Blockchain technology is an essential, primary technology with favourable application possibilities in the financial industry (Guo and Liang, 2016). The liberalization of interest rates and declining profits resulting from the reduced spread of interest rates affect the Australian financial sector. Alleviated economic transformations, financial innovation, and the development of the internet have also impacted the Australian financial industry. Thus, the Australian financial sector needs urgent modification and new growth avenues. Therefore, blockchains are essential in restructuring the basic technology of credit information systems and payments in banks, thus, modifying them. More importantly, blockchain applications will help enhance the creation of weakly intermediated and multi-centre scenarios that increase the efficiency of the financial industry (Guo and Liang, 2016). Nonetheless, regardless of the self-governing and permissionless nature of blockchains, the actual implementation and regulation of a decentralized system are issues that are still unsolved. Thus, creating a regulatory sandbox and advancing the financial industry standards to ensure efficiency in the financial sector.

Type of Business, Targeted Customers, and Strategies in the Financial Sector

The Australian financial sector covers different areas such as Asset-based finance and leasing, Funds management or Superannuation, Hedge funds, Insurance, and Life insurers, Investment banking, Payments, clearing and settlement systems, Private banking, Private Equity/Venture capital, and Retail banking. The financial sector targets a wide variety of individuals. The financial industry’s target market is insurance users, investors, families, children, organizations, etc. The Australian Financial sector focuses on five vital strategies. The first strategy is the customer outreach strategy. Customer outreach strategy is the most efficient, and it involves reaching out to customers to establish their needs to meet them. Also, customer outreach involves creating awareness of the financial services to different people. The second strategy is digitization and self-service. This strategy helps increase the personification of finances as current generations prefer operating with minimal human contact. Digitization also facilitates ease of access to services in the financial sector. Third, the financial industry has taken to social media to help create awareness of financial services due to the rapid increase in social media platforms. The fourth strategy, big data, and automation help the financial sector manage vast data more efficiently. Automation tools facilitate ease of use of financial platforms. Lastly, digital storytelling, through ads, videos, social media, and cross-channel platforms, helps financial industries market and create awareness of their products through digital technologies.

Role of Trust in the Financial Sector

The financial sector is based on trust. Trust is the primary factor that determines the success of the financial industry. Trust is essential in the financial industry as it helps individuals engage in more critical business matters instead of focusing and worrying n how they can be exploited. Also, trust makes it possible for individuals to gain the most economically through negotiations (Tyler and Stanley, 2007). Trust helps in building relationships that facilitate the occurrence of transactions. Trust helps people in the financial industry to keep and maintain their clients.

Approaches to Building Trust

Human Interactions

Human interactions are essential in building trust. People only trust other people. Technology can be utilized as supplement experiences in the financial sector. However, the financial sector requires people to help drive and achieve brand satisfaction, engagement, and customer loyalty. Customers prefer interacting with trusted experts; thus, regardless of a website’s content or chatbot, financial industries must introduce human aspects into their interactions.

Security

High levels of security in the financial industry are essential in building trust. In contemporary society, characterized by digitized systems, customers must exercise high trust in their providers. Hacking events and data breaches in the financial industry could result in reduced levels of trust by customers. Thus, financial industries should prioritize the security of their customers to increase trust levels. Financial industries should ensure they use reliable and very secure digital technologies that their customers can trust. Notably, cyber security is essential in developing trust in digital financial services.

Personification

The development of digital systems has modified the nature of experiences and alleviated personification levels expected by customers from their financial service providers. For instance, Artificial Intelligence, Machine Learning, and cloud computing have helped improve and make services possible. Financial institutions can delight their clients by offering contextual and personalized insights, nudges, and recommendations to better manage their finances. To create trust between financial institutions and customers, customers must be placed at the centre of all digital plans. Also, information on the customers should be used to provide them with helpful and relevant information according to their needs.

Customer Journeys

Customer journey is vital to the development of trust between the financial industry and customers. Financial institutions have to determine the events that occur after they acquire a new client and the client’s journey and their journey. Creating a flawless customer journey requires that financial institutions get rid of streamlining services and friction points and deliver efficient processes relating to the customer’s demands. Also, financial services should increase customer engagement levels and lower customer drop-off levels. Customers’ experiences of financial institutions should be on brand and remain consistent regardless of the methods the customer uses to engage with the institutions.

Radical Transparency

The financial industry can enhance trust through radical transparency. The Australian financial sector can provide its clients with necessary and relevant information regarding the products and services they offer to help them make informed financial decisions and gain trust in the system. More importantly, financial institutions should openly disclose vital information to customers upfront, thus, helping them steer away from misleading marketing and messaging. For instance, making terms and conditions of transactions known to the clients increases their trust in customers and makes them feel confident in their decision-making.

