Executive Summary

The investment decision-making processes are the primary focus of this project’s exploration of corporate finance. Part A provides a critical analysis of the NPV, ARR, and IRR, three of the most used tools for calculating investment cash flows, outlining their advantages, disadvantages, and practical uses. Accounting profit, cash flow statements, and sensitivity analysis are computed in Part B using these approaches and applied to the ACME Corporation case study. This research analyzes the market extensively to help readers make the best possible investment choices.

Introduction

The foundation for long-term success and profitability in the ever-changing world of corporate finance is sound investment decision-making. The methods used by financial managers to assess potential investments are the focus of this study. We aim to uncover insights on ideal investment strategies and their implications by using cash flow analysis tools in a real-world case study of ACME Corporation and critically assessing them. This paper adds to the ongoing conversation on responsible financial management and the production of wealth.

Part 1: Methodologies of Cash Flow Investment Appraisal

NPV

One way to determine how much an investment, project, or business will be worth is to look at its net present value (NPV). Estimating the quantity and timing of future cash flows and selecting a discount rate equal to the least acceptable rate of return is necessary to calculate NPV (Lu and Yin, 2021). One can use the discount rate to account for your cost of capital or the returns on other investments with similar levels of risk. A project or investment is said to have a positive NPV if the expected rate of return is higher than the discount rate (Zhang, 2021). The following is the formula for calculating the net present value of a project if there is a single cash flow that will be paid out one year from now:

NPV= (Cash flow/(1+i)^t) – Initial investment

where:

I = Required return or discount rate

T = Number of periods

If the NPV of an investment or project is positive, then the expected profits after depreciation will be more than the expected expenses, both expressed in current dollars. An investment is considered lucrative if its NPV is positive (Mellichamp, 2019). A net loss is the outcome of an investment if its net present value is negative. The idea that only investments with a positive NPV should be considered is based on this principle.

IRR

An important tool in financial analysis, the internal rate of return (IRR) estimates the profitability of possible investments. When doing a discounted cash flow analysis, an internal rate of return (IRR) discount rate will cause all cash flows to have a zero NPV (Magni and Marchioni, 2020).

Payback Period

Divide the investment amount by the annual cash flow to get the payback period. When deciding whether or not to invest, account and fund managers look at the payback period. One can use the following calculation to determine the payback period: Investment amount divided by annual cash flow is the payback period. The payback period has some drawbacks, one of which is that it needs to consider the time value of money (Nukala and Prasada Rao, 2021).

ARR

One way to calculate the expected return on an investment relative to the cost of the investment is by using the accounting rate of return (ARR) calculation. To calculate ARR, one must divide the asset’s average revenue by the initial investment made by the company. This ratio represents the expected return over the lifetime of the asset or project. One important aspect of running a business that ARR ignores is the time value of money and cash flows (Kousky et al. 2019).

