Overview

Brazil has abundant resources such as natural gas and oil products. The resources aid Brazil to have an upper hand in international commerce than most of the other nations. The Amazon Rainforest is located in this large country that creates a distinctive triangle across the eastern coast of South America. Spirituality, music, and food in Brazil, where Portuguese is the official language, are all enriched by the country’s diverse tradition of culture, which includes influences from Amerindian, European, and African peoples. Brazil is well-known across the world for both its athletic brilliance and its farming richness. Measures are being made to improve the corporate climate and stimulate economic growth amid administrative hurdles.

On the other hand, Singapore, which sits on the Malay Peninsula’s southern tip, is a desirable place to live and do trade because of its well-developed facilities, convenient transit options, rich cultural offerings, and engaged administration. Singapore’s role as a worldwide fiscal center, its many agreements governing free trade, and its powerful commercial and logistics divisions all assist the country’s economic growth, even in the face of global uncertainties and pandemic-related concerns.

Introduction

In today’s globalized environment, companies are keen to test out new international markets. Brazil and Singapore are two countries that have recently attracted much focus for their promising futures in global commerce. These nations provide fascinating possibilities and obstacles for foreign investors, notwithstanding their geopolitical and financial differences. Brazil’s strong economy and intricate politics make for a fascinating setting. The island nation of Singapore, on the other hand, has come to symbolize the astounding affluence, stable administration, and cutting-edge facilities of Southeast Asia.

Global commercial success requires a deep familiarity with the political, monetary, and cultural differences of many countries. This comparison of Brazil and Singapore sheds light on the complexities of international trade by showing that while Brazil has unrealized possibilities thanks to its abundant assets and developing financial benefits, Singapore is a model of effectiveness and steadiness thanks to its well-established institutional framework and high-quality educational system. This essay highlights the importance of informed choices for MNCs Widget pursuing to negotiate the complex world of global commerce by exploring the various types of governance, approaches for reducing international trade pitfalls, financial circumstances, infrastructure enhancements, systems of learning, and the influence of the U.S. dollar exchange rate. In order to choose the most advantageous routes for revenue development and expanding the market, which will eventually influence the future landscape of Widgets in international trade, it is crucial to recognize the complex possibilities and difficulties given by these two unique countries.

Form of Government

The Brazilian government is a presidential republic where the president is voted in on a four-year term and may run for retention if they perform well. In Brazil, political groups have the right to compete with rivals freely. Many political parties originate in a single region, but the electoral system encourages expansion. Some political factions are inconsistent in their ideology. Party switching among legislators weakens electoral alliances. Federal and local elections provide opportunities for parties in opposition to fight and win control. Although the legal framework ensures that everyone has the same rights without discrimination, there is a significant disparity in exercising those rights. Certain groups are more heavily represented in government than others. Aspirants in the 2022 election spoke to voters about economic issues and growing poverty. In the last round of voting in late October, Lula received 50.9% of the vote versus Bolsonaro’s 49.1% (Kirikkaleli & Adebayo, 2022). Deception, hostile speech on social media and other internet platforms, and acts of political violence plagued the extremely divided campaign. In a display of the country’s rich variety, Brazilians from all walks of life came together to give Luiz Lula the presidential robe. Top-level corruption is pervasive, and low government openness contributes to broad public disenchantment. Violence and harassment from the general public towards LGBT+ persons are still significant issues. Influence from large corporations often leads to corruption amongst elected officials, a severe problem in democracies.

On the other hand, since achieving independence on August 9, 1965, Singapore has existed as a parliamentary democracy. The majority party in Congress elects the cabinet and prime minister members. Since 2004, the PAP government of Lee Hsien Loong, the prime minister, has been in place. While voting day processes are usually smooth, legitimate rivalry in elections is hindered by various institutional obstacles that benefit the PAP. The PAP won 61.2% of the ballots and 83 of the 93 democratically elected positions in the 2020 polls (Chia, 2020). The Workers’ Party, the most substantial opposition organization, gained ten positions and was awarded two corrective seats, bringing the total number of opposition MPs to 12. Economics and politicians are closely intertwined due to the corporatist economic framework, which has been called oligarchic (Freedom House, 2023). These overlapping networks bolster the PAP’s political supremacy. Legislators make policy decisions, but the PAP’s legislative and structural dominance guarantees electoral success, and party leadership assures supporters adhere to party regulations. The government is not forthcoming with information on how it runs. The country has no privately owned media outlets, radio programs, or cable networks. Even though self-censorship is widespread, media sometimes broadcast criticism, commentaries, and news articles.

