as a restraint culture with an indulgence index of 26 compared to 68 for the US (See appendix 1). Although the low indulgence indicates the suppression of gratification, the increase in the prices of UNIQLO signaled to the consumers that it was an exclusive brand hence representing a top fashion brand in the market (Bailay, 2023). These outcomes indicate that the pricing of UNIQLO in the US market targeted the price-sensitive consumers of exclusive brands while targeting exclusivity through higher prices in the Indian market.

MUJI

MUJI adopts a mid-to-high pricing strategy in the US market (Nagasawa, 2020). The pricing strategy of MUJI respects premium pricing and value-based pricing strategies to appeal to the different consumer categories in the US market. Considering the culture of the US consumers, the free gratification associated with high indulgence increases the potential to purchase quality, exclusive and sustainable brands, which explains the mid-to-high pricing strategy for the different product categories (Nagasawa, 2020). In the Indian market, MUJI adopts the same mid-to-high pricing strategy but provides Indian consumers with discounts which lower the overall prices. For example, in the US and Indian markets, MUJI focuses on product differentiation where high-quality, modernised, simple and uniquely designed products are sold at elevated prices (Marketing Club, 2018). In this case, MUJI focuses on the high-end consumers and not the price-sensitive consumers, even though the products are relatively priced.

2.4 Promotion

UNIQLO

The promotion strategy of UNIQLO in the US features a combination of social media strategy, direct marketing, public relations and advertising. The customer analysis team uses the customer data to gauge customer preference and develop marketing communication (ECDB, 2024). The growth in online sales at UNIQLO in the US increases the brand’s emphasis on online marketing, especially through social media. UNIQLO also adopts celebrity marketing through global brand ambassadors such as Kei Nishikori and Roger Federer, with Katrina Kaif as the Indian market brand ambassador (UNIQLO, 2024). UNIQLO also has official social media pages on Instagram, among other social media channels, where it shares product information with customers in both the US and India. The marketing strategy of UNIQLO in the US and India differs in marketing communication in order to capture the beliefs and values of the two different cultures. In this case, the marketing communication of UNIQLO is adapted to the culture of the respective markets.

MUJI

MUJI adopts expansive marketing campaigns to publicise its products in the US and Indian markets. MUJI’s partnership with firms such as West Elm in 2020 in the US represented affiliate marketing (West Elm, 2020). MUJI also partners with social media influencers to increase brand awareness both in the US and India. The minimalist and simplicity of MUJI’s products limit the promotions that focus on the product attributes and quality despite adopting social media buzz to publicise the launch of new products (Zou & Zou, 2020). In the US and India, MUJI offers customers membership discounts and time-limited discounts (Zou & Zou, 2020). These types of discounts provide price reductions hence attracting the attention of more customers besides driving sales where the prices are reduced for a limited amount of time. MUJI also partners with designers in new product development, where it launches designer-generated products to the market (Nishikawa et al., 2013). The active involvement of designers in idea generation increases the awareness of the brand.

3.0 Segmentation, Targeting and Positioning

3.1 Segmentation

UNIQLO

UNIQLO divides the US and Indian markets based on demographic, psychographic, behavioural and geographic factors. UNIQLO targets customers in urban areas through its large stores located in urban areas rather than small flagship stores (Duoyan, 2021). UNIQLO’s focus on functionality, quality and fabric increases the relevance of the brand among consumers who look for quality apparel products at affordable prices (Woo & Jin, 2014). Further exploration of UNIQLO’s segmentation strategy is presented below.