Part 2: Analysis of ACME Corporation case

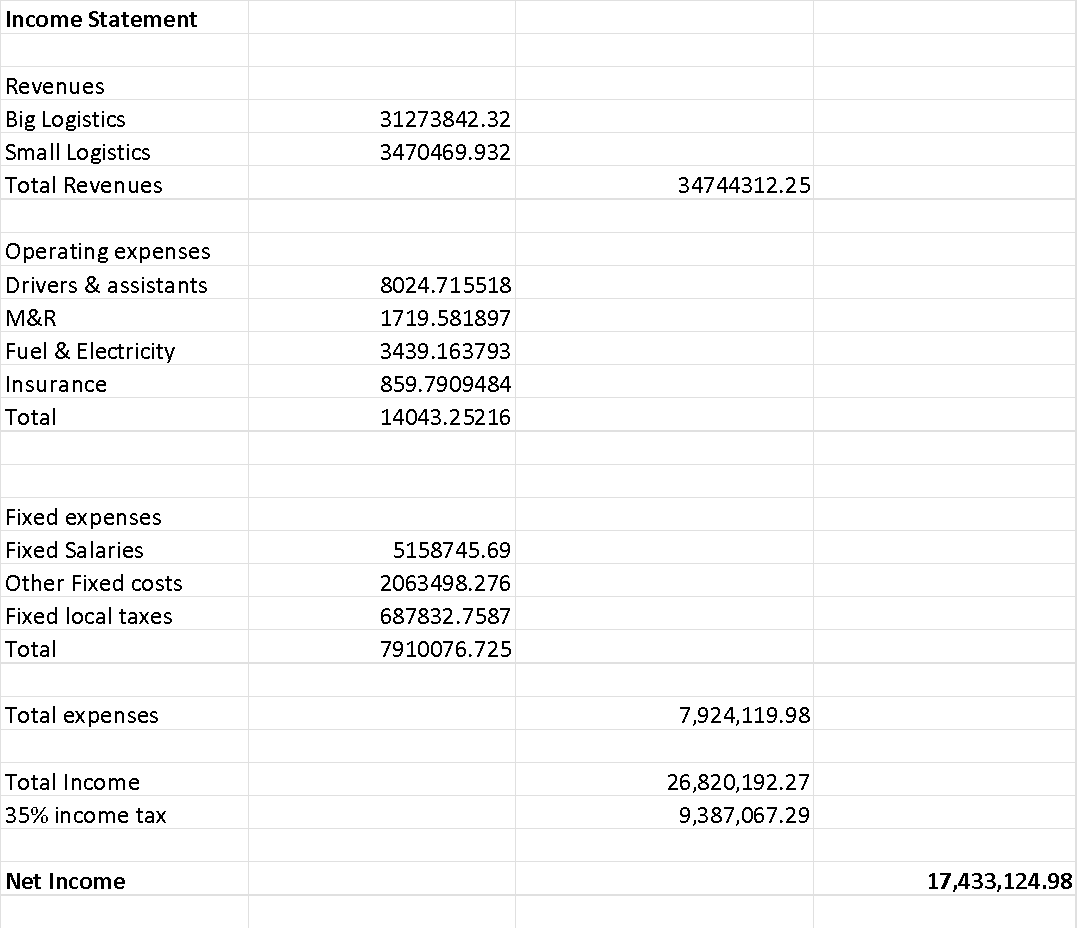

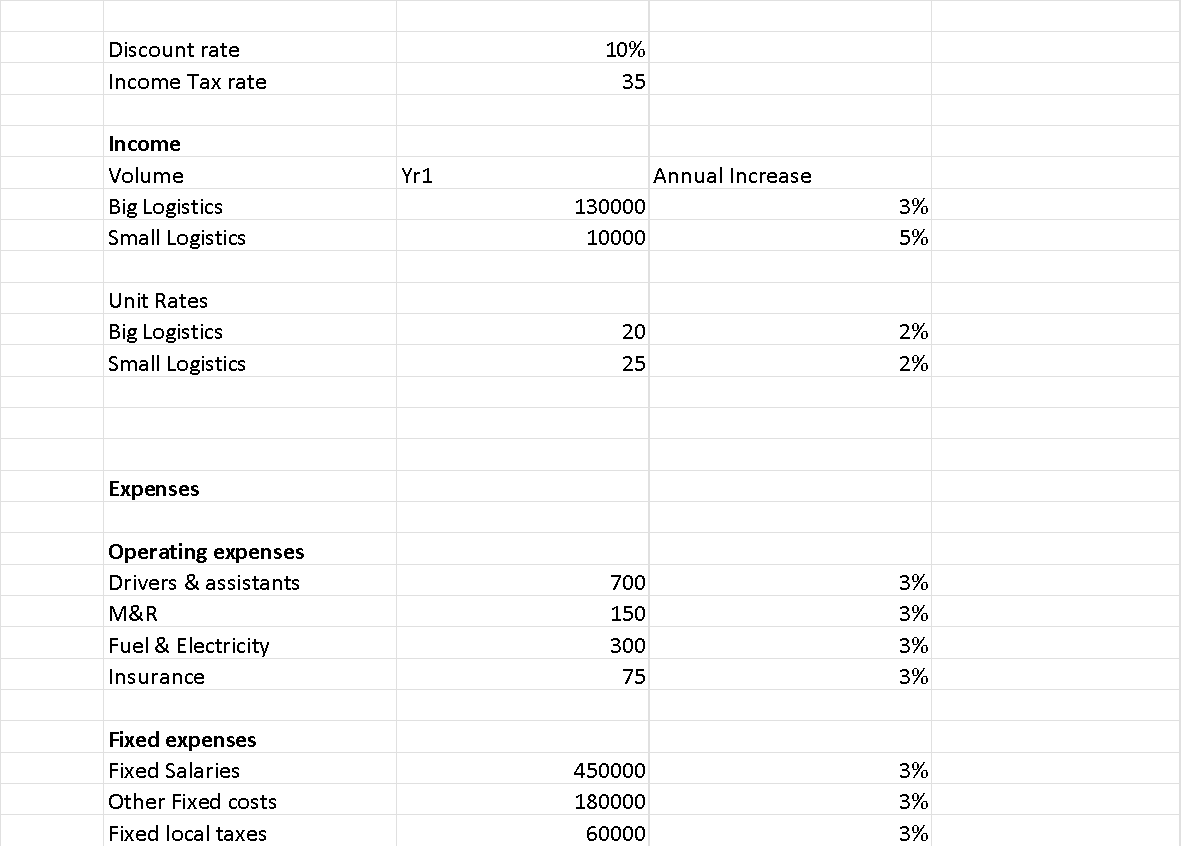