Singapore’s long-standing parliamentary system and constant PAP government make it one of the world’s most politically and legally stable countries. The administration of law is well-developed in this nation, and corruption is minor. However, the political climate in Brazil is more complicated and less foreseeable, making it more difficult for firms to develop and thrive there. It is a presidential republic with a long tradition of political unrest, scandalous corruption, and recurring partisan flip-flopping. Many of the political issues Brazil confronts are highlighted by the polarized and misinformed 2022 gubernatorial race. This suggests that Singapore is the more politically and legally sound option for global commerce and company development.

Methods to offset international trade risk

Decreasing the interest rate margin in the future would reduce the gap between the 13.75% standard interest rate set by Banco Central do Brazil and the 5% to 5.27% federal funds rate range in the United States (Freedom House, 2023). Even with the possibility of declining interest rate margins in the future, more significant economic growth and progress on measures are expected to provide minor assistance for Brazil’s currency in the short term. Currency hedging tactics minimize unpredictability regarding global commerce by mitigating the potential hazards of rate swings. Occasionally, in countries like Brazil, with a track record of political turmoil, normalcy falls progressively in plain view of the media. To mitigate the effects of civil unrest, modifications to government procedures, and confiscation of property, MNC Widget may obtain political risk coverage. MNC Widget would familiarize itself with Brazil’s legislative environment and how it might facilitate partnerships between Brazilian and international businesses. Collaborations in the area could help know all aspects of the legal framework better and be an excellent resource for information and connections. Various attempts to broaden the market include the introduction of cutting-edge technologies, the expansion of existing ones, and the creation of entirely new ones. International diversification, or less reliance on Brazil’s finances, is another strategy for mitigating risk. Several hazards may be avoided or mitigated by enforcing legal obligations on collaborators, vendors, and consumers.

In contrast, Singapore is one the most secure democracies in Asian regions, and its Parliament is based on an interpretation of Westminster’s. To guarantee they always follow the law, MNC Widget must monitor developments in legislation and regulatory frameworks. Singapore’s rapid ascent to first-world status is often attributed to the country’s open trade policies and streamlined government. The Multifunctional and Transformative Trans-Pacific Partnership (CPTPP) and the 15 bilateral and 12 regional free trade pacts (FTAs) and e-commerce accords (DEAs) that the nation has signed (Freedom House, 2023). MNC Widget may reduce tariffs while gaining accessibility to new markets using free trade agreements like the USSFTA. Singapore has achieved impressive progress in several domains and has received a heartening number of international honors that attest to the city’s vitality and world-class status. Singapore is a global crossroads, serving as a hub for international trade, the interaction between cultures, technological advances, and generating novel domestic and multinational companies. MNC Widget needs a varied economy to reduce its dependency on any one sector for success. The logistics industry in Singapore has developed outstanding infrastructure and procedures throughout time. Several activities are being undertaken throughout the supply chain to prepare the nation for the future. This would allow MNC Widget to construct robust distribution networks with many suppliers and transit routes to absorb shocks and keep production going during interruptions.

Possibilities for global commerce exist in Brazil and Singapore, but given their very different financial and political settings, how these risks might be mitigated is also different. Singapore’s stable and supportive administration offers an improved atmosphere emphasizing diversity and adaptability, whereas Brazil’s geopolitical and monetary crises need more comprehensive strategies for risk mitigation.

Comparison of economies to determine the most significant potential for profit growth