Table 1 Segmentation of UNIQLO in the US and India

| Factor | US | India |

| Demographic segmentation | Consumers aged between 17 and 55 years, both male and female | Consumers aged between 17 and 55 years, both male and female |

| Psychographic segmentation | The reasonable prices for the high-quality products | Competitively priced products with high value and functionality. |

| The customers who need competitively priced while providing high value and functionality. | ||

| Behavioural segmentation | Focus on the price, service and product attributes in line with the benefits and needs of the customers. | Focus on the price, service and product attributes in line with the benefits and needs of the customers. |

| UNIQLO provides online and offline stores to suit the purchase preferences of consumers | Online and offline channels to attract both e-commerce and in-store shopping segments | |

| Geographic segmentation | Segments the urban areas in the US with California having 35% of the stores, New York 21% and New Jersey 11% (See appendix 3) | Full market coverage focusing on customers in the urban areas. |

In the US and Indian markets, the demographic segments that UNIQLO pursues include those aged between 17 and 55 years, comprising both men and women. The demographic segments of UNIQLO, therefore, include generations Z, Y and X in both countries (Duoyan, 2021). Besides, behavioural segmentation considers the potential consumers based on prices, services and product attributes. The customers who require quality apparel products at affordable prices include a vital segment for UNIQLO besides those living in the urban areas.

MUJI

MUJI adopts “no brand” and “no logo”, which emphasises the simplicity of the brand. The “no brand” concept of MUJI targets diverse segments in the US and Indian markets (Nishikawa et al., 2013). In this case, the customers of MUJI in the US and India can be segmented based on the demographic, psychographic, behavioural and geographic characteristics of the markets. The table below compares the MUJI’s segmentation of the US and Indian markets.

Table 2 Segmentation of MUJI in the US and Indian Markets

| Factor | US | India |

| Demographic segmentation | This category comprises consumers aged between 25 and 44 years with high middle-to-high income in the US. | Consumers aged between 25 and 44 years |

| Psychographic segmentation | This segment comprises the category of potential consumers who seek simplicity and quality in products without brand and company logos. | This category comprises customers who seek exclusive and minimalist products that are differentiated from the typical products. |

| This segment also includes environmentally conscious consumers who desire environmentally friendly products made of natural materials. | Environmental conscious consumers | |

| Behavioural segmentation | This segment includes potential customers who prefer design-less minimalist products. | Consumers who prefer premium but minimalist products |

| Geographic segmentation | This segment comprises both men and women living within the major urban areas. | This segment comprises both men and women living within the major urban areas. |

MUJI segmentation of the US and Indian markets considered different factors. The differentiated marketing strategy of MUJI highlights the need to understand and focus on the market segments that provide the brand with the best opportunities in the markets where a special offer is developed to attract each segment (Nishikawa et al., 2013). For example, the location of the physical stores in the major cities in the US and India indicates the focus on geographic segmentation, i.e. men and women living in the major urban areas or cities. From the psychographic segmentation standpoint, MUJI’s products appeal to consumers seeking simplified and quality products besides those craving environment-friendly products made of natural materials.

3.2 Targeting

UNIQLO

In the US, UNIQLO adopts full-market coverage through its mid-range priced products. The majority of the store locations of the brand in the US and China are located within urban areas, indicating that the physical store targets urban dwellers. The mid-ranged prices, in this case, appeal to the price-sensitive consumers in the US, who mostly comprise young consumers aged between 17 and 25 years and need high-quality apparel products. The creative and attractive designs of UNIQLO’s products, therefore, offer the US and Indian consumers distinctive value and high quality. The standardisation strategy of UNIQLO, though, implies that the clothes do not fit other consumers due to differences in body shapes to the “typical Asian”, especially for women, which limits the targeting of consumers in the US and India (Zhao, 2017). Despite targeting price-conscious consumers in the US, the increase in product prices in India indicates the target of affluent consumers who need products that differentiate them from the typical consumers.

MUJI

MUJI targets potential customers mainly based on their psychographic characteristics and demographic characteristics in the US and Indian markets. For example, MUJI targets customers through attributes such as unidentifiable logos, environmental friendliness and minimalist design products (Zou & Zou, 2020). Therefore, MUJI targets customers who believe that their “no brand” and “no logo” products are environmentally sustainable and are made of natural materials. In terms of demographic segmentation, MUJI targets both young and older customers, which explains the diversified targeting strategy. The benefits provided by MUJI’s products include the ability to enjoy minimalist design products, especially among those consumers tired of identifiable product logos (Toda, 2019). In this case, MUJI retails a variety of products for consumers to ensure the brand serves a variety of consumers in the US and Indian markets.