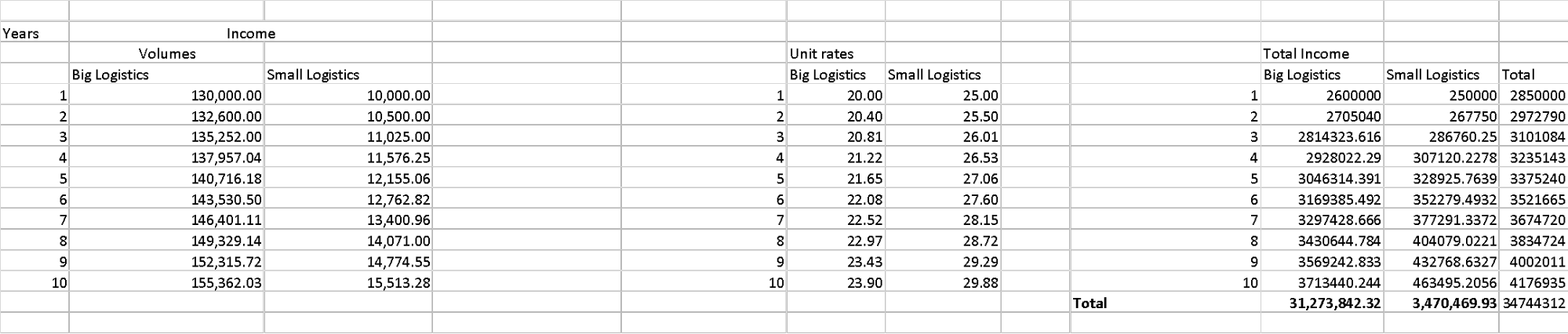

Income Statement

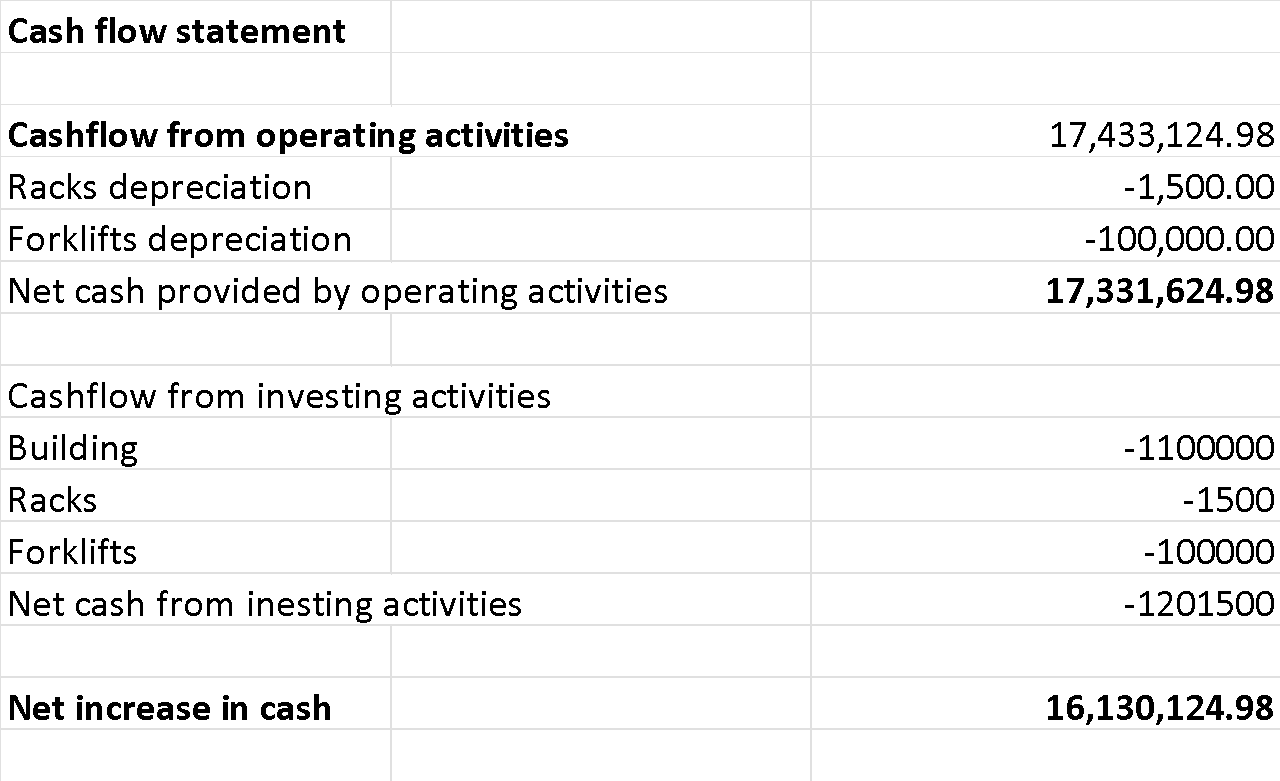

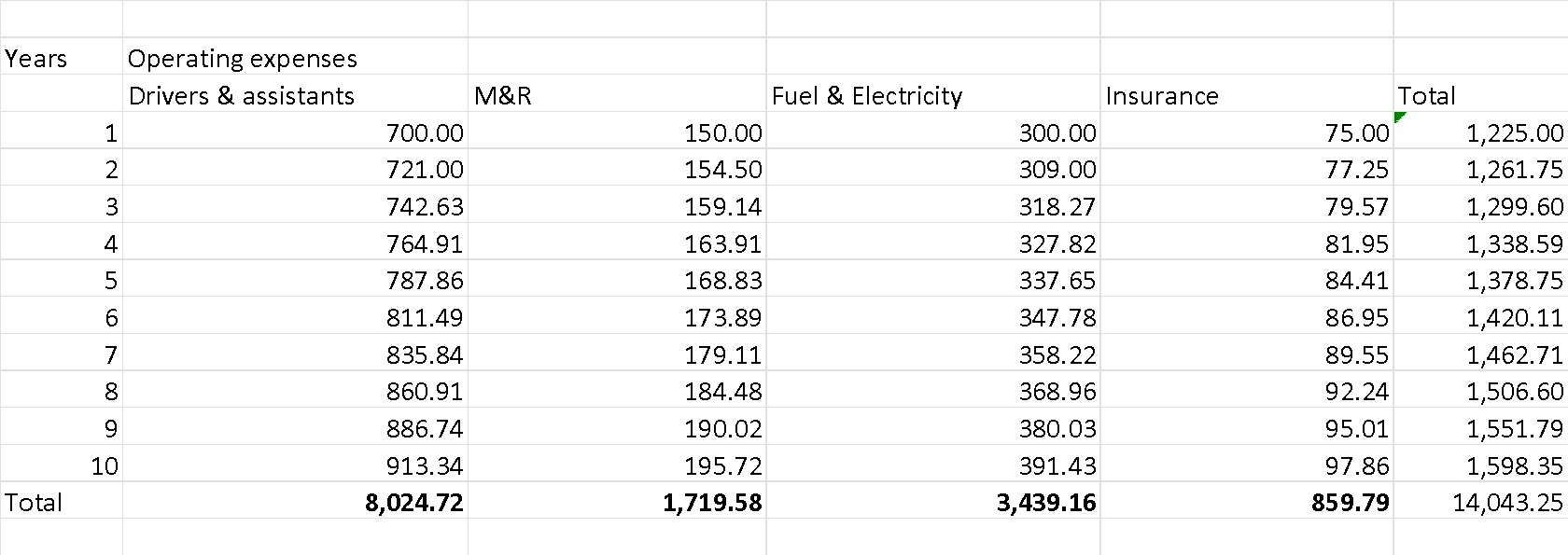