Brazil Economy

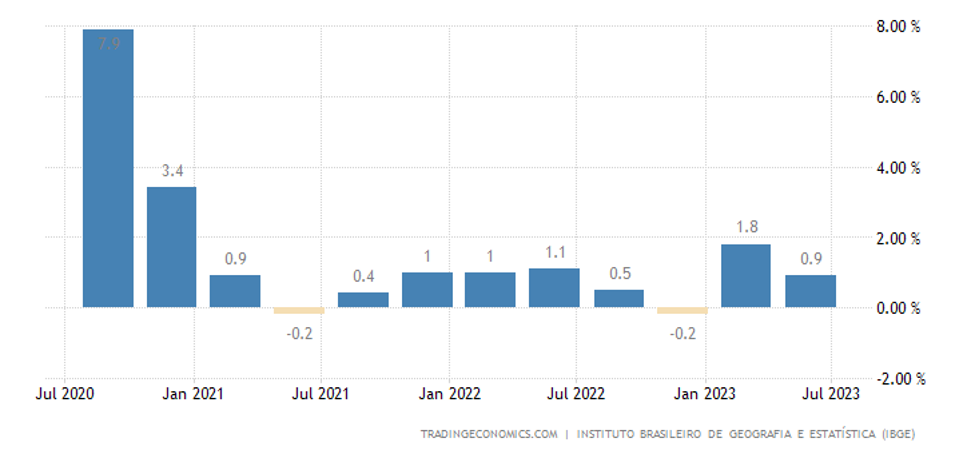

The Brazilian economy has been relatively robust so far. The first-quarter, Q1, growth of real gross domestic product (GDP) was notably strong due to increased crop yields. The coming year is expected to positively impact expenditure due to the anticipated amelioration of financial conditions, which the burden of elevated loan service expenses has hitherto hindered. The falling rates can benefit many entities, such as organizations and enterprises. Brazil’s overall local goods and services have improved by 0.9% for the second quarter, Q2, of the year. The percentage surpasses the forecasted percentage rise that was proposed of 0.3% (Trading Economics, 2023). Hence, the economy is showing promise for investments, even though it is struggling with monetary issues from the central bank of Brazil (Trading Economics, 2023). The central bank has become a significant barrier to the expansion of businesses by setting very high-interest rates in the nation.

The figure above shows the growth of Brazil’s GDP over the last three years. The GDP is expected to grow and surpass the previous quarter’s rate of 1.8%. The value currently stands at 0.9% as of July 2023 (Trading Economics, 2023). There has been increasing docking compared to last year, which shows the growth of businesses inland. Data shows that exports rose by 2.9% compared to the previous rates of the same time last year, while imports grew by 4.5% of the last year’s percentage (Trading Economics, 2023). The expected growth will result from the nation’s rising export and import activities.

Singapore Economy

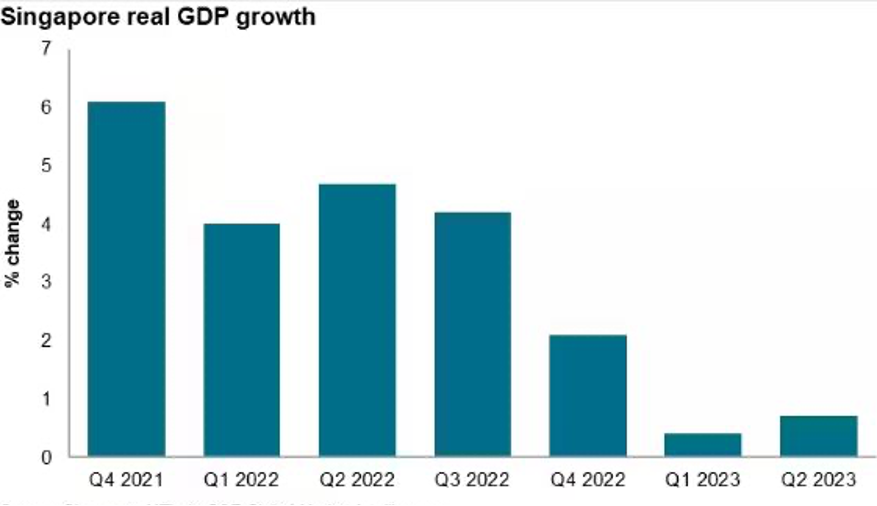

Singapore has a 0.4% increase improvement in its economy compared to last year’s data of the nation’s GDP. Singapore had the highest growth in the first quarter of this year and is expected to continue rising with time for the rest of the year. The expected percentage rise is 0.7% of the current values (Biswas, 2023). However, the nation has experienced some growth decline compared to the year’s projections. The declining economy results from declining industrial operations in Singapore, reducing the revenue generated for the nation’s GDP.