3.3 Positioning

UNIQLO

Based on the analysis provided above, UNIQLO positions itself in the US market as a high-quality apparel brand that focuses on providing competitively priced products to consumers. UNIQLO differentiates itself from competitors in the US by providing competitively priced, high-quality apparel products (Woo & Jin, 2014). In contrast, in the Indian market, UNIQLO positions itself as an exclusive apparel fashion brand based on high-tech fabrications and quality (Zhao, 2017). In this case, UNIQLO considered the singularity and uniqueness of the Indian market based on enthusiasm with low price consciousness despite the low indulgence in the country.

MUJI

The positioning strategy of MUJI in the US market is based on functionality and simplicity, with a core focus on the minimalist design of the products under the brand. Based on the description provided above, MUJI positions itself as a functional and simple brand that offers environmentally friendly products made from natural materials (Zou & Zou, 2020). Besides, the positioning of MUJI in India resembles that in the US, where it focuses on high-end consumers and not price-sensitive consumers (Zou & Zou, 2020). In this case, MUJI positions its products as simple in that the products present plain and understandable designs that blend environmental commitment with quality pursuits. The products are also useful, adaptable and versatile.

4.0 Market Entry Mode and Internationalization

4.1 Market Entry Mode

UNIQLO

The market entry mode determines the success of international market expansion. The choice of the market entry mode determines the organisational and marketing strategies of the business. UNIQLO ventured into the US market in 2005 (Matsuyama & Huang, 2023). In venturing into the US market, UNIQLO set up flagship stores in the US, which indicated the adoption of Greenfield’s investment. The Greenfield investment provided UNIQLO with the advantage of having control over all aspects of transactions in the US market (Kwon et al., 2021). The brand was, therefore, able to extend the qualities of high-quality, modernised, simple and uniquely designed products. Despite the advantages of Greenfield investment, it presents the disadvantages of high investment and high uncertainty in a new market.

UNIQLO also adopted the Greenfield investment to venture into the Indian market in 2019 (HANADA, 2023). In this mode, UNIQLO set up its first flagship store in Ambience Mall, Vasant Kunj, Delhi and focused on working with local producers to increase the sourcing base of the brand (Sharma, 2019). The Greenfield investment increased the exposure of UNIQLO to the heavy import duties in India.

MUJI

MUJI ventured into the US market in 2003. The market entry mode adopted for the US market entailed the licensing strategy. The licensing strategy where MUJI permitted MOMA to stock its products where MUJI was the licensor. The licensing strategy for an overseas market with a different culture to that of the home country reduces the cost and risk in the market expansion to the US. After developing experience in the market as a licensor, MUJI opened its stores in the US in 2007. Before opening its own stores, MUJI had no control over the marketing operations, which explains the pursuit of Greenfield’s investment later on.

MUJI ventured into the Indian market in 2016 by opening flagship stores in Mumbai and Bangalore. The flagship stores, in this case, highlight Greenfield’s investment strategy as a market entry mode in India. The Greenfield investment, although costly, provided control in managing the marketing and production of products (Kwon et al., 2021) to extend the brand values of simplicity and minimalist attributes of its product portfolio.

4.2 Internationalisation Process

The analysis of UNIQLO indicates the standardisation approach to internationalisation. The standardisation strategy involves undifferentiated use of marketing mix in the US and Indian markets (Kwon et al., 2021). in this case, the greenfield investment indicates that UNIQLO did not take time to develop knowledge of the market or gradually enter both markets.

Based on the analysis conducted, MUJI’s internationalisation, i.e. expansion into the US market, could be explained through the Uppsala model. According to Vahlne and Johanson (2017), the Uppsala model is based on the concepts of commitment, knowledge of current activities and commitment decisions. The gradual internationalisation, in this case, involves a learning process. MUJI’s internationalisation in the US began with the licensing strategy then, followed by Greenfield investment after the brand had developed market knowledge. The same case, though, did not apply to the Indian market entry model, although it adapted its products to the US and Indian markets to ensure fit due to the difference in the global destinations.