Cashflow Statement

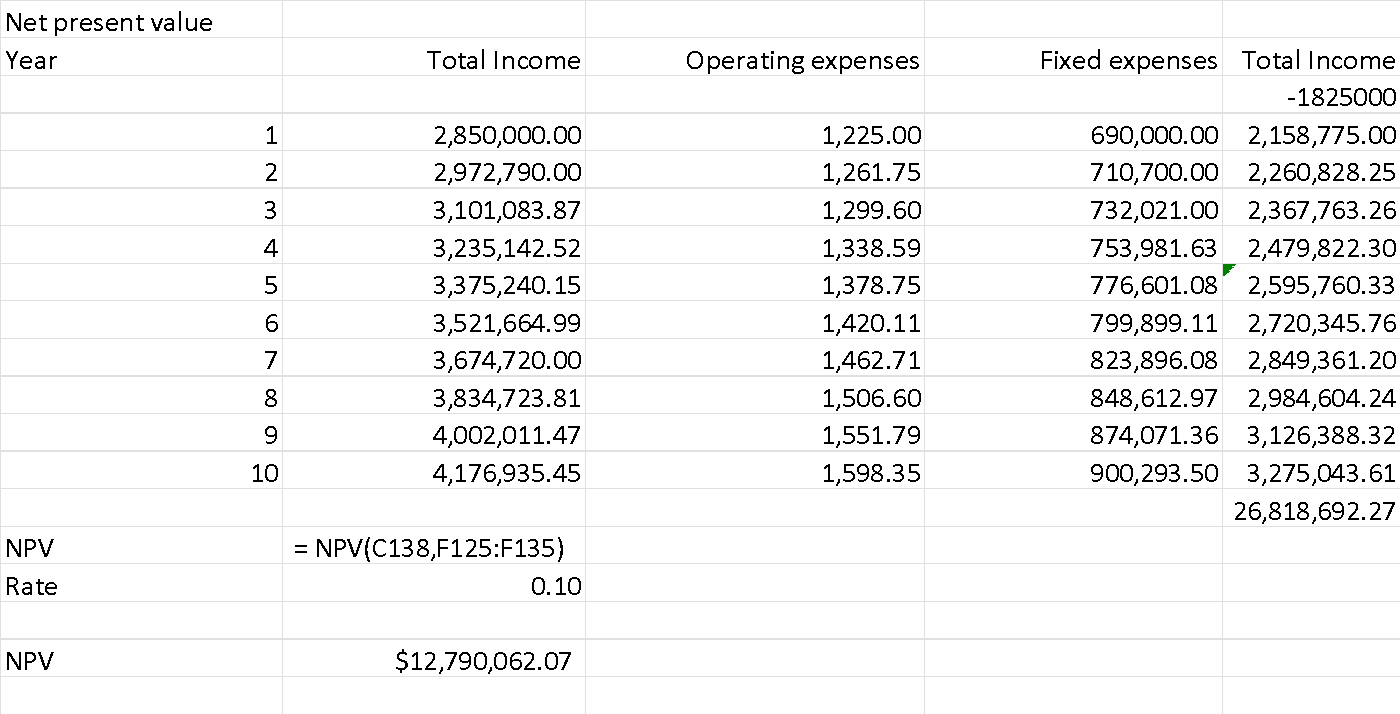

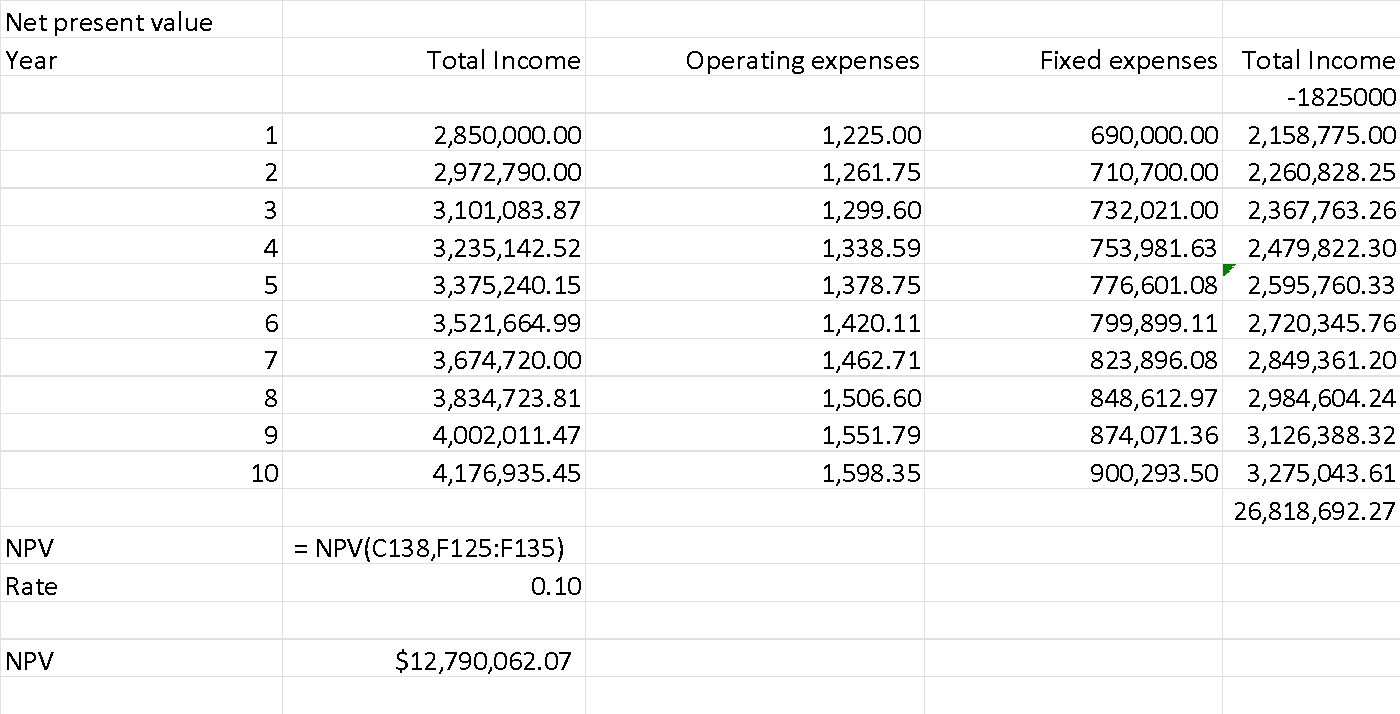

NPV

A favorable NPV is a positive NPV. One should move forward with a project if its NPV is positive and abandon it if it’s negative. A project with no NPV would not do any good or harm financially. However, a “good” NPV depends on the quality of the NPV equation’s inputs (Fitzgerald, 2022).

