Introduction

Since the emergence of the COVID-19 pandemic in 2019, firms across the world have fatally suffered. In 2020 alone, the global economy contracted by 4%. The lockdowns and border closures have increasingly affected the business landscape (Tompkins, 2022). To date, some of the firms are still experiencing devastating impacts of the pandemic that have continued to slow down their growth and development efforts. One of the firms that is exposed to devastating social, economic, and personal distress due to the fallout from COVID-19 is the Cedar Fair in the United States.

Background and History

Cedar Fair operates in the leisure and arts industry. Established in the United States, the company has invested in making people happy since the 1870s, when it started as a fun venture. Several folks developed a bathing beach, dance hall, and boat dock on Lake Erie for the purpose of creating fun for themselves. The fun venture birthed today’s Cedar Fair entertainment company (Chen et al., 2020).

It operates as a vital player in the fun market. It runs on 13 markets offering entertainment properties in Toronto, Ontario, Canada. The company serves the guests with unique events, memorable character encounters, live entertainment, delicious food and classical carnival treats. It offers a wide range of lodging options for all customers (Tompkins, 2022).

Current status

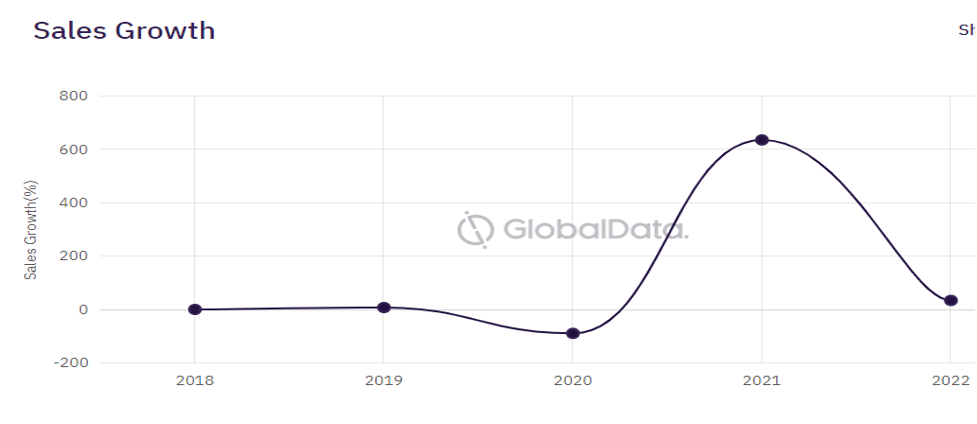

Cedar Fair operates as a world-class fun purveyor. It owns and operates about 11 regional amusement parks, two destinations for sport, dozens of restaurants, about 2,300 overnight accommodations, and four water parks. The company seeks to continue delivering fun despite the tough times arising from the impacts of the COVID-19 pandemic (Srikant & Donovan, 2022). It is extending its community partnerships to create more employment and education opportunities for more than 40,000 individuals within its location. With a responsive Corporate Social Responsibility, the company is destined to survive. Since 2019, sales have started decreasing as COVID-19 impacts were witnessed (Global Data, 2023). After sharply increasing in 2021, the sales again started decreasing in 2022 amid the dreadful impacts of the pandemic (APPENDIX A).

Today, Cedar Fair is more than just a collection of water slides and world-class thrill rides. Last year, the company hosted about 27 million guests across the 15 parks (Tompkins, 2022). It has turned to full-time, seasonal, and part-time associates as the customer demand keeps changing. Despite the unpredictable demand, Cedar Fair has continued to introduce new attractions while still boosting the existing ones. One of the most recent attractions developed in 2023 is the Wild Mouse Roller Coaster, which features holiday-themed celebrations, upgraded beverage and food programs, and immersive family rides.

Challenges

One of the major challenges involves stiff competition that threatens the company’s productivity and performance. Some of the key competitors posing hostility towards Cedar Fair company include the Walt Disney Co., Six Flags Entertainment Corp, Merlin Entertainments Ltd, and SeaWorld Entertainment Corp (Global Data, 2023). The competitive comparison is as shown;

| Parameter | Cedar Fair company | Walt Disney Co. | Merlin Entertainments ltd | Six Flags Entertainment Corp | SeaWorld Entertainment Corp. |

| State | Ohio | California | England | Texas | Florida |

| Headquarters | United States | United States | United Kingdom | United States | United States |

| Number of Employees | 4,400 | 220,000 | 21,123 | 1,450 | 3,200 |

| Entity type | public | public | Private | public | Public |

Table 1: Competitor comparison.

Another key challenge relates to the company’s financial stability. The company’s financial disasters are linked to the seasons of lockdowns, which led to a combination of bad earnings. Similarly, the social distancing stigma resulted in extreme pressure on the underlying business operations. As a result, the company went ahead to cancel its previously announced long-term adjusted EBITDA target of $600 million by the end of the year 2024 (Tompkins, 2022). Financial flexibility remains a great challenge for Cedar Fair company. It has become increasingly difficult to determine the actual impacts of the COVID-19 pandemic on its operations.