5.0 Cultural Adaptation

The analysis of UNIQLO and MUJI presented different approaches to cultural adaptation in the host countries. In the case of MUJI, the brand localised its marketing and products to the local markets, considering the differences in the preferences of the local customers (Zou & Zou, 2020). MUJI’s collaboration with designers provided an important push in increasing the production of relevant products for the US and Indian markets. Considering the high indulgence in the US market, MUJI positioned its products as an exclusive brand based on simplicity and minimalist features besides quality to provide enjoyment and prestige to the US consumers. Despite the low indulgence levels in the Indian market, MUJI positioned its products as high-priced products with the aim of attracting high-income earners (Nagasawa, 2020). In this case, the low indulgence was indicated not to deter the consumption of premium brands in the Indian market.

In contrast, although UNIQLO was able to localise and adapt its marketing, its products were standardised to promote the “typical Asian”, which presented a limitation of not fitting the body type of the consumers in the US and China (Nagasawa, 2020). Based on these outcomes, UNIQLO’s low cultural adaptation emerged as a challenge.

6.0 Conclusion

The success of UNIQLO and MUJI in the US and Indian markets are different. MUJI’s market entry into the US was more successful due to the gradual entry into the market with complete knowledge, as explained through the Uppsala model. It is evident that both brands considered Greenfield investment when venturing into the developed (US) and the developing market (India). The Greenfield investment provided control, hence the ability of the brands to control the production and marketing outcomes. Although MUJI adopted the adaptation strategy in both marketing and product development, UNIQLO’s strategy featured standardisation in product development but adaptation in marketing. In this case, the products of UNIQLO failed to incorporate cultural factors in design, i.e. the body types of the different cultures in developing products, as all their apparel products were standardised based on the “typical Asian” body. Although both brands were successful, UNIQLO needs to consider adapting its products.

7.0 Reference List

Ackerman, D. and Tellis, G. (2001) “Can culture affect prices? A cross-cultural study of shopping and retail prices,” Journal of Retailing, 77(1), pp. 57–82. doi:10.1016/S0022-4359(00)00046-4.

Bailay, R. (2023) Uniqlo: Making headway with made for all, Images Business of Fashion. Available at: https://www.imagesbof.in/uniqlo-making-headway-with-made-for-all/#:~:text=Pricing%20strategy,seems%20to%20have%20paid%20off. (Accessed: 15 February 2024).

Duoyan, H. (2021) ‘Research on zara strategy from the perspective of SWOT analysis method’, Advances in Social Science, Education and Humanities Research [Preprint]. doi:10.2991/assehr.k.210407.041.

ECDB (2024) Uniqlo.com revenue: ECDB.com, uniqlo.com revenue | ECDB.com. Available at: https://ecommercedb.com/store/uniqlo.com (Accessed: 15 February 2024).

HANADA, R. (2023) Uniqlo opens first Mumbai store in growing India push, Nikkei Asia. Available at: https://asia.nikkei.com/Business/Retail/Uniqlo-opens-first-Mumbai-store-in-growing-India-push#:~:text=Uniqlo%20entered%20India%20in%202019,India%20CEO%20Tomohiko%20Sei%20said. (Accessed: 15 February 2024).

Kwon, H., Chung, S.W. and Lee, J. (2021) “South Korean first‐tier suppliers in apparel global value chains: Upgrading and labour implications in the Asian context,” International labour review, 160(4), pp. 553–569. doi:10.1111/ilr.12212.

Lawler, R. (2023) Uniqlo to double North America stores in 2024 amid record profit, Just Style. Available at: https://www.just-style.com/news/uniqlo-to-double-north-america-stores-in-2024-amid-record-annual-profit/ (Accessed: 15 February 2024).

Marketing Club (2018) Muji -the ‘no-brand’ brand, Marketing Club. Available at: https://marketingclubimi.wordpress.com/2018/07/10/muji-the-no-brand-brand/ (Accessed: 15 February 2024).