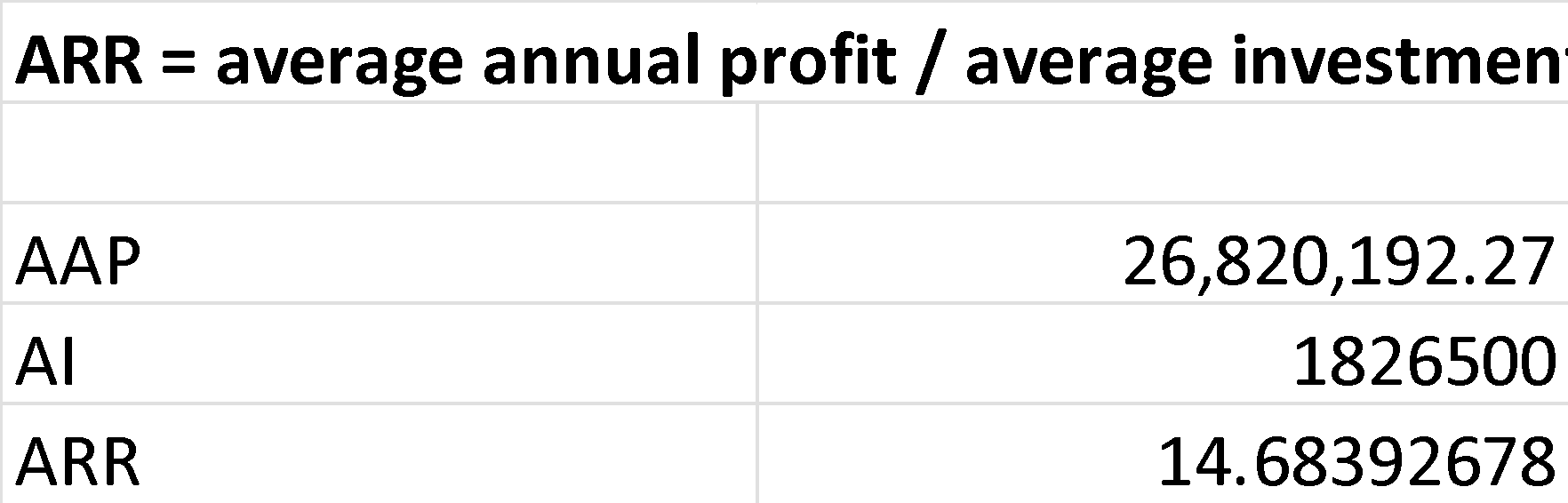

ARR

= average annual profit / average investment

The AAR is a simple way to determine how much money a mutual fund made or lost during a specific period. An important aspect of any mutual fund investor’s approach is reviewing the AAR and comparing it to other comparable mutual funds (Datar and Rajan, 2021). The estimated AAR comes out to 14.68%. This translates to an annual accounting profit of 14.68% of the original investment for the project’s duration. Remember, AAR doesn’t consider cash flows or the worth of money over time, so it might give you a partial picture of how profitable the project is. For a more comprehensive examination, it is advised to apply additional, stronger capital budgeting methods in addition to AAR.

Payback Period

The Payback Period is calculated as Initial Investment / Net Cash Flow per period, which is the payback time formula. Uneven financial flows can lead to Dividing the sum of the unrecovered costs at the beginning of the year by the cash flow during the year to get the payback period. Consider ACME: the payback term is 0.85 years, calculated by dividing 1,825,000 by 2,158,775. The lowest feasible payback period is, in general, an excellent payback period. The different factors that affect the payback period change and evolve over the life of your business, but in general, a payback period of one year is considered “healthy” for a company.

Discounted payback period

An approach to capital budgeting, the discounted payback time, is employed to ascertain a project’s profitability. By factoring in the time value of money and discounting future cash flows, the discounted payback period provides the number of years needed to recoup the initial investment.

1825000/1962522.73

0.929925535

Conclusion

Ultimately, this initiative highlights how crucial it is for corporate finance managers to do thorough investment analyses. Our understanding of the complexities of investment decision-making has been greatly enhanced by our comprehensive analysis of several capital budgeting approaches and their implementation in the ACME Corporation case study. We have offered well-informed suggestions for increasing value and promoting long-term growth by considering metrics like NPV, ARR, and IRR and doing sensitivity analysis. For future success in corporate finance and the development of strong strategic decision-making abilities, it will be crucial to combine critical analysis with theoretical frameworks.

Recommendations

The NPV of a project or investment is the sum of all expected cash inflows minus the total capital required to start the enterprise. The company considers the net present value rule when determining the continuation or cancellation of a project.