As seen in the figure above, the Singapore Ministry of Trade and Industry (MTI) predicted that the nation would have a 0.7% growth year-to-year. The forecasted values illustrate the growth about the 0.4% year-on-year improvement percentage observed in Q1 of this year. In Q2 2023, the service industry’s production increased by 3.0% y/y and 1.3% q/q (Biswas, 2023). The sector of food and hospitality, housing management, and administrative services rose by 6.1% y/y in Q2 2023 due to the relaxation of numerous COVID-19 limitations since April 2022 and rising tourist flows (Biswas, 2023). The government of Singapore continues to forecast that the GDP will progress at a rate of 0.5% to a maximum of 2.5% by the end of the year (Biswas, 2023). The predictions are based on the changes that were made to taxes. Singapore increased the GST (Goods and Services Tax) by 1% in Q1 of this year.

Brazil and Singapore’s Q2 gross domestic product (GDP) growth rates in 2023 have made it evident that Brazil has demonstrated superior prosperity. The nation offers a favorable business environment for expansions because Brazil had a 1.8% increase in its GDP for Q1 of this year and a 0.9% growth for the second quarter (Biswas, 2023). The percentage growth has surpassed the expected percentages proposed last year, which promises even better years to come for businesses. However, current data shows that the growth rate is slowly decreasing, eventually leading to unfavorable business conditions if the decline continues. On the other hand, Singapore has managed to address its declining GDP by improving its infrastructure and services sectors (Biswas, 2023). Singapore’s improving those sectors has helped industries increase their output and, in turn, helped the nation’s GDP grow. Singapore’s GDP is forecasted to continue to grow in the next decade, making the nation favorable for investment and expansion of businesses. Singapore’s Ministry of Trade and Industry predicts the nation will have a 0.5% to 2.5% increase in GDP for the following year (Biswas, 2023). However, Brazil offers better import and export services and operations that are increasing its operations daily, making it possible to shoot business-wise in the near future.

Comparison of Brazil and Singapore’s infrastructure and education system

Brazil

U.S. companies may find openings in Brazil’s infrastructure market by offering architectural and building machinery, approaches, and operations for projects in areas including rail, roadway, airports, handling of water resources, sewage, and solid waste. The GOB has an arsenal of concessions planned for the following years, intended to boost investor interest in railroads, particularly for freight. Privatizing the Santos Port Authority (SPA), Latin America’s busiest and biggest port, is a significant ongoing initiative. Brazil’s sewage and water supply industry is expected to grow more in the future. More privatization is on the horizon, which will bring fresh money into the sector’s enterprises and facilities. Most of the Brazilian population, 84.1%, has access to potable water infrastructure (Trading Economics, 2023). Brazil has a lower educational system output where students have a higher chance to complete their studies than other Organization for Economic Cooperation and Development (OECD). The percentage of those who graduate in Brazil is lower than the average percentage worldwide, making the country’s education status lower than average.

Singapore

Modern facilities and quick technology adoption allowed Singapore to evolve from a backwater trade station to one of the world’s most technologically advanced terminals. Singapore has a first-rate airport, a seaport, and telecommunications facilities, making it easy to travel to and from the rest of the globe. More work-study openings to triple by 2025, increasing the volume of employment postings for mid-career employees to 5,500, and expanding the number of retraining courses for mid-career employees are all targets established by the government (Biswas, 2023). Singapore places a premium on training capable school administrators who will work to guarantee that all students have access to a rigorous and fair education.

Companies may find profitable niches in Brazil’s rail, port, highway, airport, and managing water resources sectors. The authorities encourage Private investment, especially in the privatization of railroads and ports. However, problems still need to be addressed since only 50.8% of wastewater is treated by sewage systems (Chia, 2020). Brazil’s vocational enrolment and completion rates are lower than average compared to other OECD nations. Conversely, Singapore has transformed into a worldwide center thanks to its cutting-edge technological facilities and quick adoption of new technologies. Education geared toward improving abilities is a national priority, emphasizing reskilling employees in the middle of their careers and providing access to excellent educational experiences. Singapore’s structure and educational system stand in stark opposition to the difficulties encountered in Brazil.

The United States Dollar Strengthens and Weakens.

Brazil

The prospect of a BRICS gold-backed currency challenging the U.S. dollar has grown recently. Although Brazil is generally apolitical, it is expected to side with the BRICS group on any proposed reforms to the international monetary system (Trading Economics, 2023). Given Brazil’s moderate geopolitical posture and status as a top natural material-producing nation, a practical BRICS currency project might boost the Brazilian real versus the U.S. dollar. Twenty cents was maintained as the fixed exchange rate for the Brazilian natural to the USD. The graph below illustrates a discernible pattern of relative positivity seen throughout the preceding six-month period.