Matsuyama, K. and Huang, G. (2023) Uniqlo to open ten stores in the US, boost marketing to capture sales, Bloomberg.com. Available at: https://www.bloomberg.com/news/articles/2023-02-19/uniqlo-s-quest-to-conquer-the-us-one-cashmere-sweater-at-a-time (Accessed: 15 February 2024).

Nagasawa, S. (2020) ‘Luxury strategy by simple and pleasant lifestyle brand of Muji — flagship store strategy for Large Store location’, Journal of Textile Science & Fashion Technology, 6(4). doi:10.33552/jtsft.2020.06.000644.

Nishikawa, H., Schreier, M. and Ogawa, S. (2013) ‘User-generated versus designer-generated products: A performance assessment at muji’, International Journal of Research in Marketing, 30(2), pp. 160–167. doi:10.1016/j.ijresmar.2012.09.002.

Sabanoglu, B. (2020) Bihter Sabanoğlu. Available at: https://bihtersabanoglu.com/ (Accessed: 15 February 2024).

Sabanoglu, T. (2022) UNIQLO: Brand value worldwide 2016-2022, Statista. Available at: https://www.statista.com/statistics/980750/brand-value-of-uniqlo-worldwide/#:~:text=This%20statistic%20presents%20the%20brand,billion%20U.S.%20dollars%20in%202018. (Accessed: 15 February 2024).

Sharma, N. (2019) Uniqlo’s Market Entry Strategies in India, The Case Centre. Available at: https://www.thecasecentre.org/products/view?id=166666 (Accessed: 15 February 2024).

SmartScrapers (2023) Numbers of muji in the United States: SmartScrapers, SmartScraper. Available at: https://rentechdigital.com/smartscraper/location-reports/muji-locations-in-united-states (Accessed: 15 February 2024).

Toda, Y. (2019). Creation and transmission of brand identity: A case study of MUJI. In Proceedings of the Conference on Historical Analysis and Research in Marketing (Vol. 19, pp. 337-339). https://ojs.library.carleton.ca/index.php/pcharm/article/view/1938

UNIQLO (2024) Uniqlo Opengraph title, UNIQLO. Available at: https://www.uniqlo.com/eu/en/pages/sport/ambassadors/ (Accessed: 15 February 2024).

UNIQLO India (2023) Uniqlo. Available at: https://www.uniqlo.com/in/en/information/corp-about (Accessed: 15 February 2024).

Vahlne, J.-E. and Johanson, J. (2017) “From internationalisation to evolution: The Uppsala model at 40 years,” Journal of International Business Studies, 48(9), pp. 1087–1102. doi:10.1057/s41267-017-0107-7.

West Elm (2020) Muji announces major retail partnership with West Elm, West Elm. Available at: https://press.westelm.com/muji (Accessed: 15 February 2024).

Woo, H. and Jin, B. (2014) ‘Asian Apparel Brands’ internationalisation: The application of theories to the cases of Giordano and uniqlo’, Fashion and Textiles, 1(1). doi:10.1186/s40691-014-0004-7.

Woo, H. and Jin, B. (2014) “Asian apparel brands’ Internationalisation: the application of theories to the cases of Giordano and Uniqlo,” Fashion and textiles, 1(1), pp. 1–14. doi:10.1186/s40691-014-0004-7.

Zhao, M. (2017) Uniqlo’s global ambitions take centre stage as it eyes India, S&P Global Homepage. Available at: https://www.spglobal.com/marketintelligence/en/news-insights/trending/HfYB1xSrTjYTl4bketO_VQ2 (Accessed: 15 February 2024).

Zou, J. and Zou, Y. (2020) ‘Research on marketing strategies of Multinational Enterprises: Taking Muji as an example*’, Proceedings of the 4th International Conference on Culture, Education and Economic Development of Modern Society (ICCESE 2020) [Preprint]. doi:10.2991/assehr.k.200316.329.

8.0 Appendices

8.1 Cultural Differences based on Hofstede’s Cultural Dimensions

8.2 MUJI store locations in the US

8.3 UNIQLO Store Locations in the US

write

write