Benefits of a Trustless System

Cryptocurrencies like bitcoin and other blockchain-based systems are viewed as trustless alternatives to current governments and financial institutions. It is worth noting that blockchain systems involve more than just cryptocurrencies. Blockchain technology introduces numerous benefits to the financial sector. For instance, with the trustless and decentralized nature of blockchain technology, new opportunities in the financial industry, such as new client bases, can be determined and help benefit the business. Also, blockchain technology increases the level of transparency, enhances security, and eases traceability.

Role of Block-Chain in Creating Trust

Blockchains are used in the financial industry to create trust as they increase the level of transparency, efficiency, enhance security, and improve traceability. In financial systems, blockchains add an unmatched layer of accountability, holding every segment of the financial sector responsible and ensuring they acct in line with the industry’s growth, community, and customers. Also, compared to conventional financial services, blockchain technologies facilitate fast transactions as they allow people to people cross-border transactions to take place using digital currency, thus, creating efficiency. Blockchain systems are very secure compared to other record-keeping systems as new transactions are encrypted and linked to past transactions. The decentralized nature of blockchain technologies gives it an exceptional trustless quality whereby customers do not feel the need to transact safely as the system is already secure. Also, the blockchain ledger helps the financial industry to improve its traceability. Notably, every time transactions take place and are recorded on a blockchain, audit trails are revealed to establish the origin of the transactions. This helps financial industry institutions prevent fraud and improve their security—also, blockchains help in the authentication of the nature of transacted assets.

Business Model

The blockchain solution will apply a hybrid business model because it comprises technical generations of competing elements. A hybrid business model is preferred because it allows developers to manage complex and lengthy transitions (Furr, 2017). For instance, a hybrid business model allows the developer to handle changes between technology generations or careers. Notably, a new form of hybrid will be implemented; a platform business model. It is worth noting that product-based models create value through transacting using differentiated products to market niches; however, platform-based models create value by encouraging transactions through large-scale generic markets (Furr, 2017).

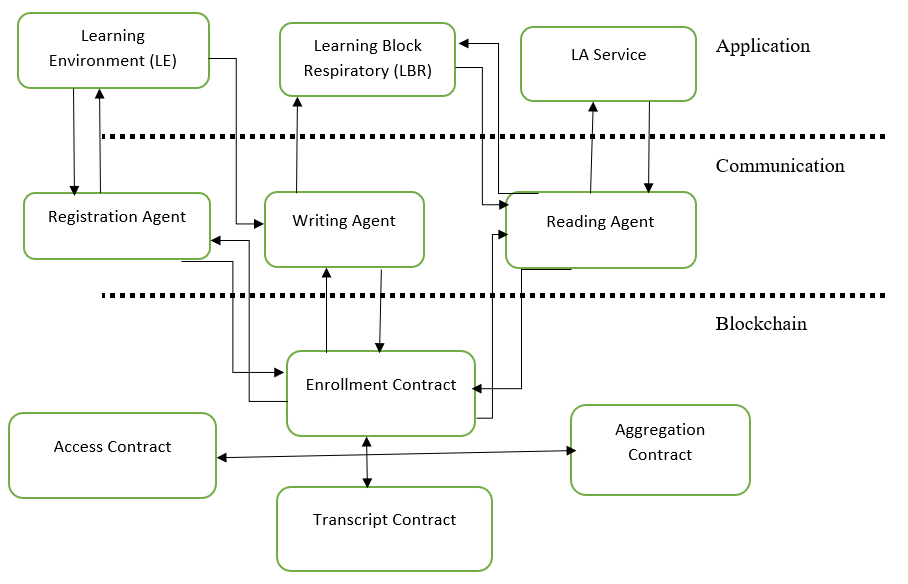

Proposed Blueprint

Learning Environment to Registration Agent – Send registration and updates.

Registration Agent to Learning Environment – confirm enrolment

LE to Writing Agent – Send LB

Writing Agent to LBR – Send/ Confirm

LBR to Reading Agent – Send

Reading Agent to LBR – Request

LA service to Reading Agent – Request

Reading Agent to LA – Send

Writing Agent to Enrollment Contract – Record

Enrollment Contract to Writing Agent – Send blockchain address

Access Contract – Handle Access Changes

Aggregation Contract – handle aggregation across participants

Transcript Contract to enrollment contract and vice versa – handle the aggregation of one participant.

The blueprint comprises an application layer, blockchain layer and communication layer. The blockchain will include different users such as investors, organizations, families, children, insurance users who will get involved in the registration process and use the system for transactions. The application layer consists of distinct components to be used in the functionality of the blockchain, e.g., LBRs(Learning Block Repository), LEs, and LA services. The communication layer will comprise modules responsible for interactions between the system and blockchain. This will comprise of the users (LBR).