Some of the company’s stocks have been exhibiting poor performances. For example, the fun stock crashed in late 2020, declining by $13 from the $55 level that it had started with early the same year. In 202 alone, the stock dropped off over 70%, causing fears about the company’s ability to remain competitive in the leisure and arts industry. Therefore, the company has experienced a strained journey towards profitability. Even worker compensation, while satisfying profitability needs, has remained challenging (Srikant & Donovan, 2022).

Consequently, Cedar Fair has gone ahead and laid off most of its seasonal and part-time employees as all the parks become fully operational once more. The remaining employees have been subjected to a salary decrease of up to 40% while the executive’s salary is slashed by 25%. In the days ahead, the salary decrease might reap off the company’s majority of its long-term employees. Due to the cost of living crisis, the employees might go ahead to explore greener pastures in other companies and end up withdrawing from Cedar Fair (Chen et al., 2020). Even the remaining employees may exhibit decreased work motivation. Without employee motivation, it will become increasingly challenging to achieve the set objectives and goals for the company.

In the days ahead, Cedar Fair may experience the challenge of staffing. Amid the unfavourable wages and salaries set for park employees, the company may find it difficult to secure employees for their parts and other units. The unprecedented demand for labour affects the company’s ability to hire successfully. As pay for employees increases across the industry, Cedar Fair company may not be able to meet the salary and wage requirements to secure the appropriate number of employees (Chen et al., 2020).

Due to the continuing restrictions on international travel, Cedar Fair still faces the challenge of reduced guests. Even though the company’s operations remain open today, international customers, who are the most lucrative, cannot use the services. Also, the closed borders have cut the flow of international customers and workers that Cedar may have hired on a seasonal or part-time basis. In addition, the delays in the establishment of new attractions have emerged as a great challenge for Cedar Fair. As a result, it exhibits a fear of emerging as irrelevant in the leisure and arts industry as it stagnates in the development of new attractions (Chen et al., 2020). This year alone, the company has only managed to introduce the wild mouse roller coast.

Recommendations.

To become healthy again and reach a fully functioning and profitable state, Cedar Fair company should take various actions. First, the company should heavily invest in emerging technologies. Today, technology is increasingly shaping the nature of operations for the majority of companies across industries worldwide. By subscribing to emerging technologies, Cedar Fair will match customer demands most uniquely and efficiently while building its competitive edge. Using blockchain technology, it will be much easier to securely manage all customer transactions and promote financial follow-ups for improved financial performance (Chen et al., 2020).

Also, Cedar Fair should improve its marketing efforts through social media. As a result, the company will manage to secure more international and domestic customers to boost its sales and profitability. The AI-powered chatbots and the ChatGPT should be integrated into the company’s websites and social media platforms, such as Facebook, to promote persuasive interactions. The virtual assistants on the company’s social media platforms will help respond to prospective customer queries, offer recommendations, assist in bookings and reinforce the overall user experience (Chen et al., 2020).

Cedar Fair is currently working on a merger with Six Flags, one of its long-term competitors. The merger is expected to combine the iconic amusement park companies in North America to enhance performance and park offerings (Tompkins, 2022). Under the merger, the companies should expand their products and service base. Leveraging their profound strength and capacities, the companies should consider venturing into transportation services, with the primary target customers remaining international and domestic guests. Through the merger, the companies could introduce their private airline services to facilitate travel for their customers. As part of the transportation initiative, the company should introduce electric vehicles. Essentially, it will be a remarkable move towards expanding the company’s CSR. The use of electric vehicles will help contribute to environmental sustainability, which builds their reputation and brand awareness (Chen et al., 2020).

Conclusion

Overall, Cedar Fair company has massively suffered since the emergence of the COVID-19 pandemic. Even as it continues to operate today, the company is still exposed to significant challenges, including staffing issues, financial instability, and a weak customer base. Therefore, it is recommended that the company consider new initiatives, such as the integration of emerging technologies and social media improvements. Also, its current idea to merge with Six Flags will help create a strong front to fight the social, economic, and interpersonal issues related to the COVID-19 pandemic.

References

Chen, M. H., Demir, E., García-Gómez, C. D., & Zaremba, A. (2020). The impact of policy responses to COVID-19 on US travel and leisure companies. Annals of Tourism Research Empirical Insights, 1(1), 100003. https://doi.org/10.1016/j.annale.2020.100003

Global Data. (2023). Cedar Fair, L.P.: Overview. https://www.globaldata.com/company-profile/cedar-fair-lp/

Srikant, C. D., & Donovan, P. (2022). Escaping the niche: how one company broke the mould. Journal of Business Strategy, 43(2), 96-104. https://www.emerald.com/insight/content/doi/10.1108/JBS-09-2020-0202/full/html

Tompkins, D. L. (2022). A Fair Price for Cedar Fair. SAGE Publications: SAGE Business Cases Originals. https://sk.sagepub.com/cases/a-fair-price-for-cedar-fair

APPENDIX A: Cedar Fair Sales Growth

Source: Global Data (2023).

write

write