The decision rule of NPV states that projects are accepted if their NPVs are positive and rejected if they are negative. Assuming the present value of the cash flows anticipated in the future exceeds the original cost, a project is considered profitable when its net present value (NPV) is positive at a certain discount rate. Investments may be considered good if their NPV is positive.

The payback period of a project is the time it takes to recoup the initial investment or reach financial stability for the company. There is more allure to an investment if its payback time is relatively quick. Since the investment will yield a return in less than a year, it might be considered good.

A shorter discounted payback period indicates that the project or investment can generate cash flows to cover its initial cost more quickly. If you want to use the discounted payback period consistently, you should only take on projects with a shorter payback term than you would want.

Following the selection rule, a corporation should select the project with the highest accounting rate of return when faced with multiple options, provided that the cost of capital is equal to or higher than that rate.

References

Datar, S.M. and Rajan, M.V., 2021. Horngren’s cost accounting: a managerial emphasis. Pearson.

Fitzgerald, K.C., 2022. The application of real options as an enhancement to the net present value technique: a case of the financial services sector (Doctoral dissertation).

Kousky, C., Ritchie, L., Tierney, K. and Lingle, B., 2019. Return on investment analysis and its applicability to community disaster preparedness activities: Calculating costs and returns. International Journal of Disaster Risk Reduction, 41, p.101296.

Lu, J. and Yin, S., 2021, April. Application of net present value method and internal rate of return method in investment decision. In Proceedings of the 4th International Conference on Global Economy, Finance and Humanities Research, Chongqing, China (pp. 10-11).

Magni, C.A. and Marchioni, A., 2020. Average rates of return, working capital, and NPV-consistency in project appraisal: A sensitivity analysis approach. International Journal of Production Economics, 229, p.107769.

Mellichamp, D.A., 2019. Profitability, risk, and investment in conceptual plant design: Optimizing key financial parameters rigorously using NPV%. Computers & Chemical Engineering, 128, pp.450-467.

Nukala, V.B. and Prasada Rao, S.S., 2021. Role of debt-to-equity ratio in project investment valuation, assessing risk and return in capital markets. Future Business Journal, 7(1), p.13.

Zhang, S., 2021, December. Comparison of Different Investment Decisions Linked with Discount Rate. In 2021, the 3rd International Conference on Economic Management and Cultural Industry (ICEMCI 2021) (pp. 2076-2080). Atlantis Press.

Appendices

Figure 1 Income Statement

Figure 2 Expenses

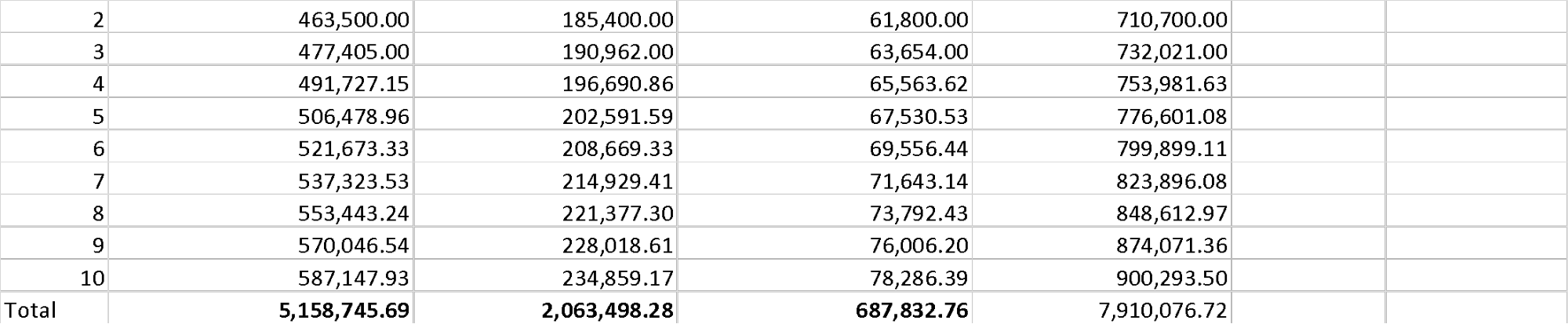

Figure 3 Net Present Value

Excel worksheet

write

write