The potential for a significant increase in the currency’s value relative to the U.S. dollar might be initiated by surpassing the existing peak level. EWZ may be able to stop its multi-year downward trend if the currency strengthens, boosting corporate earnings and the ETF’s strong dividend yield.

Singapore

Singapore’s currency exchange rate has been improving. This rate has risen over the last year. The last quarter of 2023 is anticipated to see a decline in the USDSGD. The U.S. dollar had a stellar 2022, with the Federal Reserve leading the way in determining modifications to interest rates. The value of the U.S. dollar in 2023 may be maintained, though, if U.S. inflation continues high (Nasdaq, 2023). When purchasing USD bonds using SGD, investors may be exposed to unwelcome currency-related hazards determined by current futures.

Singapore’s import-dependent economy benefited tremendously from the strong position of the Singapore dollar relative to other economies since it reduced the effects of supply-driven volatility. When factoring in the real effective exchange rate, the dollar’s worth looks far higher than it should be, illustrated below with the gradual uptrend of the U.S. dollar Singapore Dollar market.

The influence of the relative value of the U.S. Dollar (USD) on company profitability in the two nations is of considerable significance. The appreciation of the USD relative to a foreign currency can diminish the profitability of U.S. international companies that operate in that nation. This phenomenon arises because their income, expressed in the domestic currency, would diminish their worth upon conversion to United States dollars (Nasdaq, 2023). Conversely, a devaluation of the United States dollar (USD) could positively affect earnings, resulting in an increased exchange rate of foreign revenues into USD. However, the relationship between these elements exhibits variability due to various variables, including the use of hedging techniques and the unique characteristics of the local marketplace. The impact of exchange rate variations on organizations with worldwide activities significantly affects their financial performance and competitive position.

Conclusion

In conclusion, the ever-changing nature of commerce worldwide is shown by the comparison of commercial climates in Brazil and Singapore. Widget has a lot to gain from Brazil’s wealth of assets and dynamic economic performance, while Singapore’s reliability, productivity, and infrastructures give security of assurance. In order for firms and investors like Widget to make educated decisions, they must first understand the nuances of the possibilities and difficulties given by these countries. The next phase of worldwide commerce of Widget will be shaped by the strategic choice of countries as the globe changes and economies vary. Analyzing the two countries, it is more promising to expand Widget operations in Singapore for the favorable security of assurance.

References

Biswas, R. (2023, July 21). Singapore’s economic growth weakens in the first half of 2023. S&P Global Marketing Intelligence. https://www.spglobal.com/marketintelligence/en/mi/research-analysis/singapore-economic-growth-weakens-in-first-half-of-2023-jul23.html#:~:text=Singapore’s%20Ministry%20of%20Trade%20and%20Industry%20has%20maintained%20its%20GDP,and%203.5%25%2D4.5%25%20respectively

Chia, S. Y. (2020). Trade, industry, and government: the development of organizational capabilities in Singapore. In The Competitive Advantages of Far Eastern Business (pp. 52–70). Routledge. https://www.taylorfrancis.com/chapters/edit/10.1201/9781315037462-4/trade-industry government-development-organisational-capabilities-singapore-siow-yue-chia

Freedom House. (2023). Brazil. Retrieved September 19, 2023, from https://freedomhouse.org/country/brazil/freedom-world/2023

Freedom House. (2023). Singapore. Retrieved September 19, 2023, from https://freedomhouse.org/country/singapore/freedom-world/2023

Kirikkaleli, D., & Adebayo, T. S. (2022). Political risk and environmental quality in Brazil: Role of green finance and green innovation. International Journal of Finance & Economics. https://onlinelibrary.wiley.com/doi/abs/10.1002/ijfe.2732

Nasdaq. (2023). EWZ. iShares MSCI Brazil ETF (EWZ). https://www.nasdaq.com/market-activity/etf/ewz

Trading Economics. (2023). Brazil GDP Growth Rate2023 Data – 2024 Forecast – 1996-2022 Historical – Calendar. Brazil GDP Growth Rate – 2023 Data – 2024 Forecast – 1996-2022 Historical – Calendar. https://tradingeconomics.com/brazil/gdp-growth

write

write