Governance Mechanisms

Blockchain faces numerous challenges regarding security, scalability, and mass adoption. Regarding its governance, blockchain systems strain to transition from a techno-libertarian model to a more accommodative actual economy model. For excellent governance, the process of deliberation cannot occur in isolation. Regulators and innovators need to interact, learn and structure the future of blockchain technology (Niforos, 2018). This requires positioning a multi-stakeholder process to help establish an equitable, rule-based system in governance. However, a global coordination mechanism can be implicated in geopolitics, making the idea of a universal arbiter seem impossible. Scenarios of transnational cooperation can create public standards with international agencies working on harmonization standards and regulatory sandbox coordinations (Niforos, 2018). Regardless of the process, an entirely amoral technological model cannot be used to ensure the sustainability and effective governance of the blockchain.

Blockchain Challenges and Ethical Issues

Scalability

Blockchain technology may become voluminous as the transactions increase. This may result in slow implementations (Zheng et al., 2018). According to Marr, blockchain transactions can be slow to implement due to the technology’s encrypted, complex and distributed nature (Marr, 2018).

Security

Werbach states that blockchain technologies are exposed (Werbach, 2018). For instance, The platforms of Ethernet and bitcoin enforced with blockchain technology have been successively stolen since 2009, resulting in losses of about 600 million yuan (Werbach, 2018). Zheng postulated that blockchain is prone to attacks of collusive selfish miners, thus making the technology less secure (Zheng et al., 2018).

Privacy Leakage

Blockchain technology can create several addresses to replace the original identity of the user to prevent leakage of information, thus, ensuring the user’s safety. Nonetheless, blockchain technology cannot guarantee the safety of the user’s transactional information, resulting in information leakage (Meiklejohn et al., 2013; Kosba et al., 2016).

Ethical Issues

Blockchain technologies can result in ethical issues such as privacy, cyber security, and regulations and the law. For instance, creating immutable permanent records of users can increase the privacy risks for the user (Till et al., 2017). This shows that confidential building systems are complex in blockchains. Also, the uncertain nature of blockchain regulatory may result in significant consequences as it cants guarantee the authenticity of offline data. Blockchains promote innovation, competition, and productivity. Nonetheless, blockchain may result in financial terrorism, tax avoidance, and money laundering issues, as authentication is not required.

Future Trend Impacts

The Australian financial industry is accepting of blockchain technology in its operations. A recent study reveals ledger and blockchain technologies can help reduce costs in the financial industry by about $15-20 billion by 2022. Moreover, research predicted that the financial industry could leverage blockchain to acquire more than $1 billion by 2022. Thus, it is easier to state that blockchain can help secure the future of the financial industry due to its exceptions aspects.

REFERENCES

Furr, N. (2017, April 24). Hybrid Business Models Look Ugly, but They Work. Harvard Business Review. Retrieved October 26, 2021, from https://hbr.org/2016/03/hybrid-business-models-look-ugly-but-they-work

Guo, Y. and Liang, C., 2016. Blockchain application and outlook in the banking industry. Financial innovation, 2(1), pp.1-12.

Till, B.M., Peters, A.W., Afshar, S. and Meara, J.G., 2017. From blockchain technology to global health equity: can cryptocurrencies finance universal health coverage?. BMJ global health, 2(4), p.e000570.

Joshi, M., Cahill, D., Sidhu, J. and Kansal, M., 2013. Intellectual capital and financial performance: an evaluation of the Australian financial sector. Journal of intellectual capital.

Kosba, A., Miller, A., Shi, E., Wen, Z. and Papamanthou, C., 2016, May. Hawk: The blockchain model of cryptography and privacy-preserving smart contracts. In 2016 IEEE symposium on security and privacy (SP) (pp. 839-858). IEEE.

Marr, B., 2018. The 5 big problems with blockchain everyone should be aware of. Forbes, 19, p.2018.

Meiklejohn, S., Pomarole, M., Jordan, G., Levchenko, K., McCoy, D., Voelker, G.M. and Savage, S., 2013, October. A fistful of bitcoins: characterizing payments among men with no names. In Proceedings of the 2013 conference on Internet measurement conference (pp. 127-140).

Niforos, M., 2018. Blockchain Governance and Regulation as an Enabler for Market Creation in Emerging Markets.

Price, D., 5. Blockchain problems: security, privacy, legal, regulatory, and ethical issues-blocks decoded.

Tyler, K. and Stanley, E., 2007. The role of trust in financial services business relationships. Journal of Services Marketing

Werbach, K., 2018. Trust, but verify: Why the blockchain needs the law. Berkeley Tech. LJ, 33, p.487.

Zheng, Z., Xie, S., Dai, H.N., Chen, X. and Wang, H., 2018. Blockchain challenges and opportunities: A survey. International Journal of Web and Grid Services, 14(4), pp.352-375.

write

write